Determining how you’ll finance the purchase is among the most critical decisions you will make when buying a home. In most cases, you will apply for a mortgage loan. Each mortgage is different, and there are numerous types. The most prominent type of mortgage for home buyers is the 30-year fixed-rate mortgage. Assurance Financial can help you understand the 30-year fixed-rate mortgage and determine if it is right for you.

Table of Contents

- What Does a 30-Year Fixed Mortgage Mean?

- How a 30-Year Fixed Mortgage Works

- Who Needs a 30-Year Fixed Mortgage?

- Pros

- Cons

- Apply for a 30-Year Fixed Mortgage

What Does a 30-Year Fixed Mortgage Mean?

A 30-year fixed-rate mortgage is a home loan with a repayment term of 30 years. The borrower submits regular installments to disperse the balance over the 30-year period.

As fixed-rate home loans, the interest rate remains the same throughout the life of the loan. When you decide to take out a 30-year home loan with a fixed rate, the payment you owe each month is the same until you’ve finished paying the loan. If your first month’s payment is $1,000, your 12th month’s payment will be $1,000, your 36th month’s payment will be $1,000 and so on. If the interest was 5% during the first year of the loan, it would be 5% in year two, year six, year 15 and year 29.

A mortgage rate can either be a fixed interest rate or a variable rate. A fixed-rate does not change while you are paying back your loan, while a variable rate, also referred to as an adjustable-rate mortgage (ARM), can change throughout a loan.

What Is the Average 30-Year Fixed Mortgage Rate?

Many factors influence mortgage interest rates. The average interest rate has risen and fallen over the years as a result of market conditions and other factors. For example, in 1980, the average interest rate on a 30-year home loan was 13.74%. In 2000, it was 8.05% and 20 years later, in 2020, the annual average interest rate was 3.11%. In 2021, the average interest rate increased from 2.74% in January to 3.07% in November. Fannie Mae predicts that, in 2025 and 2026, the average mortgage rate will begin to decrease.

What Determines a 30-Year Mortgage Interest Rate?

Some of the factors that affect mortgage interest rates are outside of the control of the average person. Others are in your control.

Supply and Demand

Housing market supply and demand have an effect on rates. When there is a lot of demand for mortgages, interest rates usually increase. When demand is low, rates drop to make getting a mortgage more appealing to consumers.

Housing demand is high when the supply is comparatively low. Therefore, mortgage rates often increase when there are few new homes being built and few existing homes on the market.

However, mortgage rates can also impact supply and demand as much as these factors impact the rates. As mortgage rates decrease, more owners become confident they can buy a new one at an interest rate that competes with or improves upon their current rate. When more owners place their homes on the market, the housing supply rises and causes the relative demand to decrease.

As buyers purchase homes at low interest rates, the high supply levels out. The new owners want to keep their favorable interest rates, so existing homes stay off the market, and the available supply decreases, causing relative demand to lift and elevate mortgage rates with it.

There are also many outside factors that impact the housing market’s supply and demand relationship. Economic and political change often cause the housing market and mortgage rates to fluctuate.

Personal Financial Circumstances

There are a few factors that influence interest rates that homebuyers can control. The amount of other debt you have can influence your interest rate. If you have a lot of debt already, a lender might consider you a higher risk compared to someone with less debt. To compensate for the additional risk, they are likely to offer a higher interest rate.

Your credit history and score also influence the interest rate on a 30-year mortgage. Usually, the higher your score, the lower your interest rate. If you don’t have favorable credit at the moment, it can be a good idea to work on improving it before you apply for a home loan.

Finally, how much you put down upfront can also affect your interest rate. The bigger your down payment, the less of a risk you seem to lenders. In exchange, they are likely to give you a lower interest rate compared to a person who is making a smaller down payment.

Can You Pay Off a 30-Year Mortgage Early?

Thirty years seems like a long time. If you buy a house when you’re 35 years old and get a 30-year mortgage, your last payment will be scheduled for age 65, right around the time you reach retirement. One thing worth knowing about a 30-year mortgage is that just because you can take 30 years to pay it off doesn’t mean you are obligated to do so.

