Month: March 2021

Homeowners may choose to refinance for many reasons. Refinancing could potentially lower your monthly payments, allow you to consolidate debt, speed up the payoff process for your mortgage, eliminate your private mortgage insurance (PMI) and put more cash in your pocket. If you have equity in your home, you may be able to leverage it through a refinance.

Topics Covered

- Tax Deductions and Refinancing

- Cash-Out Refinancing and Taxes

- Home Improvements or Repairs That May Not Qualify for a Deduction

- Paying off Debts and Refinancing

- Mortgage Interest and Itemizing Deductions

- Home Equity

- Does Refinancing Affect Property Taxes?

- How to Get Started on Refinancing

Your home is likely your largest asset and most long-term investment, and refinancing your mortgage may allow you to get the most out of your investment. When you refinance, you can use the cash for:

- Family expenses: Your family expenses may have changed recently if you started a family or your child is heading to college. This may leave you needing more cash each month, and if you choose to refinance, this can help you adapt to these life changes.

- Home improvements: With a cash-out refinance, you can finally tackle those home improvements. No matter whether you want to put a new roof on your home or build an addition, when you refinance, you can free up more cash that can be put toward these renovations.

- Cost of living: Your cost of living may have changed since you purchased your home, particularly if you have taken a new job or your family has grown. Refinancing can make your mortgage more affordable and help you meet your financial obligations.

- Cash in your pocket: You may want more cash in your pocket to put toward investing or saving.

Before you take the next steps toward refinancing, you may be wondering about the tax implications of refinancing a mortgage. At Assurance Financial, we have developed this guide to refinance tax implications to help you determine whether a mortgage refinance may be the right option for you.

Tax Deductions and Refinancing

Are refinancing costs tax deductible? The IRS allows homeowners to deduct some of the interest paid on their mortgage debt on a primary home, secondary home or both. If you have a $650,000 mortgage on your primary home, for example, and $350,000 on a vacation home, you may be able to deduct all of your mortgage interest.

When it comes to refinance tax deductions, the same rule applies. If you choose to refinance one or even both of your mortgages, you may be able to deduct all of your mortgage interest as long as your combined mortgage principal does not exceed the limit of $1 million for married couples and $500,000 if filing separately or as a single filer.

However, there are certain requirements for what your refinance cash can be used for to be eligible for a deduction. We cover these requirements in greater detail below.

Cash-Out Refinancing and Taxes

There is a particular requirement to qualify for a tax deduction with a cash-out refinance. For your cash-out refinance to be tax deductible, you must be using the money to purchase, build or improve your house. If you use the cash for another purpose, you may not be able to take a deduction on your taxes. The following are a few examples of how you can use the refinance money to ensure it is tax deductible:

Add a Home Office

A home office can be a great, tax-deductible investment, particularly if you are self-employed or a small business owner. If you choose to add a home office to your house, you may be able to claim this as a deduction on your taxes.

With this deduction, you can claim a percentage of what you have paid on the mortgage as a business expense. When you are calculating your tax liability, you may select the regulation deduction or the simplified deduction. The deduction you will take depends on the size of your home office.

For a home office to be eligible for a home office deduction, it must meet certain requirements, including:

- Primary place of business: To claim a deduction, you should use your home office as the principal place for conducting business. Though you can conduct business from other places, your home office may need to be the place where you work the most.

- Frequent and exclusive use: If you want to claim a home office deduction, you may have to use it for business purposes only. This means you and your clients use the office space only for your business. If you use your home office as a guest room as well, you may not be able to claim a deduction.

Make a Capital Home Improvement

The part of your mortgage that you refinance and pay interest on can be deducted if you use the money for a capital improvement on your property. This means the improvement should increase the home’s value, add longevity to the property or adapt the property to a different market. Common capital improvements include:

- Fixing the roof so it is more durable

- Building an addition or new bedroom

- Installing a fence for aesthetic or privacy purposes

- Adding a spa, jacuzzi or swimming pool to your yard

A capital home improvement does not necessarily have to be a big-ticket item. You can make smaller improvements as well, such as:

- Installing a home security system

- Adding a central heating or air-conditioning system

- Replacing your windows with storm windows, especially if you live in an area prone to heavy storms

When you increase your property’s value, you may also receive more money when it is time to sell your home. These improvements may also reduce your liability for capital gains tax. Keep your receipts and careful records. This will help you remember how much money you spent and when you performed the renovations.

Improve a Rental Property

If you own a rental property, you may want to use your cash-out refinance money to repair or enhance the property. You may be able to deduct the expenses of a repair or improvement from your taxes.

You may be able to claim a deduction for a rental property because the IRS considers money you earn from a rental property as personal income. Further, you may be able to deduct interest, insurance and closing costs paid on a rental property from your income taxes as business expenses.

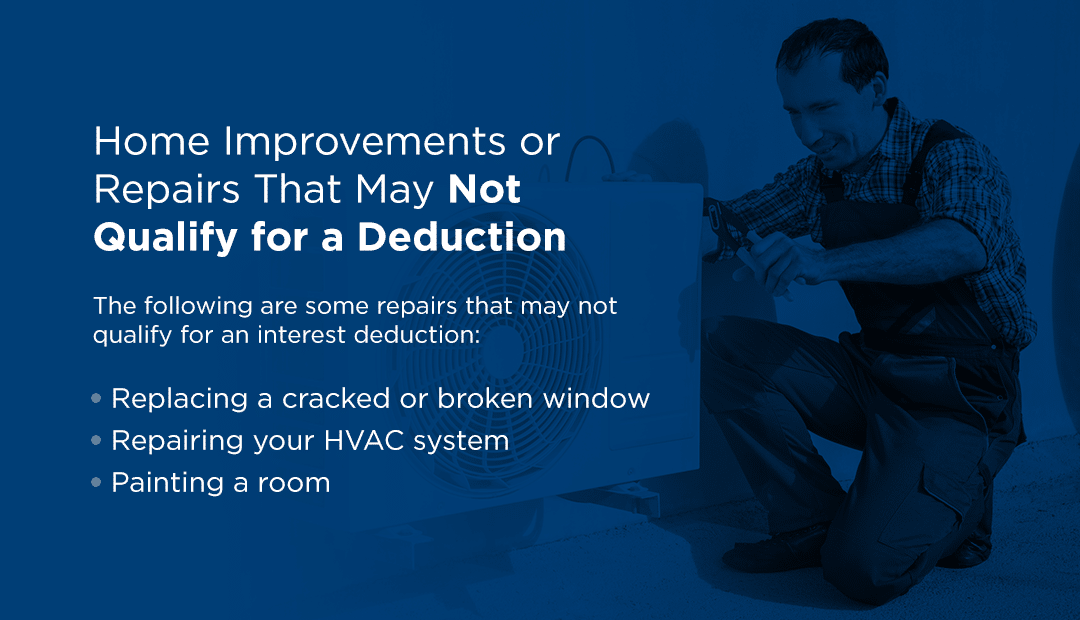

Home Improvements or Repairs That May Not Qualify for a Deduction

For tax purposes, if you use your cash-out refinance funds for something other than home improvement or repairs, this is considered a home equity loan. Some home repairs may not qualify you for an interest deduction, especially if they do not improve your property’s baseline value. The following are some repairs that may not qualify for an interest deduction:

- Replacing a cracked or broken window

- Repairing your HVAC system

- Painting a room

While a home equity loan may still be tax deductible, the limit for how much of your interest you can deduct is much lower than for a refinance. For example, if you are a single homeowner who owes $100,000 on your mortgage and you take a cash-out refinance for $160,000, you can use this extra $60,000 to make renovations or repairs. Since you are using the cash to purchase, build or improve your home and you are under the limit of $500,000, you may be able to deduct all of your mortgage interest.

