Because You’ve Earned the Best Loan Options

First off – thank you for your service. Second – we’re honored to help you get approved for your VA Loan. If you’re active duty military, a veteran, or an eligible family member of a military veteran, you may qualify. VA Loans can offer you:

Little to no down payment

100% financing

Limits the amount of closing costs you can be charged

No monthly mortgage insurance – potentially saving you hundreds of dollars each year

No pre-payment penalties

Find out more about VA Loans and eligibility from your Assurance Financial Loan Officer.

RESOURCES

Downloadable Guides

We’ve created these guides to be a valuable resource to walk you step-by-step through your next adventure.

-

First-Time Homebuyer Guide

4.6 MiB

Thanks for your interest in learning more about your mortgage options! We hope you find this information helpful. If you have more questions, please feel free to contact us anytime.

Click here to download the file -

Refinance Guide

4.35 MiB

Thanks for your interest in learning more about your mortgage options! We hope you find this information helpful. If you have more questions, please feel free to contact us anytime.

Click here to download the file

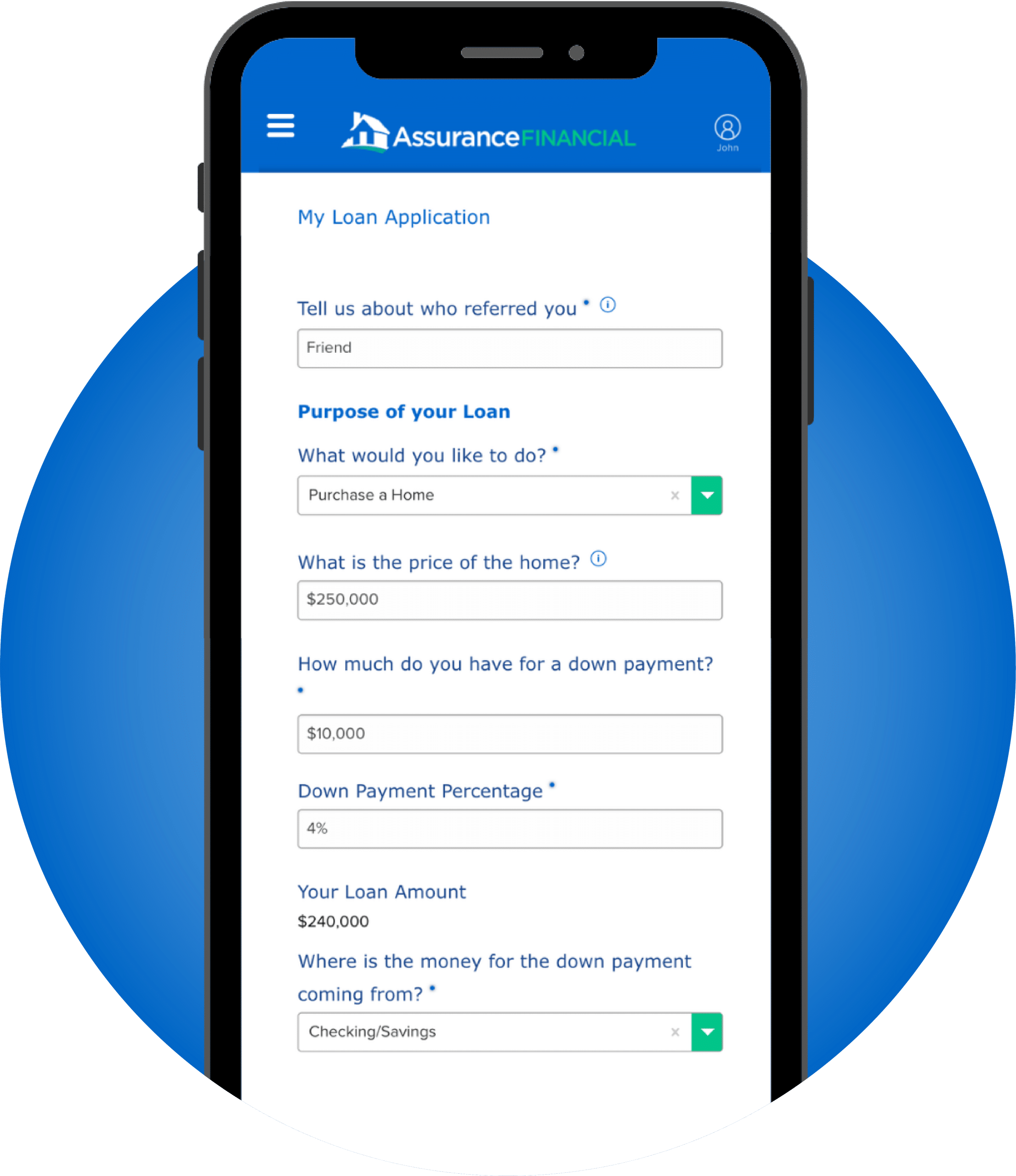

How to Get Started

There are several ways to begin the loan process.

Explore all the loans we provide

Need help with your application? We're here to lend a hand.

Our easy digital application walks you through every step of the process in terms you can actually understand. Plus, we’re always a phone call away if you get stuck.

start your application

Speak with an expert!

We have friendly experts to answer your questions. Find a loan officer licensed in your state.

Find A Loan Officer

Did we miss anything?

You still have questions, we still have answers. Take a look at what other people have been asking.

Read FAQs

Those who have served to protect this country should not have to worry about buying a home. VA loans allow qualified veterans to enjoy some benefits with different types of VA loans. These mortgages make homeownership a reality for many who have served.

What Is a VA Loan?

VA Loans are one way to finance the purchase of a home. These mortgages are backed by the Department of Veterans Affairs (VA), which means less risk for lenders. In turn, lenders can offer added advantages to VA loan borrowers.

