Category: Purchasing a Home

For many in the U.S., home buying is an essential component of the American dream. A home is also one of the most significant investments you’ll make during your lifetime, and isn’t a decision to make hastily. If you’re feeling overwhelmed at the idea of buying a home, you’re not alone. At Assurance Financial, we know how stressful the process of home buying can initially seem, and we want to make this exciting step in your life as easy and enjoyable as possible.

Before buying a home, there are a few external factors you’ll want to consider, questions you’ll want to ask yourself to determine whether you’re ready to purchase a home and pros and cons you’ll want to weigh when you find a house you’re interested in. Once you’ve run through your checklist of what to ask when buying a house and what to know before making an offer on a house, we can help you acquire your dream mortgage.

- Can I Afford the Down Payment?

- Am I Financially Stable?

- How Much House Can I Afford?

- Can I Secure a Good Mortgage Rate?

- How Long Do I Plan to Stay Here?

- Am I Ready for the Challenges of Owning a Home?

- What Do I Want in a Home?

External Factors in The Home Buying process

Outside of your financial situation, there may be external factors to consider before you decide to buy a home. What are the market’s current interest rates? How is the economy performing? How has nature affected the market? These are all things you should look into before buying a home.

1. Interest Rates

The economy, politics and banks can influence interest rates. The Federal Reserve also regulates these rates in part, though human control of interest rates can sometimes spell trouble for the housing market.

2. The Economy

Various factors, such as politics, employment levels and consumer confidence, compose the economy. When looking for a home in a specific region, you’ll want to look at the market nationally, as well as regionally. The real estate market and economy in Texas may be quite a bit different from the market in Maine, for example. The market may even vary between cities in the same state, so it can be beneficial to do some research into your potential home’s area before jumping in.

3. Impacts of Nature

Natural disasters can significantly affect the real estate market. A devastating storm can cause a thriving market to completely turn around in a matter of days. People may abandon the area, and homeowners may become renters. Listings may increase, but prices may drop and it could take quite some time for the market to rebound.

Plenty of factors from your situation come into play when looking to buy a house, but be sure you don’t overlook external factors such as interest rates, the economy and the impacts of nature when making your decision about when to enter the market.

Questions to Ask Before Buying a House

Before choosing to buy a home, there are a few questions you may want to ask yourself to determine whether homeownership is the right next step for you. Here are seven of these to get you started.

1. Can I Afford the Down Payment & Closing Costs?

The standard rule of thumb when it comes to a down payment on a home is 20%. However, you can also put a down payment of as low as 10% for a conventional loan and 3.5% for a Federal Housing Administration loan. Depending on the type of loan you’re looking to get, do you have enough money to make the down payment? You’ll also need to factor in closing costs, which can cost between 2 and 5% of the home’s value. Though the seller may sometimes contribute to these closing costs depending on the deal you get and the state of the market, you may still want to ensure you’ve saved up enough to cover these costs.

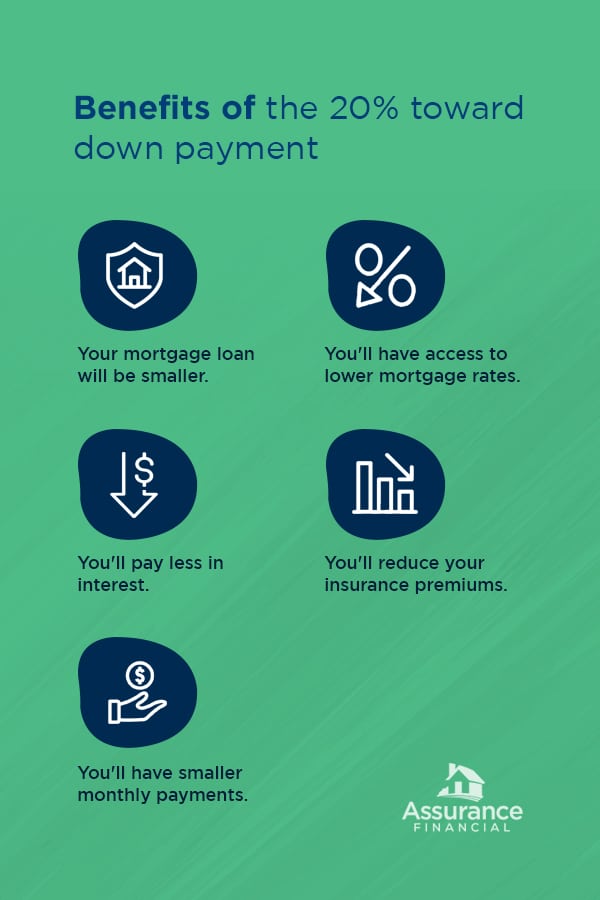

Putting a down payment of 20% toward your house can offer a range of benefits:

- Your mortgage loan will be smaller.

- You’ll have access to lower mortgage rates.

- You’ll pay less in interest.

- You’ll reduce your homeowner insurance premiums.

- You’ll have smaller monthly payments.

The more you can put down on your house up front, the more money you’ll save in the long run.

2. Am I Financially Stable?

Are you currently able to meet your other financial obligations and goals? Are you paying your bills on time every month? Are you consistently achieving your goal for retirement savings? Do you have an emergency fund? Before introducing a mortgage into the mix, you’ll want to ensure you’re covering all your other financial goals and obligations. If you’re able to say you do meet all of your other financial obligations, you may be able to comfortably fit a house into your budget.

