For the majority of home buyers, getting a mortgage is part of the process of purchasing a new home. In 2018, 86% of buyers took out a mortgage to buy their home. If you’re considering becoming a homeowner, you might wonder if it’s difficult to get a mortgage now or if it is the best time to shop for a mortgage loan. The truth is that the right time to apply for a mortgage will be different for every buyer. Your credit history, how much you have saved up and your income and employment history are just a few things that can determine whether you’ll qualify for a home loan and what type of interest rate and terms you’ll be offered. Some factors, such as market rates and time of year, also play a role when it comes to the best time to get a mortgage, but are usually beyond your control.

If you’re considering becoming a homeowner and are wondering if the time is right, get to know the factors that affect your mortgage eligibility and what you can do to make yourself a better candidate.

When Your Credit Score Is Ready

Any type of loan brings with it some amount of risk, for you as the borrower and for lenders. One way lenders can protect themselves is by offering the best terms to people who have the highest credit scores. If a lender determines that a potential borrower’s credit history isn’t good enough, they may reject a person’s mortgage application entirely.

As a general rule, the higher your credit score, the better your chances of being approved for a mortgage. You’ll also get a lower mortgage rate if you have a very good or excellent score. When determining your eligibility, most lenders use your FICO score, which is pulled from each one of the three credit reporting agencies. FICO scores range from 300 to 850, and the closer you are to 850, the better your score. Scores above 800 are “excellent” or “exceptional” while scores between 740 and 799 are very good. Any score below 580 is considered poor. If your score is in that range, it can be challenging to get any type of loan, let alone a mortgage.

The great thing about credit scores is that they aren’t fixed in stone. Your score likely fluctuates from month to month based on your current debt situation and whether you have and use credit cards. If you’re interested in applying for a mortgage, but don’t have a very good or excellent score just yet, there are things you can do to bring that score up. If you have a lot of debt, you can focus on paying it down. If you’ve fallen behind on payments, getting current and committing to paying everything on time will help to raise your score.

It’s also worth noting that mortgage programs allow people who don’t have the best credit scores to qualify for a home loan. Loans backed by the Federal Housing Administration (FHA), Department of Agriculture (USDA) and the Department of Veterans Affairs (VA) are examples of government mortgage programs available to people who might have credit scores in the 500 or 600 range. The mortgage programs do have certain restrictions and might require you to pay for private mortgage insurance, but they can be a good choice if you’re ready to buy a house and your credit score isn’t where you’d like it to be.

When You Have a Stable Income

Although it’s impossible to say what’s going to happen in the future with any certainty, lenders typically want to see proof that you have had steady employment and a stable income. To do that, they will look at several years’ worth of your tax returns. Ideally, your tax returns will show a constant or steadily increasing income over the years. Along with checking your income, lenders will also usually review your employment history. They often want to see that you’ve been with the same employer for at least two years. If you are self-employed, lenders will want to see at least two years of self-employment income.

Having a history of stable income not only influences whether or not you’ll qualify for a mortgage. It also influences how much house you can afford to purchase. Typically, a lender will want your total mortgage payment — including taxes, homeowners insurance and private mortgage insurance — to be between 25 and 28% of your gross monthly income. If you earn $6,000 per month, a mortgage payment between $1,500 and $1,680 should be comfortable for you.

Another way to calculate how much house you can comfortably afford is to multiply your annual income by two or three. If you earn $6,000 per month, your annual income is $72,000. That means a house between $144,000 and $216,000 is within your affordable range.

If you’re recently started working at a new job or are just getting started in your career, you might find that you need to wait a few years before you apply for a mortgage, to give your income and employment time to stabilize.

When You’ve Saved Enough

How much money do you need to have set aside before you can apply for a mortgage? Conventional wisdom says that you should have at least enough to put 20% of the price of the house down. If you’re purchasing a $200,000 home, you’d need to have $40,000 to put down. If you have that amount or 20% of the price of the home saved up, great. But not having that much money available doesn’t necessarily mean you won’t be able to buy a house or get a home loan.

