Category: Purchasing a Home

Lafayette, Louisiana, is at the heart of the state’s Cajun and Creole influences, giving it an authentic and historic identity that contributes to the vibrancy of this Southern city. From a rich culinary scene to a thriving arts scene, Lafayette combines some of the best elements of the South with a modern perspective.

Given this city’s vibrant history, it’s no wonder so many of its homes reflect this heritage. Whether you want an older home with plenty of character or a more modern build, plenty of options are available to make it easy for you to call Lafayette home.

As you look at potential homes, you may also want to look at housing market trends in Lafayette to ensure you can navigate the market as stress-free as possible.

Trends in the Lafayette Housing Market

The housing market in Lafayette has seen numerous fluctuations and has become competitive in recent years, with many homes selling in less than a few months. Current trends show that the median sales price of homes has decreased, with the median price per square foot increasing.

Current Housing Demands

Most homeowners receive multiple offers on their homes before selling. On average, homes sell for slightly less than their asking price and sell in less than two months. Most popular homes sell closer to their list price in just over two weeks.

Schools in Lafayette

Lafayette is part of the Lafayette Parish school system, which is one of the largest school districts in the state of Louisiana. Residents of Lafayette can only take advantage of school choice if their child currently attends one of the following schools:

- Alice Boucher Elementary School

- J.W. Faulk Elementary School

- Dr. Raphael Baranco Elementary School

There are several schools in the Lafayette Parish School District, with 25 elementary, 12 middle and eight high schools.

Lafayette’s Climate

Lafayette is close to the Gulf of Mexico, which places it under a moderate flooding risk and an extreme wind risk during hurricane season. Lafayette is also under an extreme heat risk and in the next 30 years, it will see a sharp increase in days over 100 degrees.

Find Financing That Works for You With Assurance Financial

Since the creation of Assurance Financial in 2001, our goal has been to create a seamless financing experience. Our team is here to help you find a loan option that best fits your needs, and we will handle the entire process in-house to make it smoother. Whether you need a conventional loan or want to explore other financing options, we’re here to help you buy the home of your dreams. Contact us to learn more or apply for a loan today!

Purchasing a home in Lafayette, Louisiana, can be an excellent investment and fulfilling life choice. Here are some reasons buyers choose Lafayette.

Cost of Living

Lafayette is an affordable place to live, resting more than 10% below the national average cost of living. Housing, utilities and groceries are all more affordable than average, and there are ample job opportunities to fund your expenses.

Economic Growth

Lafayette’s economy is healthy, offering gainful employment in numerous industries. Residents earn a living working in information technology, health care, finance, hospitality, tourism and other fields. The oil and gas industry is also a prominent contributor to the local economy due to Lafayette’s proximity to the Gulf Coast. Researchers expect the job economy to continue its growth after outperforming projections in recent quarters.

Weather

The Louisiana weather is another reason to consider purchasing a home in Lafayette. The city experiences plenty of warm, sunny weather throughout the year. The lowest you’ll see the temperature drop in the winter is between 40-50 degrees Fahrenheit. Rain is fairly common, and it often comes in heavy storms, so use your sunny days to explore the outdoors. All things considered, Lafayette is warm enough to save on heat, but you’ll need to power an air conditioner for most of the year.

Activities and Entertainment

The Lafayette community offers plenty of fun activities for people of all ages. The bustling city has an incredible variety of food choices, a spirited art scene and a rich network of historical sites. People in Lafayette share their diverse cultures in ways that feed the city’s soul. You’ll find opportunities to attend festivals, concerts and other events that celebrate the characteristics that make Lafayette’s community strong.

Lafayette is also a fantastic city for outdoor exploration. A short trip outside of city lines will take you to numerous beautiful locations for hiking, boating and picnicking. Dense swamps and forests cover the land, allowing plant and animal life to thrive alongside Lafayette’s residents.

Housing Market

Beyond Lafayette’s lifestyle and professional opportunities, the area also boasts a robust housing market. Homes are affordable, with the median price hovering around $240,000. Homes often sell for roughly 99% of the list price, so you can accurately gauge your investment by browsing listings. The housing market will likely continue an upward trend, so an investment today will translate to future profit.

