When shopping for a home, you’ll want to feel comfortable understanding your future payments and weighing all your options. Assurance Financial offers online tools to make planning and budgeting easier when preparing for the homebuying process. Want to determine how much you can afford to pay on your monthly mortgage?

Use our mortgage affordability calculator to get an idea of what your payment could look like. Our online tool factors in the same criteria that lenders use —we consider your household income, how much money you have available in savings or other investments, monthly limitations or obligations such as car loans and student loan payments and your credit score to assess your home affordability.

You can afford up to

Monthly Total

0

Monthly Principal and Interest

0

Monthly Taxes

208

Monthly Insurance

50

Calculators provide estimates only. Estimates shown should not be considered exact payments. Contact your local loan officer for precise and personalized information. See full legal disclosures.

Legal Disclosures

The AFG mortgage calculator is for estimation purposes only. Results do not reflect all loan programs and are subject to individual program loan limits. Qualification, rates and payments will vary based on timing and individual circumstances. This is not a commitment to lend.

Here’s a payment example based on an average home price and the most common loan type:

Loan amount: $300,000

Loan type: 30-year Fixed-Rate Loan

Interest rate/APR: 7.375% (7.692% APR)

Monthly payment: $2,072.03

Points: 1.875 points, costs due at closing

Loan-to-value (LTV): 80.00%

One point is equal to one percent of your loan amount. Payment does not include taxes and insurance. The actual payment amount will be greater. Some state and county maximum loan amount restrictions may apply. Rates shown are valid on publication date of April 18, 2024.

1If you didn’t enter taxes and insurance amounts, an estimate of your taxes is based on the state selected. This does not include all fees.

Terms Explained

At Assurance Financial, we’re the people’s people! We want you to have all the information and resources you need while planning and decision-making. Unsure what something means? Here’s an overview of the terms our calculator uses to determine what your monthly mortgage payment could be:

- Annual income: An annual gross income is the amount of money made each year before deductions such as taxes are taken out. Yearly net income refers to the amount of money remaining after those deductions.

- Monthly debts: Monthly debts describe any payments made to repay a lender or creditor for borrowed cash. Some examples include car payments, credit card debt, student loans and alimony or child support.

- Estimated annual property taxes: An estimated annual property tax is based on the value of a property. When a homeowner pays these taxes, the funds go toward that community’s public services, including the costs of road maintenance and school programs.

- Estimated annual home insurance: The estimated annual home insurance describes the amount of money someone may pay to protect their home from potential risks, such as natural disasters, fire or theft each year. The insurance payments may offer financial coverage for repairs or replacement of the house and its contents if an unexpected event occurs.

- Down payment: An upfront payment describes a lump sum of money, based on a percentage of a purchase price, paid when someone purchases a property. The person receiving the goods or service agrees to pay the rest of the amount owed over time through a loan.

- Interest rate: Interest rates are expressed in percentages and describe the cost of borrowing money. The borrower often pays an additional amount of money to the lender with the principal loan amount owed. When considering your home loan options, one of the primary criteria to evaluate is the type of interest rate you’ll have: a fixed-rate vs. an adjustable-rate mortgage.

- Loan term: A loan term describes an amount of time until a final payment is due. Loan terms are usually expressed in the number of months or years a borrower agrees to make scheduled payments until the loan is paid entirely.

- Principal and interest: The principal refers to the original amount of money borrowed or invested. The interest is the additional amount a borrower agrees to pay for borrowing the money.

Next Steps

Want to feel more financially prepared for your upcoming purchases or lifestyle changes? Assurance Financial is here to help. To speak with an expert, search our database to find a loan officer near you today! Our loan officers will work with you to get an approved loan and offer guidance throughout the loan process.

Explore our wide range of calculators

Need help with your application? We're here to lend a hand.

