Month: June 2021

When you’re shopping around for a mortgage, there are several choices you’ll make that affect the monthly payment on the loan and how much you end up paying to own your home. One decision to make is how long your mortgage will last. Options include 10, 15, 20 and 30-year mortgages. Of the various loan terms, 15-year and 30-year mortgages tend to be the most common.

Each loan term has its benefits, depending on your financial situation. Learn more about how the loan term affects the interest rate, monthly payment and other mortgage features.

15-Year vs. 30-Year Mortgage Calculator

One of the quickest ways to see the difference between a 15-year and a 30-year mortgage is to use a mortgage calculator. The calculator will give you an idea of the cost of your monthly payment based on the length of the loan, the interest rate you pay and the size of the mortgage.

Some things to understand when using a mortgage calculator include:

- Principal amount: The principal amount is how much you’re borrowing. Often, it’s not the same as the price of the home you’re buying, as you’ll most likely be making a down payment.

- Down payment: The down payment is how much you pay upfront when you close on the house and take out the home loan. It typically ranges from 3% to 20% of the home’s price, but you can put down more if you can afford to do so.

- Interest rate: The interest rate is the cost of taking out a mortgage. The more risky a loan is for a lender, the higher the rate.

- Monthly payment: The monthly payment is what you’ll need to pay for the mortgage every month. It’s usually higher for a 15-year loan since you’re paying off the principal more quickly.

- Total loan cost: The total loan cost is the amount you’ll pay for the mortgage over the next 15 or 30 years. It’s likely to be higher for a 30-year loan than for a 15-year one.

What Is a 15-Year Mortgage?

A 15-year mortgage is a home loan with a term that lasts 15 years. When you take out a 15-year mortgage and follow the repayment schedule exactly, you’ll have paid off your home in 15 years. It’s possible to pay off the mortgage sooner by making additional payments to the principal each month or from time to time. You can also refinance the mortgage at some point to take advantage of a lower interest rate or to change the length of the loan.

A 15-year mortgage might have a fixed interest rate or an adjustable rate. A fixed interest rate will remain the same throughout the mortgage term. If it’s 5% on day one, it will be 5% on the final day. Fixed-rate mortgages offer some level of predictability. No matter what happens with the market, you can rest assured that your monthly mortgage principal and interest payment will remain the same throughout the life of the mortgage.

If you choose a 15-year mortgage with an adjustable rate, you’ll likely be offered a special introductory or “teaser” rate, which will remain the same for a set period, such as five years. Once the introductory period is up, your rate can change based on the market. If you started with a 5% interest rate, it might jump up to 7% or drop to 4%, depending on current interest rates. After the introductory period, your rate will adjust on a set schedule, such as annually or every two years.

An adjustable-rate 15-year mortgage can be the more affordable option at first, particularly if rates are very low when you apply for the loan. But as rates change, you might see your monthly payment increase substantially. It’s important to make sure you can afford the monthly payment on your 15-year home loan, whether rates are low or high, if you choose to apply for one with an adjustable rate.

When you take out a 15-year mortgage, you typically need to put money down. How much you put down upfront depends on your savings and what you can afford. In some cases, a larger down payment, such as 20%, makes sense, as it means you’ll have a smaller mortgage and less to pay each month. A 20% down payment also means you don’t have to take out private mortgage insurance (PMI).

A smaller down payment, such as 5% or 10%, can make sense when applying for a 15-year loan. Putting less down means you can buy your home sooner rather than later. A smaller down payment can also allow you to keep some cash in reserve if you need it to pay for repairs. With a smaller down payment, you’ll have to pay PMI, which does add to your monthly mortgage costs.

What Is a 30-Year Mortgage?

A 30-year mortgage lasts for 30 years, provided the loan holder pays exactly as agreed, doesn’t make any additional payments on the loan and doesn’t refinance it. As with a 15-year home loan, you can pay off a 30-year mortgage before the full term by paying extra toward the principal each month or when you can afford to do so. You might also refinance the mortgage at some point to take advantage of lower interest rates or better loan terms. A refinance might extend the mortgage term or reduce it.

Like a 15-year mortgage, you can choose a 30-year loan with a fixed interest rate or an adjustable interest rate. A fixed-rate mortgage can be ideal if interest rates are low when you take out the loan. You’re effectively “locking in” the low rate. No matter what happens over the next three decades, your rate won’t go up or down.

