Different mortgage terms and rates can make the loan selection process confusing, especially if you don’t plan on keeping the loan for the full term. Use this calculator to determine the total cost in today’s dollars of various mortgage alternatives taking into account your opportunity cost of money.

3,500

Monthly fha Payment

Real APR

0

Monthly Taxes

208

Monthly Insurance

50

Up-Front MIP

0

Monthly MIP

0

Monthly Principal and Interest

0

Calculators provide estimates only. Estimates shown should not be considered exact payments. Contact your local loan officer for precise and personalized information. See full legal disclosures.

Legal Disclosures

The AFG mortgage calculator is for estimation purposes only. Results do not reflect all loan programs and are subject to individual program loan limits. Qualification, rates and payments will vary based on timing and individual circumstances. This is not a commitment to lend.

Here’s a payment example based on an average home price and the most common loan type:

Loan amount: $300,000

Loan type: 30-year Fixed-Rate Loan

Interest rate/APR: 7.375% (7.692% APR)

Monthly payment: $2,072.03

Points: 1.875 points, costs due at closing

Loan-to-value (LTV): 80.00%

One point is equal to one percent of your loan amount. Payment does not include taxes and insurance. The actual payment amount will be greater. Some state and county maximum loan amount restrictions may apply. Rates shown are valid on publication date of April 18, 2024.

1If you didn’t enter taxes and insurance amounts, an estimate of your taxes is based on the state selected. This does not include all fees.

Explore our wide range of calculators

3,500

Monthly va Payment

Real APR

0

Monthly Taxes

208

Monthly Insurance

50

VA Funding Fee

0

Monthly Principal and Interest

0

Calculators provide estimates only. Estimates shown should not be considered exact payments. Contact your local loan officer for precise and personalized information. See full legal disclosures.

Legal Disclosures

The AFG mortgage calculator is for estimation purposes only. Results do not reflect all loan programs and are subject to individual program loan limits. Qualification, rates and payments will vary based on timing and individual circumstances. This is not a commitment to lend.

Here’s a payment example based on an average home price and the most common loan type:

Loan amount: $300,000

Loan type: 30-year Fixed-Rate Loan

Interest rate/APR: 7.375% (7.692% APR)

Monthly payment: $2,072.03

Points: 1.875 points, costs due at closing

Loan-to-value (LTV): 80.00%

One point is equal to one percent of your loan amount. Payment does not include taxes and insurance. The actual payment amount will be greater. Some state and county maximum loan amount restrictions may apply. Rates shown are valid on publication date of April 18, 2024.

1If you didn’t enter taxes and insurance amounts, an estimate of your taxes is based on the state selected. This does not include all fees.

3,500

Monthly Payment

Real APR

0

Monthly Taxes

208

Monthly Insurance

50

Monthly PMI

0

Monthly Principal and Interest

0

Calculators provide estimates only. Estimates shown should not be considered exact payments. Contact your local loan officer for precise and personalized information. See full legal disclosures.

Legal Disclosures

The AFG mortgage calculator is for estimation purposes only. Results do not reflect all loan programs and are subject to individual program loan limits. Qualification, rates and payments will vary based on timing and individual circumstances. This is not a commitment to lend.

Here’s a payment example based on an average home price and the most common loan type:

Loan amount: $300,000

Loan type: 30-year Fixed-Rate Loan

Interest rate/APR: 7.375% (7.692% APR)

Monthly payment: $2,072.03

Points: 1.875 points, costs due at closing

Loan-to-value (LTV): 80.00%

One point is equal to one percent of your loan amount. Payment does not include taxes and insurance. The actual payment amount will be greater. Some state and county maximum loan amount restrictions may apply. Rates shown are valid on publication date of April 18, 2024.

1If you didn’t enter taxes and insurance amounts, an estimate of your taxes is based on the state selected. This does not include all fees.

Mortgage Terms Explained

While comparing mortgage options, let’s look at some essential terms:

- Opportunity cost: When you choose one mortgage option over another, you’ll pass up certain benefits associated with the mortgage you did not select. This loss is referred to as opportunity cost. As you compare different mortgage rates and benefits, consider what you’ll forgo with each option to make a well-rounded decision.

- Principal and interest: Most of your monthly mortgage payments will go toward the principal and interest. Principal is the amount you borrowed from your mortgage lender. It usually includes your home’s cost minus your down payment. The interest is a percentage of the principal you’re required to pay your lender to reward them for lending you money.

- Amount financed: The amount financed refers to the amount of money you borrow after making a down payment. It does not include fees or interest. For example, if you put $20,000 down on a $250,000 home, the amount financed is $230,000.

- Monthly PMI: Private mortgage insurance (PMI) is a type of insurance separate from homeowners insurance that you may be required to pay with your monthly mortgage. Lenders often require PMI for homebuyers taking out a conventional loan and making a down payment of less than 20% of the home price.

- FHA loan: A Federal Housing Administration (FHA) loan is insured by the government. The government does not directly make an FHA payment to the borrower but works with lenders to offer an FHA loan. FHA loans typically have a lower down payment than other loans and are a popular choice for first-time homebuyers or lower-income families.

- VA loan: A VA loan is backed by the Department of Veterans Affairs. This type of loan is available to qualified veterans to help them purchase a home. There are different types of VA loans, but they generally offer benefits like zero-dollar down payments and do not require monthly mortgage insurance.

