Month: September 2021

Finding a home that’s just right for you can be like looking for a needle in a haystack. The houses you visit might not be large enough, or they might be too big. They might not be located in a convenient area, or they might be in a place that’s too busy or noisy. The homes you view might not have the amenities you dream about or need to have in your residence.

If your house hunt is leaving you cold, you still have options. One option is to build your next home from the ground up instead of buying an existing house. Building a new home has many benefits. You can choose the style of the house, the number and type of rooms and the materials used.

Buying new construction is slightly different from buying an existing home in another way. The rules for loans and financing for new home construction aren’t exactly the same as they are for buying homes that already stand. Often, you’ll need to take out a construction loan first, which can convert to a mortgage once your home gets built. If you’re leaning toward building a new home, get all the details on the lending process.

Topics Covered

- FAQs About Home Construction Loans

- 1. How Do You Get Financing for a New Construction?

- 2. Is a Construction Loan a Mortgage?

- 3. What Does a Construction Loan Pay For?

- 4. What Type of Credit Score Do You Need?

- 5. How Much Can You Borrow?

- 6. What Are Interest Rates Like on Construction Loans?

- 7. What Percent Are You Asked to Put Down for a Construction Loan?

- 8. Do All Lenders Offer Construction Loans?

- 9. Is It Hard to Get a New Construction Loan?

- 10. Can I Build My Home Myself?

- Single-Closing vs. Two-Closing Transactions

- How to Finance New Construction: Types of Loans Available

FAQs About Home Construction Loans

Curious about the process of getting a construction loan? You likely have some questions. Let’s answer some of the most commonly asked questions about getting a home construction loan

1. How Do You Get Financing for a New Construction?

The process for getting a construction loan starts with an application. Most prospective home builders apply to several institutions to see what kinds of rates and loan terms are available to them. As you apply, you’ll provide detailed construction project information, including the contractor you’re working with, the building plans and timeline, and costs of materials and labor.

When approved for the loan, the borrower will place a down payment, or if they already own the land, they may be able to use the equity in their land as the down payment. The loan will finance the construction, and payment is due when the project is complete.

2. Is a Construction Loan a Mortgage?

Although a construction loan pays for the cost of building a home, it’s technically not a mortgage. A mortgage needs collateral, in this case, your home. When you are building a home, there isn’t anything to serve as collateral yet. Instead, a construction loan is a short-term loan that you either pay off once when the project is finished or convert into a mortgage.

3. What Does a Construction Loan Pay For?

Construction loans pay for most of the things involved in building a new home. The proceeds from the loan typically get paid to the contractor in installments or as certain building milestones are reached. The money can cover the cost of permits, materials and labor. The loan can also pay for the land purchased for the home.

4. What Type of Credit Score Do You Need?

Usually, borrowers need to have good credit with a score of at least 680 to qualify for a construction loan. The exact credit requirements can vary by lender and loan program. Some loan programs help people with lower credit scores purchase a new home and might be an option for you if your score is on the lower end.

5. How Much Can You Borrow?

How much you can borrow to build a new home depends on your income, the size of the down payment, and any other debts you have. Lenders may not let you borrow if your new construction loan puts your debt-to-income ratio above 45%. In other words, the amount you owe per month, including rent, credit card payments, and your new construction loan, should not be greater than 45% of what you earn each month.

6. What Are Interest Rates Like on Construction Loans?

The interest rate on a construction loan is likely to be slightly higher than the rate you’d pay on a standard mortgage. Once the loan converts to a typical mortgage, though, the rate might be more in line with what you’d pay to purchase an existing home.

7. What Percent Are You Asked to Put Down for a Construction Loan?

It depends on the construction loan you take out, but often, these loans require a higher down payment than other types of mortgages. If you apply for a conventional construction loan, you might be requested to put down between 20% and 30% upfront. With government-sponsored loans, a smaller down payment, such as 3.5%, is possible. Some construction loans have higher down payment requirements because lenders consider them higher-risk than standard mortgages.

8. Do All Lenders Offer Construction Loans?

Some lenders offer construction loans while others don’t. When looking for a loan, it’s a good idea to shop around. Luckily, Assurance Financial offers construction loans and can help you get started any time.

9. Is It Hard to Get a New Construction Loan?

In some cases, it can be harder to qualify for a construction loan than for a standard mortgage. But many loan programs make the process go smoothly and offer more accessible construction loans.

APPLY TODAY10. Can I Build My Home Myself?

Many construction loan programs require you to work with a licensed and insured contractor and ask you to submit plans before your loan is approved. If you’re a professional contractor, you might be able to build your own home. Otherwise, expect to work with a pro.

Single-Closing vs. Two-Closing Transactions

Two categories of construction loans exist — construction-only loans and construction-to-permanent loans. Construction-only loans are also called two-closing loans, as you will go through the closing process a second time should you need a mortgage once your home is built. A construction-to-permanent loan is sometimes called a single-closing loan, as it automatically converts to a mortgage after construction is complete.

Single-Closing Loan

A single-closing transaction requires less paperwork and can be less expensive than a two-closing loan. You don’t go through the closing process twice, so you only pay one set of closing costs. While you initially might pay less out of pocket for a single-closing loan, the interest rate you pay might be higher than if you were to apply for a traditional mortgage. The interest rate is typically locked in at closing.

Single-closing transactions can have strict underwriting guidelines. Your lender is likely to calculate the loan-to-value (LTV) using the appraised value or the acquisition cost, whichever is less. The LTV is the value of your loan compared to the value of the property. Lenders use it to assess risk, determine interest rates and see if you need to pay private mortgage insurance (PMI).

During the building process, the lender will make payments to the contractor on a set schedule. As the home is built, the borrower can either make interest-only payments or decide to defer payments until the loan converts to a permanent mortgage.

Once construction finishes, the loan turns into a permanent mortgage automatically. The borrower begins making principal and interest payments based on the term of the loan.

Two-Closing Loan

Two-closing transactions are the most common. They have a more flexible structure and more flexible underwriting guidelines. The LTV is calculated using appraised value, and equity is considered towards down-payment.

Unlike a single-closing loan, when you decide to get a two-closing or construction-only loan, you’ll go through the loan application process twice. Doing so has its benefits and drawbacks. An advantage of getting a construction-only loan is that it gives you more leeway when it’s time to apply for a mortgage. You can shop around for the best rate and terms and aren’t locked into the rate offered on the construction loan.

A drawback of a two-closing loan is that you will go through closing twice. That means you’ll need to apply for a mortgage once your home is ready, and you’ll sign a whole new set of documents. You’ll also pay closing costs twice.

Since you have the opportunity to get a better interest rate on your mortgage with a two-closing loan, you may save money in the long run, even though you pay closing costs again.

Construction-only loans are due as soon as the project is complete. Usually, the term of the loan is short — about a year, if not less. If a borrower has trouble finding a mortgage to pay the remaining principal on the construction loan, they might find themselves with a big bill after their home is move-in ready.

How to Finance New Construction: Types of Loans Available

Just as you have choices when buying an existing home, you have mortgage options when looking into buying new construction. Several loan programs offer construction loans as well.

