Whether you’re a first-time homebuyer or a homeowner looking to refinance your mortgage, the financial logistics of homeownership may have you asking some big questions. When considering your home loan options, one of the primary criteria to evaluate is the type of interest rate you’ll have: a fixed-rate vs. an adjustable-rate mortgage.

Interest is the amount of money your lender charges you for using their services, calculated as a percentage of your loan amount. Interest rates can be fixed or adjustable. The type of interest rate you choose depends on many factors, and the best type of loan for your situation may even change over time.

From receiving your first mortgage to refinancing for a better rate, this guide will walk you through everything you need to know about interest rate types so you’ll be a more informed homebuyer!

What Is a Fixed-Rate Mortgage?

Fixed interest rates stay the same throughout the life of the loan. Mortgages typically last for 10-30 years, depending on your financial goals and repayment plan. Of the two primary categories, fixed-rate mortgages are the more straightforward option.

You might choose a fixed interest rate if overall rates are low when you buy a house you’re planning on owning for a while.

What Is an Adjustable-Rate Mortgage?

Adjustable interest rates fluctuate during the loan’s life. Usually, adjustable-rate mortgages (ARMs) start in an introductory period, where the loan’s interest rate stays the same for the first few months or years. After that period, the rate changes on a preset basis.

Adjustable interest rates are affected by the index, which is a measure of general interest rates. When the interest rate changes, your monthly payments on an ARM might change accordingly, depending on your loan and the circumstances set by your lender. Adjustable interest rates adjust on a set schedule.

On the terms of your adjustable-rate mortgage, you might see the adjustment rate written out as, for example, 5/1. The first number is how many years the introductory period will be — in this case, five years. The second number is how much time elapses between rate adjustments — in this case, one year.

You might choose an ARM if you’re only planning on owning the house for a few years. Since introductory rates often last for the first several years, you might be interested in buying a house with an ARM and then selling or refinancing before the introductory period ends. You might also choose this type of loan if you think interest rates will continue to fall in the future.

How Are Interest Rates Determined?

Your mortgage lender gives you an interest rate based on how risky they think lending money to you will be. The riskier the loan, the higher the interest rate.

Some factors affecting your interest rate are within your control. The lender looks at how you manage money and determines how responsible you are with your finances. People who are more responsible are generally rewarded with lower interest rates.

Credit Score

Your credit score plays an important role in the interest rate you receive. Your credit score is a number usually ranging from 350 to 850 that indicates your credit and repayment history. The higher the number, the better you are at repaying your loans and managing different lines of credit.

Mortgages are a type of loan that often span multiple decades. Your lender wants to make sure they can trust you to make regular repayments over the life of the loan, even as your life and financial circumstances change, as they’re bound to over 30 years.

People with scores of 740 or higher tend to receive the lowest interest rates. Conversely, the lower someone’s score is, the higher their interest rates will be. People with credit scores under 699 might also find it more difficult to be eligible for mortgage loans at all.

Even slight differences in credit scores can add up to tens of thousands of dollars over time. For instance, someone with a score of 680-699 might have an interest rate that’s 0.399% higher than someone with a score of 760-850. If the mortgage is $244,000, the person with a lower credit score would end up paying about $20,000 more in interest than the person with the higher credit score.

To establish credit and build your credit score, try the following tips:

- Get a credit card: Build your credit history with smaller monthly payments on a credit card, keeping in mind the credit limit and interest rate of your particular card to ensure responsible spending.

- Take out multiple loans: Having a mix of credit can help boost your credit score. Reliably paying off car and student loans, for example, is another way to show lenders you’re already a responsible borrower.

- Report loans and other regular payments: If you have a credit card or other loans, those companies and lenders should already be reporting your activity to credit bureaus. Additionally, if you’re new to building credit, you can report your rental and utility payments. Having a good history of paying rent and utilities on time can sometimes help lenders see how responsible you are.

As with any financial endeavor, responsibility is key. Paying off your balances in full and staying on top of repayment schedules is highly recommended so you can establish good credit and stay out of debt.