If you instead use that $60,000 to put your child through college, you may only be able to deduct a portion of this new debt according to the limits set for home equity loans.

Paying off Debts and Refinancing

Can you use a refinance to pay off other debts? While the interest you pay on your mortgage may be tax deductible, you may not be able to deduct the interest you pay on other debts. If you want to convert the interest you pay on a credit card, for example, you may be able to roll this debt into your mortgage through a cash-out refinance. The rate for a mortgage is often lower than rates for other types of debt.

If you use a cash-out refinance to pay other debts, then for tax purposes, the funds you borrow are considered a home equity loan. This means the funds are subjected to the limits of a home equity loan in terms of how much you can deduct.

Mortgage Interest and Itemizing Deductions

Keep in mind that if you refinance your mortgage, this may decrease your total tax deductions significantly. When you are able to refinance to a lower rate, you may pay less interest, meaning you will have less mortgage interest that can be deducted at tax time.

Your interest costs can reduce substantially if you switch to a 15-year mortgage with a 3% interest rate from a 30-year mortgage with a 5% interest rate. Along with a lower rate, a shorter term can mean your interest costs fall faster over the coming years, also decreasing the amount you can deduct.

For many homeowners, their mortgage interest deduction is the factor that leads them to itemize deductions. Unless your deductions can exceed what you would receive from the standard deduction, there may be no point in itemizing. Revised benchmarks for deductions may decrease the chance that you will gain tax savings from a refinance when you itemize deductions. A tax preparer can help you determine whether itemizing or taking the standard deduction is a better financial option for you.

Overall, you may be saving money by reducing your interest costs, regardless of whether you can deduct your costs at tax time. However, you may want to anticipate that if you refinance, your deduction may be a smaller amount than you expected.

Home Equity

When you make payments on your mortgage, you will slowly build equity in your home. Equity is essentially the part of your house that is truly your own, as it is the portion of your home that you have paid off. When you have equity, you can use it to your advantage.

Previously, homeowners were able to deduct interest paid on a home equity loan for a reason other than home renovation, such as college tuition costs. However, this deduction has recently been eliminated. Now you must use the money for improving your home to qualify for a deduction.

Before it’s time to file your taxes, you may receive a Mortgage Interest Statement or an IRS Form 1098 from your lender. This shows the interest you paid on your home equity loan or mortgage the previous year. If you want to deduct the interest you paid, you may need this form. If you don’t receive this form, contact your lender. You may also want to contact your lender if you need help understanding the form.

APPLY TODAYDoes Refinancing Affect Property Taxes?

Homeowners in the U.S. are subject to property taxes. How much you’ll pay in property taxes is determined by your taxing jurisdiction at the city or county level. These taxes are typically used to fund public safety, roadwork and school systems.

Your tax rate and your assessment are used to calculate the amount you pay in property taxes every year. For example, if your property is assessed at $200,000 and your tax rate is 4%, you will pay $8,000 each year in property taxes. Your property taxes may increase if your assessment or rate increases. Refinancing your home doesn’t impact these numbers.

When you finalize your cash-out refinance near or on the date your property taxes are due, you could end up paying these taxes when you close on the loan. If this is the case, on your next tax return, you may be able to deduct what you paid on property taxes during the refinance.

Keep in mind that only the property tax payments you made during the year may be tax deductible. If you put cash into escrow to be used on future property tax payments, you may not be able to deduct this money.

How to Get Started on Refinancing

The tax implications of a refinance can be complicated. Before you choose to refinance, you may want to discuss your plan with a tax professional and a mortgage loan expert. Follow the steps below to get started on refinancing.

- Ensure a refinance will benefit you: Figure out what your goal is and whether refinancing can help you achieve it. Will this decision save you money? Are the current rates low enough? If you choose a cash-out refinance, ensure that having this money now outweighs the additional years of debt. Only you can determine what the right decision is for you, but our mortgage advisors can help you weigh your options.

- Speak with a lender: For decades, Assurance Financial has been servicing mortgages to customers. We aim to make the process of refinancing fast and simple. You may be able to get pre-qualified for a refinance in just 15 minutes with a free, no-obligation quote. As an independent lender, we offer every loan type available, and we will handle the entire process in-house.

- Complete your refinancing application: When you are ready to refinance, you can apply with us online or with one of our loan advisors. We can help you through the steps and answer any questions you may have.

- Sign the disclosures: After you complete your application, we will send you your disclosures. You’ll sign these, and if you choose, you can verify your loan terms and make sure you are accomplishing your goal of cashing out or lowering your rate.

- Provide the needed documentation: Once you sign, you will submit your documentation to us at Assurance Financial, including your income verification and asset verification.

- Submit your loan conditions: Then an in-house underwriter at Assurance Financial will receive your paperwork. The underwriter handling your paperwork will let us know if there are any other items that may be needed.

- Sign the final paperwork: After you have been approved for your refinance, you will meet with a notary to sign your final paperwork.

- Make your payments: At this point, you have completed the refinancing process. After 30 to 60 days, you can begin making your payments on the new mortgage. If you obtained a cash-out refinance, you can use your cash for your home renovations.

While the refinancing process can initially feel overwhelming, it doesn’t have to be. When you choose to work with us at Assurance Financial, we aim to ensure your journey to refinancing your mortgage is easy and stress-free as possible.

Refinance With Assurance Financial

At Assurance Financial, we know our customers are busy. Our licensed loan officers can help you determine whether a refinance makes sense for you and assist you in navigating the process. When you choose to work with us, we’ll bring our experience and knowledge to the process and help you find an optimal deal.

[download_section]

When you work with us, we’ll provide personalized attention. Whether you are looking to refinance or obtain a new loan, we can offer the loan type that’s right for you, such as:

- Conventional loan: A conventional loan may be the right choice for you if you have a stable income, good credit and a down payment.

- FHA loan: If you don’t have a sizable down payment to secure a mortgage loan, there’s good news — you may be eligible for an FHA loan. This loan type can be an attractive alternative to conventional financing due to its lower down payment and flexible credit requirements.

