Month: October 2019

Though there are many reasons a homeowner might opt to refinance, the most common reasons for refinancing a mortgage are to lower the interest rate and to lower the monthly payments. A homeowner’s needs may change as their financial situation changes, meaning the mortgage terms you chose a year or two ago may not be the mortgage terms you want today. With today’s historically low rates, now is a good time to begin considering refinancing your mortgage with Assurance Financial.

- A Lower Interest Rate is Possible

- Your Credit Score Has Improved

- You’ve Seen a Jump in Income

- You Have Concerns About Your ARM Adjusting

- The Value of Your Home Has Increased

What Does It Mean to Refinance?

When it comes to mortgages, you may have heard the term refinancing. But what does it actually mean to refinance your home?

Refinancing your mortgage essentially means acquiring a new mortgage to replace your existing mortgage. This new loan pays off the remainder of your existing mortgage, and then you become responsible for paying off your new loan. As with your existing mortgage, this new mortgage will also require application fees, a title search and an appraisal.

But how do you know if you should refinance your mortgage? Is it smart to refinance your mortgage? If it is the right decision for you, how do you go about refinancing, and what do you need to refinance your home? First, define your financial goals. Once you know what you hope to accomplish, then consider your refinancing options.

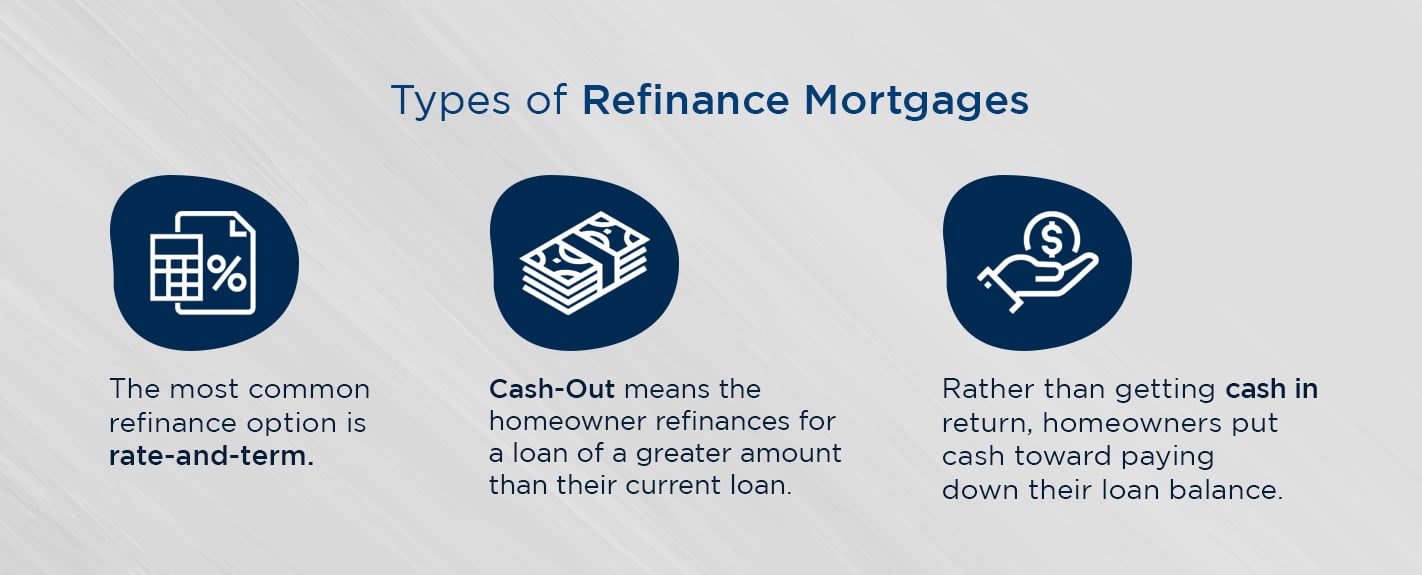

The Types of Refinance Mortgages

The three refinance mortgages you can choose from are known as rate-and-term, cash-out and cash-in.

1. Rate-and-Term

The most common refinance option is rate-and-term. This means that the term or rate of your loan, or possibly both, are different from your original mortgage. The term of your loan may change from a 30-year fixed rate to a 15-year fixed rate. Or maybe you’ll refinance from a 30-year mortgage at a 5 percent interest rate to a 30-year mortgage at a 4 percent interest rate. This could result in major savings in the long run.

2. Cash-Out

This refinance option means the homeowner refinances for a loan of a greater amount than their current loan. The homeowner receives the difference. So if you start with an amount of $100,000 owed on your current mortgage and you refinance for a loan of $120,000, you will receive $20,000 cash out. Banks typically see this refinance option as riskier, but when used responsibly, it can be an effective strategy for homeowners who want to pay off high-interest debt or build equity in their homes.

3. Cash-In

The opposite of a cash-out refinance mortgage is a cash-in refinance. Rather than getting cash in return, homeowners put cash toward paying down their loan balance. This can help homeowners access lower mortgage rates that are typically available only for lower loans or to eliminate mortgage insurance premiums, saving homeowners money.

The type of refinance mortgage you choose will depend on your individual financial situation and your goals.

So how do you know if refinancing your mortgage is right for you?

[download_section]

Signs It’s Time to Refinance

When you’ve first signed your mortgage, it may feel like everything is set in stone, but for homeowners, this is far from the truth. The decision to refinance your mortgage gives you the option to save on interest, take some time off your loan term, or cash out on your equity. If refinancing will lower the amount of interest you’ll pay on your mortgage, then you may find this to be an option worth exploring. Not sure refinancing your mortgage is the right financial move for you? Here are a few signs refinancing may be the right next step for you.

1. A Lower Interest Rate is Possible

Mortgage interest rates fluctuate constantly. Several factors impact interest rates, such as the monetary policy of the U.S. Federal Reserve, inflation, the economy and market. If the rates are currently lower than what you are paying, you may want to consider refinancing.

Replacing your mortgage for one that comes with a lower interest rate at the same remaining term is called rate-and-term financing. What decrease in rate is enough to consider refinancing? Generally, if you can get a rate that is at least one to two percent less than your existing rate, you can consider refinancing your mortgage. No rule of thumb can apply to all individuals and circumstances, however. While a one percent rate of interest may result in a large amount of savings for someone with a million-dollar mortgage, the same may not be true for someone with a mortgage that’s only $100,000.

You may even consider refinancing when the percentage saved is less than one percent. Though conventional advice calls for at least a one percent reduction, this rule of thumb is a holdover from the 50s, when loans were smaller, and homeowners continued to live in their homes until death. Today, with much larger loan sizes, a smaller percentage reduction can still result in significant savings.

Take the time to check the updated interest rate and compare it to your initial rate. Remember, your credit score determines your individual interest rate, meaning a lower rate isn’t always promised.

2. Your Credit Score Has Improved

If you’ve been working on rebuilding your credit, refinancing could benefit you. Generally, the higher your credit score, the lower your interest rate. Keep in mind, individual lenders determine the worth of your credit score, so individuals with a score that falls above 700 typically receive the lowest rates, but it is possible for you to get a great deal even if your score is between 600 and 700.

With a loan savings calculator, you can determine your APR, monthly payment and total interest depending on your credit score, type of loan, principal loan amount and your state of residence. A 30-year fixed loan for a principal amount of $100,000 at a credit score of 620 to 639 would give you an approximate APR of 5.006 percent. This adds up to a monthly payment of $537 and a total interest amount of a whopping $93,388.

What would happen if you increased your credit score to the 760 to 850 range? Your APR would drop to 3.417 percent, your monthly payment would drop to $444, and your total interest paid would be only $59,993. That’s a difference of $33,395 simply based on credit score.

