Purchasing a home is one of the largest investments you’ll make. As such, you probably want to do what you can to ensure your home is as up-to-date and comfortable as possible. However, it can be challenging to save up enough to complete home repairs and renovations. If you’ve found yourself in this situation or another situation where you need a large amount of cash, the answer may be a cash-out refinance.

With cash-out refinancing, you can accomplish your financial goals without relying on a second mortgage, personal loan or credit cards. A cash-out refinance can allow you to borrow from the equity you’ve built in your home and receive cash that can be used for just about anything like paying off high-interest debt, student loan debt or home renovations. At Assurance Financial, we have developed these cash-out refinance guidelines to help you determine if this is the right option for you.

Topics Covered

- What Is a Cash-Out Refinance?

- Uses for a Cash-Out Refinance

- How Much Cash You Can Get With a Refinance

- Benefits of Cash-Out Refinancing

- Things to Consider With a Cash-Out Refinance

- How a Cash-Out Refinance Works

- Cash-Out Refinance FAQ

What Is a Cash-Out Refinance?

While your mortgage matures, you continually gain equity in your property. Your home’s equity is the amount of your home’s value that you have already paid off. Gaining equity can happen in two ways:

- Your mortgage principal decreases as you pay your monthly payments. Each time you make a mortgage payment, you gain equity in your home.

- The value of your home increases.

To use cash-out refinancing, you must have equity built up. With a cash-out refinance, you can take advantage of your home’s equity and use the cash in exchange for a larger mortgage. When you decide to pursue cash-out refinancing, you’ll borrow more than what you owe on your current mortgage and receive the difference in cash.

Unlike taking out a second mortgage, when you decide on a cash-out refinance, you won’t be adding another payment to your monthly bills. With a cash-out refinance, you’ll pay your old mortgage, and it’ll be replaced with a new mortgage.

For instance, if you purchase a home for $300,000 and you pay off $100,000, you still owe $200,000 on your home. However, you want to make $30,000 worth of renovations. With cash-out refinancing, you’ll take a portion of your home’s equity and add what you take out of the equity to your new mortgage’s principal. As a result, your new mortgage will be worth $230,000 – the $200,000 you owe plus the $30,000 for the renovations. After closing on the loan, you will receive the $30,000 in cash from your lender.

Uses for a Cash-Out Refinance

With cash-out refinancing, you can use the money from your home’s equity for anything you want. You can use it to meet various financial needs, such as:

- Unexpected bills: If you get an unexpected car bill or medical bill, you can use your cash-out refinance to cover these unexpected expenses.

- Home improvements: With cash-out refinancing, you can make home repairs and renovations like constructing an addition or building a new roof. By refinancing, you’ll free up cash each month to put toward these improvements.

- Investing or saving: By refinancing, you’ll have more cash in your pocket that can be saved, invested or spent as you choose. If you want to take advantage of the market to build your retirement savings, for example, you can use your home’s equity to invest in your 401(K).

- Family expenses: If you are planning to start a family, your kids are heading to college or you need to support an elderly family member or a relative with medical bills, then you may want to free up some extra cash each month.

- Expenses related to the cost of living: When you purchased your home, you may have had a different cost of living due to a new job, a growing family or more expenses. Refinancing may help make your current financial reality more affordable.

How Much Cash You Can Get With a Refinance

A cash-out refinance also typically gives you access to a lower interest rate monthly than a credit card. Keep in mind that you may not be able to pull out all of your home’s equity, though you can pull out a large percentage. One exception is a VA loan, which allows you to take out the full amount of your home equity.

The amount you can take out generally depends on the value of your home. Before you can find out how much you qualify for in a cash-out refinance, your home may need to be appraised. The percentage you can take out depends on your circumstances and varies from lender to lender. Some lenders may allow you to take out all of your home equity depending on your credit score, for example, but others may not.

With cash-out refinancing, you’ll be withdrawing some of your home equity in one lump sum. After you complete a cash-out refinance, you also may pay more in interest since you’re increasing the amount of your loan.

Benefits of Cash-Out Refinancing

Homeowners choose a cash-out refinance for many reasons. If you determine that cash-out refinancing is the right option for you, you can enjoy the following benefits:

1. Renovations and Home Improvements

From a broken HVAC system to a leaky roof, upgrades are often needed at some point during homeownership. With cash-out refinancing, you can use the equity in your home to fund the renovations and home improvements needed. Whatever improvements you decide on, you may want to choose safe projects that future buyers will value.

2. Increased Credit Score

By using the cash from this type of refinancing, you may be able to increase your credit score. This is because a cash-out refinance can reduce your credit utilization, as you will now have a greater amount of credit available to you. Additionally, you can use your cash to pay off debt, further improving your credit utilization and positively impacting your credit score.

3. Debt Consolidation

Cash-out refinancing can provide you with the money needed to pay off outstanding debts. You can also transfer debts to a lower-interest payment. When you choose cash-out refinancing to pay off your high-interest credit cards, this can save you thousands in interest. Tapping the equity in your home may be less expensive than other forms of financing, such as credit cards or personal loans.