Many lenders may let you pay off your loan early. Some do charge a pre-payment or early payment penalty. Before you pay extra on your mortgage, double-check to confirm that your lender won’t penalize you for doing so.

Strategies for Paying Off a 30-Year Mortgage Early

If you are interested in paying off your mortgage early, there are multiple ways to do so.

If you get paid biweekly, you can try making biweekly payments on your mortgage instead of monthly. Divide your monthly payment in half and pay one half when you get your first paycheck of the month and the second when you get paid the second time. Since there are 26 biweekly pay periods in a year, you’ll end up paying 13 months’ worth of your mortgage rather than 12.

Another option is to add an additional amount when you schedule your monthly payment. Even paying an extra $100 or $200 per month consistently can shave years off your mortgage.

How a 30-Year Fixed-Rate Mortgage Works

When you apply and are approved for a 30-year fixed-rate mortgage, two things are certain — your interest rate will not change, and your mortgage will be broken down into a series of payments over the course of 30 years. The payments include interest and principal together and remain the same throughout the loan.

Many homeowners also pay their property tax and homeowners insurance premiums with their mortgage payments. If you put down less than 20% of the price of the home, you will also have to pay private mortgage insurance (PMI) premiums until you’ve paid off enough of the principal to equal 20% of the home’s value.

Principal

The mortgage principal is the amount you’ve borrowed to pay for your home. If you buy a $250,000 home and pay a 20% down payment of $50,000, then the amount you borrow — $200,000 — is the loan’s principal. As you make payments on your mortgage, the principal shrinks.

Interest

Interest is the fee charged by your lender for giving you the loan. One way to look at it is the cost of doing business with a particular lender. Just as you might pay a lawyer or a doctor a fee for their services, you pay your lender for their services in the form of interest.

The cost of getting a loan can vary considerably from person to person because of interest. One borrower might be offered a 5% rate on a $200,000 loan, while another borrower might be offered a 3% rate.

Since interest is a percentage of the loan amount, it tends to be higher at the beginning of your repayment period than it is at the end. For example, when you first start making payments on your $200,000 home loan, you are paying 5% interest on $200,000. As you chip away at the principal, it shrinks and so does the interest in proportion.

Although you start out paying more interest than principal on your mortgage and eventually begin paying more toward the principal and less in interest, the payment you are required to make each month remains the same due to something called amortization.

Amortization Schedule

Loan amortization is the process of paying off your debt over a defined period with fixed payments. When a mortgage is amortized, the principal and interest are combined. It differs from other types of mortgage payment schedules because you pay the same amount and know what you need to pay from month to month.

When you close on your house and finalize the 30-year fixed-rate mortgage, your lender can provide you with an amortization schedule. The schedule breaks down each payment over the life of the loan to clarify a few details:

- Payment allocation structure: The amortization schedule details how much of each payment goes toward the interest on the loan and how much goes toward the principal.

- Balance amounts: It also lists the ending balance on the loan at the end of each payment period, so you can keep track of your mortgage as you pay it off.

- Total interest accrual: You’ll also find the total amount of interest paid on the amortization schedule. The total interest gives you an idea of how much your mortgage will cost you over time.

Do All Loans Amortize?

No, amortization does not apply to all loans. An example of a mortgage that does not amortize is a balloon mortgage. If you were to agree to a balloon mortgage, you would make small payments each month for a set amount of time. Often, the payments would only cover the interest due on the loan. At the end of the repayment period, the remaining balance is due in full.

In addition to mortgages, other types of installment loans, such as car loans and student loans, typically get amortized.

Who Needs a 30-Year Fixed Mortgage?

Although 30-year fixed-rate mortgages are the most popular option for homebuyers, they are far from the only choice available. Some mortgages have adjustable interest rates, for instance. Adjustable-rate mortgages (ARMs) offer an introductory rate for a set period, such as five years. At the end of the introductory period, the rate changes based on the market.