FHA Loans

The original goal of the Federal Housing Administration (FHA) loan program is to make homeownership affordable for as many people as possible. FHA loans make getting a mortgage more accessible in a few ways. They typically have lower down payment requirements than other types of mortgages. If you want to get an FHA construction loan, you can put down as little as 3.5%. Credit requirements are also looser with FHA Loans. You can have a credit score in the 500s and still be eligible for a mortgage.

FHA loans are guaranteed by the Federal Housing Administration but don’t come from the government itself. Instead, you apply for the mortgage through an approved lender. The lender reviews your credit, income, and other documentation before deciding whether to approve you for the loan and how much interest to charge.

The type of FHA loan you apply for depends on the type of construction project you’re undertaking. If you’re building a home from scratch, you’ll apply for a single-closing, construction-to-permanent FHA loan. At the start of the process, the lender dispenses funds to the builder to cover the cost of construction. When the home is complete, the loan converts to a traditional FHA mortgage.

The other option is for people who are renovating an existing home. An FHA 203(k) loan covers the cost of rehabilitating a fixer-upper or other house that needs some TLC. You can use an FHA 203(k) loan to renovate your current home or to purchase and renovate a new home.

Two forms of 203(k) loans exist — standard and limited. The standard 203(k) is for larger projects that cost more than $35,000. The limited loan covers projects with a price tag under $35,000. One thing to remember if you’re considering an FHA loan is that the loan will require you to pay a mortgage insurance premium. You’ll pay a premium upfront and for the duration of the loan term.

VA Loans

The Department of Veterans Affairs offers VA loans to help veterans and current service members purchase homes. Like FHA loans, VA mortgages come from private lenders and are guaranteed by a government agency, in this case, the Department of Veterans Affairs. Also similar to an FHA loan, a VA loan lets you purchase a home with a limited down payment. In the case of a VA loan, you might be able to buy a house with zero down.

VA construction loans have relatively strict requirements. In addition to being a current or former member of the armed services, you may need to meet several other requirements before you can qualify. Not all lenders that offer VA loans offer VA construction loans, so you might be required to dig around before finding an eligible lender.

When considering applying for a VA construction loan, the first thing to do is to find a licensed, insured builder. You may be required to work with a professional builder if you want to use the VA program to buy your new construction home. The program doesn’t allow owners to build their homes. Next, you and the builder will work together to create plans for the home. You’ll submit those plans to the lender when you apply. You’ll also submit documentation about the building materials and the lot.

For you to qualify for a zero-down payment on a VA construction loan, the home needs to be appraised. The design of the house can’t be too unique or unusual, nor can the house be larger or more luxurious than others in the area. A home that is too “out there” will have a lower appraisal value than a house that’s more standard. Getting a low appraisal can mean you can’t qualify for a zero-down payment.

After closing on the loan and building your new home, the property will need to pass an inspection by the VA. If it passes inspection, the loan converts to a permanent mortgage.

USDA Loans

USDA loans are also backed by a government agency, in this case, the United States Department of Agriculture. The loans are traditionally meant to help lower-income households purchase a home in a rural or suburban area. Like VA loans, the USDA loan program offers 100% financing in some circumstances, meaning a borrower can buy a home with zero down.

It’s possible to get a construction-to-permanent loan as part of the USDA loan program, although it’s worth noting that the list of lenders who offer USDA construction loans is more limited than the number of lenders who offer USDA loans. If you decide to apply for a construction-to-permanent USDA loan, there are several things to keep in mind. First, you need to meet income requirements. The maximum household income you can earn varies based on location and the size of your household.

Second, you need to build your home in an eligible area. The new house isn’t required to be in a completely under-developed area, but it can’t be in a metropolitan or urban location. Some suburban neighborhoods are eligible for USDA loans, as are most rural areas. As with a VA construction loan, you need to work with an approved builder if you’re going to apply for a USDA construction loan. You can’t build the home yourself.

Like an FHA loan, you’ll be required to pay mortgage insurance when you take out a USDA loan. The insurance remains in place for the life of the loan. You might also pay a slightly higher-than-average interest rate on a USDA loan than on other types of mortgages.

USDA construction loans are usually hard to find. While many lenders participate in the USDA’s loan program, only a few participate in the construction loan program. Depending on your home-building goals, you might be better off choosing a different type of construction loan.

Conventional Loans

Although government-guaranteed loan programs can help people build and buy their homes, they aren’t the right choice for everyone. You might not qualify for government-backed loans, or you might want to buy a home in an ineligible area. While some loans, like FHA loans, make it possible to buy a home with a lower down payment, their mortgage insurance requirements can be a turn-off for some buyers.

Fortunately, it might be easier to qualify for a conventional construction-to-permanent loan than you think. Although many people believe that you need a large down payment to get a traditional mortgage, especially when you’re building a home, there are programs available that will accept a down payment as low as 3%. The size of your down payment depends on the appraised value of the home.

If you do put down less than 20% on a construction-to-permanent loan, you can expect to pay private mortgage insurance. However, unlike the mortgage insurance attached to an FHA loan, you can stop paying the premiums as soon as your LTV reaches 80% When your LTV reaches 78%, the mortgage insurance premiums will automatically terminate.

Your credit score is likely to matter more when you apply for a conventional construction-to-permanent loan than it does for a government-sponsored loan program. Ideally, you’ll want a score above 700, with a score over 740 being ideal. The higher your score, the less risky you look as a borrower. That can mean you get a lower interest rate and better loan terms from a lender.

Should you decide to go the conventional mortgage route, you have two options, depending on the value of your home. You can apply for a conforming loan, meaning the price of your home falls under the limits set by the Federal Housing Finance Agency. The conforming loan limit changes annually based on inflation. It is higher in areas with a higher cost of living and cost of homeownership.

If you’re planning on building a large, luxurious home, it’s likely that the cost of the project and the appraised value of the house will be above the conforming loan limit. In that case, you may be required to apply for a jumbo loan or a non-conforming loan. Jumbo loans can be up to $2 million. Since jumbo loans are above the limit, they don’t have the same protections as conforming mortgages. As a result, they often have higher interest rates and might require a larger down payment from the borrower.

Apply for a Construction Loan With Assurance Financial Today

Your dream home can be closer than your think. Assurance Financial offers several construction-to-permanent loan programs that will provide you with financing to build your home from the ground up.

We also offer an easy online application process. In just 15 minutes, you can see what your eligibility is. Get started today so you can begin your new construction project.

Sources:

- https://assurancemortgage.com/remodeling-construction/

- https://www.businessinsider.com/personal-finance/construction-loan

- https://assurancemortgage.com/fha-loans/

- https://www.hud.gov/program_offices/housing/sfh/203k/203k–df

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/usda-loans/

- https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-guaranteed-loan-program

- https://crsreports.congress.gov/product/pdf/RS/RS20530

- https://www.fdic.gov/consumers/community/mortgagelending/guide/part-1-docs/fannie-standard-97-percent-loan-to-value-mortgage.pdf

- https://assurancemortgage.com/appraisal-process-construction-financing/

- https://www.consumerfinance.gov/ask-cfpb/what-is-private-mortgage-insurance-en-122/

- https://www.consumerfinance.gov/about-us/blog/bad-credit-or-no-credit-when-you-want-buy-home/

- https://assurancemortgage.com/jumbo-loans/

- https://www.consumerfinance.gov/owning-a-home/loan-options/conventional-loans/

- https://assurancemortgage.com/apply/

Millennials are now the nation’s largest generation. While the exact ages of “millennials” can vary from study to study, the millennial generation typically includes people born between 1981 and 1996, making them around 25-40 years old. The Pew Research Center also uses these years to define the millennial generation.