4. Lower Interest Rates

Getting a lower interest rate is one of the most common reasons homeowners choose to refinance. If you originally purchased your property when mortgage rates were higher, a cash out-refinance may offer you a lower interest rate.

Additionally, if you are suddenly hit with an unexpected bill, you may have to pay a higher interest rate, especially if you pay the bill with a home equity line of credit or a credit card. Credit cards typically have higher interest rates than mortgages. If your home’s equity is enough to cover an unexpected bill, using a cash-out refinance could save you thousands of dollars in interest.

5. Lower Monthly Payments

With cash-out refinancing, you may be able to enjoy lower monthly payments. When you have lower monthly payments, you can put more money toward other financial needs, such as a parent’s medical bills, your child’s college tuition or a special vacation.

Additionally, if something like your child’s student loan rate is higher than the rate for your new mortgage, then tapping your home’s equity to help pay for your child’s college education may be a smart financial move.

6. Tax Deductions

Additionally, you may be able to deduct your mortgage interest from your taxes with a cash-out refinance if you use the cash to purchase, build or significantly improve your home. Eligible projects for tax deductions may include:

- Installation of a home security system.

- Construction of a fence around your home.

- Replacement of windows with storm windows.

- Construction of a new bathroom or bedroom.

- Addition of a central heating or air conditioning system.

- Addition of a hot tub or swimming pool in your backyard.

- Improvements to your roof that allow it to more effectively protect you and your belongings from the elements.

Home improvements should make your home more accessible or add value to it to qualify for tax deductions.

Things to Consider With a Cash-Out Refinance

Before you commit to cash-out refinancing, there are a few considerations to be made. The following are various aspects of a cash-out refinance for you to consider if you are interested in this option:

Leaving Equity in Your Home

Depending on your loan, you may need to leave a certain percentage of equity in your home. Conventional loans and FHA loans both require homeowners to leave some equity in their homes after cash-out refinancing. The only exception is for a VA loan for which you are not required to leave any equity following a cash-out refinance.

Cash Isn’t Immediately Accessible

As when you purchase a home, you may need to submit to appraisal and underwriting processes before the lender can approve your cash-out refinance. Even after closing, you have a few days to cancel the loan. You also won’t receive your cash immediately after closing. Instead, it will take a few days after closing before you receive your cash, so if you need money immediately, then cash-out refinancing may not be the best option for you.

At Assurance Financial, you can cancel your cash-out refinance for no cost within three days after closing. After these three days, your new loan will be funded, and your previous loan will be paid.

Closing Costs

Similarly to purchasing a home, you will pay closing costs if you refinance. Common closing costs include:

- Appraisal fees

- Lender origination fees

- Credit report fees

- Attorney fees

If you only need a small loan, review whether the closing costs may negate what you will be saving with a lower interest rate.

To avoid paying closing costs upfront, you may be able to roll them into your new mortgage. However, in this case, you may pay a higher interest rate. If you take out another 30-year mortgage or you refinance at a higher interest rate, you may pay more interest in total. Shop multiple lenders to make sure you are getting the most competitive terms and rates.

Changing Loan Terms

With cash-out refinancing, you will pay your original mortgage and then replace it with a new mortgage. As a result, since your new mortgage may take you a longer amount of time to pay off, your interest rate may change, and your monthly payment may be adjusted.

For example, if you have an adjustable-rate mortgage (ARM), you may want to replace it with a fixed-rate mortgage. Alternatively, you may want to switch to an ARM if you began with a fixed-rate mortgage. Whatever you choose, make sure you review your lender’s Closing Disclosure and analyze the new loan terms.

How a Cash-Out Refinance Works

The steps involved in the cash-out refinancing process are similar to the steps of purchasing a home. After determining that you meet the requirements for a cash-out refinance, you select a lender, submit your application, get approval and receive your check.

How to Qualify for a Cash-Out Refinance

Since lenders take on more risk with cash-out refinancing, it can be a bit harder to qualify. However, every lender sets their own requirements for determining which homeowners qualify for a cash-out refinance. The following are some of the common requirements for a cash-out refinance:

- Equity in your home: If you want to pursue a cash-out refinance, you need to have equity in your home. Unless you are eligible for a VA refinance or another exception, you may not be able to cash out all of your home equity, so you may want to carefully review your current equity before committing to a refinance and ensure you can convert enough to meet your goals.

- High or improved credit score: For a cash-out refinance, you typically need a score of at least 600. If you have a high credit score, you’re more likely to qualify for a cash-out refinance and more likely to get a lower interest rate.

- Low credit utilization: If you are concerned about your credit score, you may want to review your credit utilization. Generally, it is recommended to keep your credit utilization below 30%. This means you use less than 30% of your total credit limit. If you have a credit limit of $3,000, this means spending less than $900.

- Low debt-to-income ratio: Your debt-to-income (DTI) ratio refers to the total amount of your monthly payments and debts divided by your monthly income. If you pay a total of $2,000 per month in bills, for instance, and your total income per month is $5,000, your debt-to-income ratio is $2,000 divided by $5,000, which is 40%. Keeping your DTI ratio as low as possible can make you more likely to qualify for a cash-out refinance.