Home Financing in Lafayette

Assurance Financial is a mortgage banker with experience in Lafayette’s housing market. We are experts on Lafayette’s economy and housing and are active members of the local community. We can help you move forward with housing opportunities in Lafayette, so contact us online to discuss financing.

Atlanta is a thriving city in the northwestern corner of Georgia and one of the most affordable major cities in the United States. More and more buyers are choosing Atlanta for a few key reasons — the robust housing market offers a dependable and secure entry point into the city’s many lifestyle and economic opportunities.

Access to the City

Buying a home in Atlanta will fill your days with unique experiences and lasting memories. You’ll find eclectic food choices and experiences like local farmers markets, multicultural fine dining and delicious street food. Dozens of museums, parks and entertainment venues fill the Atlanta community, too. The actively expanding BeltLine trail system makes Atlanta easier to navigate every day. The weather is toasty in the summer and mild in the winter, so you can comfortably enjoy the city all year.

Employment Opportunities

As one of the largest cities in the U.S., Atlanta is a hub for business and commerce. You’ll find lucrative job opportunities in numerous booming industries like financial technology, logistics, health care, information technology and manufacturing. Whether moving to Atlanta to jumpstart your career or move upward on the ladder, tapping into this community’s options can help you get started.

Affordability

Atlanta stands out as one of the more affordable major cities in the U.S. Expenses like utilities and groceries are even with or below the national average.

As a major city, housing is still more expensive than you’d find in smaller areas, but the city’s lifestyle and financial opportunities can be worth the investment.

Plus, you receive more livable value for your home investment in Atlanta than other major cities. The cost of housing in Manhattan is 407% above Atlanta, meaning you can purchase a spacious home with a yard in Atlanta for a fraction of the price you’d pay in New York.

Healthy Housing Market

Purchasing a house is a significant investment, so it helps to know the local housing market is healthy. Atlanta’s housing market is diverse and vital. You’ll find numerous properties for sale, including apartments, single-family homes, duplexes, condominiums and more. The median sale price hangs around $375,000 to $400,000 — a figure that has improved due to increased construction that supplements the housing inventory. You’ll build equity through mortgage payments while the property’s value rises over time, bringing a gainful return when you sell.

Applying for Home Financing in Atlanta

At Assurance Financial, we support buyers in search of a home they love and an investment that builds their wealth. Our Atlanta-based loan officers will help you understand your borrowing options and the ways you’ll benefit from purchasing a property in the city that rose from the ashes, so we can assist you when you contact us online for more information.

Prairieville, Louisiana, is a small census-designated place just south of Baton Rouge. The area is full of beautiful homes, and the robust local economy supports its residents. If buying a home is in your future, Prairieville could be a great place to look. After all, purchasing a home in Prairieville has several advantages beyond the general benefits of homeownership.

The Region

Part of why homeowners love living in Prairieville is its location in a unique region. Sitting on the outskirts of Baton Rouge, Prairieville showcases a mixture of suburban and rural living. The climate offers moderate to hot temperatures throughout the year, allowing residents to enjoy outdoor time exploring the Mississippi River and numerous parks.

The Size

Prairieville is a relatively small area, with just over 34,000 people living inside its boundaries. Its low population lends itself to a comfortable life within a tight-knit community. The city of Baton Rouge is nearby for convenient access to entertainment and other opportunities. Meanwhile, major highways run through the area for easy travel to Lafayette or New Orleans.

The Cost of Living

Prairieville is a pragmatic place to live from a financial perspective. Residents save on utility expenses compared to the rest of the nation while spending an average amount on groceries. Homes in Prairieville are large and luxurious, resulting in housing prices over the national average. However, the calm lifestyle and beautiful land are worth the investment.

The Job Opportunities

Job opportunities are ample in Prairieville due to its proximity to Baton Rouge. Residents can easily commute from their Prairieville homes to their jobs with the many growing businesses in the region. Health care and biotech are two industries that thrive in the Prairieville area and offer wages that can support your lifestyle.

