You make better decisions when you fully understand your mortgage. Taking some time to crunch the numbers can help you develop an accurate assessment of your loan situation so you’re more likely to pay it off in the long run. Here at Assurance Financial, we have the information you need to estimate your mortgage payment and provide a mortgage lending calculator that can make the task a little easier. If you know what type of mortgage you’ll be applying for, you may also be able to use a calculator designed for that loan type, like a conventional mortgage calculator or a jumbo mortgage calculator.

Need to quickly calculate your estimated mortgage payment? Use our mortgage payment calculator to determine how much you may need to pay.

Want to learn more? Below we’ve mapped out how to calculate your estimated mortgage payment and highlighted a few details to pay attention to during the process.

- Why Is It Important to Calculate My Estimated Mortgage Payment?

- What Information Do I Need to Get Started, and Where Can I Find It?

- What Is a Fixed-Rate Loan? How Do I Calculate It?

- How Do I Calculate an Interest-Only Loan Estimate?

Why Is It Important to Calculate My Estimated Mortgage Payment?

Most people who buy a home secure a mortgage to finance their purchase. The mortgage includes both the principal and the interest, which is paid to the lender in monthly installments for the duration of your loan’s term. A home is generally the largest purchase a person makes during their lifetime, so you’ll want to know exactly what you’re getting yourself into before you take the leap.

Calculate your estimated mortgage payment to determine whether you can actually afford the home you’re looking to buy. Here are a few reasons why it’s important to calculate your estimated mortgage payment:

1. You Can Plan Your Financial Future

Calculating an estimated payment will also help you when you’re planning out your financial future. Because most mortgages last for many years, often up to 30 years, having a solid estimate of what your cost of living will be every month for the coming years or decades will give you the freedom to plan how much money you can allocate to other expenses and financial goals.

2. You’ll Determine How Much Home You Can Actually Afford

Calculating your estimated payment will also give you an idea of how much house you can comfortably afford. Can you afford a $300,000 home? Or can you only comfortably afford a home valued at $150,000? Knowing early on how much you can actually afford will save you a lot of time and potential heartbreak when you don’t waste your time considering houses out of your price range.

When you calculate your estimated mortgage payment, you may want to ensure that your monthly payment won’t keep you from meeting your other financial obligations and goals. With this mortgage payment, can you still afford your other monthly bills? Will you still be able to hit your target savings rate for retirement and your emergency fund? Is this a payment that can comfortably fit into your budget?

If the answer is no, then you may want to consider another home or a mortgage with different terms. Or you may simply want to put off buying a home until it’s an expense you can comfortably cover.

If the answer is yes, and you are comfortable with your estimated mortgage payment, then buying a home may be the right next step for you.

What Information Do I Need to Get Started, and Where Can I Find It?

To begin calculating your estimated mortgage payment, think about the following information for the potential mortgage loan:

- Your monthly income

- The market value of the home

- The loan amount

- The type of loan

- The interest rate on the loan

- The number of years you have to repay

1. Your Monthly Income

If you have a budget, you should already know exactly what your monthly income is. If you don’t have a budget yet, you may want to create one so your calculations for home affordability will be easier. If you don’t know your monthly income, check your pay stubs from the past few months. Add up your paychecks for each month to calculate your monthly income.

If you have a large monthly income that consistently gives you a huge surplus in your budget, that may affect the loan terms you choose. With a large income, maybe you feel comfortable with larger monthly mortgage payments and want to opt for a 15-year term that will result in you repaying your loan much faster than you would for with a 30-year term.

2. The Market Value of the Home

To figure your mortgage payment, you’ll need to know the market value of the home you’re interested in purchasing. How much is your home going to cost you? Though the median listing price for a home in the U.S. is about $300,000, the market varies in different areas. The median home price in some California cities, for example, is nearly $1 million. In other areas, the median home price may be closer to $100,000 or even less.

3. The Loan Amount

To calculate your estimated mortgage payment, you’ll also need to factor in the total loan amount. The amount of money you borrow for the loan is also known as the principal. When estimating your mortgage payment, experiment with the loan amount to determine how much of a loan you can comfortably afford. You may only qualify for a maximum loan amount, so knowing how much you can expect to get from a lender can help you determine whether you can finance the home you’re interested in.

