How to Get a First Time Home Loan – On Your Budget.

Making the leap from renting a home to owning one is an exciting decision. So many people dream of home ownership, and pursuing that dream reflects your financial security and accomplishment. It’s something to feel proud of. Now, as you undertake the fun journey of looking for a first home that appeals to you, it’s also time to scrutinize your finances and decide how you want to pay for your home.

Home lenders want to assist people like you with home buyer programs. You will find many first-time homeowners loans available that meet your financial and other practical needs.

Saving for a down payment can be the biggest obstacle you face when buying your first home. That’s why we offer down payment and closing cost assistance programs. These programs could give you a helpful cash buffer for other expenses, like the home inspection and home repairs. Taking advantage of these programs may allow eligible borrowers in approved areas to:

Get discounted private mortgage insurance

Choose a 30-year fixed rate loan

Move into a new home more quickly *Income limits and other restrictions may apply.

Find out more about these programs and eligibility from your Assurance Financial Loan Officer.

“I remember telling my mom that I would grow up and live in a mansion. I talked about having an awesome pool to party with all my friends! Now that I need to find a way to pay for it, I'd rather a simple two-bedroom that I can share with my fiancée. Down payment assistance? Yes, thank you! Adulting is not everything I thought it would be, but I feel like we should have a place to call our own and make monthly payments work for us."

RESOURCES

Downloadable Guides

We’ve created these guides to be a valuable resource to walk you step-by-step through your next adventure.

-

First-Time Homebuyer Guide

4.6 MiB

Thanks for your interest in learning more about your mortgage options! We hope you find this information helpful. If you have more questions, please feel free to contact us anytime.

Click here to download the file -

Refinance Guide

4.35 MiB

Thanks for your interest in learning more about your mortgage options! We hope you find this information helpful. If you have more questions, please feel free to contact us anytime.

Click here to download the file

How to Get Started

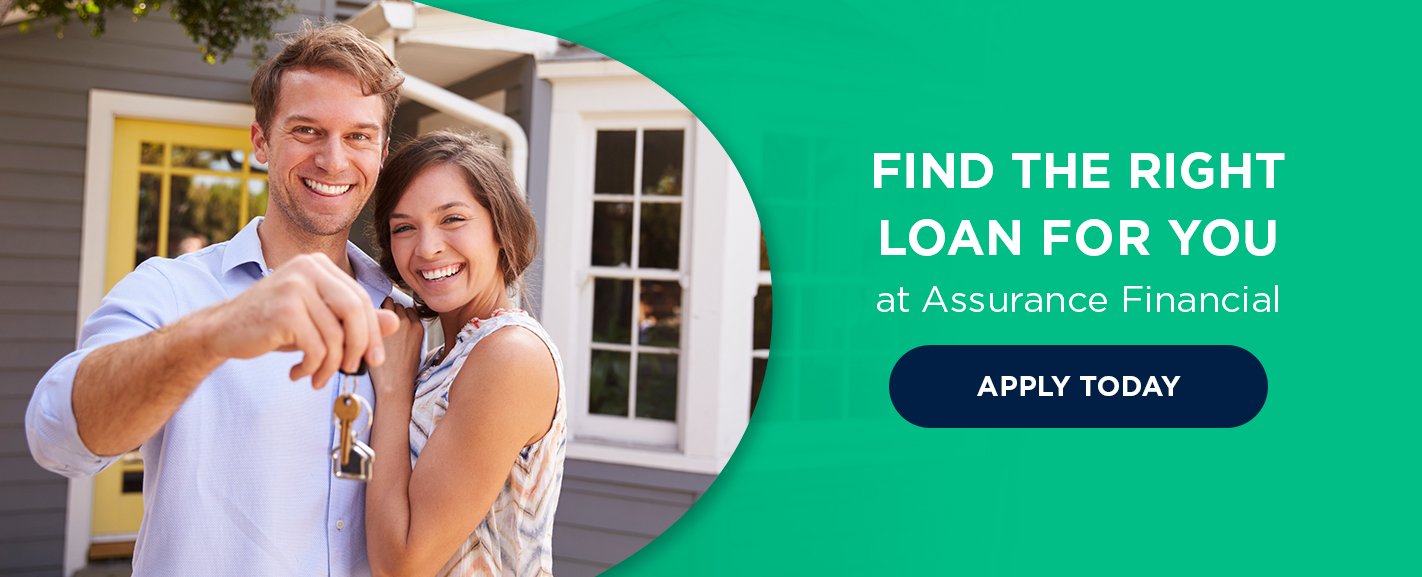

There are several ways to begin the loan process.