The youngest millennials are now reaching the age where they may be thinking about buying real estate. Many older millennials are wanting to buy a home if they haven’t already. Unfortunately, millennials have some unique challenges when it comes to buying a home. If you’re at this stage in life, you may have some questions.

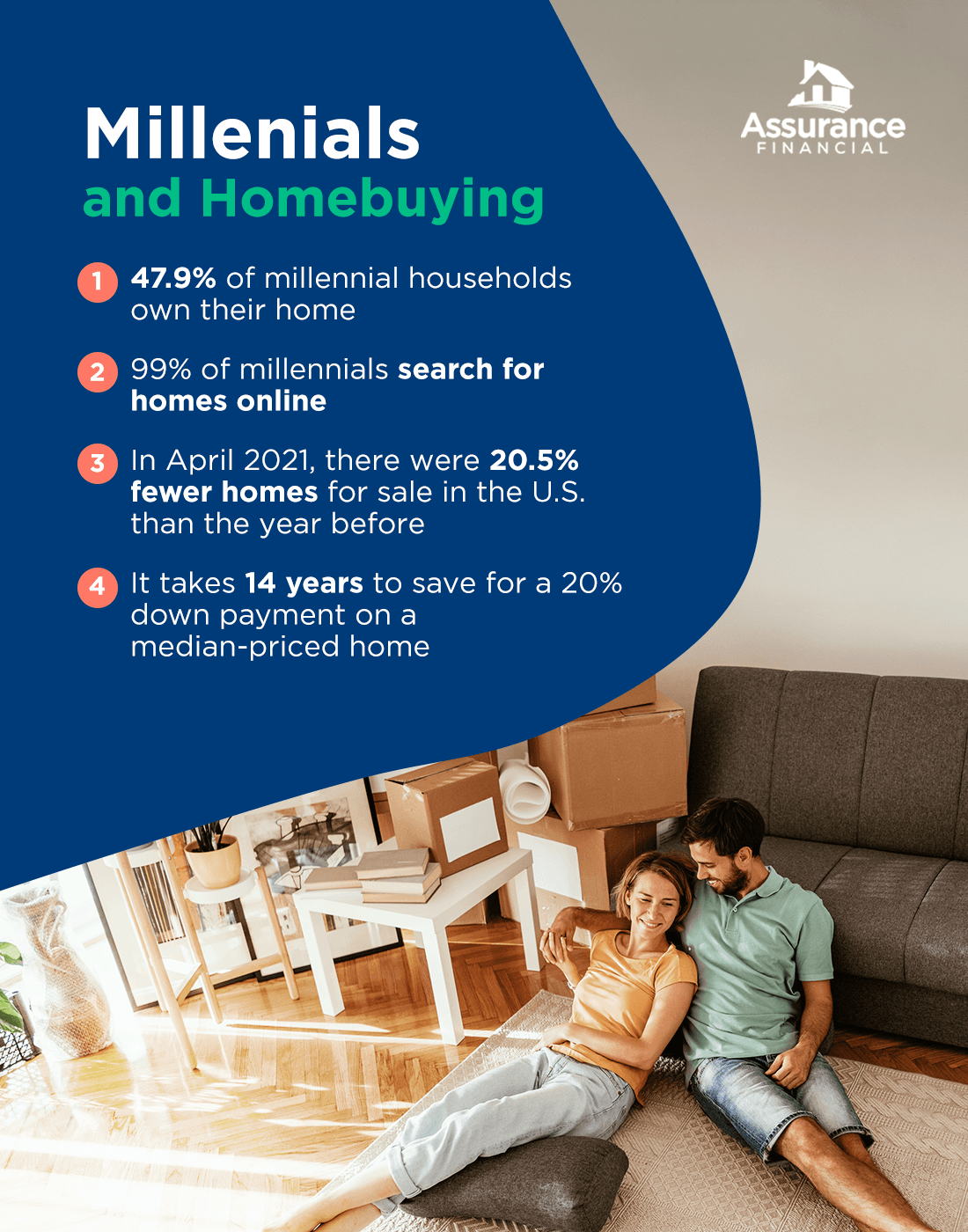

What Percentage of Millennials Are Buying Homes?

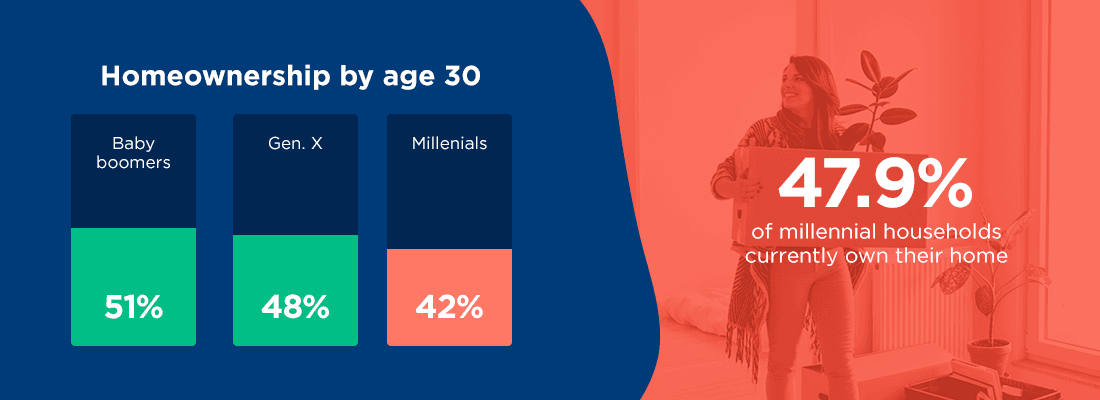

Currently, less than half of millennials own their homes. A study Apartment List published in February 2021 reported that 47.9% of millennial households own their home. This rate is below earlier generations, but it is growing as millennials increase in age.

The homeownership rate three years ago was only 40%. The current homeownership rate for Generation X is 69.1% and the rate for baby boomers is 78.8%. The millennial homeownership rate is increasing, but more slowly than it did for previous generations. Even so, millennials account for more than half of all new mortgages.

Comparing this rate another way shows that homeownership is generally decreasing. According to the 2021 Apartment List report, by age 30, millennial homeownership is only 42%. At the same age, Generation X was at 48% and baby boomers were at 51%. The previous year’s study reported that 35-year-olds in 1981 were almost 20% more likely to own their homes than 35-year-olds in 2016.