The Housing Market

Prairieville’s housing market makes it a viable option for many buyers. Sales prices eclipse the national median due to the number of higher-end properties in the area. Most homes sell for around 97% of their list prices. With the right financing, you can purchase a home at a competitive price and see its value grow steadily over time. Properties move quickly, so loan pre-qualification can help your offer stand out.

Finance a Home in Prairieville

At Assurance Financial, we support buyers entering the Prairieville community through a comprehensive list of loan options. Our Prairieville loan officers know the region and its economy. We can help you get familiar with the area and determine whether Prairieville is a good fit for your family. We have borrowing options for buyers in various economic situations, so contact us online to learn more. Or, if you’re ready to shop in the Prairieville housing market, you can apply for a mortgage online.

You’ll consider a wide range of factors when choosing a new home, one of those being where you’ll live. The city in which you decide to purchase a home will impact your lifestyle and financial situation, which is why Baton Rouge is a popular option for many buyers.

Assurance Financial helps people purchase comfortable homes in areas that match their needs. With loan officers stationed in the Baton Rouge community, we’re familiar with the local economy and what it’s like to live there. Work with us when making your move.

Life in Baton Rouge

This city’s proximity to New Orleans and the Mississippi River means there’s a great variety of entertainment and activities in Baton Rouge. Whether you enjoy fine dining, nightlife, collegiate sports or music, you can find a way to fill every weekend. The area is also bustling with family-friendly attractions like museums, the Baton Rouge Zoo and various parks along the river. Hot summers and moderate winters make it possible to enjoy time outdoors for most of the year.

You’ll also find economic opportunities in the Baton Rouge area. The medical and biotech industries are experiencing growth in the area, bringing and influx of well-paying jobs. Moving can be a great way to jumpstart or advance your career.

Financial Benefits

Baton Rouge’s strong local economy has many financial benefits. Beyond the area being full of job opportunities, the cost of living in Baton Rouge is 3% lower than the national average, so you can maximize your income’s value. Utilities, housing and groceries are all on par with or below the national average. These factors mean you can earn enough to support your lifestyle with funds remaining to grow your wealth.

The strong housing market is another key contributor to Baton Rouge’s livability. The same house would cost you less here than in larger cities like New Orleans. Homes sell for around $250,000 on average, which is more than $100,000 below the national median, and inventory is high enough to meet demand while preserving the market’s upward trajectory. When you’re ready to sell your Baton Rouge home, you’ll find comfort in a housing market with steady growth and a sale-to-list ratio of 95% or higher.

Find a Loan Officer in Louisiana

At Assurance Financial, we offer various types of loans that help buyers purchase property in Baton Rouge or refinance their home. As an independent, full-service financial institution, we are a dependable partner for one of life’s most important investments. Feel free to contact us online for more on our borrowing options.

Taking out your first mortgage is a huge life step. A mortgage is a critical tool to have — it allows you to become a homeowner without putting down hundreds of thousands of dollars on the spot, and it lets you pay off your loan over time. About 96% of first-time homebuyers finance the purchase with a mortgage.

But mortgages are immensely complex, and many homeowners have questions when they first get started. How do mortgage payments work, exactly? And what is included in your monthly mortgage payment? We’re here to answer your questions so you can approach your new mortgage with confidence.

Topics Covered

- What Are Mortgage Payments?

- How Does a Mortgage Loan Work?

- What Is Included in a Mortgage Payment?

- Mortgage Payment Formula

- Mortgage Vs Loan

- Frequently Asked Questions About Mortgage Payments

What Are Mortgage Payments?

What is a mortgage payment? Mortgage payments are the payments you make on a long-term loan that enables you to buy your home.

Almost everyone who owns a home has a mortgage and makes mortgage payments. Homeowners typically make these payments monthly, over a fixed period of years. Some standard options include 15-year and 30-year mortgages.

What are the advantages of spreading out mortgage payments across more or fewer years? Each approach comes with pros and cons:

- Shorter mortgages: Shorter mortgages tend to have lower interest rates and allow the homeowner to pay less interest overall. The tradeoff is that because the schedule becomes more compressed, these mortgages require higher monthly payments.

