Month: October 2020

Between 2015 and 2019, there was an average of 13.8 natural disasters per year. Natural disasters can range from hurricanes to hail storms and wildfires to tornadoes. They might be unavoidable, but with a bit of planning and preparation, you can reduce severe weather damage and its effects on your home and family.

The first step to take toward emergency preparedness is to recognize and understand the types of hazards and disasters your home and family are likely to face. From there, you can focus on creating a disaster preparedness plan that outlines what to do and where to go if a storm or other natural disaster is headed your way.

You can download our full disaster prep guide here.

Topics Covered:

- Steps to Creating a Disaster Preparedness Plan

- What to Do After a Disaster Occurs

1. Identify Hazards

Some types of natural disasters are more likely to occur in certain parts of the U.S. than others. It’s important to plan for the type of hazards your household could potentially experience based on your location. A few possible hazards to include in your planning are:

- Earthquakes: Earthquakes can happen across the U.S., but they are much more common along the West Coast in Hawaii, Alaska and along the Mississippi River Valley. When an earthquake occurs, the ground shakes suddenly as rocks beneath the surface shift. Preparing your home for an earthquake often involves securing loose objects and furniture. During an earthquake, it’s important to know where to go for cover and protection.

- Floods: Flooding occurs when water rises and covers dry land. A flood can happen anywhere and can range from mild to severe in terms of damage. They can occur as a result of rain and storms or as a result of an overflow of water from a dam or storm system. Floods are one of the most common natural disasters in the U.S.

- Hurricanes: Hurricanes occur along all coasts of the U.S. The effects of hurricanes can also be felt further inland. They bring with them heavy rains, strong winds and the potential for flooding. Depending on the severity of a hurricane, your preparedness plan might involve leaving your home and moving out of the path of the hurricane, or you might shelter in place until the storm is over.

- Snowstorms and extreme winter weather: Heavy snow, ice, high winds, freezing rain and excessively cold temperatures can all be part of extreme winter weather. Although extreme winter weather is more common in the Northern and Midwestern parts of the U.S., some warmer parts of the country have also experienced out-of-the-ordinary snowstorms. Preparing for snowstorms and winter weather can involve prepping your home to protect it against freezing temperatures, stocking up on supplies and knowing what to do to keep your family warm and safe throughout the storm.

- Tornadoes: Although tornadoes most commonly occur in the Southeastern and Midwestern parts of the U.S., they can develop anywhere across the country. Tornadoes can bring with them wind speeds above 200 mph. They can pick up cars and destroy buildings. Preparing for a tornado means knowing where to go in your home to seek shelter and learning how to recognize the signs that a funnel cloud is on its way.

- Wildfires: Wildfires are unplanned and often burn through natural areas such as forests, prairies and grasslands. If not quickly controlled, they can spread to surrounding communities and cause damage to houses and other buildings. If you live in an area that experiences wildfires, it’s vital that you have a home evacuation plan and emergency response plan. You can also take steps to protect your home from fire damage before a wildfire occurs.

In addition to the more common hazards above, you might need to make a plan to prepare for a volcanic eruption if you live in an area with active volcanos or a plan for a tsunami if you live in a coastal area.

2. Create a Preparedness Plan

Everyone in your household should be on the same page when it comes to emergency situations and how you’ll handle them. Part of the process of developing an emergency response plan should include holding a family or household meeting. During the family meeting, focus on creating a disaster preparedness plan.

Who attends the meeting and who is responsible for what in the event of an emergency largely depends on who is in your household and their ages. You can explain the basics of natural disasters and emergencies to young children, for example, but you most likely won’t expect them to take on responsibilities if a disaster or emergency strikes. As you put together your home evacuation plan, consider the following factors:

The Types of Disasters Likely to Occur in Your Area

Different types of natural disasters and emergency situations require a different response. Research the variety of potential disasters to find out how many typically occur in your region during the year. You should also investigate the risk of one or more of those situations being severe enough to require evacuation or sheltering in place.

How You Can Get Information in the Event of an Emergency

During an emergency, power might go out and the internet might not work. Decide how you’ll stay connected to the outside world. You might invest in a battery-powered radio or a wind-up radio. If your mobile phone still works in an emergency, you may be able to receive emergency alerts on it.

How You’ll Evacuate if Needed

Talk to your household members about how you’ll leave home if needed due to an emergency. Your evacuation plan should include a route to take to get to a safe place and a mode of transportation to get there safely, such as a car. Also, have a destination in mind if you need to leave. Can you go to a family member’s house or the home of a friend? If not, you might need to learn the location of the nearest emergency evacuation shelter.

Where You’ll Meet if You Need to Leave and Get Separated

It might be the case that you and your household members have to split up when you get an evacuation order. To be on the safe side, have a plan for where you’ll meet up if you get separated.

How You’ll Communicate With One Another

Along with knowing where to find your household members in the event of an emergency, make a plan for staying in touch during a natural disaster. Make sure everyone in your household has each other’s phone numbers stored in their cellphones and written down on a piece of paper.

It’s also a good idea to have the contact information for your family doctor, your children’s schools, your work and your children’s caregiver written down on a piece of paper that members of your household have with them at all times. Also, include the contact information of a relative or friend who lives in another town. That person can serve as the central contact point if you and your family need to evacuate and lose contact with each other.

What You’ll Do About Household Pets

If you have pets in your home, you want to protect them in the event of an emergency. Include your pets in your plan by deciding who will put them in their crates or carriers and transport them to the car when you’re evacuating. You might want to make a sign and put it by your front door letting emergency responders know there are pets in the house who may need to be rescued.

The Safe Spot in Your Home

While some situations will require you to leave your home, not all of them will. Determine an ideal location in your home to seek shelter during an emergency event. For example, in the event of a tornado, a small room without windows on the lowest floor of your home is usually the best place to seek shelter.

3. Gather Supplies and Prepare

Stock up on supplies to keep your family fed, hydrated, comfortable and warm in the event of an emergency. The Centers for Disease Control and Prevention (CDC) recommend having a three-day supply of food on hand in case you are unable to leave your home or in case of supply chain disruption. The foods you keep on hand should:

- Not require refrigeration or cooking.

- Have a long shelf life.

- Be low in salt.

- Be appropriate for babies and any adults who follow a special diet.

You may need to swap out the foods in your disaster preparation kit from time to time, as they approach their expiration or “best by” date. Keep an inventory of your emergency food stash that also includes the expiration dates of the products. As the dates approach, consume the food to keep it from going to waste, then replace it with new products.

Along with food, the CDC also recommends having an adequate amount of water on hand for each person in your home, in case a disaster affects the plumbing. Have at least one gallon of water per person and pet in your home per day. If you live in an area with a hot climate, or if people in your home are ill or pregnant, you might want to have more than one gallon per person. The CDC recommends having at least three days of water on hand, if not two weeks’ worth of water.

Food and water aren’t the only things to stock up on and include in your emergency preparation kit. You should also have a first-aid kit and an adequate amount of medication. Make sure you have enough prescription medication on hand in case of an emergency, as well as a supply of over-the-counter medicines, such as pain relievers and cold medicine. You’ll also want to have a thermometer.

First-aid supplies to include in your disaster preparedness kit include:

- Bandages

- Antibacterial ointments

- Antibacterial wipes

- Burn creams

- Tweezers

- Scissors

- Vinyl or another type of non-latex gloves

Your kit should also include any items your family or household members need, such as contact lenses and cleaning solution, asthma inhalers and diabetic testing strips. Don’t forget about comfort and warmth when stocking your kit. Include blankets and sweaters for each member of the family, in case you lose power or the heating goes out as a result of a storm.

It can also be worthwhile to learn certain skills to complement your kit, such as first-aid skills. If possible, take a CPR certification course and a first-aid course. Also, become familiar with your home and the location of shut-off valves in case you need to turn the water or electricity off during a disaster. Make sure others in the home know the locations of shut-off valves, too.

