The amortization schedule is a record of your loan payments that shows the principal amounts and the interest included in each payment. The schedule shows all payments until the end of the loan term. Each payment should be the same per period — however, you will owe interest for the majority of the payments. The bulk of each payment will be the loan’s principal. The last line should show the total interest you paid and your principal payments for the full term of the loan.

The process of obtaining a mortgage can feel overwhelming, especially for first-time homebuyers. Many of the mortgage-related terms may be new to you, such as conforming loans, non-conforming loans, fixed interest rates, adjustable interest rates, and loan amortization schedules.

The amortization schedule for a mortgage is an essential component to understanding the breakdown of your payments during the term of your mortgage.

Still have questions or need more information? Below is an overview of what this article covers!

Topics Covered

- Loans That Get Amortized

- Loans That Don’t Get Amortized

- Pros and Cons of Amortized Loans

- Pros and Cons of Unamortized Loans

- Amortized vs. Unamortized Loans

Frequently Asked Questions

- Loan Amortization Definition

- What Is an Amortization Schedule?

- How Do Amortization Schedules Work?

- How to Calculate Amortization?

- What Are the Amortization Schedule Uses?

- What Are a Few Things to Keep In Mind About Amortization?

- Secure the Right Loan With Assurance Financial

Loan Amortization Definition

What is loan amortization? Loan amortization is the schedule of periodic payments for a loan and gives borrowers a clear picture of what they’ll be repaying in each repayment cycle. You’ll have a fixed, consistent repayment schedule over the entire period of your loan term.

1. Loans That Get Amortized

Amortization schedules are typically used for installment loans with known payoff dates, fixed interest rates and fixed monthly payments, such as:

- Mortgage loan: Most conventional home loans are 15-year or 30-year terms with a fixed interest rate. Though many homeowners may not keep their mortgage that long, such as if they sell their home or refinance, the loan functions as if you are going to keep it for the entire 15-year or 30-year term.

- Car loan: Many car owners obtain an amortized auto loan for a term of five years or less. Some drivers decide whether they can afford a car based on what their fixed monthly payment will be.

- Personal loan: A personal loan you can obtain from a credit union, bank or an online lender also tends to be amortized. Typically, personal loans are given for a term of three years at a fixed interest rate with a fixed monthly payment. Personal loans are generally used for debt consolidation or small personal projects.

You will pay these loans off with consistent payments until the balance is zero.

2. Loans That Don’t Get Amortized

Not every type of loan is amortized. The following are examples of loans that don’t get amortized:

- Mortgage loan: Most conventional home loans are 15-year or 30-year terms with a fixed interest rate. Though many homeowners may not keep their mortgage that long, such as if they sell their home or refinance, the loan functions as if you are going to keep it for the entire 15-year or 30-year term.

- Car loan: Car owners typically get an amortized auto loan for a term of five years or less. Some drivers decide whether they can afford a car based on what their fixed monthly payment will be.

- Personal loan: A personal loan you can obtain from a credit union, bank or an online lender also tends to be amortized. Typically, personal loans are given for a term of three years at a fixed interest rate with a fixed monthly payment. Personal loans are generally used for debt consolidation or small personal projects.

If you apply for any of these types of loans, don’t expect an amortization schedule.

3. Composition of an Amortized Loan Payment

Payments for your loan go toward:

- Principal: This portion of your payment goes toward reducing the balance of your loan.

- Interest: This portion of your payment is what you pay your lender for loaning you money.

You make payments in regular installments of a set amount, though the ratio of interest to principal changes over the repayment period. This change in the ratio of interest to principal is detailed further in a loan amortization schedule.

What Is Amortization?

Amortization lowers the book value of a loan by spreading regular payments out over a set period of time. Amortization can also apply to an intangible asset, and in this case, works similarly to depreciation. You make consistent payments on a loan, gradually lowering its total value until the loan is completely paid off.

Getting a loan is much more appealing than having to save for the full price of a house or car, and amortization is the process of breaking up the loan, making it an accessible payment method. Calculating how long it will take to pay off the loan with amortization can help you forecast your monthly costs.

