Category: Videos

In the U.S., most of the population lives in urban areas. But for some people, living in a rural or country area is more appealing. If you prefer rural living over city life, a program from the United States Department of Agriculture (USDA) can help you buy a home. Every year, the USDA uses its Rural Development program to invest about $20 billion in helping families across the United States buy and improve their homes. The program was created to boost rural economies and improve quality of life.

Below we’ve mapped out an overview of the USDA Rural Development Guaranteed Housing Loan Program, explaining how it works and if you’re eligible for loans.

Topics Covered

- What Is a USDA Loan?

- Types of USDA Loans

- Who Should Get a USDA Loan?

- Pros and Cons of a USDA Loan

- Who Qualifies for a USDA Loan?

- Other Mortgage Options

What Is a USDA Loan?

The USDA loan program is part of the department’s single-family housing program. It aims to encourage the purchase of homes in rural or suburban areas by making mortgages easier for borrowers to obtain. Compared to conventional loans and other types of government-guaranteed loans, USDA loans have lower down payment requirements and lower income requirements. The loans also have strict income and location requirements.

USDA loans fall into several categories, with some only available to borrowers with the lowest incomes. The loans can be directly from the USDA or offered by private lenders and guaranteed by the department. The USDA’s Rural Development program also offers grants to individuals who want to work on housing construction projects.

Although the goal of the USDA loan program is to make homeownership more available to a wider swath of buyers, there are certain requirements people need to meet before they are eligible for the loans. The USDA’s programs have income limits and often have credit score requirements.

USDA loans are sometimes known as Section 502 loans. The mortgages seek to provide very-low to moderate-income buyers with access to sanitary, decent and safe housing in eligible areas.

Types of USDA Loans

The USDA’s Single-Family Housing program includes several types of loans that are made directly to borrowers, in addition to grants and loans made to organizations that help lower-income individuals purchase or improve their homes. The loans and grants that are part of the program include:

1. Direct Loans

These mortgages are designed to suit low- to very-low-income applicants. The income threshold varies by region, and with subsidies, interest rates can be as low as 1%. Direct loans come from the USDA, not from a private lender.

To qualify for a direct loan, a borrower needs to:

- Have an income below the “low income” limit for their area.

- Be in need of safe and sanitary housing.

- Agree to live in the home as their primary residence.

- Be legally able to take on a loan.

- Be unable to get a mortgage through other means.

- Be a U.S. citizen or eligible non-citizen.

- Be allowed to participate in federal programs.

- Be able to repay the debt.

The house a person buys with a direct USDA loan needs to meet several requirements, too. As of 2021, it needs to be less than 2,000 square feet and should be situated in a rural area with a population under 35,000. The value of the house needs to be less than the loan limit for the area. It can’t be used for income-producing activities and can’t have an in-ground pool.

Borrowers who get payment assistance can end up with rates as low as 1%. The USDA allows people to get direct loans with 100% financing, meaning they don’t have to make a down payment. Although the repayment period is typically 33 years, there is an option to extend it to 38 years based on a borrower’s income eligibility.

Since loans in the direct loan program come straight from the USDA, people who are eligible and interested in applying for one should apply directly through their local Rural Development office. The loan program is open year-round.

2. Guaranteed Loans

While direct loans come from the USDA itself, guaranteed loans come from private lenders. The loans are backed by the USDA, meaning that it will step in and pay if the borrower defaults on the loan. The lending requirements for a guaranteed USDA loan are slightly looser than the requirements for a direct loan.

Borrowers need to be U.S. citizens or eligible non-citizens. They need to meet income requirements, but the maximum income allowed is higher than for the direct loan program. Eligible borrowers need to earn no more than 115% of the median income in their area. As with the direct loan program, people who get a guaranteed USDA loan need to live in the home as their primary residence.

Location requirements are a little looser for the guaranteed loan program, as well. The location should be a rural area, but some suburban areas also qualify. Potential borrowers can put their address into the USDA’s eligibility website to verify that it qualifies for a mortgage.

People who get a guaranteed loan from the USDA can get 100% financing, meaning no down payment is needed. The USDA will guarantee up to 90% of the loan amount. People can use the loans to buy, build or rehab a qualifying home.

3. Home Improvement Loans and Grants

The USDA loan program also includes loans and grants that help homeowners modernize, improve or repair their homes and grants that help older homeowners pay to remove safety and health hazards from their homes. Eligible homeowners need to earn less than 50% of the median income for their area.

As of 2021, the maximum loan amount is $20,000 and the maximum grant amount is $7,500. Homeowners who qualify for both a grant and a loan can combine them, receiving a maximum of $27,500. People who receive a USDA home improvement loan have 20 years to repay it. While the grants usually don’t need to be repaid, if a homeowner sells their property within three years of getting the grant, they will have to pay it back.

Both grants and home improvement loans come directly from the USDA, and availability can vary based on area and time of year. Eligible individuals can apply for a loan, grant or both at their local Rural Development office.

4. Rural Housing Site Loans

While direct and guaranteed USDA loans are available to individual borrowers, the department also has loan programs for organizations that provide housing to low-income or moderate-income homebuyers. Eligible organizations include nonprofits and federally recognized tribes. The loans have term limits of two years and either charge a 3% interest rate or a below-market rate, depending on the loan type.

5. Mutual Self-Help Housing Technical Assistance Grants

USDA technical assistance grants are given to nonprofits or federally recognized tribes that help very-low and low-income individuals build their own homes. The homes need to be located in eligible areas and the people who will live in the homes need to perform most of the labor of building the houses, with some assistance from the organization. The grant money can be used to help recruit people to the program and to provide supervisory assistance to families, but it can’t be used to fund the actual construction of the home.

Who Should Get a USDA Loan?

When you’re buying a house, you have a lot of decisions to make, such as the location of your new home, its size and its amenities. You also need to choose the type of mortgage you get. Whether a USDA loan is right for you or not depends on a few factors.

The loans are designed to encourage people to buy homes in rural areas. But the USDA’s definition of a rural area, at least for its guaranteed loan program, might be much broader than you think it is. Often, homes in suburban areas qualify for USDA loans. The only areas that are fully excluded are metropolitan or urban ones, so if you know you definitely want to buy in a city, the USDA loan program may be off the table for you.

Your income can also determine whether or not the USDA loan program is right for you. Buyers need to meet income limits, so as long as you qualify as a very low to moderate-income earner in your area, you may be eligible.

It can also be worth determining what other loans you qualify for, if any. Usually, USDA loan borrowers can’t get financing through other means, such as a conventional mortgage or FHA loan. If that describes you, it may be worthwhile to seriously consider a USDA loan.

Apply Now

Pros and Cons of a USDA Loan

While there are many benefits to a USDA home loan for the right applicant, these mortgages aren’t for all borrowers. Let’s take a closer look at the advantages and drawbacks of the loan program:

Pros of a USDA Loan

Some of the benefits of getting a USDA loan include:

- 100% financing available: Saving up for a down payment can be difficult, especially if a potential homebuyer earns just above or below the median income in their area. USDA loans let people get mortgages without putting any money down. The loans don’t have private mortgage insurance requirements, which can help buyers save more. Since the USDA guarantees 90% of the loan note, the risk to lenders is reduced.

- Open to very-low and low-income borrowers: Qualified borrowers need to earn 115% or less of the median income in their area to get a guaranteed USDA loan. The income limits for direct loans and home improvement loans and grants are even lower. The loans make it possible for people to buy a home who may otherwise struggle to get approved for a loan.

- Open to borrowers who can’t get other loans: In addition to opening up mortgages to people who don’t have high enough incomes, the USDA loan program makes it possible for borrowers who aren’t eligible for conventional or other types of home loans to buy a home. The loan program removes barriers such as down payments from the process.

- Fixed-rate interest: The interest rate on a guaranteed USDA loan is fixed for the life of the loan. The fixed-rate offers stability to borrowers.

- Long repayment period: USDA direct loans allow people 33 or 38 years to repay their mortgages. The 38-year term helps to ensure low-enough monthly payments for very low-income borrowers. Loans the USDA guarantees have a 30-year repayment term.