Loan-To-Value Ratio

A loan-to-value ratio is the amount of the loan compared with the price of what the loan is for. For example, a $20,000 down payment on a $100,000 house would leave you with a mortgage of $80,000. That means your ratio would be 80% since you’d be borrowing 80% of the home’s value.

The bigger your down payment, the lower the loan-to-value ratio, which usually results in a lower interest rate. The smaller your down payment, the higher the ratio, which is riskier for the lender, possibly resulting in a higher interest rate for you.

Loan Term

In general, even though shorter-term loans have higher monthly payments than longer-term loans, paying off a loan over a shorter amount of time means you pay less interest, lowering the total cost you pay over the life of the loan. Because of this, shorter-term loans usually have interest rates that can be as much as 1% lower than those of longer-term loans.

Property and Location

The type of property you buy might also affect your interest rate. Loans on manufactured houses and condominiums, as well as investment properties and second houses, are typically riskier. Borrowers are more likely to default on a loan — stop making regular payments — for properties that aren’t their primary residence or for houses on land they don’t own. Riskier loans usually come with higher interest rates.

The location of the house you buy may also affect your interest rate, as lenders sometimes offer different interest rates in different states or counties. The interest rate for a house in a rural area, for example, might look different from the rate in an urban area.

While you can take steps to be in good financial standing and plan a home purchase with minimal risk, some factors that can affect the interest rate you receive are beyond your control, including the following two considerations.

The Economy

General economic growth means more people can afford to buy houses. More buyers in the housing market mean more people applying for mortgages. For lenders to have enough capital to lend to an increased number of people, they need to drive interest rates higher. In contrast, when the economy is slow, mortgage demand decreases, and lenders can offer lower interest rates.

Inflation

When prices of goods rise, a dollar loses buying power. A certain amount of money that could place a good down payment on a house 20 years ago would cover a smaller percentage of the price of a similar house today. To compensate for the regular shifts in inflation, lenders apply higher interest rates to their loans.

As you look into buying a home, you may want to keep an eye on broad economic trends, and, if possible, adjust your buying process to reflect times when the overall market is offering lower interest rates.

[download_section]

What Are the Similarities Between Fixed and Adjustable Rates?

Fixed-rate mortgages and ARMs are different loan types, but they both have the same eventual goal — to help you finance your dream of owning a home.

The same factors determine the starting interest rates of both types of mortgages. Your credit score and overall financial situation, as well as general economic shifts, can help or hinder your ability to get a low rate. From there, you either keep that rate for the length of the loan or have it be your starting point for future changes.

What Are the Differences Between Fixed and Adjustable Rates?

