It’s the age-old question: What came first, the home or the baby? Many people are asking themselves, “Should we buy a house or have a baby?” Does it make more sense to buy a house after having a baby, or should you do it before, so that you’re all settled in by the time you’re ready to start a family?

The answer is that there is no one right answer. Buying a house and having a baby at the same time makes sense for some people. Purchasing a home before welcoming a child is the right choice for others, and buying a house after having a baby makes sense for some. Here’s what you need to know about getting a mortgage, expenses connected to your new home and new baby and a few benefits of each option.

Qualifying for a Mortgage Before Having a Baby

The process of qualifying for a mortgage before you have a baby is very similar to qualifying for a mortgage after you’ve had your child, with one notable exception. If you or your partner are currently on maternity or paternity leave when you apply for the loan, your leave could affect your ability to qualify for a mortgage. Being on unpaid leave can complicate the mortgage application process, as your mortgage lender might not be able to verify your income, even if you plan on returning to work after a few weeks. For that reason, it can make more sense to apply for your mortgage and buy your house pre-baby or wait until both you and your partner have gone back to work after the baby arrives before you start the mortgage process.

When you apply for a home loan, the lender will look at the following areas to determine whether you’re eligible for a mortgage, how much you can borrow and the interest rate you’ll pay.

- Your income: How much you and your partner earn plays a major role when it comes to determining how much you can borrow. As a general rule, the more you earn and the more stable your income is, the more you can borrow to buy a house. If either you or your partner plans on staying home with the baby and not earning income, it might be a good idea to see if you qualify for a mortgage using the other person’s salary. That way, you’ll avoid buying more house than you can comfortably afford after the baby arrives and your income situation changes.

- Your credit: Your credit history and score also have a considerable effect on the mortgage process. The higher your score, the better the terms on the loan you’ll receive. As with income, if one person doesn’t have the best credit or has a troubled credit history, it might be worthwhile to try and qualify for the mortgage using just one partner’s credit.

- Your employment history: How long you’ve been with a particular employer or have been self-employed also plays a role when you’re qualifying for a home loan. Lenders like to see a stable employment history, as it implies that you will continue to work for a company or continue to have a reliable source of income.

- Your other debts: Another factor lenders consider when reviewing a mortgage application is the number of other debts an individual or couple has and the amount of those debts. In many cases, your debt-to-income ratio should be under 36%. If you earn $1,000 per month, your monthly debt payments should be less than $360. In some cases, your debt-to-income ratio can be up to 45% or 50%, but 36% is usually preferable for you and your lender.

- Your assets: A lender wants to know how much you have in savings or investments when you apply for a mortgage. There are two reasons why information about your assets is important. First, it lets a lender know that you have enough money for the down payment. It also can provide some peace of mind to the lender that if you lose income, you’ll still have a way to make your mortgage payments.

Do You Need to Tell the Lender About Your Family Plans?

Lenders can’t discriminate against people who are pregnant, who have children or who are considering having children in the near future. They also can’t discriminate against people who are out on parental leave. If you are currently pregnant or have plans to become pregnant soon, you have no obligation to tell a lender. They also can’t ask you about your family plans.

If you are currently on maternity or paternity leave, it is a slightly different story. Income is an essential element when approving or denying a person for a loan, so consider providing your lender with plenty of documentation about your leave, such as when it will end and how much your income will be once your leave is over. Your employer might be willing to write a note that provides income information and a start and end date for your leave.

While lenders can’t discriminate against people on leave, being on unpaid leave can make it challenging for parents to get a mortgage. It’s a good idea to work with a lender who is understanding from the beginning and willing to work around your leave rather than deny your application.

Common Expenses Related to Homes and Children

Buying a home and having a child are two major life events that bring with them several expenses. Understanding the cost of getting pregnant and buying a house can help you determine if one or the other — or both — is the right choice for you at the moment. Take a look at some of the hidden and not-so-hidden costs of homeownership and parenthood.

House-Related Expenses

Some of the expenses related to owning a home are ongoing, while others are less frequent.