Cons of a USDA Loan

Some potential drawbacks of a USDA loan include:

- Restrictions on the location: USDA loans aren’t for people who want to live in cities or highly developed areas. The loans are exclusively for purchasing a home in rural or certain suburban areas. While the loans can’t buy homes in places like San Francisco, Philadelphia or New York City, the total area that does qualify for a USDA loan is likely larger than you think.

- Restrictions on housing type: USDA loans need to pay for a single-family residence. The direct loan program has more restrictions than the guaranteed loan program. Homes purchased with a direct loan need to be “modest in size” and can’t have in-ground pools. For both types of loans, the borrower needs to live in the house they buy.

- Loan limits may apply: Limits for a USDA loan are typically based on a borrower’s income and how much they can repay. For direct loans, the price of the home needs to be below the limit set for the area. The limit is often about $285,000but can be more in areas with a higher cost of living.

[download_section]

Who Qualifies for a USDA Loan?

Income limits to qualify vary by region and size of household. Consult the USDA map and table to find specific requirements for your location. The loan program only funds owner-occupied primary residences. You must be a U.S. citizen and have a dependable income to qualify.

Other qualifications include making a monthly payment that is 29% or less of your monthly income and good credit history. Metropolitan areas are excluded from the program. However, some suburban areas may qualify. Also note that you don’t have to be buying your first home to get a USDA loan.

Income Qualifications

You’ll need to provide proof of income to qualify for a guaranteed USDA loan. If you’re self-employed or work as a seasonal employee, you need to provide two years of income records. People who have full-time or part-time, year-round employment only need to provide proof of income for one year. The income limit varies based on your location and how many people live in your home.

Asset Qualifications

Since the USDA loan programs don’t require a down payment, you don’t have to show proof of assets like you would when applying for a conventional loan. You won’t have to verify that you have a down payment or that you have a sufficient amount of cash reserves when you apply for the loan.

Credit Qualifications

The USDA doesn’t outline specific credit qualifications for the guaranteed or direct loan programs. People applying for a direct loan will have to demonstrate the ability to repay what they borrow, which can be based on their assets, income and other existing debt.

People applying for a guaranteed USDA loan also need to demonstrate an ability to repay the loan. The individual lender might also require a certain credit score, but the USDA doesn’t outline any credit requirements.

In some cases, borrowers who don’t have traditional credit might be able to use alternative forms of credit to demonstrate their creditworthiness and ability to repay to a lender. Non-traditional credit options might include rental payment history, auto insurance payment history or utility bill payment history. If you’re considering applying for a USDA loan, your lender can provide you with more specific details about credit requirements.

Debt-To-Income Ratio

To keep people from borrowing more than they can comfortably afford to pay back, the USDA loan program has recommended monthly payment and debt-to-income limits for borrowers. If you get a USDA loan, the total amount of your housing payment shouldn’t be more than 29% of your income before taxes. For example, if you earn $2,000 per month, your housing payment should be no more than $600. Your housing payment is more than just the principal and interest on the mortgage. It also includes:

- Homeowners insurance

- Property taxes

- Homeowners association fees or dues

- Rural Development annual fee

Your total debt-to-income ratio needs to be low, less than 41%, to qualify for a USDA loan. Your total monthly debt might include:

- Student loan debt

- Credit card debt

- Car debt

If you earn $2,000 per month, no more than $820 of that should go toward debt payments, which includes your housing payments and any other loans you have.

Other Mortgage Options

For borrowers who meet income requirements and who want to buy in an eligible rural or suburban area, a guaranteed or direct USDA loan can be a great deal. It lets you become a homeowner without having to save up a hefty down payment and without having to have a high income.

It could be that you’re not eligible for a USDA loan due to your income or where you want to live. In that case, you still have plenty of options available:

- Conventional mortgage: You do have to make a down payment with a conventional mortgage, usually between 3% and 20%. If you put down less than 20%, you also have to pay private mortgage insurance premiums. Conventional mortgages tend to have stricter lending requirements than other options, meaning you typically need to have a very good or excellent credit score to get approved and to get the best rates.

- FHA loan: An FHA loan is another type of government-backed mortgage. It’s designed to help people with smaller down payments and less-good credit buy a home. You can put down between 3.5% and 10% to get an FHA loan, and you’ll need to pay mortgage insurance for the duration of the loan.

- VA loan: Like USDA loans, VA loansoffer 100% financing, meaning no down payment is needed. The loans are backed by Veterans Affairs and are only available to former or current members of the armed services and their widows.

Choosing the right mortgage is as important as choosing the right home. The right lender can help you weigh the pros and cons of each mortgage option so you choose the one that works best for you.

Apply for a USDA Loan With Assurance Financial Today

Does a guaranteed USDA loan seem like the right choice for you? Start your application with Assurance Financial today. Our online application streamlines the paperwork process, so there’s no need to scramble to find the right documents. Get started today!

Linked Sources:

- https://www.rd.usda.gov/programs-services/single-family-housing-direct-home-loans

- https://www.rd.usda.gov/programs-services/single-family-housing-guaranteed-loan-program

- https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfp

- https://www.rd.usda.gov/programs-services/single-family-housing-repair-loans-grants

- https://www.rd.usda.gov/programs-services/rural-housing-site-loans

- https://www.rd.usda.gov/files/RD-SFHAreaLoanLimitMap.pdf

- https://assurancemortgage.com/conventional-loans/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/apply/

When you own your home, you can feel a sense of stability and security. You have a roof over your head and a place to raise a family if you choose to do so. You also get full control over how you decorate the home and any changes you make to it.

There’s another benefit to homeownership, and that’s the chance to build equity in your home. Many homeowners look at their property as an investment. If you live in the house for long enough and make enough payments on the mortgage, at some point, your property will be worth more than you paid for it. Another way that a home acts as an investment is through equity. The more equity you have in your home, the more homeowner advantages you can enjoy. Learn more about the value of building home equity and what you can do to maximize it.

Table of Contents

- What is Equity?

- Why is Building Equity Important?

- How to Build Equity in Your Home

- Work With Assurance Financial

What Is Equity?

Home equity is simply the difference between your home’s value and the amount you owe on the mortgage. If you own your home free and clear, your equity is the same as the property’s value. Here’s a quick example of how equity works. Suppose your home’s market value is $300,000. You have a mortgage on the home and still have $220,000 left to pay on it. In this example, the equity in your home is $80,000, or $300,000 minus $220,000.

For many homeowners, equity increases the longer they own their homes. As you make payments on your mortgage, the principal on the loan decreases. Meanwhile, the share of your equity grows.

Although equity usually goes up, it can drop. For example, perhaps you bought a home worth $300,000 and took out a $250,000 mortgage to do so. At the time of closing, your equity in the home was $50,000. Then, a recession happened and the value of homes in your area dropped. Your home now has a market value of $250,000 and you have $225,000 left on your mortgage. Even though you’ve paid off some of your loan principal, since the value of the property has fallen, you now only have $25,000 in home equity.

Why Is Building Equity in a Home Important?

Building equity in your home helps you establish financial freedom and flexibility. The greater your home equity, the better you may be able to weather financial hardships that come your way. Once you establish some equity in your home, you can use the cash value of the equity when necessary. There are two ways to tap into your home’s equity.

One option is to apply for a home equity loan. Just as your mortgage uses your home as collateral, so does a home equity loan. Usually, you can borrow up to 85% of the full amount of equity you have in your home. If your equity is $50,000, your home equity loan can be up to $42,500.

You can use the funds from the loan for pretty much any purpose. Some people use the loan to cover the cost of a home improvement project, while others use the loan to help pay for their children’s college education. Typically, you repay the loan in installments, making monthly payments until you’ve repaid it in full, plus interest. The amount of interest you pay depends on the market conditions, your credit score and how much you borrow.

The other way to tap into your home’s equity is with a home equity line of credit (HELOC). A HELOC is similar to a credit card. You have a credit limit and can borrow up to that limit. Once you repay the amount you’ve borrowed, you can borrow more, provided you’re still in the draw period.