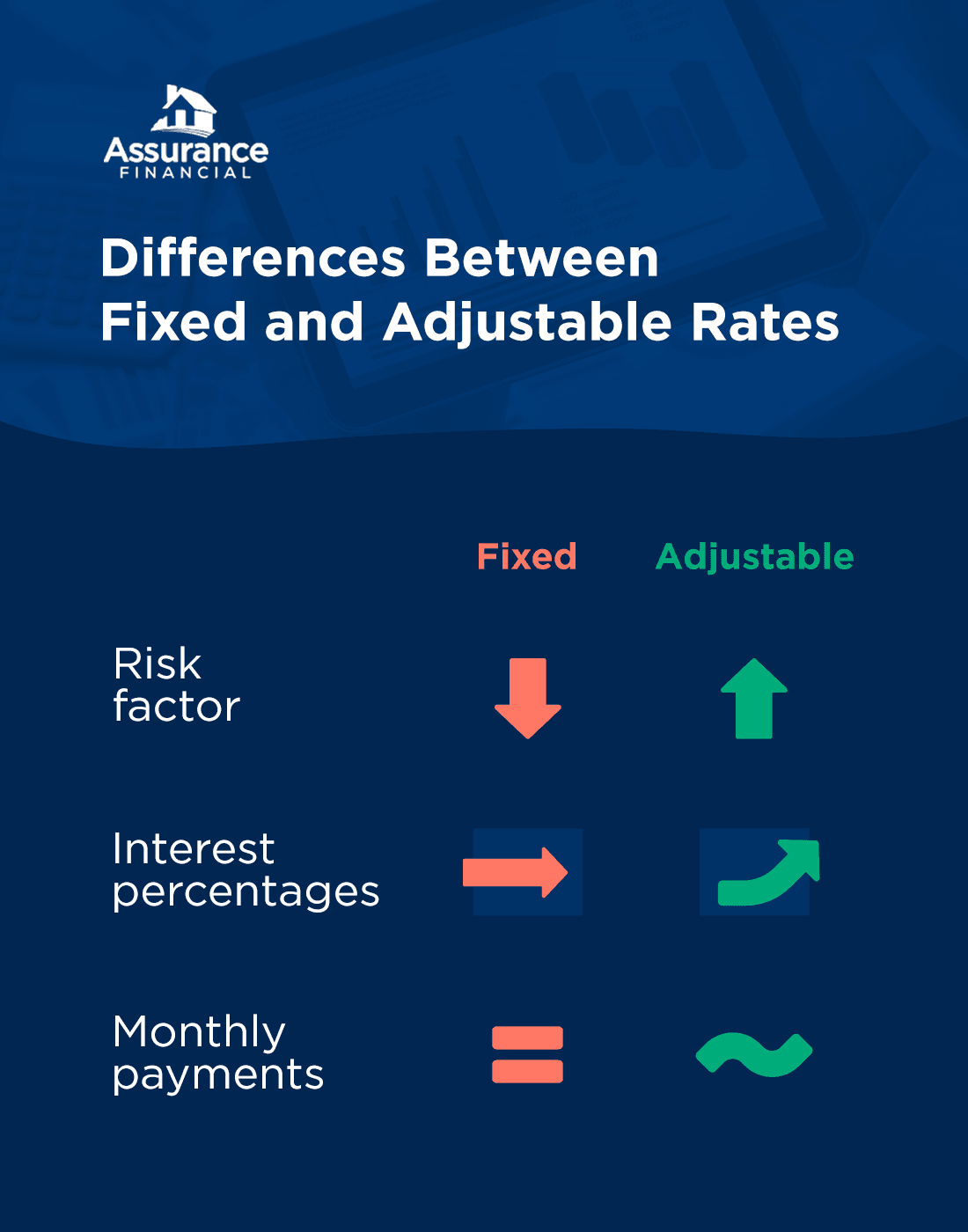

The main difference between fixed and adjustable interest rates is that fixed rates stay the same, while adjustable rates can fluctuate depending on the market. Some of the other major distinctions include:

- Risk factor: Since fixed-rate mortgages offer the same interest rate for the duration of the loan, they’re less risky than the uncertainty that can come with adjustable-rate mortgages.

- Interest percentages: Fixed-rate loans often have higher interest rates than the rates during ARM introductory periods. After the introductory period, however, ARM rates may rise higher than the fixed rates for comparable loan situations.

- Monthly payments: With fixed-rate loans, the monthly mortgage payments stay the same throughout the loan’s life. With ARMs, your monthly mortgage payments will fluctuate to reflect the economic changes that shift your interest rates.

From 2008 to 2014, 85%-90% of homebuyers chose a fixed-rate mortgage, up from the historical percentage of 70%-75% of buyers. In that same time span, 10%-15% of homebuyers chose an ARM, down from the historical percentage of 25%-30% of buyers.

Despite the wide gap in those statistics, neither fixed- nor adjustable-rate mortgages are inherently better than the other, because all home-buying situations and financial circumstances are unique. Both types of mortgages have benefits and drawbacks that you should consider in light of your personal finances and needs.

What Are the Pros of Fixed-Rate Mortgages?

Fixed interest rates offer many benefits, including:

- Rate stability: If market interest rates are low when you get your mortgage, you’ll keep that low rate for the duration of your loan. You can strategically pay less in interest by buying a home while interest rates are low.

- Protection: A fixed rate protects you from sudden rises in market interest rates.

- Consistent payments: Fixed-rate mortgages allow you to create a steady budget because your monthly payments stay the same for as long as you own your home. You’ll always have a good idea of what your housing costs will be month to month and year to year.

What Are the Cons of Fixed-Rate Mortgages?