- Jumbo loan: Sometimes your dream home exceeds the limits of conforming loans. Maybe you live in an expensive housing market or maybe you just want a large, beautiful home. Whatever the case, a jumbo loan can help you finance the home of your dreams.

- Construction loan: If you are looking to build a new home or renovate your property, you may want to apply for a construction loan. Our construction loan programs offer flexible draw schedules and competitive rates and fees.

- USDA RD loan: If you live in a designated suburban or rural area, you may be eligible for a USDA RD loan. Moderate-income and low-income borrowers may benefit most from this type of loan, as it doesn’t require a down payment and may offer affordable rates.

- VA loan: If you are a veteran or active service member, you may be eligible for a VA loan. This loan type requires little or no down payment and limits closing costs. There is also no monthly mortgage insurance or pre-payment penalties.

Take just a few minutes to start your application with Abby or find a loan officer today to learn more about how to refinance a mortgage.

Sources

- https://assurancemortgage.com/refinance-your-home/

- https://www.irs.gov/publications/p936

- https://assurancemortgage.com/four-signs-you-should-refinance-your-mortgage/#section12

- https://assurancemortgage.com/conventional-loans/

- https://assurancemortgage.com/construction-loans/

- https://assurancemortgage.com/jumbo-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

If you’ve had your existing home loan and mortgage for a little while, it’s only natural to wonder if you could get a better deal. A mortgage is a tremendous responsibility — so you need a reliable understanding of whether refinancing is a good or bad idea. The guide below will lay out some of the pros and cons to help you make sure you’re refinancing your home for the right reasons.

Should You Refinance Your Home?

Whether or not to refinance your home is a big decision. Your choice will likely hinge on several factors, including your goals, your current financial situation and the terms of the new loan you can get.

Is it good or bad to refinance your home? The answer is that it depends. You may hear excited chatter about home refinancing from friends or coworkers currently working their way through the process. If you know mortgage rates are low and your acquaintances are boasting about the low rates they got, you might feel tempted to look into refinancing for yourself. And certainly, refinancing your home can be the right decision as long as you educate yourself thoroughly about the process and know what benefits you can and cannot achieve.

Refinancing your home is often an attractive idea in specific scenarios. Say you need ready cash to tackle a financial emergency or want to pay off your mortgage more rapidly. In that case, refinancing can often give you the flexibility and security you need to weather a challenging time or meet your financial goals sooner.

Even though the idea of refinancing your home can be enticing and the results can bring you real benefits, you should also be aware of certain realities of the process. When you’re thinking about whether or not to refinance, here are a few considerations to keep in mind:

- Time requirements: With some lenders, refinancing your mortgage is often time-consuming and laborious — you’ll likely need to gather up documents like bank statements and pay stubs to demonstrate your financial stability and convince the lender that you’re a low-risk investment. Fortunately, with Assurance Financial, you can apply in as little as 15 minutes.

- Expenses: The expenses of refinancing a home also sometimes undo some of the expected financial advantages. Fees and closing costs could quickly add up, and the new loan may have a higher rate that increases the homeowner’s financial burden over time. A “no-cost” mortgage may come with a particularly high interest rate that negates the anticipated monetary benefits.

- Hit to your credit: In thinking about whether to refinance a mortgage or not, many people also wonder if the refinancing process will hurt their credit. The answer is that your credit may temporarily take a minor hit. Refinancing your home means the lender will pull your credit score. The pull will be a hard inquiry and may result in a temporary dip in your score. Closing out your old loan will also reduce your credit score slightly.

When you’re wondering whether to refinance or not, it helps to have clear, detailed information on the potential drawbacks and missteps so that you can make an informed decision.

Reasons Not to Refinance Your Home

Is refinancing bad for your financial goals? In some situations, refinancing’s disadvantages outweigh the potential gains. The next few sections will discuss several reasons why you may not want to refinance.

1. To Consolidate Debt

Refinancing your home in an attempt to consolidate debt can be a good financial move in some circumstances, but it isn’t always the most prudent strategy. Many homeowners who refinance to consolidate debt assume that doing so will lighten their financial burden. They may believe that by creating one payment plan with a reasonable rate, they’ll be able to make their budget more manageable.

Under the right circumstances, consolidating debt can be a smart financial move. Paying off high-interest credit card loans with a low-interest mortgage, for instance, is sometimes strategically sound because it reduces your overall payments. This strategy, however, comes with a few things you’ll need to keep in mind.

The first involves the difference between an unsecured loan and a secured loan. A secured loan requires collateral backing, whereas an unsecured loan does not. Credit card debt, for instance, is unsecured. If you fail to pay your credit card bills, the credit card company cannot come to your house and repossess any of your belongings. You may take a hit to your credit score, but that’s a far more manageable outcome than losing your car or home. In this sense, an unsecured loan is a relatively low risk, though the tradeoff is that it will probably come with much higher interest rates.

A mortgage, though, falls into the category of secured debt, with your home as collateral. If you consolidate extensive debts into your mortgage and then fail to make the required payments, you could well find yourself facing a home foreclosure.

An additional consideration is that many homeowners who refinance for debt-management reasons also end up creating a slippery financial slope for themselves. If they cannot manage their spending, they may quickly accumulate new credit card balances and have trouble paying them down along with the new mortgage payments. Remember that it’s always free to review your options with Assurance Financial — we can help you weigh the pros and cons of restructuring your debt.

2. To Save Money for a New Home

Some homeowners become interested in refinancing their mortgages because they want to save money for a down payment on a new home. However, a move like this can have significant drawbacks. Be prepared to crunch the numbers to figure out whether this strategy will help you save money or not. You’ll need to figure out how soon a mortgage refinance will help you start saving money and whether that timeline aligns with your time frame for moving.

Say that refinancing your home would give you lower mortgage payments each month. Say also that the upfront expenses of refinancing are significant enough that it would be four years before your monthly savings made the cost of the new loan worthwhile.

If you’re not planning to move for several years, this strategy will probably work out well. If you’d rather move within the next two or three years, though, refinancing your home in this way wouldn’t help you save enough money in time.

The bottom line is that even though refinancing a mortgage may seem like an attractive money-saving option, you’ll need to do the math. That way, you’ll know how soon you’ll see benefits and whether that timeline will align well with your financial priorities. You can use Assurance Financial’s refinancing calculator to investigate more specific numbers and calculate concrete refinancing costs and savings.

3. To Reduce Your Payments

One common reason for a homeowner to consider refinancing a mortgage is to gain lower interest rates and reduce monthly payments. Doing this gives you the immediate financial freedom to save, invest or have more cash on hand for expenditures each month. If your goal is to save money every month, this is a good strategy for you.

