You Have a Vision. We Fund It.

Building or renovating a home is a big commitment, requiring both time and money. Fortunately, we provide the expertise and loan program to help you save both. Our construction and renovation loan programs offer competitive fees and rates, as well as flexible draw schedules, to keep you and your builder or contractor moving efficiently throughout the process.

Up to 95% financing, subject to appraised value

Permanent loan programs, including Conforming Conventional, FHA, VA, and Jumbo (up to $1.5MM)

Extended lock protection

Roll the cost of both home and renovation into one loan

Find out more about this program and eligibility from your Assurance Financial Loan Officer.

RESOURCES

Downloadable Guides

We’ve created these guides to be a valuable resource to walk you step-by-step through your next adventure.

-

First-Time Homebuyer Guide

4.6 MiB

Thanks for your interest in learning more about your mortgage options! We hope you find this information helpful. If you have more questions, please feel free to contact us anytime.

Click here to download the file -

Refinance Guide

4.35 MiB

Thanks for your interest in learning more about your mortgage options! We hope you find this information helpful. If you have more questions, please feel free to contact us anytime.

Click here to download the file

How to Get Started

There are several ways to begin the loan process.

Explore all the loans we provide

Need help with your application? We're here to lend a hand.

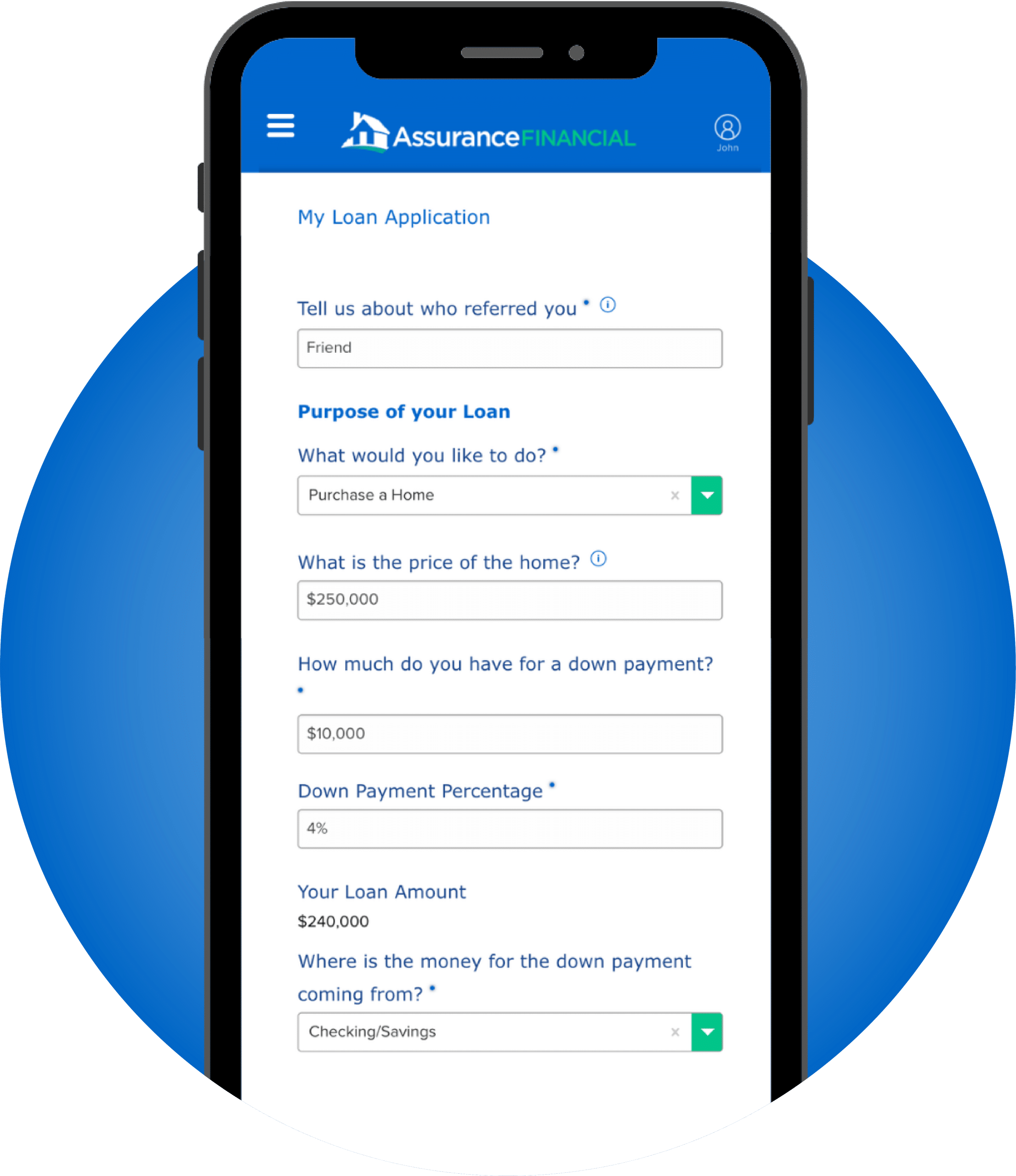

Our easy digital application walks you through every step of the process in terms you can actually understand. Plus, we’re always a phone call away if you get stuck.

start your application

Speak with an expert!