The biggest drawback of fixed interest rates is the potential for receiving a high interest rate for the entire life of your loan. If market interest rates are higher than average when you buy your house, you’ll pay a high amount of interest. Even if market rates drop after you’ve taken out your mortgage, you’ll still have to pay the high rate you started with.

If you’re interested in getting a fixed-rate mortgage, it could be helpful to monitor the market and wait for a time when the interest rates are low before moving forward with your home purchase.

What Are the Pros of Adjustable-Rate Mortgages?

When considering your loan options, you may choose an ARM over a fixed-rate mortgage for several reasons, including:

- Lower upfront costs: When you first take out an ARM, the introductory rate is usually lower than the market rate for a comparable fixed-rate mortgage. The low fixed introductory rate gives you a good deal for the first few years. Lower initial payments may even let you qualify for a larger loan, making it possible for you to buy your dream house.

- Rising interest protections: Most ARMs have a rate cap, which keeps their interest rates from rising above a set percentage. The cap can be for each adjustment — so your rate never rises above a certain point each time it goes up — or for the life of the loan, so your rate never ends up being more than a certain percentage total.

- Future rate drops: The flexibility of an ARM means your interest rate could drop even lower at certain points in the future. This potential for automatic drops lets you take advantage of lower interest rates without refinancing your loan.

What Are the Cons of Adjustable-Rate Mortgages?

Smart financial decisions look different for everyone. The disadvantages of ARMs include:

- Future rate rises: While ARMs are appealing during times of low market rates, if rates unexpectedly rise, you could pay higher monthly payments than initially planned.

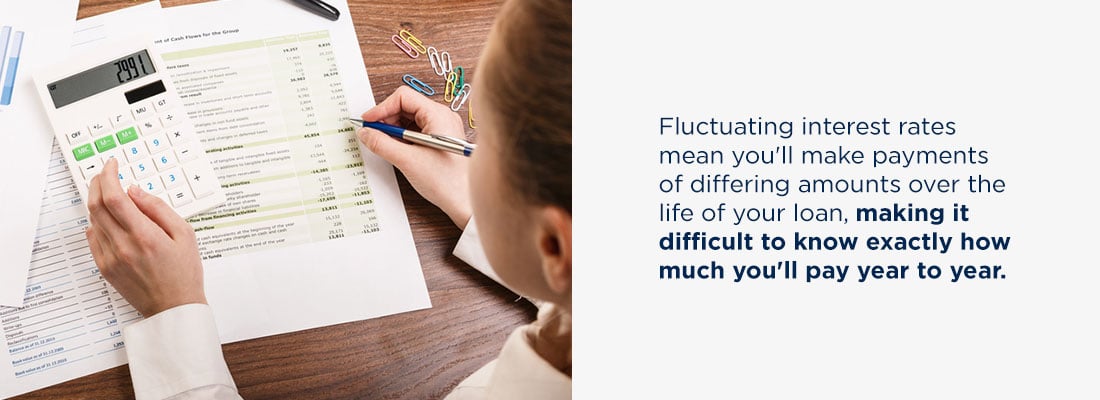

- Budgeting difficulties: Fluctuating interest rates mean you’ll make payments of differing amounts over the life of your loan, making it difficult to plan ahead and know exactly how much you’ll pay year to year. However, other total monthly payments associated with your house or property can still change from month to month, such as property taxes, homeowners insurance or mortgage insurance. If you’re already prepared to pay fluctuating bills each month, you may feel more comfortable with the changes in your loan payments due to adjustable interest rates.

- Unexpected rate rises: A drop in interest rates doesn’t always decrease your monthly payments after new adjustments dates. Some ARM interest-rate caps stop your rates from rising too high all at once but may carry over the remaining percentage points from previous increases to years where the interest rates don’t change much. So, even if you don’t think your interest will rise one year, it could rise anyway due to overflow from previous years.

Additionally, many people take advantage of their low introductory period rate to buy a house they plan on selling before their rates change and potentially rise. However, this plan is risky. Changes to your moving schedule or unexpected life events might mean you’ll own your current house for longer than you planned.