An ARM can decrease if rates have dropped or increase if they have spiked. Although an ARM can offer you a lower rate than a fixed-rate mortgage at the start, there is the risk that your rate may increase later on, and with it, your monthly payment.

Alternatives to 30-Year Mortgages

Thirty years is also not the only term available for a home loan. Some loans have 15-year terms. Less common are 10-year, 20-year or 25-year mortgages. The longer the mortgage term, the smaller the monthly payments are, as you have more time to pay the loan. A person who might struggle to make payments on a $200,000, 15-year loan might find they are comfortable making payments on a $200,000 30-year loan.

When to Choose a 30-Year Fixed-Rate Mortgage

A 30-year fixed-rate mortgage can be the right option for you if:

- You live in an area with expensive housing: A 30-year home loan can put buying a home within reach, even in areas where the price of housing is high. Another way of thinking about it is that you can get more house for your money if you get a 30-year mortgage instead of a 15-year loan.

- You want a predictable payment schedule: Your mortgage payment can be predictable if you get a 30-year fixed-rate home loan. The interest and principal payment stay the same for the entire repayment period.

- You want a lower monthly payment: Since you are going to take twice as long to pay down the loan, the monthly payment on a 30-year loan is usually considerably lower than the payment due on a 15-year mortgage, even if the principal balance is the same. Paying less toward housing each month can mean you have more money to put toward other financial goals, such as saving for retirement or for your children’s education.

[download_section]

