When home-buyers consider the cost of purchasing a home, they tend to focus on mortgage rates and how much they’ll be paying in interest over the life of the loan, as that is by far the biggest cost associated with a mortgage. It’s also important, though, to consider other costs since they can quickly add up.

The final hurdle all homeowners face before they finally purchase their home is closing costs. These fees typically represent a significant amount of the total home purchase and usually cost between three to six percent of the mortgage. Closing costs can be a big, unexpected expense for a potential home-buyer who isn’t anticipating them.

So how can you calculate exactly how much you’ll pay in closing costs? What fees are included in these costs, and can you roll them into your mortgage? Can you avoid paying them altogether?

Below, we’ll explain why these expenses are incurred and what you can expect to pay at closing.

- What Are Closing Costs?

- What Fees Can I Expect at Closing?

- What Is a Good Faith Estimate?

- How Do I Calculate Closing Costs and What Should I Expect to Pay?

- Who Pays Closing Costs?

- Can Closing Costs Be Included in a Mortgage?

- When Are Closing Costs Paid?

- Can You Avoid Closing Costs?

What Are Closing Costs?

Closing fees are a cost associated with the transfer of ownership during the home purchasing process. These fees are required to officially complete a real estate transaction. Either the buyer or seller pays these fees on the settlement date. The law requires lenders to offer a loan estimate within three days of receiving an application. The information on the application will dictate the closing cost. However, these fees are not always final and are subject to change.

The lender should issue a closing disclosure statement at least three business days before the closing date. The closing costs estimate on these documents should be closer to your total expected payment. Before closing, compare the final fees to your initial loan estimate and ask your lender to explain any changes in costs.

What Fees Can I Expect at Closing?

Closing cost fees vary and mostly depend on the type of property you buy, where you live and the loan you secure. Below some of the fees most commonly included in closing costs.

- Appraisal fee: This fee is paid to the appraiser who is assessing the property’s value.

- Application fee: This fee is the cost for the lender to process your application. The fee typically covers services, like a credit check or appraisal. Before you submit your application, ask your lender what this fee includes and negotiate if possible.

- Attorney fee: This fee covers the cost for an attorney to review the closing documents. Some home-buyers may not be required to pay this fee, as not every state requires this step.

- Courier fee: To complete the transaction of your loan, your documents must be transported quickly. This fee covers the cost of that transportation.

- Credit report fee: Lenders require a tri-merge credit report to approve your credit history and score. This fee covers the cost of pulling a credit report, which ultimately determines the interest rate you’ll pay on your loan.

- Deposit for mortgage insurance and property taxes: You may be asked to put down a total of two months’ worth of mortgage insurance payments and property taxes at closing.

- Discount points: This expense is paid upfront if you want to get a lower mortgage rate. It is not always available, but you can ask your lender about it.

- Home inspection: Before closing on a home, you’ll want to schedule an inspection to ensure the property you’re about to purchase is in good condition. An inspector will notify you if any home repairs are needed. If repairs are required, you can use that information to negotiate a lower price from the seller.

- Homeowners’ insurance: This insurance covers potential damage to your house, and you may be required to pay for the first year of that insurance upfront at closing.

- Loan origination fee: The origination fee covers the administrative costs incurred by the lender and is typically about one percent of the loan amount. In some cases, lenders offer home loans with no origination fee.

- Pest inspection fee: As with a home inspection, you may want to schedule a pest inspection. In some states and for government loans, this inspection is required. This is because repairs for termites or dry rot can be quite costly.

- Private mortgage insurance payment: Unless you’ve made a down payment of at least 20 percent, you may need to pay private mortgage insurance. At closing, you’ll pay the first month’s payment if this insurance requirement applies to you.

- Property tax: Generally, at closing your lender will also want you to pay any taxes that are due within 60 days of the purchase. This can be one of the biggest expenses at closing, and the amount you’ll pay depends on the tax rate in your home’s town or county and the value of the home.

- Recording fee: This fee is for recording the property’s change in ownership and is charged by the county or city.

- Title insurance fee: This fee refers to both the buyer’s policy and the lender’s policy. These policies protect the buyer and lender respectively in the case of a title dispute.

- Transfer tax: This tax is incurred when the title of the house passes to the buyer from the seller.

- Underwriting fee: This fee covers your lender’s underwriting costs and the research process to approve you for the loan.

Though you may see some of these fees in your closing costs, your loan is not likely to include all of them.

What Is a Good Faith Estimate?