Some programs, like VA and USDA loans, don’t require a down payment. Others, such as FHA loans, let you put down as little as 3.5%. You can also take out a conventional, or non-government-backed mortgage with as little as 3% down.

Although you can buy a house and get a mortgage with a small down payment, you should answer some questions to determine if it’s the right choice for you. The smaller your down payment, the larger your monthly mortgage payment. Can you afford the bigger monthly payment? If you put down less than 20%, you’ll also be responsible for paying private mortgage insurance premiums. How long you need to pay the premiums depends on the type of loan you get. The amount of the premiums depends on the size of your down payment. Your premiums will be lower if you put down 10% compared to putting down 3 or 5%. Will you be able to afford the cost of the premiums?

In addition to the down payment, you’ll need to have enough cash to cover closing costs and to create a cushion in case anything in the home needs repair or replacement after you’ve purchased it. Often, it’s recommended to have between 1 and 3% of your home’s value set aside in cash to cover the cost of repairs and maintenance. The age and condition of your home also influence how much you should save up before purchasing it. You might want to have a larger reserve for an older home with fewer updates. If the home is newer or was more recently updated, you can often safely have a smaller home repair emergency fund.

Additional Factors to Consider Before Shopping for a Mortgage

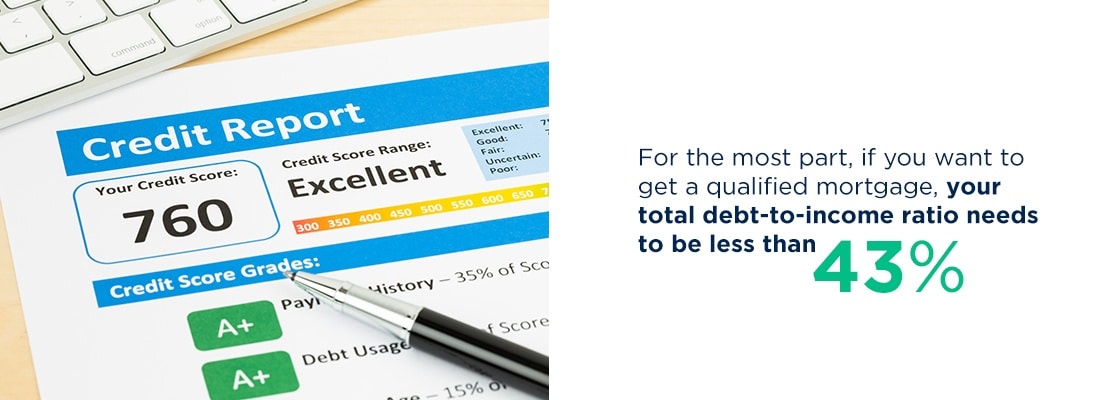

While your credit score, income and savings are three of the biggest things that determine whether or not it’s the best time to close on a mortgage, a few other factors also come into play. One of those factors is the amount of other debt you currently have. For the most part, if you want to get a qualified mortgage, your total debt-to-income ratio needs to be less than 43%. Your debt-to-income ratio is a comparison of the amount you earn each month to what you pay towards loans and debts.

Let’s say you earn $6,000 a month. You have credit card debt with a monthly payment of $100 and student loan debt with a monthly payment of $400. So far, your debt to income ratio is a little more than 8%. You’re also interested in buying a house that would have a mortgage payment of $1,600 per month, including taxes and insurance. Added to the $500, your total debt climbs to $2,100 and your debt-to-income ratio becomes 35%.

If your credit card payments were $500 per month and your student loan payments were $800, it would be more of a stretch to get approved for a mortgage with a $1,600 monthly or to afford to borrow that much. With an income of $6,000, a mortgage payment of $1,600 and other debts totaling $1,300 per month, your debt-to-income ratio would be 48%.