However, in terms of your overall financial planning, your monthly payments are less important than your loan’s total cost. Imagine that you refinance a 20-year mortgage into a 30-year mortgage — the mortgage terms that 90% of Americans tend to choose — to gain a slightly lower monthly payment.

While you’ll pay less per month, you’ll now be paying your mortgage for an extra 10 years. Say your mortgage payment is $1,500 per month. That adds an extra $180,000 to your mortgage’s total cost — $1,500 x 12 x 10. Even if you save $250 a month, in 25 years, that only adds up to $75,000 in savings. This scenario is another excellent example of a place you can use our mortgage calculators to take a closer look at the numbers for your home.

4. To Focus on Investments

Homeowners sometimes consider a mortgage refinance in hopes of saving money they can then put into their financial investments. In theory, this approach is sounder than refinancing merely to reduce monthly payments. After all, even if your monthly savings are modest, you can invest the extra money to significantly increase your funds.

This strategy has its drawbacks as well, though. If you’re not careful, you might end up putting your money into investments that yield a lower interest rate than the rate on your mortgage. Be sure to select investments with higher yields than your mortgage rate so you can ensure a profitable tradeoff.

Practically speaking, refinancing your mortgage to put the monthly savings into investments often creates an additional challenge. It’s all too tempting to spend the money instead of investing it. Despite your best intentions, you may end up siphoning off a little cash at some point to put toward a big purchase or pad your holiday budget a little. Each time you do it, you may tell yourself it’s all right because it’s not that much money — $20 here, $40 there.

Over time, those small splurges add up to a significant sum that you haven’t invested. Once that happens, if you’re not investing more than you’re paying in interest on your mortgage, you lose the benefit of having refinanced your home.

In some cases, though, refinancing to focus on strong investments may work out well. Talk to one of the knowledgeable professionals at Assurance Financial to figure out what strategy is right for you.

5. If You’re Planning on Moving

We’ve discussed how important it is to do the right calculations before refinancing your current home so you can save up to buy a new house. Be sure the timeline on which you’ll start recouping your refinancing expenses in monthly savings is compatible with your time frame for purchasing the new home.

If you’re planning on moving soon, refinancing your current home generally isn’t wise. In most scenarios, you won’t have time to reap the benefits of the refinanced loan before you have to start over with a loan for your new home purchase. Banks and lenders tend to front-load the interest costs into the early payments, so you’ll pay larger chunks at the beginning of your loan than at the end. If you know your tenure in your home is going to be short, paying so much upfront doesn’t make much sense.

You might also be considering switching from a fixed-rate to an adjustable-rate mortgage (ARM) if you are planning a move in the near future. An adjustable-rate mortgage sometimes seems appealing because its rate changes to reflect the current market rates. If market rates go down, you’ll be able to take advantage of those new, lower rates yourself instead of being locked in at your initial, higher rate.

However, adjustable-rate mortgages work the other way, too. If market rates go up, your interest rate will go up also when your ARM resets. If you’re planning to move, you might feel tempted to go with the ARM because you think you’ll move before the higher rates can kick in. This strategy can be a risky gamble, though. If your moving timeline gets delayed and your mortgage does reset to the new, higher market rates, you can find yourself paying much more in interest fees than you bargained for.

In some scenarios, refinancing even though you plan to move soon is a sound strategy because of the rate benefits you may gain. Talk to one of our experienced advisors to get more insight into what’s best for your situation.

6. If You Don’t Have Enough Equity in Your Home

Some homeowners consider refinancing their mortgages when they don’t have much equity built up in their homes. This plan is often a risky one as well.

Leveraging your home’s equity can sometimes be a wise strategy. If you have sufficient equity built up in your home — say you’ve been making a steady stream of mortgage payments and paid off a substantial part of your home’s value — it becomes easy for you to borrow against that value through a home equity loan. You might take out a home equity loan for a renovation project, for instance, so you can upgrade your home and increase its resale value.

However, not having enough equity in your home can make refinancing risky, especially if you do plan to take out home equity loans. Most lenders want you to have a reasonably low loan-to-value (LTV) ratio before they’ll consider refinancing your mortgage. LTV refers to the amount of your remaining loan in proportion to the value of your home. If you haven’t paid off much of your loan — and, therefore, haven’t built up much equity — many lenders will pass on giving you a new loan for refinancing.

The specific number will vary among different banks and lenders. On average, many lenders will look to see whether you have at least 20% home equity before they’ll consider you a strong candidate for refinancing. If you haven’t yet hit that 20% threshold, you may need to spend a few years making interest payments before you qualify for favorable refinancing terms.

Remember, too, that if you refinance and take out a home equity loan simultaneously, you’ll end up paying interest on both. This increases your monthly expenditures and cuts significantly into the savings you might have received from refinancing your mortgage.

Keeping as much equity in your home as you can is often the best approach to take for your financial security. But in many cases, homeowners cash in some of their home equity to cover the closing costs and other fees associated with refinancing. If you don’t have much home equity to begin with, doing so can put you right back where you started in terms of your progress toward paying off your loan.

As you weigh your options, try plugging some numbers into our refinancing calculator, or reach out to one of our friendly advisors for help.

When Is the Right Time to Refinance?

So far, we’ve primarily discussed reasons you might opt not to refinance your home. In light of these potential drawbacks, is refinancing ever a good idea?

Despite the cautions laid out above, refinancing your home can be beneficial in some scenarios. Here are some examples.

1. You Can Secure a Lower Interest Rate and Long-Term Financial Savings

Refinancing for a lower interest rate is a common strategy among homeowners. If you can refinance your home to get a lower interest rate without incurring costs that wipe out your interest savings, this is often a smart way to go.

Recent evidence suggests more homeowners should take advantage of this option — a 2016 paper in the Journal of Financial Economics reported that in a sample of Americans for whom refinancing would have been favorable, 20% failed to pursue the possibility. These homeowners forfeited savings of about $11,500 on average, the paper concluded.

Restructuring your mortgage so you can get a lower interest rate is a sound idea — just be sure you’ve done the right calculations to ensure you won’t be paying more elsewhere. If you’ll incur hefty fees or end up making payments over a significantly extended time frame, this strategy may not pay off. You should still refinance your mortgage if reducing your interest rate ends up giving you a better overall deal — just put in the extra work to check out the details to make sure it does.

[download_section]

2. You Can Shorten the Terms of Your Loan

In some cases, you’ll be able to restructure your loan so you’re paying about the same interest rates over a much more condensed amount of time. In this scenario, refinancing your home can be an excellent financial boon. If you can get similar rates, your monthly payments won’t increase too much, and making fewer payments will give you substantial savings in the long run.

3. Your Credit Score, Income or Home Value Has Increased

An increase in your credit score, income or home value is often a signal that refinancing your mortgage will result in a favorable financial outcome:

- Credit score: If your credit score increases significantly, lenders will likely view you as a more secure and attractive risk. With a better credit score, you can often qualify for better loan terms, including lower interest rates, that make refinancing your home a worthwhile option.