The more equity you have in your home, the bigger your financial cushion if you need to borrow against it. It’s important not to go overboard when borrowing against your home’s equity. If you have difficulty repaying your home equity loan or HELOC, you do risk losing your home, just as you would if you can’t make payments on your original mortgage.

Even if you don’t plan on borrowing against your home, equity matters. If you’re planning to sell the property in the near future, the larger your equity, the more cash you’ll walk away from the closing table with. Having a lot of equity in your current home can mean you have more to put down on your next home. It can also help you afford a more expensive house the next time you are in the market.

How to Build Equity in Your Home

The less you owe on your mortgage, the more equity you likely have in your home. Several factors can influence the amount of equity you have, including the value of your home and the size of your home loan. While you can’t take control of the market, you can do several things to help build equity in your home:

1. Make a Large Down Payment

Although there are many programs that make it possible to get a home loan without putting down a hefty down payment, if you’re interested in building home equity right off the bat, one of the best things to do is make a large down payment.

Let’s say you’re interested in purchasing a home worth $250,000 and you’re trying to decide how much to put down. If you made a down payment of 5%, or $12,500, you would have equity of $12,500 from the start. You’d also have to make private mortgage insurance payments on the loan until you’d paid off 20% of its value.

Your equity would jump to $25,000 if you made a down payment of 10%, and your monthly private mortgage insurance payments would drop. If you can afford a 20% down payment, your equity in the home would be $50,000 from the beginning. You also wouldn’t have to make any private mortgage insurance payments, and your monthly mortgage would be notably smaller than if you put down 10% or 5%.

When deciding if it’s worth it to make a big down payment or not, there are some things to consider aside from home equity. One factor is how long it will take you to save up your down payment. If home values in your area are increasing rapidly and you have enough to put down 5% or 10%, it can make sense to buy now, even though you don’t have a full 20% down payment. By the time you saved enough to put down 20% on a $250,000 home, a property once worth $250,000 might be selling for $300,000 or more in a competitive market.

Another thing to consider is how making a larger down payment will affect your savings. It’s a good idea to have extra money set aside after you buy a house to cover unexpected repairs or to make improvements. If a big down payment will drain your savings, it may be better to save some money for a rainy day, so you don’t have to borrow additional money to pay for home-related expenses.

When buying a home, the amount people put down typically depends on their status as homebuyers. First-time buyers put down a median of 6%, while repeat buyers pay a median of 16% down.

2. Make Larger Mortgage Payments

If making a big down payment upfront doesn’t work for your budget or would put homeownership years out of reach, another way to build equity relatively quickly is to boost the size of your mortgage payments. When you closed on your home, you likely got a copy of the amortization schedule, which detailed how your mortgage payments will break down over the term of your loan, provided you made the same payment each time.

When you make a bigger-than-required mortgage payment, that schedule is completely updated, as you’ll be reducing the size of your principal and speeding up the repayment process. You’ll also be building equity in your home by reducing your debt obligation. Even paying an extra $100 per month reduces your mortgage amount, improving your equity.

You have a few options when it comes to boosting your mortgage payments. One option is to increase the amount you put towards the principal each month. Many mortgage providers give you the option of paying extra towards the principal when you schedule your monthly payment. You can choose to pay an additional $100, $500 or more each month, based on your budget.

Another way to make bigger mortgage payments is to pay more often. If you pay half of your monthly mortgage payment every other week, you’ll end up making one extra monthly mortgage payment per year.

You can also decide to make a lump sum, additional payment to your mortgage when you can. For example, if you get a hefty tax refund, you might decide to apply some or all of it toward your mortgage. If you inherit money, you can put it toward your mortgage, reducing the size of your principal and boosting your home equity.

3. Improve Your Property

Bringing down your mortgage principal is one way to raise your home equity. The second option is to increase the value of your property. The good news is that there are things you can do to improve your property and its value. Here’s how to build home equity with home improvements:

- Update the kitchen or bathrooms: Kitchens and baths tend to be the rooms that really sell homes. The better and more desirable your home’s kitchen and bathrooms are, the more you can ask for when selling it and the higher the property’s value. A minor, mid-range kitchen remodel might boost the value of your home by $18,206 and allow you to recoup about 78% of the cost of the remodel.

- Add curb appeal: Improving your home’s curb appeal can increase its value by about 7%. Think of it this way, more buyers will be interested in a property that looks attractive and inviting from the outside than in a property that looks like it’s in need of some TLC. Boosting curb appeal doesn’t have to cost a lot, either. Adding a few planters, repainting the porch and door and making sure the lawn is trimmed and trash is picked up can go a long way.

- Improve the doors: Although people often focus on the aesthetics of the home when they think about value, the bones of a home matter, too. In fact, a home with good bones and practical upgrades is often worth more than a house that doesn’t have those features. Replacing older front doors and garage doors with high-quality, more efficient options is going to raise the value of your home. When choosing replacement doors, think of efficiency and how well they seal the home to keep warm or cool air from escaping. You also want to consider security to enhance people’s feelings of safety when they are on the property.

- Fix the roof: Roofs can be expensive, and buyers are drawn to a home that has a new roof compared to a property with an old one that they might have to replace themselves. How much it may cost to replace your roof can vary based on the materials, but you can typically expect the project to boost the value of your home anywhere from $16,000 to $24,000. Many homeowners recoup about 60% to 66% of the project’s cost when they sell the property.

- Add on to the home: Size matters when it comes to home value. A three or four-bedroom home is going to be worth more than a two-bedroom home. If you have space and the budget, it can make sense to add on to the property. Building an addition can also be a good option if your family size is growing and you’re not ready to sell your home and move.

- Make energy upgrades: A home that’s energy-efficient is more attractive than one that has high utility bills. Energy-efficient homes tend to be more comfortable, even in extreme weather, than non-efficient homes. People are willing to pay more for a house with Energy Star rated appliances, low utility bills and improved comfort. Some efficient upgrades you can make include improving the HVAC system or furnace, installing better windows and replacing older appliances with more efficient models.

- Make the home safe and smart:Smart home technology streamlines people’s lives and can make your home more attractive and valuable. Installing a smart thermostat, smart lights and smart door locks are just a few of the technological updates you can make to improve your home’s value. Safety is another thing to consider. Make sure the home has working smoke alarms and carbon monoxide detectors. Most states require alarms and detectors for a home to be up-to-code.

[download_section]

4. Refinance Your Home Loan

When you first bought your home, you might have taken out a 30-year mortgage. If you’re interested in building home equity more quickly, it can make sense to refinance your loan to a 15-year mortgage. There are some key differences between the two types of loans:

- Time: You’ll repay a 15-year loan in half the time it takes to pay off a 30-year loan. That means you’ll own your home outright much sooner.

- Interest:Usually, 15-year mortgages have lower interest rates than 30-year loans because lenders view them as less risky. A lower interest rate means you pay more toward your loan principal each month, which also helps you build equity more quickly.

- Payment size:You pay more toward a 15-year mortgage each month than to a 30-year loan simply because you’re paying the loan off more quickly. A bigger principal payment means equity builds more quickly.

Depending on what interest rates were like when you applied for your mortgage the first time, you might get a better rate on a 15-year loan, reducing your monthly costs. Also, if you initially had private mortgage insurance on your loan, refinancing can mean that you no longer have to pay it. If the value of your property has increased enough and you’ve paid down enough of your first mortgage, you might have equity of 20% or more in your home when it’s time to refinance.

Before you decide to refinance your mortgage, it helps to crunch the numbers to make sure that doing so will benefit you in the long run. You’ll have to pay closing costs on the loan, which means more money upfront. You also want to make sure you can afford the higher monthly payment on the loan before you can commit to it.

If you’re unsure about committing to a higher monthly payment but can afford to make bigger mortgage payments at the moment, one option is to make payments as if you had a 15-year loan rather than a 30-year loan. You’ll pay down your principal, building equity in the home, but you will also have the option of going back to your standard monthly payments if you lose a job or have a reduction in your income.

