Category: Press

How Assurance Financial’s Focus on Appraisal Innovation Built a Winning Customer Experience

Creating a digital mortgage space isn’t something you need to be thinking about; it’s something you should already be putting into play. The pandemic exposed a lot of pain points of digitizing the mortgage process and some deficiencies with traditional appraisal operations. Now that consumers have had a taste, it has only accelerated demand for a modern experience.

What’s more, the digital transformation that borrowers demand brings cost savings and efficiency gains for lenders. In a recent webinar, Reggora CEO Brian Zitin spoke with Katherine Campbell, Assurance Financial’s Chief Digital Officer, and its Director of Operations, Scott Alexander, on why they prioritized the digital experience, their approach to implementation, and how they’ve achieved success. The trio discusses how the digitization of the space is happening at lightning speed and how the consumer market has gone from surprise and delight to absolute expectation.

Read more and watch the full interview here.

Written by Darius Thigpen, Reggora

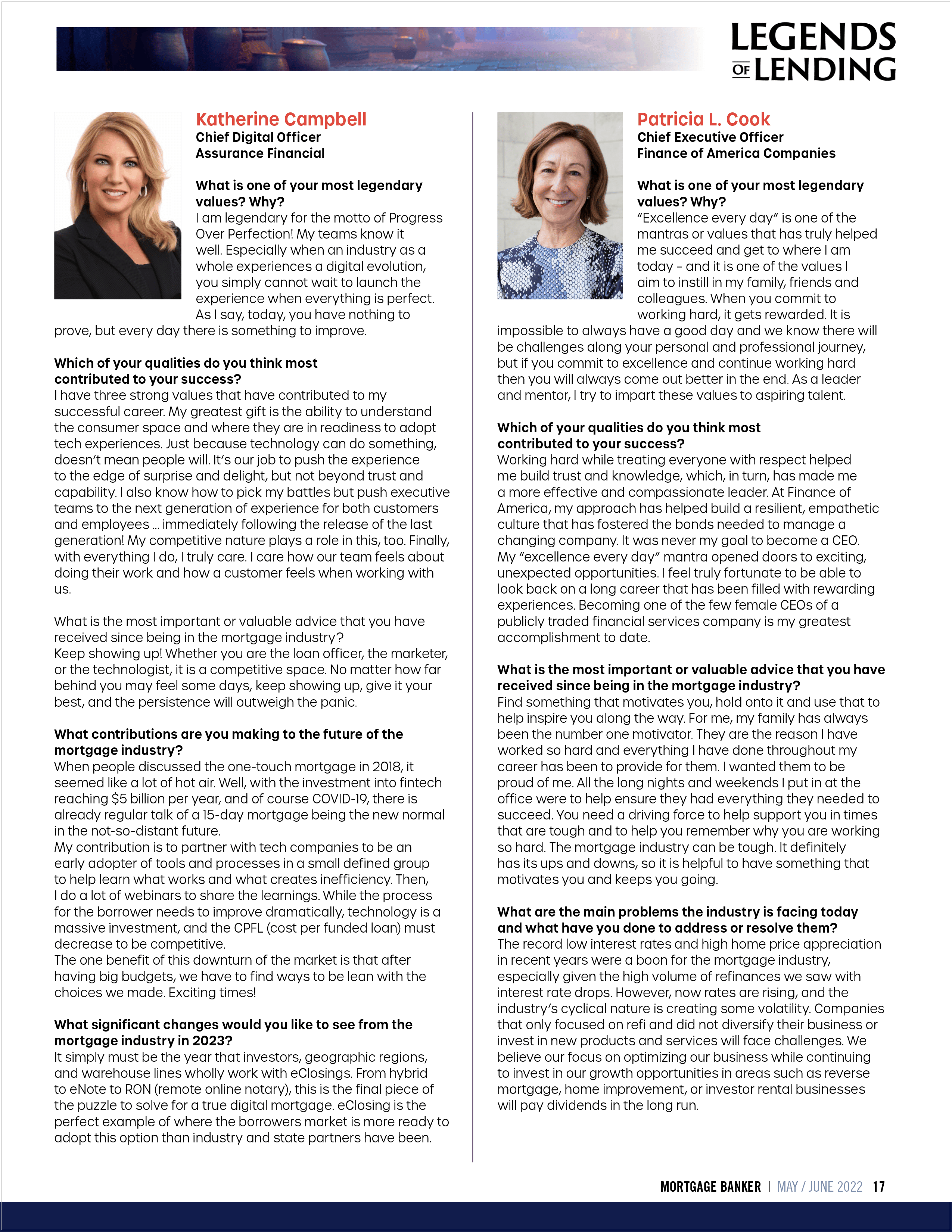

Mortgage Banker Magazine recognized Katherine Campbell, Assurance Financial Chief Digital Officer, with their 2022 “Legends of Lending” award.