- Income: If you change jobs, get a raise or otherwise boost your household income, you’ll also become a more attractive prospect for lenders. Providing proof of a higher income can often get you more favorable interest rates if you choose to refinance.

- Home value: If the housing market in your area is hot, the value of your home may rise over the years. In that case, you can leverage that value to your benefit. You may also be able to get cash-out refinancing, which allows you to apply for a larger mortgage and then receive the difference between your old and new mortgages in cash.

Partner With Assurance Financial for Help With Refinancing Your Home

Once you’ve gone through the pros and cons and decided refinancing is the right choice, what’s the next step?

For reliable, knowledgeable assistance with refinancing your home, contact Assurance Financial. We can give you a free rate quote and then help you gain a custom, competitive rate that makes refinancing an ideal option for you.

At Assurance Financial, we make it easy to apply for a mortgage and estimate costs during the process. When you work with us on refinancing your home, you’ll gain quick, dependable service and be able to determine right away which options make sense for your needs and budget. We also have every type of loan available on the market — from conventional mortgages and Veteran’s Affairs (VA) loans to Federal Housing Administration (FHA) loans and loans tailored specifically to modular and jumbo homes.

Some mortgage companies promise quick, digital service. With Assurance Financial, you’ll get something better: personal service that takes your individual goals into account. We never outsource your loan details, either — we underwrite everything in-house. You’ll gain the peace of mind of knowing your information is secure and that we’re handling everything with a personal, knowledgeable touch.

Contact us today to start a conversation about refinancing your home, or start a loan application online.

Sources:

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://sf.freddiemac.com/articles/insights/why-americas-homebuyers-communities-rely-on-the-30-year-fixed-rate-mortgage

- https://assurancemortgage.com/calculators/

- https://www.investopedia.com/terms/l/loantovalue.asp

- https://www.forbes.com/advisor/refiroadmap/

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://www.sciencedirect.com/science/article/abs/pii/S0304405X16301507

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

For many homebuyers, saving for a down payment can be a significant obstacle to homeownership. Depending on the type of loan, you may have to put down 20% to get the best rate. For a home that costs $250,000, a 20% down payment is $50,000. This amount can take years for a homebuyer to save up, leaving you trapped in rentals until you can finally scrape together enough.

Fortunately, not every mortgage loan requires a sizeable down payment. The average percentage also varies by region, soaring in areas where housing is more expensive. If you intend to purchase a home, aim to maintain a stable financial life. That means you may not want to quit your job, buy a new car, go back to school or open a new line of credit, unless doing so may improve your credit score.

Look for ways to save instead of spend. If you can’t comfortably make budget cuts, that might signify your homebuying budget is not realistic. To help you save enough money, we have compiled a list of creative ways to save money for a downpayment on your new home.

Calculate How Much You Need to Save

Before you start to focus on your savings goal, you may first want to calculate how much you want to save. Discuss your situation with mortgage lenders who can let you know how much of a loan you may be eligible for. However, merely learning how much you qualify for is not enough to determine your goal. Instead, it’s best to figure out how much you can comfortably afford.

Consider keeping your total housing payment between 28 and 36% of your gross monthly income. Your front-end ratio to give you conservative results is 28%, and 36% is your back-end ratio to provide more aggressive results, which usually requires a higher down payment and credit score.

Spending too much on your housing can leave you struggling to pay your other bills and live comfortably, so you may want to keep your costs between these percentages of your budget. Your total housing expenses may include:

- Your mortgage principal and interest

- Homeowners insurance

- Real estate taxes

- Homeowners association dues, if any

- Private mortgage insurance, if applicable

Use one of our mortgage calculators to determine how much home you can afford. On top of the total housing expense you can afford each month, you may also want to include your 20% down payment on this home.

For example, using our calculator, if you have a combined annual income of $60,000 and an interest rate of 4.5%, the home you can afford is approximately $221,000. Your payment for the front-end ratio is $1,400, and your payment for the back-end ratio is $1,800.

To calculate your down payment, multiply your mortgage amount of $221,000 by 20% to get $44,200 for your down payment. Keep in mind that you’ll also want your payment to cover closing costs.

Decide on Your Timeline

Next, decide on your timeline for purchasing a home. Do you want to buy a house in two years? In five years? Your goals will impact how much you need to save each year.

With the example above, if you want to purchase a home in two years, you’ll want to save $22,100 each year. If you plan to buy a house in five years, you’ll want to save $8,840 each year. The sooner you want to become a homeowner, the more you’ll need to save each year.

Keep Tabs on Your Spending

When you first glance at your budget, it may seem impossible to save for a home. On top of carving out a large chunk of your paycheck for rent, you also likely have to pay for utilities, groceries, transportation, insurance and internet — not to mention the costs of treating yourself to luxuries like vacations and going out to eat.

Unless you’re lucky enough to live rent-free, saving as much money as you need for a down payment can feel impossible. However, you may have more room in your budget than you realize, especially if you don’t already have a spending plan.

One of the best ways to save money for a down payment is by keeping tabs on your spending. Many of us spend more than we realize on small expenses, such as going out to eat, picking up snacks at the gas station and grabbing our morning coffee before work. It all adds up – $5 here, $10 there, and next thing you know, you’ve gone over your budget.

When you take steps to become aware of your spending habits, you can identify opportunities to cut back. One rule of thumb you may want to follow is the 50-30-20 rule. With this budgeting method, you’ll allocate:

- 50% of your monthly income to your needs

- 30% of your monthly income to your wants

- 20% of your monthly income to debt payoff and savings

See where you can cut costs in your expenses for needs and wants, so you can dedicate more of your income to your savings. Many choose to cut back only on frivolous expenses. However, you might be able to reduce your monthly bills, such as by shopping around for car insurance or asking for a discount on your cellphone bill.

Stop Unnecessary Expenses

Many of us spend on more than the bare necessities. When you’re working toward a substantial financial goal like saving for a down payment, this can be the time to scale back on unnecessary expenses or stop them until you reach your goal.

Once you start tracking your spending, you’ll likely notice you’re paying quite a bit for items you don’t need. Do you tend to sip a late-night glass of wine while shopping online? Are you still paying every month for a gym membership you no longer use? These are the first expenses you can cut out.

When you commit to saving, you may be surprised how much fat you can trim from your budget. Follow the tips below to cut unnecessary expenses.

-

- Cook more at home: By cooking more meals at home, you can spend less on restaurant dining and food delivery. Depending on your family’s size and how often you usually eat out, this can save you hundreds each month. If you struggle to find the energy or time to cook daily, try meal prepping to make several meals at once you can reheat later.

- Cancel your cable: If you pay for cable, try going internet-only. If you use streaming services, look into family plans, as these can be cheaper when you split them.