- VA funding fee: A VA funding fee may be required with a VA loan. It’s a one-time payment made at closing. VA funding fees are calculated as a percentage of the loan amount. This percentage varies depending on factors like how much you put down on your home.

How Mortgage Interest Works

Interest rates vary between mortgages, so it’s essential to consider these rates before selecting a loan. Generally, you’ll pay less interest with a shorter-term loan but have higher monthly payments. Shorter-term loans are usually repaid in 10, 15 or 20 years.

A longer-term mortgage requires repayment over a greater period, commonly 30 years. Since your mortgage payments will be spread out over more time, your monthly payments will be less. However, you’ll accrue more interest with a longer-term loan, and it may come with a higher interest rate.

Other factors influencing interest rates include your credit score, income, loan size and the economy.

Speak With a Loan Officer

There are many factors to consider when selecting a mortgage. Experts are available to help you make sense of the process, conduct a mortgage cost comparison and find a loan suiting your needs.

At Assurance Financial, our licensed loan officers are happy to guide you through the entire loan selection and application process. Find your loan officer today to take the next step toward your home sweet home.

Explore our wide range of calculators

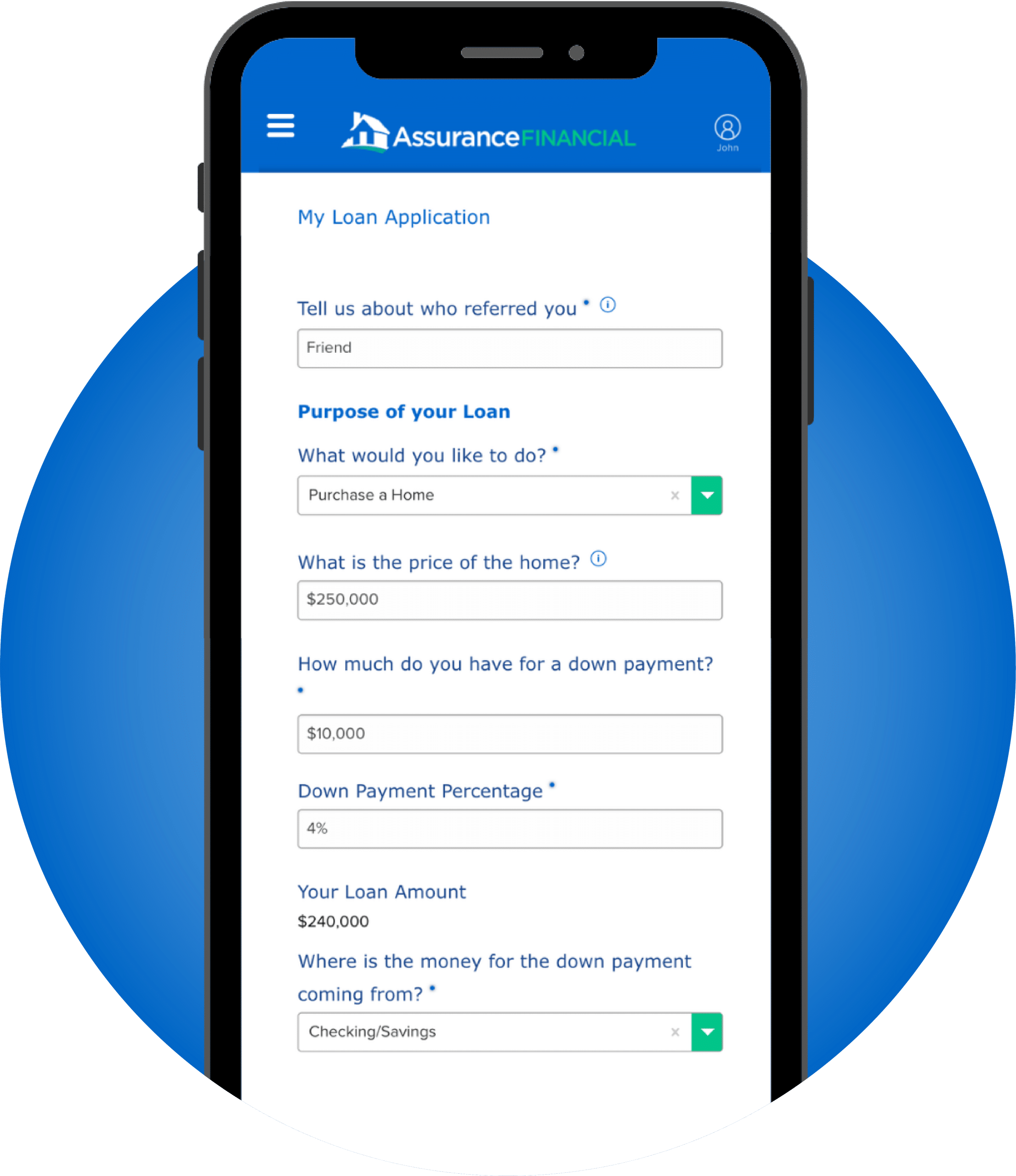

Need help with your application? We're here to lend a hand.

Our easy digital application walks you through every step of the process in terms you can actually understand. Plus, we’re always a phone call away if you get stuck.

APPLY NOW

Speak with an expert!

We have friendly experts to answer your questions. Find a loan officer licensed in your state.

Find A Loan Officer

Did we miss anything?

You still have questions, we still have answers. Take a look at what other people have been asking.

Read FAQs