Explore all the loans we provide

Need help with your application? We're here to lend a hand.

Our easy digital application walks you through every step of the process in terms you can actually understand. Plus, we’re always a phone call away if you get stuck.

start your application

Speak with an expert!

We have friendly experts to answer your questions. Find a loan officer licensed in your state.

Find A Loan Officer

Did we miss anything?

You still have questions, we still have answers. Take a look at what other people have been asking.

Read FAQs

First-Time Home Buyer Loans

A first-time home buyer loan is a special offer for people who have never purchased a home before or have not owned a home within the past three years. They often include special incentives that remove some restrictions on home loans and reduce some of the costs associated with the home buying process.

Single parents and displaced homemakers whose previous home ownership was with a spouse may also qualify for first-time home buyer loans. You can find a range of home loans for first-time home buyers available, and many of them are tailored to buyers who meet certain qualifications. Our loan officers can assist you with finding one that meets your financial needs and helps you purchase the home you have dreamed of owning.

What Are the Different Types of Mortgages Available for First-Time Home Buyers?

Purchasing a home can be overwhelming for first-time homebuyers. The average age of a first-time homebuyer has continued to rise, especially as homebuyers are burdened with large amounts of student loan debt that make saving up for a home difficult.

Traditional U.S. Federal Housing Administration first-time home buyer loans are among the most popular loan options for those buying their first homes. This is not the only program available, though. You can also look into other options, such as:

- VA loans for veterans

- Fannie Mae HomeReady loan program

- Freddie Mac Home Possible program

- Conventional fixed mortgages

- FHA Loans

- USDA Loans

These options offer maximum flexibility to tailor the program to your financial needs. You should look over your first-time home buyer checklist to ensure the home you want to purchase has everything you want. Then, it’s time to apply for the loan that will help you achieve your dream of ownership.

Overview of First-Time Homebuyer Loans and Programs

There are several government home loans designed specifically for first-time homebuyers. Some of the most common first-time homebuyer government programs include:

1. FHA Loans

FHA loans are a great loan option for first-time homebuyers looking to finance a home at a lower interest rate and with a small down payment.

FHA refers to the Federal Housing Administration, an agency of the U.S. Department of Housing and Urban Development. FHA loans are insured and distributed by the FHA, and these loans protect your mortgage lender in the event you default on your mortgage.

FHA loans can be secured with lower down payments, and they offer competitive interest rates and closing costs when compared to conventional loans. With a credit score of 580 or higher, you may be able to put down as little as 3.5 percent of your home’s purchase price.

2. VA Loans

VA loans are an attractive loan option for military members. These loans are backed by the U.S. Department of Veterans Affairs, and those who are eligible include active-duty military members, surviving spouses and veterans. A portion of this loan is guaranteed by the VA, and they offer competitive interest rates. They also don’t require a down payment, which makes this loan an excellent option for military members who don’t have much savings.

Homebuyers don’t have to pay private mortgage insurance with a VA loan. There’s also no minimum credit score required to be eligible, and if you struggle to make your payments on the mortgage, the VA can negotiate with your lender for you.

3. USDA Loans

USDA loans are an excellent loan option for first-time homebuyers who are looking to finance a rural property with little to no down payment.

The USDA — U.S. Department of Agriculture — offers a homebuyer assistance program for homes purchased in certain rural areas. The USDA guarantees the loan, and first-time homebuyers can sometimes obtain a loan without any down payment.

The credit score requirements are a bit higher for a USDA loan than for an FHA loan. With a credit score of 640 or above, homebuyers can qualify for a loan after a simple application process. If you have a score below 640, you may still be able to qualify, but you will likely have to present additional documentation.

This program also has income limitations that vary by region, so if your income exceeds the limit, you may not be able to qualify for a USDA loan.

4. Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac are two government entities that work with lenders to provide mortgage options for low to moderate-income families. Loans backed by Fannie Mae or Freddie Mac can offer homebuyers competitive interest rates. Homebuyers may also be able to qualify for a loan with a down payment as low as three percent of the home’s purchase price.

FHA Loans

If you’re looking to purchase your first home but unsure if you qualify for a conventional loan, an FHA loan may be the right financing option for you. If you’ve dealt with financial challenges in the past, this loan option offers low barriers for qualification than other conventional loans.

What Are FHA Loans?