- Utilities: You’ll need to pay to keep the lights on, the furnace operating and the water running at your home. If you want internet and television services, you’ll need to pay for those, as well. The cost of utilities can vary based on the size of the house and how much energy your family uses. Local rates also vary, and some areas are more expensive than others.

- Repairs and maintenance: The equipment and systems that keep your house ticking will need ongoing care and maintenance and might need more extensive repairs from time to time. Maintenance involves things such as tune-ups of the HVAC system or furnace, cleaning the dryer vents and mowing the lawn. Repairs can include fixing broken appliances, leaks in the plumbing or issues with the electrical system. Experts usually recommend that homeowners have at least 1% of the price of the home set aside to cover maintenance costs and repair bills.

- Furniture, appliances and decorations: You’ll want to fill your new home with furniture and decor to put your own personal spin on it. Depending on what type of appliances came with the house and their age, you might also want to purchase new ones or upgrade existing ones. While furniture and appliances can be expensive, especially if you’re buying a lot all at once, the good news is that they are usually a one-time cost or a once-in-a-decade cost.

- Homeowner’s insurance premiums: If you have a mortgage, you need to have homeowner’s insurance. Usually, your monthly mortgage payment includes the cost of your insurance premiums. Still, it’s something to plan for, as you don’t want to be surprised when your first mortgage bill is several hundred dollars more than you expected.

- Property tax: Property tax is another expense that can vary widely based on location. Some areas have a high tax rate, while others have a relatively low one. Some cities or municipalities offer tax abatements to certain types of homeowners or to people who buy specific kinds of property. Like your homeowner’s insurance, your property tax is usually collected with your mortgage payment.

- Homeowners’ association (HOA) fees: Depending on the type of neighborhood you move into, you might have to pay HOA fees. Usually, HOA fees are required when you live in a condo or townhouse development. The fees cover the cost of maintaining common areas, such as the lobby of a condo building or the parking area in a residential development. The fees can vary from area to area and can suddenly increase if an unexpected event, such as an excessive amount of snowfall or extensive storm damage, occurs.

Child-Related Expenses

It costs a middle-income family an average of $12,980 per year to raise a child. The three largest expenses are housing, food and child care and education. For now, let’s take a look at the costs associated with bringing a new baby home.

- Delivery: Although insurance is meant to cover many of the costs of having a baby, the average insured woman paid $4,569 to deliver a baby in 2015. How the baby is born and where they are born can affect the price of delivery. For example, it usually costs more to have a C-section than to deliver vaginally.

- Clothing: Baby clothes are cute, but they also cost money. You might get a lot of clothes at your baby shower, but you can also expect your little one to outgrow those onesies and tiny T-shirts at a rapid pace.

- Baby gear: Babies typically need a lot of stuff, from car seats to bassinets and from cribs to strollers. There’s also the cost of “fun” things for babies, such as toys and walkers. One way to reduce the cost of gearing up for baby is to buy previously-owned items or to accept hand-me-downs from relatives and friends.

- Food: Babies who breastfeed get a nearly free source of food for the first few months or year of their lives. But not every baby can be breastfed, meaning some parents will need to plan on purchasing formula. As your baby begins to eat solid foods, usually around six months, you’ll want to add the cost of their food to your budget.

- Daycare: Although parents can decide to stay home with their child indefinitely, many need to go back to work at some point. The cost of daycare for an infant varies greatly from region to region but is generally high. In Mississippi, annual infant care costs $5,436, or about 11% of the median household income. In Washington, D.C., the average annual infant care cost is $24,243, or 28.3% of the median household income.

Should you buy a house before you start or increase your family? There are some advantages to finalizing the housing search and purchase before the baby arrives.

- You have time to settle in: If you buy your home with a growing family in mind, but before any children arrive, you will have plenty of time to settle into the house and get unpacked before you start planning the next phase of your life. You can even enjoy the house as just the two of you for a while, depending on whether you are pregnant when you buy your home.

- You can finish home projects before baby arrives: Waiting to start your family until after you’ve bought a home gives you time to tick all those home projects off of your list. The nesting instinct often kicks in when women are pregnant, which means you might get a shot of energy and feel the gumption to fix that leaking kitchen faucet, redo the backsplash or wallpaper the bedroom before your newest family member arrives.