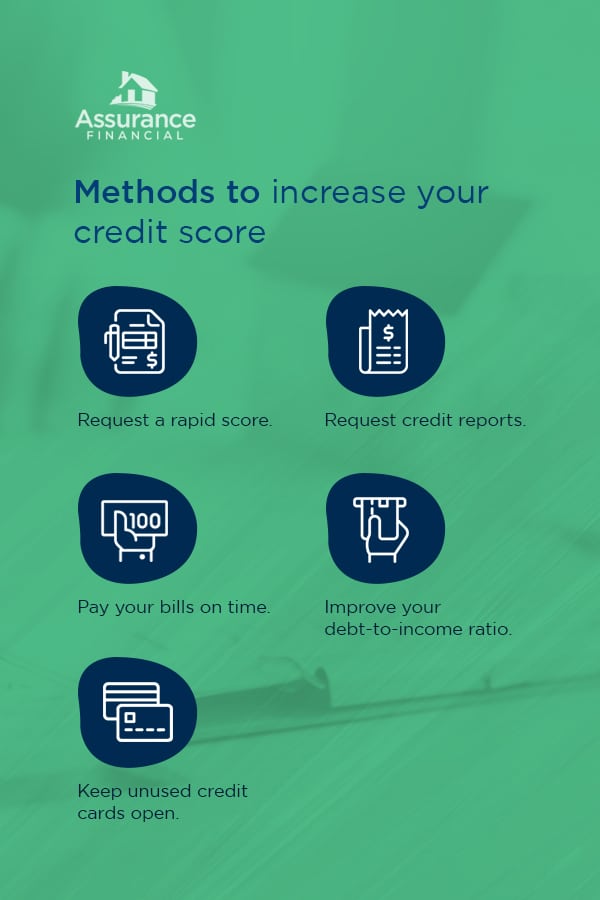

One of the most important factors that mortgage lenders take into consideration is your credit history. Even a mere one point increase in your credit score can reduce mortgage fees. Fortunately, there are plenty of methods to increase your credit score to ensure you get a great mortgage interest rate:

- Request a rapid rescore.

- A rescore can purge any errors that are hurting your credit score, potentially boosting your score from a few points to 100 points in a matter of days. Mortgage lenders can use this method to help borrowers increase their credit scores.

- Request credit reports. You can request one free credit report a year from three major bureaus –– Equifax, Experian and TransUnion. Report any errors you find as soon as possible. If you’re focusing on improving your credit score over several months, request a free credit report every four months from one of the three bureaus so you can track how your credit score is improving.

- Pay your bills on time. Your past and present payment performance are considered to be a reliable indicator of your future payment performance to lenders. Paying late or missing payments is a quick way to harm your credit score, so be certain you’re making consistent, on-time payments. Use automated payments to ensure you don’t forget to pay any of your bills.

- Improve your debt-to-income ratio. You can increase your credit score when you pay off debt and keep your credit card balances low. The general recommendation is to keep your credit use at 30 percent –– meaning you use under 30 percent of your credit line. If your credit limit is $2,000, that means you shouldn’t charge over $600.

- Keep unused credit cards open. By not closing unused credit cards that aren’t costing you any annual fees, you can retain your credit mix and credit history and keep your use ratio low.

If your credit score has improved and you think you may qualify for a lower interest rate on your mortgage, you may want to consider refinancing. If you decide refinancing may be a viable option for you, be sure to perform the calculations yourself, as mortgage rates fluctuate and may drop even lower.

3. You’ve Seen a Jump in Income

An increase in income can be great if you’re looking to refinance to a shorter loan term. Going from a 30-year mortgage to a 15-year term can save you thousands of dollars in interest.

As in the example above, a 30-year fixed loan of $100,000 at a high credit score of 760 to 850 would result in a monthly payment of $444 and a total interest amount of $59,993 at an APR of 2.845 percent. If you reduce your loan term to 15 years, however, the APR on the same amount of loan principal and at the same credit score changes to 2.845 percent, and the total interest amount drops to $22,967 –– a difference of $37,026. That’s an even bigger jump in savings than by improving your credit score.

A caveat of the 15-year loan term, though, is your monthly payment increases. At a 30-year term, your monthly payment is $444. However, with a 15-year term, your monthly payment is $683. If your budget can comfortably accommodate an additional $239 a month, then this may be an excellent option for you. But if the increased monthly payment makes your budget uncomfortably tighter, you may want to consider sticking with your 30-year loan term.

With a 15-year fixed loan term, you may pay more toward your mortgage each month, but you’ll also see huge savings in the amount of interest you pay over the term of your loan. High-income earners or those with enough wiggle room in their budget may want to opt for the shorter loan term.

4. You Have Concerns About Your ARM Adjusting

Adjustable rate mortgages (ARMs) vary over the life of the loan. The rates depend on not only market conditions, but also the type of loan you have. Some ARMs adjust once a year, while others adjust after five or seven years. In most cases, you’ll pay less interest with an adjustable rate mortgage and have lower monthly payments early in your loan term.

If your existing mortgage is at a fixed-rate and you anticipate that interest rates will continue falling, you might consider switching to an adjustable rate mortgage. If you plan to move within a few years, changing to an ARM may make the most sense for your situation since you won’t be in your home long enough to see the loan’s interest rate rise.

Alternatively, the most unsettling thing about ARMs is when it’s time for the loan to adjust, interest rates and payments may skyrocket. Refinancing and switching over to a fixed rate mortgage may be a good option for you if you’re worried you won’t be able to afford your payments when your loan adjusts.

5. The Value of Your Home Has Increased

Since 2011, the values of homes has risen from an average of $250,000 to an average of $394,000. Yet many homeowners don’t refinance their mortgages when the value of their home increases. If your home’s value has increased, refinancing may be a beneficial option for you. If you’re looking quickly to pay off other high-interest debts or fund major purchases, this avenue may be even more appealing.

Cash-out refinancing is a financing option that allows you to acquire a new, larger mortgage so you can receive the difference in cash between your new mortgage and your previous mortgage. For example, maybe your house was originally valued at $250,000. You put 20 percent toward a downpayment –– $50,000.

Your mortgage of $200,000 is now $140,000 after a few years of payments, but now your house has increased in value from $250,000 to $300,000. You may now opt to refinance your mortgage for more than your remaining balance of $140,000. If you refinance for $165,000, you can use that $25,000 difference to pay off high-interest debt, make home improvements or fund major purchases.

If you’re in a financial situation in which you know you can comfortably pay back that additional $25,000 of mortgage debt, this may be the right move for you. If you’re thinking you may use this cash to pay off other high-interest debt, be sure to calculate whether you’ll end up paying more interest for that debt than for your mortgage. If you’ll ultimately pay more interest for other high-interest debts, then cash-out refinancing may be a great choice for you. If you’ll pay more in mortgage interest, you may want to stick with your existing mortgage.

Be sure to check the value of your property so you can have an accurate estimate before refinancing your mortgage. Over or underestimating your home’s value may result in you overpaying and saving less.

If any of these five signs apply to you, it may be time to consider refinancing your mortgage.

What Is the Refinancing Process?