Lenders are protected by the Federal Housing Administration when they lend FHA loans to homeowners. Because these loans are backed by the FHA, you don’t need a perfect credit score or a large down payment to qualify. In fact, first-time homebuyers may be able to purchase a home with a down payment of as little as 3.5 percent or no down payment at all. If you struggle with your payments, you also have the option of refinancing an FHA loan.

Should You Apply for an FHA Loan?

Do you have less-than-excellent credit? Have you filed for bankruptcy before? Are you still working on improving your finances? If these apply to you, you may not qualify for a conventional loan, but you may still qualify for an FHA loan.

First-time homebuyers don’t usually have perfect credit or don’t have enough saved to put 20 percent down on their dream home. Younger people often haven’t been building their credit very long or been in the workforce long enough to save up a significant amount of money. This is why an FHA loan can be such a great option for first-time homebuyers.

Consider applying for an FHA loan if:

- You have a credit score of at least 500: With a credit score of 500-579, you may be able to qualify for an FHA loan as long as you have a down payment of 10 percent. With a credit score of 580 or above, you may be able to qualify with a down payment of just 3.5 percent.

- You have a steady employment history: Since you don’t need a perfect credit score for an FHA loan, lenders look more closely at employment. To qualify for an FHA loan, you may need to show a steady employment history or that you have been with your employer for a minimum of two years.

- You have a debt-to-income ratio of no more than 31 percent: The debt-to-income ratio for your home should tell lenders you’re likely to pay your mortgage every month. Additionally, your personal debt-to-income ratio shouldn’t be higher than 43 percent.

- You can pay mortgage insurance: With an FHA loan, borrowers must pay an Upfront Mortgage Insurance Premium, along with an Annual MIP. You can either pay your Upfront Mortgage Insurance Premium at closing or roll it into your mortgage. Your Annual MIP, on the other hand, is paid every month.

- Your home has been approved by an appraiser: To qualify for an FHA loan, your home has to meet certain requirements and must be appraised by an FHA-approved appraiser.

- Your home is your primary residence: You can’t acquire an FHA loan for investment properties. An FHA loan needs to be for your home.

VA Loans

If you’re an active service member, a military veteran or a surviving spouse, you may be able to obtain a VA loan. These loans are guaranteed by the U.S. Department of Veterans Affairs, so you won’t have to pay mortgage insurance, and you may not need a down payment.

What Are VA Loans?

The U.S. Department of Veteran Affairs administers loans for service members. This loan is meant to give financing options to military spouses and veterans who want to purchase a new home.

There are no minimum income requirements to qualify for a VA loan, though you’ll need to earn enough to cover your loan and other monthly fees. This lack of an income requirement can make this loan option appealing for veterans who may be earning a low income.

The VA also doesn’t place a cap on how much you can borrow, but they do set limits on the amount of liability they’ll assume. This limit will vary based on your location. As of 2020, the limit for most VA loans is $510,400. For high-cost areas, the limit is $765,600.

If you struggle with making your mortgage payments, the VA also may be able to help you. The VA may negotiate with the lender on your behalf and help you refinance or figure out your repayment plan so you can avoid foreclosure. The Interest Rate Reduction Refinance Loan program, known as IRRRL, can allow you to reduce your interest rates.

Should You Apply for a VA Loan?

VA loans can be particularly appealing to first-time homebuyers because you can get a home without a down payment, and you won’t have to pay private mortgage insurance, which homebuyers often have to pay if they put less than 20 percent down with a conventional loan.

If you meet one of these basic qualifications, you may apply for a VA loan:

- You served on active military duty for at least 90 days during wartime.

- You served on active military duty for at least 181 days during peacetime.

- You served as a National Guard or Reserves member for at least six years.

- You were married to someone who died while serving or who died after sustaining injuries while serving.

Consider applying for a VA loan if:

- You have a credit score of at least 620: If you have a credit score of 620 or higher, you’re more likely to qualify for a VA loan. With a credit score below 620, you’ll likely be given a higher interest rate.

- Your home is your primary residence: You can’t use a VA loan to purchase a second property or vacation home. You can also use a VA loan for cash-out financing, adapted housing grants and for the Interest Rate Reduction Refinance program.

- You earn enough to pay your monthly fees: Though there may not be an income requirement to qualify for a VA loan, you’ll be expected by your lender to earn enough that you can pay back your loan.