Many millennials are giving up on ever owning their own home. In 2018, 10.7% expected to rent forever. Then in 2019, the number rose to 12.3%. In 2020, the rate jumped to 18.2%. The majority of millennials cite affordability as one of the main reasons they can’t buy a home right now, but that’s not to say homeownership is unattainable. There are many loan programs designed to assist first-time homebuyers.

Why Should Millennials Buy a Home?

Buying a home has long been considered the “American Dream” and a sign of financial well-being. While some argue that millennials are killing the housing market, studies show that millennials do want to buy homes.

There are many reasons to buy a home instead of renting. Let’s go into detail about the main benefits:

1. Stability in Housing Costs

Owning your home means you’ll have more stability when it comes to your monthly housing costs. You won’t have to worry about lease terminations or rent increases. With a fixed-rate mortgage, you’ll have greater predictability in your costs year over year. While your property taxes and home insurance rates may fluctuate, the majority of your costs will not increase.

2. Forced Saving

Paying your mortgage is like being forced to save money. As you pay off your loan, you are gaining equity in your house. This is very different from paying rent. At the end of your lease, you don’t gain anything. After you’ve finished paying your mortgage, you own a very valuable asset worth tens of thousands of dollars. You’re more likely to spend some extra cash when you’re renting instead of saving it. With your mortgage, you’re basically requiring yourself to put money away where you can’t spend it.

3. Asset Ownership

Eventually, you will pay off your house. When you do, you’ll own a very valuable asset. You can continue living there mortgage-free. Once you own your home completely, a significant portion of your income will be freed up.

If you continue renting, the rent will likely go up a little every year or every few years, and it will never end. When you buy a home, it will end and you can live there at a much lower monthly cost. If you choose, you can also sell the house. Houses tend to appreciate in value, so you’re making an investment that could grow.

4. Tax Breaks

Another benefit of homeownership is the tax breaks. You could actually get a lot of money back in this way. There is the mortgage interest tax deduction, the mortgage tax credit, and the home sale tax exclusion. With the mortgage interest tax deduction, married couples can deduct the interest they pay on up to $750,000 of a home loan.

The mortgage tax credit applies to lower-income households that qualified for and received the Mortgage Credit Certificate. With this, you will receive a credit amount of the mortgage interest paid in the year. If you ever decide to sell your home, you can enjoy tax breaks with the home sale tax exclusion. This applies to capital gains of $250,000 for single people and $500,000 for married couples. You’ll have to pay tax on profits beyond these amounts.

5. Community

When you buy a house, you become part of the community. Homeownership is usually a long-term situation, and you’ll get to know the people around you. You can make friends with neighbors and become more tied to that place. A sense of community is an important part of living a long and healthy life.

6. Pets

Buying a home means you no longer have to worry about pet deposits, additional rental fees, and other problems that go with having pets in a rental. Many apartments don’t even allow pets, making it extra difficult if you ever need to move. When you own the home, you can have as many pets as you wish. Adopt that second, third or fourth cat or give a home to an adorable puppy!

7. Design Freedom

Another great thing about owning your home is the freedom to design it however you want. Aren’t you tired of removable hooks and sticky tack? Don’t you wish you could paint rooms a different color, or change up the layout of something? When you own your home, you don’t have to worry about what your landlord will charge to “fix” whatever you did. Nail that painting to the wall, paint your front door, and open up that room. These changes can improve how you feel about your home, and they may also add value to your property.

What Is the Mortgage Process?

The homebuying process today is much different than it was 20 years ago. At Assurance Financial, you can get pre-qualified online in just 15 minutes. We pull your credit and quote a no-obligation rate. Your loan advisor will help you decide what type of loan applies to your situation. There are conventional, VA, FHA, construction, modular home, jumbo loans, and more.

Once you’ve found the property you’d like to buy, you will complete a full application. Next is processing. This includes appraisal, underwriting, and approval of the loan. Then you sign with a notary to close your loan and get the funding. The entire process typically takes about 25 to 30 days.

Buying a house can be hard when you feel inexperienced with the process. Learn more by reading this article on the 10 Common Mistakes First-Time Homebuyers Make.

[download_section]

How Have Millennials Changed Homebuying?

The homebuying process changes as times change, technology advances and people find better ways to do things. This is no different now that millennials are entering the housing market at high rates.

Millennials are waiting longer than previous generations to buy their first home. This is due to a number of reasons, but it affects the housing market and statistics on millennial homeownership rates. Many are choosing to move back in with their parents due to economic factors. According to a Pew Research study, 52% of adults aged 18-29 are now living with their parents. Millennials, and some older members of Generation Z, are using this time to pay off student loans and other debts while trying to save money.

The delay in homebuying may also be due to the fact that millennials are starting families later than previous generations. Another study from Pew Research states that only 46% of millennials are married, while at the same age 57% of Generation X were married and 64.5% of baby boomers were married.

Millennials are also driving the change toward online and internet homebuying. In fact, 99% of millennials search for homes online. Online mortgages are also becoming more popular. Previous generations had to head to a bank or ask a realtor, but today you can simply go online and apply for a mortgage in 15 minutes. Millennial homebuyers are also more likely than older generations to shop around for a mortgage to find the best rate. Many millennials also prefer text-based communication and video tours of homes, so many companies are having to make the change to updated technology.

Tips for Millennial Homebuyers

Each year, more and more millennials are buying homes. The benefits of owning your own home are clear, but it can be hard to get there. What do you need to do to get started?

1. Save for a Down Payment

Before you can buy a house, you need a down payment. In some instances, you may not need the whole 20%, but you will need some money. The biggest challenge facing many millennials is student loans. Out of millennials who reported saving for a down payment was difficult, 48% of younger millennials and 41% of older millennials said that student loans were the biggest factor that delayed saving.

High rent, car loans and credit card debt were the next factors. You will likely need to pay off some of your debt before you can save enough money for a down payment. Having a large down payment can lower your interest rate and help you bypass private mortgage insurance.

2. Improve Your Credit Score

Paying off your debts on time can help improve your credit score, which makes it easier for you to get approved for a better mortgage. Different mortgage options will have different credit score requirements, but you typically need a score over 500. A conventional loan requires a credit score of over 620, so it’s important to pay attention to your credit score. A score of 740 or higher is considered an excellent score and will potentially help you get a smaller down payment requirement and lower interest rate.

3. Calculate What You Can Afford

You will also need to figure out how much house you can afford. Once you have the down payment figured out, calculate your current income and expenses and decide what you are looking for in a house. Can you afford the type of home you’re looking for? Figure out the amount of monthly payments you will be able to afford, keeping in mind the interest payments, property taxes, home insurance fees and any other fees you may be paying. Use our handy mortgage calculator to help you decide how much you would be comfortable spending.

4. Get Approved for a Loan

It’s important to get approved for a loan before you make an offer. This will help you stand out in the market because it lets the seller know you can cover the down payment and the mortgage. Houses are selling faster than ever, so being approved in advance can help give you an edge. It will also give you a more precise figure for the price range of houses you can look at before you fall in love with a home outside your budget.

Make Buying a House Easier With Assurance Financial

First-time homebuyers have many decisions to make when it comes to getting a mortgage. Assurance Financial is available to make it easier and answer any questions you might have.