- Exercise at home: Cancel your pricey gym membership and start working out at home. Run, walk or bike outside. All are free ways to get the exercise you need.

- Shop mindfully: When shopping, choose store brands and use loyalty apps or coupons. Eat before you go to the grocery store, as you may be more likely to make impulse purchases if you do your grocery shopping while hungry. Make a list before you leave for the store, so you’ll only buy what you need.

- Skip vacations: If you plan on purchasing a home in a year or two, you may want to skip getaways for that amount of time and save the money you would’ve otherwise spent on vacationing.

- Make your coffee at home: While buying a coffee each morning may seem like a small, inconsequential expense, it can quickly impact your wallet. Depending on how much coffee you buy, brewing your coffee at home can save you hundreds or thousands each year.

[download_section]

Save for an Emergency Fund First

Though it may sound counterintuitive, ensure you have an emergency fund before you begin saving for a house down payment. While you are saving for your home, you may face other large, unexpected expenses, such as:

- Major car repairs

- Temporary job loss

- Emergency medical care

- Replacement of a totaled vehicle

An emergency fund can cover these unexpected expenses when they arise, so they don’t ruin your financial plans. If you have to dip into your emergency fund, ensure you replenish it as soon as possible.

Find a Roommate

If you live in a two-bedroom apartment, you may be using this room as an office, workout room or storage. To save money, you may want to consider finding a roommate who can use this room instead.

Getting a roommate who can pay rent and share financial responsibility for utilities can significantly cut down your housing costs and help you speed up your savings rate for your down payment.

Automate Your Savings

Another great way to save for a down payment is by automating your savings. Look into high-yield online savings accounts that don’t have minimum balance requirements and set up an automatic deposit from your paycheck or direct deposit to this account.

Without any additional effort on your part, you can begin earning a percentage on the amount in your savings account. Along with opening this account, commit to using this money only for your down payment. Luckily, when the deposit is automatic, you don’t have to remember to move money every month or every paycheck, and you won’t feel tempted to spend this money.

Choose a high-yield savings account for your down payment instead of a risk-type investment vehicle, such as stocks. You want to ensure you don’t lose your money and it’s there when you need it. Riskier investments are best for long-term financial goals like retirement, rather than for funds you want access to in a few years or months.

Get a Side Hustle

A side hustle isn’t only for college students! Anybody can start a side hustle that supplements their income. If you have a creative talent or some extra time, there are numerous ways you can earn extra income.

- Sell unwanted items: Look around your apartment, and you’re likely to find something you no longer use or want that you can sell for quick cash. Do some spring cleaning, or choose a minimalist lifestyle and get rid of everything you no longer use or love. You can sell these items to a consignment store or host a garage sale.

- Babysit: If you’re good with kids, you may want to look for babysitting opportunities.

- Sell your creative projects: Open an Etsy shop if you have a creative streak. Items like jewelry, stickers, candles, personalized items and digital designs tend to sell well on Etsy.

- Monetize a video channel: Imagine getting paid to do what you’d be doing in your free time anyway. If you enjoy playing video games, start a streamer channel. If you love playing with makeup and experimenting with different looks, create a YouTube channel where you offer beauty tips and tutorials.

- Drive for a ride-sharing service: Drive for Uber or Lyft during your free time on the weekends or after work.

- Tutor: If you have expertise in specific subjects because of your educational background or work experience, consider a tutoring side hustle.

While it’ll take some effort on your part, the results can be well worth it. With a side hustle, you can throw all or most of your additional cash toward your savings goal for a down payment.

Go DIY

You may be surprised by the number of items you can make and projects you can complete yourself. Need a face mask? Try to make one with products you have at home. Pinterest can be an excellent tool for anyone looking to go DIY. Find cleaning hacks, free recipes and ways to get the most out of your household items.

Use Cash vs. Card

Be honest with yourself about how you spend. For some people, using a debit or credit card can lead to overspending, as it doesn’t always feel like you’re using “real” money. With a card, it can be more challenging to keep track of how much you’re spending – until you see your monthly bank statement. And by then, it’s too late.

To combat this, you may want to consider switching to cash. When you only have a finite amount of spending money in your wallet, you may second-guess whether you need that new pair of boots or if that $5 latte is worth it.

Paying for small, everyday purchases with cash can help you develop self-discipline and prevent you from spending money you could otherwise put toward saving for your down payment. With cash payments, you can be sure you’re only using the money you have on hand and not putting yourself in credit card debt.

Pay Down High-Interest Debts

If you have high-interest debts, these can impede your ability to successfully save for a down payment, especially if the higher interest rate is on a large balance. Along with needing to dedicate a significant amount of money each month toward paying down this debt, it may be damaging your credit score.

Your credit score can be a make-or-break factor when you’re looking to purchase a home, as it impacts your ability to get a fair rate or to qualify for a loan at all. Fortunately, once you pay down or pay off your credit cards, they won’t continue negatively impacting your credit score.

Start by paying the balance on your highest-interest card. If you can’t pay it off, see if you can transfer your balance to a lower-interest card. After this transfer, pay the balance as soon as possible.

Renegotiate Your Rent

If you pay your rent on time each month, you may want to ask your landlord about a rent reduction. In exchange, you can agree to a longer lease term. Your landlord may be willing to compromise, as it can be challenging to find good tenants.

If your landlord can’t or won’t budge, you may want to start looking for a more affordable rental where you can negotiate costs, such as utilities, amenity fees and parking. You may even be eligible for a rent-free month after signing a new lease. This move alone may pad your savings account as you identify other ways to save for your down payment.

Bank Windfalls

By banking all your windfalls, you may shorten the process of saving for your down payment. Windfalls include:

- Gifts

- Bonuses

- Income-tax refunds

- Sale of personal assets

- Large commission checks

By depositing these funds in your savings account, you may speed up the process of saving enough to buy your dream home, possibly cutting months or years off your savings timeline.

Borrow From a Relative

Especially if you are a first-time homebuyer, you may receive a financial gift from your parents or relatives to help you buy your first home. If you have or will be receiving a gift from your family to help with your down payment, include this amount on your mortgage loan application.

Remember, not all mortgage loans permit the use of gifts for a down payment. Ask a loan officer whether their terms permit gifts and what documentation the gift may require for your mortgage options.

Request Down Payment Assistance

Some organizations may be willing to help you with your down payment. Many nonprofits and states have programs to aid low-income or first-time homebuyers. Ask mortgage lenders for information on programs in your area and specific to your situation.

Determine whether you qualify for down payment assistance with the U.S. Department of Agriculture Rural Housing Service, the Veterans Administration or the Federal Housing Administration. You may also want to check with local housing authorities to determine whether they have a program that can help.

Apply for Mortgage From Assurance Financial

Since Assurance Financial’s founding in 2001, we have aimed to service the loan industry differently. We can service your loan from start to finish, saving you time and effort. As a full-service, independent residential mortgage banker, we can handle the entire loan process for you with care.

