Millennials are now the nation’s largest generation. While the exact ages of “millennials” can vary from study to study, the millennial generation typically includes people born between 1981 and 1996, making them around 25-40 years old. The Pew Research Center also uses these years to define the millennial generation.

The youngest millennials are now reaching the age where they may be thinking about buying real estate. Many older millennials are wanting to buy a home if they haven’t already. Unfortunately, millennials have some unique challenges when it comes to buying a home. If you’re at this stage in life, you may have some questions.

What Percentage of Millennials Are Buying Homes?

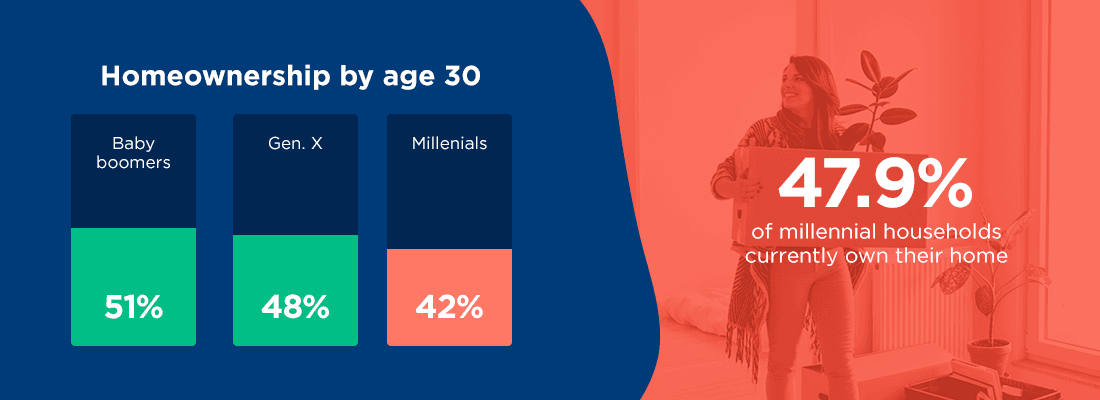

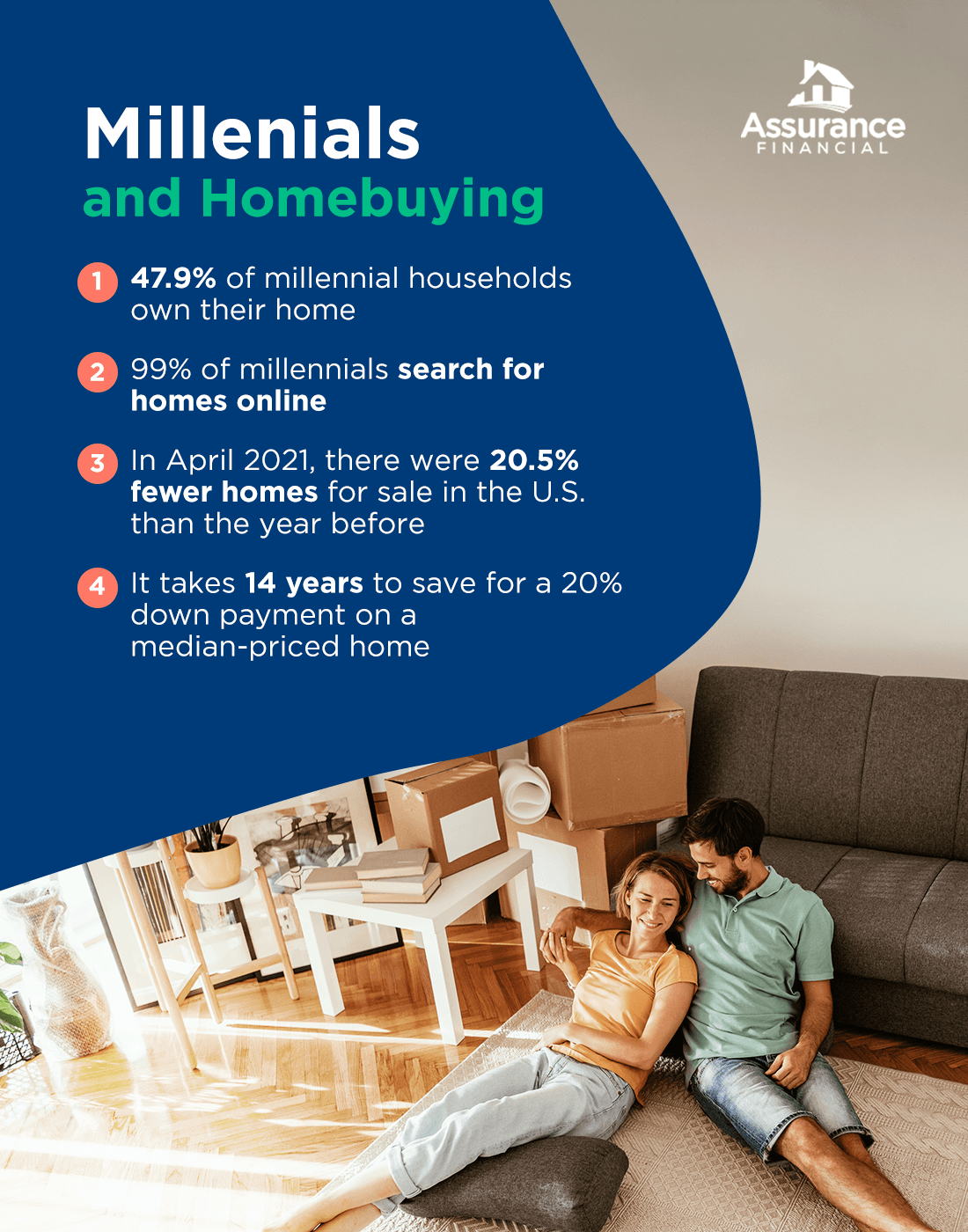

Currently, less than half of millennials own their homes. A study Apartment List published in February 2021 reported that 47.9% of millennial households own their home. This rate is below earlier generations, but it is growing as millennials increase in age.

The homeownership rate three years ago was only 40%. The current homeownership rate for Generation X is 69.1% and the rate for baby boomers is 78.8%. The millennial homeownership rate is increasing, but more slowly than it did for previous generations. Even so, millennials account for more than half of all new mortgages.

Comparing this rate another way shows that homeownership is generally decreasing. According to the 2021 Apartment List report, by age 30, millennial homeownership is only 42%. At the same age, Generation X was at 48% and baby boomers were at 51%. The previous year’s study reported that 35-year-olds in 1981 were almost 20% more likely to own their homes than 35-year-olds in 2016.

