Category: Loans

We pride ourselves on the expertise and approachability of our loan officers. We make sure everyone knows everything about home loans. The purpose of this is to ensure that we can assist you to find the best option for your situation and needs. When you work with us, we join your team, working with you to make sure everything moves as smoothly as possible.

However, no matter who you work with, there are basic principles every agent should have to assist you in the best way. These are the pillars our Loan Officers are trained under, and it’s the standard every home loan officer should adhere to when working with a client:

Know The Builders In Your Market

Multiple options for financing, terms, and processes are only available if the agent knows various builders within the area. Without this, they can’t assure you’re going to get the best option. Even if they don’t have an extensive history in the market, they should know the builders.

Understand The Builder’s Products & Specialties

Knowing what they can do and offer is a no-brainer for an experienced agent. If your agent knows the builders in the area, but not their expertise and offering, it’s a red flag.

Be Up To Date On What Lots Are Available & What To Look For

A good way to check and make sure this is happening is see if your agent accompanies you when the builder is walking you through the lot. Take note of the agent’s engagement, since they should have a basic understanding of the factors that are important to you. From excellent communication, experience with the builder and keeping your best interest at the forefront, your agent should be your best friend throughout this process.

[download_section]

New Construction Knowledge

Starting and financing a new construction build can be a tedious and overwhelming process. If the agent meets with you and doesn’t outline the processes involved, with the builders, lenders, sales reps, etc., then they didn’t do their homework.

Home loans are complicated. Financing new construction builds are also complicated. The point of working with an agent is for them to do all the heavy lifting, taking away the stress and getting you the best option for your situation and needs.

This principle is what we were founded on, and it’s what drives every one of our agents to deliver the most comprehensive, knowledgeable, and valuable information to you. Building your dream home shouldn’t be a nightmare. We make sure it isn’t. Contact our Loan Officers today!

Are you looking to finance a new construction project? Before your loan can be approved, your lender will need an appraisal for the home construction. Existing homes are usually easy to appraise because they can be compared to other homes. But how can a home be appraised before it’s even built?

The appraisal process for financing new construction can seem complicated at first, but as with everything else in this process, the steps you take are determined by how you’d like to finance the construction. Your lender is investing in your home, and if you cannot pay for it, they’ll need to sell it. Most lenders want to help you, but the venture may be risky for them if there aren’t many comparable homes in your area.

When planning the construction of a new home, you may want to know what can work against you during the appraisal process and how an appraiser will evaluate your home plans. You may end up reconsidering some of your home’s planned features or put in additional effort to find comparisons for your new home. If you’re feeling worried or overwhelmed with your construction loan appraisal process, we have the information you need to put your mind at ease.

- The Role of the Appraisal Process in Construction Financing

- How Long Does the Appraisal Process Take?

- Steps of the Appraisal Process

- Acquiring Specs and Cost Breakdown

- Estimating Home Value

- Analyzing Elements of Credibility

- Completing the Uniform Residential Appraisal Report

- Obtaining the Certificate of Completion

- Review Your Appraisal

- Make Upgrades or Changes

- Finance Your Construction Loan

- Underwriting for Construction Loans

- Closing

The Role of the Appraisal Process in Construction Financing

An appraisal is an opinion given by a licensed appraiser on the value of a property. The appraiser must follow set rules when appraising a property. The appraisal is just as important as your income, credit and assets when you’re applying for a construction loan. For new home construction, the appraisal is even more important than an appraisal for an existing home.

The two options here are if the builder will finance or if the buyer will finance. Usually, when the builder is the borrower, they:

- Own the lot already

- Don’t know who the future homeowner will be

If you’d like the builder to fund the construction, then a “subject to” appraisal will be performed at the time of the initial underwriting.

A “subject to” appraisal is where the value of the property is based off what the home will be worth in the future. It helps you evaluate the home after the improvements have been made. “Subject to” appraisals are a good way to make sure you don’t “over-improve” your home.

Appraisals are good for 120 days or 180 days for Veterans Affairs Loans (VA). If the house is not completed within this time, either a “Recertification of Value” or a new appraisal will be completed by the appraiser before the purchase is finished.

When the house is complete, the appraiser will provide a “Final Inspection” report. It’s important to note that if the builder finances the construction, the Loan-To-Value (LTV) is calculated by using the lesser of the purchase price or the appraisal.

The other side of the coin is if you, the buyer, will be financing the construction. Usually, when the homeowner is the borrower, they:

- Own the lot already

- Have a contract for construction with a builder

- Will use the loan funds to pay their builder

In this process, there are no drastic differences between this and builder financed. This appraisal process starts off with a “subject to” appraisal performed at the time of the initial underwriting. The appraisals are still good for 120 days or 180 days for VA loans.

If the house is not completed within this period, either the appraiser will complete a “Recertification of Value” or a new appraisal, although there is an exception for VA loans.

How Long Does the Appraisal Process Take?