We are “The People People” and have earned approval from Fannie Mae/Freddie Mac and Ginnie Mae. Our latest application technology makes starting your loan fast and simple, and our end-to-end support ensures the process is smooth. Once we review your initial application, we’ll offer you a free, no-obligation quote. After you receive your quote, you can complete the long-form application and submit your documentation.

Once we receive your application, we’ll handle all the processing in-house. After you finish appraisal and underwriting, we will determine whether to approve your loan. At this stage, we will close and fund your mortgage.

When you’re ready to finance your dream home, contact us at Assurance Financial if you prefer to apply with the assistance of one of our loan advisors. If you need assistance or have questions at any stage, our advisors are here to help.

Sources

Each time you make a payment on your mortgage, you gain equity in your home. The difference between your property’s value and the amount you still owe on your mortgage is your home equity. You may be able to use this equity to borrow money, but is it better to get a second mortgage or refinance? How do you determine which is the best option for you? We compiled this guide to a second mortgage vs. refinance to define each option and help you compare their advantages and disadvantages.

Topics Covered

- What Is a Second Mortgage?

- When to Get a Second Mortgage

- What Is Refinancing?

- When You Should Refinance

- What Is the Difference Between a Second Mortgage and Refinance?

What Is a Second Mortgage?

When you obtain a second mortgage, you’re borrowing against the equity in your home. This cash is given to you in a lump sum or in installments via a credit line, depending on your preference.

Types of Second Mortgages

There are two kinds of second mortgages. These are known as a home equity line of credit (HELOC) and a home equity loan:

- Home equity line of credit: Another kind of second mortgage is a HELOC, which gives you continual access to your equity at a variable rate. When you take out a home equity line of credit, you’ll begin with a draw period. During this period, you typically can spend up to your credit limit and pay only your accumulated interest. After the draw period, you’ll pay back your remaining balance via monthly installments.

- Home equity loan: With this type of loan, you borrow against your home equity and receive a lump sum payment. You’ll pay back this loan in monthly installments at a fixed interest rate.

How Does a Second Mortgage Work?

Along with your monthly payment for your primary mortgage, you’ll make repayments on your second mortgage. If you obtain the primary mortgage and the second mortgage from different companies, you’ll pay each lender separately. As you make payments on both loans, you will regain equity in your home.

Keep in mind that you won’t be able to access all of your home equity when you choose a second mortgage. For instance, if you have $90,000 worth of equity, you may only be given access to $80,000. The amount of equity you may need to leave in your property can vary based on several factors, including your current debt, your credit score and your lender.

What Are the Requirements of a Second Mortgage?

One condition that comes with a second mortgage is that your mortgage lender will put a lien on your house when you’re given a loan or cash. Liens are legal claims to properties that allow a lender to seize the property under certain conditions. When you secure a second mortgage, you’ll have two liens — one with the lender of your primary mortgage and one with the lender of your second mortgage.

In this scenario, if you default on your home and the property goes into foreclosure, your primary lender will get their money first and the rest will go to your secondary lender. As a result, your secondary lender bears more risk and will likely offer you a higher interest rate.

Ensure you can comfortably make both payments each month. If you run into financial hardship, such as a job loss, you could be more likely to lose your house.

What Are the Advantages of a Second Mortgage?

When you take on a second mortgage, you may enjoy several advantages, including:

- Keeping current loan terms: If your primary mortgage has a great interest rate, you can keep this rate when you secure a second mortgage, as a second mortgage won’t replace your existing loan. Rather than change your current loan terms, a second mortgage will add an extra payment to your monthly expenses.

- Paying fewer closing costs: With a second mortgage, a home equity loan lender tends to cover most or all of your closing costs. Since you may not have to pay closing costs at all, you can save thousands of dollars.

- Deciding how you get the money: You can select whether you want a HELOC or a home equity loan. If you want a lump sum, you may want to select a home equity loan. If you want to tackle a home renovation or another ongoing project and you don’t know exactly how much money you may need, you may want to choose a HELOC instead.

What Are the Disadvantages of a Second Mortgage?

You may also deal with some drawbacks if you choose to take on a second mortgage, such as:

- Stuck with original mortgage terms: When you get a second mortgage, this won’t impact your original mortgage. With a second mortgage, you can’t change your primary mortgage’s interest rate or term.

- Additional monthly payment: On top of paying your primary mortgage each month, you’ll also have a monthly payment for your second mortgage. Missing a payment may risk the loss of your home.

- Another lien on your home: Having another lien on your home can put you at greater risk of foreclosure if you are unable to consistently pay your lenders.

When to Get a Second Mortgage

While a second mortgage isn’t right for everyone, it may be the right option for you. The following are some situations in which you may want to obtain a second mortgage:

- You want to keep your mortgage terms: Getting a second mortgage may be the right option for you if you want a lump sum of cash without changing your mortgage terms. While you may pay more interest on your second mortgage, you will keep your interest rate on the primary mortgage. This may not be an option if you choose to refinance instead.

- You don’t know how much money you’ll need: If you have an ongoing home project and you’re unsure how much money you will need upfront, a HELOC may be useful. With a home equity loan, you need to know how much you’ll need when you apply for this loan. When you secure a HELOC, you can make your payments as you go and use your line of credit up to the limit.

- You want to pay credit card debt: Compared to credit cards, second mortgages tend to have lower interest rates. If you have multiple credit card balances, you may want to take out a second mortgage to consolidate your credit card debt.

- You aren’t able to get a cash-out refinance: If you are rejected for a refinance, which tends to have a lower interest rate, you may be able to secure a second mortgage instead.

If you believe you can handle two monthly payments, a second mortgage may be the right option for you.

APPLY TODAYWhat Is Refinancing?

Refinancing is the process of replacing your primary mortgage with a new loan. When you refinance or remortgage, you can select a new lender, get a new interest rate, change your loan term or obtain a new loan type. With a refinance, you can:

-

- Cover family expenses: Do you want to offer financial support to an older relative? Are you planning to start a family? Do you have a child heading to college soon? No matter what your goals are, having extra cash each month can help you adapt to major life changes.

- Make home improvements: If you want to invest in a new roof or an addition, refinancing can free up cash that you can use for renovations.

- Manage your cost of living: Your cost of living may have changed since you got your mortgage. You may have a new job or kids, and refinancing can make your mortgage more affordable so you can manage your new cost of living.

- Enjoy extra cash in your pocket: Whether you want to save, spend or invest, refinancing can help put extra cash in your pocket.

[download_section]

The Types of Refinances

There are two types of refinances known as a cash-out refinance and a rate and term refinance:

- Cash-out refinance: A cash-out refinance lets you access your equity in exchange for a higher principal. For instance, if you have a mortgage with a $120,000 principal balance and you want to do $30,000 worth of repairs on your home, you would accept a loan of $150,000. You’ll then receive the $30,000 in cash after you close.