5. Let Your Property Value Rise

You might know people who bought homes or apartments decades ago for prices that seem impossibly low today. For example, someone might have bought an apartment on the Upper West Side of Manhattan for $100,000 in the 1970s. Today, that same property is likely worth millions. Although home values can dip during recessions or periods of economic instability, for the most part, they trend upward. If you buy a house today, it’s likely to have a higher value in five or 10 years. Depending on the heat of the market, your home’s value can rise sharply after just a few years.

If you don’t have immediate plans to sell and don’t need to move right away, it makes sense to stay put in your home and let the market take its course. As long as you keep paying down the mortgage and the economy keeps growing, you’re going to see your home’s equity increase.

Interested in Refinancing Your Mortgage? Work With Assurance Financial

Refinancing your home loan lets you take advantage of lower interest rates and helps you build equity sooner. Assurance Financials’ team of licensed loan officers are here to help you through the refinancing process and can help you see if it’s the right option for you. Start your application today or find a loan officer near you.

Sources:

Linked:

- https://assurancemortgage.com/what-is-a-mortgage-payment/

- https://www.consumer.ftc.gov/articles/0227-home-equity-loans-and-credit-lines

- https://www.nar.realtor/sites/default/files/documents/2020-downpayment-expectations-and-hurdles-to-homeownership-report-04-16-2020.pdf

- https://www.remodeling.hw.net/cost-vs-value/2020/

- https://magazine.realtor/daily-news/2020/01/27/how-much-does-curb-appeal-affect-home-value

- https://assurancemortgage.com/is-refinancing-a-bad-idea/

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/find-a-loan-officer/

Not Linked:

- https://www.nerdwallet.com/article/mortgages/6-ways-to-build-your-home-equity

- https://www.nerdwallet.com/article/mortgages/how-to-increase-home-value

- https://www.nerdwallet.com/article/mortgages/home-equity-explained-matters

- https://www.investopedia.com/articles/personal-finance/042015/comparison-30year-vs-15year-mortgage.asp

- https://www.nerdwallet.com/article/mortgages/not-just-higher-interest-rates-affecting-mortgage-refinance-possibilities

- https://firsthome.com/5-tips-for-building-equity-in-your-home/

- https://www.homelight.com/blog/what-makes-property-value-increase/

- https://www.bankrate.com/home-equity/how-to-build-equity-in-your-home/

- https://www.thebalance.com/build-equity-315654

When you’re in the process of shopping for a home and a mortgage, you’re likely to encounter what looks like alphabet soup. All those letters and mortgage statement abbreviations can make your head spin. Once you know what mortgage term abbreviations and acronyms stand for, you can navigate the process with ease. Check out some of the most commonly used acronyms, what they represent and where you’re most likely to see them.

Mortgage Term Abbreviations to Know

Do you know your APR from your PITI? Here’s a key to decipher commonly used mortgage and underwriting acronyms.

1. ACH (Automated Clearing House)

You have an ACH or an automated clearing house to thank for the ability to send payments electronically. Instead of writing a check to put down your earnest money, you can send it to your real estate agent using an ACH.

Even if you’re a first-time homebuyer, you’ve probably encountered an ACH before in your life. If your employer pays you via direct deposit instead of a check, you’re getting your money through an ACH. If you pay your utility bills or smartphone bill online through your bank account, you’re using an ACH.

2. AMI (Area Median Income)

Some types of home loans have AMI or area median income requirements. To qualify for those types of mortgages, your income needs to fall below a certain threshold. For example, the Home Possible® mortgage requires an income below 80% of the AMI in a particular census trace. Loans with an AMI limit are typically designed to help people who would otherwise not qualify for a mortgage to purchase a home.

3. APR (Annual Percentage Rate)

The annual percentage rate or APR is the interest rate on a mortgage expressed as a yearly rate. One way to understand APR is the cost of borrowing money. APR includes the interest rate charged on the mortgage, as well as the cost of fees, such as origination fees and broker’s fees.

You use a mathematical formula to determine the APR on a mortgage. First, you add the amount of interest you’ll pay over the loan term and any fees charged. You divide that sum by the total mortgage amount. Then, you divide that by the number of days in the loan term. Next, multiply the result by 365, then multiply that result by 100 to get the APR percentage. The lower the APR, the more affordable the mortgage is and the less you’ll pay over the life of the loan.

4. ARM (Adjustable-Rate Mortgage)

The interest rate you pay on your home can change at certain points during the life of the loan. If you have a mortgage with a rate that changes, you have an adjustable-rate mortgage or ARM. When your rate changes depends on the type of ARM you have. For example, a 5/1 ARM has an introductory rate that is valid for five years. After the fifth year, the rate can change based on market conditions. From then on, the rate will adjust every year.

An ARM can be appealing if interest rates are high and might drop in the future. When interest rates are low, there is a chance the rate on an ARM will increase over time, increasing the cost of the mortgage.

5. ATR (Ability to Repay)

No one wants to take out a mortgage that will be difficult to pay back. A lender particularly doesn’t want to lend more than a borrower can repay, as the lender risks losing a significant sum of money. Lenders use the ability to repay or ATR rule to determine whether a borrower can repay their mortgage.

To calculate ATR, a lender looks at a borrower’s assets, income, monthly costs, employment history and credit history. To abide by the ATR rule, a lender needs to make a good faith and reasonable determination. They also can’t use a teaser or introductory rate to determine a borrower’s ATR.

6. CD (Closing Disclosure)

When you’re about to close on your home, your lender will give you the CD or closing disclosure. The CD is a five-page document listing all the details and costs of your mortgage. It will have your name, the details of your loan, a list of loan costs, a list of taxes and other costs and loan disclosures. The CD also tells you how much cash you need to bring to closing and lists all the transactions that have taken place, such as any credits from the seller.

7. C to P (Construction to Permanent Loan)

If you are building your home, you typically need to first take out a construction loan, not a traditional mortgage, to fund the cost of building the house. A construction loan is typically a short-term loan that only pays for the cost of building a house. Once the home is built, you take out a separate mortgage on the property, using the new home as collateral. A construction to permanent loan or C to P turns into a standard mortgage once construction is completed.

Another name for a C to P is a single-close loan. You may also see this acronym written as C2P, C/P or C-to-P.

8. DTI (Debt-to-Income)

The acronym “DTI” refers to your debt-to-income ratio and compares the amount of debt you have to your monthly income. If you earn $5,000 per month and have $2,500 worth of loan payments each month, your DTI is 50%. DTI is one of the factors lenders use to calculate your ability to repay your mortgage. If DTI is high, a lender might be hesitant to approve you for a mortgage. Generally speaking, the lower your DTI, the better. Usually, the upper DTI limit for a qualified mortgage is 43%.

9. ECOA (Equal Credit Opportunity Act)

Thanks to the Equal Credit Opportunity Act or ECOA, you can’t be refused a mortgage on the basis of your sex, age, marital status, race, religious beliefs, color, national origin or need for public assistance.

The ECOA also prevents lenders from offering you different loan terms based on the previously mentioned factors. For example, a lender can’t give you a lower interest rate because you are a woman or increase your rate because you are over 50 years old. The ECOA also prevents lenders from asking about your plans for having children or not.

10. EMD (Earnest Money Deposit)

You’ve found the house that’s the “one,” you made an offer and it was accepted. To show the seller you’re serious about the purchase, you need to put down earnest money. An earnest money deposit or EMD is a percentage of the home’s sale price, usually about 1 to 3%. If all goes well with the process, the EMD is applied to the final price of the home.

If the house doesn’t pass inspection or the sale doesn’t go through due to an allowable contingency, the buyer gets the EMD back. But if the buyer cancels the sale or backs out for another reason, the seller gets to keep the EMD. In any case, the EMD is held in an escrow account until the sale is finalized.

[download_section]

11. FAIR (Fair Access to Insurance Requirement)

A Fair Access to Insurance Requirement (FAIR) Plan is a type of insurance policy designed to provide coverage to homeowners whose property is considered high risk. FAIR is a state-mandated program and usually costs more than a private insurance policy. For some homeowners, a FAIR Plan is their only option.