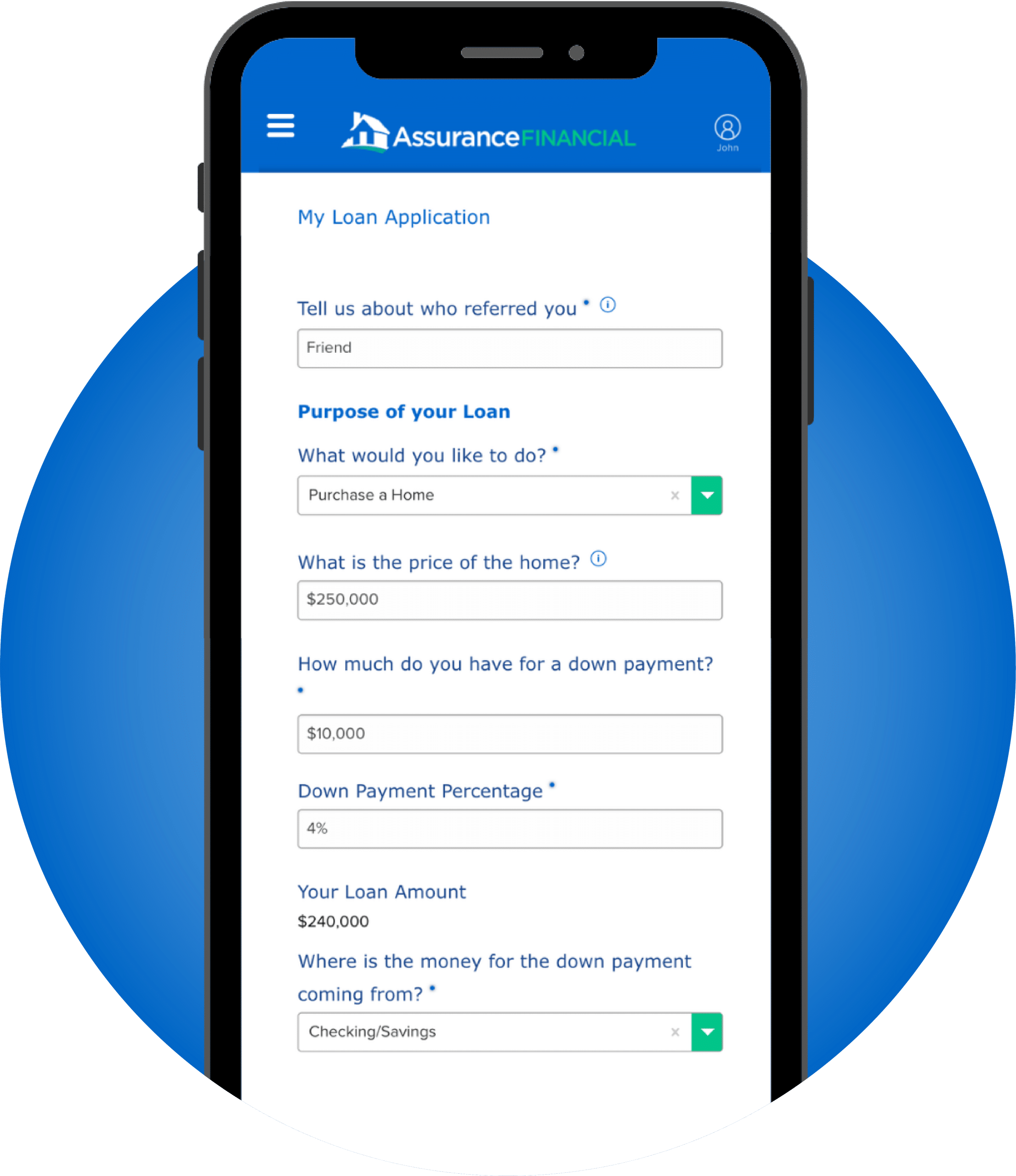

Our easy digital application walks you through every step of the process in terms you can actually understand. Plus, we’re always a phone call away if you get stuck.

APPLY NOW

Speak with an expert!

We have friendly experts to answer your questions. Find a loan officer licensed in your state.

Find A Loan Officer

Did we miss anything?

You still have questions, we still have answers. Take a look at what other people have been asking.

Read FAQs