Many millennials are giving up on ever owning their own home. In 2018, 10.7% expected to rent forever. Then in 2019, the number rose to 12.3%. In 2020, the rate jumped to 18.2%. The majority of millennials cite affordability as one of the main reasons they can’t buy a home right now, but that’s not to say homeownership is unattainable. There are many loan programs designed to assist first-time homebuyers.

Why Should Millennials Buy a Home?

Buying a home has long been considered the “American Dream” and a sign of financial well-being. While some argue that millennials are killing the housing market, studies show that millennials do want to buy homes.

There are many reasons to buy a home instead of renting. Let’s go into detail about the main benefits:

1. Stability in Housing Costs

Owning your home means you’ll have more stability when it comes to your monthly housing costs. You won’t have to worry about lease terminations or rent increases. With a fixed-rate mortgage, you’ll have greater predictability in your costs year over year. While your property taxes and home insurance rates may fluctuate, the majority of your costs will not increase.

2. Forced Saving

Paying your mortgage is like being forced to save money. As you pay off your loan, you are gaining equity in your house. This is very different from paying rent. At the end of your lease, you don’t gain anything. After you’ve finished paying your mortgage, you own a very valuable asset worth tens of thousands of dollars. You’re more likely to spend some extra cash when you’re renting instead of saving it. With your mortgage, you’re basically requiring yourself to put money away where you can’t spend it.

3. Asset Ownership

Eventually, you will pay off your house. When you do, you’ll own a very valuable asset. You can continue living there mortgage-free. Once you own your home completely, a significant portion of your income will be freed up.