What Is an Amortization Schedule?

A table that shows periodic loan payments is referred to as an amortization schedule. You may also hear this referred to as a mortgage amortization schedule or mortgage amortization table. This amortization schedule includes the amount of principal and interest within each payment. Each monthly payment is listed to the end of the loan term, when the loan will be paid off. Each payment is the same throughout the amortization schedule.

Early in the amortization schedule, the payments are applied mostly to the interest of the loan, whereas the payments later in the schedule are applied mostly to the principal of the loan. The percentage of every payment that is paid toward interest continually decreases, while the percentage of each payment that goes toward the principal of the loan continually increases. This means the balance of the principal of your loan will not decrease much in the earlier part of your repayment schedule.

Though the amount of interest and principal you’ll be paying off differs each month, your total payment will be the same month to month. This makes budgeting easier for the years that you have the loan. You can also find the total of the principal payments and interest for your entire loan balance in the last line of your amortization schedule.

How Amortization Schedules Work

What is included in an amortization schedule?

- Interest costs: For every payment, a portion goes toward paying off interest. The interest of each payment is calculated by multiplying the remaining balance of your loan by the interest rate.

- Principal repayment: After applying the interest charge, the rest of the payment goes toward paying down the principal of the loan.

- Scheduled monthly payments: Each of your monthly payments is listed individually for the entire duration of your loan.

The interest of a loan is calculated based on the loan’s most recent balance. When a payment exceeds the amount of interest, this payment reduces the principal. The interest rate is then applied to this new principal balance, and because the balance is lower, the amount of interest will also be lower. This is why the interest and principal in an amortization schedule have an inverse relationship. As the portion of interest in a payment decreases, the portion of principal in the payment increases.

The amortization schedule will generally contain seven columns:

- Month: This is simply a number that denotes each month of your repayment period.

- Beginning balance: This is the principal balance you have at the beginning of each new month before you make a loan payment.

- Scheduled payment: This is your monthly loan payment. This number will be the same every month.

- Principal: This is the amount paid toward your principal with every payment. Each month, this number will increase.

- Interest: This is the amount paid toward your interest with each payment. Every month, this number will decrease.

- Ending balance: This is the balance of your loan after you make your monthly payment.

- Total interest: This column keeps track of how much you have paid toward interest so far. The final row will show you how much interest you’ll pay in total over the duration of the loan. Your amortization table may or may not include this cumulative interest amount.

The number of rows in your amortization table depends on the term of your loan. For example, if you have a 30-year mortgage, you’ll pay your loan off over the course of 360 months. This means your amortization table will have 360 rows.

Alternatively, the columns of your amortization schedule may be each month of your loan term, while the rows are your beginning balance, payment, principal, interest, ending balance and total interest.

When you calculate the amortization of your loan, you can create your own table with this information for the duration of your loan.

How to Calculate Amortization

How do you calculate amortization? To create an amortization table, you have a few options:

- Use an online loan amortization calculator that will create the amortization schedule.

- Use a spreadsheet to create an amortization table and analyze your loan.

- Create an amortization table by hand.

If you want to set up your own amortization table, whether by hand or on a spreadsheet, you’ll need to know how to perform the calculations.