An adjustable rate mortgage can make sense if rates are high when you apply for the loan, and you expect them to drop eventually. After the introductory term, getting a lower rate on the loan can mean your monthly payments drop significantly. If you get an adjustable rate mortgage when rates are high, you can most likely refinance to a fixed-rate loan if rates fall in the future. That way, you can lock in a lower rate on your mortgage.

The monthly payment on a 30-year mortgage depends on the price of the home you’re buying and the size of your down payment. The bigger your down payment, the lower your principal amount and the lower your monthly payment. As with a 15-year loan, if you put down less than 20% when buying a house with a 30-year mortgage, you’ll most likely need to pay PMI premiums, usually until you’ve paid off enough of the loan so that the principal is 80% or less of the home’s value.

Many people find that taking out a 30-year mortgage allows them to buy a bigger or more expensive home than they could afford if they chose a 15-year home loan. Spreading the payments out over a longer term can help you buy a home in an area that would otherwise be financially out-of-reach. This is likely why 30-year mortgages are more common than 15-year home loans.

Costs of a 15 vs. 30-Year Loan

When trying to decide between a 15-year mortgage and a 30-year mortgage, it can be helpful to compare the costs of each option. Generally, a 30-year loan costs less upfront but costs more over time. You’ll pay more upfront for a 15-year loan but can end up saving a considerable amount in the long run. The following are areas in which you’ll experience differences between these two loan types:

1. Monthly Payments

There’s likely to be a substantial difference between the monthly payment on a 15-year mortgage versus a 30-year mortgage. Since you’re spreading out the payments on a 30-year loan over 360 months, rather than 180 months for a 15-year loan, you end up with a much smaller monthly payment.

Some borrowers take advantage of the lower monthly payments by purchasing a more expensive home. For example, with a 30-year mortgage, you might be able to afford a $300,000 home while you could only afford the payments on a $200,000 home with a 15-year mortgage.

2. Interest Rates

Several things determine the interest rate your lender offers, including the mortgage term. Generally, the less risky the lender thinks you are, the lower the interest rate they offer. Most lenders consider 15-year mortgages to be lower risk than 30-year loans, as it takes less time for the borrower to repay them, meaning there’s less chance that someone will default on the loan.

For that reason, you’re likely to get a lower rate if you apply for a 15-year loan than you would for a 30-year loan, even if everything else is the same, such as the size of the mortgage, your credit score and your down payment. A lower interest rate means your monthly payment is lower, saving you money in the short term. You’ll also put more money towards the principal on the loan more quickly when you get a lower rate.

3. PMI Premiums

If you put down less than 20% when you take out a mortgage, the lender will likely charge you PMI premiums. PMI offers the lender protection in case you default on the loan or stop making payments.

The size of your PMI premium depends on several factors, including the size of your down payment. Usually, the lower the down payment amount, the higher your premium. The size of the loan and the loan term also influence the size of your insurance premium. With a 30-year loan and a small down payment, you might expect a higher PMI premium than with a 15-year loan and a small down payment. Your premiums can be a monthly fee that is tacked on to your mortgage payment, or you can pay the full premium upfront when you close on the home.

4. Total Costs

In the long run, a 15-year mortgage often ends up costing less than a 30-year mortgage. Paying a lower interest rate every month can add up to significant savings over time. A lower PMI premium can also help you save money.

Depending on your circumstances and how long you plan on remaining in your home, paying more over the long run might not be something you’re concerned about. If you’re concerned about saving as much money as possible or paying as little as possible in extra costs for your home, a shorter mortgage term might be right for you.

Should You Choose a 15-Year or 30-Year Mortgage?

Mortgages aren’t one-size-fits-all. What works for one borrower might not be right for another. When deciding between a 15 or 30-year mortgage, here are some things to think about:

- You can afford a higher monthly payment:15-year mortgages typically have higher monthly payments since you’re paying the loan off in half of the time. Take a close look at your budget to figure out how much you can comfortably afford to spend on your mortgage each month. It could be that you can swing the higher monthly payment of a 15-year home loan based on your income and other financial commitments.

- You want to focus on saving cash: On the flip side, the lower monthly payments 30-year mortgages typically offer might make more sense for you if you want to build up cash reserves or save money for other financial goals, such as retirement or your child’s college education. You might have more disposable income or more money to dedicate toward savings if you choose a loan with a 30-year term.