VA loan options come with many benefits. Veterans and service members can buy a home with little money down, and in some cases, zero money down. They can also enjoy lower monthly mortgage payments if they use their loan to refinance their current home. Borrowers with this type of financing also do not need to pay mortgage insurance.

Who Qualifies for a VA Loan?

If you’ve had at least six months of active service, you may meet VA loan requirements. If you are part of the National Guard or are a reservist, you may also qualify, provided you have at least six years of service or have been called for active duty.

What Are the Requirements for a VA Loan?

You need to meet certain requirements to be eligible for a VA loan. How long you need to have served in the armed forces depends on whether you were on active duty or a member of the National Guard.

Eligibility requirements are as follows:

- If you served during times of war before 1981: You are eligible for a VA loan after 90 consecutive days of service.

- If you served during peacetime before 1981: You are eligible for a VA loan after 181 days of service.

- If you served between 1980 and 1990: You are eligible for a VA loan after 24 months of continuous service or after 181 days of being on active duty.

- If you served after 1990: You are eligible for a VA loan after 24 months of continuous service or after 90 days on active duty. If you are discharged due to a disability related to your service or for a hardship, you can have less than 90 days of service.

- If you’re currently on active duty: You’re eligible for a VA loan after 90 continuous days of service.

In addition, some spouses of military members may be eligible for this type of home loan. Widowed spouses of veterans who died due to a service-related disability or while in active service may also qualify.

To qualify for a VA loan, you must also not have been discharged under dishonorable conditions.

You need to meet some financial requirements to be eligible for a VA loan, too:

- Income: You need enough income to pay for your mortgage and related costs.

- Residual income: You need to have sufficient income beyond the cost of your mortgage.

In addition to these requirements, you also need to meet the lender’s eligibility requirements. Your lender may have income-to-debt ratio requirements, income minimums and other requirements you must meet. If you work with Financial Assurance, our team can help you understand exactly what benchmarks you need to reach to qualify.

Do I Qualify for a VA Loan?

If you are wondering whether you can secure a VA loan, you can reach out to Assurance Financial for more details. You can contact a loan officer to discuss your situation with a mortgage expert.

What Credit Score Do I Need for a VA Loan?

The VA oversees the veterans’ loan program, but the VA does not directly issue loans. Lenders issue the loans, which the VA secures. The VA does not set credit score minimums for the mortgages they secure. The department wants to get as many service members and veterans as possible supported in purchasing a home.

However, since lenders issue mortgages, lenders ultimately decide what credit scores are needed for their products. Most lenders do have minimums when it comes to loan applications. They may not be willing to accept borrowers with scores below that number.

The good news is that VA loans are secured, which can mean the credit requirements are less strict compared to other loans. If you have some dings on your credit but qualify for a VA mortgage, you may still be able to secure a home loan. The extra security offered to the lender by the VA can help offset some of the risk for the lender.

You can also improve your chances of qualifying for a home loan by working on your credit score before you apply for a home loan. In addition, you can work with a lender such as Assurance Financial. We handle all processing and underwriting in-house, which means you can get answers about your loan options.

Why Get Pre-Qualified for a VA Loan Online

The pre-qualification process isn’t just for conventional mortgages. It’s also an important step when you apply for a VA loan online. When you go through the pre-qualification process, you see if you’re likely to get approved for the loan or if there are things you need to do first.

Some of the things that are likely to happen during the pre-qualification process include:

- Credit check: A lender will run your credit to see what your history is and to get an idea of your score. If your score isn’t quite where it needs to be at this point, the lender might make recommendations to you to help you improve it.

- Income assessment: At this stage, the lender will ask you about your income to get a sense of how much you can afford to borrow. While there’s no income verification at this point, it’s important to be honest with the lender, as you want to get the most accurate estimate possible.

- Asset check: The lender will also ask you about assets you have and plan on using to pay for your home. They’ll ask if you have a down payment saved and, if so, how much. They might also ask you about other savings you have. Don’t worry too much if you don’t have a large down payment available, as you can get a VA loan with 0% down.

How to Apply for a VA Loan

If you’re ready to apply for a VA loan online, follow these steps:

- Find a VA-approved lender: Not every lender is qualified to offer VA loans. Look for one approved by the VA, such as Assurance Financial.

- Get your Certificate of Eligibility (CoE): The sooner you get your CoE, the easier the process will be. You can apply for the CoE through the VA’s website or fill out and mail in a paper application.

- Gather your documents: Depending on your lender’s requirements, you’ll likely need various documents to confirm your income and assets. Once you have the documents, you can move into the pre-qualification process.

- Look for a home: After getting pre-qualified and finding out how much you can borrow, it’s time to start looking for a home. After finding a home that works for you, put in an offer. If the seller accepts it, you can move on to the next step. If not, keep looking.

- Submit a full application: The formal application process starts once you’ve had an offer accepted on a house. Now’s the time to submit the full application with Assurance Financial. You’ll also need to provide financial records at this stage, such as bank statements and tax returns. If you have any questions along the way, your loan officer at Assurance Financial is happy to answer them.

Connect With a VA Loan Officer Online Today

If you’re wondering about how to obtain a VA loan or have any questions about your eligibility, Assurance Financial is here for you. We offer a free rate quote to help you understand how affordable a home could be.

Our helpful staff can also help you find mortgage products that could be a match for you. Assurance Financial is a VA-approved lender and also has many types of home loans for virtually every situation. Whether you want to build a home, access home equity, buy your first home or have another need, our loan officers will work to find your solutions.

To get started applying for a VA home loan, contact your local Assurance Financial loan officer. The process to pre-qualify can take as little as 15 minutes and could be the first step you take to move into your own home.