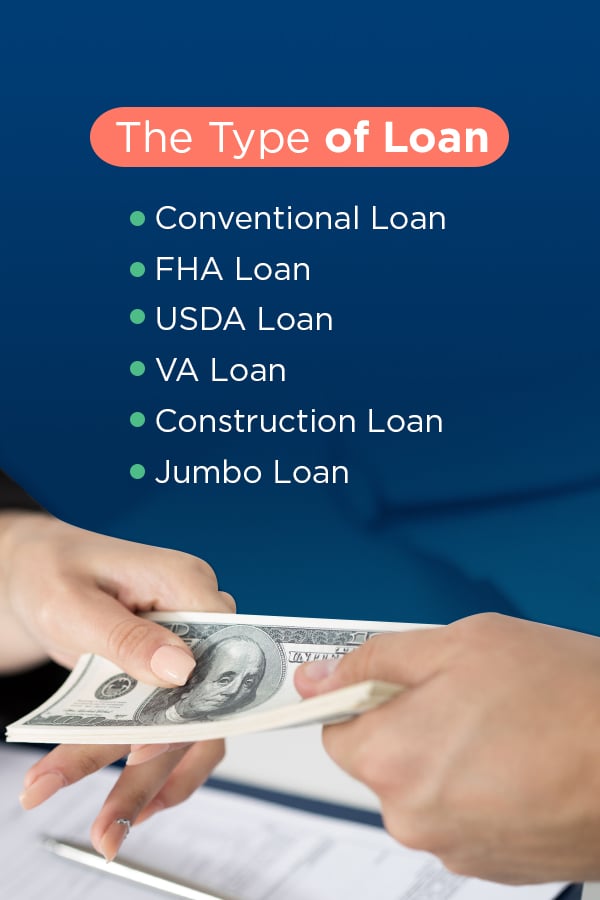

4. The Type of Loan

It may also be helpful to have an idea of which type of mortgage loan you’ll be securing to calculate your estimated mortgage payment. There are six major types of mortgage loans:

- Conventional loans

- FHA loans

- USDA loans

- VA loans

- Construction loans

- Jumbo loans

Conventional Loan

A conventional loan is the most common type of mortgage in the U.S. The down payment necessary for a conventional loan tends to be higher than other mortgage options. You can choose either a fixed or adjustable interest rate. A conventional loan is great for new homebuyers, and you may be able to eliminate private mortgage insurance premiums by paying a large enough down payment.

To be eligible for a conventional loan, you should have a moderate credit score and a low debt-to-income ratio. You’ll probably also want a 20 percent down payment. For a loan of $100,000, that amounts to $20,000 for a down payment.

FHA Loan

An FHA loan is insured by the Federal Housing Administration. If you don’t have great credit or a large income, then an FHA mortgage may be a great option for you. They tend to be popular with first-time homebuyers, and you can get a fixed interest rate for a 15-year or 30-year term.

To be eligible for an FHA loan, you need a credit score of at least 500, an employment history from the last two years and verifiable income. You could put as little as 10 percent down if your credit score falls between 500 to 579. If your credit score is at least 580, your down payment may be as low as 3.5 percent.

USDA Loan

A USDA loan can be secured by borrowers who live in qualifying areas designated by the Department of Agriculture. For this loan type, you don’t need to have an excellent credit score or a high income. In fact, to qualify for this loan type, you need to have a low income relative to your area. You also must be a citizen or eligible non-citizen, and you must make the home you’re purchasing your primary residence.

VA Loan

A VA loan is specifically for veterans and is backed in part by the Department of Veterans Affairs. These loans generally have the lowest rates of the major mortgage types and can be secured by members of the military, Reserves, National Guard or their spouses.

You can qualify by:

- Serving for 90 consecutive days during wartime

- Serving for 180 days during peacetime

- Serving for six years in the Reserves or National Guard

- Being the spouse of a service member who died on active duty

Construction Loan

A construction loan pays for buying land and building a house. Generally, these loans come with a maximum one-year term, and the lender will distribute the money to the borrower as construction progresses rather than in a lump sum. Rates tend to be higher for this loan type than for others because of its high risk for lenders.

To qualify for a construction loan, you’ll want a good credit score, a stable income, a large down payment and a low debt-to-income ratio.

Jumbo Loan

A jumbo loan is for homes that are particularly pricey. If you’re looking to purchase a home that will cost more than $424,100, and you’re a high-income earner, you may want to consider a jumbo loan.

Qualifying for a jumbo loan is more difficult than other loans. You’ll need a higher credit score, a low ratio of debt-to-income and a significant down payment. You’ll also need to provide proof of cash reserves, employment history and income. Because requirements can vary from lender to lender, you’ll want to check with your lender to see the exact requirements for a jumbo loan.

Everyone has their own individual financial situation and goals, which is why there are multiple loan options to meet the various needs of borrowers.

[download_section]

5. The Interest Rate on the Loan

Your loan’s interest rate is another piece of information you’ll need to calculate your estimated mortgage payment. Mortgage interest rates fluctuate with the market and are affected by factors such as the U.S. Federal Reserve’s monetary policy, the market, the economy and inflation.

The interest rate will determine what the total cost is of borrowing your loan from the lender. Interest is essentially a fee the lender charges for loaning you the money to purchase your home. In the early years of paying off your loan, your monthly payment will primarily be interest.

For borrowers, the interest rate you can secure depends on your credit score and history. Generally, borrowers with higher credit scores tend to receive the lowest interest rates. However, you likely will still receive a good interest rate if your score falls between is mid-range. Use your credit score in your calculations to help you determine what interest rate you may qualify for and how that affects your overall financial obligation. If your credit score is low and results in a high-interest rate, you may want to take some steps to improve your credit score before pursuing a mortgage loan.