If you apply for a reverse mortgage, you will receive a form called a Good Faith Estimate. A GFE gives you some basic information about your loan, which is meant to help you understand the cost of the loan, compare offers and make an informed decision. Lenders are required to give you a GFE within three business days after receiving your application and any other required information. You can’t be charged any fees, except a credit report fee, before you receive a GFE and tell the lender you want to proceed with the loan.

You’ll also receive a Truth-in-Lending disclosure, which gives you information on the costs of your credit. You should receive a disclosure when applying for the loan and a final disclosure prior to closing.

The law also required GFEs for regular mortgages until 2015. For most types of mortgages, a form known as the Loan Estimate took the place of the GFE on October 3, 2015. This three-page form gives you details about your loan, including the monthly payment, estimated interest rate and total closing costs. The lender must also provide this form within three business days of receiving your application. You should also receive a five-page document called a Closing Disclosure at least three business days before closing on your mortgage loan.

If you apply for another type of loan, such as a HELOC, you won’t receive a GFE or Loan Estimate, but you should get a Truth-in-Lending disclosure.

How Do I Calculate Closing Costs and What Should I Expect to Pay?

On average, most homebuyers will pay between 2% and 5% of the purchase price of their home in closing costs. If you’re looking into how to calculate closing costs, you’ll need to have some information on different factors. The amount varies depending on the amount of the mortgage loan, the loan type and the region in which you are purchasing.

For example, if your home costs $200,000, you may pay between $4,000 and $10,000 in closing fees. Before closing, discuss the details of these costs with your lender and find out if they are willing to offer you a loan with lower fees.

The average cost of closing fees for homebuyers is $6,837. The higher the purchase price of your home, the higher your closing costs will be. While the average closing costs for a $150,000 house might be between $3,000 and $7,500, the average closing costs for a $600,000 are between $12,000 and $30,000.

If you don’t have a real estate agent to estimate the total amount of your closing costs for you, you can calculate the total by adding the fees yourself.

Though the seller does cover certain closing costs, there are closing costs that the buyer should expect to be responsible for paying. But how much will each fee actually cost you? Here is a breakdown of the typical closing costs that homebuyers can expect to pay:

-

- Appraisal fee: This fee can cost the buyer $500 to $1,000 or more. This cost is generally paid upfront.

- Lender fees: This cost can be several percentage points of your total loan amount. Lender fees include an application fee, processing fees, underwriting fees, wire transfers and more.

- Property insurance and taxes: The cost of property insurance and taxes can range from $1,000 to $4,500 or more. The annual premium for property insurance is generally owed at closing. Your property tax amount depends on your location and your lender. Generally, upon closing, lenders will require that you pay for at least two to three months of your property taxes.

- Title fees: These fees typically cost about $300 to $2,500 or more. Whether the buyer or seller covers these fees depends on the state they are buying and selling in. Title fees generally involve title search fees, title insurance and notary fees.

- Transfer taxes: These taxes can vary by region. The transfer taxes refer to the transfer of the property’s deed and can be paid by either the seller or buyer or split between them.

Costs vary by location, and sometimes buyer closing costs can be negotiated and paid for by the seller. Sellers may be responsible for paying liens on the property, property taxes, real estate commissions, title taxes, transfer taxes and utility bills that are past due.

Negotiating with your seller can be a great way to reduce your closing costs. Most of these costs are negotiable. In some cases, the seller may even be willing to cover all of the closing costs. When you’re facing the expense of closing costs on your potential new home, don’t be afraid to discuss and negotiate these costs with the seller.

Who Pays Closing Costs?

Both buyers and sellers are responsible for closing costs. The amounts can vary widely by property, jurisdiction, mortgage type and even the negotiations between the buyer and seller. Because the term “closing costs” is used as a catchall, it can include many costs that come due at closing on both sides. For example, if the seller is behind on their property taxes, they’ll need to ensure they’re current before closing.

Typically, the seller pays most of the fees, including both real estate agents’ commissions. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%.

The bulk of the costs for sellers comes down to the commission for the real estate agents, but it can be harder to determine how much closing costs are for the buyer. Buyers pay more varied costs related to the process of buying the home, like inspections and underwriting, along with prepaid costs like homeowners insurance and escrow.

Most of these costs are out of pocket for buyers, but you may be able to get another party to cover some or all of the costs. Sometimes, you can negotiate with the seller or roll some of the closing costs into your mortgage.

Down payment assistance programs may be able to help with covering closing costs. Your escrow company can also put a credit toward your down payment if you put any earnest money into escrow when putting in your offer.

Closing Costs for Sellers vs. Closing Costs for Buyers

The seller typically takes on the majority of closing costs, and they can often be deducted “off the top” of the price of the home, so there is no separate payment needed. Although buyers can sometimes shop around for lower fees, sellers don’t usually have as much flexibility. Still, the largest item is typically the commission for a real estate agent, which you may be able to negotiate.