- You want flexibility: You can enjoy more wiggle room with a 30-year mortgage compared to a 15-year loan, in some cases. As long as the mortgage doesn’t have a prepayment penalty, you can pay more towards it each month, pay the loan down more quickly and reduce the total costs. If your financial situation changes, you can switch back to paying only the minimum required. You can do the same with a 15-year loan, but since the monthly payments tend to be higher, paying extra might be more of a stretch for you.

- You want to get the lowest interest rate possible: If interest rates are low, you have excellent credit and you’re putting down 20% or more on the home, taking out a 15-year loan can be what helps you get the best interest rate available. Even with all other factors considered, the rates on 15-year mortgages tend to be lower than on 30-year loans. Getting the lowest rate possible lets you save money each month and in the long run.

- You want to buy a bigger or more expensive home: Depending on your housing needs or the area you live in, a 30-year mortgage might be the option that lets you become a homeowner. For example, if you live somewhere where housing prices are higher than average, you might need to take advantage of the lower payments available with a 30-year loan to afford a home. Or, if you need to buy a larger house to accommodate your family’s needs, a 30-year mortgage can make doing so affordable.

- You want to be debt-free sooner: Although mortgage debt is typically an example of good debt, you might be dreaming of the day when you’ll be entirely debt-free. In that case, a 15-year loan can help you reach your goal sooner.

Benefits of a 15-Year Mortgage

If you’re considering a 15-year mortgage, here’s a quick review of some of the benefits of a shorter-term mortgage:

- Interest rates tend to be lower: You’re likely to get a lower interest rate on a 15-year loan, which saves money in the short term and the long term. Long term, you’ll pay less interest since you are making 180 payments, rather than 360.

- Equity tends to build more quickly: Your home’s equity is the difference between the value of your home and the amount you still owe on the mortgage. With a 15-year loan, you build equity faster since you pay more towards the principal each month. Paying off the loan more quickly also lets you build equity. With more equity, you can borrow against the house to make renovations or pay for other big expenses, such as your children’s college. Having more equity also means you get to pocket more money if you eventually sell the home.

- The overall cost is lower: The total cost of a 15-year mortgage might be substantially less than a 30-year home loan. The lower interest rates combined with fewer payments means the cost of interest ends up being significantly lower. If you need to take out PMI, you might get a lower monthly premium with a 15-year loan, further reducing the mortgage cost. Plus, you might end up buying a home with a lower price tag if you choose a 15-year loan, which also reduces the total cost of the house.

Benefits of a 30-Year Mortgage

For the right borrower, 30-year mortgages have their advantages. Some notable benefits of a 30-year home loan include:

- The monthly payment is often lower:The monthly payment on a 30-year loan is usually less than the monthly payment on a 15-year loan. That can mean one of two things. If you can afford the higher, 15-year loan payments, you might be able to buy a more expensive home with a 30-year loan. If the payment on a 15-year mortgage is out of your reach, choosing a loan with a 30-year term can make homeownership financially attainable.

- You might have more freedom: You can expect to have some more freedom with a 30-year loan than a 15-year mortgage. You can make adjustments to your budget more easily when your mortgage payment is lower. If you want to, you can pay extra on the mortgage each month, even potentially treating it like a 15-year loan. If you need to, you can pay only what’s required. Since a 30-year mortgage can make homeownership more affordable, you might find you have income left over each month to set aside for other financial goals. If necessary, you can build up an emergency fund, boost your retirement savings or set money aside for a vacation.

- Homeownership can be attainable: 30-year mortgages are the most popular type of home loan for a reason. They open the doors to homeownership for a wider range of people. If a 15-year mortgage were the only option, many people wouldn’t be able to afford the higher monthly cost or would be limited to buying the least expensive homes.

Apply for a Mortgage With Assurance Financial Today

When choosing a mortgage, there’s more to think about than the size of the loan and the interest rate. The loan term is also worth your consideration. Whether you are leaning towards a 15-year loan or a 30-year mortgage, Assurance Financial can help you find the home loan that’s right for you. Start your mortgage application today to learn more about your options.

Linked Sources:

The COVID-19 pandemic changed many things. It introduced new phrases, like “indoor dining” and “pandemic pod,” to people’s vocabulary. It changed how people spent their time, with work and happy hour all happening from the living room. And, perhaps most importantly for people thinking of buying a home soon, it changed the housing market.