With a FAIR Plan, multiple insurance providers offer coverage, spreading the risk out in case something happens in the home. How much coverage you get with the plan depends on your state. Note that not every state offers access to FAIR Plans.

12. FHA (Federal Housing Administration)

The Federal Housing Administration or FHA offers mortgage insurance protection on FHA loans. The FHA is a government agency and is part of the U.S. Department of Housing and Urban Development (HUD). It’s a self-funded agency, generating income from the mortgage insurance it offers. Since the agency was created in 1934, it has provided insurance protection for more than 46 million home loans.

FHA loans make it possible for buyers who otherwise wouldn’t qualify for a mortgage to purchase a home. Mortgages made under the FHA program come from private lenders but have the agency’s guarantee in case the borrower defaults.

APPLY TODAY13. FICO (Fair Isaac Corporation)

When a lender pulls your credit score, you might hear them mention your FICO score. FICO stands for Fair Isaac Corporation, an analytics company that developed the formula used to calculate FICO scores. Although there are other types of credit scores available, FICO claims to be the most widely used. Your FICO score provides a lender with an idea of your borrowing history and how likely you are to repay your loan.

14. FMV (Fair Market Value)

A home’s fair market value or FMV is the price it would sell for under normal conditions. FMV isn’t necessarily the sale price of a home, as other conditions can affect its final price. For example, if the house is in an in-demand area, a bidding war might push its final price above the FMV.

Municipalities often use FMV to determine the tax rate on a home. A home with a high FMV will have higher property taxes than one with a lower FMV.

15. FRM (Fixed-Rate Mortgage)

A fixed-rate mortgage or FRM is the inverse of an ARM. The interest rate on an ARM can change on a particular schedule depending on current rates. But the interest rate on an FRM will be the same throughout the loan’s term.

With an FRM, your mortgage payment will remain constant for the life of your loan. If you happen to apply for your mortgage when rates are low, you won’t have to worry about the interest rate increasing as time goes on. You also have predictable payments throughout the duration of your loan.

16. FSBO (For Sale by Owner)

While many sellers choose to work with a real estate agent when listing and selling their property, some prefer to do things on their own. With a for sale by owner or FSBO property, the seller assumes all responsibility for the transaction. Not working with a real estate agent means they don’t have to pay the agent’s commission, but they could also potentially price their home too low or make a mistake with the paperwork.

17. GFE (Good Faith Estimate)

A lender provides a borrower who is taking out a reverse mortgage with a good faith estimate or GFE. The goal of a GFE is to help borrowers understand the cost of the reverse mortgage and let them compare mortgage offers.

18. HELOC (Home Equity Line of Credit)

Home equity is the difference between the amount a person owes on their mortgage and the value of their home. If a person has positive equity and needs cash for a renovation project or other reason, they can open a home equity line of credit or HELOC and borrow against their equity.

A HELOC is similar to a credit card. There’s a limit, usually no more than 80% of the equity in the home. A person can borrow up to the limit, then repay the loan and borrow more. HELOCs typically have a draw period, during which you can borrow against the property, and a repayment period.

19. HOA (Homeowners Association)

Some properties, such as condos and homes in subdivisions, have a homeowners association or HOA attached to them. When you buy a property with an HOA, you automatically become an HOA member once you close on the home.

HOAs set rules for each property and conditions homeowners need to meet. For example, an HOA might require homeowners to complete certain maintenance tasks annually or might dictate what color the exterior walls of a house can be. Usually, when you buy a property with an HOA, you need to pay an HOA fee, usually monthly.

20. HUD (Housing and Urban Development)

The U.S. Department of Housing and Urban Development or HUD is a cabinet that’s part of the executive branch of the U.S. government. President Johnson created HUD in 1965 as part of the “War on Poverty.” HUD aims to enforce housing laws and address the country’s housing needs. Its programs include the FHA mortgage insurance program, subsidized housing for low-income individuals and families and Section 8 rental vouchers.

21. LE (Loan Estimate)

When you apply for a mortgage, a lender will provide you with a three-page loan estimate or LE. The lender needs to provide you with an LE within three days of getting your application. An LE gives you useful information, including the details of the monthly payment amount, the interest rate and anticipated closing costs. It’s not a final document but can provide you with a general idea of whether you can afford a mortgage at the moment.

22. LT (Loan Term)

The loan term or LT is the length of time you have to pay back a loan. For mortgages, loan terms can be anywhere from five years to 30 years. The longer the LT, the smaller the monthly payment, but the more you end up paying in interest over the life of the loan. Loans with shorter terms also usually have lower interest rates than longer-term loans.

Loan terms can also refer to conditions in your mortgage about borrowing money. Terms can include details like interest rates, penalty fees or special conditions.

23. LTV (Loan-to-Value)

The loan-to-value ratio or LTV compares the principal of a loan to the value of a home. The higher the LTV, the higher the risk for a lender.

For example, if your home’s value is $300,000 and your mortgage is $270,000, you have an LTV of 90%, which a lender might view as a risky loan. In contrast, if your mortgage is $150,000 on a house worth $300,000, your LTV falls to 50%. You can reduce your LTV by making a bigger down payment when you buy a house. With a larger down payment, you are more likely to get a lower interest rate and may not have to pay mortgage insurance.

24. MIP (Mortgage Insurance Premium)

If you take out an FHA loan, you’ll have to pay a mortgage insurance premium or MIP on top of your principal and interest payments. You’ll need to make an upfront MIP payment and will also have an annual MIP, which is broken up into 12 monthly payments. The annual MIP is for the life of the loan.

Don’t confuse MIP with the acronym “PMI,” or private mortgage insurance. Only FHA loans have MIP.

25. PITI (Principal, Interest, Taxes and Insurance)

When you take out a mortgage, your monthly payment will include more than just the principal payment on the loan and any interest due. You’ll also have to pay property taxes and homeowners insurance premiums. In the mortgage world, these terms are bundled together as principal, interest, taxes and insurance or PITI for short.

Knowing the PITI on your mortgage gives you a good idea of whether you can afford the monthly payments or not. A mortgage’s principal and interest may be $1,000 per month, which might work with your income. But if you add the taxes and insurance due, the total PITI might be $1,500, which could be more of a stretch.

26. PMI (Private Mortgage Insurance)

You can take out a conventional mortgage with a down payment of less than 20%. When you put down less than 20%, you’ll most likely need to pay a private mortgage insurance or PMI premium. PMI offers the lender some protection in case you default on the home loan.

PMI and MIP aren’t the same, although they are similar. When you have a conventional loan with PMI, you can remove the mortgage insurance after your LTV reaches 80%, which would be the equivalent of you putting down 20%. If your home value increases quickly, you might be able to refinance your mortgage to remove the PMI sooner than anticipated.

27. QM (Qualified Mortgage)

A qualified mortgage or QM meets certain requirements and is generally considered a stable, lower-risk loan. A key feature of a QM is that the borrower has the ability to repay the loan. When issuing a QM, the lender must make sure the borrower’s DTI isn’t more than 43%. QMs can’t have interest-only payments or allow for negative amortization, meaning the value of the principal can’t increase over time.

28. RD (Rural Development) Loan

A United States Department of Agriculture (USDA) RD loan is designed to help people buy homes in rural or suburban areas. Several types of USDA loans are available, including mortgages offered directly by the USDA and mortgages guaranteed by the USDA, similar to how the FHA guarantees FHA loans. To qualify for a USDA loan, you need to meet income requirements. The house also needs to be in a designated rural or suburban area.

29. TILA (Truth in Lending Act)

Thanks to the Truth in Lending Act or TILA, a lender needs to provide you with the details of a loan’s cost so you can shop around and compare your options. You also have the option of backing out of a loan offer within three days under this act. The TILA also offers protections for credit cards and other forms of credit, not just mortgages.

