After the hassle of buying a home, does refinancing make sense? In some situations, you may benefit from refinancing your home, but you need to know more about these particular instances as well as when refinancing may not benefit you. Do not lightly make your decision to refinance your home. Careful consideration of your finances and your current situation will help you choose when to refinance your home.

- Why Would You Want to Refinance a Mortgage Right After Purchase?

- How Often Can You Refinance a Mortgage?

- What to Know Before Refinancing

- How to Know When Refinancing a Mortgage Is Right for You

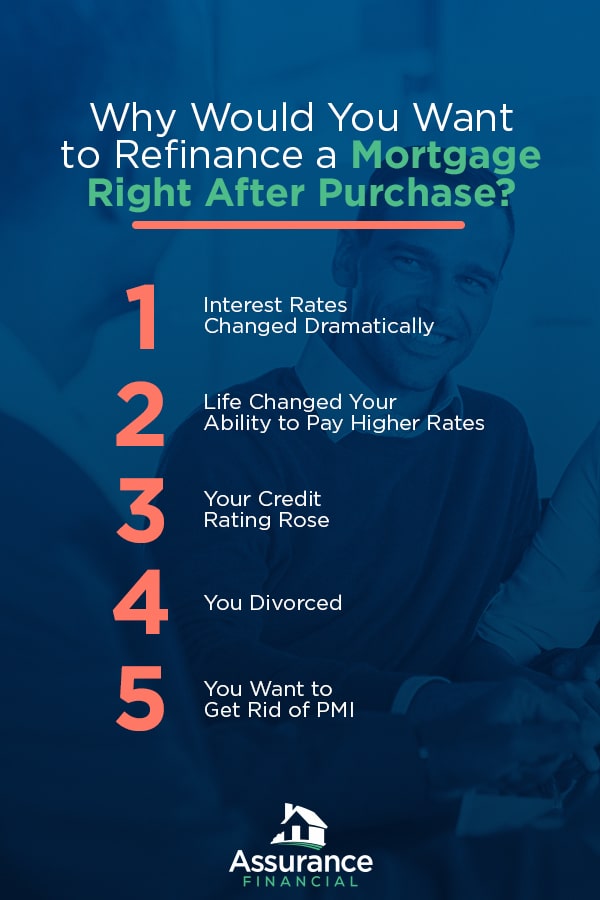

Why Would You Want to Refinance a Mortgage Right After Purchase?

When someone asks us, “Can I refinance right after buying a home?” the answer is yes, but with reservations. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within 120 to 180 days of issuing the loan. The more money you put into your home, the easier it will be to refinance, regardless of when you do it. Ideally, you should pay at least 20% of the home’s value before you seek to refinance to make qualifying a more straightforward process.

Only a couple of situations justify refinancing soon after you buy your home. These typically deal with major changes in your life or finances. Even if you experience a change that might warrant a rapid refinance of your mortgage, always talk to your lender, first to get personalized advice. Here are some reasons you might need to refinance soon after buying:

1. Interest Rates Changed Dramatically

The economy can change in the blink of an eye, and if mortgage interest rates in your area have plummeted since you bought your home, you may consider refinancing. Unless interest rates drop more than 0.5%, refinancing for lower payments does not make sense.

A study done in December 2010 showed that households eligible for refinancing could save $160 monthly on their mortgage payments thanks to lower interest rates. Unfortunately, at the time, 20% of families that could have refinanced to take advantages of the savings did not, leaving behind an average of $11,500 on their homes they could have saved.

If the interest rates decline significantly, you will save more money the sooner you refinance. However, don’t forget about closing costs. The amount you save should cover the closing costs for refinancing, which could be 3% to 6% of your home’s value. If you cannot justify the closing costs in monthly savings from the lower interest rate, you may not need to refinance.

2. Life Changed Your Ability to Pay Higher Rates

Occasionally, unexpected life events will sometimes get in the way of your ability to pay your mortgage. If you initially took out a 15-year loan, you can stretch out the payments by refinancing to a 30-year loan. You will still need to pay the closing costs, but the option of changing to a longer-term loan could help save money if an unexpected circumstance leaves you unable to afford your higher mortgage payments. The downside to this option is the increased amount of interest you will pay over time, but you may need the lower rates more than the lower total cost.

3. Your Credit Rating Rose

The interest rates you get for your mortgage depend mainly on your credit score. While your credit score may not usually change quickly, it could surge after clearing disputed charges or paying off large debts. Also, the more time that passes after a bankruptcy, the less of an effect the event has on your credit. Talk to your lender if your credit score has risen significantly since you took out your home loan to see if you can qualify for lower rates through refinancing with your new, better credit score.

4. You Divorced

When you signed your home loan, if you did so with your spouse, refinancing is the only way to get that person off your mortgage if you divorce. When refinancing, your individual income may change rates unless you have a cosigner on the loan whose assets can ensure you get the same or lower interest than before.

When refinancing, you may be able to request a loan to include your spouse’s half of the equity to pay her for half the house. For example, if you have a $200,000 home loan, and have paid $60,000 of it, you will owe your spouse $30,000 for his portion of the home. You should then refinance for $170,000 to cover the remaining $140,000 in the house plus your spouse’s $30,000.

Since this matter also has legal implications, talk to your lawyer about property and divorce laws in your area if you have any questions about your specific situation.

5. You Want to Get Rid of PMI

Personal mortgage insurance, PMI, ensures your lender that you will make mortgage payments. Usually, you will need this if you get a loan with a down payment of less than 20% of the home’s value. However, did you know that when you make enough payments to have 20% of your home’s value in equity, you can drop PMI? In some cases, you can call the lender, but just a phone call may not be enough. If rates have also changed, you may want to refinance to get rid of the PMI monthly payments and take advantage of better rates. Doing so can save you money each month.