At the pandemic’s start in early March 2020, interest rates were already near record-lows. Then, the average rate on a 30-year fixed mortgage was 3.45% — jump forward a few months to September, and the average rate on a 30-year fixed mortgage was 2.89%. By March 2021, rates had ticked back up to 3.08%. But after that, something curious happened.

Generally, the demand for housing influences rates. When more people want to buy a home than there are homes available, home prices tend to skyrocket. Additionally, interest rates tick upward in a seller’s market. But that doesn’t seem to be the case now — inflation is up. Historically, that means rates should be up. However, in the summer of 2021, interest rates took another dip, down to 2.98% in June.

In many ways, the mortgage rates since COVID-19 are likely what’s fueling demand for housing. Given the low inventory and sky-high housing prices, many buyers would — in more ordinary times — prefer to wait out the market. That said, buying a home today means you could potentially lock in a historically low interest rate, possibly for the next 15 or 30 years.

There’s another reason why people might be drawn to purchasing a home today, rather than waiting for the market to shift in favor of buyers. Concerns about inflation and rising prices are making many people wonder if interest rates are likely to go up soon. There’s a sense of “act now,” or get a high rate.

What’s a good mortgage rate today? If you wait out the current seller’s market and end up with a slightly higher interest rate, would that be the end of the world? It all depends on your perspective. Buying now means you could possibly lock in a lower rate — but if the market is so competitive that you end up in a bidding war and go over your budget, you might not save much in the long run. Sometimes, getting a higher rate on a lower-priced home is preferable to getting a low rate on a pricier home.

Is now the time to apply for a mortgage or refinance? Depending on your specific circumstances, the answer might be yes — even if the housing supply is low. Along with being affected by the economy overall, mortgage interest rates are also affected by you. Your personal credit history, the type of mortgage you apply for, the length of the loan and how much you borrow all affect your interest rate. Now might also be an ideal time to refinance, if you already have a mortgage and would like to take advantage of record-low interest rates.

If you’re curious to see what sort of rate you’d get on a mortgage, it doesn’t hurt to look. Learn more about mortgage interest rates and what influences them, then start your application and get ready to take advantage of record-low mortgage rates.

What Are Mortgage Rates?

Mortgage rates are the rate of interest on a mortgage the lender sets. Two of the main types of mortgage rates are as follows.

- Fixed: Fixed rates feature a set interest rate that does not change throughout a loan. A fixed rate protects you from unexpected increases in payments if interest rates in the market rise. While the interest rate stays the same throughout the loan, the terms vary depending on the loan itself. Most fixed-rate mortgages last on terms from 15, 20 or 30 years, with 30 being the most common. A 30-year mortgage offers the lowest payments per month, but overall, the cost will be higher due to interest payments. Shorter terms feature lower prices overall, though monthly payments are higher.

- Variable: Variable rates, also called adjustable-rate mortgages (ARMs), can change. Typically, these rates start lower than the average fixed rate and rise over time. The rate can eventually pass that of a common fixed rate, so at some point, you will pay more per month than you would with a fixed mortgage. Variable rates do have a fixed period where the interest percentage cannot increase, which can last between one month to 10 years. From there, the rate changes at a determined frequency to keep up with market trends. That period between changes is adjustment frequency. ARMs will also come with a ceiling, which prevents the rate from passing a certain point.

In general, the two primary mortgages above answer what mortgage rates are. They serve as an umbrella for a variety of other loans depending on the type of mortgage you seek and the lender you work with to obtain it. The mortgage rate a lender charges you will determine your monthly mortgage payments and the total cost of the mortgage. A realistic mortgage rate is a low one you can afford to pay without breaking the bank, but how do lenders decide on these interest rates?

How Banks Regulate and Determine Mortgage Rates

Depending on the type of loan you have, lenders regulate mortgage rates based on different factors. Some of these are unique to your history, while others depend on external factors. Among the external influences of how mortgage rates are determined are as follows.

- Inflation: Prices gradually rise over time, and the value of a dollar declines with inflation. Lenders that provide ARMs must compensate for inflation to maintain the original value of their loans’ interest rates. Expect your variable rate to rise over time as your lender monitors inflation.

- Economic growth: If economic growth is high with increasing employment, income and spending, the demand for mortgages increases. Since more individuals have more money to spend, they may spend that money on homes. Lenders only have so much available money to give, so a rise in mortgage demand means an increase in mortgage rates. The reverse of this is also true. If the economy sees a decline, fewer people will buy homes, and rates may go down.