You can get pre-qualified for a loan in just 15 minutes. We offer personalized service, and we have an average of 4.98 stars out of thousands of reviews from people just like you. The latest application technology makes starting your loan simple and fast. You can get started completely online with our digital assistant or speak with a licensed professional.

Assurance Financial offers every type of loan on the market and we provide end-to-end processing of your loan under one roof. Live your dream and get the mortgage that works for you. Want more information? Check out our First-Time Homebuyer Checklist. Feel free to reach out to a loan advisor for answers to any additional questions you may have.

Linked Sources:

- https://www.apartmentlist.com/research/millennial-homeownership-2021#fn-1

- https://www.apartmentlist.com/research/homeownership-by-generation

- https://studentloanhero.com/featured/millennials-have-better-worse-than-generations-past/

- https://www.cnbc.com/video/2021/05/25/why-the-us-is-facing-a-housing-shortage.html

- https://www.irs.gov/publications/p523https://www.irs.gov/publications/p936

- https://www.pewresearch.org/fact-tank/2019/01/17/where-millennials-end-and-generation-z-begins/

- https://www.pewresearch.org/fact-tank/2020/09/04/a-majority-of-young-adults-in-the-u-s-live-with-their-parents-for-the-first-time-since-the-great-depression/

- https://www.pewresearch.org/social-trends/2019/02/14/millennial-life-how-young-adulthood-today-compares-with-prior-generations-2/

- https://www.nar.realtor/newsroom/housing-market-reaches-record-high-home-price-and-gains-in-march

- https://www.nar.realtor/sites/default/files/reports/2017/2017-real-estate-in-a-digital-age-03-10-2017.pdf

- https://assurancemortgage.com/apply/

- https://contentimages.o-prod.unison.com/images/downloads/Unison_Affordability-Report_2019.pdf

- https://cdn.nar.realtor/sites/default/files/documents/2021-home-buyers-and-sellers-generational-trends-03-16-2021.pdf

- https://www.cnbc.com/2020/08/21/why-the-homeownership-gap-between-white-and-black-americans-is-larger-today-than-it-was-over-50-years-ago.html

- https://assurancemortgage.com/first-time-homebuyer-checklist/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/10-mistakes-first-time-homebuyers-make/

- https://assurancemortgage.com/how-to-get-a-mortgage-loan/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/mortgages-explained/

Owning a home may be the American dream, but paying off your mortgage early seems more like a far-fetched fantasy. We have good news. It isn’t, and paying off your mortgage early could help you save thousands of dollars in interest, get rid of big monthly payments, and live lien-free! By understanding the process and having the proper plan, it’s even possible for young homeowners to pay off their mortgage by 30.

Regardless of your age, there are ways to turn your paid-off mortgage fantasy into a reality. We’re going to break down the steps, answer some of your most pressing questions and help you take the next step toward your financial freedom!

To understand how paying off your mortgage early works, let’s look at how your current payments are set up. When you pay your monthly bill, that money is split two ways. One-half goes to the principal, which is also known as the mortgage balance. The other half goes toward paying the interest, which is the percentage your bank is charging for them to loan you the money.

When you’re trying to pay off your mortgage early, you can contribute additional funds to the principal balance, which then reduces how much you owe and shortens the timeline of repayment, resulting in fewer interest payments.

Let’s say you’re buying a home and you take out a 30-year fixed mortgage for $125,000 with a 4 percent interest rate. Your payment would be around $596.77 a month, but over the life of the loan, you’d end up paying close to $89,836.59 in interest. That’s on top of the amount you originally borrowed, turning a $125,000 loan into a $214,836.59 one.

Now let’s say you decided to pay an extra $100 a month on this same mortgage, interest and term length. Now, instead of paying $89,836.59 in interest by the end of the loan, you would have to pay $65,806.74. That small monthly boost saves you $24,029.85! It also shortens your loan term by 86 months and leaves you with a new total of $190,806.74. So, with just an extra $100 a month, you save 27 percent in interest and pay it off 24 percent faster.

This is only one example of early mortgage repayment, so we’re going to explore other methods and scenarios that may work better for you. But before we break down how you can do it, it’s valuable to ask yourself if you should do it. Not all experts think that paying off your mortgage early is as sweet a deal as it sounds. Keep reading to find out why.

Should You Pay Off Your Mortgage Early?

Just because you can do something, doesn’t mean you should, and the same goes for where to put your extra cash. Some people might ask, “Isn’t getting out of debt a good thing?” but they’re asking the wrong question. It can be a good goal for some and the wrong goal for others, and knowing the difference requires case-by-case examination.

Each person’s finances come with a wide range of variables, such as income, expenses, debts, interest rates, credit scores, and the bank being used. Taking financial recommendations and holding them up to the light of your own circumstances is an important part of planning your financial goals.

Sometimes the perks of paying off your mortgage early don’t outweigh the opportunity of putting your cash to work somewhere else. So, without any clear “should you” or “shouldn’t you,” let’s investigate the benefits and the risks of early mortgage repayment and how they may apply to your finances.

Benefits of Early Repayment

The first benefit of paying your mortgage off early is that it can save you money in interest fees. As we’ve demonstrated, paying more each month or refinancing for a shorter term with a better rate could save you thousands of dollars! Those are some significant savings. The best part is, it doesn’t take much to see those kinds of positive results.

In our original scenario, we only bumped up the payment by $100 and it saved you $24,029.85 in interest and shortened your loan term by 86 months. Imagine if you doubled that? At $200 extra a month, you’re looking at $52,117.49 in interest savings and paying off your loan 137 months sooner. That’s 11 years and 5 months saved. Can’t swing the $100? Cut that in half and you’re still saving $13, 978.59 and saving yourself 4 years of payments. A little goes a long way!

Paying off your mortgage sooner also frees up money in your monthly budget later in life. With your mortgage bill gone, you could contribute that monthly amount to any number of things, such as other debt, your 401k, Roth IRA, HSA, your emergency fund, or other investment opportunities. It could allow you to spend your later years doing the things you’ve always wanted to do, like travel or take up an interesting hobby. Dreaming of ways to spend that monthly payment can be a real motivator to pay off your house early!

Some people weigh the value of early repayment against missed investment opportunities. While stocks typically have a greater return, they’re not always reliable. The market can be volatile, but your mortgage payment is showing up no matter what the market’s doing. So if you have $100,000 in investments and the market takes a turn, your portfolio could take a devastating hit. Unfortunately, your lender isn’t going to adjust your bill accordingly. Mortgages have fixed liability, so no matter what happens to you, your loan is still gonna be due.

Few people regret getting out of debt. You could gain even more by putting your extra money elsewhere, you probably won’t wish that you still had a mortgage when it’s finally gone. When considering repayment, numbers play an important role in our deliberation, but we can’t ignore the emotional and psychological impact of financial decision-making. Since the stock market isn’t guaranteed to give you predictable returns, the psychological benefit of owning your home free and clear cannot be easily dismissed!