If you continue renting, the rent will likely go up a little every year or every few years, and it will never end. When you buy a home, it will end and you can live there at a much lower monthly cost. If you choose, you can also sell the house. Houses tend to appreciate in value, so you’re making an investment that could grow.

4. Tax Breaks

Another benefit of homeownership is the tax breaks. You could actually get a lot of money back in this way. There is the mortgage interest tax deduction, the mortgage tax credit, and the home sale tax exclusion. With the mortgage interest tax deduction, married couples can deduct the interest they pay on up to $750,000 of a home loan.

The mortgage tax credit applies to lower-income households that qualified for and received the Mortgage Credit Certificate. With this, you will receive a credit amount of the mortgage interest paid in the year. If you ever decide to sell your home, you can enjoy tax breaks with the home sale tax exclusion. This applies to capital gains of $250,000 for single people and $500,000 for married couples. You’ll have to pay tax on profits beyond these amounts.

5. Community

When you buy a house, you become part of the community. Homeownership is usually a long-term situation, and you’ll get to know the people around you. You can make friends with neighbors and become more tied to that place. A sense of community is an important part of living a long and healthy life.

6. Pets

Buying a home means you no longer have to worry about pet deposits, additional rental fees, and other problems that go with having pets in a rental. Many apartments don’t even allow pets, making it extra difficult if you ever need to move. When you own the home, you can have as many pets as you wish. Adopt that second, third or fourth cat or give a home to an adorable puppy!

7. Design Freedom

Another great thing about owning your home is the freedom to design it however you want. Aren’t you tired of removable hooks and sticky tack? Don’t you wish you could paint rooms a different color, or change up the layout of something? When you own your home, you don’t have to worry about what your landlord will charge to “fix” whatever you did. Nail that painting to the wall, paint your front door, and open up that room. These changes can improve how you feel about your home, and they may also add value to your property.

What Is the Mortgage Process?

The homebuying process today is much different than it was 20 years ago. At Assurance Financial, you can get pre-qualified online in just 15 minutes. We pull your credit and quote a no-obligation rate. Your loan advisor will help you decide what type of loan applies to your situation. There are conventional, VA, FHA, construction, modular home, jumbo loans, and more.

Once you’ve found the property you’d like to buy, you will complete a full application. Next is processing. This includes appraisal, underwriting, and approval of the loan. Then you sign with a notary to close your loan and get the funding. The entire process typically takes about 25 to 30 days.

Buying a house can be hard when you feel inexperienced with the process. Learn more by reading this article on the 10 Common Mistakes First-Time Homebuyers Make.

[download_section]

How Have Millennials Changed Homebuying?

The homebuying process changes as times change, technology advances and people find better ways to do things. This is no different now that millennials are entering the housing market at high rates.

Millennials are waiting longer than previous generations to buy their first home. This is due to a number of reasons, but it affects the housing market and statistics on millennial homeownership rates. Many are choosing to move back in with their parents due to economic factors. According to a Pew Research study, 52% of adults aged 18-29 are now living with their parents. Millennials, and some older members of Generation Z, are using this time to pay off student loans and other debts while trying to save money.

The delay in homebuying may also be due to the fact that millennials are starting families later than previous generations. Another study from Pew Research states that only 46% of millennials are married, while at the same age 57% of Generation X were married and 64.5% of baby boomers were married.

Millennials are also driving the change toward online and internet homebuying. In fact, 99% of millennials search for homes online. Online mortgages are also becoming more popular. Previous generations had to head to a bank or ask a realtor, but today you can simply go online and apply for a mortgage in 15 minutes. Millennial homebuyers are also more likely than older generations to shop around for a mortgage to find the best rate. Many millennials also prefer text-based communication and video tours of homes, so many companies are having to make the change to updated technology.

Tips for Millennial Homebuyers

Each year, more and more millennials are buying homes. The benefits of owning your own home are clear, but it can be hard to get there. What do you need to do to get started?

