Mortgage Guidance, Wherever You Are

Find a Licensed Assurance Financial Loan Originator Near You

We're not licensed in your state yet, but we're still here to help! Explore our blogs for helpful mortgage insights.

Blogs

Estimate Your Payment

Get an idea of what your monthly payment may look like. For a full estimate, contact a mortgage expert!

Connect with an Expert

3,500

Monthly Payment

Real APR

0

Monthly Taxes

208

Monthly Insurance

50

Monthly PMI

0

Monthly Principal and Interest

0

Calculators provide estimates only. Estimates shown should not be considered exact payments. Contact your local loan officer for precise and personalized information. See full legal disclosures.

Legal Disclosures

The AFG mortgage calculator is for estimation purposes only. Results do not reflect all loan programs and are subject to individual program loan limits. Qualification, rates and payments will vary based on timing and individual circumstances. This is not a commitment to lend.

Here’s a payment example based on an average home price and the most common loan type:

Loan amount: $300,000

Loan type: 30-year Fixed-Rate Loan

Interest rate/APR: 7.375% (7.692% APR)

Monthly payment: $2,072.03

Points: 1.875 points, costs due at closing

Loan-to-value (LTV): 80.00%

One point is equal to one percent of your loan amount. Payment does not include taxes and insurance. The actual payment amount will be greater. Some state and county maximum loan amount restrictions may apply. Rates shown are valid on publication date of April 18, 2024.

1If you didn’t enter taxes and insurance amounts, an estimate of your taxes is based on the state selected. This does not include all fees.

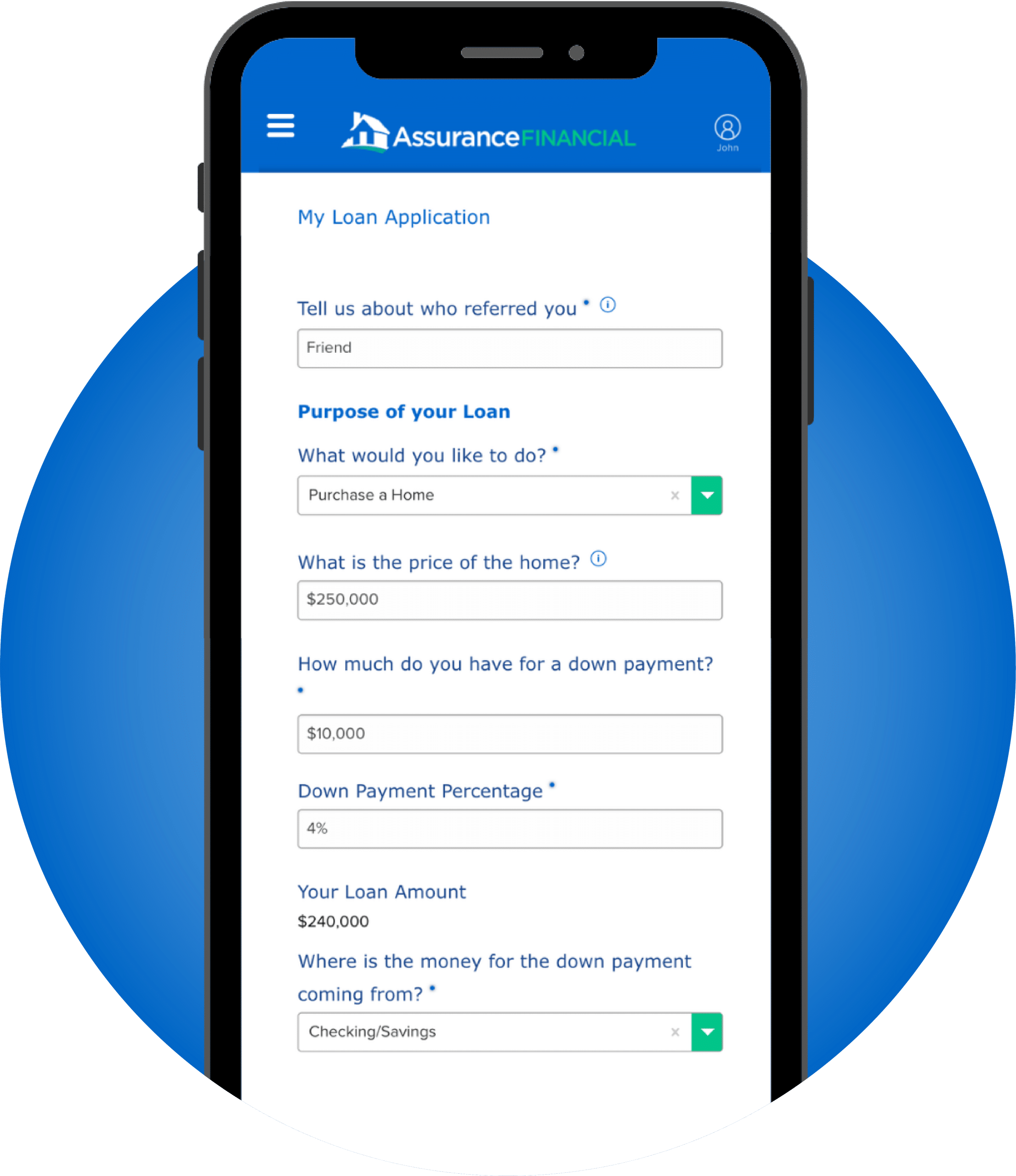

We’ve made applying for a mortgage easy.

Apply online anytime, anywhere

Our simple mobile-friendly tool walks you through every step.

Real people ready to help

Our loan experts are always a phone call away if you have questions at 1-866-790-7980.

Start your Application