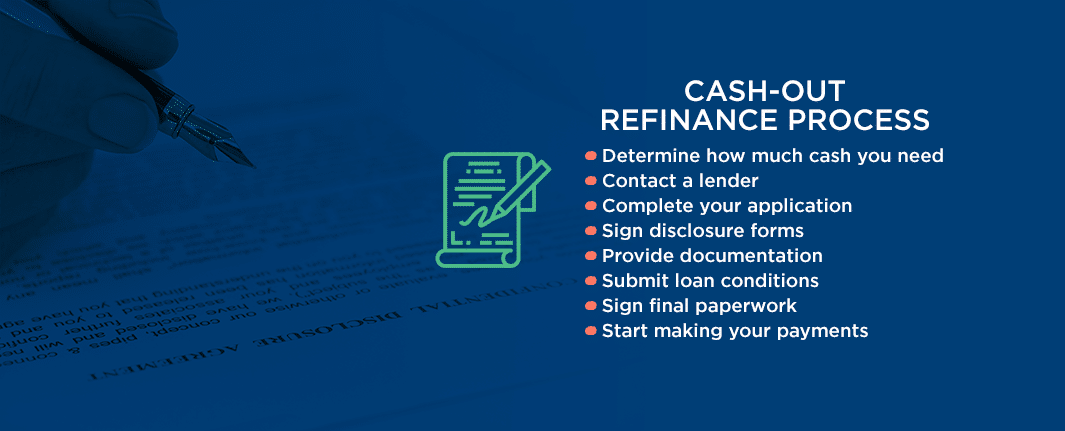

Cash-Out Refinance Process

The following are the steps in the cash-out refinancing process:

- Determine how much cash you need: After you determine that you meet the requirements to qualify for cash-out refinancing, you may want to do some math to determine how much you need for your goals. If you want to perform renovations or repairs, for example, you may want to get estimates from contractors. If you plan on consolidating your debt, you may want to review your bank and credit card statements to determine how much cash you’ll need to pay your debts.

- Contact a lender: At Assurance Financial, we strive to make your refinancing process as fast and painless as possible. You can get pre-qualified in as little as 15 minutes and receive a no-obligation quote. We offer every type of mortgage loan available, and we can provide you with a credit check and a rate quote for free.

- Complete your application: When you’re ready to pursue a cash-out refinance, you can start your application with us by speaking with one of our loan officers.

- Sign disclosure forms: At Assurance Financial, we will send your initial disclosures to sign. You can also use this opportunity to ensure you’re achieving your goal and to verify your loan terms.

- Provide documentation: After you sign your disclosures, you will provide your documentation, such as income and asset verification.

- Submit loan conditions: Next, we will send your paperwork to an in-house underwriter who will inform us about any additional items that are needed.

- Sign final paperwork: After you are approved for your cash-out refinance, you will sign your final paperwork with a notary.

- Start making your payments: At this point, the refinancing process is complete. After the funding process, you’ll start making payments in 30 to 60 days on your new mortgage.

Getting Approved for a Cash-Out Refinance

After applying for cash-out refinancing, you will receive the decision from your lender about whether you have been approved for the refinance. Your lender may request financial documents, such as W-2s, pay stubs or bank statements as proof of your debt-to-income ratio. After you are approved, your lender will guide you through the next steps.

Cash-Out Refinance FAQ

Do you have additional questions or concerns about cash-out refinancing? The following are a few of the most frequently asked questions we receive about cash-out refinancing:

1. Can I refinance and roll auto loans into my mortgage?

Yes, any debt can be paid off with cash out of your home. You cannot necessarily “roll” the debt, but you will get an account, like a checkbook, and you can make it payable to anything you want.

2. If I have a home equity loan, can I consolidate that into my mortgage if I refinance? What about with HELOC?

Yes, a lot of homeowners choose to do this, and some choose to open another equity line.

3. Can I consolidate student loans into a mortgage?

Yes, you can consolidate your student loans into your mortgage. This is also referred to as debt reshuffling, and it can be particularly attractive to those who have sufficient home equity.

4. Do I need to pay taxes on a cash-out refinance?

Since the cash you take out through a cash-out refinance is a loan, it is not considered income by the IRS. As a result, you don’t need to report it when filing your taxes, though you may get a beneficial tax deduction if you do report it. To better understand your options, speak with a tax professional.

Learn More About Cash-Out Refinancing From Assurance Financial

Are you ready to refinance? At Assurance Financial, we have been servicing loans to customers since 2001. When you choose to work with us, you can speak with one of our loan officers. Our loan officers are available across multiple states, and they have the expertise and knowledge needed to guide your cash-out refinancing and find the best deal available to you.

We will aim to find you a competitive rate or a deal that lets you draw on your equity. Contact us at Assurance Financial to learn more about cash-out refi requirements or apply for a new loan today.

Sources

- https://assurancemortgage.com/four-signs-you-should-refinance-your-mortgage/

- https://assurancemortgage.com/about-us/

- https://assurancemortgage.com/find-a-loan-officer/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/apply/