Some common closing costs for sellers include:

- Realtor commissions: The real estate agents for both the buyer and the seller receive compensation, usually paid for by the seller as a percentage of the total purchase price.

- Title fees: The seller takes care of the fees to transfer the home’s title to the buyer.

- Homeowners association (HOA) fees: If the seller has any outstanding fees owed to their HOA, they’ll need to pay them at closing.

- Property taxes: Similarly, the seller must cover any unpaid property taxes at closing.

Buyers have to pay for most of the other fees we’ve already discussed, such as:

- Attorney costs

- Home inspection fees

- Appraisal fees

- Underwriting or credit reporting fees

- Prepaid interest

- Homeowners insurance

- Title fees and insurance

- Escrow

While many people don’t consider it a closing cost, your down payment is also due at closing.

Can Closing Costs Be Included in a Mortgage?

The short answer is yes, you can finance your closing costs. This doesn’t mean you’re not paying them. It just means you’re not paying thousands of dollars upfront when you close on your new home. After a large chunk of your savings goes toward a down payment, financing your closing costs may seem like an appealing financial move.

If you live in your home for only a few years or you’re able to pay your loans off quickly, then rolling your closing costs into your mortgage might be a worthwhile option.

For many home-buyers, however, paying closing costs over the long run may actually end up costing you more than if you had paid your closing costs in cash upfront. Your lender may also not allow rolling in closing costs with your mortgage, so if you want to pursue this payment avenue, be sure to first discuss it with your lender.

When Are Closing Costs Paid?

Closing is the point at which the property’s title transfers to the buyer from the seller. Closing costs are also paid at this time.

However, if you opt to finance your closing costs or to secure a no-closing-cost mortgage, then you will effectively pay for your closing costs or for the lender’s recouping of your closing costs over the years of your loan term.

Can You Avoid Closing Costs?

If you’re a home-buyer, you may be looking into various avenues that will allow you to save money on your home purchase. One of those ways may be reducing or even eliminating closing costs.

1. Deduct Closing Costs During Tax Season

Despite what you might have heard about all closing costs being tax-deductible, the truth is that most are not. However, there are a few that may apply to you, and the tax deduction could be substantial.

If you want to deduct your closing costs, you won’t be able to take a standard deduction. To deduct the following costs as a buyer, you will need to use a Schedule A for itemizing your deductions.

- Property taxes: You may be able to deduct property taxes you paid at closing.

- Mortgage insurance premiums: Mortgage insurance premiums that you prepaid may be deductible.

- Discount points: If you pay for discount points to lower your mortgage interest rate, these may be tax-deductible.

Though you may be able to deduct some of your closing costs come tax season, you may not want to rely on that deduction to significantly lower or avoid your closing costs altogether.

2. Secure a No-Closing-Cost Mortgage

If you want to avoid closing costs entirely, you may be able to secure what is called a no-closing-cost mortgage. While lenders will cover many of the fees that fall under closing costs, they will also charge you a higher interest rate for the loan. Your monthly payment will be larger, but you also won’t have to spend as much money upfront, especially when you’re also handing over a sizeable down payment.

For many first-time buyers, coming up with enough money to front all of the initial costs associated with purchasing a home can be challenging. These no-closing-cost mortgages can help alleviate some of that initial financial burden. If you’re a home buyer who has found their ideal home and you want to move in now without needing to wait months or years to save up enough to cover all of the initial costs, this may be the right option for you, especially if you’re planning to live in the home only short-term.

To determine whether a no-closing-cost mortgage is right for you, you may want to crunch the numbers to see if what you’ll be saving upfront is really worth the added expense of a higher interest rate over the life of the loan.