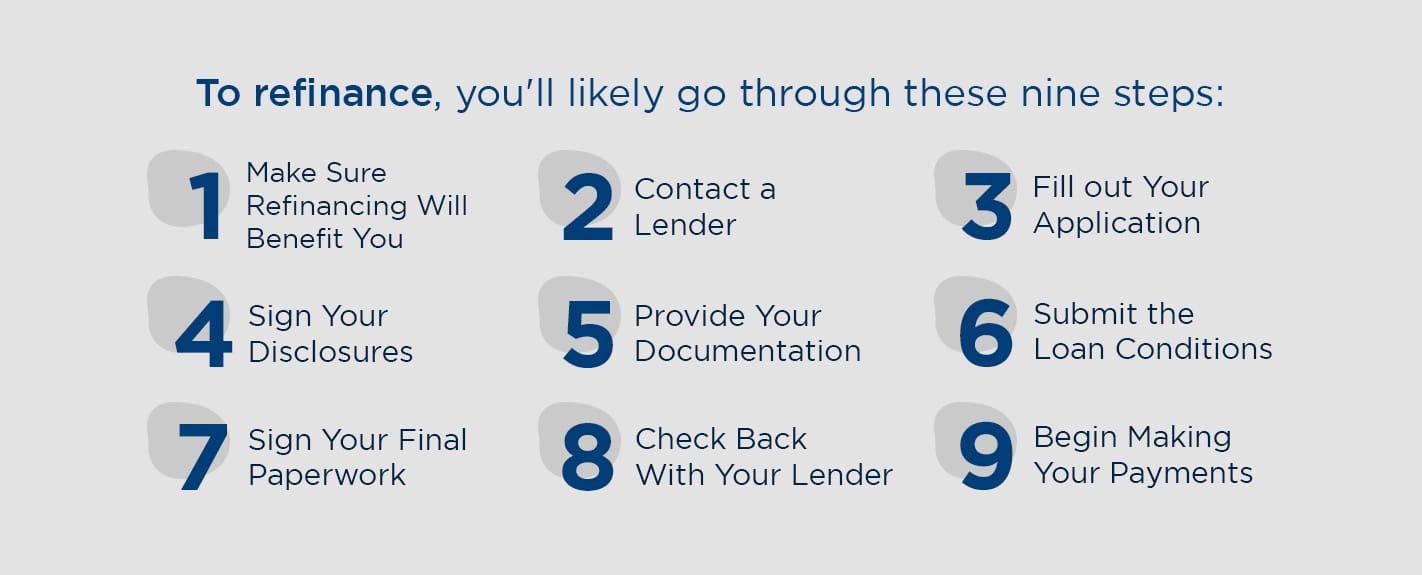

Whether you’re refinancing to lower your monthly payments, to lower your interest rate or to free up some cash to pay off high-interest debt or build equity in your home, you’ll probably want to know what you can expect from the process of refinancing a mortgage before jumping right in. To refinance, you’ll likely go through these nine steps:

1. Make Sure Refinancing Will Benefit You

Your first step in refinancing your mortgage is making sure that refinancing will be beneficial for you. Know what your goal is and determine whether you can attain it. Are current rates low enough for you? Will you ultimately be saving money? If you cash out, make sure having that money right now will outweigh the extra years spent in debt. Everyone’s financial situation and priorities are different, so only you can decide what the best decision is for you.

2. Contact a Lender

With Assurance Financial, we want to make your refinancing process as quick and painless as possible. We offer the chance to get pre-qualified in just 15 minutes, with a no obligation quote and a free rate quote. You can apply online or with one of our experts licensed across the country. We have every type of loan available, and because we’re an independent lender, we won’t pass around your loan or data to anyone else like other mortgage brokers. With no obligation, we can check your credit, provide you with a rate quote and send you the numbers.

3. Fill out Your Application

Once you are ready to refinance, you can begin your application with us.

4. Sign Your Disclosures

We’ll send you the initial disclosures for you to sign and you may also take this opportunity to verify the loan terms and ensure you’re accomplishing your goal of either lowering your rate or cashing out.

5. Provide Your Documentation

After signing, you’ll then provide your documentation to us, such as asset verification and income.

6. Submit the Loan Conditions

We’ll then send your paperwork to one of our in-house underwriters who will let us know if any additional items are needed.

7. Sign Your Final Paperwork

After approval, you’ll sign with a notary.

8. Check Back With Your Lender

After three days, during which you can cancel your refinance for no cost, your loan will be funded. At this point, your previous mortgage will be fully paid.

9. Begin Making Your Payments

Now you’re done with the refinancing process! You can start making the payments on your new mortgage, which will be due in 30 to 60 days after the funding process.

Refinancing a mortgage can seem overwhelming at the start, but it doesn’t have to be. With Assurance Financial, we strive to make your journey to refinancing as quick and simple as possible.

Refinancing With Assurance Financial

Refinancing your mortgage may be a smart move if you’re still in the early years of your mortgage and can get a lower interest rate by refinancing.

If you want to save money, refinancing your mortgage may be the right move for you.

You can refinance with us today at Assurance Financial. For most Americans, the American Dream includes homeownership. We want you to own the house of your dreams –– with the mortgage terms of your dreams. You can apply with us and get instant verification by signing into your bank accounts and payroll platforms, so there’s no need to fax any statements.

To get a mortgage, you need a licensed loan officer on your side, and we’re here to help. We use the latest in application technology to make starting the loan process fast and simple, and we offer the service you need for end-to-end processing all under one roof.

Curious how we have an average 4.98 star-rating across thousands of reviews? Discover why we’re one of the best lenders for your mortgage refinance today. Find a loan officer near you with us at Assurance Financial for more information on refinancing.

Getting ready to purchase a house is an exciting and nerve-wracking journey. With so many steps on the road to becoming a homeowner, we know it’s easy to feel overwhelmed. There is one step you can take that will get you closer to your goal of owning a home. As a bonus, it helps you sort out your budget and boost your chances of sellers accepting your offer. The answer to some of your house hunting worries is pre-qualification for a mortgage.

Mortgage pre-qualification may seem like as big of a process as purchasing a home, but it is actually one straightforward step along the way. At Assurance Financial, we understand the pre-qualification process and want to help you achieve your dreams of homeownership. This article explains why you should get pre-qualified before looking for a home.

- What Is a Mortgage Pre-Qualification?

- Why You Should Get Pre-Qualified for a Mortgage

- When to Get Pre-Qualified for a Mortgage

- How to Get Pre-Qualified for a Mortgage

- Mortgage Pre-Qualification Process

- Get Pre-Qualified With Assurance Financial

What Is a Mortgage Pre-Qualification?

Mortgage pre-qualification means a lender is willing to provide you a certain amount of money to purchase a home. Pre-qualification doesn’t necessarily guarantee a mortgage. It does, however, provide a maximum loan amount that you could receive.

You may have heard the terms “pre-qualification” and “pre-approval” in the lending world. What you may not know is that there is a difference between the two:

- Pre-qualification: Consider pre-qualification to be an estimate. This number is not a guarantee because lenders base it on a simple financial overview. With an estimate of your credit score, monthly debts and a few other details, a lender provides a general number for what you pre-qualify. Pre-qualification does not have the same authority as pre-approval, but it will give you an idea of what you can get pre-approved.

- Pre-approval: Lenders base this on an in-depth analysis of your finances. Pre-approval is a hard number for a loan amount. You receive pre-approval after lenders conduct a credit check and review your completed mortgage application. While pre-approval still isn’t a guarantee, it is a more carefully estimated number than pre-qualification.

Why You Should Get Pre-Qualified for a Mortgage

You may think that getting pre-qualification adds another item on your house hunting to-do list. However, getting mortgage pre-qualified makes buying a house less stressful in the long run. By getting pre-qualified, you can:

- Know your budget: With pre-qualification, you can narrow down your pool of potential homes. Build your budget based on what a lender is willing to provide. You’ll have an upper limit that help you avoid looking at top-dollar homes that aren’t within your budget.

- Surpass other potential buyers: Having your pre-qualification in hand gives you an advantage over other possible buyers. It shows that you are ready and willing to purchase a home. Your competition may not have their pre-qualifications ready, so if you do, you’ll be more attractive to sellers than other buyers who aren’t as prepared.

- Make your offer more attractive: When you find your dream home and put in an offer, you want agents and sellers to pick you without hesitation. Mortgage pre-qualification helps put a seller’s mind at ease. Make them more likely to accept your offer with a simple step.

- Save time: Pre-qualification allows you to finalize your mortgage more swiftly after you’ve found the home of your dreams. There’s no need to fill out paperwork and wait for lenders to process it when you’re eager to get settled in your new house. Take care of everything beforehand so you have one less task to worry about as you buy a home.