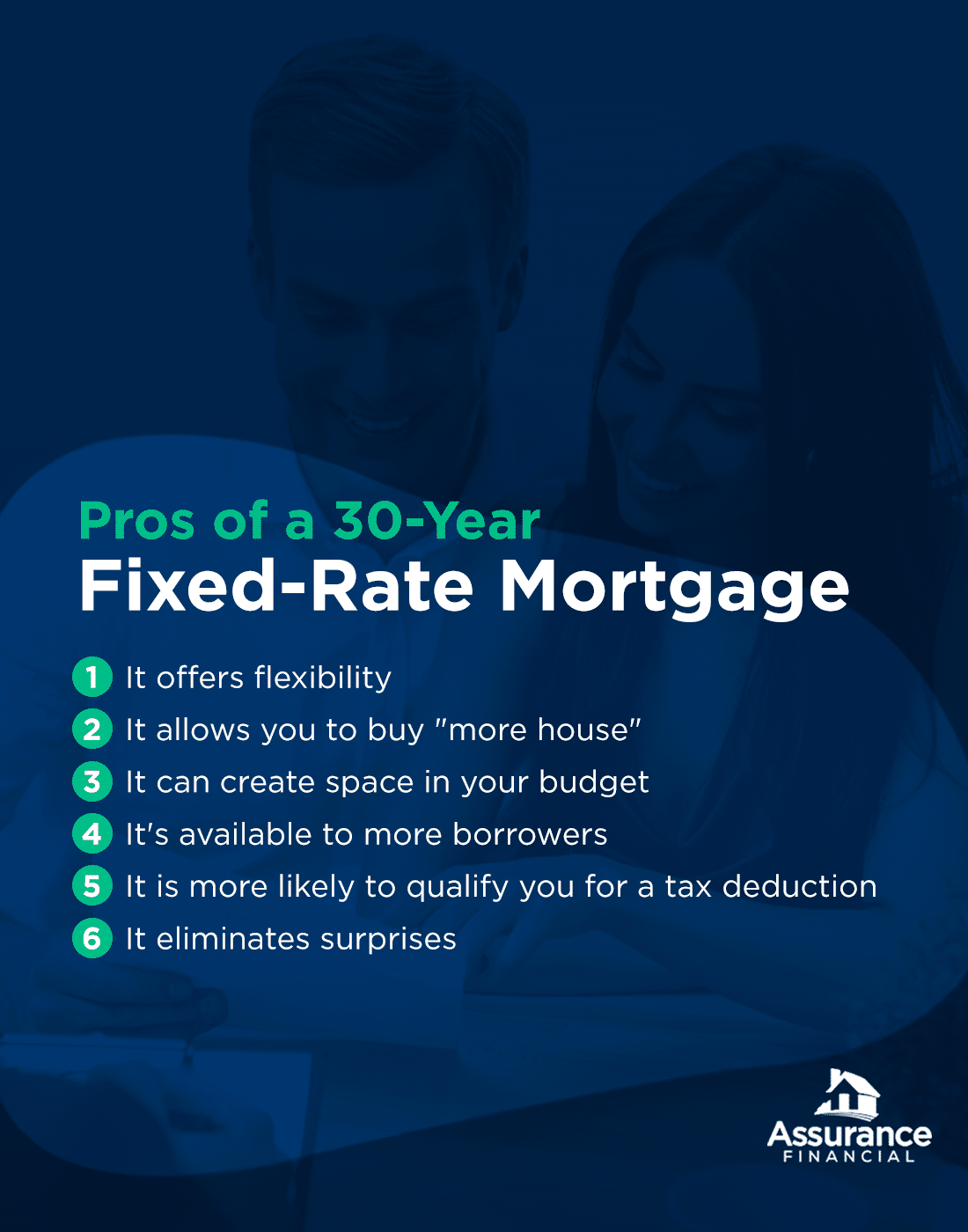

Pros of a 30-Year Fixed-Rate Mortgage

For many borrowers, the pros of a 30-year fixed-rate mortgage make it worthwhile.

1. A 30-Year Fixed-Rate Mortgage Offers Flexibility

When you take out a 30-year fixed-rate mortgage, you can stick to the amortization schedule provided by your lender or choose to pay extra on the loan, reducing your debt and speeding up the process of owning your home outright.

For example, you may decide to pay several hundred dollars more than you owe each month when you have the space in your budget to do so. But if your expenses increase or your income drops, you have the option of paying what’s due on the loan and holding off on making extra payments until you can afford it again.

2. A 30-Year Fixed-Rate Mortgage Allows You to Buy “More House”

You can often afford to buy a more expensive home with a 30-year mortgage compared to a 15-year loan, depending on your income. If you live in an area with high housing costs, a 30-year mortgage can make it easier to buy a home that meets your family’s needs and fits within your budget.

3. A 30-Year Fixed-Rate Mortgage Can Create Space in Your Budget

Since the monthly payment on a 30-year mortgage is often lower than the payment due on a 15-year loan, it can give you some wiggle room in your budget. You can use any additional income you have to pay down your home loan more quickly, or you can choose to save it for a rainy day or for another financial goal.

4. A 30-Year Fixed-Rate Mortgage Is Available to More Borrowers

Depending on your income and other financial circumstances, you might find it easier to qualify for a 30-year mortgage compared to other options. Since the monthly payments are lower for a 30-year compared to a 15-year mortgage, you can qualify for a 30-year loan with a lower income.

5. A 30-Year Fixed-Rate Mortgage Is More Likely to Qualify You for a Tax Deduction

You can deduct the interest you pay on your mortgage from your income each year, but it’s not always the most appropriate option. For itemizing your deductions to make sense, the amount needs to be more than the standard deduction.

In 2022, the standard deduction is $12,950 for single tax filers and $25,900 for married couples who file a joint return. For a head of household, the standard deduction is $19,400. Since you often pay more interest on a 30-year mortgage during the early years of repayment, it can make you more likely to save on your tax bill.

6. A 30-Year Fixed-Rate Mortgage Eliminates Surprises

A 30-year fixed-rate mortgage can be an ideal option for people who like predictability. You know what your payments are, so you can create a dependable budget. You don’t have to worry about costs increasing year after year, so it can eliminate some stress from your life.

Cons of a 30-Year Fixed-Rate Mortgage

A 30-year fixed-rate mortgage does have some drawbacks that are important to think about.