4. Practice Your Plan

Practice makes perfect, including a family emergency plan. Doing test runs or drills of your plan can help you smooth out any wrinkles or find solutions to any problems that come up before a real emergency occurs.

It’s a good idea to practice both a shelter-in-place plan and an evacuation plan so you can see how your household members respond in each type of situation. When you practice your plan, try to complicate the situation. For example, you might practice what you would do if you and your spouse became separated just before you had to evacuate, or if you have to evacuate from your home while your spouse is at the supermarket or their workplace.

Since situations can change from year to year, practicing your plan once or twice a year allows you to make adjustments as needed. During the COVID-19 pandemic, your evacuation plan should include a plan for protecting your household members from the virus, particularly if you end up having to go to a public shelter.

Along with performing dry runs of your emergency plan, make an effort to keep track of your supplies. Rotate out older foods and water every few months, replacing them with new items. Test the items in your kit, such as the radio and thermometer, to make sure they still work and that the batteries are fresh. If contact information for anyone in your family changes or if your emergency contact changes, make sure to keep that information up to date.

5. Protect Your Home and Family

In addition to having a plan in place in the event of an emergency, there are steps you can take to protect your family and house from the damage caused by an event such as a hurricane, tornado or winter storm:

- Install the right equipment: Some home features, such as a sump pump, can help reduce the damage caused by flooding and strong storms. It’s also a good idea to have alarm systems installed at home, such as smoke alarms and carbon monoxide detectors, to alert you to any potential hazards.

- Keep the area around your home clutter free: Outdoor furniture, toys, grills and gardening equipment can blow around during a storm with strong winds, causing damage to your house or other structures. If possible, limit the number of items you store outside. If you do have outdoor furniture or other gear, find a way to secure it before a storm comes. You can tie it down or store it in a garage or shed.

- Care for trees and shrubs: Prune trees and shrubs to reduce the chance of branches breaking away and falling off during a storm or other disaster.

- Clean your gutters: If leaves and other debris collect in the gutter around your roof, water damage can occur. The damage can be severe after a snowfall or during a storm with excessive rain. Cleaning the gutters at least once a year can help reduce water damage to your roof.

- Barricade your windows: Hurricane-strength winds can easily shatter windows. Tornados can also break windows. Covering up the windows of your home with plywood or shutters before a storm strikes can help keep the home in one piece and can protect the people inside the house.

- Maintain your home’s systems: Keeping your home’s systems in good working order means they will be more likely to keep functioning in an emergency. Have your heating system maintained each year to make it more likely to keep working during a blizzard or other winter storm. If you live in an area that experiences frequent, long-lasting power outages, installing a backup generator can be a smart move. The generator can kick on when the main power goes out, keeping you and your family warm and comfortable in the midst of a storm.

- Purchase the right amount of insurance: Depending on your location and the risk level for certain types of disasters, you might need to purchase special homeowners insurance to keep your home adequately protected. If you live in an area with a lot of flooding, you’ll need flood insurance in addition to your basic policy. Talk to your insurance agent to make sure you have the right amount of insurance for your property.

You can download our full disaster prep guide here.

What to Do After a Disaster Occurs

What you do after a disaster largely depends on whether you had to evacuate your home or not. If you did have to leave your home, it’s best to wait until local officials give you the all-clear that it is safe to return. When you get to your home, proceed with caution. You might want to inspect the outside of the house first, walking around the perimeter to assess any damage.

Be sure to give your insurance company a call, as someone from their team will need to come out and evaluate the damage before you can file a claim. If you are concerned that the event caused structural damage to your property, you may want to call a structural engineer to evaluate the condition of the building before you go inside.

When you do go back into your home, keep an eye out for the following:

- Cracks in the walls, ceiling and along the foundation

- Damage to water pipes

- A rotten egg smell, which is the sign of a gas leak

- The state of the electrical system — if possible, turn the electricity off

- Standing water in your basement — avoid going into a basement with standing water and arrange to have it pumped out

Now is also the time to reconnect with loved ones who were in the area or any family members you might have been separated from. If you have young children, check in with them to see how they are coping with the situation. Some children might show signs of distress immediately after a disaster or emergency, while others might seem calm at first but have concerns later on. You might consider scheduling therapy for your children or yourself and arrange for everyone in your family to see a doctor after an emergency situation.

Apply for a Mortgage With Assurance Financial Today

Your home is likely one of the biggest investments you’ll make, which is why it’s vital to have a plan to protect it and the important people who live in it if a disaster strikes.

If you’re in the process of searching for a home, whether you’re a first-time buyer or are looking to upgrade, the first step is to see if you qualify for a mortgage. Our easy online mortgage application and helpful Loan Officers make the process a breeze. You can get pre-qualified for a home loan in 15 minutes! Get started today.

Sources

- https://coast.noaa.gov/states/fast-facts/weather-disasters.html

- https://www.ready.gov/earthquakes

- https://www.ready.gov/floods

- https://www.ready.gov/hurricanes

- https://www.ready.gov/winter-weather

- https://www.ready.gov/tornadoes

- https://www.ready.gov/wildfires

- https://www.ready.gov/tsunamis

- https://www.ready.gov/volcanoes

- https://www.ready.gov/sites/default/files/2020-03/create-your-family-emergency-communication-plan.pdf

- https://www.ready.gov/plan

- https://www.ready.gov/evacuation

- https://www.ready.gov/alerts

- https://www.cdc.gov/disasters/foodwater/prepare.html

- https://www.cdc.gov/prepyourhealth/takeaction/personalneeds/index.htm

- https://www.cdc.gov/prepyourhealth/takeaction/paperwork/index.htm

- https://www.habitat.org/impact/our-work/disaster-response/disaster-preparedness-homeowners/disaster-supply-kit

- https://www.habitat.org/impact/our-work/disaster-response/disaster-preparedness-homeowners/family-evacuation-plan

- https://www.ready.marines.mil/Make-a-Plan/Making-a-Family-Emergency-Plan/

- https://blog.litchfieldbuilders.com/5-ways-can-protect-house-natural-disaster

- https://www.cdc.gov/childrenindisasters/before-during-after.html

- https://www.ready.gov/returning-home

- https://www.unitedway.org/my-smart-money/immediate-needs/ive-experienced-a-natural-disaster/what-to-do-after-a-disaster

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/experienced-homebuyer/

As the 2024 election approaches, you might wonder what kind of impact it will have on the mortgage interest rate you pay. Learn more about what factors determine the rate you get on a loan and what you can do to make sure you get the lowest rate possible when you apply for a mortgage.

When you take out a mortgage to buy a house, you become responsible for paying back the amount you borrowed, or the principal, as well as interest on the loan. The amount you pay in interest can vary depending on multiple factors. When buying a home, your personal credit history and the current economic situation can all impact interest rates on your home loan. The situation in the world around you, such as if it is an election year, might also have some effect on interest rates.

How Have Presidential Elections Affected Mortgage Rates in the Past?

Since politics and social conditions can play a role in influencing mortgage rates, it’s natural to wonder if an upcoming election will have an impact on mortgage rates. Freddie Mac began keeping track of average monthly mortgage interests for 30-year fixed-rate home loans in April of 1971. With this data, it’s possible to look at the numbers to see if there are discernable patterns or changes in interest rates during election years.

The year after Freddie Mac started tracking mortgage rate averages, 1972, was an election year. In 1972, the annual average interest rate was 7.38%, slightly lower than the average from April to December 1971, which was 7.55%. There was a slight dip in rates to 7.29% in April 1972, but otherwise, interest rates hovered around 7.4% for much of the year.

Four years later, in 1976, the average interest rate was 8.87% — not much different from the average rate of 9.05% in 1975 or 8.85% in 1977. Inflation was a big issue in the late 1970s, so by 1980, the average rate had climbed to 13.74% at 2.5 percentage points higher than it was in 1979. The next year, the rate had reached 16.63%, so it’s not clear whether the rise was due to the election or to other economic factors at play.