- The Federal Reserve: The reserve’s monetary policy doesn’t directly determine mortgage rates. It does, however, establish the Federal Funds rate, which can have a similar impact as economic growth. When the Federal Reserve increases the money supply, mortgage rates go down, and vice versa.

- The bond market: Because investment firms provide investment products with mortgage-backed securities (MBSs), they must encourage buyers. To get more investors in MBSs, lenders must be sure these securities generate yields for buyers. That, in turn, has an impact on how much lenders charge for mortgage rates.

- The housing market: It’s no surprise the housing market has an impact on mortgage rates. When fewer houses get built or sold, mortgage rates can decline because of less demand for loans. Rates also go down as more individuals choose to rent rather than own.

With these external factors and ones from the individual borrower, a lender evaluates the risk of a loan and adjusts the mortgage rate from there. If a lender believes a loan is a high risk, the mortgage rate will be higher. A higher rate of interest ensures the lender gets the loan amount back before the homeowner can default — or fail to pay. To determine the risk, a lender evaluates aspects of your financial history.

How Are Mortgage Rates Determined?

When it comes to what mortgage rates are based on, some factors are in your control. Let’s go over a few things you can focus on that will help you find, or qualify for, a good mortgage rate. Evaluate the following from your financial history to see how a lender would determine your mortgage rates.

1. Your Credit

Your credit history and score determine the most significant factor in getting the perfect mortgage rate. A credit score reflects financial behavior, from payment history to debts and the age of your credit. Lenders look at your credit history to verify that you can repay the mortgage promptly. The sweet spot is around 660, with excellent credit being anything above 700.

The threshold for credit requirements depends on the type of mortgages and the lenders. For mortgages insured by the Federal Housing Administration, you can get a mortgage with a credit score as low as 500. Keep in mind, lenders want one thing at the end of any deal — buyers to repay their money to them. A high credit score gives them the confidence you can do that and will result in a better mortgage rate. The reverse also follows that logic, where a lower credit score may cause higher mortgage rates.

Clean up your credit score before applying for a mortgage to get the best possible rate. Improving your score can involve correcting any mistakes and paying off debts or liabilities.

2. Your Job

As we said above, lenders want to make sure you can repay your mortgage. The ability to repay a mortgage is crucial to lenders, so another factor they review is your employment history and income. If you don’t have a job, you’re probably not going to get a good mortgage rate — — and you may not get any mortgage in general. The same standards also apply to your income and assets.

So, what are lenders looking for in a borrower? First, you should be an employee that’s on salary, and, second, you should have maintained that job for at least two years. By providing W-2 forms or other relevant tax documents, as well as two years of tax returns, you can show a lender you have reliable means to pay back a loan.

3. Your Income

As mentioned, lenders will provide you with a better mortgage rate if they are confident you can pay them back. Most lenders will look at how much debt you currently have in comparison to your income, the type of down payment you can afford to put down and your cash reserves. All of these focus on your ability to pay your mortgage. The more confident lenders are about your ability to pay them, the better your rate will be. The takeaway here is to live within your means, so don’t apply for a jumbo mortgage — anything over $460,000 — if your annual income is $30,000.

For an idea on how a lender will react to your income, you can figure out your debt-to-income (DTI) ratio. The number includes your monthly debts and what you would take on with a new home, divided by your monthly income. Lenders want to see a DTI ratio of around 30% or less. By checking this number yourself, you can get an idea of your budget when searching for a home and applying for loans.

While lenders look at the main factors above through financial documents you provide, other considerations influence your mortgage rates. Mortgage rates are also based on the following:

- Your location: Depending on where you’ll purchase a home, your interest rates will vary. Urban and rural homes cost vastly different amounts, so it follows that the rates can change, as well. Depending on the type of loan you go with when you buy a house, your state and even county can influence your mortgage rate. Sometimes, you don’t have the freedom to choose any location you’d like to live in, but if you do, research different areas to find the best mortgage rate.

- Your new home’s price: It may seem obvious, but mortgage rates are also based on how much you pay for your new house. Generally, your loan includes the price of your new home and closing costs, minus any down payments you’ve made. Some loan types can also include your mortgage insurance, which will impact the mortgage rate. Set a budget for yourself based on your finances and how much a lender pre-qualifies you for to help guide your home search.

- Your loan term and type: Remember that your loan term is how long you will take to pay off your mortgage. If you go with a 15-year term, you would have a lower interest rate than you would with a 30-year term. As we’ve outlined above, there are different loan types you can choose. Fixed rates will not rise over time, while ARMs or variable rates can change.