6. The Number of Years You Have to Repay

The final piece of information you’ll need to calculate your estimated mortgage payment is the length of your loan. How many years will you have to repay your loan? Most loans have a 30-year term but some are 15 years.

If you’re interested in lowering your monthly payment, you might consider increasing the term of your loan. Monthly payments for a $200,000 mortgage will be higher for a 15-year loan term than for a 30-year term, for example.

If you consistently have a surplus in your monthly budget, however, you may feel comfortable with a higher payment if it means you’ll pay off your mortgage in half the time. A 15-year fixed loan also tends to offer a lower interest rate than a 30-year fixed loan.

For example, on a 30-year loan of $160,000 at a fixed rate of 4.125 percent, your total interest paid would be approximately $119,000. For a 15-year fixed loan of the same amount at an interest rate of 3.52 percent, you’ll pay only about $46,000 in interest. That amounts to $73,000 saved by repaying your mortgage in half the time.

When calculating your estimated mortgage payment, you’ll want to have these important pieces of information on hand. For any information you don’t have exact numbers for, experiment with the numbers in your calculations to see what might work for you.

What Is a Fixed-Rate Loan? How Do I Calculate It?

A fixed-rate loan has an interest rate that doesn’t change at all over the course of the loan term. The monthly payment stays the same every month, which makes monthly or yearly budgeting easy and predictable for borrowers. Fixed-rate mortgages generally have higher rates than variable rate loans, but they also protect homeowners from fluctuations in the housing market. Further, since the housing crisis of 2008, the gap between adjustable rates and fixed rates has virtually closed, meaning fixed interest rates can be just as low as variable rates.

If interest rates in the market increase, you won’t be affected and won’t have to worry about your interest costs or mortgage payments increasing. You can find a fixed interest rate for several term options, including 15-year and 30-year terms. With a fixed rate, when you initially begin paying your mortgage, your early payments tend to be mostly interest rather than principal. Over the years, your payment will gradually comprise more principal than interest. This process is known as loan amortization.

This does not affect the size of your monthly payment, which remains consistent month to month until the loan balance is completely repaid.

A fixed-rate loan is a great option for a borrower who wants the stability of a consistent monthly payment and wants to avoid the risk of a variable interest rate that may cause increased payments.

So how do you calculate your fixed-rate loan? You need to know the amount of the loan and the mortgage payment factor. The formula for those loans is: Loan Payment = Amount/Discount Factor.

Before you begin, you’ll need to calculate the discount factor using the following formula:

- Number of periodic payments (n) = payments per year times number of years

- Periodic Interest Rate (i) = annual rate divided by the number of payments per

- Discount factor (D) = {[(1 + i) ^n] – 1} / [i(1 + i)^n]

Seem complicated? Check out Assurance Financial’s Mortgage Calculator Tool and we can help.

To use the calculator, you’ll first input your mortgage loan information. This includes your mortgage loan amount, your annual interest rate, the number of months of your loan term and your desired amortization schedule.

Next, you’ll fill in your property information. This includes the sale price of the property, your annual property taxes, your annual hazard insurance and your monthly private mortgage insurance. You may also opt to let our system estimate your property taxes, hazard insurance and private mortgage insurance for you.

After you’ve filled in all the applicable information, hit Calculate, and we’ll give you your estimated monthly payments and an estimate of how much you’ll pay in interest over the life of the loan. Check to see how close you came when you calculated the estimates yourself.

How Do I Calculate an Interest-Only Loan Estimate?

Interest-only loan estimates are far less complicated to calculate. With each payment, you aren’t actually paying down the loan. Lenders generally list interest rates as annual figures, so you’ll divide the rate by 12 for each month of the year to calculate what your monthly rate will be. The formula for an interest-only loan is:

Loan Payment = Amount x (Interest Rate/12)

or

P = A x I

For example, if your interest rate is 6 percent, you would divide 0.06 by 12 to get a monthly rate of 0.005. You would then multiply this number by the amount of your loan to calculate your loan payment. If your loan amount is $100,000, you would multiply $100,000 by 0.005 for a monthly payment of $500.

A simpler calculation may be first multiplying the loan amount of $100,000 by the interest rate of 0.06 to get $6,000 of yearly interest, then dividing that $6,000 by 12 to get your monthly payment of $500. Regardless of which method you choose, you’ll still end up with the same value.

Your payment amount will stay the same until you make an additional payment, after a certain period when you’re required to make an amortizing payment or you pay off the entire loan.

Finance Your Home With Assurance Financial

Still confused about how to calculate your estimated mortgage payment? Contact Assurance Financial today or check out our Mortgage Calculator Tool. Our team of loan officers is dedicated to making the loan process as easy as possible for you.

At Assurance Financial, we want to help you secure the right mortgage for your dream home. Financing your home should be an exciting, memorable time in your life, and we want to make every step in the process as smooth and enjoyable for you as possible. When you contact us, we’ll put you in touch with a loan officer who will help you secure the right mortgage for your dream home.