30. VA (Veterans Affairs) Loan

A Veterans Affairs or VA loan is a mortgage for people who are currently serving in the armed forces or who have in the past. Surviving spouses of veterans can also qualify for VA loans. The VA guarantees part of the loan, so a borrower who might not otherwise qualify for a mortgage can get more favorable terms from a private lender. One notable feature of many VA loans is that they don’t require a down payment. VA loans also don’t have a MIP or PMI payment.

Apply for a Mortgage With Assurance Financial Today

Ready to buy a home? You can apply for a mortgage with Assurance Financial in just 15 minutes. Start your application today and remember we’re here for you if you have any questions about mortgage acronyms or abbreviations.

Sources:

- https://www.consumerfinance.gov/ask-cfpb/what-is-an-ach-en-1065/

- https://www.fdic.gov/consumers/community/mortgagelending/guide/part-1-docs/freddie-home-possible.pdf

- https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-mortgage-interest-rate-and-an-apr-en-135/

- https://www.investopedia.com/terms/a/apr.asp

- https://files.consumerfinance.gov/f/documents/cfpb_charm_booklet.pdf

- https://www.investopedia.com/terms/1/5-1_arm.asp

- https://www.consumerfinance.gov/rules-policy/final-rules/ability-to-pay-qualified-mortgage-rule/

- https://www.consumerfinance.gov/owning-a-home/closing-disclosure/

- https://www.investopedia.com/terms/c/construction-mortgage.asp

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791/

- https://www.consumer.ftc.gov/articles/0347-your-equal-credit-opportunity-rights

- https://assurancemortgage.com/applying-for-home-loan-pregnant/

- https://www.investopedia.com/terms/e/earnest-money.asp

- https://www.thebalance.com/fair-plan-policies-2645392

- https://www.hud.gov/federal_housing_administration

- https://www.hud.gov/program_offices/housing/fhahistory

- https://assurancemortgage.com/fha-loans/

- https://www.investopedia.com/terms/f/ficoscore.asp

- https://www.investopedia.com/terms/f/fairmarketvalue.asp

- https://www.fdic.gov/resources/consumers/consumer-assistance-topics/mortgages.html

- https://www.investopedia.com/terms/f/for-sale-by-owner.asp

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-good-faith-estimate-what-is-a-gfe-en-146/

- https://www.consumer.ftc.gov/articles/0227-home-equity-loans-and-credit-lines

- https://www.investopedia.com/terms/h/hoa.asp

- https://www.hud.gov/about/qaintro

- https://www.hud.gov/topics/housing_choice_voucher_program_section_8

- https://www.investopedia.com/loan-terms-5075341

- https://www.investopedia.com/terms/l/loantovalue.asp

- https://www.hud.gov/program_offices/housing/comp/premiums/ufmain

- https://www.consumerfinance.gov/ask-cfpb/what-is-piti-en-152/

- https://www.consumerfinance.gov/about-us/blog/how-decide-how-much-spend-your-down-payment/

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-qualified-mortgage-en-1789/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/everything-you-need-to-know-about-usda-rural-loans/

- https://www.occ.treas.gov/topics/consumers-and-communities/consumer-protection/truth-in-lending/index-truth-in-lending.html

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/5-things-know-va-loans/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/loan_process/

You’ve recently visited a home, and it feels like the one. You put in an offer, the seller accepted it and now it’s time for the home inspection. Scheduling a home inspection is an essential part of the homebuying process. The inspection can clue you into any issues in the house that you might have missed and can protect you from buying a home that has many problems.

Even if everything about the home looked great when you toured it the first time, the inspection isn’t something you want to skip. You can use the information you get from the inspector to negotiate with the seller and to correct any concerns before you close on the property. Although many buyers schedule their own inspection, sellers can also set up a home inspection before they list their home. A pre-listing inspection can give a seller an idea of what should be fixed up before the house goes on the market.

Whether you are the buyer or seller, a home inspection can help you save money and time.

Table of Contents

- What is Home Inspection?

- When Should the Home Inspection Take Place?

- How to Hire a Home Inspector?

- What to Expect as a Buyer

- What to do During and After a Home Inspection

- What to Expect as a Seller

- How to Prepare

- What Sellers can do After

- Cost of a Home Inspection

- What’s in a Home Inspection Report?

- Apply Today

What Is a Home Inspection?

A home inspection is a non-invasive examination of the structure and systems of a home. During an inspection, a home inspector will check out the house from top to bottom, evaluating the condition of everything from the foundation to the roof. The inspection usually takes place with the buyer or seller present and often takes several hours to complete. How long the inspection takes depends on the size of the home and its overall condition. A larger house or a house that has many issues will usually require a longer inspection than a small home or a home that has few problems.

The home inspection often involves three parts, in which an inspector will:

- Identify issues in the home.

- Recommend ways to correct any issues.

- Take photos of the structures and systems in a home to include in the report.

One thing worth noting about a home inspection is that the issues uncovered are typically those that are visible. An inspector isn’t going to make holes in the walls of the home or tear up the flooring to look at the condition of the subfloor. They won’t try to look at pipes or wiring beneath the walls or floors, either. If it isn’t safe to evaluate or examine a particular area of the home, the inspector will also generally leave it. For example, although a roof inspection is usually part of the process, if the roof is too high to safely reach with a ladder, an inspector might examine it through a pair of binoculars, rather than going onto it.

While a home inspection will check most areas of the home, there are some things the inspector won’t evaluate. Usually, swimming pools, fireplaces and septic systems aren’t included in the home inspection. The inspector is also likely not to comment on the condition of the soil or ground underneath.

When Should the Home Inspection Take Place?

If a buyer is scheduling a home inspection, it usually occurs shortly after a seller has accepted the buyer’s offer and after both parties have signed a purchase agreement. Your real estate agent should include an inspection contingency clause in the agreement. The clause gives you the option of scheduling an inspection and outlines a time frame for it, such as up to seven days after the parties sign the purchase agreement.

The clause should also state that you have the option of backing out of the sale of the home if you and the seller can’t agree on negotiations or if the inspection turns up significant issues with the home.

When someone is selling their home, they might decide to schedule a pre-listing inspection. During a pre-listing inspection, the inspector will check the home for any issues and recommend changes the seller can make before putting their home on the market. After a pre-listing inspection, a seller can decide what improvements to make to increase the sale price of their home. They can also use the information in the report to set the price of the home.

How to Hire a Home Inspector

If you are in the process of buying a home, you get to choose the person who performs the inspection. Just as you might have shopped around for your real estate agent, it’s a good idea to shop around before you choose a home inspector. Your agent might have a list of recommended inspectors for you to work with, but it often pays to do your own research. You want to hire someone who is certified and who you can trust to give you an unbiased opinion. The inspectors your agent recommends might offer the agent a referral bonus, which means they aren’t exactly a neutral party.

You might want to ask friends or relatives who recently purchased a home in your area who they worked with for the inspection and if they’d recommend the inspector they used. An online search can tell you if others have had a positive experience with a particular inspector or if there are any complaints or concerns raised about them.

You can also ask the inspector to share a sample copy of the report they provide. That way, you can see how detailed the report might be and can get a sense of how well the inspector describes the issues with the property.

What to Expect During a Home Inspection as a Buyer

If a seller has accepted your offer for their home and has agreed to a home inspection contingency, set aside several hours on the day of the inspection to give the inspector time to do their job and to give yourself the opportunity to be present for as much of the process as possible. You don’t have to be at the home during the inspection, but being there is usually recommended. Walking through the property with the inspector can help you gain a better understanding of any issues and what they might mean for your safety and comfort if you end up buying the property.