- You’ll have less to pack: Babies and children might be small, but they tend to have a lot of stuff. If you buy your house before getting pregnant, any gifts you get during the shower or any items you purchase for your newborn can be sent directly to your home. You’ll end up with fewer things to pack and haul, which can also help you save money on the cost of movers or renting a truck.

- Baby can get settled into their new home: Babies and toddlers are creatures of habit and routine — once you establish those habits and routines with them. Moving can throw a wrench into their routine, meaning you might go from having a baby who sleeps through the night to having a baby who wakes up every two hours screaming. If you’re already in your home and settled when the baby is born, you don’t have to worry about disrupting their sleep schedule or another routine later.

- It can be easier to search for a house when child-free: Before you buy a house, you have to find a house. That can be easier to do when it’s just you or you and your partner looking. If you have a baby already, you’ll need to find a babysitter for them or bring them with you to look at homes. While a very young baby will likely sleep through the experience of househunting with their parents, you might not want to run the risk of them waking up screaming when you’re in the middle of checking out an open house.

[download_section]

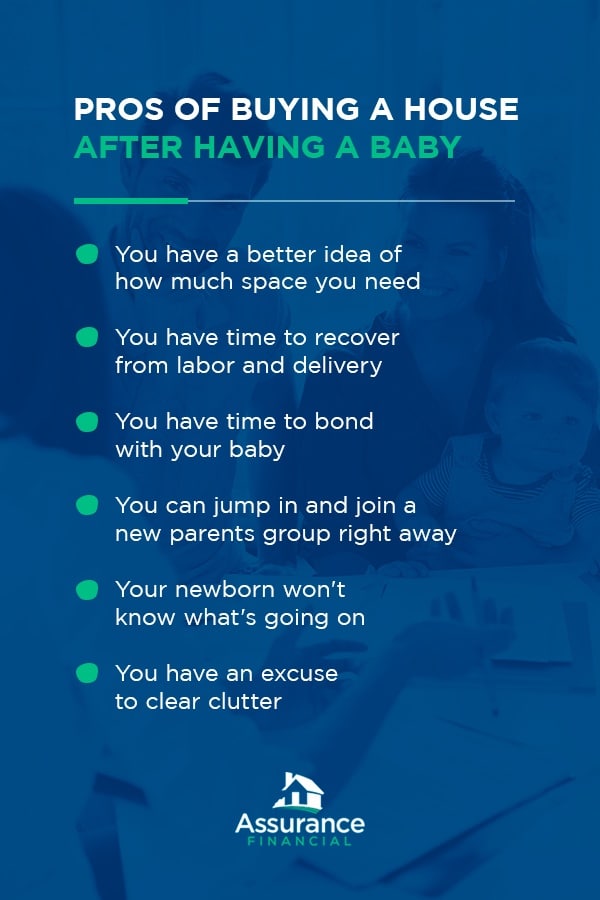

Pros of Buying a House After Having a Baby

Waiting to buy your home and move until after you have had your child or expanded your family can also make sense, depending on your needs and circumstances. Some of the benefits of postponing the home buying process until after you have a baby include:

- You have a better idea of how much space you need: If you wait to start looking for a home until after you’ve had your child, you’ll have a better idea of what works and what doesn’t in your current home and what you would like from your future residence. For example, you might find that a two-bedroom is too small for you, your partner and your baby and that you’d like at least a three-bedroom home. Or you might realize that you want some outdoor space for your child to play safely as they get older. You might decide going up and down steps with a baby in tow is challenging and that you’d prefer to move into a single-story ranch home.

- You have time to recover from labor and delivery: Although it varies from woman to woman, many find that they do need time to take it easy and recover after childbirth. That can be particularly true of women who give birth via a C-section. If you wait to start looking for homes until after your baby is born, you can also give yourself plenty of time to heal from the labor itself.

- You have time to bond with your baby: You can take all the time you need to bond with your baby if you decide to wait until after they are born to move. You might choose to postpone the housing search until after your parental leave is up so that you can spend that time connecting with your child.