1. You’ll Pay More in Interest

Over the course of 30 years, you are likely to pay considerably more in interest on your mortgage than you would on a loan with a shorter term. For example, if you borrowed $160,000 with a 3.37% interest rate, you would pay $94,726.03 in interest over the 30 years. If you borrowed the same amount with the same interest rate for 15 years, you would pay $44,086.16 in interest over 15 years.

2. Interest Rates Are Usually Higher

You don’t just end up paying more interest over the life of your home loan when you have a 30-year mortgage. You might also have to pay a higher interest rate. Lenders consider risk when they set interest rates. A 15-year mortgage is typically considered a lower risk to a lender, as the term is shorter and there is less of a chance of a borrower defaulting. While 30-year mortgages are very common, they are also considered higher-risk and usually have somewhat higher interest rates.

3. Thirty Years Is a Long Time

Another thing to consider before applying for a 30-year mortgage is that 30 years is a relatively long time. It’s difficult to envision what your life will be like at the end of your mortgage term.

One thing to remember is just because your mortgage will be paid off in 30 years, it doesn’t mean you need to keep the loan for that long. If you can afford to pay extra toward the mortgage, you are free to do so. You can also sell your home before the 30 years is up and use the proceeds from the sale to pay off the mortgage.

4. It Will Take Longer to Build Up Equity in Your Home

Your home’s equity is the difference between the value of your home and the amount you owe on the mortgage. When you take out a mortgage with a shorter term, you pay down the principal relatively quickly, building up more equity in your home. With a 30 year loan, it takes longer to chip away at the principal, meaning you have less equity.

The longer it takes to build up equity, the greater the chance you may end up upside-down on the mortgage if the market takes a hit. When you’re upside-down, you owe more on the home loan than the house is worth.

5. It Can Be Harder to Put 20% Down

You might qualify for a bigger loan with a 30-year term compared to a 15-year term. But it can also be more challenging to come up with a sizable down payment when you’re buying a more expensive house.

For example, you’ll need $40,000 to put 20% down on a $200,000 house. The amount jumps to $60,000 for a $300,000 house. Not having 20% to put down doesn’t mean you can’t buy a house. It simply means you’ll have to pay PMI and you may not get the best possible interest rate.

6. You Might Buy More Home Than You’re Comfortable With

Another thing to consider when getting a 30-year mortgage is that you might end up buying more house than you can take care of or manage. Bigger houses tend to have higher upkeep costs. They also tend to require more care and attention compared to smaller, less expensive homes. For example, if you buy a home with a large yard, someone will need to take care of the yard.

Apply for a 30-Year Fixed-Rate Mortgage

When you find the home of your dreams, your next step is obtaining the right mortgage to fund your purchase. For many homebuyers, a 30-year fixed-rate mortgage is the best option, especially if you can secure a low interest rate and low monthly payments. Assurance Financial can help you achieve your dream of homeownership. Our services are customized options that can cover your home purchase.

Why Trust Us for 30-Year Fixed-Rate Mortgages?

At Assurance Financial, we know that every homebuyer has individual needs, and as mortgage experts, we can help you identify the right solution for your unique financial needs. While buying a home is an exhilarating experience, it also requires a firm grasp of your financial situation, a thorough understanding of the terms you’re agreeing to and a long-term commitment to paying back a loan. We can provide certainty and stability on your homebuying journey by delivering the following advantages when you trust us as your mortgage lender:

- Large range of mortgage loan options: To serve each of our homebuyers, we offer a variety of loan options, including conventional loans, FHA loans, VA loans and construction loans.

- Comprehensive approach to lending: We complete the entire lending process under a single roof, from application to closing.

- Versatile application process: You can choose whether you want to complete your application online or with the assistance of one of our loan officers.

- Accredited services: We are approved by Fannie Mae, Freddie Mac and Ginnie Mae to service and issue mortgages.

Contact Assurance Financial

If a 30-year mortgage with a fixed rate seems like a good option for you, applying for a home loan can be simple. Get started on your application today or schedule an appointment with a loan officer at a time that works for you.