- Longer mortgages:Longer mortgages tend to have higher interest rates. So homeowners who choose these mortgages will pay more interest overall. The appealing tradeoff is that by spreading the payments over a longer term, homeowners can lower their monthly payments to more affordable sums. So extended options are often attractive to homeowners looking to create more room in their budgets each month.

Benefits of Making Regular Mortgage Payments

Paying down your mortgage provides you with a couple of different benefits. One is that it reduces the amount of debt you have. As you slowly, steadily make payments, you decrease your debt burden. You increase your debt-to-income ratio, making yourself a more attractive borrower if you decide to take out new loans. You also get a little closer to having your home paid off and having a bit more cash to spend each month.

The second benefit is that you accrue home equity. Home equity is the amount of your home that you have paid off. It equals the value of your home minus the value of your remaining mortgage. So the more of your mortgage you pay down, the more home equity you’ll have. Maintaining as much home equity as you can is an excellent strategy for maintaining financial stability. You can also borrow strategically against your equity by taking out home equity loans — to perform renovations, say, and boost the eventual resale value of your home.

How Does a Mortgage Loan Work?

A mortgage loan is a type of loan that is used to purchase a property, such as a home or a piece of land. You borrow money from a lender to purchase the property and the property serves as collateral for the loan. Here’s how it works:

- Application: You apply for a mortgage loan with a lender, which involves providing personal and financial information.

- Pre-approval: The lender evaluates your creditworthiness and pre-approves you for a certain loan amount.

- Property search: You search for a property to purchase within the pre-approved loan amount.

- Property appraisal: The lender hires an appraiser to determine the value of the property to ensure it is worth the amount being borrowed.

- Loan approval: The lender approves the loan, and you sign a mortgage agreement that outlines the terms and conditions of the loan.

- Down payment: You make a down payment on the property, which is a percentage of the purchase price.

- Closing: You meet with the lender to finalize the transaction. This involves signing a promissory note and a deed of trust, which gives the lender a security interest in the property.

- Repayment: You make monthly payments on the loan, which typically include principal, interest, taxes and insurance. The loan is usually repaid over a period of years.

- Ownership: Once the loan is fully repaid, you own the property outright.

What Is Included in a Mortgage Payment?