- You can jump in and join a new parents group right away: Depending on how far away you end up moving, you might need to find a new social circle when you arrive. You might want to expand your social group after having a baby anyway, especially if the rest of your friends are still child-free. Waiting to move until after your baby is born means that as soon as you get settled into your new neighborhood, you can join a local parents group or another social club designed for parents of young ones, such as a Mommy and Me yoga club or a Stroller Strides exercise club.

- Your newborn won’t know what’s going on: Babies, particularly newborns, are easier than most people give them credit for. They sleep a lot of the day and aren’t going to have a clue what is going on. You can tuck your sleeping baby into their car seat and drive them across town or across the state, and they will have no idea that they are somewhere different when they arrive. If you need to find a babysitter for your little one while you move, you might find that you have an easy time convincing a grandparent or close friend to watch them.

- You have an excuse to clear clutter: You might have gotten a lot of gifts and gear for your baby that you ended up not needing. Depending on when you move, your little one might have already outgrown some of their clothes. Waiting until after baby arrives to move can mean that you have a chance to sell or give away some of the baby gear you know you won’t need. You don’t have to worry about lugging it from one home to the next.

Pregnant and Buying a House? Apply for a Mortgage Online With Abby

Whether you’re currently pregnant, about to become pregnant or have recently added to your family, the first step in the home buying process is to get approved for a mortgage. Abby is Assurance Financial’s digital loan assistant. She’s here to walk you through the process and to help you gather all the information you need during your application. If you’re ready to get started, you can apply for a mortgage in less than 15 minutes.

Sources:

- https://assurancemortgage.com/applying-for-home-loan-pregnant/

- https://selling-guide.fanniemae.com/Selling-Guide/Origination-thru-Closing/Subpart-B3-Underwriting-Borrowers/Chapter-B3-6-Liability-Assessment/1736872241/B3-6-02-Debt-to-Income-Ratios-02-05-2020.htm

- https://selling-guide.fanniemae.com/Selling-Guide/Origination-thru-Closing/Subpart-B3-Underwriting-Borrowers/Chapter-B3-3-Income-Assessment/Section-B3-3-5-DU-Requirements-for-Income-Assessment/1736867221/B3-3-5-01-Income-and-Employment-Documentation-for-DU-08-07-2019.htm

- https://www.zillow.com/mortgage-learning/qualifying-for-a-mortgage/#qualify

- https://www.capitalone.com/bank/money-management/saving-house/qualify-for-mortgage/

- https://theweek.com/articles/717349/3-tips-buying-home-expecting-child

- https://www.bankrate.com/mortgages/proving-income-to-land-a-mortgage/

- https://dreamhomefinancing.com/buy-house-before-having-baby/

- https://themortgagereports.com/60552/how-to-get-a-mortgage-on-maternity-leave

- https://www.nytimes.com/2010/07/20/your-money/mortgages/20mortgage.html

- https://www.credit.com/blog/can-you-be-denied-a-mortgage-if-youre-pregnant-157075/

- https://www.bankrate.com/mortgages/maternity-leave-mortgage-approval/

- https://www.usda.gov/media/blog/2017/01/13/cost-raising-child

- https://www.realtor.com/advice/home-improvement/how-much-should-you-budget-for-home-maintenance-and-repairs/

- https://www.nerdwallet.com/blog/finance/budgeting-for-new-homeowners/

- https://www.hgtv.com/lifestyle/real-estate/immediate-expenses-for-new-homeowners-to-expect

- reuters.com/article/us-health-maternity-costs/even-for-insured-women-having-a-baby-in-the-u-s-is-costly-idUSKBN1Z7300

- https://www.epi.org/child-care-costs-in-the-united-states/#/DC

- https://www.newyorklife.com/articles/breakdown-of-biggest-expenses-for-your-child

- https://www.moving.com/tips/why-you-should-move-before-the-baby-comes-or-wait-why-you-shouldnt/

- mortgages.com/buying-house-and-owning-home/buying-house-when-babys-way-look-and-budget-you-leap

- https://assurancemortgage.com/meet-abby/

- https://assurancemortgage.com/apply/