- Your down payment: If you can make a larger down payment, it may be the right choice. The more you can pay upfront for a home, the lower your interest rate can be. As lenders evaluate the risk of giving you a loan, a sizeable down payment serves as reassurance that you will pay back the mortgage. Generally, if you can afford 20% of the new home, you will be in a good position for your mortgage rate. Consider the amount you can provide for a down payment as you build your budget.

The factors above, combined with the external influences we outlined above, help a lender determine your mortgage rate. Since your mortgage rate is a percentage of your monthly loan payment, it follows that higher payments will result in a higher mortgage rate. Your mortgage rate will also vary between the type of loan you choose.

How Do Loan Types Affect Mortgage Rates?

Just as your financial history can have an impact on mortgage rates, the type of loan you choose when purchasing your home can do the same. While the answer to what is a good mortgage rate for first-time homebuyers may not have one simple answer, you can find loans that are better for first-time homeowners. There are many loan options out there, and some of the primary ones are as follows.

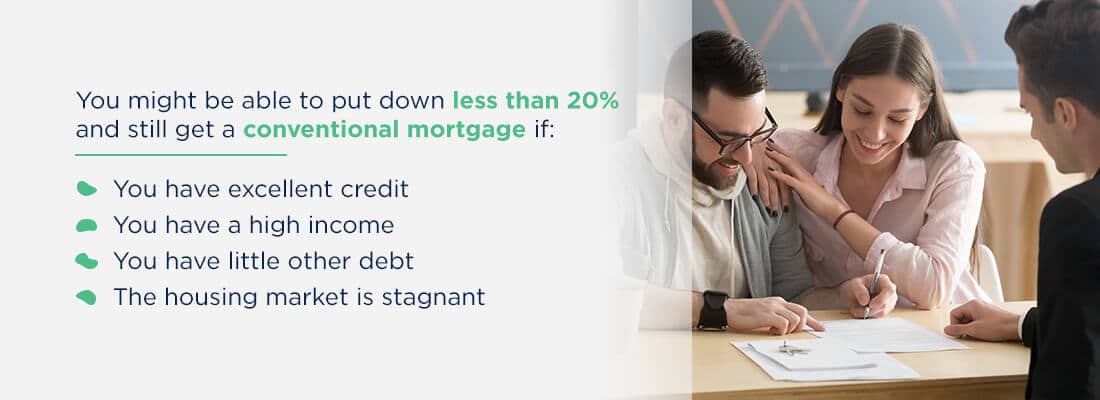

- Conventional: You can receive a traditional mortgage through a private lender, such as banks or credit unions. The government-sponsored enterprisesof Fannie Mae and Freddie Mac also offer conventional loans. If your financial history features certain hurdles, you may have a more difficult time getting a traditional mortgage. Consider other loans if you’ve suffered bankruptcy or foreclosure within the past seven years, you have a lot of debt or you’re just getting started in the housing world. Because the expectation with a conventional loan is that you pay a higher down payment, mortgage rates are not as high with this loan.

- FHA: Also called a Federal Housing Administration loan, these don’t require as high of a credit score or down payment as a conventional loan. The FHA approves lenders and insures mortgages they provide for an FHA loan. Because of the less restrictive conditions needed for an FHA mortgage, it is popular with first-time homeowners. You may need to pay two types of mortgage insurance premiums with an FHA mortgage. The lower expectations of a significant down payment and strong credit score mean mortgage rates with an FHA loan can be higher.

- USDA: You might not expect the United States Department of Agriculture (USDA) to finance homes, but they do work to develop rural and suburban areas. USDA loans are for low- to moderate-income individuals looking to purchase a home in a rural area. The specifics of this mortgage mean it’s not for everyone. USDA loans come in 15- or 30-year fixed options, with no ARMs available. First-time homebuyers may find a USDA loan works best for them. As you would with an FHA loan, you must pay mortgage insurance on a USDA loan. These loans often feature lower mortgage rates, so it may be something to consider if you fit all of the requirements and recommendations.

- VA: Private lenders such as banks fund these loans, while the Department of Veterans Affairs guarantees them. If you are an active member of the military, a veteran meeting specific service requirements or a surviving spouse of a veteran who has passed away, you could be eligible for a VA loan. While a VA mortgage itself has no credit requirement, a lender may put one in place for security. There is also no requirement for mortgage insurance, and you may find better interest rates with a VA loan. If you meet the service requirements, you may think VA loans are your best option. With a VA loan, though, you must pay a VA loan funding fee, and you can only purchase a primary home, rather than a secondary home.