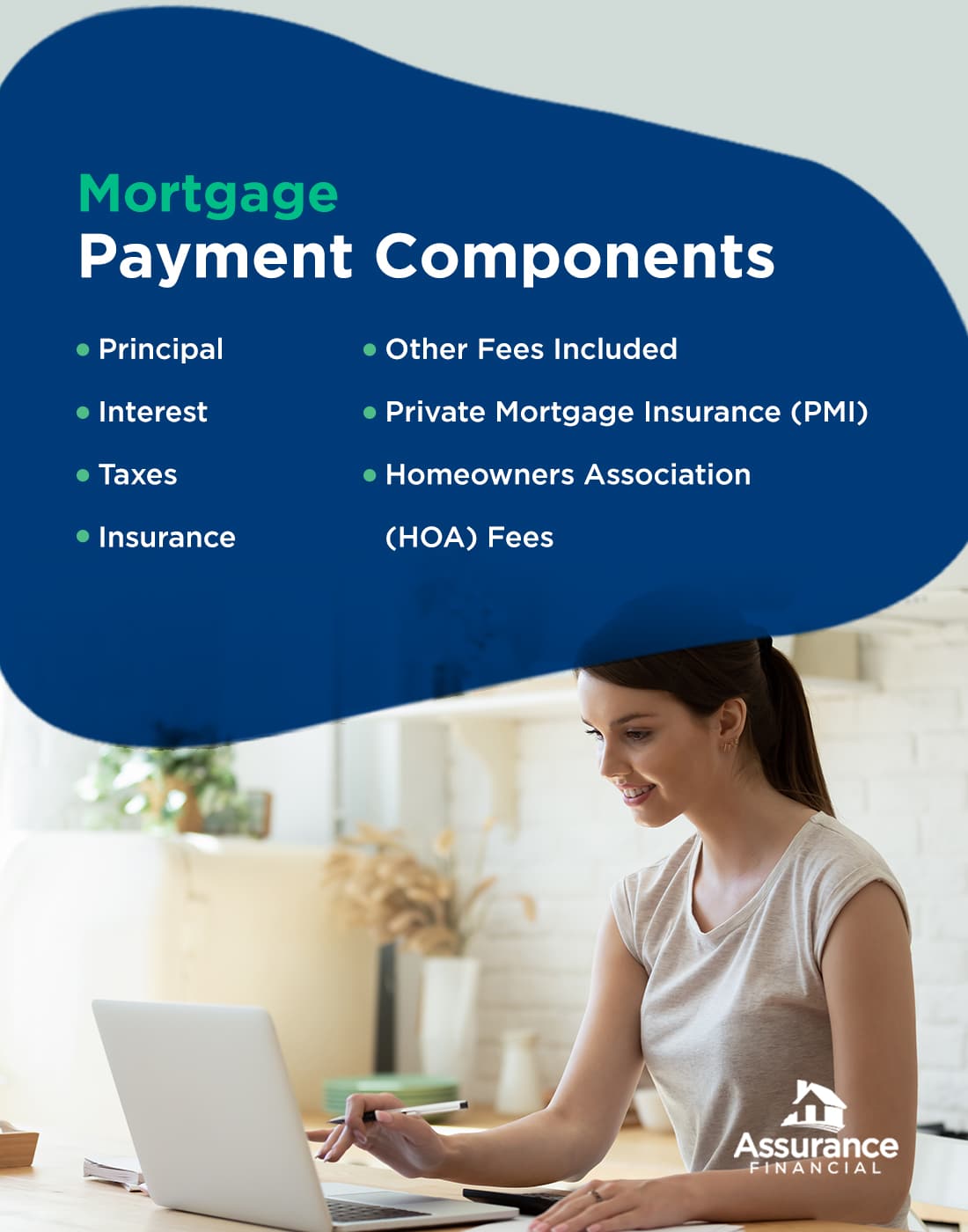

Your mortgage payments consist of many different components that all combine into a single sum. Four main components — principal, interest, taxes and insurance (PITI) — go into the makeup of your mortgage payments, and additional fees may be included as well.

Below is a breakdown of those components:

1. Principal

The principal is the amount of money you borrowed from your mortgage lender and have to pay back. Generally, that sum is the price of your home minus your down payment. Say you bought a $300,000 house and put down a 20% down payment of $60,000. Your principal is then $300,000 – $60,000, or $240,000.

Most of your mortgage payment each month goes toward paying down the principal and interest. The part of your monthly payment that goes toward your mortgage principal is what pays down your loan and builds your home equity. Most mortgage structures favor paying down more of the interest at the beginning of the loan and more of the principal at the end.

2. Interest

Interest is the amount charged on the principal because the lender is loaning you the money. The purpose of interest is to reward the lender for taking the risk of lending to you. Charging interest is how lenders make money, keep their businesses running and pay their employees.

Interest rates vary from mortgage to mortgage, and conditions can change quickly. Interest rates decreased between 2018 and 2021, with average interest rates on a 30-year fixed-rate mortgage falling to as low as 2.65% in January 2021. Interest rates in 2023 are somewhat elevated, but many experts predict decreases as the year goes on.

The amount of interest included in your monthly mortgage payment varies inversely with the amount of principal included. At the beginning of your home loan, your payments will include a higher proportion of interest. Toward the end of your loan, that proportion will be much lower.

3. Taxes

Some mortgage payments also include real estate taxes, also known as property taxes.

Local governments assess property taxes to fund public services like schools, fire and police departments and the public works departments that maintain municipal infrastructure. The government requires these taxes annually, but homeowners typically pay them in monthly installments as part of their mortgage payments.

How does the local government receive those funds if it collects them only once per year? Your lender will hold the taxes for you in escrow and pay them once they come due.