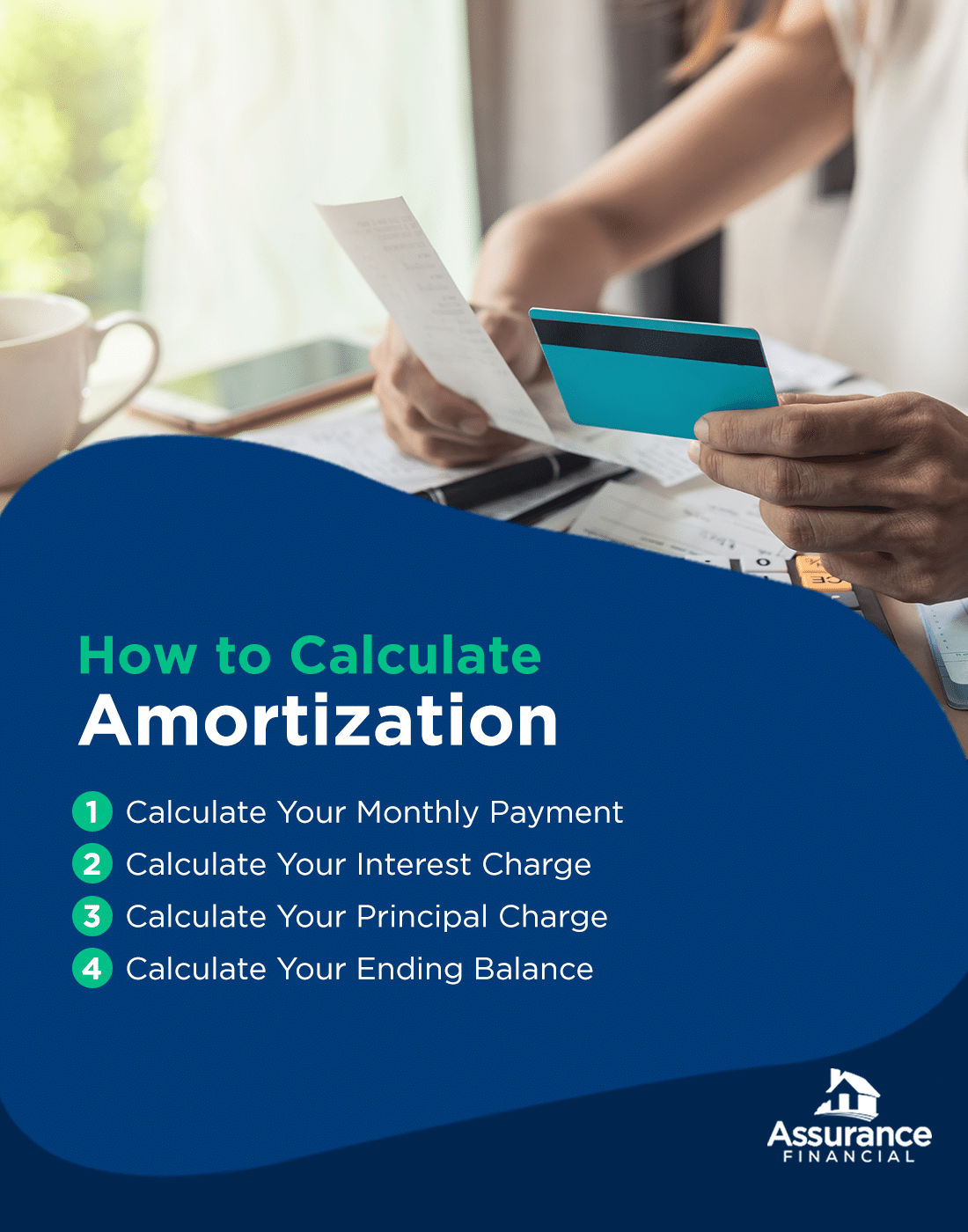

To calculate the amortization of your loan, follow these steps:

- Calculate your monthly payment: This number will be the same every month.

- Calculate your interest charge: To do this, multiply your beginning balance by your monthly interest rate. Your interest charge will decrease every month.

- Calculate your principal charge: To do this, subtract your interest charge from the monthly payment. This number will show how much you’ll pay toward the principal that month.

- Calculate your ending balance: To do this, subtract the beginning balance by the amount of principal paid that month. This number will be your ending balance for that month.

- Repeat steps 2 to 4: Use the ending balance from step 4 as your beginning balance for the next month.

1. Calculate Your Monthly Payment

To calculate your monthly payment, you’ll need to know the amount of your loan, the term of your loan and your interest rate. These three factors will determine how much your monthly payment is and how much interest you’ll pay on the loan in total.