We have friendly experts to answer your questions. Find a loan officer licensed in your state.

Find A Loan Officer

Did we miss anything?

You still have questions, we still have answers. Take a look at what other people have been asking.

Read FAQs

Construction Mortgage Loans

You may have a dream home in mind, and whether you want to build that home or renovate your current property to reflect your vision, you need financing. Traditional home loans do not cover labor, construction materials and the other costs of big renovations or construction. This is where construction mortgage loans can be handy.

Construction loans can be used by many types of borrowers, including:

- New homebuyers interested in building a home or renovating a property

- Homeowners interested in home restoration

- Builders contracted out by a buyer

What Is a Construction Loan?

A construction loan is a shorter-term home loan designed specifically for home construction and renovation. You can use the loan for construction materials and the labor required to build or renovate your home.

Once you have completed the construction, you can roll over your financing into a more traditional mortgage. This usually happens after the construction professionals are paid and your certificate-of-occupancy is issued.

Another option is that you may have one closing. Assurance Financial offers this option, as well as the traditional two-closing financing option. With one closing, your financing is one loan that goes from a construction loan to a mortgage. This type of financing draws against the loan and closes out at completion. Since there is only one closing, you may save on the additional closing costs that you might incur if you close twice — once on a construction loan and then again on a permanent home loan.

How to Qualify for a Construction Loan

If you decide to use construction loan options or your home equity to pay for renovations or a new build, you will need to find a construction professional or homebuilder. Ask for recommendations from friends and family. Contact the National Association of Homebuilders to find recommended professionals.

Once you have a few names to consider, contact different homebuilders to ask for estimates. Make sure any builders you consider have a good reputation, insurance and certification. Look for professionals who have handled similar projects to yours.

It is important to speak to construction professionals first so you have an accurate quote for the job, as well as details about the job. Your lender will need to understand how much you need in financing to complete the project and estimate how long the building is likely to take.

To get your financing, you may need to make a downpayment or already have equity in the project. The amount you need will depend on a number of factors, including the size of the loan you are seeking. While in some cases you may need a down payment of 20%, this can vary widely depending on your situation.

You can use the equity of your loan as part or all of the down payment if you own the land where you are building. If you do not own the land, you may need to find a down payment some other way. You may also need to purchase the land after the construction loan is closed.

There are many ways to finance your construction and your down payment. If you would like to build your home or want to be able to make additions or changes to your property, apply for a loan with Assurance Financial or reach out to a loan officer near you to explore your options.

What Credit Score Do I Need for a Construction Loan?

Since construction loans do carry risks for lenders, you need a credit score of at least 680 and preferably 700-720 or higher. The higher your credit score and the more collateral or cash for a down payment you have, the better a chance you may have for securing financing.

Our Construction Loan Options

If you’re wondering where to get a construction loan or have questions about how to get a construction loan, wonder no more. Assurance Financial has many options to help you determine how to finance new construction or renovation.

We offer both builder-financed and buyer-financed construction loans. Builders can turn to Assurance Financial to secure financing, so they can have the assets they need for a project and stay in control of the build.

If you are a homeowner or home buyer interested in hiring a builder to renovate your home or build a home on a lot, Assurance Financial can help. You can apply for a construction loan designed for you online or by speaking to a local loan professional.

You can get construction loans for secondary residences such as vacation homes, or for primary, owner-occupied residences. If you want construction for an investment property, you will need a commercial loan, instead.

Another option you will have with Assurance Financial is a two-closing or single-closing loan. A single-closing loan will automatically convert into a traditional mortgage and may save you on second closing costs. Or, you can choose two-closing loans, which can be more flexible.

Not sure which loan is right for you? Apply with Assurance Financial or speak to one of our loan officers. Assurance Financial can listen to your plans and help you find the right loan for your needs. Or, we can allow you to apply online quickly.

Assurance Financial is serious about finding you the right financing, so you can enjoy the home you’ve wanted. We know there is no such thing as a cookie-cutter solution when it comes to your home and mortgage, which is why we work with you and treat you like a member of our family.

At Assurance Financial, we’re The People People with technology. We put the humanity back into home financing.

Construction Loans Near Me

Assurance Financial has experts licensed in 28 states, so we can pair you with a people person and mortgage professional near you. When you want to build a dream home or renovate extensively, we can help you explore your options.

Apply for a Construction Loan Online Today

Assurance Financial makes it easy to apply for a construction loan. Worried about being treated like a number? It’s not an issue with Assurance Financial. Even when you apply for a loan quickly online, you are paired with a local loan officer who treats you like a person and makes sure you get the loan you need, with no algorithms involved!

Want to talk to a person from the start? No problem. Whether you’re dream-sizing, buying or shopping for a construction loan for any reason, our professional and friendly loan advisors can help.

Here’s another secret about Assurance Financial — we take care of your mortgage processing under one roof. As a full-service, independent mortgage banker, we don’t shop your home loan or construction loan around. We underwrite in-house, so you can enjoy full confidence. If you have a question about the application or your home loan, we can answer it because we’re the professionals who are handling it.

Assurance Financial can also help you with just about any loan, not just construction loans. Ready to start living in a home all your own? Apply online for a loan or find a loan officer near you.