1. Save for a Down Payment

Before you can buy a house, you need a down payment. In some instances, you may not need the whole 20%, but you will need some money. The biggest challenge facing many millennials is student loans. Out of millennials who reported saving for a down payment was difficult, 48% of younger millennials and 41% of older millennials said that student loans were the biggest factor that delayed saving.

High rent, car loans and credit card debt were the next factors. You will likely need to pay off some of your debt before you can save enough money for a down payment. Having a large down payment can lower your interest rate and help you bypass private mortgage insurance.

2. Improve Your Credit Score

Paying off your debts on time can help improve your credit score, which makes it easier for you to get approved for a better mortgage. Different mortgage options will have different credit score requirements, but you typically need a score over 500. A conventional loan requires a credit score of over 620, so it’s important to pay attention to your credit score. A score of 740 or higher is considered an excellent score and will potentially help you get a smaller down payment requirement and lower interest rate.

3. Calculate What You Can Afford

You will also need to figure out how much house you can afford. Once you have the down payment figured out, calculate your current income and expenses and decide what you are looking for in a house. Can you afford the type of home you’re looking for? Figure out the amount of monthly payments you will be able to afford, keeping in mind the interest payments, property taxes, home insurance fees and any other fees you may be paying. Use our handy mortgage calculator to help you decide how much you would be comfortable spending.

4. Get Approved for a Loan

It’s important to get approved for a loan before you make an offer. This will help you stand out in the market because it lets the seller know you can cover the down payment and the mortgage. Houses are selling faster than ever, so being approved in advance can help give you an edge. It will also give you a more precise figure for the price range of houses you can look at before you fall in love with a home outside your budget.

Make Buying a House Easier With Assurance Financial

First-time homebuyers have many decisions to make when it comes to getting a mortgage. Assurance Financial is available to make it easier and answer any questions you might have.

You can get pre-qualified for a loan in just 15 minutes. We offer personalized service, and we have an average of 4.98 stars out of thousands of reviews from people just like you. The latest application technology makes starting your loan simple and fast. You can get started completely online with our digital assistant or speak with a licensed professional.

Assurance Financial offers every type of loan on the market and we provide end-to-end processing of your loan under one roof. Live your dream and get the mortgage that works for you. Want more information? Check out our First-Time Homebuyer Checklist. Feel free to reach out to a loan advisor for answers to any additional questions you may have.

Linked Sources:

- https://www.apartmentlist.com/research/millennial-homeownership-2021#fn-1

- https://www.apartmentlist.com/research/homeownership-by-generation

- https://studentloanhero.com/featured/millennials-have-better-worse-than-generations-past/

- https://www.cnbc.com/video/2021/05/25/why-the-us-is-facing-a-housing-shortage.html

- https://www.irs.gov/publications/p523https://www.irs.gov/publications/p936

- https://www.pewresearch.org/fact-tank/2019/01/17/where-millennials-end-and-generation-z-begins/

- https://www.pewresearch.org/fact-tank/2020/09/04/a-majority-of-young-adults-in-the-u-s-live-with-their-parents-for-the-first-time-since-the-great-depression/

- https://www.pewresearch.org/social-trends/2019/02/14/millennial-life-how-young-adulthood-today-compares-with-prior-generations-2/

- https://www.nar.realtor/newsroom/housing-market-reaches-record-high-home-price-and-gains-in-march

- https://www.nar.realtor/sites/default/files/reports/2017/2017-real-estate-in-a-digital-age-03-10-2017.pdf

- https://assurancemortgage.com/apply/

- https://contentimages.o-prod.unison.com/images/downloads/Unison_Affordability-Report_2019.pdf

- https://cdn.nar.realtor/sites/default/files/documents/2021-home-buyers-and-sellers-generational-trends-03-16-2021.pdf

- https://www.cnbc.com/2020/08/21/why-the-homeownership-gap-between-white-and-black-americans-is-larger-today-than-it-was-over-50-years-ago.html

- https://assurancemortgage.com/first-time-homebuyer-checklist/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/10-mistakes-first-time-homebuyers-make/

- https://assurancemortgage.com/how-to-get-a-mortgage-loan/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/mortgages-explained/