- Rate and term refinance: This type of refinancing lets you adjust how your mortgage is set up without impacting your principal balance. If you want to lower your monthly payment, you can accept a longer term. If you want to save on interest and own your house faster, you can shorten your loan term. You may also be able to refinance to a lower rate if market rates are now lower than when you obtained your mortgage.

How Does Refinancing Work?

The application for a refinance is similar to your original mortgage application. First, you’ll submit your financial documentation to the lender, and then the lender will underwrite your loan. In most cases, before you can refinance, you may also need an appraisal. With a refinance, you may need to pay for some of the same items as during your original mortgage process, including:

- Application fees

- An appraisal

- A home title search

After the underwriting and appraisal are completed, the next steps are closing and signing your new loan. If you obtain a cash-out refinance, you’ll likely receive your money a few days after you close on your loan.

As with a second mortgage, keep in mind that you may not be able to access all of your home equity when you choose a refinance.

What Are the Advantages of Refinancing?

Should you refinance your mortgage? When you take on a refinance, you may enjoy several advantages:

- You’ll pay only a single mortgage payment each month: You’ll replace your current mortgage with your new loan when you refinance, so you’ll only make one mortgage payment each month.

- You can change the term and rate of your loan: With a refinance, you may be able to adjust your term and rate, which can be useful if you are struggling to make your monthly mortgage payments. You may be able to replace an ARM with a fixed-rate mortgage or vice versa. If you secure a second mortgage, you may not have this option.

- You may be able to refinance all of your home equity: If you are eligible for a VA loan, you may be able to borrow all of your home’s equity.

- You may get a lower interest rate: You’ll face less risk when you have only one lien on your home. This means you may have a lower interest rate with a cash-out refinance than you would with a second mortgage. Market rates may also be lower now than when you secured your original loan.

What Are the Disadvantages of Refinancing?

If you choose to take on a refinance, you may also deal with some drawbacks, such as:

- You may be offered a different interest rate: You may be required to accept a different interest rate depending on the current market rates. If rates are higher now than when you secured your mortgage and you are forced to take on a higher rate, you may lose money.

- You may have to pay higher closing costs: When you refinance, you are responsible for paying your closing costs. This means you may need a few thousand dollars in cash when you close on your loan. You may be able to roll the closing costs into your loan, but this will increase your monthly payment.

When You Should Refinance

How do you know if refinancing is the right choice for you? There are many reasons you may choose to refinance, including:

- You want to change your term or rate: If you want to change the term or rate of your loan, you may want to choose a refinance. With a second mortgage, you cannot change your primary loan’s terms.

- You want to pay your mortgage faster: The sooner you can free yourself of a monthly mortgage payment, the more money you’ll be able to allocate to your other financial goals like retirement, vacations and renovations. If your mortgage is your only debt, paying it off will leave you debt-free.

- You want to eliminate private mortgage insurance (PMI): If you build up enough equity in your home you may be able to eliminate PMI.

- You want to take cash out of your equity: If you unlock the equity in your home, you can increase your cash flow and tackle those long-anticipated home renovations.

- You want to consolidate debt: If you have plenty of home equity and your aim is to consolidate debt, a cash-out refinance may be the right choice for you. When you reduce the number of bills you pay each month, you can simplify your finances.

- You want a lower monthly payment: With a lower monthly payment, you can keep more money in your pocket to save for other financial goals, such as your next family vacation or your kid’s college tuition.

Typically, you’ll have to cover closing costs, but compared to second mortgages, interest rates tend to be lower for cash-out refinances. To determine whether refinancing is right for you, try our refinancing calculator.

What Is the Difference Between a Second Mortgage and Refinance?

A home is a place to live, an asset and a potential source of cash to cover upgrades, repairs or emergencies. If you want to leverage your home’s equity to cover major costs, you may want to refinance your mortgage or secure a second mortgage. When you are considering a second mortgage vs. a cash-out refinance, weigh the pros and cons of both to determine which may be the right option for you.

Similarities Between Second Mortgages and Refinancing

With both a second mortgage and a cash-out refinance, you can use the cash as you choose. However, you may only want to borrow against the equity in your home if you want to consolidate debt or make home improvements. In each scenario, your house is considered the collateral. This means if you fail to make your payments, it may lead to foreclosure on your home.

Differences Between Second Mortgages and Refinancing

Second mortgages tend to have higher interest rates than cash-out refinances. However, closing costs are typically higher for a cash-out refinance than for a HELOC or home equity loan.

While a second mortgage is an additional loan to your first mortgage, a cash-out refinance is a single, larger loan. You will have another payment to make when you get a second mortgage. And with a second mortgage, equity in your home may be only partially accessible. With a cash-out refinance, you may have the option to access all of your home’s equity.

Apply at Assurance Financial

Is a remortgage or second mortgage right for you? At Assurance Financial, we can help you finance your dream home at any stage of life. We can help you get the mortgage loan you need efficiently and offer end-to-end support to ensure the process goes smoothly. Our mortgage options for homebuyers include:

- Conventional mortgage loans: If you have a stable income, good credit and a down payment, a conventional mortgage may be the right option for you.

- Second mortgages: If you are already a homeowner and want to borrow against the equity in your home without affecting your primary mortgage, you may want to apply for a second mortgage.

- FHA mortgage loans: These loans are available to moderate-income and low-income households. If you qualify for an FHA loan, you may be able to put down a lower down payment.

- VA mortgage loans: These loans are available for veterans or active service members. These loans are secured via the U.S. Department of Veterans Affairs.

- Construction loans: If you are building a new home, you may want to obtain a construction loan.

- Jumbo mortgage loans: Sometimes your dream home exceeds the limits for conforming loans. This means you may need a jumbo mortgage to finance a more expensive property.

- USDA RD mortgage loans: If you want to purchase a home in a designated rural or suburban area, you may qualify for a USDA RD

- First-time homebuyer loans: If this is your first time purchasing a home or you haven’t owned a home in the last three years, you may be eligible for a first-time home loan.

- Modular home loans: If you are purchasing a manufactured or prefabricated home, you may be able to obtain a modular home loan.

- Non-qualified loans: Also known as non-QM loans, these are available to homebuyers with lower credit scores.

Our loan advisors at Assurance Financial want to help you with your mortgage today. Contact us to learn more about the best option for you.

Sources

- https://assurancemortgage.com/second-property-mortgages/

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://assurancemortgage.com/conventional-loans/

- https://assurancemortgage.com/second-property-mortgages/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/construction-loans/

- https://assurancemortgage.com/jumbo-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/guide-to-cash-out-refinancing/

- https://assurancemortgage.com/how-soon-can-i-refinance-my-mortgage/

- https://assurancemortgage.com/what-are-closing-costs/

- https://assurancemortgage.com/what-kind-of-home-loan-should-i-get/