In 1984, the average rate was 13.88%. From then on, rates started to fall as the economy improved. By the next election year, 1988, the average interest rate on a 30-year mortgage was 10.34%. During the next four years, it continued to fall. In 1992, the average rate was 8.39%. Although rates were falling year after year, over the course of a 12-month period, there weren’t significant changes in interest rates.

The average interest rate in 1996 was 7.81%. That year, rates rose slightly from an average of 7.03% in January to 8.32% in June before dropping to 7.6% in December. In 2000, an election year with a particularly dramatic election, rates remained relatively constant, with an annual average of 8.05%. Rates showed a similar pattern in 2004, remaining relatively stable. Even in 2008, in the midst of the Great Recession, interest rates hovered between 5.29% and 6.43%, which isn’t a lot of movement.

Rates have been near record lows in the most recent election years. In 2012, the average was 3.66%. In 2016, it was 3.65%. Interest rates dropped to record lows in 2020, but those changes were due more to the pandemic and economic concerns than the election.

What Happens to Mortgage Rates After an Election?

Does an election have an effect on mortgage rates after the fact? Just as there doesn’t seem to be much impact on rates due to a pending presidential election, the results of the vote also don’t seem to bring about much of a change. What might be more important for interest rates are other social and political factors that accompany an election year. If anything, these fluctuations may be more likely to affect people’s decision to buy a home or not more than who might be elected the next president.

If you are considering buying a home and are in the process of shopping for a mortgage, it may be favorable to take the loan with the best rate you are offered now, rather than wait to see what may or may not change in November.

What Are Mortgage Interest Rates?

Lenders charge interest both to make money on a loan and as a form of protection. A lender is taking a risk when it issues a mortgage. It’s giving you, the borrower, a lump sum of cash and then waiting 15, 20 or 30 years for you to pay it back. Even if you have a steady job, high income and excellent credit history when you take out the loan, there’s a risk that your situation will change and you might become unable to repay your loan. Charging interest ensures that the lender will make a least some money on the mortgage, even if a borrower ends up defaulting on the loan.

Types of Mortgage Interest Rates

When you apply for a mortgage, you can generally choose between two types of interest rates: fixed and adjustable. A fixed interest rate remains the same for the entire term of the loan. If you apply for a 30-year mortgage with a 4% interest rate, you will pay 4% in year one and in year 30. Your monthly mortgage payment will stay the same for the entire term of the loan with a fixed rate.

An adjustable-rate mortgage (ARM) has an interest rate that changes over time based on market rates. Often, the rate on an ARM is lower than the rate on a fixed-rate mortgage to make it more enticing for the borrower. The initial rate might last for a year or several years. When the initial rate expires, it resets to reflect the current market rate. Depending on circumstances, your monthly payment could rise considerably from one year to the next with an ARM, or it could drop.

The initial rate on an ARM often lasts for a period of three, five or seven years. Once that period ends, the rate might change every year or on another pre-determined schedule. Some ARMs have adjustment caps, which prevent the rate from increasing too much. For example, you might take out a loan with an ARM that has a 5/3/5 cap. The first five means that your interest rate can’t increase by more than five percentage points over the initial rate. Each time the interest rate adjusts, it can’t increase more than three points over the current rate. Over the course of the loan, the rate can’t ever be more than five points above the initial rate.

An ARM can seem appealing, as the initial rate on the loan is often lower than the rate on a mortgage with a fixed interest rate. As a borrower, it helps to think about how long you plan on living in your new home and whether you can afford an increase in your monthly mortgage payment if the interest rate goes up.

What Has an Impact on Mortgage Rates?

Whether an interest rate is adjustable or fixed is just one factor that determines what a lender might charge you when you apply for a mortgage. Multiple factors influence mortgage rates. Some of those factors are within the control of the borrower, while others are not. Factors that you can’t control include the economy and the Federal Reserve’s monetary policy.

Knowing what you can control when it comes to the rate you’re offered and understanding how the larger world affects mortgage rates can help you get the timing right when you apply for a home loan. The following are some of the factors that might affect your rate:

1. Credit History

When a lender gives you a mortgage, they are taking on a risk, which is part of the reason why you need to pay interest on the loan. A lender uses your credit history and score to assess how risky it would be to lend you money. The lower your credit score or the weaker your credit history, the more interest a lender is likely to charge. If you have a history of stellar credit and a score in the excellent range, you are more likely to get a better interest rate.

2. Down Payment Size

The size of your down payment also affects the perceived risk level of your mortgage. The more you pay upfront in comparison to the amount you borrow, the less risk there is to the lender. Putting 20% down is likely to get you a lower rate than if you were to put down 5% or 10%.

3. Loan Type and Length

The type of mortgage you get also affects your interest rate. VA loans and FHA loans often charge different interest rates compared to conventional loans. In some cases, the rates on a VA or FHA loan might be lower than the rate on a conventional loan.

How long you have to repay the mortgage influences the interest rate, too. Generally, shorter loan terms are lower risk for lenders, so the interest rate is lower.

4. Local Housing Markets

The state of the housing market in the area where you hope to buy can also affect the interest rate on your mortgage. If there is a lot of competition for houses in your area, interest rates can go up due to overall supply and demand. Lenders only have so much money to lend, so when there is a high demand for mortgages, they may increase the rates they charge.

5. Inflation

Mortgage rates can increase as inflation increases, allowing lenders to continue to earn a profit. If you take out a loan with a monthly payment of $1,000, the $1,000 per month that you pay in five years won’t be worth as much as the $1,000 per month you pay now, as a result of inflation.

6. 10-Year Treasury Bonds

Broadly speaking, mortgage rates tend to track the rates on 10-year Treasury bonds. When rates on Treasury bonds drop, mortgage rates tend to drop. When Treasury bond rates go up, mortgage interest rates typically go up. Treasury bonds and mortgage rates are connected because investors who are considering purchasing mortgage-backed securities typically look to the rate on long-term Treasury bonds to get an idea of what they can charge.

Mortgage-backed securities can be risky for investors, so they often want to get the highest rate possible when purchasing them. The actions of investors and the fluctuations in the bond market can push mortgage rates up or down.

7. The Federal Reserve

Mortgage interest rates often seem to move in relation to the actions of the Federal Reserve, or Fed. When the Fed announces it is lowering rates, mortgage rates tend to decrease, too. The Fed’s decisions can have an effect on the yield of Treasury bonds, but not always. The Fed also issues monetary policies, such as deciding to buy or sell debt securities, which can affect interest rates on mortgages.

8. State of the Economy

When unemployment is low and gross domestic product (GDP) is high, the demand for mortgages often increases. People feel more secure, so they are more likely to buy a home. In times of economic growth, interest rates often go up. When unemployment is high and production is down, mortgage rates often drop, since people are usually more hesitant to purchase a home.

What Is the Federal Reserve?

When people talk about interest rates, one institution they often mention is the Federal Reserve. Although the Fed gets mentioned a lot in discussions of the economy and the financial state of the U.S., many people don’t know what it is or what it does. The Fed is the U.S. central banking system. Its main mission is to keep the financial system in the U.S. stable and secure. To do that, it performs four functions:

- Establishing monetary policy: The Fed aims to keep employment high and inflation low. It sets a federal funds target rate to keep inflation down. The target rate is the amount of money each bank in the U.S. needs to have deposited with one of the Fed’s 12 banks. During a recession, the Fed might lower the target rate. In the midst of a good economy, it might raise the rate to keep inflation at bay.

- Providing payments: The Fed acts as the bank of the government and is responsible for the checking account of the Treasury Department. It also controls the amount of money in circulation. When needed, it can increase the amount of currency and coins out in the world.

- Regulating banks: Banks that are part of the Federal Reserve system need to follow the rules and regulations set by the Fed to keep financial markets stable.

- Maintaining stability: In extraordinary circumstances, the Fed might take additional actions to ensure the stability of U.S. banks. For example, after September 11, 2001, the Fed gave several banks loans to keep them from going under.

The Federal Reserve dates back to 1913 when President Woodrow Wilson signed the Federal Reserve Act into law. In the more than 100 years since its creation, the roles and responsibilities of the Fed have evolved based on the needs of the country.

Who Is on the Federal Reserve?

The Fed consists of three components: the Board of Governors, the 12 Federal Reserve Banks and the Federal Open Market Committee (FOMC).

Seven people serve on the Federal Reserve Board of Governors. The current U.S. president names each member to the board for a term of 14 years. The board members’ terms are staggered so that each president has the chance to name two new members during a four-year term. Staggering the terms helps to keep the board politically neutral. Since one term ends every two years, a president won’t have the chance to stack the board. A president who serves one four-year term can name two members, while a two-term president can name four board members.

A president might use several criteria to decide who to name to the Board of Governors. Each board member needs to come from a different Federal Reserve district. They should also somehow reflect the commercial, industrial, agricultural or financial interests of the U.S.

The FOMC consists of the seven board members and five presidents of Federal Reserve banks. The president of the Federal Reserve Bank of New York is always on the FOMC. The remaining four bank presidents can be from any of the other 11 banks. Each bank president serves a one-year term on a rotating basis. The FOMC meets eight times a year, during which it discusses the state of the economy and financial situation in the U.S. and what it can do to promote stability and sustainable growth.

Is the Federal Reserve Connected to the President?

Aside from having the current president of the U.S. name members to the Federal Reserve Board of Governors every two years, the Fed has limited connection to the president. The U.S. president cannot tell the Board of Governors what to do and shouldn’t try to influence the policy and other decisions the board makes.

Does the Fed Set Mortgage Rates?

A common misconception people have is that the Fed sets mortgage rates or defines interest rates. The Fed sets the target fund rate, which is the interest banks charge each other when they lend to each other. Many banks use the target fund rate as a benchmark when deciding their own interest rates to charge. Mortgage rates can track the rates charged by banks on other loan products, such as credit cards.

Apply for a Mortgage With Assurance Financial Today

Ready to get the ball rolling and see what interest rate you qualify for on a mortgage? Get started on your mortgage application with Abby, our digital assistant, today. You can apply online from the comfort of your home at any time of day or night. The process takes just 15 minutes. Apply today to take the next step in your homebuying journey.

Sources:

- https://www.bankrate.com/mortgages/current-interest-rates/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/fha-loans/

- https://www.policygenius.com/mortgages/how-does-mortgage-interest-work/

- https://www.hsh.com/first-time-homebuyer/what-moves-mortgage-rates-the-basics.html

- https://www.thebalance.com/treasury-note-and-mortgage-rate-relationship-3305734

- https://www.stlouisfed.org/in-plain-english/federal-reserve-board-of-governors

- https://www.investopedia.com/mortgage/mortgage-rates/fixed-versus-adjustable-rate/

- https://www.thebalance.com/what-is-a-mortgage-interest-rate-4584864

- http://www.freddiemac.com/blog/homeownership/20160201_hiw_arm.page

- https://www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/

- https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

- https://www.federalreserve.gov/monetarypolicy/fomc.htm

- https://www.federalreserve.gov/faqs/how-is-a-federal-reserve-bank-president-selected.htm

- https://www.federalreserve.gov/releases/h15/

- https://www.federalreserve.gov/faqs/credit_12846.htm

- https://www.federalreserve.gov/faqs/what-economic-goals-does-federal-reserve-seek-to-achieve-through-monetary-policy.htm

- http://www.freddiemac.com/pmms/pmms30.html

- https://www.creditkarma.com/advice/i/what-is-the-federal-reserve

- https://www.bankrate.com/mortgages/federal-reserve-and-mortgage-rates/

- https://mygatormortgage.com/presidential-election-affect-on-mortgage-rates/

- https://themortgagereports.com/59520/forecast-mortgage-rates-after-2020-election

- https://www.newamericanfunding.com/blog/how-do-elections-affect-mortgage-rates/

- https://www.nerdwallet.com/blog/mortgages/fed-mortgage-rates/

- https://assurancemortgage.com/meet-abby/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/conventional-loans/

- https://www.federalreserve.gov/aboutthefed/structure-federal-reserve-system.htm

If you’ve served in the armed forces, the VA loan program can help make your dream of becoming a homeowner come true. The VA loan program is one of the most generous government-backed mortgage programs available, as it doesn’t require a down payment or mortgage insurance.

You might have a lot of questions about VA loan requirements before you apply. Here’s everything to know about VA home loans so you can decide if it’s the right step to take on the path toward homeownership.

Table of Contents

- What is a VA Loan?

- What are the Requirements for a VA Loan?

- Who Qualifies for a VA Loan?

- What Types of VA Loans are Available?

- Apply for a VA Loan Today

What Is a VA Loan?

A VA loan is a type of mortgage. The loan usually comes from a private lender, such as Assurance Financial, but is backed by the Department of Veterans Affairs. VA loans have several features that set them apart from conventional mortgages or other types of government-sponsored home loans:

- They usually don’t require a down payment.

- They don’t require private mortgage insurance.

- They typically have lower interest rates and lower closing costs.

- They are only available to people who have a connection to the U.S. armed forces.

Why Do VA Loans Exist?

The VA loan program was created after World War II, in the mid-1940s, as part of the Servicemen’s Readjustment Act. The goal of the loan program was to help soldiers who were returning home from the war or their widows purchase a home. The Act aimed to smooth soldiers’ readjustment into civilian life. Since the program got started, more than 18 million VA loans have been created.

How Does a VA Loan Work?

One common source of confusion about VA loans is the origination of the loan. Many people assume that the U.S. government issues the loans directly to borrowers. While there are VA direct loan programs, most VA loans come from private lenders.

Private lenders, including banks, credit unions and mortgage companies, issue the loans to eligible veterans or active-duty service members with a guarantee from the Department of Veterans Affairs. If the borrower should stop making payments, the VA guarantees the loan and will step in and make the payments.

Having the VA’s guarantee doesn’t mean the borrower is free and clear if they have to default on their mortgage or fall behind on payments. Their credit score will still take a hit, and it is possible to foreclose on the home if the borrower can’t get current on their payments.

Instead, the VA’s guarantee helps protect the lender. The company issuing the loan can feel confident that the VA will step in and make the payments if the borrower falls behind. The VA’s guarantee reduces the lender’s risk, meaning it can offer better interest rates to borrowers.

Can You Foreclose on a VA Loan?

A VA loan can go into foreclosure. The VA has programs in place to help borrowers avoid foreclosure, though. A veteran struggling to repay their mortgage can get help from the VA, whether they have a VA loan or not.

If a veteran does have a VA loan, they can request assistance from a VA loan technician if they are concerned about missing payments or falling behind. Once a borrower falls more than 61 days behind on payments, the VA automatically assigns a technician to their case.

A VA loan technician will review a borrower’s options with them to help them avoid foreclosure. Options might include:

- Modifying the loan to reduce monthly payments.

- Moving the loan into forbearance so a borrower has additional time to make payments.

- Creating a repayment plan to help the borrower make up any missed payments.

- Delaying foreclosure so a borrower can sell the home.

- Arranging a short sale of the home if the loan amount is more than the home’s value.

- Transferring the deed instead of foreclosure.

Generally speaking, borrowers who purchased their home after 1990 will not have to repay the government if they foreclose on the house.

How Is a VA Loan Different from Other Government-Backed Mortgages?

A VA loan differs from other government-backed mortgages, such as an FHA loan or USDA loan, in a few different ways. Like VA loans, FHA and USDA loans are guaranteed by the federal government — either the Federal Housing Administration or the U.S. Department of Agriculture.

The main difference between VA loans and FHA loans is that FHA loans usually require a borrower to take out mortgage insurance. The borrower has to pay the mortgage insurance for the life of the loan. FHA loans also have higher down payment requirements than VA loans.

A significant difference between VA loans and USDA loans is the type of home you buy. USDA loans are designed to encourage homeownership in rural or suburban areas. If you apply for a USDA loan, you can’t buy a house in the city or a highly developed area.

The source of the loans can also vary. Some USDA loans come directly from the government, while private lenders generally issue VA and FHA loans.

Do VA Loans Take a Long Time to Close?

The VA lending process doesn’t take longer than the conventional mortgage process. The average time to close for conventional and VA loans is the same — about 44 days. VA loans also have a slightly higher closing rate than conventional loans, at 70% versus 67%.

What Are the Requirements and Terms for a VA Loan?

VA loans aren’t available to all borrowers. Beyond meeting the service eligibility requirements, you might also have to meet financing requirements to qualify for a loan. Financing requirements can vary from lender to lender.

What Are VA Financing Requirements?

Since the VA approves private lenders to issue most VA loans rather than issuing the loans directly, those private lenders usually establish any financing requirements for borrowers. However, they may base their financing requirements on recommendations from the VA.

For example, a lender is likely to look at your income when determining how much you can borrow. They’ll use a debt-to-income (DTI) ratio to determine if you can afford to make payments on the mortgage. The ratio compares the amount of money you bring in to the amount you pay towards obligations, such as your mortgage, car loans and other debts monthly.

While there’s no actual upper limit on the debt-to-income ratio, 41% seems to be the magic number for most VA lenders. If a lender agrees to let someone borrow enough that their debt-to-income ratio is more than 41%, the lender needs to provide a compelling reason why.

Similarly, the VA doesn’t have strict requirements regarding a borrower’s credit history and score. But a lender might. For example, a lender might decide not to approve a veteran with a credit score below 600.

Do VA Loans Have a Down Payment?

Generally speaking, VA loans do not require a down payment since the VA itself guarantees the loans. Although a borrower can decide to put some money down when purchasing a home, many don’t. Almost 90% of all VA loans are issued without a down payment.

With conventional mortgages, the recommended down payment is usually 20%. While it’s possible to get a conventional loan with less money down, borrowers who put down less typically have to pay private mortgage insurance (PMI) and higher interest rates. That’s not the case with a VA loan.

Do You Need Mortgage Insurance for a VA Loan?

Some lenders require a borrower to take out private mortgage insurance in certain situations, such as a conventional loan when a person puts down less than 20% or an FHA loan. PMI protects the lender, as it backs the loan and will cover payments if a borrower defaults.

When a person puts down a smaller down payment, the lender considers them a riskier borrower. PMI helps to mitigate that risk. In the case of a conventional loan, PMI is no longer required once a person has made enough payments to build up 20% equity in their home. FHA insurance payments are for the life of the loan.

There are no VA loan PMI requirements, fortunately. Even with zero percent down, a VA loan borrower can skip the PMI because the VA is essentially acting as mortgage insurance.

How Much Are Closing Costs on a VA Loan?

VA loans often have lower closing costs than conventional mortgages or other government-backed home loans. The VA puts certain limits on lenders that restrict the fees they can charge. For example, the lender can’t charge you settlement or attorney’s fees at closing, nor can they charge prepayment penalties. A lender can charge a loan origination fee, title fee and appraisal fee, among others.

One closing cost you’ll encounter with a VA loan but not with other types of mortgage is the VA funding fee. The VA funding fee helps to reduce the tax burden of the VA loan program. The size of the fee is directly tied to the size of your down payment. If you put less than 5% down, the fee is 2.3% for your first VA loan. If you put more than 5% down, the fee ranges from 1.4% to 1.65%.

What Is the Interest Rate on a VA Loan?

Often, borrowers who qualify for a VA loan can get a lower interest rate than they would on a conventional mortgage. VA loans usually have lower interest rates than other mortgages because of the government guarantee.

However, there’s no set interest rate for VA loans. One lender might have slightly higher or lower rates than another. Shopping around allows you to compare rates before committing to one lender.

Is there a Loan Limit for a VA Loan?

Unlike some mortgages, there’s no hard and fast limit for the amount you can borrow with a VA loan. Instead, borrowers receive entitlements based on the price of the home they are buying. If a veteran has full entitlement, they don’t have a loan limit.

What might restrict the amount a person borrows is their income compared to their debt. Ideally, the debt-to-income ratio will stay below 41%, meaning some homes might be out of a borrower’s budget.

What Type of Property Can You Buy With a VA Loan?

You need to use a VA loan to buy a property you’ll live in. You can’t use the mortgage to buy a second home or investment property. However, you can buy a property with up to four units and rent out some of the units. You can also buy a property such as a condo, as long it’s in a VA-approved development.

[download_section]

Who Qualifies for a VA Loan?

To qualify for a VA loan, you need to be a veteran or active duty member of the U.S. armed forces or the surviving spouse of a service member. Whether you can get a VA loan or not depends on how long you’ve served.

What Are the Service Requirements for a VA Loan?

As a general rule of thumb, the service requirements to qualify for a VA loan are either 90 or 181 days. If you’re currently on active duty or served during wartime, the requirement is 90 days. If you served during a time of peace, the 181-day requirement applies.

There are some exceptions to the 90- or 181-day requirements. If you received a hardship discharge, had a disability connected to service or had certain medical conditions, you might qualify for a VA loan without fulfilling the 90 or 181 days. You aren’t eligible for a VA loan if you were dishonorably discharged or discharged for bad conduct.

How Do You Get a Certificate of Eligibility?

Applying for the Certificate of Eligibility (COE) is the first step toward proving your eligibility for a VA loan and getting approved for the loan. You can apply for a COE online. Before you apply, make sure you have the appropriate paperwork, such as your discharge papers or a signed statement of service.

If you are applying for a VA loan because you are the surviving spouse of a service member who died, you also need to get a COE, but the application process is slightly different.

Can a Civilian Get a VA Loan?

Generally speaking, civilians can’t get VA loans. You need to be a current service member or a veteran to qualify for the loan program. The one exception is if your spouse was in the armed forces and died or was disabled while in the line of duty.

While you can’t qualify for a VA loan if you have no connection to the armed forces, you do have other government-backed loan options available, such as the USDA loan program or FHA loans. You can also take advantage of programs designed for first-time homebuyers that might not be connected to the federal government.

Do You Have to Get Pre-Qualified for a VA Loan?

When you’re in the market to buy a home, it’s a good idea to get pre-qualified before you start the official house hunt. That’s true whether you’re applying for a conventional mortgage or a VA loan.

During the pre-qualification process, the lender will review your credit, income and assets and give you an idea of the interest rate you’d get on a loan and the amount you can borrow. Going through the pre-qualification process helps you feel confident that you can get approved for a loan and buy the home of your dreams.

Can You Get a VA Loan After Bankruptcy?

Yes, it’s possible to qualify for a VA loan after filing bankruptcy or having other credit difficulties. You’re likely to be eligible for a VA loan sooner after bankruptcy than other mortgage types. Depending on the type of bankruptcy, you can apply for a VA loan between one and two years after filing.

If you’ve had to foreclose on a home in the past, you can still qualify for a VA loan later. Usually, you’ll be eligible for a VA loan two years after a foreclosure, provided you meet other qualification requirements.

What Types of VA Loans Are Available?

The VA has several loan programs. The type of loan that works for you depends on where you are in the home buying or owning process and if you meet specific eligibility requirements. Get to know the various types of VA loans.

What Is a VA Purchase Loan?

A VA purchase loan is probably the mortgage that comes to mind when most people think of the VA loan program. It’s designed to help veterans or active-duty service members buy a home. The loan comes from a private lender and is guaranteed by the VA. You can use a VA purchase loan to buy or build a home or to make an existing home more energy-efficient.

What Is a Native American Direct Loan?

While VA purchase loans come from private lenders, Native American Direct Loans (NADL) come directly from the VA. Like purchase loans, NADLs don’t require a down payment or private mortgage insurance. The closing costs on NADLs are also low, though you will need to pay the VA funding fee.

To qualify for a NADL, you need to be a veteran and you or your spouse needs to be Native American. The home you purchase with a NADL needs to be on federal trust land. You can also use the loan to refinance a NADL or to improve or build a home on federal trust land.

What Is a VA Cash-Out Refinance Loan?

If you already have a home loan but qualify for a VA loan, refinancing might make sense for you. The VA has two refinancing options. The first is a cash-out refinance loan. When you get a cash-out refinance, you generally borrow against the equity in your property. The refinancing process lets you get some cash, which you can use to renovate the home or for any other purpose.

One benefit of a VA cash-out refinance loan is that it lets you switch a non-VA loan to a VA loan so you can take advantage of a potentially lower interest rate, low closing costs and as little as zero down.

What Is a VA Interest Rate Reduction Refinance Loan?

The second refinancing option from the VA is the interest rate reduction refinance loan (IRRRL). With the IRRRL, you can switch from a loan with a higher interest rate to one with a lower rate or switch from an adjustable to a fixed-rate loan.

To get an IRRRL, you need to have a VA purchase loan already.

Apply for a VA Loan With Assurance Financial in 15 Minutes or Less

A VA loan can put homeownership within your grasp if you’re a veteran or otherwise meet the loan’s eligibility requirements. With Assurance Financial, finding out if a VA loan is right for you can take less than 15 minutes. Start the application process today to get ready to buy your dream home tomorrow.

Sources:

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/conventional-loans/

- https://www.military.com/money/va-loans/history-of-the-va-loan.html

- https://www.va.gov/housing-assistance/home-loans/trouble-making-payments/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/fha-vs-va-loans/

- https://www.benefits.va.gov/BENEFITS/factsheets/homeloans/VA_Guaranteed_Home_Loans.pdf

- https://www.va.gov/housing-assistance/home-loans/loan-types/

- https://www.va.gov/housing-assistance/home-loans/funding-fee-and-closing-costs/

- https://www.va.gov/housing-assistance/home-loans/loan-limits/

- https://www.va.gov/housing-assistance/home-loans/eligibility/

- https://www.va.gov/housing-assistance/home-loans/how-to-apply/

- https://www.va.gov/housing-assistance/home-loans/surviving-spouse/

- https://assurancemortgage.com/why-get-pre-qualified-before-looking-for-home/

- https://blogs.va.gov/VAntage/19931/va-busts-four-home-loan-myths-that-hurt-veteran-homebuyers/

- https://assurancemortgage.com/guide-to-cash-out-refinancing/

- https://assurancemortgage.com/apply

A starter home isn’t meant to be forever — that’s why it’s called a starter home. If your family is about to grow, you might find yourself wondering if you should buy a bigger house. For 26% of buyers between the ages of 30 and 39, a life change, such as the birth of a child, was the key factor that encouraged them to look for and buy a new home.

Whether you already own a home or not, there are some factors to consider during the process of buying a home for your family. Carefully consider what you need from your new home, as well as how the decision to buy a house may affect your finances and other areas of your life.

What to Consider When Buying a House for Your Family

There’s more to buying a house than making sure you find a place with the right number of bedrooms or a decently sized kitchen. As you start the search process for a home for your growing family, here are a few things to keep in mind:

1. Your Family Status

Consider the size of your family today and what the size of your family might be in the near future. You and your partner may be expecting your first child, or you may have recently had a baby. Do you plan to be a one-child household, or do you hope to grow your family beyond that? If you have plans to continue adding to your family, you may want to look for a house to grow into. If you purchase a two- or three-bedroom home right now, your family could outgrow it quicker than you’d like.

2. Your Budget

Just as you did when buying your first home or deciding how much you could afford to pay for rent, think carefully about your budget before you buy a bigger and potentially more expensive home. If you own your home, how much will you get from the sale? When setting your budget, it helps to err on the conservative side. If you and your partner both work, it might be a good idea to use just one partner’s income when determining how much house you can afford. That way, if one person loses their job, you can still be able to make your mortgage payments.

3. What You’ll Do With Your Current Home

If you own your current home, decide what you will do with it before you start the process of looking for a new house. It’s often ideal to sell your existing house first so you do not end up paying two mortgages. Selling your current home before you shop around or make an offer on a new property can also give you peace of mind that you have the down payment and closing costs needed for your next home purchase.

If you decide you aren’t going to sell your current property, it may be helpful to figure out what you’ll do with it — like renting it out or listing it as a vacation property — before moving on.

4. Who Will Care for What

Moving to a bigger home or a home with a bigger yard can mean more responsibilities. Before you make the move, it’s a good idea to think about what more space or more property will actually mean for you. Will you need to hire a landscaper or gardener to care for the lawn and other exterior areas of your home?

If you are moving into a house that is significantly larger than your current home, will you be able to keep up with cleaning it? You might decide to hire a housekeeper to clean the property for you. You may also decide to create a cleaning schedule and chore chart with your family members so everyone knows what needs to be done, when it needs to be done and who is responsible for doing it.

5. Your Must-Have Amenities

Before you look for a house for your growing family, make a list of the things you absolutely have to have, such as a garage, a finished basement or a sizable back yard. Focus on things that you likely wouldn’t be able to change once you bought the home or that would be difficult to adjust.

For example, you can always update a kitchen or finish a basement, but it can be difficult to make a small backyard bigger or to add another story onto your home.

6. Other Costs of Owning a Home

Your mortgage payment is likely to increase when you buy a bigger house. It may not be the only cost of living that is likely to go up, though. You might have a higher property tax payment, as well as higher utility bills if you move to a bigger, more expensive property. There is also the cost of moving and purchasing new furniture to keep in mind.

7. Your Plan for Living in the Home

Though life can be unpredictable, it helps to go into a home purchase with a general sense of how long you’ll stay there. Do you see your next property as a long-term home, somewhere you’ll remain until your children have grown up and moved out? Or do you expect to sell the house and move somewhere else in the near future? How long you hope to stay in a house may influence the size of the property you buy and the features you look for.

8. How Easy the House Will Be to Sell

Even if you hope to stay in your next home for many years, it is worth considering the resale value of the property and whether it may be easy to sell in the future.

Although there is no guarantee a home will sell quickly later on or that its value will increase notably, there are some signs that suggest that a property may be in-demand when you decide to move on. A house with good bones, that’s on a relatively quiet block in a popular neighborhood and that is near good schools is likely to sell more quickly compared to one with an unusual layout that is on a busy street.

What to Look for in a Family Home

Once you’ve considered the big picture of buying a new home, it’s time to focus on what you actually want the new home to have. Factors such as the size of the house, the number of rooms it has and its location can all influence how comfortable you and your loved ones feel inside the home.

When deciding what you want in your family home, there is no right or wrong answer. What works for you, your partner and your children are what matters most in your selection. With your family in mind, here are some factors to pay attention to when house hunting:

1. Overall Size of the House

It’s a good idea to start your house hunt with a general estimate of what size house you would like. You can use a figure such as the amount of square footage or the number of rooms to guide you. For example, you might want a bedroom for every person in your family, as well as an extra room for a guestroom and a room for an office or lounge area. Also, consider the size of the backyard you’ll want and the size of additional features, such as a garage or storage shed.

2. Number of Bedrooms

How many bedrooms do you need? In addition to having enough rooms for each person in your family at the moment, you might want a house that offers room to grow and has more bedrooms than you currently need.

3. Number of Bathrooms

Another thing to look for in your new home is the number of bathrooms available. If you have a small family, you may think one bathroom is enough. But as your child gets older, you might appreciate having a second bathroom, whether it’s an additional full-size bathroom or a powder room off of the living area. You and your partner might also appreciate having your own en-suite attached to the main bedroom in the house.

4. Tubs vs. Showers

Along with the number of bathrooms, consider what type of fixtures they contain. A shower stall without a tub might be a good fit when only adults live in your home. But it’s often easier for babies, toddlers and young children to wash up or be bathed in a tub. You may want to look for a house that has a least one bathtub to make bath time easier for everyone.

5. Finished Basement

A finished basement adds to the footprint of the house and gives you more usable space. Your kids can use the basement as a play area or study room once they start school. You can also use it as a bar or lounge area for entertaining guests in your home.

6. Unfinished Basement

You may prefer to buy a house that has an unfinished basement or other rooms that need renovation or finishing. Purchasing a home that needs some work gives you options. You can turn the basement into an in-law suite, for instance, or make it into the main bedroom. If you have the time to work on home improvement projects, buying a house that needs some work might be a good way to save money and make your new family home feel like your own.

7. Amount of Storage Space

Kids generate a lot of stuff, from strollers and diaper bags to school supplies and sporting equipment. You might want a house that has plenty of room to store all their items, whether in the form of a large mudroom or ample closet space. You may also want to make sure there is plenty of storage space for you and your partner’s possessions, especially if you have a large wardrobe or extensive shoe collection.

8. Exterior Space

One of the reasons people often move as they start a family or as their family grows in size is to take advantage of increased exterior space. If you want space for your kids to run and play or want a place for your pets to run around, consider the size of the yard at your new home.

In addition to size, another thing to consider is the layout and design of the yard. Is it fenced in, or can you easily add a fence for privacy and security? Is the yard on a hill, or is it relatively flat? It’s also worth noting how close the yard is to the street. Even with a fence, you may prefer to look for a yard that is set back from the road to reduce the chance of your kids or pets running into the street.

9. Home Layout and Floor Plan

Some home layouts or floor plans make more sense than others, and some are better suited for families with children. Consider the location of the bedrooms in the new home. Will your bedroom be close to your child’s so you can hear them if they have a bad dream and call out in the middle of the night?

Also, think about the location of the bathrooms. Having at least one bathroom on each floor can be convenient, as can having a bathroom located near the kids’ rooms and one near or attached to the main bedroom.

10. School Districts

If you plan to send your children to public school, the district a particular house is situated in may make or break your interest in it. Even if you don’t want to send your kids to public school, it can still be worthwhile to look for a home in a popular district, as the quality of schools around a property often affects its resale value.

11. Neighborhood Feel

The general location of the home is another thing to look for. What can the neighborhood offer you and your family? You might want to look for playgrounds nearby, local cafes or restaurants, and easy access to shopping. Research the neighborhood before putting in an offer. Is it the type of place where people feel comfortable taking a walk or do people mainly drive around in their cars?

12. Safety

Neighborhood safety is one thing to consider. Another thing is the safety of the home itself. Some houses aren’t particularly kid-friendly. They might have open stairs or railings that are easy for a small person to slip through or get caught in. If there is a swimming pool on the property, it’s important that it is fenced in or otherwise in compliance with local code. The condition of the electrical system is another safety concern to think about.

[download_section]

Consider a Mortgage When Buying a Family Home

It costs the average family $233,610 to raise a child from birth through the age of 17, or about $12,980 per year. When you’re spending that much per child, you might wonder how it would be possible to afford to buy a house for your family — particularly a house that has a higher price tag than the one you currently own or rent.

Fortunately, you don’t need to pay for your new house in full upfront. A mortgage allows you to make payments on the property that are spaced out over many years. The most popular mortgage term is for 30 years, which gives you plenty of time to pay down the loan.

How Does a Mortgage Work?

A mortgage is a type of loan used to buy a home. When you take out a mortgage, the house you buy serves as collateral on the loan. That means if you are unable to make your monthly mortgage payments, the bank or mortgage lender can foreclose on, or claim, your property.

To get a mortgage, you first need to apply for it. During the application process, a lender will likely verify your income, credit score and savings to determine the amount you are eligible to borrow and the interest rate you will pay. The interest rate is the cost of getting the loan. It’s an additional amount you pay each month on top of the principal payment to the lender.

What Mortgage Options Are Available?

There are multiple types of mortgages available for different homebuyers. If you are buying a house for the first time, there are several programs specifically for first-time homebuyers. First-time buyer loans often accept borrowers who earn lower incomes or who do not have a sizable down payment to pay upfront. There are also mortgages available for people who already own a home and are looking to purchase another one. Construction loans are an option if you plan to build your family’s next home.

Mortgages also differ in how they are repaid and the length of the loan. Although many borrowers opt for a 30-year loan, loan terms of 15, 20 or 25 years are also available. The shorter the mortgage term, the higher your monthly payments will be, but the less you will pay in interest over the life of the loan. Mortgages with shorter loan terms also often charge lower interest rates.

The amount of interest you pay on a mortgage depends on several factors. Your credit score and the size of the down payment affect the interest rate. The higher your score and the bigger your down payment, the lower the interest on the loan. Interest rates are also based on market conditions.

If you decide to get a fixed-rate mortgage, the interest rate will stay the same for the length of the loan. In a mortgage with a variable rate, the interest rate can change over the term of the loan, depending on the market. That means your monthly payment might increase or decrease every so often, which can affect your budget.

Apply for a Mortgage Today

If you’re considering buying a house for your growing family to live in, it’s a good idea to begin the mortgage process before shopping. Getting pre-qualified for a home loan before you begin the house hunt means you know how much you can comfortably borrow and whether or not a lender is likely to approve you for a loan.

Applying for a mortgage doesn’t have to be complicated. In fact, Abby, Assurance Financial’s virtual assistant, can walk you through the process in just 15 minutes. To get started, you’ll need proof of income, such as your paystubs, your ID and your most recent tax return. We’ll take care of the rest.

Ready to purchase a home for your growing family? Apply online with Abby today!

Sources:

- https://www.nar.realtor/sites/default/files/documents/2020-generational-trends-report-03-05-2020.pdf

- https://www.phillymag.com/sponsor-content/tips-buying-house-growing-family/

- https://www.realtor.com/advice/buy/home-youre-buying-good-resale-value/

- https://www.quickenloans.com/blog/things-look-shopping-next-home

- https://www.todaysparent.com/family/family-life/when-to-buy-a-bigger-house/

- https://www.opendoor.com/w/blog/how-to-find-the-ideal-home-when-starting-or-growing-a-family

- https://movement.com/blog/2016/04/19/growing-family-7-things-you-need-to-know-before-buying-bigger/

- http://www.exithgm.com/buying-a-home/buying-house-growing-family/

- https://primaryresidentialsf.com/home-buyer-advice/buying-a-house-for-a-growing-family/

- https://www.usda.gov/media/blog/2017/01/13/cost-raising-child

- https://assurancemortgage.com/everything-you-need-to-know-about-30-year-fixed-rate-mortgages/

- https://assurancemortgage.com/experienced-homebuyer/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/remodeling-construction/

- https://www.consumerfinance.gov/ask-cfpb/how-does-paying-down-a-mortgage-work-en-1943

- https://www.lendingtree.com/home/mortgage/how-does-a-mortgage-work/

- https://www.nerdwallet.com/blog/mortgages/how-to-apply-for-a-mortgage/

- https://assurancemortgage.com/apply/

You’ve recently visited a home, and it feels like the one. You put in an offer, the seller accepted it and now it’s time for the home inspection. Scheduling a home inspection is an essential part of the homebuying process. The inspection can clue you into any issues in the house that you might have missed and can protect you from buying a home that has many problems.

Even if everything about the home looked great when you toured it the first time, the inspection isn’t something you want to skip. You can use the information you get from the inspector to negotiate with the seller and to correct any concerns before you close on the property. Although many buyers schedule their own inspection, sellers can also set up a home inspection before they list their home. A pre-listing inspection can give a seller an idea of what should be fixed up before the house goes on the market.

Whether you are the buyer or seller, a home inspection can help you save money and time.

Table of Contents

- What is Home Inspection?

- When Should the Home Inspection Take Place?

- How to Hire a Home Inspector?

- What to Expect as a Buyer

- What to do During and After a Home Inspection

- What to Expect as a Seller

- How to Prepare

- What Sellers can do After

- Cost of a Home Inspection

- What’s in a Home Inspection Report?

- Apply Today

What Is a Home Inspection?

A home inspection is a non-invasive examination of the structure and systems of a home. During an inspection, a home inspector will check out the house from top to bottom, evaluating the condition of everything from the foundation to the roof. The inspection usually takes place with the buyer or seller present and often takes several hours to complete. How long the inspection takes depends on the size of the home and its overall condition. A larger house or a house that has many issues will usually require a longer inspection than a small home or a home that has few problems.

The home inspection often involves three parts, in which an inspector will:

- Identify issues in the home.

- Recommend ways to correct any issues.

- Take photos of the structures and systems in a home to include in the report.

One thing worth noting about a home inspection is that the issues uncovered are typically those that are visible. An inspector isn’t going to make holes in the walls of the home or tear up the flooring to look at the condition of the subfloor. They won’t try to look at pipes or wiring beneath the walls or floors, either. If it isn’t safe to evaluate or examine a particular area of the home, the inspector will also generally leave it. For example, although a roof inspection is usually part of the process, if the roof is too high to safely reach with a ladder, an inspector might examine it through a pair of binoculars, rather than going onto it.

While a home inspection will check most areas of the home, there are some things the inspector won’t evaluate. Usually, swimming pools, fireplaces and septic systems aren’t included in the home inspection. The inspector is also likely not to comment on the condition of the soil or ground underneath.

When Should the Home Inspection Take Place?

If a buyer is scheduling a home inspection, it usually occurs shortly after a seller has accepted the buyer’s offer and after both parties have signed a purchase agreement. Your real estate agent should include an inspection contingency clause in the agreement. The clause gives you the option of scheduling an inspection and outlines a time frame for it, such as up to seven days after the parties sign the purchase agreement.

The clause should also state that you have the option of backing out of the sale of the home if you and the seller can’t agree on negotiations or if the inspection turns up significant issues with the home.

When someone is selling their home, they might decide to schedule a pre-listing inspection. During a pre-listing inspection, the inspector will check the home for any issues and recommend changes the seller can make before putting their home on the market. After a pre-listing inspection, a seller can decide what improvements to make to increase the sale price of their home. They can also use the information in the report to set the price of the home.

How to Hire a Home Inspector

If you are in the process of buying a home, you get to choose the person who performs the inspection. Just as you might have shopped around for your real estate agent, it’s a good idea to shop around before you choose a home inspector. Your agent might have a list of recommended inspectors for you to work with, but it often pays to do your own research. You want to hire someone who is certified and who you can trust to give you an unbiased opinion. The inspectors your agent recommends might offer the agent a referral bonus, which means they aren’t exactly a neutral party.

You might want to ask friends or relatives who recently purchased a home in your area who they worked with for the inspection and if they’d recommend the inspector they used. An online search can tell you if others have had a positive experience with a particular inspector or if there are any complaints or concerns raised about them.

You can also ask the inspector to share a sample copy of the report they provide. That way, you can see how detailed the report might be and can get a sense of how well the inspector describes the issues with the property.

What to Expect During a Home Inspection as a Buyer

If a seller has accepted your offer for their home and has agreed to a home inspection contingency, set aside several hours on the day of the inspection to give the inspector time to do their job and to give yourself the opportunity to be present for as much of the process as possible. You don’t have to be at the home during the inspection, but being there is usually recommended. Walking through the property with the inspector can help you gain a better understanding of any issues and what they might mean for your safety and comfort if you end up buying the property.

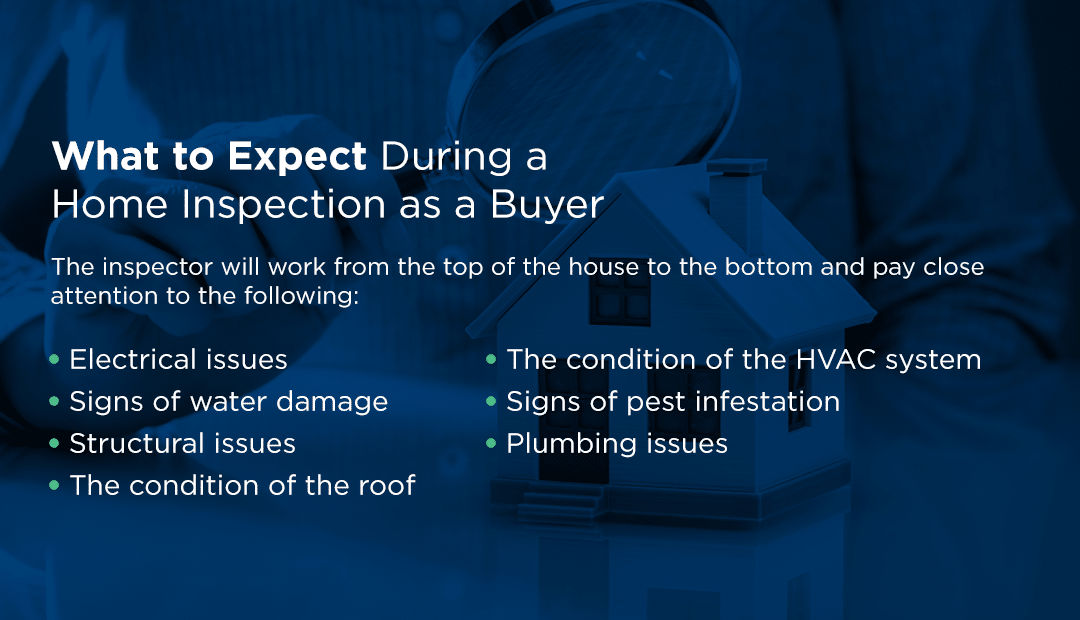

Your real estate agent doesn’t have to be present during the inspection, but many choose to be there. If your agent is present, they are equipped to give you advice on how to negotiate with the sellers if there are any issues with the house that you want fixed before closing. The inspector will work from the top of the house to the bottom and pay close attention to the following:

- Electrical issues: The inspector will test the outlets in the home to verify they are grounded. They will also look at the circuit breaker and check to see that the wiring is up to code. If there are problems with the house’s electrical system, the inspector will describe them to you and will give you an idea of what you can do to correct them.

- Signs of water damage: The inspector will look for visible signs of water damage, such as a crack in the wall or signs of moisture in the basement. They will advise you on what you can do about any damage.

- Structural issues: During the inspection, the inspector will note potential structural concerns, such as signs of bowing on the facade of the house or signs that the floor is not as supported as it should be. They will also look at windows and doors to make sure they open and shut as they should and to confirm that they are straight.

- The condition of the roof: Many inspections require the inspector to get on the roof to check it out and make comments about its condition. The inspector notes the state of the roof and its perceived age and usually provides the buyer with an idea of what type of repair or maintenance it might need.

- The condition of the HVAC system: The inspector will test the HVAC system, whether it includes central air and heat or just heat. They will record the age of the system and its condition and will recommend changes or fixes as needed, such as replacing the air filter or considering upgrading an older system. During the inspection, they will turn on the heat or air conditioning to see how it performs.

- Signs of pest infestation: The inspector will also look for visible signs of pest damage. In many cases, a separate pest inspection, such as a termite inspection, is recommended as part of the home inspection process.

- Plumbing issues: While the inspector isn’t going to cut into walls to see if pipes are leaking, they will check the accessible areas of the house’s plumbing. They will test the water pressure coming from the faucets and will evaluate how well the drains function. They will also look at the pipes in the basement and make recommendations about the conditions of the piping and the location of shut-off valves.

The inspector is also likely to test any appliances that will be included in the sale of the home to make sure they function properly. For example, they may run a cycle in the washing machine and turn the dryer on. They will also look at the refrigerator and oven in the kitchen.