- Solve any problems: As you obtain your pre-qualification, you may come across errors in your credit report or other documentation. Discovering these issues before purchasing a home will save you time and hassle.

- Plan other expenses: Having a price range to play in helps you map out additional costs that come with a home. Be sure to incorporate these into your budget so that you do not risk going over what the lender can provide. Calculate your current expenses in the mix, as well, for accurate numbers.

The above are all essential reasons to get pre-qualified for a mortgage. You wouldn’t make a substantial purchase without calculating your budget first, so why would you purchase a house without seeing how much a lender pre-qualifies for you? Ease some of your stress and get an idea of how much you can afford to put into a new house with mortgage pre-qualification.

When to Get Pre-Qualified for a Mortgage

If you’re wondering, “When should I get pre-qualified for a mortgage?” the answer is simple. As we’ve explained above, the best time to get pre-qualified is before house hunting. You shouldn’t jump right in and apply for pre-qualification without a timeline, though. Other factors contribute to when you should try to obtain mortgage pre-qualification.

- After you’ve checked your credit score: Check your score months in advance to have an idea of how a lender will respond to your application. While checking your score may cause an initial change, over time, it will return to its previous number or improve. Use this time to get your finances in order before you seek pre-qualification.

- Not long before beginning your house hunt: Especially if you think the process of searching for a home could take a couple of months, you’ll want to make sure your pre-qualification doesn’t expire before your search is over. Knowing your timing is a crucial part of when to get mortgage pre-qualification.

While we’ve said before that obtaining a pre-qualified mortgage makes your offer more attractive to sellers, it’s helpful to know why. Get pre-qualified before looking into a home because:

- Agents may not work with you unless you’re pre-qualified.

- It shows there will be little to no problems finalizing a mortgage.

- It tells sellers a bank has verified your information.

- Agents and sellers see that you’re serious about buying a home.

- Sellers may accept offers under asking price when submitted with pre-qualification.

- It strengthens your offer if you’re self-employed.

Mortgage pre-qualification says a lot to agents and sellers. Acquiring it can be a great tool to keep in your back pocket when negotiating pricing, competing with other potential buyers, or submitting an offer on your dream home. Such an impressive part of your application may seem like it would be difficult to acquire, but many processes for pre-qualification are more straightforward than you might expect.

[download_section]

How to Get Pre-Qualified for a Mortgage

Knowing the importance of mortgage pre-qualification may leave you wondering how to get pre-qualified in the first place. Your pre-qualification status and amount depend on different factors that lenders see from various documents you submit. Lenders verify certain aspects of your finances and your history, such as:

- Income and employment verification: To pay off the loan a lender pre-qualifies you for, you’ll need to have a source of income. Lenders want an idea of your annual income so they may properly evaluate how much to pre-qualify for you. Lenders may contact your place of employment to confirm your status there, as well.

- Assets: In addition to the money you have coming in, lenders also like to see what money, property or other assets you already have. Like income, assets contribute to how much you could potentially receive from a lender since they represent what payments you could handle.

- Credit: Specifically, lenders want to see a good credit score. Lenders evaluate credit scores because they factor your payment history, current debts, types of credit, length of history and any new credit accounts. These details all represent your financial ability and trustworthiness, among other qualities, that will assure a lender they can confidently provide you a loan.

Lenders look into your credit score and other aspects of your financial background when you apply. Rather than provide the lender with these numbers, you simply need to gather documentation. To confirm your employment, income, assets and debt, a lender will ask you to submit the following documents and information when you seek pre-qualification:

- Social Security number

- Form of identification, either your passport or driver’s license

- Federal and state tax returns, typically the two most recent

- W-2 forms and your two most recent pay stubs

- Two years of records and 1099 forms if you are self-employed, a freelancer or independent contractor

- Real estate income and rental property information

- 60 days of bank statements for the accounts you’re using to qualify

- Two months of statements from retirement and brokerage accounts

- Monthly and real estate debt statements

You may be asked to include relevant names, addresses and account numbers with the information you provide. Lenders may also ask for records of rent payment, divorce decrees or related court orders and documents from bankruptcy or foreclosure.

From the information above, a lender will determine if they can pre-qualify you and how much they can offer you. You’re more likely to get an offer if your credit score is a minimum of 600, so be sure to check and correct your score if necessary.

Mortgage Pre-Qualification Process

If you’ve got the documentation above ready to go, you’re almost ready to begin the mortgage pre-qualification process. Be sure to consider what to do before getting pre-qualified for a mortgage first.

You may want to check your credit score and credit reports before applying to know what loans you can apply for and solve any issues with your score. You should also consider your debt-to-income ratio. Calculate this using what you make per month and how much you owe back in debt or loans. Think about how your mortgage will factor into that number for an idea of what a lender could offer you.

Once you’ve evaluated your income, assets and credit, it’s time for the lender to do so. Every lender has an application for mortgage pre-qualification, and some offer convenient online forms to speed up this step. After you’ve applied, the length of the mortgage pre-qualification process depends on the lender. Here are the basics of that time frame:

- Sometimes, it may take as little as 24 hours or up to three days for a lender to pre-qualify you.

- If you are self-employed, it may take the full three days for a lender to calculate your pre-qualified rate.

- The lender’s workload and the availability of your information also influence how long mortgage pre-qualification takes.

- Gather the documents and information listed above and have them ready for the lender so the process is swift.

Apply Now

Your mortgage pre-qualification does not last forever. Because your credit score and other factors fluctuate, the average mortgage pre-qualification lasts between 60 to 90 days, though that number may change depending on the lender. Give yourself enough time to get pre-qualified before looking for a home, but be sure to keep the expiration date in mind as you search.

In addition to an expiration, paperwork from a lender can include other information, such as:

- The loan amount

- The type of loan

- The terms of the loan

- Estimated payments and interest

- Approximate closing costs

The details of your pre-qualification help you sort out your finances and plan how you will purchase your dream home. Remember that these numbers are not a guarantee of a mortgage.

Once you are pre-qualified, you must still go through the process of underwriting and finalizing a mortgage. Receiving the funds that a lender calculated in a mortgage pre-qualification depends on a few factors such as:

- A home inspection

- An acceptable home appraisal

- Adequate homeowner insurance

It may feel like a lot rides on obtaining mortgage pre-qualification, but the process is worth it since it gets you one step closer to your dream home. With all the benefits of organizing your budget and looking more appealing to sellers, getting pre-qualified is one step of home buying you should be sure to take.

Get Pre-Qualified With Assurance Financial

If you’re getting ready to purchase a home in the future, be sure to get pre-qualified for a mortgage. With us at Assurance Financial, you can get pre-qualified in 15 minutes for an idea of your pre-qualification rate. We have the latest in application technology to make the process smooth, fast and straightforward. If you’d prefer to meet with someone, you can also find a loan officer today to begin your journey of mortgage pre-qualification and home buying.

Do the benefits of mortgage pre-qualification have you ready to get the process started? Fill out our 15-minute online application for instant verification of your income and assets. We’ll provide a quote to start you on your home-buying journey. Contact us with any other questions you may have about the mortgage pre-qualification process. We’ll put your needs first and work with you to help your homeowner dreams come true!

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing

Additional Resources You May Also Like

When it comes to renting vs. buying a home, many people may feel overwhelmed by how to make the best decision for themselves. Is it better to rent or get a mortgage? Are there situations when it’s better to rent?

Ultimately, the decision to rent or buy is a personal one and is a question that you may answer differently at various stages of your life. If you’re trying to decide whether to rent or buy, you’ll want to base your decision on your finances, your lifestyle, your location and your goals. In this article, we’ll cover renting vs. buying pros and cons as well as reasons to buy or rent.