Risks of Early Repayment

While there are plenty of benefits to early repayment, there is a fair share of risks as well. Your mortgage may not be the best loan to pay off first. You should prioritize other high-interest debts, like credit cards and student loans before your home. Your interest savings on your mortgage will pale in comparison to what you could save if you paid off your other debts first.

Some people make good use of the snowball method, which is based on the idea of a snowball rolling down a hill and growing in speed and size as it goes. Financially, this looks like paying extra on the debt with the highest interest rate and working down the list until you’re paying off the lowest interest rate.

So let’s say you have a credit card with a $5,000 balance and a 16 percent interest rate, a student loan balance of $7,500 with a 7 percent interest rate and your $125,000 mortgage at a 4 percent interest rate. Following the snowball method would look like paying the credit card first, followed by the student loan, and then the mortgage. This way, you’re saving the most on interest payments.

But before you even start the snowball method, you should be sure to have a healthy emergency or rainy day fund for any unforeseen expenses. Without one, you may end up accruing more high-interest debt in order to cover these events, which would counteract all the work you put into paying off your original loans.

Another risk of early mortgage repayment is missing out on other investment opportunities with higher returns. While the stock market isn’t guaranteed, there is a historical basis of an average return dating back as far as 1928. While not all stocks are fool-proof, some are safer than others and can yield a return that outweighs what you would’ve saved in interest payments.

The same could be said for retirement accounts or other savings methods that use compounding interest. The sooner you save, the more money they can accrue. So if your interest rate is 4 percent but your portfolio returns an average of 7 percent, you’ll lose money by paying your mortgage off faster.

Paying off your mortgage early can also tie up the majority of your net worth in a non-liquid asset. There’s a difference between having $125,000 invested in a home and having $125,000 in cash. Smart investors try to have a balance between liquid and non-liquid assets, so if paying off your home is going to skew that balance, you may want to consider evening things out instead of wrapping up all your wealth into a house.

Imagine if you had a life event that cost you more than your emergency fund. Getting cash to cover things like losing your job, medical treatment for a serious illness or even something like starting your own business would mean you would either have to borrow against your house, which practically defeats repaying it early, or selling it, something that may not be a reasonable option if that house is the one you live in!

You also need to consider the fact that paying off your mortgage early is a long-game investment. If you, like most homeowners, have a fixed rate, then your monthly payment is staying the same until the loan is paid in full, which means you won’t see the fruits of your labors until the term is up.

If you end up quitting on paying extra, you could end up with dead equity, or money tied up in an investment that isn’t making you anything. Unless you see your early repayment through to the end, you could be wasting the money you’re using to pay off your mortgage by not investing it in something with higher returns.

Lastly, paying off your mortgage early requires sacrifices, which brings us back to the emotional and psychological aspects of this decision. It can take years to see the benefits of early repayment. Mortgages are for the long haul, and even if you cut a 30-year term in half, that’s still 15 years before you’re using that disposable income in a discretionary way.

Is Early Repayment Right for You?

You should base your financial decisions on your individual circumstances, but we can help frame some scenarios that can help you quickly decide if early repayment works for you. We’ve created two qualifications lists to review that may help you figure out if paying extra on your mortgage is a good idea.

Here are some reasons to forgo extra payments on your mortgage:

- You have other high-interest debts

- You don’t have an emergency fund

- You aren’t on track for retirement

- You’ll benefit from using your mortgage interest as a tax deduction

Conversely, here are the scenarios where paying off your mortgage early could be beneficial:

- Your high-interest debts are paid, you have an adequate emergency fund, and you’re paying into retirement

- You have a healthy balance between liquid and non-liquid assets

- You already have a healthy stock portfolio

- You have the opportunity to refinance to a lower interest rate

- Your monthly income increased

Neither of these lists covers the full scope of every possible scenario, but if your situation identifies overwhelmingly with either of these lists, then you probably have your answer on whether you should pursue paying off your mortgage early.

Ways to Pay Off Your Mortgage Early

If you’ve done your homework, reviewed your finances, and decided that paying off your mortgage is right for you, then we want to teach you some ways to make that dream a reality. There are a few different strategies for paying off your mortgage early. Choosing the best one for your financial circumstances depends on your current mortgage and how much you want to or can contribute to your efforts.

Switch to a Biweekly Payment Schedule

The first option is to switch to a biweekly payment schedule. This is a great option if you don’t have extra income in your monthly budget to contribute since your payment stays the same. You’ll just pay it in two installments. So if your payment is $596.77, as in our mortgage example from earlier, you’ll pay $298.39 one week and then another $298.39 two weeks later.

The reason this can help you pay off your house early is that it uses the weeks of the year to your advantage. When you’re on a once-a-month schedule, you end up paying 12 times on your loan. But, on a biweekly schedule, you pay 26 times a year, which affords you one extra annual payment. That means an extra $596.77 a year, which would be the equivalent of an extra $49.73 a month, and we already covered what an extra $50 months could mean for interest savings!

Increase Your Monthly Payment

We’ve already covered how paying a little extra each month can cut down your loan term and interest payments, but there are several possible ways to do it. Most lenders will let you set up an automatic deduction, though that payment would be fixed when you set it up. You could also manually pay extra each month, which may be less convenient but it allowing you flexibility in your contributions.

Several methods can help you decide how much extra you want to contribute month-to-month. It could be as simple as an arbitrary number or rounding up your monthly payment, which would look like bumping up your $596.77 payment to $600. You could also take a non-essential budget item, like a subscription service or your daily cup of artisan coffee, and spend that money on your principal instead.

Another method you could try is the dollar-a-month method. This is where you add one extra dollar a month for the life of the loan. So in the first month, you’d pay just one dollar more. But by month 86, you pay $86 dollars more.

No matter how you decide to do it, consider choosing the option that you’re most likely to stick with or can afford to see through to the end. Remember, you don’t want to risk any dead equity.

Commit Bonuses and Tax Returns to Your Loan

Another way to pay off your mortgage early is to commit any windfalls, like work bonuses, casino winnings, or your annual tax return, to repayment. So instead of adding extra to your payment per month, you’d be contributing a lump sum whenever they come in. So let’s say you get a $1,200 tax return in June and a $1,500 Christmas bonus in December. You’d simply take those checks and pay them on your principal.

This strategy doesn’t cut into your monthly budget but considers whether you have the discipline to spend your bonuses on your mortgage. Be sure to also check whether your loan has a prepayment penalty before using this strategy!

Refinance to a Shorter Loan

It’s common for home-buyers to opt for a long-term loan in order to reduce their monthly payments, but over time your financial circumstances may change for the better and you could use your increased cash flow for extra payments on your mortgage.

Refinancing is a great way to put that new or freed up cash to good use. By refinancing for a shorter loan term, your monthly payments will go up but your timeline and interest will go down. If you also qualify for a better interest rate, that could increase your savings even further!

So let’s say you have a balance of $112,839.43 on your $125,000, 30-year fixed loan with 4 percent interest and 25 years left on the life of the loan. In those five years, you’ve increased your monthly cash flow and you find out that you qualify for a better interest rate. By refinancing your house to a 15-year fixed loan with a 3 percent rate, your monthly payment of $597 goes up by $197 but you will save $39,154 in interest.