If you lower the principal or interest rate of your loan, you’ll also lower your monthly payment and save money. You can also lower your monthly payment by increasing the term of your loan, but you’ll ultimately pay more in interest.

You can calculate your monthly loan payments using this formula: M=P[r(1+r)^n/((1+r)^n)-1)]. If this formula seems overwhelming, don’t worry. The calculation is actually pretty simple:

- M: This denotes your monthly mortgage payment.

- P: This denotes the principal amount of your loan. For example, if your loan is $100,000, this is the number you would plug in for P.

- r: This denotes the monthly interest rate for your loan. The interest rate you’re given for your loan is an annual rate, which means you’ll need to divide this number by 12, as there are 12 months in a year. This will give you your monthly rate. For example, if your interest rate is 4.5%, your monthly rate is 0.045/12=0.00375.

- n: This denotes the total number of payments you’ll make on your loan. For example, a 30-year mortgage will have 360 payments. You can calculate this number by multiplying the number of years for your loan term by 12, which is how many months there are in a year. 30×12=360.

For example, use the numbers above:

- Starting balance: $100,000

- Monthly interest rate: 0.00375

- Total number of payments: 360

M=100,000[0.00375(1+0.00375)^360/((1+0.00375)^360)-1)]

The monthly payment for a $100,000 mortgage at an annual interest rate of 4.5% for a 30-year term is $506.69.

2. Calculate Your Interest Charge

The next step is calculating the interest charge. Multiply your beginning balance by your monthly interest rate. Again, to calculate your monthly interest rate, divide your annual interest rate by 12.

- 4.5%/12=0.00375

For the first payment of the above example, you’ll multiply $100,000 by 0.00375. This gives you an answer of $375.

- $100,000×0.00375=$375

This is the interest you’ll pay the first month. Keep in mind that your interest charge will decrease every month.

3. Calculate Your Principal Charge

Then, to figure out your principal charge, subtract your interest charge from your monthly payment. For the above example, subtract your interest charge of $375 from your monthly payment of $506.69.

- $506.69-$375=$131.69

This remainder of $131.69 is what you’ll pay in principal the first month.

4. Calculate Your Ending Balance

Finally, you’ll calculate your ending balance for that month. To calculate this ending balance, subtract the amount of principal you paid that month from the balance of your loan.

For the first month of the above example, subtract your loan balance of $100,000 by the principal charge of $131.69.

- $100,000-$131.69=$99,868.31

This ending balance will be the beginning balance of the next month. Repeat steps two through four for each month of your amortization schedule. If you’re calculating your amortization table yourself, you can check your math with an amortization schedule calculator.

Amortization Schedule Uses

An amortization schedule can help you understand exactly how borrowing a loan will work and how it will impact your finances.

1. Figuring Out What Borrowing Will Truly Cost

An amortization schedule provides you with details about your loan. You’ll get a comprehensive picture of your loan beyond your monthly payment. You can track exactly how much of your payments are going toward principal versus interest and how much you’ll be paying for interest in total.

Though many consumers base the affordability of a mortgage or a car loan on the monthly payment, the interest expense is a better way to assess the true cost of what you’re buying. In fact, lower monthly payments can actually mean you’re paying more in interest.

For example, a $100,000 mortgage will have a higher monthly payment at a 15-year term than a 30-year term, but you’ll pay much more in interest for a 30-year term than a 15-year term. With an amortization table, you’ll know how much interest you’ve paid so far or during a certain year, along with how much principal you still owe. Additionally, an amortization schedule will also help you calculate how much equity you currently have in your home.

2. Making the Right Decision

Having the full picture of your loan will also help you decide which loan is right for you. You can compare different loan options and terms, such as how much you may be able to save if you obtain a lower interest rate.

With an amortization schedule for your mortgage, you can also calculate how much you might save by making early payments. When you pay off your debt early, you’ll save money by paying less in interest. You can also calculate how much more you’ll need to pay every month to pay off your mortgage early, such as in 20 years rather than 30 years.