Remember, these loans come with other costs — from lender fees to mortgage insurance — that may offset the lower mortgage rates. Ultimately, the interest you pay depends on the other factors we’ve explained above. Still, knowing the different loans out there can help you when you evaluate what else mortgage rates are based on as you search.

How Can You Apply for a Mortgage Rate?

If you’re asking yourself, “What mortgage rate can I get?” your best bet is to evaluate your finances and apply for a mortgage. Before you apply for a mortgage rate, ask yourself these questions:

- What can you afford monthly?

- Could you adapt if mortgage rates rise?

- What is the current trend of rates, and will that continue?

- How long will you live in the home you purchase?

- Where will you be living?

With those questions, you can help yourself eventually choose what type of loan is best for you. Since that and other factors we’ve mentioned before impact your mortgage rate, expect to provide financial information as you seek what a lender can offer you.

What Documentation Do I Need for a Mortgage Application?

When you apply for a mortgage and mortgage rate, you must submit documentation that provides details about your:

- Credit history and score

- Debts and liabilities, if any

- Assets and properties, if any

- Income and job

Using the information you provide, lenders can pre-qualify you for a particular mortgage amount. Check your credit score and finances before you plan on applying to see mortgage rates. If your credit score isn’t as strong as you’d like, you can then use that time to adjust and improve your score to make yourself more appealing to lenders. You can also choose what type of loan to apply for depending on the strength of your credit score.

Mortgages to Apply for When Purchasing a Home

The type of loan you should apply for depends on different factors. For example, you may want to consider ARMs or variable rates if you meet one or more of the following conditions.

- You’re a short-term homeowner: If you don’t plan on living in one home for an extended amount of time, a variable rate allows you to own your home with a lower mortgage rate. With an average fixed-rate period between one to seven years, ARMs provide flexibility to move within that time.

- You expect an increase in your income: Whether you’ve finished furthering your education, you’re entering a promising career or you anticipate receiving funds from a trust, your income can increase. You will then be able to keep up with payments as your mortgage rates rise over time.

- You’re selling your old home: Until the proceeds from the sale come in, you won’t want to take on more expenses. An ARM will start you out with lower rates you can afford as you sell your home. Once you’ve sold the property, you will be able to afford the increasing mortgage rate that comes with variable mortgages.

Your overall mortgage payment comes from the principal — also known as the initial amount borrowed — the life of the loan and the mortgage rate. You will want to calculate your mortgage costs with different loan types to explore how they affect your mortgage rates as you prepare to apply with a lender. Keep the factors above in mind and remember a high mortgage rate is what you cannot work with to live within your means. Explore your options, and you will discover how to find a good mortgage rate.

Apply for a Mortgage With Us

Applying for a mortgage can be a complicated process, since there are several things lenders will review. Knowing what lenders are looking for and making that as attractive as possible is one of the best steps you can take in getting a great mortgage rate. Luckily, you have us.

At Assurance Financial, we’ll work with you, assessing your situation and doing all the heavy lifting for you. Contact one of our experts today and let us help you get the perfect mortgage rate!

Updated: 9/13/2021

Linked Sources:

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/apply/

- https://www.investopedia.com/terms/m/mortgage-rate.as

- https://www.investopedia.com/mortgage/mortgage-rates/fixed-versus-adjustable-rate/

- https://www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/

- https://www.investopedia.com/terms/d/default2.asp

- https://assurancemortgage.com/important-credit-score-home-loan/

- https://assurancemortgage.com/how-to-get-a-mortgage-loan/

- https://www.forbes.com/sites/robertberger/2015/05/07/6-tricks-to-getting-a-great-mortgage-rate/

- https://consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

- https://assurancemortgage.com/what-kind-of-home-loan-should-i-get/

- https://www.nerdwallet.com/blog/mortgages/usda-loan-calculator/

- https://www.investopedia.com/mortgage/mortgage-rates/fixed-versus-adjustable-rate/

- https://assurancemortgage.com/find-a-loan-officer/

- http://www.freddiemac.com/pmms/pmms30.html

- https://www.marketwatch.com/story/what-inflation-mortgage-rates-are-still-falling-despite-concerns-about-rising-prices-on-consumer-goods-11620914775