If you’re looking at your property taxes and wondering why they don’t line up with the price of your home and your tax rate, remember that counties usually base property taxes on the assessed value of your home rather than on the purchase price. A property assessor looks over your house and then tells the local government its value.

So if you got a massive house at a great price, you might still have hefty property taxes incorporated into your mortgage payments. Say you bought a $600,000 home for $500,000. If the county property tax rate is 1.5%, you’ll pay $9,000 in property taxes for the year — $600,000 x 0.015. Divided by 12 months, that’s $750 in taxes on your mortgage payment.

4. Insurance

Does a mortgage payment include insurance? Usually, though not always. Your mortgage payment generally includes your property insurance payment and your private mortgage insurance (PMI) payment if applicable.

Property insurance is the insurance that covers your home in the event of a disaster like a fire, hurricane, tornado or even a burglary. It can include homeowners insurance as well as additional riders like flood and earthquake insurance.

Property insurance takes most of the risk from the homeowner and transfers it to the insurance company. So you’ll pay a little more each month, but you’ll pay a lot less in repair and replacement costs if disaster strikes.

Insurance payments work similarly to property tax payments. You’ll include them as part of your monthly mortgage payment even though they’re due only once a year. Your lender will hold the insurance money in escrow for you and pay it when the insurance company requires it.

5. Other Fees Included

Your mortgage payments may also include miscellaneous other fees, such as loan processing fees. These fees are likely to account for a minimal percentage of your overall monthly payment.

6. Private Mortgage Insurance (PMI)

If you make a down payment of less than 20% when you buy your home, your lender will likely require you to take out private mortgage insurance (PMI). Lenders use your down payment amount as a proxy to assess the risks associated with lending to you. Your PMI costs add a little to your mortgage payment each month.

Unlike property insurance, which protects you in case of a disaster, PMI protects your lender. It covers your lender if you become unable to make your monthly mortgage payments. If you miss payments, your PMI will kick in to cover the costs so your lending company doesn’t lose its investment. PMI will not protect you, however. If you fall behind on payments, you can still lose your home to foreclosure even though you have PMI coverage.

PMI is also important to many lenders because it enables them to sell loans to other investors. Having insurance backing minimizes these investors’ risk and makes them more willing to take on the loans.

PMI is relatively easy to remove from your mortgage payments after a while. Generally, once you’ve accumulated 20% home equity, you’ve convinced your lender of your fiscal reliability and can request to drop your PMI. Alternatively, you can sometimes stop your PMI at the midpoint of your amortization schedule — after the 20th year of a 40-year mortgage, for instance.

Additionally, once you pay off more of your loan, your mortgage insurance should drop automatically — usually once the balance reaches 78% or less of the original mortgage amount.

7. Homeowners Association (HOA) Fees

If you belong to an HOA, your mortgage payment sometimes includes HOA fees. These fees keep you in good standing with your HOA and, as with the lumped-in insurance and tax payments, offer convenience by minimizing the number of separate payments you must make.

Check out our mortgage calculators to help you better prepare for your loan.

Mortgage Payment Formula

The formula to calculate the monthly mortgage payment is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1 ]

Where:

M = Monthly mortgage payment

P = Principal amount borrowed (the loan amount)

i = Monthly interest rate

n = Number of monthly payments (loan term in years multiplied by 12)

For example, let’s say you take out a $200,000 mortgage loan with a 4% annual interest rate and a 30-year loan term. To calculate the monthly mortgage payment:

P = $200,000

i = 4% / 12 = 0.003333 (monthly interest rate)

n = 30 x 12 = 360 (number of monthly payments)

M = $200,000 [0.003333(1 + 0.003333)^360] / [(1 + 0.003333)^360 – 1]

M = $954.83 (rounded to the nearest cent)

Therefore, your monthly mortgage payment would be $954.83. Note that this formula does not include taxes, insurance or any other additional fees that may be included in the monthly mortgage payment.

Mortgage vs. Loan

A mortgage is a type of loan that is specifically used to purchase a property, such as a home or a piece of land. The property serves as collateral for the loan, which means that if you don’t make the mortgage payments, the lender can foreclose on the property and sell it to recoup their losses.