One thing we left out of our calculations is the closing costs, which can total from two to three percent of the loan. Depending on your situation, that extra percentage could offset any money you would save on interest. Even so, there are other good reasons to consider refinancing, such as consolidating debt, taking out cash on your home, or paying off private mortgage insurance.

If you’re considering refinancing, check with a lender to find out what you’re eligible for, and then use a reliable refinance calculator to crunch the numbers to see whether refinancing could help you pay off your mortgage early and save you money!

[download_section]

Refinance Your Mortgage with Assurance Financial

Of the ways to pay off your mortgage early, refinancing is the one that requires the right financial partner. But we don’t want you to settle for a loan officer who’s in it for the commission. Choose Assurance Financial instead. With over 20 years of lending experience and a 4.8-star customer rating taken from thousands of reviews, we are the partner you deserve.

In addition to our stellar customer service, we have the latest in application technology to make starting your loan simple and fast. With our end-to-end processing, as well as Fannie Mae, Freddie Mac and Ginnie Mae service approval, we do not need to outsource your loan details. We keep it all under one roof, which keeps your information safe and in one place.

Let Assurance Financial help you get a loan that fits your needs. To start your application online, apply with Abby or get in touch with one of our experts. We can’t wait to help you take the next step!

Linked Sources:

- http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

- https://www.ramseysolutions.com/debt/how-the-debt-snowball-method-works

- https://www.forbes.com/advisor/mortgages/principal-interest/

- https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-fixed-rate-and-adjustable-rate-mortgage-arm-loan-en-100/

When it comes to financing a home or a build, several factors are involved in the type of loan you apply for. The interest rate is a key factor, but the more important one is the down payment. A down payment on a home is the money you give to the lender initially. Typically, this is a piece of the overall cost of what is being borrowed. Whatever amount is left over after the down payment is paid must be paid off over time in the form of a mortgage.

Generally, a down payment is a percentage of the total cost being borrowed. It’s important to note that any down payment under 20% normally requires mortgage insurance. However, if you put down more than 20%, you don’t need insurance.

How Much Is a Normal Down Payment on a House?

One of the most important things to learn when you’re going through the process of buying a home and applying for a mortgage is that there’s no such thing as “normal,” especially when it comes to the down payment. How much you pay upfront when you purchase a home depends on several factors, and each homebuyer’s situation is likely to be different from the rest.

Although 20% is often considered the “gold standard” down payment amount, the actual average is much lower. Depending on a person’s home buying status, the average amount people put down is around 6%. People buying their first homes usually make smaller down payments than repeat homebuyers.

There are a few things to consider when deciding how much you can afford to put down or how much you should put down when buying a home. One factor is what you can afford. Another is the housing market in your area. When it’s a seller’s market, meaning there is more demand for houses than homes available, a higher down payment will make you stand out as a buyer. In a buyer’s market, when there are more homes than demand, you can probably make a lower down payment and still get a good value on your mortgage.

It’s also worth considering how your down payment will influence the cost of your mortgage or the type of loans available to you. Your down payment has a direct impact on your mortgage’s loan-to-value ratio (LTV) and private mortgage insurance.

What Is a Loan-To-Value Ratio?

The LTV is the amount of your mortgage compared to the appraised value of your home. Your lender uses LTV to determine their risk when issuing a mortgage. The lower the LTV, the lower the perceived risk to the lender. For example, if you were to make a 20% down payment when buying a home, the LTV would be 80%. If you put down 40%, the LTV would drop to 60%. On the flip side, if you put down 10%, the LTV is 90%.

LTV affects risks in a few ways. First, the lower the LTV, the less money the lender will lose if borrowers default on their mortgage. If someone buys a $300,000 home and puts down 20%, the mortgage principal will be $240,000. But if that same borrower makes a 10% down payment, the principal amount increases to $270,000.

A higher LTV can be risky for a lender because there is a higher chance the borrower will default on the loan in general. When people can put down a large amount upfront, they signal a lender that they’re serious about homeownership and the commitment involved. With a smaller down payment, a borrower could seem less serious about their purchase.

Lenders can do a few things to make up for higher LTVs and the perceived higher risks. Often, when LTV is above 80%, a lender will charge a borrower a higher interest rate. Borrowers who put down less than 20% also usually have to purchase private mortgage insurance, paying a monthly premium in addition to their mortgage and interest payment.

LTV is important when you first buy a home, and it plays a role throughout your time as a homeowner. As you pay down the mortgage, the LTV drops, bit by bit. An increase in your home’s value can push LTV down, which can be good news for you as a borrower.

For example, when you purchased your home, it was appraised at $300,000. You borrowed $270,000 for an LTV of 90%. A few years later, your home is reappraised and its value is $350,000. You’ve also paid off $20,000 of your loan, pushing your principal balance down to $250,000. The LTV has dropped to 71%, meaning you could remove any mortgage insurance premiums. If you refinance, you might get a better interest rate, too.

Ideally, the LTV will steadily decrease during your time as a homeowner. In a perfect world, the value of your home would go up while the principal on your mortgage drops. That doesn’t always happen, though. If the value of your home drops, the LTV goes up. For example, after a couple of years, the value of your $300,000 home has fallen to $250,000. If you’ve paid $20,000 on your $270,000 mortgage, your LTV would be 100% since the house’s value is the same as what you owe on the home loan.

Making a larger down payment can help keep your home from going “underwater,” meaning you end up owing more on it than the house is worth.

What Is Private Mortgage Insurance?

Lenders typically expect buyers who put down less than 20% to pay private mortgage insurance (PMI) premiums. PMI gives the lender an extra layer of protection. If the borrower defaults or stops making payments as agreed, the insurance company reimburses the lender for the missed payments.

PMI can seem like an unnecessary added expense for a homebuyer, but sometimes, it’s the best option. If you don’t have enough saved to put down 20%, choosing a mortgage with PMI premiums and a smaller down payment can help you become a homeowner sooner rather than later. Your monthly PMI payment depends on the size of your mortgage and how much you’ve put down. The smaller the down payment, the larger the PMI.

On conventional mortgages, PMI premiums aren’t permanent. The lender will automatically remove them from your mortgage once the LTV falls to 78%. You can also request that the PMI be removed once your LTV has dropped to 80%.

What Are Closing Costs?

The down payment isn’t the only thing you need to pay upfront when you buy a home. You also need to pay closing costs or fees to your lender for getting a mortgage. Depending on how much you’ve saved, closing costs can affect how much you can afford to put down.

If you’ve saved $50,000 and want to buy a $250,000 home, you can put down a full 20%. You can put down $50,000 minus whatever your closing costs are. The cost of closing varies from location to location but is usually in the neighborhood of 3% to 6% of the purchase price of the home. Your lender can give you an estimate of your closing costs when you apply for a loan, which can give you a better idea of how much home and down payment you can afford.

[download_section]

Pros and Cons of a 20% Down Payment

While you don’t always have to put 20% down, there are definite benefits. There are also some drawbacks to making a large down payment, depending on your financial situation. Take a closer look at the pluses and minuses of paying a lot upfront.