- You can move in within two months: After you purchase the home, you may be required to move in within two months, as the VA wants borrowers to use their homes for their primary residence. One exception is if a VA loan holder is deployed immediately after the purchase of the home.

USDA Rural Development Loans

Another great first-time homebuyer program option is a USDA Rural Development loan. If you’re looking to finance a rural property, then you may want to consider a USDA loan.

What Are USDA Rural Development Loans?

USDA loans are offered by the U.S. Department of Agriculture to borrowers who live or want to live in an eligible rural or suburban location. Borrowers can secure USDA loans with lower interest rates, even without a down payment.

This program was created with the intention of enhancing the quality of life in rural and suburban areas and providing home loans to those with lower incomes. In fact, having a high income may make you ineligible for a USDA loan.

As such, a USDA loan can be an excellent option for a first-time homebuyer who may have a lower income and little savings to put toward a down payment.

Should You Apply for a USDA Rural Development Loan?

Consider applying for a USDA Rural Development loan if:

- Your home is located in an eligible area: To qualify for a USDA loan, your property must be located in an eligible rural or suburban area.

- Your home is your primary residence: USDA loans must be used to purchase a primary residence, not a second property or vacation home.

- You are a lower-income earner: Your income should be relatively low for your region. You can use the USDA’s income eligibility calculator to determine whether you qualify.

- You have a credit score of at least 620: When applying for any mortgage, the higher the credit score, the better. Though lenders may be more lenient about credit scores for borrowers of USDA loans, your loan terms will be better with a good credit score.

- Your debt-to-income ratio is below 41 percent: Lenders want to see a reasonable debt-to-income ratio from their borrowers, so they know the borrowers will pay back their loan. If your credit score is higher than 680, you may still be able to qualify with a higher debt-to-income ratio.

Find the Right Loan for You at Assurance Financial

Benefits for First-Time Home Buyer Financing

You may have many home loan options available to you depending on your background. Veterans, for instance, also qualify for special loan programs.

Many people choose to use first-time home loans as they are conceived to address many of the issues you may worry about when you purchase your first home. The advantages of using this type of program include:

- Lower down payments: You don’t have any current home equity to trade on, and so you may not have saved up as much money for a down payment

- Historically low interest rates: Rates for mortgage loans for first-time home buyers are often lower than you will find with other programs

- Open to those with lower credit scores: If you have a short credit history or are paying down debt, first-time homeowner programs are ideal

Sometimes, first-time homebuyer programs also include financial need restrictions. If you want to buy a home with a high price tag, you may need to revisit your options. A first-time homeowner loan may not be the best fit, but no matter what you decide on, you can get prequalified in just minutes with Assurance Financial. Prequalification will make the home shopping process easier.

What Credit Score Should a First-Time Home Buyer Aim For?

First-time homebuyer credit scores should be above 580 to ensure you meet FHA minimums. You have a better chance of approval if your score is a bit higher, such as 620 to 640. You can raise your credit score by paying down your debt, paying your bills on time and keeping your balance on your credit cards low. Steady attention to your credit score will help raise it to increase your chances of approval for a loan.

Your credit score is not the only factor in your loan approval, though. Mortgage loans for first-time home buyers also depend on:

- Documenting your income through pay stubs and past income tax returns

- Debt-to-income ratio measuring how much of your income goes toward paying off current debt

Our First-Time Home Buyer Mortgage Options

We provide a range of possibilities for first-time home buyers. Many want to pursue a traditional 30-year fixed-rate mortgage. This offers a predictable and low-risk option to secure the funds you need for your first home. Some of the advantages of this type of loan include paying the same rate throughout the length of the mortgage and spreading repayment out over three decades, lowering your payments.

You may find other options that are an even better fit. With historically low interest rates available, many people are interested in a shorter payoff period, which will lead to paying less interest over the long term. Do you want to explore a 20-year lending term? Ask our loan officers about the possibilities.

In addition to offering variable rates and terms, we also have homebuyer programs geared toward veterans. We can explore other special programs you may qualify for as a member of the armed services or another notable background. Talk to us about any programs you think you may be eligible for, and we can get you answers.

The most critical part of looking for the right first-time homeowner loan is to find a program that will benefit you for the long term. Think beyond today to what your financial goals will be a year, five years, 10 years or even further down the line.

Apply for a First-Time Home Buyer Loan Today

Wondering how to get a first-time homeowners loan? Let us aid you with finding the best mortgages for first-time buyers. You can contact one of our home loan officers located across 28 states. Reach out today to find one near you.