Another thing to consider when trying to decide if it’s a good time to apply for a mortgage is the amount of tax you’ll need to pay for the property and how having a mortgage will affect your tax bill. If you itemize your deductions when you file your tax return, you can deduct what you pay in interest on your mortgage for loans under $750,000 that were taken out after 2017. Since the standard deduction is now $12,200 for single filers and $24,400 for joint married filers, itemizing to deduct your mortgage interest might not save you any money.

The property tax rate in your area and the value of your home will affect your monthly mortgage payment. When you’re shopping around for a home loan, it’s important to know what the tax rate is and how much of your monthly payment will go towards taxes. If you want to live in an area with high property taxes, you might find the value of the home you can afford is lower than if you were to consider buying in an area with lower taxes.

The Mortgage Business Cycle

As you get ready to apply for a mortgage, it can be helpful to pay attention to the time of the month. For many lenders, the beginning of the month is when they are trying to get the most applications, while the middle of the month is the time to gather all the supporting documents and to prepare loans for final approval. The end of the month is often the best time to close on a mortgage for lenders and borrowers.

If you reach out during the first week of the month, or on the first day of the month, a lender is likely to be less pressed for time and more available to see to your needs. That’s not to say that you should only try to get a mortgage at the start of the month. Lenders are available at all times. But if you want the most attention, it can be helpful to contact a lender earlier in the month rather than later.

Apply for a Mortgage When You’re Ready

There’s really no one “right” time to apply for a mortgage. Your friend might be ready to apply for a home loan when they have enough saved to put 10% down and they have a credit score of 760. You might not feel ready to make the jump into homeownership until you have at least 20% saved for a down payment and your credit score is at least 800. Your income also plays a big role in helping you determine when you’re ready. If your housing payment will be more than 25 to 28% of your monthly income, you might want to hold off on purchasing until your income is higher or you have more saved up, since a larger down payment would bring down your monthly payment.

If your credit is very good or excellent, you have a stable income and you have enough saved up, you might still decide to hold off on applying for a mortgage due to your current lifestyle. You might not be sure how long you’ll stay in an area, for example. Usually, it’s a good idea to wait to buy until you’re sure that you’ll be staying put for at least a few years. What you plan on doing with your life over the next few years might also influence whether or not you’re ready to buy a home and get a mortgage. Having a child or getting married are usually two life changes that cause people to seriously consider homeownership.

If there’s a big change in your life, later on, you can always make adjustments, such as selling your home and upgrading to a bigger property, as needed.

APPLY TODAYAssurance Financial Can Help You Decide When the Time Is Right to Get a Mortgage

At Assurance Financial, our goal is to help our customers achieve the American dream of homeownership. We want to help you find the right mortgage for you, at the right time for you – no matter what stage you are in your life. Our mortgage experts are licensed in 43 states and are happy to work with you to guide you towards a home loan customized to you. If you’re ready to get started, apply today.

Sources:

- https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers#financing

- https://www.myfico.com/credit-education/credit-scores

- https://assurancemortgage.com/first-time-homebuyer-programs/

- https://www.bankrate.com/mortgages/how-your-credit-score-affects-your-mortgage-rate/

- https://www.nerdwallet.com/article/mortgages/credit-score-affects-mortgage-rate

- https://www.fdic.gov/consumers/consumer/moneysmart/podcast/documents/borrowing-money-how-much-mortgage-can-i-afford.pdf

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791/

- https://www.thebalance.com/how-much-home-can-you-afford-mortgage-rule-of-thumb-1289846

- https://singlefamily.fanniemae.com/media/20786/display

- https://www.realtor.com/advice/finance/home-repair-emergency-fund/

- https://www.irs.gov/publications/p936

- https://www.businessinsider.com/the-best-time-to-buy-a-home-according-to-a-mortgage-analyst-2018-9

- https://www.creditsesame.com/blog/mortgage/right-time-to-apply-for-a-mortgage/

- https://www.creditkarma.com/tax/i/buying-a-house-tax-tips/

- https://assurancemortgage.com/apply/

- https://www.quickenloans.com/learn/best-time-to-buy-a-house

- https://loans.usnews.com/when-is-the-best-time-to-get-a-mortgage

- https://www.usa.gov/tax-benefits