Pros of 20% Down

Some reasons to put down 20% include:

- No PMI payment: When you put down at least 20% upfront, you don’t have to pay PMI premiums, which can help you save money on your monthly payment.

- Possibly lower interest rate: Buyers who put down more upfront look less risky to lenders, meaning you may get a lower interest rate on your mortgage. Paying less in interest saves you money each month and in the long run.

- You’ll look better to lenders and sellers: In a competitive market, sellers will be extra picky when considering offers because they can afford to be. They’re more likely to consider offers with bigger down payments than those with smaller ones. Lenders might be more attracted to buyers with bigger down payments, too, and might compete with other lenders to get your business.

- You’ll borrow less: The more you put down, the less you end up borrowing. That means a lower monthly payment. It can also mean that you can take out a loan with a shorter term, such as a 15-year mortgage instead of a 30-year. You’ll pay the loan off more quickly and will end up paying less overall.

Cons of 20% Down

A few reasons to consider a smaller down payment include:

- It can take a while to save up 20%: Unless you find an amazing deal on a home, 20% of the average purchase price is a considerable sum of money. If you’re looking for homes in the $250,000 to $300,000 range, you’ll need to save between $50,000 and $60,000, plus closing costs. If you can comfortably save $400 per month, it would take you over 12 years to save up $60,000. By that time, your housing needs might have changed and the price of homes might have gone up even more.

- It can make you “cash poor”: Even houses that look good upon inspection tend to throw a few surprises at their new owners. You buy a house and a month later, the refrigerator breaks, or there’s a leak in the plumbing. It’s a good idea to have some cash leftover in savings to cover any unexpected home-related expenses. If you sink all of your money into a down payment, you won’t have enough left for emergencies.

- You can lose money if your home value drops: As a general rule, property values tend to increase over time. But there is a chance that the value of your home will fall. If you put 20% down and the value of your home drops by 30%, you’ve lost money. You’re also likely to see a smaller return on investment if you make a big down payment and your property value increases.

What if You Don’t Have a 20% Down Payment?

If you don’t have 20% to put down on your home purchase, don’t worry. You’re in the same boat as plenty of other homebuyers. Several home loan programs allow people to buy a home without putting a full 20% down.

Minimum Down Payment for a Conventional Loan

At the height of the housing boom in the early 21st century, borrowers could easily get conventional mortgages with small or no down payments. The housing crisis brought those days to a grinding halt, and for a while, 20% down was the way to go for a conventional loan.

But as time has marched on and the housing market has recovered, down payment requirements have become somewhat looser. As long as you meet the lender’s requirements for income, credit, and employment history, and you agree to pay PMI, you can take out a conventional mortgage with a 5% or 10% down payment.

If you don’t have 5% to put down, there is an option to get a conventional loan with 3% down, meaning the LTV is 97%. Mortgages with 97% LTVs typically have income limits for borrowers. They also require higher PMI premiums. Borrowers usually need to complete homebuyer education programs, too.

Minimum Down Payment for an FHA Loan

Another mortgage option for people who can’t put 20% down is the FHA loan program. The FHA mortgage program started in the 1930s to help more Americans afford homeownership. To facilitate buying a home, it allows people to put down 3.5%. People who have credit scores that would make it more challenging to get a conventional loan can often qualify for an FHA loan.

FHA loans allow for smaller down payments for a couple of reasons. First, they are guaranteed by the Federal Housing Administration, a government agency. If a borrower stops making payments on the mortgage, the FHA has the lender’s back.

Second, borrowers need to pay for mortgage insurance when they take out an FHA loan. They get charged a premium upfront at the time of closing and need to pay a monthly premium. Depending on when a borrower took out their FHA loan, the premium is usually for the life of the mortgage.

The mortgage insurance on an FHA loan makes it possible for someone who can’t afford a large down payment to buy a home today and makes the home more expensive in the long run. If you have the credit to qualify for a conventional loan, that might be a more affordable option than an FHA loan.

Can You Buy a House Without a Down Payment?

If you don’t have much money available to make a down payment on a home, you might still qualify for a mortgage. Some mortgage programs allow for financing of up to 100% of the home’s value. Whether buying a home without a down payment is a good idea or not depends on your financial circumstances and whether you qualify for a special mortgage program.

VA Loans

VA loans let active duty service members and veterans purchase homes without a down payment. To qualify for a VA loan, you need to obtain a certificate of eligibility that verifies that you meet the requirements.

Along with allowing people to buy a home with no money down, the VA loan program also makes homeownership more affordable. Unlike other loan programs, there is no mortgage insurance associated with a VA loan. Closing costs also tend to be lower for VA loans than other loan options. If a borrower is having trouble repaying their loan, the VA offers support and assistance.

Credit requirements can be looser for a VA loan than they are for conventional mortgages. You might qualify for a VA loan with a credit score as low as 620. Exact credit requirements vary from lender to lender, and the VA itself doesn’t set any minimums.

USDA Loans

If you’re interested in buying a home in a more rural area and meet certain income requirements, a USDA loan can be an option. Like VA loans, USDA loans allow for up to 100% financing. The loans come from private lenders but are backed by the U.S. Department of Agriculture. The goal of the USDA loan program is to help people who would otherwise have limited housing options find a clean and safe place to live.

USDA loans do charge a monthly mortgage insurance premium to borrowers. Like the FHA loan program, borrowers need to pay an upfront mortgage insurance premium and a monthly premium when they take out a USDA loan.

If a borrower has trouble repaying their USDA loan, the government agency can step in. The USDA guarantees 90% of the loan value, meaning it will reimburse the mortgage lender for any losses, up to 90% of the principal, if a borrower stops making payments.

Other Options

While government-sponsored loans are really the only 0% down options available today, there are other programs available to buyers who might have trouble coming up with a down payment. Your state or city might have first-time homebuyer programs that pay for a portion of your down payment. It’s worth looking around to see what options are available to you to make buying your home more feasible.

How Does a Down Payment on a House Work?

The down payment on your home affects your mortgage in several ways:

- How much you borrow: The bigger your down payment, usually the less you end up having to borrow, which can mean you can afford a shorter mortgage term.

- How much you pay monthly: The smaller your mortgage, the lower your monthly payments of principal and interest. You can have more wiggle room in your budget and might be able to save up for other financial goals.

- How much interest you pay: Bigger down payments equal lower risk in the eyes of lenders, which could mean a lower interest rate, too.

- How much home you can afford: If you have a hefty down payment saved, you might be able to afford a more expensive home than someone with a smaller down payment.

Apply for a Mortgage With Assurance Financial Today

When deciding how much to put down on your home, there’s no one right answer. A smaller down payment might be right for one homebuyer and a bigger down payment right for another. If you’re curious about your down payment options and want to learn more about the various mortgage options available, Assurance Financial can help. You can start your mortgage application with us online in just minutes. Apply today to get on the path toward homeownership.

Linked Sources:

- https://www.consumerfinance.gov/ask-cfpb/when-can-i-remove-private-mortgage-insurance-pmi-from-my-loan-en-202/

- https://assurancemortgage.com/conventional-loans/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/5-things-know-va-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/apply/