- When You Should Buy vs. When You Should Rent

- When to Buy

- When to Rent

- Reasons to Buy a Home

- Types of Loans That Make Sense

- Great Buying Locations

- Reasons to Rent

- Locations That Are Better for Renting Longer

- Securing a Home Mortgage With Assurance Financial

When You Should Buy vs. When You Should Rent

Whether you rent or buy is a personal choice. There’s no right answer that’s best for everyone, and the choice can change for a person throughout their life. Renting may be the right option for you right now, and owning a home may be the right option for you in three years. If you’ve taken a job in another state, renting might be the best option for you until you find a home to buy in your new area. Maybe you live in an area where it makes more sense financially to buy than rent.

Whatever your situation may be, there are a few key factors that can help you determine when you should consider paying a mortgage vs. paying rent.

When to Buy

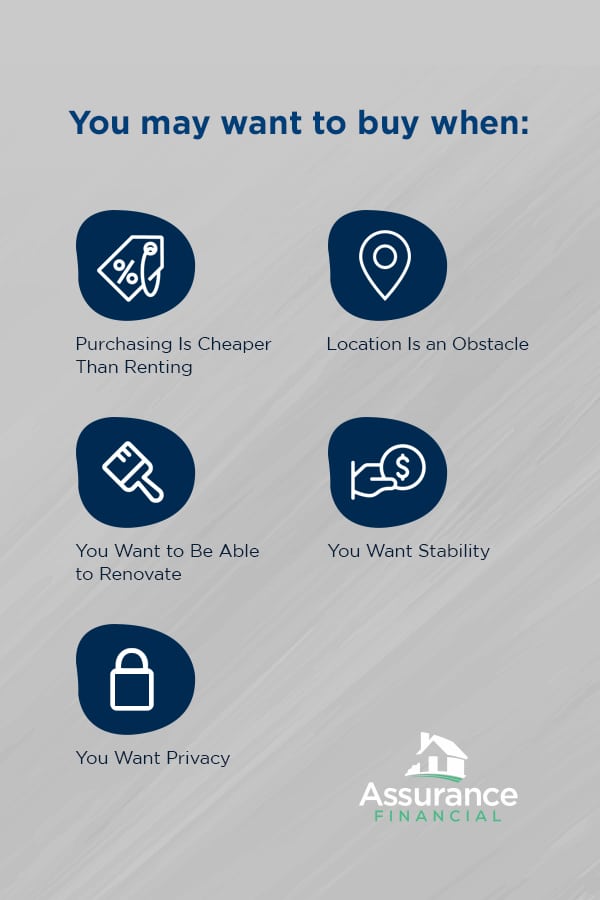

If any of these apply to you, you may want to consider buying.

1. Purchasing Is Cheaper Than Renting

You can use an online calculator to play with the numbers and discover which may be the better financial option for you. Generally, rent may be the better financial option in the short-term, but buying is usually cheaper over the course of a few years.

For example, if you stay in your home for two years, buying a $100,000 home with a 20% down payment of $20,000, at an interest rate of 3.75% over a 30-year loan term, is cheaper than renting a home for $800 a month. If you only stay for one year, renting is cheaper.

If you pay $200,000 for a home with a 20% down payment of $40,000 with the same interest rate and loan term, you would have to stay in your home for five years for buying to be cheaper than a monthly rent of $800. At a rent of $500 a month, however, buying is never cheaper than renting, though the savings between them does become quite minuscule.

2. Location Is an Obstacle

In some areas, there simply may not be any properties for rent. If your heart is set on a certain location, then your only viable option may be buying a home.

3. You Want to Be Able to Renovate

When you rent, you can’t change anything about your home without permission from the owner. If you enjoy decorating and making a space your own, you may feel restricted when renting a home that you can change only with your landlord’s permission.

4. You Want Stability

When you’re not tied to a lease and beholden to a landlord, you get to choose when you move. With the right loan, you’ll also get the financial predictability of a consistent monthly mortgage payment.

5. You Want Privacy

When renting, you may also have less privacy than you would if you owned a home. Generally, landlords must give notice before they’ll be entering a tenant’s home, but in an emergency, the landlord may come in unannounced.

When to Rent

On the other hand, you may want to rent if any of these describe your situation.

1. You Can’t Afford the Upfront Costs

If you don’t have enough savings to cover the transaction costs of purchasing a house, then you may want to rent. Buying a home can bring with it some hefty initial costs, such as inspection fees and a down payment. A down payment alone can be as much as 20% of your home’s cost depending on the type of mortgage loan you secure. You may also have to deal with other fees that can amount to thousands of dollars, including closing costs that can be as much as 3 to 5% of the loan amount.

2. You Won’t Be Able to Cover Unexpected Maintenance Expenses

If you don’t have extra savings set aside to pay for unexpected maintenance costs or the financial ability to save up and pay for those major repairs, then it may not be the right time for you to buy a home.

3. You Aren’t Comfortable With Risk

Homeownership can also be riskier than renting. Your home is an asset and could be at risk for expensive damages, especially any damages not covered by insurance that then become a financial burden you have to shoulder alone.

4. You Don’t Want to Deal With or Pay for Home Maintenance

If you don’t have the desire to maintain a home, then owning may not be the right option for you. Homes require a fair bit of maintenance and upkeep, such as mowing the lawn, cleaning the gutters and keeping appliances in working order. This maintenance can cost you either time if you perform the tasks yourself or money if you choose to outsource the job to someone else.

Reasons to Buy a Home

In many cases, it’s usually better to buy a home rather than rent one. Here are a few reasons you should buy a home:

1. You Will Eventually Pay off Your Mortgage

The main difference between rent and a mortgage is that, when you buy a home, you eventually will no longer have a mortgage on your house. Then, you’ll only be responsible for paying your taxes, insurance and maintenance costs. When you rent, those rental payments never stop as long as you continue living in that home.

Some may argue that when you’re renting, you don’t have to worry about paying taxes, insurance or maintenance costs, but that’s exactly where your rent money is going –– to cover the property’s expenses and then some so the owner can make a profit. When you’re renting, you simply don’t know how much of your rent is going toward those costs and how much is going straight to the owner’s pocket.

APPLY TODAY2. Your Monthly Payments for Owning Might Be Cheaper Than Renting

In some areas, renting a place may be several hundred dollars more a month than your monthly cost of owning a home. Even when taking into consideration taxes, insurance and maintenance, your monthly cost for owning a home can save you money, especially over the course of a few years. Even renting a much smaller property may be more expensive than purchasing a home.

How long you have to own your house for it to be cheaper than renting depends on how much your home costs, how much you put down and how much you would’ve been paying for rent. Owning a home may take five years to be cheaper than renting, or it might be the cheaper option immediately.

3. Your Home Is an Asset

The real estate market does see fluctuations in home values, but historically, home values have appreciated over time. You can also build equity in your home, which you can’t do while renting. Additionally, you can borrow against your home equity if you’re hit with an unexpected expense or when you want to work toward another financial goal, such as upgrading your home or paying for a child’s college tuition.

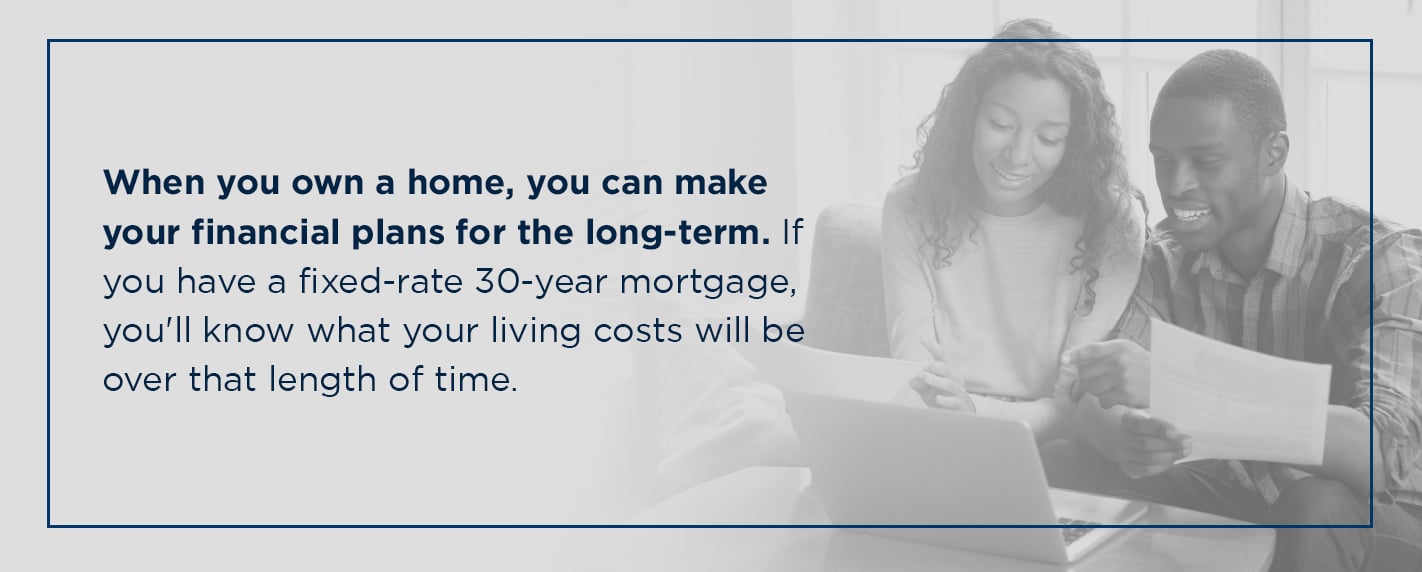

4. You Can Make Financial Plans for the Long-Term

If you’re renting and your lease ends in a year, you don’t necessarily know what the future holds for the cost of your living situation after the end of your lease. Your landlord may also have the option of ending your lease early, so you may not know what the cost of living will be for you at that time.

When you own a home, you can make your financial plans for the long-term. If you have a fixed-rate 30-year mortgage, you’ll know what your living costs will be over that length of time. Knowing what your living situation is going to cost you in the long run makes it much easier for you to plan for your financial future.

5. Your Space Is Entirely Your Own

When you purchase a home, you decide whether you want to make changes to the space. You can renovate, repaint or redecorate. You may have some limitations if you have a strict homeowners’ association, especially on the outside of your property, but otherwise, you should have mostly free rein and certainly more freedom than as a renter. A home you own is a place to build a life and make memories for you and your family, so it also brings with it a personal value that can’t be quantified in dollars.

Types of Loans That Make Sense

If you want to buy a home, you may now be wondering how you can choose the right mortgage loan for you. To make your decision, you’ll want to look at all your options. The easiest way to make your decision may be to quickly eliminate the loans you know won’t work for you. Here are a few of the more common loan types that may make sense for you:

1. 30-year Fixed Mortgage

A 30-year fixed mortgage is a loan in which the interest rate and mortgage payments stay consistent for 30 years. After 30 years, you will have repaid your loan. This mortgage type is an excellent option if you prefer the stability of a fixed monthly expense and plan on living in your home for at least 10 years. This is generally considered a mostly risk-free mortgage option.

2. 15-year Fixed Mortgage

A 15-year fixed mortgage is much like a 30-year fixed mortgage except the loan is paid off in half the time. Payments and interest stay the same month to month, and this loan type generally offers the lowest fixed rates. However, it also tends to require high monthly payments since you’re paying off the loan in half the time.

This option is great for someone who wants to build equity quickly and can afford higher monthly payments.

3. Adjustable-Rate Mortgage

Also known as an ARM, an adjustable-rate mortgage is a loan in which the interest rate adjusts during a predetermined time and frequency. Typically, this loan type offers an initial lower rate than that of a 30-year fixed mortgage and interest rates adjust with the market. If interest rates in the market lower, your interest rate will lower. If interest rates increase, so will your mortgage’s interest rate. When your ARM adjusts, you may end up paying more or less than you did at your initial rate.

This option is great for someone who may plan on selling their home well before 30 years. For example, if you’re planning on selling the home in five years, and you secure a loan with an adjustment period of 5 years, you won’t have to worry about a payment increase. By paying an initial low interest rate, you can save the extra cash at your disposal every month or use it to make high-yield investments.

Reasons to Rent

In some cases, you may prefer renting over buying. Here are a few financial and lifestyle reasons for renting:

1. You Won’t Have to Pay for Maintenance Expenses

When the air conditioning fails, the refrigerator breaks or the roof starts leaking, the cost of that repair will fall to your landlord, not you. Since maintenance costs can range from a few hundred to tens of thousands of dollars, this could be a major expense that you won’t have to worry about, though it is possible that your landlord has built the cost of these unexpected repairs into your monthly rent.

2. You Have More Mobility

Once your lease is up, you can pick up and move without worrying about renting out or selling the property. If you want to live in different places or move frequently, renting may be a better option for you than owning a home.

However, most leases do last for several months or up to a year, so you don’t necessarily have the freedom to move whenever you want.

3. You Can Usually Find Cheaper Rent

Though this isn’t always necessarily true, you’ll likely be able to find cheaper monthly rent than the cost of a house. This does tend to vary by location, however.

In some cities where the cost of homes is astronomical, renting may be the best financial option for you. Maybe the location you want to move to simply doesn’t have homes for sale or the homes for sale are well out of your price range but an apartment rental isn’t. If you want to move to a certain area because it’s a good neighborhood or because of its culture, then renting may be your only affordable choice.

You’ll also want to keep in mind what living situation you’re seeking and the properties you’re comparing. Renting a one-bedroom apartment should be cheaper than buying a three-bedroom house, but maybe you’re not willing to live in a one-bedroom apartment. A better comparison would be to compare renting a three-bedroom apartment to buying a three-bedroom house to see which is actually the more affordable option.

4. You Won’t Have to Worry About the Home Depreciating in Value

Because houses are assets, they can appreciate or depreciate in value. If you buy a home and it depreciates, you may lose money if you try to sell it. If you’re renting, you don’t have to worry about the home’s value depreciating.

5. Smaller Spaces Are Cheaper to Decorate and Furnish

Though the American Dream often includes owning a large home, a smaller living space is generally cheaper to decorate, furnish and maintain. If you buy a home with more rooms and more space, you’ll want to fill those walls and empty space with decorations, larger couches, bigger tables and more. On the lifestyle side of things, when you rent a smaller space, you’ll also probably spend less time cleaning and performing minor home repairs than you would for a bigger house.

You also may not have to worry about the general upkeep of the property, such as mowing the lawn or cleaning out the gutters, since that may be something the landlord takes care of or outsources to someone. However, this isn’t always true. Some landlords may require the tenant to mow their own yard, especially if they’re renting an entire house.

Locations That Are Better for Renting Longer

In some cities throughout the nation, the increase in home prices has rapidly outpaced the increase in rent costs. In these areas, renting may make more financial sense or even be the only available option:

- San Francisco, California: The market in this city is staggering. The median home price? $1.4 million. The median monthly rent? $4,500.

- San Jose, California: Other cities in California are not far behind. The median home price in San Jose is $950,000, and the median monthly rent is $3,290.

- San Diego, California: The median price of a home in this city is $645,000 and the median rent is $2,850.

- Seattle, Washington: In this city, the median listing price of a home is $665,000, while the median rent is $2,190.

- Portland: Oregon: In Portland, the median listing price for a home is $450,000, and the median monthly rent cost is $1,950.

- Las Vegas, Nevada: In Las Vegas, the median home price is $288,000, while the median rent is $1,490.

- Sacramento, California: In California’s capital, the median listing price is $329,000 for a home, while the median rent cost is $1,570 per month.

- Los Angeles, California: In LA, the median listing price for homes is $880,000, and the median rent is $3,790.

- Washington, D.C.: The median listing price for a home here is $599,000, while the median monthly rent is $2,680.

For both buyers and renters in these cities, the cost of living can be enormous and the shortage of available homes can make finding a place to live, let alone an affordable one, extremely challenging for some would-be and current residents.

Securing a Home Mortgage With Assurance Financial

You deserve to find your dream home and be able to afford it. At Assurance Financial, we want to help you make that happen by providing you with the mortgage terms that are right for you.

We’re an independent lender, and we can help turn your dreams of homeownership into reality. With end-to-end processing under one roof, you can rest assured that your path to homeownership will be fast and smooth.

Ready to finance your home? Contact one of our loan officers today so we can help you secure the right mortgage for your dream home.

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing

Additional Resources You May Also Like

For many in the U.S., home buying is an essential component of the American dream. A home is also one of the most significant investments you’ll make during your lifetime, and isn’t a decision to make hastily. If you’re feeling overwhelmed at the idea of buying a home, you’re not alone. At Assurance Financial, we know how stressful the process of home buying can initially seem, and we want to make this exciting step in your life as easy and enjoyable as possible.

Before buying a home, there are a few external factors you’ll want to consider, questions you’ll want to ask yourself to determine whether you’re ready to purchase a home and pros and cons you’ll want to weigh when you find a house you’re interested in. Once you’ve run through your checklist of what to ask when buying a house and what to know before making an offer on a house, we can help you acquire your dream mortgage.

- Can I Afford the Down Payment?

- Am I Financially Stable?

- How Much House Can I Afford?

- Can I Secure a Good Mortgage Rate?

- How Long Do I Plan to Stay Here?

- Am I Ready for the Challenges of Owning a Home?

- What Do I Want in a Home?

External Factors in The Home Buying process

Outside of your financial situation, there may be external factors to consider before you decide to buy a home. What are the market’s current interest rates? How is the economy performing? How has nature affected the market? These are all things you should look into before buying a home.

1. Interest Rates

The economy, politics and banks can influence interest rates. The Federal Reserve also regulates these rates in part, though human control of interest rates can sometimes spell trouble for the housing market.

2. The Economy

Various factors, such as politics, employment levels and consumer confidence, compose the economy. When looking for a home in a specific region, you’ll want to look at the market nationally, as well as regionally. The real estate market and economy in Texas may be quite a bit different from the market in Maine, for example. The market may even vary between cities in the same state, so it can be beneficial to do some research into your potential home’s area before jumping in.

3. Impacts of Nature

Natural disasters can significantly affect the real estate market. A devastating storm can cause a thriving market to completely turn around in a matter of days. People may abandon the area, and homeowners may become renters. Listings may increase, but prices may drop and it could take quite some time for the market to rebound.

Plenty of factors from your situation come into play when looking to buy a house, but be sure you don’t overlook external factors such as interest rates, the economy and the impacts of nature when making your decision about when to enter the market.

Questions to Ask Before Buying a House

Before choosing to buy a home, there are a few questions you may want to ask yourself to determine whether homeownership is the right next step for you. Here are seven of these to get you started.

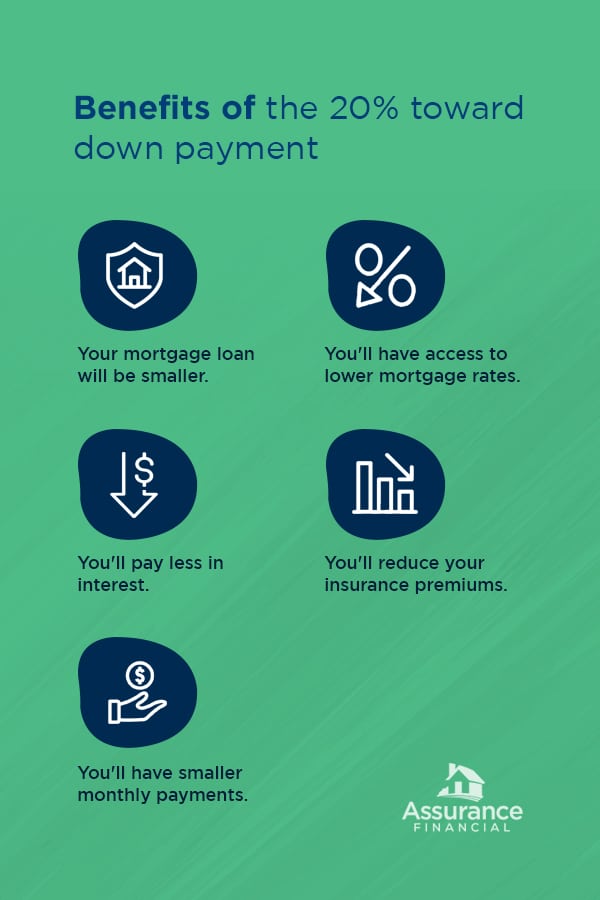

1. Can I Afford the Down Payment & Closing Costs?

The standard rule of thumb when it comes to a down payment on a home is 20%. However, you can also put a down payment of as low as 10% for a conventional loan and 3.5% for a Federal Housing Administration loan. Depending on the type of loan you’re looking to get, do you have enough money to make the down payment? You’ll also need to factor in closing costs, which can cost between 2 and 5% of the home’s value. Though the seller may sometimes contribute to these closing costs depending on the deal you get and the state of the market, you may still want to ensure you’ve saved up enough to cover these costs.

Putting a down payment of 20% toward your house can offer a range of benefits:

- Your mortgage loan will be smaller.

- You’ll have access to lower mortgage rates.

- You’ll pay less in interest.

- You’ll reduce your homeowner insurance premiums.

- You’ll have smaller monthly payments.

The more you can put down on your house up front, the more money you’ll save in the long run.

2. Am I Financially Stable?

Are you currently able to meet your other financial obligations and goals? Are you paying your bills on time every month? Are you consistently achieving your goal for retirement savings? Do you have an emergency fund? Before introducing a mortgage into the mix, you’ll want to ensure you’re covering all your other financial goals and obligations. If you’re able to say you do meet all of your other financial obligations, you may be able to comfortably fit a house into your budget.

A mortgage is a long financial commitment. Even most shorter-term mortgages are at least 10 years. The standard mortgage term is 30 years, so ideally, you’ll want to be financially stable for the duration of your mortgage, which could be several decades. Job security and a steady income are great ways to ensure financial stability, but since job loss can happen to anyone, you’ll want to ensure you can continue paying your mortgage even in the face of losing your source of income.

To prepare for this possibility, you may want to save several months’ worth of living expenses to cover you during your gap in employment. If you work in a field with high demand and you can reasonably expect to get hired in a short amount of time, you may only plan to save up for three to four months of living expenses. If you don’t work in a field with high demand and you anticipate a job loss may leave you unemployed for several months, consider saving up an emergency fund of six to 12 months of living expenses. That way, even if you remain unemployed for an entire year, you won’t have to worry about making the payments on your mortgage and bills every month.

3. How Much House Can I Afford?

Take your existing budget and input the new monthly expenses you can expect after you acquire a mortgage. You’ll want to estimate your principal, interest, taxes and insurance to plug into your budget.

Use a Mortgage Calculator

To determine the numbers for your principal and interest, you can use an online mortgage calculator. Experiment to see how much you could comfortably fit into your budget and what amounts would be stretching your budget uncomfortably thin. You can also look at the current rates from a lender like Assurance Financial for different types of loan terms, such as 15-year versus 30-year or conventional versus FHA. Try out of our Assurance Financial mortgage calculators today! Several payoff calculators also exist on many real estate websites. This can help with long-term planning which could help you avoid mistakes.

Taxes and Homeowner Insurance

To determine the approximate cost of your property taxes, you can look online for homes for sale in the area you’re interested in and find examples of what the approximate taxes might be. Usually the home you are purchasing includes historical property tax information as part of the buying process. Estimating your homeowner insurance may be a little trickier without an address to give your insurance company, but they may still be able to provide you a with reasonable estimate or range. We also recommend looking into past insurance claims on the home. Understanding the history of past insurance can open your eyes to a wealth of information on your potential new home, and may give you the information needed to change your total budget requirements.

A Quick Note On Homeowners’ Association Dues and Other Expenses

Other costs potential homeowners may overlook include fees for a homeowners’ association, an alarm system, condo fees or utilities. To get estimates for these services, especially homeowners’ association dues, you can research what residents in the area tend to pay for these expenses or contact the utility company to ask about the costs in that specific neighborhood or area. If you’re upscaling from a small apartment to a larger space, you may also want to increase other living costs that tend to go up when you have more space, like furniture, decor and property maintenance.

4. Can I Secure a Good Mortgage Rate?

First, do you know what you should consider to be a good mortgage rate? In short, a reasonable rate is one you can afford and that works with your budget. Here’s a closer look at the factors that will help you find or qualify for a fair mortgage rate.

- Credit score: Your credit score is probably the most critical factor when it comes to securing a mortgage. A high credit score tells lenders you’re likely someone who will repay them. Lenders will look at your credit history to determine whether you’ll be able to afford your mortgage and consistently make your payments. Higher scores generally result in the lowest rates, but you’re also likely to qualify for a favorable rate with a score in the mid-range. However, if you want to secure an FHA loan, you could get a mortgage with a lower score. You can request a free credit report every year from the three major credit bureaus. Choose from TransUnion, Equifax and Experian to request your credit report to determine whether your credit score could already secure you a good mortgage rate. You may find you need to do a little more improvement before applying for a mortgage.

- Employment history and income: Lenders also look at your employment history. They want to see you’ve held a job for at least two years and what your income is. If you are not employed, you’re unlikely to get a mortgage at all, let alone a mortgage with a good rate. Lenders may also look at your debt-to-income ratio and your assets. They want to feel confident you have the means to pay them back the money you’re borrowing.

5. How Long Do I Plan to Stay Here?

If you aren’t planning on staying in an area for long, buying a home may not the best option for you. Generally, it’s best to buy a house only if you plan on staying in it for at least five years. This length of time allows you to build up equity in your home and make up for the costs that went into buying, selling and moving.

If you plan on moving within a few years, you may want to consider an ARM — adjustable-rate mortgage — which have rates that adjust every year, unlike fixed-rate mortgages. If market conditions are optimal and rates are consistently dropping, an ARM may be the right option for you in a relatively short-term living situation.

6. Am I Ready for the Challenges of Owning a Home?

A significant difference between owning and renting is that when you own a home, you’re entirely responsible for everything inside it. When the refrigerator stops working or the air conditioning system fails, the cost of making these repairs comes out of your pocket. Before buying a home, you may want to have money set aside in anticipation of property and household damages.

The cost of a home isn’t only what you pay up front, but your continued maintenance and upkeep as well. Yard and outdoor maintenance can include mowing the lawn, raking leaves, clearing debris, cleaning out the gutters, power washing the house or resealing the deck. You may need to worry about paying an exterminator to remove bugs or rodents that enter your house. It’s also smart to get your air conditioning and heating systems inspected at least once a year, along with changing air filters a few times throughout the year. These costs are ongoing, so you’ll want to keep these in mind as you make your yearly or multi-year budget.

As with an emergency fund, you may want to consider specifically earmarking some cash for unexpected repairs that might pop up. You may want to follow one of two rules of thumb when deciding how to save up for these potential expenses.

- Save $1 per square foot: Every year, set aside $1 for every square foot of your house. If your home is 2,500 square feet, for example, you should save $2,500 every year.

- Save 1% of the sales price of the house. This percentage is not the amount of your mortgage, but the value of the home if you put it on the market today. If your home is currently worth $500,000, that means you would save $5,000.

If you want to save the minimum toward home repairs every year, you may follow the first rule of thumb. If you’d rather err on the side of caution, you may want to follow the second rule of thumb.

7. What Do I Want in a Home?

When compiling your list of questions to ask when buying a home, don’t forget to ask yourself what qualities you find desirable in a house. Make a list of your potential home’s must-haves, what you would like it to have and what your dealbreakers might be.

Your must-haves are any factors your home needs to have for you to buy it. Maybe on your must-haves list, you want central heat and air, rather than having to maintain separate heating and A/C units for each room. Or, perhaps your home needs to be one-story so you don’t need to deal with as much daily upkeep and cleaning. Many parents prioritize finding homes in a good school district to benefit their children. Being in a good school district not only improved your child’s education, but also makes for a better long-term investment. Most real estate websites, such as Zillow and Realtor.com, include school district and rating with each home listing.

Regardless of what you put on your list, you won’t buy a home lacking any of these items.

Your nice-to-haves are perks you would enjoy, but aren’t crucial enough that you would turn down a home that doesn’t have them. These might include a two-car garage or a nice view from the property or new appliances and major systems. If the home does not have these qualities, you’ll still consider purchasing it if it checks all the boxes on your must-have list.

Your list of dealbreakers is anything that would make you not want to buy a home. If you live with multiple people, for example, a dealbreaker for you may be a house with fewer than two bathrooms. Or, maybe you can’t stand the idea of living on a loud, busy street.

If you’ve answered positively to most of these questions, you may be ready to buy a home.

What to Consider Before Making an Offer on a House

Before making an offer on a home, there may be a few factors specific to that house to consider. These factors can include a home inspection, other offers and any work you need to get done based on the condition of the home. Here’s what to know before making an offer on a house.

1. Home Inspection

When you’ve found a house and you want to put an offer in, you will need to get it inspected. Typically, you can take advantage of a 10-day inspection period by bringing in a home inspector to assess the house. You may also want to consider hiring people who work in other trades, such as roofing, plumbing and electricity. A home inspector may not be able to catch everything. Bring in someone who is licensed in a specific profession and who will know what to check in a house before buying, tell you what might be wrong with the system and estimate how much it would cost to fix it. We also recommend using your own home inspector, and not one that your real estate agent works with. Can friends and family for recommendations. When negotiating the sales price of your home with the seller, having this information can work well in your favor.

2. Other Offers

Competition for a home can strike fear into the hearts of homebuyers, especially those who are entering the market for the first time. They worry about offering more than they can reasonably afford or missing out on their dream home. Here are a few tips for standing out from the crowd with your offer.

- Write a letter to the seller: A personal letter may help you be more memorable as a potential buyer. Selling a home can be a stressful and highly emotional time, and a letter with sentimental value can push you over the edge into their favor.

- Use specific numbers: Specific, rather than round, numbers will stick out more in a seller’s mind and may also put your offer just ahead of other buyers, even if only by a couple hundred dollars.

- Show flexibility: Develop your offer around the seller’s specific needs. A seller moving out of the state may want a sooner closing date, so being flexible with the seller may earn you the bonus points that get you the home of your dreams.

Remember, even if you lose out on a bid, you’ll eventually find the right house at the right time with the right bid, and making an offer doesn’t cost anything.

3. Necessary Home Improvements

If you need to do work or make improvements to the home, you’ll want to consider whether the costs of these improvements can fit into your budget. If you anticipate the costs will be too high, you may want to reconsider purchasing the house. On the other hand, if the improvements are minor and the costs can reasonably fit into your budget, you may want to move forward with purchasing. Replacing the roof, for example, could be a pricey home improvement. In contrast, painting a few rooms or installing a new faucet might be a remodeling project that’s within your budget.

Find Your Financing With Assurance Financial

At Assurance Financial, we want to help you achieve your American dream of homeownership. With us, you can find the home of your dreams with the ideal mortgage terms. Buying a house doesn’t have to be overwhelming when you work with the Assurance Financial team.

When applying for a mortgage, you’ll want to have a licensed loan officer to help you through the process. Our application technology and end-to-end processing under one roof will make your loan process quick and straightforward.

Find a loan officer near you today at Assurance Financial to get started, and discover why we’re one of the best lenders for financing a home mortgage.