During this time, your adjustable interest rate could rise beyond what you were planning to pay. ARMs have plenty of benefits, but with unexpected market shifts, it’s not safe to assume they will help you avoid paying more in the long run.

Why Would You Refinance to Change Your Interest Rate Type?

Refinancing a loan means taking out a second mortgage and using it to pay off and replace your first mortgage. Refinancing can be an important option to consider, especially if your high interest rate has you wondering if you can get a better deal. While refinancing is a major responsibility, it might serve you well depending on the type of mortgage you already have.

The terms of your current loan and the state of the economy might make you want to refinance your home loan and change the type of loan in the process.

Adjustable to Fixed

There are potential benefits to switching from an adjustable-rate mortgage to a fixed-rate mortgage. The switch might set you up with a lower rate that you can keep for the remaining duration of your loan. If you want to buy a house while interest rates are high, getting an ARM and refinancing to a fixed-rate mortgage when interest rates decrease can be a cost-effective solution.

Additionally, switching to a fixed rate can release you from the uncertainty that comes along with adjustable interest rates. If the economy goes up or down, your new fixed rate will stay the same, which can benefit you — especially when adjustable interest rates spike.

Fixed to Adjustable

If you have a fixed-rate mortgage and want to switch your interest rate due to a drop in overall rates or an improvement to your credit score that would make you eligible for a lower rate, you would most likely need to refinance your loan.

If you’re planning on selling your house soon, however, refinancing to an adjustable-rate mortgage may not be the best idea. Sometimes, refinancing comes with long-term benefits you receive after a while. If you don’t think you’ll own your house long enough to start reaping those benefits, then staying with your current loan is the smartest financial option.

How Should You Prepare to Get the Most Out of Your Mortgage?

As you embark on the journey of buying or refinancing a home, you’ll want to be as ready as possible to receive the best interest rate for your financial situation. When thinking about applying for a mortgage, keep the following tips in mind:

- Build credit: Open new lines of credit well in advance of applying for a home loan. By doing so, you’ll have already-established credit that can help you later on.

- Look ahead: Consider any additional loans or major expenses you may need to pay in the future. Think about whether making a big home purchase is the best use of your finances at this time.

Let Assurance Financial Help You Find a Loan for Your Home

Buying a house is an exciting time in your life. Choosing the right mortgage for you and your family can help make the time spent in your new home even more enjoyable.

Whether you’re looking for a fixed-rate mortgage or interested in the benefits of adjustable interest rates, Assurance Financial is here to help. We will walk you through every step of the process, from deciding what kind of mortgage is best for you to giving you all the information you need to apply and get approved for your home loan.

Get in touch with us today to start your road to homeownership!

Linked Resources:

- https://assurancemortgage.com/finding-right-mortgage-loan-for-you/

- https://files.consumerfinance.gov/f/201204_CFPB_ARMs-brochure.pdf

- https://assurancemortgage.com/mortgage-term-glossary/

- https://www.investopedia.com/articles/personal-finance/080615/highest-credit-score-it-possible-get-it.asp

- https://www.nerdwallet.com/article/mortgages/how-are-mortgage-rates-determined

- https://www.forbes.com/advisor/mortgages/how-your-credit-score-affects-your-mortgage-rates/

- https://assurancemortgage.com/how-to-build-credit-to-get-loan/

- https://www.nerdwallet.com/article/mortgages/loan-to-value-calculator

- https://www.consumerfinance.gov/owning-a-home/loan-options/#interest-rate-expand-header

- https://www.consumerfinance.gov/about-us/newsroom/manufactured-housing-loan-borrowers-face-higher-interest-rates-risks-and-barriers-to-credit/

- https://www.nerdwallet.com/mortgages/mortgage-rates/investment-property#:~:text=Your%20interest%20rate%20will%20generally,that’s%20not%20your%20primary%20residence.

- https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

- https://www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/

- https://www.investopedia.com/terms/f/fixed-rate-payment.asp

- https://www.investopedia.com/terms/a/arm.asp

- https://www.investopedia.com/mortgage/mortgage-rates/adjustable-rate-go-up/

- https://assurancemortgage.com/is-refinancing-a-bad-idea/

- https://assurancemortgage.com/contact-us/