On the other hand, a loan is a more general term that can refer to any type of borrowing, such as a personal loan, a car loan or a business loan.

The main differences between a mortgage and a loan are:

- Purpose: A mortgage is used to purchase a property, while a loan can be used for a variety of purposes.

- Collateral: A mortgage is secured by the property being purchased, while a loan may or may not require collateral.

- Repayment period: Mortgages typically have longer repayment periods than other types of loans, often spanning decades.

- Interest rates: Mortgage interest rates are typically lower than interest rates for other types of loans due to the fact that they are secured by the property being purchased.

Frequently Asked Questions About Mortgage Payments

Below are a few commonly asked questions about mortgage payments and how they work:

1. When Are Mortgage Payments Due?

Mortgage payments are typically due on the first of every month, but they work differently from rent payments in terms of what month they cover. With rent payments, you typically pay upfront, putting down money on the first of the month for the upcoming month. With mortgage payments, on the other hand, you generally pay in arrears — paying for the previous month instead of the upcoming one.

2. When Do Mortgage Payments Start?

When new homeowners close on a house, paying the closing fees as they do, they often wonder how soon their mortgage payments will kick in, hoping for a little breathing room.

And they typically get it. Because you pay in arrears, your first mortgage payment is usually due on the first day of the month after the month you closed. Say for example that you closed on your house on January 19. Your first mortgage payment would be due on March 1 and would cover February.

What about the interest due for January? That interest generally rolls into your closing costs. You’ll be able to see the exact amount in your closing disclosure forms, along with your interest rate, loan amount and monthly payments.

3. Do Mortgage Payments Go Down Over Time?

If you have a fixed-rate mortgage, your mortgage payments will not drop over time.

However, the amounts that comprise your loan do change over time due to your amortization schedule — the schedule of your payments. This schedule impacts how interest payments and principal payments are distributed. Generally, your initial mortgage payments favor your interest. You’ll be paying off more of your interest at first and less of the principal. Over time, as you pay down your home loan, your payments start to include more principal and less interest.

The result is that you pay down your interest faster than you pay down your principal. Why?

At the beginning of your loan, you naturally have a higher loan balance. So you owe more interest every month once you apply your interest rate to that loan balance. As time goes by and your loan balance decreases, you’ll owe less interest every month. So most of your payment will then go toward the principal, even though your total payment stays the same.

All that said, your mortgage payments may change slightly because of alterations in your insurance or tax rates. If your home’s value rises, for instance, your property taxes will likely rise as well, increasing your overall mortgage payment.

4. What Happens if I Make a Large Principal Payment on My Mortgage?

If you make a large payment on your mortgage, the extra payment goes toward paying down your principal. So in many cases, making a large payment is advantageous if you can afford it. It enables you to pay down your mortgage sooner and build equity faster.

And paying down the principal also helps you reduce your interest. The reason is that your lender calculates your interest from the amount of your principal. So if you lower your principal, you’ll lower your remaining interest as well.

With some mortgages, though, your lender will assess a prepayment penalty if you pay your mortgage down early. The prepayment penalty exists to compensate the lender for the interest it loses if you pay off your mortgage more quickly than expected. So you’ll probably want to sit down and do the calculations to figure out the best option for your finances. Determine whether your finances will benefit more if you pay your mortgage early and lower its overall cost or if you pay it slowly and steadily to avoid the prepayment penalties.

5. What Happens if I Miss a Mortgage Payment?

If you miss a mortgage payment, the penalties you’ll face depend on how late you were and how often you’ve missed payments in the past.

First Payment

Generally, the first time you miss a payment, you’ll receive a short grace period in which to get your payment up to date. That grace period is often about 15 days. Mortgage lenders need to receive their money — still, they understand that life happens, and they don’t want to penalize otherwise good, reliable clients. If you make your payment within that grace period, you probably won’t incur any penalties.