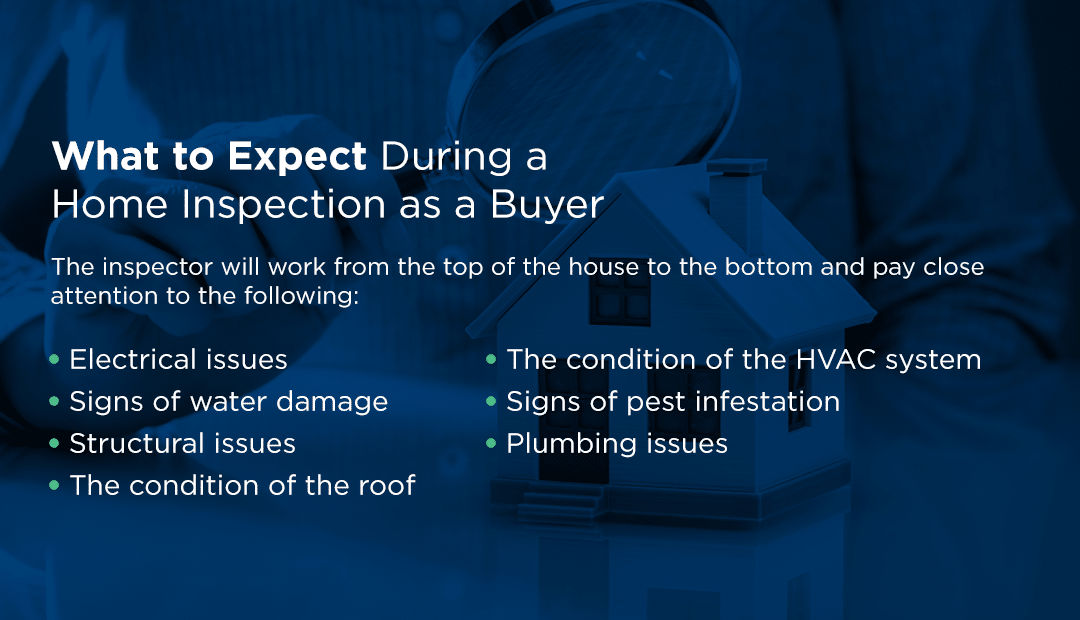

Your real estate agent doesn’t have to be present during the inspection, but many choose to be there. If your agent is present, they are equipped to give you advice on how to negotiate with the sellers if there are any issues with the house that you want fixed before closing. The inspector will work from the top of the house to the bottom and pay close attention to the following:

- Electrical issues: The inspector will test the outlets in the home to verify they are grounded. They will also look at the circuit breaker and check to see that the wiring is up to code. If there are problems with the house’s electrical system, the inspector will describe them to you and will give you an idea of what you can do to correct them.

- Signs of water damage: The inspector will look for visible signs of water damage, such as a crack in the wall or signs of moisture in the basement. They will advise you on what you can do about any damage.

- Structural issues: During the inspection, the inspector will note potential structural concerns, such as signs of bowing on the facade of the house or signs that the floor is not as supported as it should be. They will also look at windows and doors to make sure they open and shut as they should and to confirm that they are straight.

- The condition of the roof: Many inspections require the inspector to get on the roof to check it out and make comments about its condition. The inspector notes the state of the roof and its perceived age and usually provides the buyer with an idea of what type of repair or maintenance it might need.

- The condition of the HVAC system: The inspector will test the HVAC system, whether it includes central air and heat or just heat. They will record the age of the system and its condition and will recommend changes or fixes as needed, such as replacing the air filter or considering upgrading an older system. During the inspection, they will turn on the heat or air conditioning to see how it performs.

- Signs of pest infestation: The inspector will also look for visible signs of pest damage. In many cases, a separate pest inspection, such as a termite inspection, is recommended as part of the home inspection process.

- Plumbing issues: While the inspector isn’t going to cut into walls to see if pipes are leaking, they will check the accessible areas of the house’s plumbing. They will test the water pressure coming from the faucets and will evaluate how well the drains function. They will also look at the pipes in the basement and make recommendations about the conditions of the piping and the location of shut-off valves.

The inspector is also likely to test any appliances that will be included in the sale of the home to make sure they function properly. For example, they may run a cycle in the washing machine and turn the dryer on. They will also look at the refrigerator and oven in the kitchen.

What to Do During a Home Inspection

During the home inspection, it’s a good idea to trail the inspector and take note of what they say. A trustworthy inspector will encourage you to ask questions throughout the process and will be happy to answer them for you. Although you might want to take notes and photos during the inspection, keep in mind that the inspector is also taking photos and will create a report to share with you at the end of the process.

What to Do After a Home Inspection

Once the home inspection is complete, it’s time for you to consider negotiating. You’ll usually get a copy of the inspection report within a few days. After reviewing it with your real estate agent, you can prepare a list of items you’d like the seller to correct before closing. You might also ask the seller to provide a credit to cover the cost of repairs you do yourself.

Usually, your agent will guide you toward requesting fixes for significant issues. If the furnace didn’t work during the inspection or if the inspector recommends tuning up the HVAC system, that is something worth asking the seller to do. Smaller concerns, such as installing a cover over a light switch or adding a smoke detector, might be things you decide to take on yourself.

What to Expect During a House Inspection as a Seller

If you are selling your home and decide to have a pre-listing inspection, you can expect an experience similar to the buyer’s. During the process, the home inspector will examine the home’s roof, plumbing, HVAC system, electrical system, structure and overall condition. They will provide a report that lets you know what they recommend doing.

A pre-listing inspection has its pros and cons. One advantage is it lets you know about any issues and gives you the chance to correct them, so you can list the house for a higher price. A pre-listing inspection can also save you time after you get an offer on the home, as you’ll have already fixed up many potential concerns.

A drawback of a pre-listing inspection is that it alerts you to any issues, and you then have to disclose those issues to potential buyers. Depending on the concerns, they might be enough to keep someone from making an offer on the home. Before putting your home on the market, talk to your real estate agent to see if they recommend a pre-listing inspection.

How to Prepare Your House for a Home Inspection

The seller is generally not present when a potential buyer arranges for a home inspection. While you aren’t expected to be there for the inspection, there are a few things you can do to the house in advance:

- Test the drains:Make sure sink and tub drains run clearly before the inspection so you don’t have to worry about them raising red flags for a buyer. If the drains are running slowly, you might want to snake them or otherwise clean them before the inspector arrives.

- Replace light bulbs: If lights don’t work, an inspector might wonder if there is an issue with the electrical system.

- Test smoke and carbon monoxide alarms: Non-functioning smoke or carbon monoxide alarms are a safety concern during an inspection. Test the alarms in the home and replace their batteries in advance.

- Prune trees and shrubbery: Trim any tree branches that extend over the roof of the house and prune back shrubbery. Improving the landscaping before the inspection reduces the chance of damage caused by fallen branches and also helps to keep rodents away from the home. Pruned trees and shrubs also help improve the curb appeal of the home, which can make it more attractive to potential buyers.

- Remove pets from the property: If you are still living in the house, clear everyone out before the inspector arrives, including your pets.

- Clear clutter: If you still have belongings in the home, either clear them out before the inspection or organize them so they aren’t blocking the inspector’s path. An inspector can only examine accessible areas and isn’t allowed to touch your belongings. If there are boxes in front of the circuit panel or near the HVAC system, the inspector might not be able to reach it to do their job correctly.

- Keep everything on:Keep appliances on and plugged in, even if the house is vacant. The inspector will need to test that things work and won’t be able to do so if, for example, the refrigerator has been unplugged for several weeks.

- Replace the air filters in the HVAC: Replacing the air filters in the HVAC system allows it to function at its best and most efficient when the inspector tests it.

- Organize repair and maintenance receipts: If you don’t provide the inspector or buyer with receipts or proof of maintenance, they may make their best guess about the age or condition of the systems in a home. Make the receipts and other proof of maintenance available to the buyer and inspector to avoid this.

What Sellers Can Do After a Home Inspection

After a home inspection, be prepared for the buyer to come to you with a list of things they’d like corrected before closing or a credit request so they can make the corrections themselves. Your real estate agent can be a helpful source at this point to guide you through the negotiation process. Keep in mind that some issues, such as code violations or structural issues, usually need to be corrected before closing. Other issues, such as a broken refrigerator or a missing light switch cover, usually don’t have to be repaired before the sale goes through.