Amortized vs. Unamortized Loans

For most borrowers, amortized loans are the better, more common option, though whether an amortized loan is right for you depends on your circumstances.

1. Pros and Cons of Amortized Loans

Amortized loans allow borrowers to pay principal and interest at the same time, so you’ll gain equity in your asset while you’re paying off your loan. You also know exactly how much you’ll be paying each month for the duration of the loan repayment period, which makes financial planning much easier. With an amortized mortgage schedule, you’ll know how much your mortgage will cost you every month this year, next year and 30 years from now.

Because borrowers pay both principal and interest at the same time, monthly payments can be higher. With an amortized loan, some borrowers may also be unaware of the loan’s real cost, as they focus more on the monthly payment and disregard the total interest the loan will cost them.

2. Pros and Cons of Unamortized Loans

Unamortized loans, on the other hand, are attractive to borrowers because of their interest-only payments, which tend to be lower than amortized loan payments of combined principal and interest. The monthly payments for unamortized loans are also easier to calculate since you only have to worry about the interest. These lower, interest-only payments allow borrowers of unamortized loans to save up enough to make a large lump sum payment.

For consumers who rely on lump-sum income, such as commission, bonuses or payment from contracts, unamortized loans tend to be a better financial option.

However, since you’ll be paying lower payments of interest-only, you’ll have to make a large payment toward the end of your repayment period, known as a balloon payment. This lump-sum payment will go toward the principal of your loan. Planning ahead with an unamortized loan is crucial to ensure you save up enough to make that large payment down the road. Additionally, because you aren’t initially paying any principal of the loan, you’re also not gaining any equity in your home or vehicle while making your interest-only payments.

For many borrowers, amortized loans are a better option. Home loans, car loans and personal loans tend to be amortized, but some mortgages, like balloon loans, can also be unamortized. Compare costs and take a good look at your personal finances to determine which is the right option for you.

Things to Keep In Mind About Amortization

Keep in mind the information that amortization tables don’t account for. This information includes:

- Fees: An amortization table generally doesn’t include additional fees for your loan, such as closing costs on a mortgage or origination fees.

- Additional expenses: Your amortization schedule doesn’t include every cost related to your home. You may also have to pay expenses such as property taxes or private mortgage insurance (PMI) that aren’t included in your amortization schedule.

- Extra payments: A standard amortization schedule won’t account for extra payments. You can make an extra payment on your mortgage to pay your debt down early, but you may have to use your own amortization schedule to calculate the benefit of making an extra payment and how this will affect your remaining loan payments.

Though an amortization schedule breaks down your loan payments by month and illustrates exactly what you’ll be putting toward principal and interest in each payment, this amortization table may not provide a complete picture of how much your asset will cost you. When deciding how much home you can afford, for example, keep in mind that there are costs beyond monthly payments and interest to consider.

Amortization Schedules FAQ

Below are some commonly asked questions about amortization schedules:

1. What Is the Purpose of an Amortization Schedule?

Looking at individual payments will allow you to compare loan options more easily. You will be able to tell how much the accrued interest of each loan would cost each month. You will understand the interest rates of each type of loan better, and without having to visualize that information, you can select the option that works best for you.

Amortization schedules also help you stay on track for completing your payments once you secure a loan. They are handy if you ever need to refinance, and they continue to be useful for tax purposes, if needed.

2. What Does an Amortization Schedule Show?

The amount you borrow is the principal amount, and the interest is what the lender charges for their services. Your schedule should show both values, so you will see how much the interest costs. It’s easier to look at an amortization schedule than to estimate how much you will pay monthly or to calculate the numbers on your own.

3. How Do I Get an Amortization Schedule?

An amortization schedule will be provided when you close on a loan. You can also use an online calculator tool. With the right information, creating one yourself in Excel or a comparable program can save you some time when you’re still deciding on a loan.

Secure the Right Loan With Assurance Financial

Are you comparing your loan options? Want to make sure your loan is affordable over a long-term period? Find a loan officer who can help you create your ideal amortization schedule with Assurance Financial.

[download_section]

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing