Month: December 2021

Whether you’re a first-time homebuyer or a homeowner looking to refinance your mortgage, the financial logistics of homeownership may have you asking some big questions. When considering your home loan options, one of the primary criteria to evaluate is the type of interest rate you’ll have: a fixed-rate vs. an adjustable-rate mortgage.

Interest is the amount of money your lender charges you for using their services, calculated as a percentage of your loan amount. Interest rates can be fixed or adjustable. The type of interest rate you choose depends on many factors, and the best type of loan for your situation may even change over time.

From receiving your first mortgage to refinancing for a better rate, this guide will walk you through everything you need to know about interest rate types so you’ll be a more informed homebuyer!

What Is a Fixed-Rate Mortgage?

Fixed interest rates stay the same throughout the life of the loan. Mortgages typically last for 10-30 years, depending on your financial goals and repayment plan. Of the two primary categories, fixed-rate mortgages are the more straightforward option.

You might choose a fixed interest rate if overall rates are low when you buy a house you’re planning on owning for a while.

What Is an Adjustable-Rate Mortgage?

Adjustable interest rates fluctuate during the loan’s life. Usually, adjustable-rate mortgages (ARMs) start in an introductory period, where the loan’s interest rate stays the same for the first few months or years. After that period, the rate changes on a preset basis.

Adjustable interest rates are affected by the index, which is a measure of general interest rates. When the interest rate changes, your monthly payments on an ARM might change accordingly, depending on your loan and the circumstances set by your lender. Adjustable interest rates adjust on a set schedule.

On the terms of your adjustable-rate mortgage, you might see the adjustment rate written out as, for example, 5/1. The first number is how many years the introductory period will be — in this case, five years. The second number is how much time elapses between rate adjustments — in this case, one year.

You might choose an ARM if you’re only planning on owning the house for a few years. Since introductory rates often last for the first several years, you might be interested in buying a house with an ARM and then selling or refinancing before the introductory period ends. You might also choose this type of loan if you think interest rates will continue to fall in the future.

How Are Interest Rates Determined?

Your mortgage lender gives you an interest rate based on how risky they think lending money to you will be. The riskier the loan, the higher the interest rate.

Some factors affecting your interest rate are within your control. The lender looks at how you manage money and determines how responsible you are with your finances. People who are more responsible are generally rewarded with lower interest rates.

Credit Score

Your credit score plays an important role in the interest rate you receive. Your credit score is a number usually ranging from 350 to 850 that indicates your credit and repayment history. The higher the number, the better you are at repaying your loans and managing different lines of credit.

Mortgages are a type of loan that often span multiple decades. Your lender wants to make sure they can trust you to make regular repayments over the life of the loan, even as your life and financial circumstances change, as they’re bound to over 30 years.

People with scores of 740 or higher tend to receive the lowest interest rates. Conversely, the lower someone’s score is, the higher their interest rates will be. People with credit scores under 699 might also find it more difficult to be eligible for mortgage loans at all.

Even slight differences in credit scores can add up to tens of thousands of dollars over time. For instance, someone with a score of 680-699 might have an interest rate that’s 0.399% higher than someone with a score of 760-850. If the mortgage is $244,000, the person with a lower credit score would end up paying about $20,000 more in interest than the person with the higher credit score.

To establish credit and build your credit score, try the following tips:

- Get a credit card: Build your credit history with smaller monthly payments on a credit card, keeping in mind the credit limit and interest rate of your particular card to ensure responsible spending.

- Take out multiple loans: Having a mix of credit can help boost your credit score. Reliably paying off car and student loans, for example, is another way to show lenders you’re already a responsible borrower.

- Report loans and other regular payments: If you have a credit card or other loans, those companies and lenders should already be reporting your activity to credit bureaus. Additionally, if you’re new to building credit, you can report your rental and utility payments. Having a good history of paying rent and utilities on time can sometimes help lenders see how responsible you are.

As with any financial endeavor, responsibility is key. Paying off your balances in full and staying on top of repayment schedules is highly recommended so you can establish good credit and stay out of debt.

Loan-To-Value Ratio

A loan-to-value ratio is the amount of the loan compared with the price of what the loan is for. For example, a $20,000 down payment on a $100,000 house would leave you with a mortgage of $80,000. That means your ratio would be 80% since you’d be borrowing 80% of the home’s value.

The bigger your down payment, the lower the loan-to-value ratio, which usually results in a lower interest rate. The smaller your down payment, the higher the ratio, which is riskier for the lender, possibly resulting in a higher interest rate for you.

Loan Term

In general, even though shorter-term loans have higher monthly payments than longer-term loans, paying off a loan over a shorter amount of time means you pay less interest, lowering the total cost you pay over the life of the loan. Because of this, shorter-term loans usually have interest rates that can be as much as 1% lower than those of longer-term loans.

Property and Location

The type of property you buy might also affect your interest rate. Loans on manufactured houses and condominiums, as well as investment properties and second houses, are typically riskier. Borrowers are more likely to default on a loan — stop making regular payments — for properties that aren’t their primary residence or for houses on land they don’t own. Riskier loans usually come with higher interest rates.

The location of the house you buy may also affect your interest rate, as lenders sometimes offer different interest rates in different states or counties. The interest rate for a house in a rural area, for example, might look different from the rate in an urban area.

While you can take steps to be in good financial standing and plan a home purchase with minimal risk, some factors that can affect the interest rate you receive are beyond your control, including the following two considerations.

The Economy

General economic growth means more people can afford to buy houses. More buyers in the housing market mean more people applying for mortgages. For lenders to have enough capital to lend to an increased number of people, they need to drive interest rates higher. In contrast, when the economy is slow, mortgage demand decreases, and lenders can offer lower interest rates.

Inflation

When prices of goods rise, a dollar loses buying power. A certain amount of money that could place a good down payment on a house 20 years ago would cover a smaller percentage of the price of a similar house today. To compensate for the regular shifts in inflation, lenders apply higher interest rates to their loans.

As you look into buying a home, you may want to keep an eye on broad economic trends, and, if possible, adjust your buying process to reflect times when the overall market is offering lower interest rates.

[download_section]

What Are the Similarities Between Fixed and Adjustable Rates?

Fixed-rate mortgages and ARMs are different loan types, but they both have the same eventual goal — to help you finance your dream of owning a home.

The same factors determine the starting interest rates of both types of mortgages. Your credit score and overall financial situation, as well as general economic shifts, can help or hinder your ability to get a low rate. From there, you either keep that rate for the length of the loan or have it be your starting point for future changes.

What Are the Differences Between Fixed and Adjustable Rates?

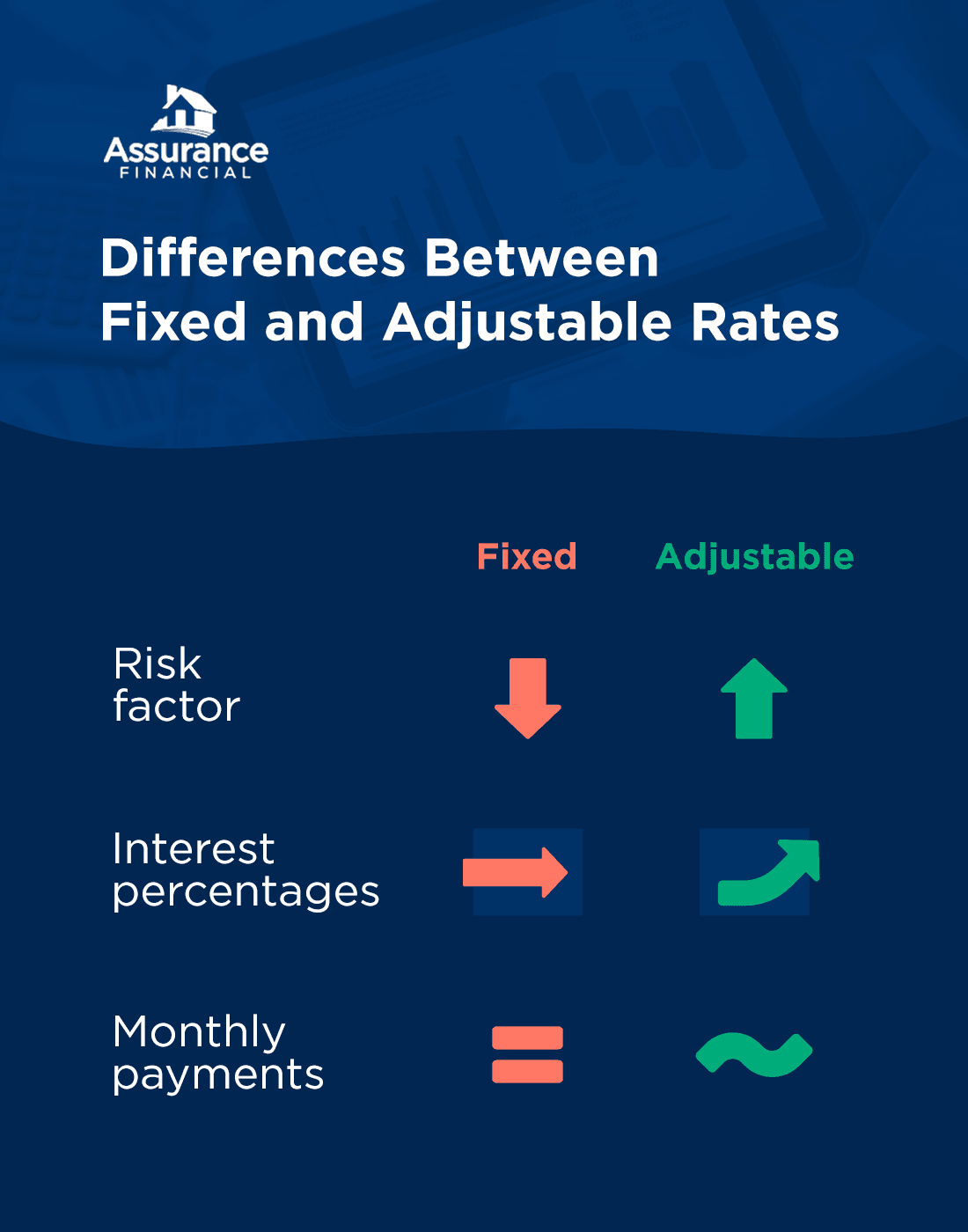

The main difference between fixed and adjustable interest rates is that fixed rates stay the same, while adjustable rates can fluctuate depending on the market. Some of the other major distinctions include:

- Risk factor: Since fixed-rate mortgages offer the same interest rate for the duration of the loan, they’re less risky than the uncertainty that can come with adjustable-rate mortgages.

- Interest percentages: Fixed-rate loans often have higher interest rates than the rates during ARM introductory periods. After the introductory period, however, ARM rates may rise higher than the fixed rates for comparable loan situations.

- Monthly payments: With fixed-rate loans, the monthly mortgage payments stay the same throughout the loan’s life. With ARMs, your monthly mortgage payments will fluctuate to reflect the economic changes that shift your interest rates.

From 2008 to 2014, 85%-90% of homebuyers chose a fixed-rate mortgage, up from the historical percentage of 70%-75% of buyers. In that same time span, 10%-15% of homebuyers chose an ARM, down from the historical percentage of 25%-30% of buyers.

Despite the wide gap in those statistics, neither fixed- nor adjustable-rate mortgages are inherently better than the other, because all home-buying situations and financial circumstances are unique. Both types of mortgages have benefits and drawbacks that you should consider in light of your personal finances and needs.

What Are the Pros of Fixed-Rate Mortgages?

Fixed interest rates offer many benefits, including:

- Rate stability: If market interest rates are low when you get your mortgage, you’ll keep that low rate for the duration of your loan. You can strategically pay less in interest by buying a home while interest rates are low.

- Protection: A fixed rate protects you from sudden rises in market interest rates.

- Consistent payments: Fixed-rate mortgages allow you to create a steady budget because your monthly payments stay the same for as long as you own your home. You’ll always have a good idea of what your housing costs will be month to month and year to year.

What Are the Cons of Fixed-Rate Mortgages?

The biggest drawback of fixed interest rates is the potential for receiving a high interest rate for the entire life of your loan. If market interest rates are higher than average when you buy your house, you’ll pay a high amount of interest. Even if market rates drop after you’ve taken out your mortgage, you’ll still have to pay the high rate you started with.

If you’re interested in getting a fixed-rate mortgage, it could be helpful to monitor the market and wait for a time when the interest rates are low before moving forward with your home purchase.

What Are the Pros of Adjustable-Rate Mortgages?

When considering your loan options, you may choose an ARM over a fixed-rate mortgage for several reasons, including:

- Lower upfront costs: When you first take out an ARM, the introductory rate is usually lower than the market rate for a comparable fixed-rate mortgage. The low fixed introductory rate gives you a good deal for the first few years. Lower initial payments may even let you qualify for a larger loan, making it possible for you to buy your dream house.

- Rising interest protections: Most ARMs have a rate cap, which keeps their interest rates from rising above a set percentage. The cap can be for each adjustment — so your rate never rises above a certain point each time it goes up — or for the life of the loan, so your rate never ends up being more than a certain percentage total.

- Future rate drops: The flexibility of an ARM means your interest rate could drop even lower at certain points in the future. This potential for automatic drops lets you take advantage of lower interest rates without refinancing your loan.

What Are the Cons of Adjustable-Rate Mortgages?

Smart financial decisions look different for everyone. The disadvantages of ARMs include:

- Future rate rises: While ARMs are appealing during times of low market rates, if rates unexpectedly rise, you could pay higher monthly payments than initially planned.

- Budgeting difficulties: Fluctuating interest rates mean you’ll make payments of differing amounts over the life of your loan, making it difficult to plan ahead and know exactly how much you’ll pay year to year. However, other total monthly payments associated with your house or property can still change from month to month, such as property taxes, homeowners insurance or mortgage insurance. If you’re already prepared to pay fluctuating bills each month, you may feel more comfortable with the changes in your loan payments due to adjustable interest rates.

- Unexpected rate rises: A drop in interest rates doesn’t always decrease your monthly payments after new adjustments dates. Some ARM interest-rate caps stop your rates from rising too high all at once but may carry over the remaining percentage points from previous increases to years where the interest rates don’t change much. So, even if you don’t think your interest will rise one year, it could rise anyway due to overflow from previous years.

Additionally, many people take advantage of their low introductory period rate to buy a house they plan on selling before their rates change and potentially rise. However, this plan is risky. Changes to your moving schedule or unexpected life events might mean you’ll own your current house for longer than you planned.

During this time, your adjustable interest rate could rise beyond what you were planning to pay. ARMs have plenty of benefits, but with unexpected market shifts, it’s not safe to assume they will help you avoid paying more in the long run.

Why Would You Refinance to Change Your Interest Rate Type?

Refinancing a loan means taking out a second mortgage and using it to pay off and replace your first mortgage. Refinancing can be an important option to consider, especially if your high interest rate has you wondering if you can get a better deal. While refinancing is a major responsibility, it might serve you well depending on the type of mortgage you already have.

The terms of your current loan and the state of the economy might make you want to refinance your home loan and change the type of loan in the process.

Adjustable to Fixed

There are potential benefits to switching from an adjustable-rate mortgage to a fixed-rate mortgage. The switch might set you up with a lower rate that you can keep for the remaining duration of your loan. If you want to buy a house while interest rates are high, getting an ARM and refinancing to a fixed-rate mortgage when interest rates decrease can be a cost-effective solution.

Additionally, switching to a fixed rate can release you from the uncertainty that comes along with adjustable interest rates. If the economy goes up or down, your new fixed rate will stay the same, which can benefit you — especially when adjustable interest rates spike.

Fixed to Adjustable

If you have a fixed-rate mortgage and want to switch your interest rate due to a drop in overall rates or an improvement to your credit score that would make you eligible for a lower rate, you would most likely need to refinance your loan.

If you’re planning on selling your house soon, however, refinancing to an adjustable-rate mortgage may not be the best idea. Sometimes, refinancing comes with long-term benefits you receive after a while. If you don’t think you’ll own your house long enough to start reaping those benefits, then staying with your current loan is the smartest financial option.

How Should You Prepare to Get the Most Out of Your Mortgage?

As you embark on the journey of buying or refinancing a home, you’ll want to be as ready as possible to receive the best interest rate for your financial situation. When thinking about applying for a mortgage, keep the following tips in mind:

- Build credit: Open new lines of credit well in advance of applying for a home loan. By doing so, you’ll have already-established credit that can help you later on.

- Look ahead: Consider any additional loans or major expenses you may need to pay in the future. Think about whether making a big home purchase is the best use of your finances at this time.

Let Assurance Financial Help You Find a Loan for Your Home

Buying a house is an exciting time in your life. Choosing the right mortgage for you and your family can help make the time spent in your new home even more enjoyable.

Whether you’re looking for a fixed-rate mortgage or interested in the benefits of adjustable interest rates, Assurance Financial is here to help. We will walk you through every step of the process, from deciding what kind of mortgage is best for you to giving you all the information you need to apply and get approved for your home loan.

Get in touch with us today to start your road to homeownership!

Linked Resources:

- https://assurancemortgage.com/finding-right-mortgage-loan-for-you/

- https://files.consumerfinance.gov/f/201204_CFPB_ARMs-brochure.pdf

- https://assurancemortgage.com/mortgage-term-glossary/

- https://www.investopedia.com/articles/personal-finance/080615/highest-credit-score-it-possible-get-it.asp

- https://www.nerdwallet.com/article/mortgages/how-are-mortgage-rates-determined

- https://www.forbes.com/advisor/mortgages/how-your-credit-score-affects-your-mortgage-rates/

- https://assurancemortgage.com/how-to-build-credit-to-get-loan/

- https://www.nerdwallet.com/article/mortgages/loan-to-value-calculator

- https://www.consumerfinance.gov/owning-a-home/loan-options/#interest-rate-expand-header

- https://www.consumerfinance.gov/about-us/newsroom/manufactured-housing-loan-borrowers-face-higher-interest-rates-risks-and-barriers-to-credit/

- https://www.nerdwallet.com/mortgages/mortgage-rates/investment-property#:~:text=Your%20interest%20rate%20will%20generally,that’s%20not%20your%20primary%20residence.

- https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

- https://www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/

- https://www.investopedia.com/terms/f/fixed-rate-payment.asp

- https://www.investopedia.com/terms/a/arm.asp

- https://www.investopedia.com/mortgage/mortgage-rates/adjustable-rate-go-up/

- https://assurancemortgage.com/is-refinancing-a-bad-idea/

- https://assurancemortgage.com/contact-us/

If you’re wondering when you should downsize your home, understand that it may be a lengthy process. While everyone’s timeline looks different based on their situation, downsizing involves a multistep process:

- Downsizing your possessions

- Preparing your home to sell

- Selling your home

- Finding and moving into a new house

If you have more space than you need, would like to save some money or plan to travel more, downsizing could be a great step to help you reach your goals. Discover the reasons and benefits of downsizing your home.

Should I Downsize My Home?

If you’re considering downsizing your home, you may be committing to a large, long-term project. Even if you have a short timeline — whether due to a sudden move or retirement — be sure to take the time to ensure downsizing is right for you. Reflect on why you want to downsize and what the process will involve realistically.

Some questions you may want to consider before downsizing your home include:

- What are my motivations for downsizing? If you want to downsize because you’re looking for a different layout for your home or to have different amenities, consider whether it might make more sense to reorganize or renovate your current home. Many homeowners whose needs change often decide to take out a second mortgage to fund their renovations.

- What do you love about your current home? During the process of buying a new home, you may be tempted to focus on the negatives of your current space. Instead, consider the aspects of your current house you love and use, and add those to your must-have list.

- What will my family or I gain from downsizing? Think about the activities and projects you will be able to accomplish with a smaller home. Perhaps it will allow you to travel more, or mean a safer environment for the children and older adults in your family.

- What are my primary concerns about downsizing? Most people’s main concern with downsizing is budget. You might also worry about missing out on storage, outside space and other amenities you enjoy in your current house.

- What is my timeline? Consider when you’d like to start your downsizing process, how long you want to take and when you ultimately want to complete the process and be in your new space.

- What are my current and future needs? When considering downsizing, think about what you need right now and how your needs might change in the future. Will you have kids moving out, parents moving in or other considerations you’ll want to account for in the downsizing process?

Reasons to Downsize Your Home

Everyone’s reasoning for downsizing will be unique to them, but there are a few important reasons many people choose to downsize. Most of these have to do with a person’s budget, living situation or dreams for the future. Take a look at six reasons why you should downsize your home:

1. Maintenance Costs

With larger homes and larger yards, you’ll confront higher costs of maintaining your spaces. Most homeowners should budget at least 1-4% of their home’s total cost to annual maintenance — you can budget less for newer homes and add more for older homes that may require more repairs. That means a 20-year-old house that originally cost $500,000 might need a budget of $20,000 each year, while a house for the same price that’s brand new may only need $5,000 for incidental maintenance and upkeep.

Smaller homes have lower price points in many cases, so the cost of maintaining them yearly is much less. With less square footage, you’ll spend less on things like flooring, roofing and heating and cooling costs. Downsizing also might mean a smaller or no outside space, resulting in little to no cost to maintain your yard.

2. Retirement

Most people begin thinking about downsizing while considering retirement. With a little more time on their hands, many envision traveling and participating in activities that make keeping up with a large home more difficult. When you reach retirement age, you may also begin thinking about the future and the potential challenges your current space might incur as you age.

Large homes with steps, steep driveways and other mobility challenges can be dangerous for older adults. Modifications, such as stairlifts, ramps and railings, may be simple and affordable to add to existing homes, but tasks like widening doorways, adjusting counter heights, leveling flooring and remodeling the shower or tub may prove more expensive than they’re worth. In most cases, downsizing is a better alternative as people reach retirement age and have less use for the space.

For many retired individuals and couples, condos and townhomes are attractive options when thinking about downsizing. They often provide on-site maintenance with staff handling outside work as well. Secondly, they also provide a community for older adults to gather together, a service that becomes incredibly important given the increased rates of loneliness in retired adults.

3. Unused Space

If you find you’re leaving entire rooms or wings of your house vacant for extended periods of time, it may be a sign to consider downsizing. When initially purchasing a home, it can be tempting to go with an option that has more rooms and closets than you need. However, having extra, unused space may seem wasteful if your family doesn’t use it as time passes.

Many parents find they have a lot of unused space in their homes after their children move out for college and job opportunities. With whole rooms and bathrooms suddenly out of use, downsizing becomes an attractive idea. In addition to spending less time on upkeep — unused rooms still need vacuuming and dusting, after all — downsizing can provide opportunities for people to start saving for retirement.

4. Travel

Traveling can be a wonderful experience that broadens your mind and introduces you to new experiences. Many who travel frequently find keeping up with their home while away is difficult. From the extra expenses for house sitters or security systems to the added worry of something happening while away, many travelers decide to downsize.

Many avid travelers downsize to condos and townhomes or smaller homes — some even turn to tiny homes — to reduce the cost and hassle of keeping up with a larger home. Whether you travel for fun or work, having less space to manage can give you peace of mind while away. Some also find that downsizing makes funds available to embark on the adventures they’ve always wanted to go on.

[download_section]

Benefits of Downsizing Your Home

If you’re on the fence about whether downsizing is right for you, consider all the benefits that come with enjoying a smaller living space. Many people have concerns about storage, sleeping space and privacy when moving to smaller homes, condos or townhomes, but the following are some amazing benefits you can reap when downsizing your space:

More Time

Many homeowners feel the time they spend on household chores interferes with their ability to spend time with their family and friends. Some time-consuming household tasks include:

- Yardwork

- Floor cleaning

- Laundry

- Dishes

However, there are hundreds of other tasks that require the homeowner’s attention. This time can double if something breaks down or malfunctions, and you have to make time to call a repair technician, schedule an appointment and find an alternative solution until the problem is fixed.

With a smaller home, you have less space to maintain, meaning tasks like vacuuming, mopping and deep cleaning take less time. Downsizing might also mean reducing the volume of clothes and the number of appliances you own, drastically reducing laundry time and potential maintenance issues.

Less Debt and More Savings

In most cases, moving into a smaller home means the actual cost of the home is much less, in addition to lower maintenance and upkeep costs. If you have a good real estate agent and time your home sale optimally, you could get up to full or more than the asking price for your home. This can set you up with more money to spend on your new home mortgage and even free up some extra funds to put toward paying off any debt.

If you have a few acres on your larger property, you might rely on a yard service to maintain your lawn — when you move to a smaller place with a smaller yard, you can likely do the yard work yourself, or at least pay less for the service to maintain your yard. You’ll also have less furniture, decorations and supplies to buy for the smaller space.

Simplicity

Some people find downsizing is great for their mental health and emotional well-being. Psychologists have found that living in cluttered living spaces can contribute to heightened levels of anxiety and can even lead to a phenomenon called “mental clutter.” When you have a lot of space, your tendency may be to fill it up — which often happens when people have plenty of storage space to keep things they don’t use every day.

Having less space and fewer things to fill it with can lead to a simpler life. Certain life philosophies and approaches advocate for reducing your possessions and keeping only the essential items for your life. In doing so, people can experience a more fulfilling life.

Reduced Energy Costs

On average, most households spend over $2,000 on utility bills each year. For larger houses, you might spend more — but downsizing means your utility costs could lower. That can leave more money in your budget each month for things like groceries and mortgage payments, or you can save that money for a special trip or another investment.

Urban Living

If you downsize, it can open up more possibilities as to where you can live. Many families with young children in school find life simpler in the suburbs. With more space to spread out, families enjoy the safety and familiarity of wide-open neighborhoods. However, when kids move out or the time comes to downsize, urban living becomes a possibility.

With almost everything you could need within a few steps from your front door, living in the middle of a big city is extremely attractive to some people. The bustle of city life and the cultural diversity can make every day an adventure. While city living tends to be more pricey than living in the suburbs, many save on transportation, utilities and maintenance costs in smaller city quarters. Living in a city might also make travel more accessible due to access to airports and train stations.

How to Downsize Your House

If you’ve decided downsizing is right for you and your family, the next step is actually doing it. While planning can help immensely with the process, there are a few processes that can help.

Timing Is Everything

When planning to downsize, knowing the housing market situation is essential. If you can time your home sale during a period where there are more buyers than supply, you’ll get the best price for your home. This seller’s market means you will have more power in selling your current home. Some buyers may even waive inspections and offer more than the asking price.

When you have more money from the sale of your current home, you can put that towards a down payment on your smaller home or condo. In most cases, this means you may be able to afford a nicer home or one in a more expensive area. You might also choose to offer a larger down payment to reduce the amount you’ll have to pay each month.

You might also want to time your downsizing with a buyer’s market when there’s plenty of supply and little demand, making it more likely you’ll get a great deal when purchasing your new home. If you plan to downsize significantly, this approach could be a great idea. Even if you may lose a little on the sale of your larger place, you’ll still have plenty to put toward your smaller place.

Methods of Downsizing Your Possessions

When planning to move somewhere smaller, one of your first thoughts is likely, “Okay, but what do I do with all this stuff?” If you’ve been in your current space for a while, you’ve likely amassed a sizable collection of clothing, toys, furniture and other items you may not be able to take to your new place. Before you begin preparing your home for sale, start downsizing your possessions.

Starting with this makes the moving process easier and also gives you a good idea of how much storage and space you’ll need in your new place. You can also do this even if you’re still on the fence about downsizing to a new home. Many people like to do small clear-outs seasonally, often in spring, to rid their closet of clothes they haven’t worn in a year or two. However, the type of clean-out you’ll need to do for downsizing will likely be more intense.

Go through every room and take a close look at everything you own. Most people use a three-pile method — keep, donate, toss — to sort through items, but this method can be overwhelming when looking at all your possessions at once. The following are a few particular methods you might employ when downsizing your possessions:

- Inventory method: If you’re a lover of spreadsheets, this might be the method for you. Take inventory of all your belongings by categorizing them into certain groups, such as clothing, appliances, kitchen tools and toys. Seeing all your items laid out visually on a screen or piece of paper will help you realize how much you have. As you clean out items from your home, remove them from your list until you have a manageable number.

- The KonMari method: The KonMari method focuses on items that “bring joy” and approaches tidying and downsizing as a process of ensuring you surround yourself with things you love and use. For this method, you’ll divide your possessions based on categories and sort through them. If they do not “spark joy,” it’s time to give them up.

- Room-by-room method: Taking your house room by room, you’ll completely sort each one before moving on to another. Many people start with the toughest room first, which often is a garage, attic or basement. This method can help compartmentalize your clearing out, especially if a busy schedule means you can’t upend your entire house all at once.

What Does Downsizing Mean for My Mortgage?

Whenever you sell your home, your mortgage will likely change. When downsizing, this often means your current mortgage is more than your new one will be. If you own your home outright, you can sell the old one and pocket the difference. However, most people still own at least some of their mortgage when they decide to sell and downsize to a smaller home.

The benefits of downsizing your home for a new mortgage may include:

- Saving money to pay off debt, invest or fund travel plans.

- Being able to offer a larger down payment on your new home.

- Moving to an area where home prices are more expensive.

A potential challenge you might face is that your current home may not be worth as much as you think. Homes tend to depreciate no matter what, but you can counteract this by investing a little in your home to bring important features up to date. Things like kitchens and bathrooms can be expensive remodels, but it often pays off when it comes to selling your home, especially in a competitive market.

When you sell your home, you will likely have a sizable amount of equity to cash in on. The buyer’s money will go toward paying off the rest of the mortgage and the sale’s closing costs. However, if you have a more valuable home than the one you’re buying, you can pocket the difference as profit.

What Kind of Mortgage Should I Get After Downsizing?

After you downsize and sell your home, you’ll be looking for a new mortgage. The most common mortgage options are 10, 20, 15 and 30-year mortgages. For first-time home-buyers, usually young people or young families, a 30-year mortgage is a great option to get lower monthly payments and put less money down.

However, if you’re downsizing into a new home, especially if you’ve retired, a 15-year mortgage is a great option. Some of the benefits of a 15-year mortgage might include:

- Lower interest rates.

- Equity builds more quickly.

- Lower overall cost due to interest savings.

Apply for a Mortgage With Assurance Financial

There’s a lot to consider when you decide to downsize your home. Thinking about selling your home and purchasing a new one can be an overwhelming prospect, but working with a qualified financial partner can help make the process much smoother.

Assurance Financial makes applying for a mortgage simple and straightforward. We offer every type of loan available on the market and are committed to offering competitive rates and superior customer service. You can apply online in 15 minutes with our digital assistant, Abbey, or speak with a licensed loan officer.

Linked sources:

- https://assurancemortgage.com/second-mortgage-vs-refinance/

- https://www.forbes.com/sites/juliadellitt/2018/06/20/why-you-need-to-adjust-your-monthly-budget-for-home-maintenance/?sh=610b6db934a0

- https://assurancemortgage.com/tiny-home-mortgages-explained/

- https://www.psychologytoday.com/us/blog/fulfillment-any-age/201705/5-reasons-why-clutter-disrupts-mental-health

- https://www.energystar.gov/products/ask-the-expert/breaking-down-the-typical-utility-bill

- https://assurancemortgage.com/buyers-vs-sellers-market/

- https://assurancemortgage.com/15-vs-30-year-mortgages/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/find-a-loan-officer/

There are many factors to consider when selling a home, and you may be wondering what happens to your mortgage when you move. After all, the 2018 American Community Survey found that the median length of time homeowners stayed in their homes was 13 years, a shorter length of time than most mortgage terms.

Recent data from the Pew Research Center found that at the end of the fourth quarter of 2020, the rate of American households that owned their own home increased to around 65.8%. With so much homeownership throughout the country, mortgages are an imperative topic. If you’re one of the many Americans that own a home with a mortgage, you should know your options when it comes time to sell.

Here’s a comprehensive guide to what happens if you sell your house and still owe money.

Topics Covered

- Should I Pay Off My Mortgage Before Selling My House?

- What Happens to My Mortgage When I Sell My House?

- Selling Your Current Home Before Buying Another

- Buying a New Home Before Selling Your Current One

- How to Get a Mortgage on a New Home

Should I Pay Off My Mortgage Before Selling My House?

If you plan to move and already have a mortgage on your current home, your first thought may be to pay off your mortgage early, so you’re free of your monthly payments. Though it isn’t necessary to pay off a mortgage before you sell your house, it may be a viable option depending on your situation. This option requires some planning, but you can make it happen.

There are several benefits to paying off a mortgage early:

- Saves interest fees: Over the life of a 15- or 30-year loan, interest can stack up and sometimes double what homeowners pay, despite their original loan amount. When homeowners decide to pay their loan off early, they get to eliminate some of the interest they would pay in the future and save themselves years of payments.

- Frees up monthly funds: This process also opens up more funds in your monthly budget, giving you greater flexibility with that cash later in life. When your mortgage payments are gone, you could contribute that money into your emergency fund, retirement account or other investments, or save up for that vacation you always planned.

Many variables can factor into your decision, so it’s essential to crunch the numbers and examine your financial situation individually.

Here are two of the most common strategies to pay off your mortgage early:

1. Higher or More Frequent Payments

One of the simplest ways to decrease the life of your mortgage is to make payments more often. Although bi-monthly payments will cost the same amount as your previous mortgage payments, they’ll use the weeks of the year to give you an additional annual payment. When multiplied over several years, one extra yearly deposit can lead to a considerable amount of savings.

Consider increasing your monthly payments, consistently paying more on your mortgage than the minimum requirement. Manually adding extra is a flexible option that allows you to contribute any amount you choose. Add $100 more, $50 more or any variable amount you decide to contribute over your loan’s life.

2. Refinancing

Some homeowners choose to fix their loan for 30 or 40 years but may later decide to pay it off sooner. By refinancing your mortgage, you can refigure your loan for a shorter timeframe, increasing your monthly payments and decreasing your interest.

However, refinancing may not be the best idea when you’re looking to move. Some homeowners may want to refinance to put the money they would have spent on interest payments toward their savings for a down payment. If your savings don’t add up before your planned move, a refinance could cost you more money than it’s worth. Use Assurance Financial’s refinance calculator to determine whether a refinance is right for you.

Ultimately, choosing to pay off a mortgage before you move may not be your best option. Depending on your timeframe and your other investment opportunities, you may decide to keep that cash and set it aside for a new down payment. Whatever you choose, weigh your choices and consider which is in your best interest.

What Happens to My Mortgage When I Sell My House?

According to Freddie Mac, almost 90% of American homeowners finance their homes with a 30-year mortgage. Still, many homeowners will move to another house before that timeframe ends. This situation is common, so you can follow standard practices for selling a home with a mortgage attached.

If you’re selling your house before the mortgage term is up, you can take one of two avenues:

1. Traditional Home Sale

In a traditional home sale, the seller lists the house for a price that will cover the following costs:

- The mortgage’s remaining costs

- Existing home equity loans or home equity lines of credit (HELOCs), if applicable

- Mortgage prepayment penalties, if applicable

- Closing costs, including agent commissions, taxes and other fees

After taking care of the above expenses, whatever amount is left over is the seller’s profit. To pay for the rest of the mortgage, the closing manager sets up an escrow account into which the buyer will deposit their payment. Then, the title company will distribute the final mortgage payment to the lender. As a result, the seller no longer has that mortgage.

If you’re unable to sell your home for enough money to cover the associated costs, you’ll have to pay them out of pocket, wait until you can sell the house for more or request a short sale. In an ideal situation, the seller can cover the remaining balance of their loan, pay for closing costs and put a down payment on their next home from the sale price. This scenario requires good home equity — which is the homeowner’s financial stake in their house — to warrant a high enough price.

A home’s equity is comprised of the following elements:

- The original down payment

- The home’s gains in market value

- Mortgage principal payments

- The cost of renovations or improvements the seller made to the house

Getting a quote for your mortgage payoff when selling your house helps determine the price you need to sell your home. A mortgage payoff shows you the total amount you need to pay to settle your mortgage debt, including your interest and other unpaid fees. If you tell your lender about your plan to sell your home, they’ll provide you with a mortgage payoff quote.

2. Short Sale

When your house has too little equity to pay for your mortgage, it has negative equity. Without enough cash to cover your remaining mortgage balance, plus the closing costs, a short sale may be your only option. In a short sale, the buyer purchases the home for less than the seller’s debt against the property. These sales require approval from your lender because they leave the mortgage company at a financial loss.

The approval process for a short sale usually takes longer than for a traditional sale since the seller has to convince the lender they can’t pay off their loan. To convince the lender, the seller must either show that the housing market dropped, so their home is worth less than their debt, or prove they’re incapable of keeping up with their payments. Because the lender is trying to recoup as much of their losses as they can, the process may take a while.

Another negative aspect of short sales is they remove the seller’s negotiating power. This entire process depends on the lender’s approval, including the sale of the house. Even when the buyer and seller agree on a price, the lender may end up declining the buyer’s offer to hold out for a higher one. Ultimately, short sales negatively affect a seller’s credit score and make it more challenging to get a home in the future.

Selling Your Current Home Before Buying Another

If you’ve examined all of your options and want to go ahead with the sale of your home, you may want to know whether you should sell it before or after buying a new one. This answer could be as simple as establishing how much you have in savings to spend on a down payment. Most sellers find that selling their current home opens up their home’s equity so they can use that profit for their next home.

Pros of Selling First

By selling first, you can enjoy the following benefits:

- More negotiating power: When you buy a new house before selling your current one, you put more pressure on yourself to sell quickly and at a high price. Depending on what strategy you use to purchase a new home while still responsible for an old one, you may feel compelled to accept the first offer you receive. However, selling first allows you to negotiate with buyers and wait to sell until you get the offer you want.

- Less pressure: Buying a new home before someone purchases your old one puts you on a crunched timeline to get rid of your current home as fast as possible. Waiting for the right buyer while paying for two properties can be a lot to handle. If you sell first, you can take your time considering sales strategies and making any renovations or repairs.

- Total equity for future purchases: Perhaps one of the most compelling reasons to sell before buying another house is the potential to tap into your current home’s equity when you make your next purchase. If you pocket a considerable profit, you may be able to pay a larger down payment and take out a smaller mortgage on your next home. With a high enough profit, you may even be able to offer cash, which is very appealing to sellers.

For the above reasons, selling a current home before buying another is usually the most straightforward course to take. When stepping into the market to purchase a new home, the lack of pressure on your time and funds can help you make the best decision regarding a sale and give you more money to put toward your next home.

If you’re in a seller’s market, selling before buying can be even more profitable. In a seller’s market, sellers have the upper hand in negotiations because there are fewer homes than potential buyers. This situation gives sellers the ability to keep their asking price high or even raise it. Because there’s such high demand, homes usually sell quickly in a seller’s market.

Cons of Selling First

However, selling before buying could also cause some logistical concerns. If you sell your home quickly, you might have to find temporary housing before purchasing your new home. When there’s a lot of competition in the housing market, a seller could reject your offer, and the property could go to another buyer. Should that happen unexpectedly, you might need to move your belongings into a rental unit or pay for storage until you can move somewhere else.

Before deciding when to sell, calculate the costs involved and whether you may experience a time crunch when going to buy. There may be a situation where timing forces you to move in with a friend or sublet an apartment for a while. That said, the cost of moving twice and storing your furniture and belongings until you buy a new house generally won’t outweigh the benefits of selling before buying a new home.

[download_section]

Buying a New Home Before Selling Your Current One

Sometimes, buying first can be appealing when you can afford to buy without recovering the equity in your old home or you’re in a buyer’s market and have negotiated an excellent deal for a house. This option may require some extra steps and additional help with financing the purchase. If you’re unable to pay for a new home out of pocket, you have several options for financing:

1. Home Sale Contingency

A home sale contingency is a clause you can include in your offer to purchase a house. This clause tells the seller you need to find a buyer for your own home before closing on the purchase. A sale and settlement contingency gives you the legal right to exit a contract if you don’t receive an offer for your current home in time. A settlement contingency protects you if an offer on your old home falls through.

A significant drawback to a home sale contingency is that it could make your offer less competitive to sellers. If the seller sees you can’t make a firm offer, they could pass over you in favor of a committed buyer when negotiating a deal. If you’re only able to make less competitive offers, buying a home could take longer. However, if the seller accepts your offer, you’ll be able to keep the home you want under contract while you wait for a buyer.

2. Bridge Loan

Another option for financing a purchase is taking out a bridge loan. These are short-term loans designed to bridge the time between when a homebuyer needs financing and when it becomes available. With a bridge loan, you can access the resources you need to pay for your current mortgage and make a down payment toward your new house.

These loans can be a simple way to get financing quickly. Note that you’ll need to make monthly payments on the bridge loan while also paying for your existing mortgage. However, when you sell the old home, you can use your profit to pay off the bridge loan. If your home takes a while to sell, you could be paying two mortgages on top of the bridge loan payments as you wait.

3. Two Mortgages

If you can afford it, carrying two mortgages may be the least complicated option for financing a home. Maintaining two mortgages while you wait for your old house to sell can keep you from entering into another loan like a bridge loan.

However, carrying two mortgages at once probably doesn’t sound enjoyable. The cost of two mortgages can become steep, so you may not be interested. Still, it could give you greater freedom to make an offer without being tied to a home sale contingency.

How to Get a Mortgage on a New Home

Whether you’ve already sold your old home or are just beginning the house-hunting process, you’ll need a mortgage before closing on a new house. Here are the steps you need to take to be ready to make that purchase and move into your next home.

1. Save for a Down Payment

The down payment may look different depending on whether you’ve already sold your old home. With the profits from your old home in your pocket, you can use it for a down payment along with any other funds you saved. Because a larger down payment means a smaller loan size, choosing to save the money you would have spent on your morning later can go a long way.

If you’re buying a home without the benefit of your previous home’s equity, you may qualify for a conventional loan with a down payment of only 3-10%. There are also mortgage programs that require as little as 0% down, like United States Department of Agriculture (USDA) loans and Veterans Affairs (VA) mortgages. With certain qualifications, you can reduce the amount you need for a down payment and avoid paying for private mortgage insurance.

2. Explore Mortgage Options

Before applying for a loan, consider which loan types are most beneficial for you in your financial situation. Some homebuyers choose to go with a conventional mortgage with 15-, 20- or 30-year loan terms. Special considerations — such as your credit score, veteran status or location — can qualify you for other loan types. With some careful research and the help of our dependable loan advisors, you can find the best mortgage type for your needs.

Also, think about what features you want in a house and what you’re willing to sacrifice. It may be best to buy a smaller or less updated home to keep your mortgage debt lower or concentrate your monthly debt payment on loans with higher interest rates, such as school or credit card payments. On the other hand, you may be comfortable buying at the higher end of your price range if you have few or no other debts.

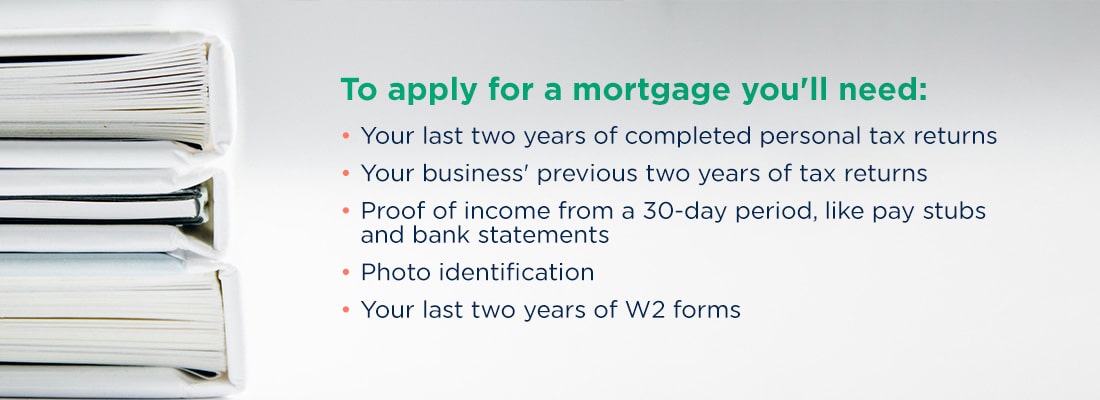

3. Complete an Application

Once you’re ready, you’ll want to apply for the mortgage of your choice. To apply, you’ll need some paperwork, including:

- Your last two years of completed personal tax returns

- Your business’ previous two years of tax returns, if applicable

- Proof of income from a 30-day period, like pay stubs and bank statements

- Photo identification like a driver’s license

- Your last two years of W2 forms

Once you have your forms in order, you can apply online, and your lender will look over your financial information to give you an estimated interest rate. With the online application at Assurance Financial, you can submit all of this documentation in as little as 15 minutes and get pre-qualified for a loan within 24 hours.

4. Wait for Processing and Underwriting

Once you’ve found the home you want and the seller has accepted your offer, your lender sends your financial information over to a loan processor, who double-checks all of the details and will contact you if they need any clarification.

After processing, your lender will likely order a home appraisal to determine the value of the property you intend to buy. Once an appraiser looks over your home, a loan underwriter will review your credit score and application once more to make the final approval. This stage finalizes the amount of your loan and your interest rate.

5. Head to Closing

When your loan is cleared, you can begin the final steps in your journey to homeownership. The title company will set up a closing day with you, and you can sign many of your closing documents online beforehand.

On closing day, you’ll bring your down payment in the form of a cashier’s check, plus any other fees and closing costs you may be required to pay. Alternatively, you can choose to set up a wire transfer for the funds. After you sign the last bit of paperwork, you’ll get the keys to your new home.

Get Started With Assurance Financial

If you’re looking to get a mortgage for your new home or refinance an old mortgage, Assurance Financial is ready to help. We provide complete support at every step of your loan application, and our licensed loan officers are experts at getting the home loan that best suits your needs. With a variety of loan types and competitive rates, we provide mortgage solutions for homebuyers at any stage of life.

At Assurance Financial, we understand you want a smooth mortgage process that leads you to your dream home. To get started and discuss your mortgage options, find a loan officer today and see why Assurance Financial stands out from other online mortgage lenders.

Linked Sources:

- https://assurancemortgage.com/paying-off-mortgage-early/

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://myhome.freddiemac.com/blog/homeownership/20190815-mortgage-options

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-payoff-amount-is-my-payoff-amount-the-same-as-my-current-balance-en-205/

- https://assurancemortgage.com/everything-you-need-to-know-about-usda-rural-loans/

- https://assurancemortgage.com/5-things-know-va-loans/

- https://assurancemortgage.com/what-is-a-conventional-mortgage/

- https://assurancemortgage.com/apply/

- https://data.census.gov/cedsci/table?q=duration%20of%20homeownership%202018&tid=ACSDP1Y2018.DP04

- https://www.pewresearch.org/fact-tank/2021/03/08/amid-a-pandemic-and-a-recession-americans-go-on-a-near-record-homebuying-spree/

eClose Results: How Assurance Succeeds with Digital Closings

Featuring Assurance Financial Director of Operations, Scott Alexander

As Briana Ings, VP of Product at Snapdocs, kicked off the TMConnect webinar, Scott discussed how Assurance Financial’s partnership with Snapdocs on eClose technology has enabled them to optimize their operations. A huge stack of documents has turned into a couple of pages for their funders. They are not losing deals by physically shipping paperwork, and they are able to consolidate conversations from multiple vendors into one place.