How Often Can You Refinance a Mortgage?

Technically, American law doesn’t officially limit the number of times you can refinance your home. Since you have no legal restrictions, you could seek new loan terms as many times as you want. Certain factors will play into when and how often you should refinance, including when you can break even and how many properties you have.

Some people refinance more than once. One couple did it twice on the same property in the same year, but this may not make financial sense for you. If you need to know how soon you can refinance after refinancing, look at the numbers. The savings must make up for the payments and any penalties. When the figures show you can recoup your losses quickly, you can refinance as often as you like.

Decide your break-even time. This time will be when you recover the costs you paid from your refinance in savings you’ve made. Compare your current loan payments and subtract the amount after refinancing. Divide the closing costs and fees by this number to find out how many years it will take for your investment to pay for itself.

For instance, if you have a $200,000 mortgage and closing costs to refinance cost 4% of the total, you will pay $8000 in closing fees. If you reduce your payment by 1%, you will save $2000 each year. To recover the closing amount, you will need to make payments on your newly refinanced loan for four years.

What to Know Before Refinancing

Before you refinance, you need to understand about the possible drawbacks of the process as well as the steps of the ordeal itself. Pay attention to these factors:

1. Prepayment Penalties

Paying off your mortgage early by refinancing or selling your home may come with prepayment penalties. Some mortgages come with prepayment penalties. Talk to your lender about the policy on early payment for your current home loan before refinancing. Your lender should inform you about prepayment penalties when you close on your mortgage.

Mortgages may have one of two types of prepayment penalties, also known as prepays. Both types penalize you if you refinance before paying off the loan. Hard prepays penalize buyers for both selling and refinancing, whereas soft prepayment penalties only cost borrowers a fee after selling the home.

While these penalties only happen during the first one to three years of the loan, they can add up. For instance, some lenders may charge 80% over six months of interest-only payments. You will most likely want to read the information about prepays in your closing information carefully and discuss any questions you have with your lender.

2. Appraisal Process for Refinancing

Your home will need reappraising as a part of the refinancing process. The appraisal process protects the lender by ensuring the value of the house is close to the mortgage value. Since so much of your mortgage payment comes from the home’s value, having an accurate appraisal will help you, too. You won’t overpay for your home.

You must schedule the appraisal and pay for it yourself. These inspections can cost between $300 and $400. If you have a large property or multiple units, the cost and time to conduct the appraisal will rise. Standard times for the assessment can take between three and ten business days.

3. Closing Costs

Just as you had to pay closing costs with your original home loan, you will need to cover these for your refinancing. Essentially, refinancing is transferring your old mortgage to a new rate. It still requires the same steps required for you to take out a loan, including paying 2% to 5% of the home’s value in fees.

4. Impact on Credit Score

Each time you refinance, the lender will conduct a hard inquiry of your credit. Too many of these types of examinations can negatively impact your credit score, even if you make regular on-time payments. Refinancing once or twice is fine, but the shorter the time between these loans or your original borrowing and refinancing, the more significant the impact you will see on your credit score.

5. Process of Refinancing a Mortgage

The process of refinancing has multiple steps. You will need to prepare yourself for the process, so you don’t feel surprised or unprepared by anything. Researching the process and your options will make you better prepared for choosing the right lender and finding the best interest rates.

First, get an idea of your home’s worth and determine how much equity you have. Generally, lenders won’t refinance if you have less than 5% equity in your home. Ideally, you want 20% equity or more in your home for the best chances at qualifying for a refinance.

A lot of the refinancing process requires research. Not all lenders offer the same interest rates, and your credit score and other personal factors will affect how much you pay. You need to compare rates from several lenders and find out what fees they charge. Check with the mortgage companies to see what paperwork they need hard copies of. Many can connect electronically to various financial institutes, so you don’t require printouts of financial documents.

Once you’ve done your research, apply for a loan to get an estimate for refinancing. You should get an estimate within three days. If you approve of the terms, the loan process continues with the lender carefully reviewing your application documents.

At this stage, you need to get an appraisal. In some cases, your lender may set up this inspection or ask you to do it. After appraising the home, the reviewer will send a report about the home’s value to both you and the lender.

The lender will have an underwriter comb over the paperwork and your home’s appraisal. You may need to answer questions about your refinancing application. Address these quickly to keep the process moving forward.

Lock in the rate at any time, but you should do it before closing. At closing, you will sign the needed documents and make any fee payments. Once closed, your new loan takes over for covering your home’s mortgage.

How to Know When Refinancing a Mortgage Is Right for You

Several situations make refinancing a good option. Don’t just go through the process if mortgage rates drop a little. Wait for a significant drop or any of these other signs that you will save a considerable amount of money. Refinancing is a good idea if you:

- Move from an adjustable rate mortgage to a fix-rate loan

- Change from a 30 or 40-year term to a shorter 15-year term

- See interest rates drop at least 0.5%

- Have an interest-only loan that will decrease

These situations could make refinancing a valuable way to save money. While you don’t want to enter the process needlessly, you also don’t want to leave money on the table by failing to refinance at the proper time.

Does Refinancing Make Sense for You?

Having a close relationship with your lender is critical to working through the refinancing process. At Assurance Financial, we have people and technology to work for you and with you. If you think it’s the right choice for you at this stage in your life, contact us at Assurance Financial about refinancing your home. Through a refinance, you may be able to lower your payments or get cash from your home’s equity.

To see if you qualify, meet with one of our loan advisors in person. You can find out more about our rates and whether you qualify for refinancing. No matter how you work with us, we’ll help you find your ideal home loan options. We’re the people you can trust.