So how long does a construction loan appraisal take? The appraisal itself can take two to four weeks or even longer if the area is farther away from where the appraisers work and live. Keep this general timeline in mind as you’re getting into the appraisal process.

Steps of the Appraisal Process

Construction loans are usually higher risk than loans for completed properties. Risks for construction loans include improvements not being completed, cost overruns, mechanic’s liens and faulty construction. To reduce their risk, lenders can:

- Control the disbursement of the loan funds

- Acquire title insurance endorsements before every disbursement

- Hold the contractor’s profit back

- Get lien releases

- Acquire completion and payment bonds

The lender’s goal is always to have enough funds to complete the construction. Because a loan for new home construction can present several risks for a lender, the appraisal plays a key role in determining whether the lender will approve a borrower for a loan and for how much. In many cases, an appraisal can even be the cause for loan denial.

So what exactly is the appraisal process for construction financing? Here are the steps, from construction loan pre-appraisal to certified completion.

1. Acquiring Specs and Cost Breakdown

Builders should keep a building plan for the home they are constructing and specifications that list the construction materials used. Builders will also keep a cost breakdown list for the labor of each home they build. The plot plan for a new construction home should show where it will be located on the site, along with where any accessory buildings will be located. Homebuilders will give mortgage lenders a home’s building plan, cost breakdown list, plot plan and spec sheets for an appraisal.

The more detailed and accurate spec sheets and home construction plans are, the more likely an appraiser can determine the level of finish and construction in your future home. An appraiser may discuss the home with the builder representative and even the borrower to confirm or get a better understanding of the drawings, spec sheets and level of finish on the new construction.

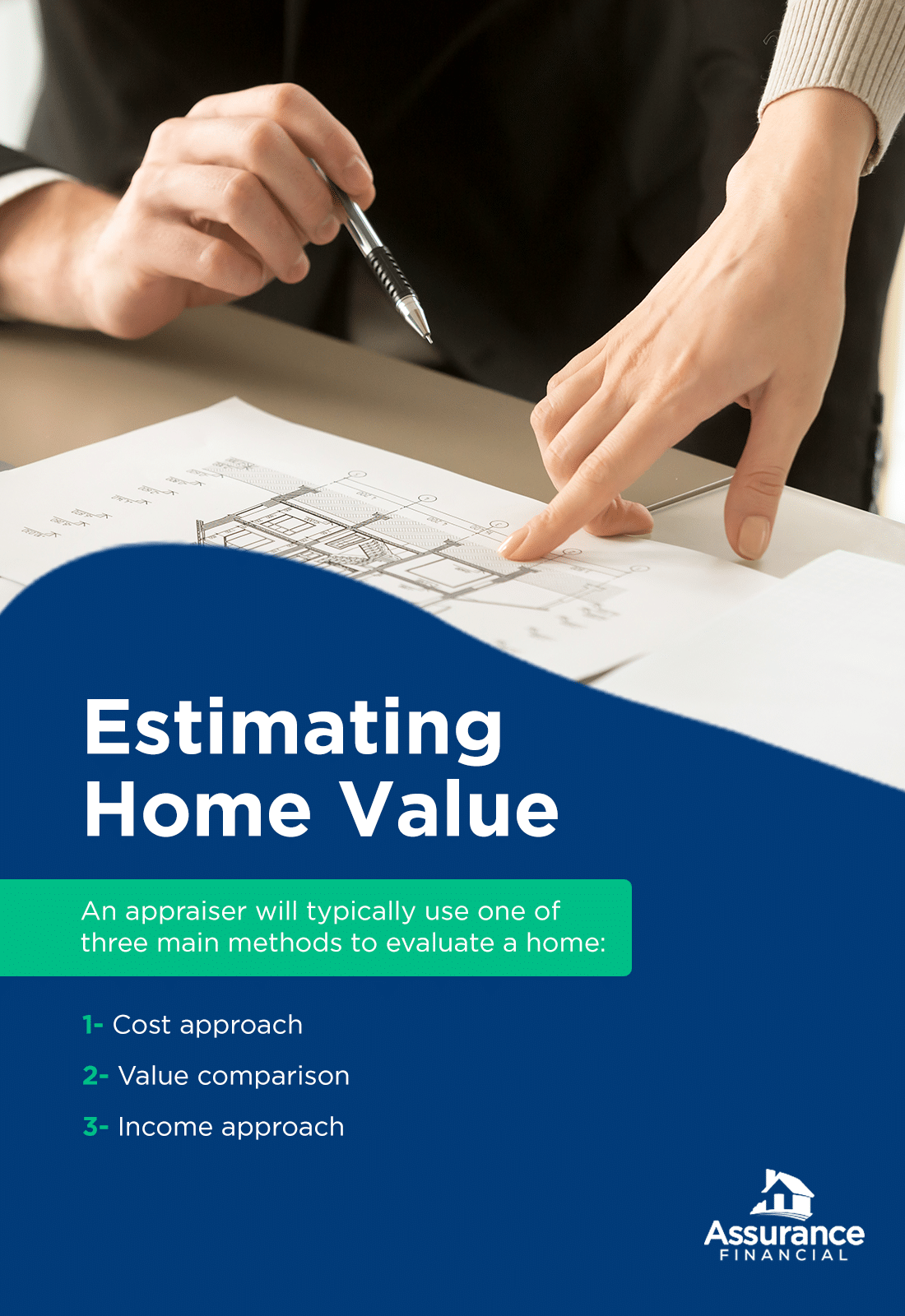

2. Estimating Home Value

An appraiser will typically use one of three main methods to evaluate a home:

- Cost approach: In the cost approach, the appraiser adds the cost of the land to the cost to reproduce or replace the house. This method can be inaccurate, however, because appraisers use a national database to determine costs, and materials can cost different amounts depending on where in the country you’re located.

- Value comparison: The value comparison approach estimates a home’s value by looking at the sale prices of similar homes nearby. This method is the most common, so finding comparable properties is essential. Because a new construction home can be unique for its location, though, there may be few comparable homes in the area.

- Income approach: This appraisal method isn’t very common, but it accounts for whether the home will be an income-producing property.

For a house to be comparable to your new home construction, it must typically be located a set limit of miles away and on a similar size of land. For urban areas, comps must be within half a mile or less but can sometimes be extended to a mile. For suburban areas, comps must be located within 1 to 3 miles. For rural areas, comps must be located within 5 to 10 miles.

A home can also only be considered a comp if it has sold on the open market in the last six months. Sometimes this can be extended to a year, but most lenders prefer comps that are six months old or less.

If you are planning to build a colonial-style home of 1,500 square feet on 3 acres of land, your appraiser must locate three other homes of approximately 1,500 feet on about 3 acres of land. If the appraiser can’t find at least three comparable homes, they could find it difficult to establish your new home’s value, leading to a possible loan denial or the lender lowering your loan amount.

Without sales in the immediate neighborhood, appraisers may expand their searches to nearby areas for homes that are similar, even sometimes exceeding the lender’s distance guidelines if necessary to acquire a credible value estimate. The appraiser will explain why a sale was used and any dollar adjustments that account for the differences in markets between the different locations.

Alternatively, an appraiser may also find a comparable older home within the same neighborhood as the new home construction. If this older home has similar square footage, finishes and overall utility, then a comparison can be made, adjusting for the differences in age, condition and depreciation.

The best approach you can take as the borrower is to know the area in which you are hoping to build a home. Some borrowers want to build homes that are much bigger and more expensive than other homes in the area, which is known as overbuilding. Though they may be qualified as a borrower, their loan could still be denied if the appraiser can’t establish a legal appraisal value. If you want to build on a lot of 20 acres in an area where most homes are built on 2 to 3 acres, you may also face issues with the appraisal. Lenders want to be able to sell a property quickly if necessary, but if a home is out of the ordinary for the area, they may not be able to do so, making the home construction a risky investment.

3. Analyzing Elements of Credibility

An appraisal must contain several key elements to be considered credible. The appraiser will identify the property they will be appraising and the total scope of the work they will be performing. Your home’s appraisal will list an estimated value and how this estimate was derived. The appraisal process requires appraisers to use certain forms to present their data and analysis clearly.

4. Completing the Uniform Residential Appraisal Report

Many home appraisers use this report. Fannie Mae developed the Uniform Residential Appraisal Report (URAR) to allow home appraisers to produce credible appraisals on both existing and new construction homes. Appraisers can combine this URAR with the estimated cost of the land and builders’ documents to determine home values for construction homes.

5. Obtaining the Certificate of Completion

Once all the needed improvements are made, the appraiser will return to verify the work. According to Fannie Mae, the certificate of completion must:

- Be completed by your home’s appraiser

- State improvements were completed and align with conditions and requirements from the initial appraisal report

These are the main steps involved in the appraisal process, but you aren’t ready to finance your new home construction just yet.

What’s Next After the Appraisal Process Is Complete?

When the house is complete, the appraiser will provide a “Final Inspection” report. The appraiser of the new construction home will send the appraisal to your mortgage lender to use when deciding on your loan. Here are some new construction appraisal guidelines to follow.

1. Review Your Appraisal

What if the appraisal is lower than what you expected? First, review the appraisal thoroughly. Check for issues in adjustments or missing features in the description of your planned improvements that the appraiser may have missed. If there are items you feel weren’t accounted for adequately in the appraisal, make a list.

You may also want to review the comparable sales included in the report. Double-check for factors that may have a negative influence on the comparable sale’s value that the appraiser may have overlooked and failed to account for, such as a school system. Check the gross living area, also known as the taxable living area, for each sale. You can find this information in the local tax record online. Make sure all of the data you find is congruent with what the appraiser has reported.

If you’ve found any significant errors or inconsistencies in the report after your close review, create a polite, thoughtful document to support your conclusions with facts and data and pass it on to the lender. You can request a second appraisal if necessary.

2. Make Upgrades or Changes

If you’re unsatisfied with the appraised value of your new home construction, you may also want to consider making upgrades that can impact the appraisal. Hardwood floors tend to have the most significant impact on the value of a home relative to their cost. Buyers like hardwood floors on the main level of the home, along with a hardwood staircase leading up to the second level. If it’s in your budget, you may also want to consider hardwood on the landing and hall of the second level.

Some features are low-value, high-cost items. Maybe they’re on your list of desired aspects of your home, but they will likely work against you during an appraisal. A basement will probably be on this list, as it’s essentially a concrete wall underground that contains a room or two and doesn’t add much square footage. But a basement requires excavation, plumbing and the cost of concrete, meaning it’s costly without contributing much value to the property. Another example is a wraparound porch, which may add a little extra room to your structure but doesn’t count toward the home’s total square footage.

You don’t necessarily need to give up your dream basement or wraparound porch, but you may want to discuss with your builder whether these features will be worth the hurdle you’ll face during an appraisal. Whatever upgrades you choose, research their cost-effectiveness. If you can find an upgrade that adds a lot of value at little cost, try to incorporate those changes into your home construction plans to increase the appraisal value.

After you’ve made any necessary changes for the appraisal, your appraiser will send the information on to your lender.

3. Finance Your Construction Loan

After the appraisal is completed, the lender will determine the actual amount they’re willing to lend you for your construction project. The loan you’ll receive will be the lesser amount of:

- The maximum amount you are qualified to borrow

- 80% of your home’s appraised value

Maybe you’ve been approved for a $200,000 loan. If the value of your home is appraised to be $250,000, 80% of that is $200,000. Because you’ve been approved for a $200,000 loan, you’ll receive that full amount from your lender. However, if your home is appraised to be $225,000, 80% of that is $180,000, and that is the amount you will receive from your lender.

You may choose a combination loan, also known as a construction-to-permanent loan, which is when a construction loan is combined with a long-term loan. Because construction loans are short-term loans, you may want a loan that begins after construction on your new home is completed.

During the construction period, you will pay interest only. When this construction loan period is complete, your loan will then convert to an amortized loan.

4. Underwriting for Construction Loans

For a construction-only loan, a lender will generally require a take-out loan as the source of repayment from another lender. This second lender will provide the loan to the borrower once construction is complete. The lender for a construction-only loan will be less concerned with the borrower’s qualifications, but they will review the builder’s experience and the construction contract.

For construction-permanent loans, lenders will put more emphasis on a borrower’s qualifications, such as their credit, assets and income ratios.

5. Closing

To close on your construction loan, you’ll need:

- The clean title for your land

- The appraisal report

- The final underwriting

At closing, you’ll sign many documents that confirm you’ll be borrowing this amount of money from the lender, they’re charging you interest, and you will pay it back within a certain timeline. Lenders use a deed of trust and a promissory note for construction loans, along with a building loan agreement that includes:

- How the loan will be disbursed

- When the loan will be disbursed

- The conditions to the disbursements, such as title endorsements, percentage of completion, inspections and lien releases

When you’re ready to finance your new construction home, Assurance Financial is here.

[download_section]

Finance Your New Home Construction With Assurance Financial

Whether you or the builder finance the home, the process is meant to be as seamless and intuitive as possible. Some people may not know the steps to take or the questions to ask, but that’s why we’re here.

Financing and constructing your dream home should be one of the most exciting times of your life. At Assurance Financial, we want to help you make this step in your journey memorable and easy. We’re an independent lender, and we specialize in making homeownership dreams come true. When you work with us, you’ll receive end-to-end processing under one roof.

Ready to finance your new home construction? Contact one of our loan officers today to find out how we can help you finance your next construction build!

-

- A construction-to-permanent loan brings you through the entire process of buying and completing construction with a single loan.

This loan helps you avoid obtaining separate lots and construction financing, meaning there are fewer moving pieces. Toward the end of the construction period, you can work with your lender to change the construction loan into a permanent loan. This type of loan can cut down on the confusion, paperwork and headaches associated with getting several different loans and financing options. It makes sure everything is in one place. However, you must still apply for it, and just like any other loan, this one depends on whether you own the land.

If you do not own the land you’re building on, a construction loan streamlines the borrowing process to one closing transaction.

If you own the land on which you’re building, remodeling or renovating, a construction loan is still advantageous. It will ensure you have the funds you need to do new construction or a rebuild on the property you currently own, helping you transition into a permanent loan.

Topics covered:

- What is a construction-to-permanent loan?

- Uses for construction loans

- The construction phase and how it works

- The process of moving a construction loan to a permanent loan

- Benefits of construction-to-permanent loans

- Disadvantages of construction-to-permanent loans

- What are the requirements for a construction loan?

- Construction-to-permanent loan rates

What Is a Construction-to-Permanent Loan?

Construction-to-permanent financing is a type of loan which allows you to build or renovate your home. When the construction process concludes, this loan rolls over into a traditional mortgage without you having to go through another closing. You’ll only have to pay for one set of closing costs.

A construction-to-permanent financing loan may suit you for several reasons. This financing allows you to borrow up to $2 million. You lock in construction-to-permanent mortgage rates when you apply, so you may not have to worry about increasing interest rates as you build.

You can use this type of loan for a lot, a build on your lot or renovations. It can cover labor and material costs for your primary or vacation residence. Your property must also be a one-unit, single-family home to qualify for a construction-to-permanent loan.

During the construction phase, you’ll make interest-only payments, and your lender will schedule home inspections to check in on how the home construction is progressing. After closing, you use the remaining savings from your down payment to pay your builder so they can begin construction. When your remaining down payment savings are gone, you can then draw from your construction-to-permanent loan to fund construction costs.

After the construction concludes, the loan will then become a permanent loan, such as a conventional loan with a 30-year term.

About Construction Loans and Uses for Construction Loans

No matter how excited you are to begin the construction process on your dream home, you may still be feeling a bit overwhelmed about all the unknowns of construction loans. That’s why we want to help you understand the basics — so you can feel comfortable moving forward with the construction process.

1. Types of Construction Loans

You can obtain one of two main types of construction loans.

- Stand-alone construction loan: In this situation, you’ll acquire two separate loans. The first is solely for the construction of your home — the stand-alone construction loan. This loan covers your construction costs. After construction concludes, you’ll secure a separate traditional loan.

- Construction–to–permanent loan: In this situation, you’ll obtain only one loan. At first, the loan pays for the home’s construction costs. Then, after you move in, the loan converts into a permanent loan. Essentially, you get two loans in one rather than dealing with two separate loans.

2. Drawing From Your Loan to Pay for Construction

Unlike conventional loans, lenders don’t provide construction loans in a single lump sum. Instead, they pay out in smaller installments, known as draws, throughout the construction process. When the construction wraps up, the lender transfers the total cost amount to you, the borrower.

A draw goes to the builder for reimbursement of the construction costs. Because a draw is a reimbursement, you or the builder must pay for construction costs upfront. Before making these draws, the lender will perform an inspection to estimate the cost and assess project progress.

3. Construction Loan vs. Home Equity Line of Credit

When making home improvements, you may want to select between a construction loan and a home equity line of credit. A HELOC is a line of credit a lender gives to the borrower against the equity in their home.

- A HELOC has a fixed interest rate repaid over the home loan term, which is typically 15 to 30 years.

- A construction loan will have higher monthly payments because of its limited term, usually three to five years.

- You’ll typically pay less interest for a construction loan than for a HELOC because construction loans have a fixed interest rate over a short duration, while you’ll generally repay a HELOC over many years.

- Borrowers typically repay a HELOC in interest-only payments for the initial five to 10 years. The interest rate will increase when you begin making principal payments.

Construction loans aren’t only for building a new home — they can also be an excellent loan option for home improvements.

[download_section]

The Construction Phase and How It Works

During the construction phase, you’ll navigate disbursements, inspections, draws and statements.

- Disbursements: Before you receive each of your loan fund disbursements, your lender schedules an inspection to check in on the initial work. You use your money first and then receive loan disbursements. The amount you receive in a disbursement corresponds to the construction progress. Your lender disburses funds to reimburse for materials installed or labor completed.

- Inspections: You can contact your lender so they can schedule an inspection to determine the percentage of work the builder has completed according to your draw schedule. You also may want to schedule an inspection if you’re concerned about the quality of the workmanship on your home.

- Draws: Once you place a draw request, your lender will generally release those funds within two to three business days.

- Statements: In the month after your initial disbursement, you’ll receive monthly statements. Each statement will list the interest that has accrued on the disbursed loan funds.

The Process of Moving a Construction Loan to a Permanent Loan

There are several steps to move a construction loan to a permanent loan.

- Finish construction: A construction loan typically has a loan term of six months to two years. The homebuilding process ends when the loan disbursements and draw periods conclude, and every party has received payment for labor and materials.

- Schedule a final inspection: After construction wraps up, you need to schedule a final inspection. The building inspector will ensure your property complies with your area’s building codes. After a successful inspection, you’ll receive a certificate of occupancy.

- Shop for a permanent loan: After you have your home built, inspected and certified, you can start browsing your options for a permanent loan. A loan conversion will already be in place for a construction-to-permanent loan, but if you have a construction-only loan, this is the point in the process when you’ll begin searching for the right mortgage for you.

- Schedule an appraisal: During the appraisal, a professional will assess the property to determine its value compared to other property sales that have recently occurred in your area. This task can be tricky if there aren’t many comparable sales. If your home is more upscale or unique than other houses in your neighborhood, it may be challenging for your appraiser to find comparable properties, which can significantly impact your home’s value. The appraisal is pivotal for securing a conventional, permanent mortgage so the lender can assign a value to the collateral.

- Apply for a permanent mortgage: Now you’re ready to apply for a permanent mortgage. Remember the requirements for the types of mortgages you’re interested in, such as your credit score, your cash reserves and your debt-to-income ratio. These factors will determine whether you qualify for specific mortgage options. For an idea of what you can afford to spend, you can use our home mortgage calculator.

- Finish the conversion: After the loan has closed, you’ll begin making your mortgage payments.

The Benefits of Construction-to-Permanent Loans

Let’s go over the basics — a construction-to-permanent loan will let you borrow upward of $2 million, locking in interest rates when you apply and enabling you to finance a lot or build on a lot for your primary residence or vacation home. Now, let’s cover the specific benefits of a construction-to-permanent loan for your home construction.

1. Save Money and Time

The primary advantage of construction-to-permanent loans is that you do not have to choose a construction loan and then close on a second, permanent loan when your construction completes. This solution will save you the hassle of finding an additional loan and save you money on closing since you’ll only have fees associated with closing on one loan.

At the end of the construction period, your home construction financing will convert into a permanent loan without additional closing costs. Then, you will begin paying interest and principal each month. By securing a construction loan and permanent mortgage at once, you’re also avoiding any changes in the market during or after construction. You can avoid potentially higher interest rates, saving you money in the long term.

2. Easier to Qualify

Construction-to-permanent loans are also easier to qualify for than stand-alone construction loans. A construction loan is riskier for a lender because they can’t use an existing home as collateral if you can’t pay back the loan, so the borrower has to meet many eligibility requirements. You’ll need to supply your lender with details about the contractors and subcontractors, the materials they will use and the home’s size. The lender also needs to believe that you can pay your monthly payments for you to qualify. They may require you to have an excellent credit score, cash reserves, a significant down payment and a low debt-to-income ratio.

For borrowers who don’t have these qualifications, a construction-to-permanent loan is generally a better option than a stand-alone construction loan. In some cases, you may not qualify for a construction-only loan, so a construction-to-permanent loan may be your only option.

3. Interest-Only Payments During Construction

With a construction-to-permanent loan, you get a 12-month period where you make interest-only payments on already distributed funds. As you transition into a permanent loan, you can decide if you want a fixed or adjustable-rate loan for financing.

By not having to pay down the principal during the construction phase, your payments will be lower, and you’ll have more time to save or spend that extra money on unexpected construction costs.

4. Flexible Terms

Even though you’ll provide your lender with plans for the property’s construction, a construction loan tends to be more flexible than a traditional loan in its guidelines and loan terms. You can probably adjust your loan terms to work with your needs as progress continues on your new property.

If you want to build on a lot you own or extensively renovate your property to make it your dream house, a construction-to-permanent loan may be the right financing for you.

Disadvantages of Construction-to-Permanent Loans

Though a construction-to-permanent loan is an excellent option for many borrowers looking to build a new home, there are a few disadvantages to this type of loan or instances in which you may want to opt for a different loan.

- Potentially higher interest rates: Interest rates on construction-to-permanent loans tend to be higher than conventional loans because of their increased risk. A lender needs to be sure that they are making a smart investment by allowing you to borrow money, and they will protect themselves by charging a higher interest rate than you may be able to find for other mortgage types.

- Larger down payments: For a construction-to-permanent loan or a construction-only loan, lenders typically want a substantial down payment. Depending on your home’s anticipated cost, you may have some difficulty saving up a down payment of 20% or more.

If the construction loan is for a second home, you may want to take out a stand-alone construction loan if you can pay a smaller down payment, and you’ll sell your first home to move into the new construction. Ideally, you’ll have a lot more cash after you sell your current home, and you can continue living in your home while the second property is under construction.

Frequently Asked Questions About Construction-to-Permanent Loans

Now, you probably have a reasonable idea about whether a construction-to-permanent loan is an option for you and your homebuilding project. With such a significant undertaking, you want to be confident that you have as much information as possible about the process of constructing and taking out a loan. We’ve gathered answers to some of the most frequently asked questions about construction-to-permanent loans.

1. What Are the Requirements for a Construction Loan?

Construction-to-permanent loan lenders may be taking a more significant risk with a construction loan than with a traditional mortgage. After all, many construction processes face unpredictable hurdles. Renovations and builds can experience delays or go over budget, and the result may not be worth as much as projected.

To protect against these issues, construction-to-permanent loan requirements require you to have the following.

- A good builder: You will need to speak to an experienced, licensed and insured builder who has worked on similar projects. Check recommendations and backgrounds carefully to find a licensed general contractor who can do the work.

- Details of the build: Once you have a builder, make sure you have what is known as a “blue book” of the construction project, which will list everything from floor plans to the materials you will use in your new home or renovation.

- Good credit: You may need a credit score of at least 680 and ideally of 700 to 720 or higher to qualify for this type of financing.

- An estimate: You may need to work with an appraiser to determine the expected home value. Whether you need this step will depend on your circumstances and your lender.

- A down payment: You may need a down payment of 20%, but this number may vary widely, depending on your assets, circumstances, proposed project and more. If you are not sure how much you need, you can speak to a loan officer at Assurance Financial to get details about how to qualify for a loan.

- Cash reserves: A construction loan reimburses the builder, which means the builder or borrower needs to have the cash reserves to cover the costs of construction upfront. As a result, you might need to save up a lot of money beforehand.

You’ll also want to understand your home’s equity to help you decide whether to get a construction loan or a home equity line of credit. You’ll need equity in your home to take out a HELOC. Your line of credit will depend on the equity you have in your home — not your home’s total value.

Understanding the requirements for obtaining a construction-to-permanent loan is critical to ensuring you will qualify for a loan when you’re ready to build your dream home.

2. What Percent Do You Put Down for a Construction-to-Permanent Loan?

Because construction-to-permanent loans cover more than the cost of purchasing a finished home, down payment requirements are usually higher than regular construction loans. Most lenders ask that you make a down payment of about 20% of the property’s projected value, at minimum, while others may require up to 25 or 30%. If you put less than 20% down, the lender will probably require you to have private mortgage insurance to protect their lending investment.

While you can have a general expectation about the down payment needed for a construction-to-permanent loan, all lenders have different requirements. For example, FHA loans typically require a low down payment because they are for lower-income homeowners, and USDA loans require no down payment at all. Your lender can assess your situation and give you an accurate estimate.

3. Is It Cheaper to Buy or Build a House?

The answer to this question depends on several factors unique to each potential homeowner. Variables that influence price include the property’s location and the home’s style and size. With construction projects, delays may emerge due to weather, shipping setbacks or other unexpected holdups, which can set you behind schedule. There are no setbacks like this when buying a finished home if an inspector doesn’t detect any issues.

New construction can also provide you with several areas for saving. You have the flexibility to choose a less expensive property, like one further from a city center. Buying off-plan property or a vacant lot can lower stamp duty, the property tax based on the land’s value at the time of sale. Some states also offer grants specifically for first-time homeowners. When exploring this option, carefully consider long-term payment requirements.

4. How Many Years Is a Construction Loan?

Construction loans of all kinds are short-term, lasting only about six months to two years. This term gives enough time for the contractor to build the property and for you to move in. Because of this shortened timeframe, the lender must receive a detailed and realistic budget with a construction timeline. During the construction period, or each time you want to draw more loan funds, the lender will make inspections to see how the project is progressing.

After the project concludes, a construction-to-permanent loan transitions into a fixed or adjustable-rate mortgage. Terms for these kinds of mortgages are usually 15 to 30 years. All told, you may be paying on a construction-to-permanent loan for anywhere from 16 to 32 years.

Construction-to-Permanent Loan Rates

Because you will lock in a construction-to-permanent loan for a long-term basis, you may get a higher interest rate. The longer the loan term is, the higher the interest rate tends to be. Your rate may also be higher if the property owner is also the builder, as the construction may not be of the same quality and meet the standards as the work of a licensed contractor. Fortunately, as your home gets closer to completion, you may get a lower rate.

With a construction-only loan, you might qualify for a lower rate since the loan will be for a shorter duration. However, with a construction-only loan, you also risk getting a higher interest rate for your permanent loan if the market changes or if your financial situation worsens.

Construction-to-Permanent Options and Loan Lenders

Not every lender offers construction loans, and some will only provide construction loans if borrowers can meet rigorous requirements. That’s why comparing lenders is so critical for finding an ideal option for your home construction.

Assurance Financial has several options for your construction-to-permanent loan needs. We have these single-closing loans and two-closing loans if you prefer the added flexibility. Our team provides loans for homebuyers and builders. If you meet the requirements for a USDA loan and your project meets specific thermal standards, you may even qualify for USDA construction-to-permanent loans, which may come with competitive rates.

Assurance Financial understands it can be challenging to find the right financing product for you. If you have a vision for your home, come to us, and we may be able to help make that dream a reality with practical suggestions and loan products. Since we underwrite in-house and don’t shop your mortgage around, we may be able to offer flexibility to help meet your needs.

Apply for a Construction-to-Permanent Loan Today

You don’t want a loan — you want a home. Assurance Financial understands that. It’s why we pride ourselves on being The People People with technology. We treat you like a person, not a number, and we explain your options in plain English. We are not just about numbers, but rather about your homeownership goals.

Our goal is to help more Americans reach the dream of homeownership. It’s why we focus on mortgages and offer a range of loan products to help you accomplish your goals. Whether you’re building new construction, renovating or buying an existing home, Assurance Financial has loans for you.

Ready to apply? You can speak to a person, as we have mortgage experts licensed in 28 states. Our friendly and experienced professionals can listen to your goals and concerns and address them with customized advice.

Our process is simple. We pre-qualify you in 15 minutes by pulling your credit score and offering you a free, no-obligation quote on a rate. Once you have found your home, builder or are ready to refinance your property, fill out the full application. We take care of processing, including in-house underwriting, and let you know if you have approval. Once you sign with a notary to close your loan, you can start breaking ground on your new home or moving. Since we handle end-to-end processing without outsourcing, we can take care of your application quickly and answer your questions.

To begin building your dream home, you first need to ensure you have all the funds required. We take the stress out of the entire process with our construction-to-permanent loans, making everything easier, faster and all in one place.

If you need help converting your construction loan into a permanent one or are interested in financing a new build, contact our loan officers and let us help you find the perfect option for you!

Linked Sources:

https://assurancemortgage.com/remodeling-construction/

https://assurancemortgage.com/construction-loans/

https://assurancemortgage.com/vacation-home/

https://assurancemortgage.com/down-payment-home-loan/

https://www.hud.gov/topics/common_questions

https://crsreports.congress.gov/product/pdf/RS/RS20530#page=6

https://www.investopedia.com/mortgage/heloc/

https://assurancemortgage.com/usda-loans/

https://assurancemortgage.com/fha-loans/

https://assurancemortgage.com/find-a-loan-officer/

Unlinked Sources:

https://www.forbes.com/advisor/mortgages/construction-loans/

https://www.bankrate.com/mortgages/construction-loans-explained/

https://time.com/nextadvisor/mortgages/what-are-construction-to-permanent-loans/

https://www.mebank.com.au/the-feed/build-or-buy-your-first-home/

Getting ready to buy your first home? Making a few mistakes along the way is common. Below we’ve listed 10 of the most common mistakes first-time homebuyers MAKE and how you can avoid them!

- Overlooking additional expenses.

- House-hunting before getting preapproved.

- Spending all their savings.

- Not being realistic about what’s affordable.

- Opening new lines of credit before the deal is closed.

- Maxing out on the mortgage limit.

- Neglecting to plan for the future.

- Forgetting inspection.

- Leading with emotion.

- Not meeting with a loan officer in person.

1. Overlooking additional expenses.

Once you’re officially a homeowner, there are a few additional expenses you’ll have to pay every month on top of your mortgage payment. Homeowners are responsible for paying property tax, insurance, and fees for any repairs that are required. Consider these additional expenses during your decision-making process because it’ll save you from a few surprise expenses in the future!

2. House-hunting before getting preapproved.

We understand: viewing houses is much more exciting than sitting in a lender’s office. However, being preapproved before looking at homes allows you to understand your options fully. Your lender will produce a loan amount based on your current financial situation, which can help you correctly narrow down which homes work for you.

3. Spending all their savings.

Spending the majority of your savings on the mortgage down payment can be a disastrous mistake. Many homebuyers reach deep into their savings so they can pay 20 percent or more for their down payment and avoid mortgage insurance. This practice can substantially reduce your monthly mortgage payment amount but it is unwise if it leaves you with no savings at all. Emergencies and unexpected expenses can pop up at any moment, and having a rainy-day fund to rely on offers invaluable peace of mind.

4. Not being realistic about what’s affordable.

What you think you can afford and what you actually can afford doesn’t always line up. Before you begin the home buying process, sit down and map out a budget for your expenses. Include car payments, loan payments, groceries, health insurance and any other fees you come across every year. Subtract this amount from your salary after tax to see where a mortgage payment can fit in with your other expenses.

5. Opening new lines of credit before the deal is closed.

If your credit score changes drastically between the pre-approval process and closing, your loan may be completely transformed. Extreme changes lead many lenders to modify their terms or rescind the offer entirely. During the home buying process, refrain from opening new lines of credit and make sure you’re meeting all of your monthly payments.

6. Maxing out on the mortgage limit.

You shouldn’t always take the largest amount your lender will throw at you. Staying below your mortgage limit will offer you more financial flexibility, in the long run, leaving you room to cover additional expenses. Use your monthly budget to figure out what your limit should be.

7. Neglecting to plan for the future.

It’s fun to imagine what your life will look like in a house. However, you should also take some time to question how the property and neighborhood will change over time. Consider what kind of development plans are in the works for the area and local zoning laws. These details will help realize whether the property is right for you.

8. Forgetting inspection.

Before closing, it’s essential to get an accurate assessment of the condition of the house. Without an inspection, important repairs or structural problems may get swept under the rug and come back to haunt you. Hold off on any commitments before receiving a full picture of the house’s current physical condition to prevent making a huge financial mistake.

9. Leading with emotion

Buying a home is an exhausting, frustrating process. It’s incredibly easy to fall in love with a house out of your price range and be unrealistic about your budget. During your search, remain vigilant and sensible about what you can afford. It’ll save you from severe financial hardships in the future.

10. Not meeting with a loan officer in person.

Online research is an excellent place to start, but your home buying process isn’t complete until you’ve met with a loan officer in person. A loan officer can help you fully understand every step of the mortgage process and clear up any confusion you may have.

At Assurance Financial, our home loan experts specialize in residential home loans and are dedicated to assisting you every step of the way.