3. No-Closing-Cost Mortgages vs. Other Mortgage Options

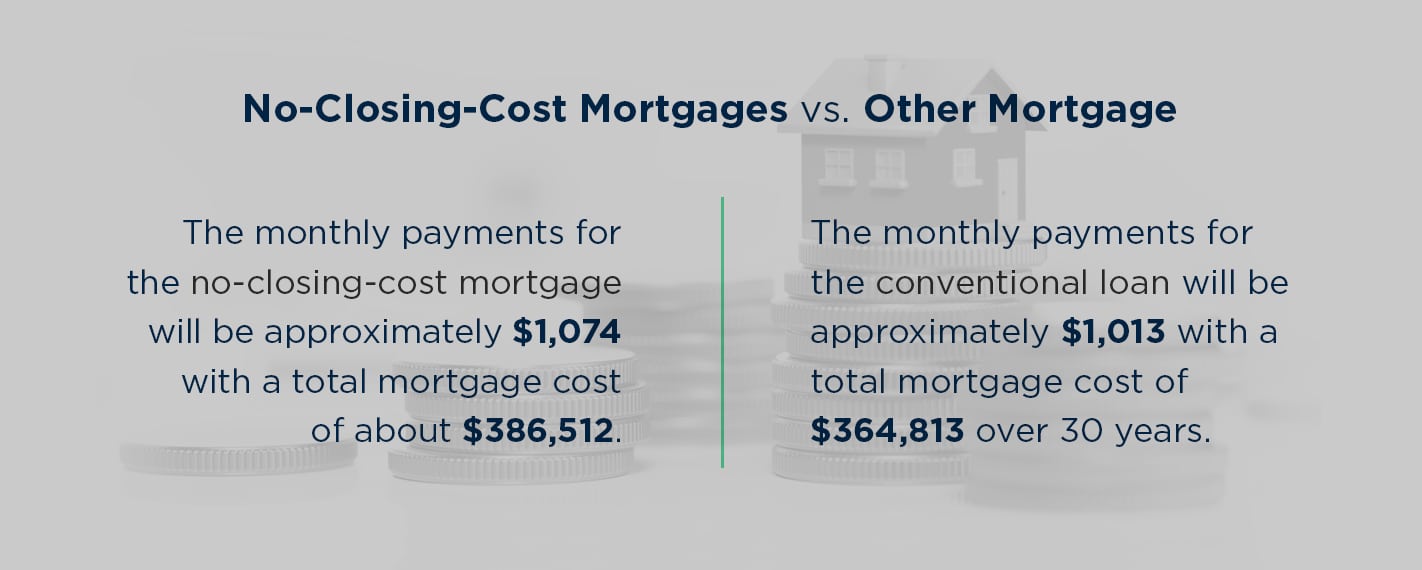

Start by weighing the total costs of a no-closing-cost mortgage against the total costs of a conventional mortgage.

If you were looking to finance a home for $200,000, you might start by looking at a conventional loan with a four and a half percent fixed rate for a 30-year term and $4,000 in closing costs. For that same loan amount, a no-closing-cost mortgage may offer a five percent fixed rate without any closing costs.

The monthly payments for the conventional loan will be approximately $1,013 with a total mortgage cost of $364,813 over 30 years. The monthly payments for the no-closing-cost mortgage will be approximately $1,074 with a total mortgage cost of about $386,512.

If you accept the no-closing-cost mortgage, within the first couple of years, you’ll break even on the amount you saved through the lender covering your closing costs. After that point, you’ll be paying more than you would with a conventional loan due to your higher interest rate. At a term of 30 years, you could end up spending tens of thousands of dollars more with a no-closing-cost mortgage than you would’ve with a conventional loan.

Other mortgage options offer low-interest rates, and you can also secure certain loans without any down payment. The VA loan is known for its low-interest rates for service members and little to zero down payment. An FHA loan can be secured with a down payment of as little as three and a half percent of the total loan amount. A USDA loan can be secured for low or zero down payment and offer low interest rates for those who live in qualifying areas. Some loan options are intended for those with low income and little savings, so these loans can be great alternatives to no-closing-cost mortgages for qualifying applicants to consider.

Closing costs are not always set in stone. Many can be reduced or waived, such as application and origination fees, so you may be able to lower or reduce fees if you discuss them with your lender without the worry of increasing your interest rate.

Remember that sellers who are very motivated to sell their home may also be willing to contribute to your closing costs. They can contribute up to six percent of the home’s sale price, so you may want to discuss your options with the seller as well.

Get Started With Assurance Financial

On average, closing costs are an extra few thousand dollars that home-buyers need to shell out during the initial process of purchasing their new home. With the significant burden of a down payment that already exists for many home-buyers, those additional thousands of dollars may be yet another significant savings challenge.

Though some may want to take the option of financing their closing costs or of securing a zero cost mortgage, these options often don’t save buyers any money in the long run, especially if it means taking on a higher interest rate for their mortgage. Fortunately, buyers have a number of options when it comes to reducing or eliminating closing costs, especially when you work with the right lender.

Assurance Financial is dedicated to providing the assistance you need to receive your loan hassle-free. Financing your home should bring you joy, and at Assurance Financial, we want to help you make the process of buying your home as joyous and exciting as possible.

Ready to get started? Apply in as little as 15 minutes at Assurance Financial! Learn more about the loans we offer and the options available for first-time homebuyers.

[download_section]