Second Payment

If you miss a second payment, or if the grace period goes by and you still haven’t made your first missed payment, you’ll start to feel the consequences. The first thing your lender will do if you miss mortgage payments or don’t pay within the allotted grace period is to impose a late fee. You’ll still be responsible for the missed payment, and you’ll have to pay a little extra as well. The late fee acts as a deterrent to discourage you from missing future payments. Depending on its policies, your lender may also report your delinquency to the credit bureaus. If your lender reports the late payment, you’ll take a hit to your credit score.

Once you miss two payments, your lender considers you to be in default on your mortgage. At this point, the lender is likely to become stricter and more forceful in its communications with you about making payments. However, most lenders don’t want to foreclose on a home unless they have no other options, so you can very likely still work out a payment deal at this point.

Third Payment

After three missed payments, you will receive a letter from your lender advising you that you have 30 days to make the missed payments, and then your lender will begin foreclosure proceedings. If you don’t make payments during that 30 days, foreclosure will start.

The upshot is that you’ll need to ensure you make your mortgage payments on time each month so you can stay in the home you love. Remember that your mortgage is a secured loan — your house and property make up the collateral to secure it. If you fail to make mortgage payments, you could lose your home to foreclosure.

6. Can I Change My Mortgage Payment Amounts?

If you have a fixed-rate mortgage, you’d usually need to refinance your home to change your mortgage payment amounts.

Many homeowners refinance their homes at some point to lower their interest rates, increase or reduce the mortgage length, or reduce their monthly bills. Refinancing is a considerable undertaking since you’re applying for a mortgage all over again. Still, it is well worth the trouble in many scenarios.

To obtain changeable mortgage payments, you can also take out an adjustable-rate mortgage. If you have an adjustable-rate mortgage, your monthly payments will change often as your interest rates fluctuate.

With an adjustable-rate mortgage, the interest rate remains fixed for a determined time and then adjusts at predictable intervals — every five years, every year, even every month. At the end of the predetermined period, the interest rate adjusts to reflect the current market rate.

Adjustable-rate mortgages can be a risky gamble — you can’t be certain how your rates will change. If you feel confident that interest rates will drop over time, though, you might consider taking out an adjustable-rate mortgage to reap the benefits of market changes.

Apply for a Mortgage With Assurance Financial

When you’re ready to take the exciting step of purchasing a new home, work with Assurance Financial to take advantage of historically low rates.

We make it easy to apply for a mortgage and estimate costs during the process, and you can get pre-qualified in 15 minutes. Our licensed, approachable, trustworthy loan officers have the industry knowledge and expertise to get you custom competitive rates. And we have just about every type of home loan available, from conventional loans to FHA and VA loans to loans designed specifically for jumbo or modular homes.

Whether you’re a first-time homeowner, downsizing, dreamsizing or looking for an investment property or a vacation home, we can make getting started with your loan quick and convenient. And because we’re an independent lender rather than a mortgage broker, we give you the security and peace of mind of knowing we’ll never pass your loan or personal data on to anyone else.

Apply online, or contact us today for a no-obligation quote.

Sources:

- https://files.consumerfinance.gov/f/documents/cfpb_market-snapshot-first-time-homebuyers_report.pdf(4)

- https://assurancemortgage.com/everything-you-need-to-know-about-30-year-fixed-rate-mortgages/

- https://assurancemortgage.com/how-to-get-a-mortgage-loan/

- https://assurancemortgage.com/does-pre-approval-affect-credit-score/

- https://assurancemortgage.com/loan-application-process/

- https://assurancemortgage.com/what-is-down-payment-home-loan/

- https://assurancemortgage.com/what-are-closing-costs/

- https://assurancemortgage.com/what-is-a-mortgage-payment/

- https://fred.stlouisfed.org/graph/?g=NUh

- https://www.forbes.com/advisor/mortgages/mortgage-rates/

- https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

- https://www.consumerfinance.gov/ask-cfpb/when-can-i-remove-private-mortgage-insurance-pmi-from-my-loan-en-202/

- https://assurancemortgage.com/calculators/

- https://assurancemortgage.com/how-do-you-calculate-your-estimated-mortgage-payment/

- https://www.investopedia.com/ask/answers/081516/how-many-mortgage-payments-can-i-miss-foreclosure.asp

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/purchase-your-home/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/