The publication asked readers and mortgage professionals to nominate mortgage leaders deserving of the “Legends of Lending” award. They set out to find the most talented, ambitious, and legendary individuals who achieve excellence and make a difference in the mortgage industry.

Check out Katherine Campbell’s feature below. Read the full May/June 2022 edition of Mortgage Banker Magazine here.

We’re proud to announce that Assurance Financial has received Total Expert’s 2022 award for “The Technology Trailblazer”!

Each year, Total Expert recognizes its customers who are leveraging their technology to drive the future of customer experience in financial services with “The Expys”. This awards program celebrates high-achieving companies and individuals and applauds ingenuity, innovation, hard work, and customer-centric strategies.

“The Technology Trailblazer” award is described as an organization putting smart technology to work and blazing the trail for the industry. It’s given to a team of early adopters who know the power to transform lies with a strategic, modern technology stack and a willingness to drive meaningful change.

“Incredibly proud of the progressive work this team produces. We offer solutions that serve our customers and internal team that ease and delight this complex product.” – Katherine Campbell, Assurance Financial Chief Digital Officer

Assurance Financial Earns Spot in the Top 10 Mortgage Companies for Customer Satisfaction in 2021

BATON ROUGE, LA – April 27, 2022

Experience.com has named Assurance Financial one of America’s top-ten medium-sized lenders in 2021 for customer satisfaction after receiving a 4.92 average rating on nearly 6,000 reviews.

Assurance Financial is also proud to announce that seven of our originators placed in the top 1% of Loan Officers in the country for customer satisfaction.

- Damian Cook of Atlanta, GA

- Elise Walker of Baton Rouge, LA

- Erinn York of Lafayette, LA

- Lauren Tylock of Lafayette, LA

- Lynn Sharer of Prairieville, LA

- PJ Tavernit of Baton Rouge, LA

- Willie Tucker of Huntsville, AL

With over a million reviews from more than 50,000 loan officers across 350 companies nationwide on the Experience.com platform, Assurance Financial considers it a great honor to be included among America’s top-ten medium-sized lenders.

“It’s a testament to the pride that our team takes in delivering an excellent experience for all stakeholders in the home loan process,” Assurance Financial CEO, Kenny Hodges, said. “Of course, the borrower is paramount, but communicating timely and accurately to all parties involved in the transaction has proven to be a great recipe for success. Between our Mortgage Loan Officers and our fulfillment team, everyone is working to ensure that we are going above and beyond the clients’ expectations.”

According to Experience.com, the results are based on survey completion rates, the number of reviews, and the star ratings submitted to the platform by verified customers.

Read more about the Experience.com 2021 Top Performer’s awards here.

Assurance Financial CEO and President, Kenny Hodges, was featured in an article by National Mortgage News on the mortgage industry’s increasing alignment with sports brands.

“From bass fishing to the Super Bowl, lenders see a large pool of consumers they can reach through athletic sponsorships.

“When you’re in a college town – in general – those colleges are one of the biggest employers. They’re really the main show in town,” said Kenny Hodges, CEO and President of Assurance Financial. His company has established business partnerships with the athletic departments at Louisiana State University, located in Assurance’s home base of Baton Rouge, Louisiana, as well as with the University of Alabama, University of South Carolina and University of Louisiana-Lafayette.

The sponsorships also provide a natural link between a company and younger consumers ready to enter the workforce, who frequently settle near their alma mater. A lender’s association helps create top-of-mind awareness among them as they begin their careers and enter the home-buying age.

“If you can get behind those types of schools, and show your support, we hope it means something to our customers and to our referral partners,” Hodges said.”

Assurance Financial made the 2022 National Mortgage News list of top 50 Best Mortgage Companies to Work For! When we say our culture is different, we mean it, and we continue to prove it.

The awards program is dedicated to recognizing lenders that are supportive employers and providing them with employee feedback on their strengths and weaknesses. The program is a partnership between National Mortgage News and the Best Companies Group, which conducts extensive employee surveys and reviews employer reports on benefits and policies. The employee survey covers eight topics: Leadership and Planning; Corporate Culture and Communications; Role Satisfaction; Work Environment; Relationship with Supervisor; Training, Development and Resources; Pay and Benefits; and Overall Engagement.