At the very least, as the seller, you should be prepared to offer something to the buyer after the inspection. If the process turned up multiple issues, you’ll have to disclose them to any future buyers, should the current deal fall through. Accordingly, it might be worthwhile to be as flexible as possible and try to work with the buyer to come up with a solution that works for both of you.

Cost of a Home Inspection

The cost of a home inspection can vary based on the size of the home and its location. The bigger the home, the more the inspection will cost. The type of home also influences the cost of the inspection. A condo or apartment inspection will usually cost less than the inspection of a free-standing home. The average cost is a few hundred dollars.

Some inspections are more detailed and thorough than others, which also affects the price. For example, a buyer might decide to have a termite inspection and radon test as part of their overall home inspection, which will raise the price tag.

Usually, the buyer pays for the inspection, but there are cases when they might be able to get the seller to pay. If it’s a buyer’s market and the seller really wants to sell the home, a buyer might be able to negotiate the cost of the inspection into their offer. During a seller’s market, when there is a lot of demand for homes and not many available, a seller can easily refuse to pay for the inspection. They might be able to waive the home inspection contingency entirely, depending on how hot the market is.

What’s in a Home Inspection Report?

Within a week or so of the inspection, the buyer, seller and their respective real estate agents will receive a copy of the inspection report. The report will usually be a very detailed, multi-page document that explains what a home inspection does and doesn’t do and describes the condition of the home. The inspector also highlights the type of issues they discovered during the process and makes recommendations for correcting problems. The report will also contain photos of the areas of the home and of any potential issues in the house.

In the report, the inspector will describe the various systems in the home and its overall structure. They will record the age of certain appliances and systems or will estimate the age as best as they can based on the information available.

Take the First Step Toward Homeownership With Assurance Financial

If you are looking to buy your first home or are planning to sell your home and move into a newer or bigger house, the first thing to do is get pre-qualified for a mortgage. Starting your mortgage application early on lets you know how much house you can afford and whether you qualify for a loan or not. Apply today to get started on your homebuying journey.

Sources:

- https://www.nerdwallet.com/article/mortgages/home-inspection

- https://www.zillow.com/sellers-guide/pre-listing-home-inspection/

- https://www.realtor.com/advice/sell/why-get-a-home-inspection-before-putting-your-home-on-the-market/

- https://www.consumerreports.org/home-inspections/how-to-choose-a-home-inspector/

- https://www.quickenloans.com/learn/what-you-need-to-know-before-hiring-a-home-inspector

- https://www.investopedia.com/articles/personal-finance/102913/contingency-clauses-home-purchase-contracts.asp

- http://www.homebuyinginstitute.com/mortgage/when-does-the-home-inspection-occu

- https://www.homeadvisor.com/cost/inspectors-and-appraisers/hire-a-home-inspector

- https://www.homeinspector.org/Buyers-And-Owners/Homebuyers-Guide/FAQs-about-Home-Inspection

- https://www.nerdwallet.com/blog/mortgages/home-inspection-dos-donts-homebuyers/

- https://www.homelight.com/blog/how-home-inspection-works/

- https://www.homelight.com/blog/home-inspection-tips/

- https://themortgagereports.com/37715/home-inspection-checklist-what-to-expect-on-inspection-day

- https://www.houselogic.com/buy/how-to-buy-step-by-step/home-inspection-what-to-expect/

- https://www.parealtors.org/home-inspection-specifications/

- https://www.thebalance.com/getting-through-the-home-inspection-1797764

- https://www.parealtors.org/waiving-inspection-contingencies-in-a-sellers-market/

- https://www.zillow.com/sellers-guide/bad-home-inspection-for-sellers/

- https://www.realtor.com/advice/sell/handle-repair-requests/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/why-get-pre-qualified-before-looking-for-home/

- https://assurancemortgage.com/what-are-closing-costs/

- https://assurancemortgage.com/five-questions-to-ask-before-buying-a-home/

- https://assurancemortgage.com/calculators/how-much-can-i-afford/

You plan on buying a house in the near future, and you know you’ll need a mortgage to do so. The question is, which type of mortgage may be best for you? Mortgages vary in term length, type of interest rate and the amount of interest charged. One available option is a 15-year, fixed-rate mortgage.

Apply NowStill have questions or need more information? Below is an overview of what this article covers!

Topics Covered

Frequently Asked Questions

- What Is a 15-Year Fixed Mortgage?

- How Does a 15-Year Fixed-Rate Mortgage Work?

- What Makes up Your Mortgage Payment?

- How Much Can You Afford to Borrow?

- Is a 15-Year Fixed Mortgage Right for Me?

- Apply for a Home Loan Online

As you weigh your mortgage options, it’s important to understand how getting a 15-year home loan will affect your monthly payments and how much you end up paying for your home over the long run. It’s also important to understand how a fixed interest rate differs from an adjustable rate. Get all the details on a 15-year fixed mortgage so you can determine if it’s the right option for you.

What Is a 15-Year Fixed Mortgage?

A 15-year fixed mortgage is a loan with a repayment period of 15 years and an interest rate that remains the same throughout the life of the loan. Like other types of mortgages, you use a 15-year, fixed-rate mortgage to buy property. Many people obtain a mortgage to buy their primary residence, while others obtain a mortgage to buy a vacation home or property to rent out to others.

To understand what a 15-year fixed mortgage is, it helps to break down some commonly used terms in the mortgage business:

- Term: The mortgage term is the length of time you have to repay the loan. At the end of the term, the entire loan needs to be repaid to the lender. The length of the term influences the size of the monthly payments, as well as the interest charged on the loan. Mortgages with shorter terms, like a 15-year home loan, are considered less risky to the lender, so they often have slightly lower interest rates compared to longer-term mortgages, like a 30-year loan.

- Interest: Interest is the price you pay to borrow money, usually a percentage of the loan, such as 3% or 4%. A lender determines your interest rate based on factors such as your credit score, income, the loan term and the market. The type of interest rate — whether it’s fixed or adjustable — also plays a part in determining when you pay.

- Fixed-rate: Some mortgages have a fixed interest rate. With a fixed-rate mortgage, you pay the same interest rate throughout the life of your loan. For example, a 15-year mortgage with a 5% fixed rate will have a 5% rate until the borrower pays off the mortgage or refinances. One advantage of a fixed-rate mortgage is that it allows you to lock in a rate when they are low. You can rest assured that your mortgage principal and interest payment will stay the same month after month, no matter what happens in the market. On the flip side, if you get a fixed-rate home loan when rates are high, you could be stuck paying a high interest rate for years.

- Adjustable-rate: Unlike a fixed-rate home loan, the interest rate on an adjustable-rate mortgage (ARM) changes at various points throughout the repayment period. Often, an ARM may have an introductory rate. The introductory rate tends to be lower than the interest rate available on a fixed-rate loan. After the introductory period ends, the rate may change based on whatever is going on in the market. It can go up, meaning your monthly payments may go up. It can also drop, meaning you may pay less each month. Some borrowers take out an ARM initially and later refinance to a fixed-rate loan.

- Principal: The principal is the amount of money you’ve borrowed to buy your home. If you purchase a $250,000 house, pay a 10% down payment of $25,000 and borrow $225,000, the $225,000 would be the loan’s principal. If you can pay extra against the principal as you pay down your mortgage, you can shorten the length of time it takes to pay off the loan completely.

- Mortgage insurance: Depending on the size of your down payment, you may have to pay mortgage insurance on top of the principal and interest charged on the loan. Mortgage insurance offers an additional layer of protection to the lender, in case the borrower struggles to make payments. It is usually required when a person makes a down payment under 20% of the home’s value. You can cancel the mortgage insurance payment once you have paid off enough of the principal to have 20% equity in your home.

How Does a 15-Year Fixed-Rate Mortgage Work?

A 15-year fixed-rate mortgage works similarly to other types of mortgages. You apply for the loan by providing proof of income, employment, assets and your credit history. If approved, you put down a certain amount of money, then make payments on the loan each month until it is paid off. The amount you can afford to borrow when you apply for a 15-year fixed mortgage depends on a variety of factors.