A mortgage is a long financial commitment. Even most shorter-term mortgages are at least 10 years. The standard mortgage term is 30 years, so ideally, you’ll want to be financially stable for the duration of your mortgage, which could be several decades. Job security and a steady income are great ways to ensure financial stability, but since job loss can happen to anyone, you’ll want to ensure you can continue paying your mortgage even in the face of losing your source of income.

To prepare for this possibility, you may want to save several months’ worth of living expenses to cover you during your gap in employment. If you work in a field with high demand and you can reasonably expect to get hired in a short amount of time, you may only plan to save up for three to four months of living expenses. If you don’t work in a field with high demand and you anticipate a job loss may leave you unemployed for several months, consider saving up an emergency fund of six to 12 months of living expenses. That way, even if you remain unemployed for an entire year, you won’t have to worry about making the payments on your mortgage and bills every month.

3. How Much House Can I Afford?

Take your existing budget and input the new monthly expenses you can expect after you acquire a mortgage. You’ll want to estimate your principal, interest, taxes and insurance to plug into your budget.

Use a Mortgage Calculator

To determine the numbers for your principal and interest, you can use an online mortgage calculator. Experiment to see how much you could comfortably fit into your budget and what amounts would be stretching your budget uncomfortably thin. You can also look at the current rates from a lender like Assurance Financial for different types of loan terms, such as 15-year versus 30-year or conventional versus FHA. Try out of our Assurance Financial mortgage calculators today! Several payoff calculators also exist on many real estate websites. This can help with long-term planning which could help you avoid mistakes.

Taxes and Homeowner Insurance

To determine the approximate cost of your property taxes, you can look online for homes for sale in the area you’re interested in and find examples of what the approximate taxes might be. Usually the home you are purchasing includes historical property tax information as part of the buying process. Estimating your homeowner insurance may be a little trickier without an address to give your insurance company, but they may still be able to provide you a with reasonable estimate or range. We also recommend looking into past insurance claims on the home. Understanding the history of past insurance can open your eyes to a wealth of information on your potential new home, and may give you the information needed to change your total budget requirements.

A Quick Note On Homeowners’ Association Dues and Other Expenses

Other costs potential homeowners may overlook include fees for a homeowners’ association, an alarm system, condo fees or utilities. To get estimates for these services, especially homeowners’ association dues, you can research what residents in the area tend to pay for these expenses or contact the utility company to ask about the costs in that specific neighborhood or area. If you’re upscaling from a small apartment to a larger space, you may also want to increase other living costs that tend to go up when you have more space, like furniture, decor and property maintenance.

4. Can I Secure a Good Mortgage Rate?

First, do you know what you should consider to be a good mortgage rate? In short, a reasonable rate is one you can afford and that works with your budget. Here’s a closer look at the factors that will help you find or qualify for a fair mortgage rate.

- Credit score: Your credit score is probably the most critical factor when it comes to securing a mortgage. A high credit score tells lenders you’re likely someone who will repay them. Lenders will look at your credit history to determine whether you’ll be able to afford your mortgage and consistently make your payments. Higher scores generally result in the lowest rates, but you’re also likely to qualify for a favorable rate with a score in the mid-range. However, if you want to secure an FHA loan, you could get a mortgage with a lower score. You can request a free credit report every year from the three major credit bureaus. Choose from TransUnion, Equifax and Experian to request your credit report to determine whether your credit score could already secure you a good mortgage rate. You may find you need to do a little more improvement before applying for a mortgage.

- Employment history and income: Lenders also look at your employment history. They want to see you’ve held a job for at least two years and what your income is. If you are not employed, you’re unlikely to get a mortgage at all, let alone a mortgage with a good rate. Lenders may also look at your debt-to-income ratio and your assets. They want to feel confident you have the means to pay them back the money you’re borrowing.

5. How Long Do I Plan to Stay Here?

If you aren’t planning on staying in an area for long, buying a home may not the best option for you. Generally, it’s best to buy a house only if you plan on staying in it for at least five years. This length of time allows you to build up equity in your home and make up for the costs that went into buying, selling and moving.

If you plan on moving within a few years, you may want to consider an ARM — adjustable-rate mortgage — which have rates that adjust every year, unlike fixed-rate mortgages. If market conditions are optimal and rates are consistently dropping, an ARM may be the right option for you in a relatively short-term living situation.

6. Am I Ready for the Challenges of Owning a Home?

A significant difference between owning and renting is that when you own a home, you’re entirely responsible for everything inside it. When the refrigerator stops working or the air conditioning system fails, the cost of making these repairs comes out of your pocket. Before buying a home, you may want to have money set aside in anticipation of property and household damages.

The cost of a home isn’t only what you pay up front, but your continued maintenance and upkeep as well. Yard and outdoor maintenance can include mowing the lawn, raking leaves, clearing debris, cleaning out the gutters, power washing the house or resealing the deck. You may need to worry about paying an exterminator to remove bugs or rodents that enter your house. It’s also smart to get your air conditioning and heating systems inspected at least once a year, along with changing air filters a few times throughout the year. These costs are ongoing, so you’ll want to keep these in mind as you make your yearly or multi-year budget.

As with an emergency fund, you may want to consider specifically earmarking some cash for unexpected repairs that might pop up. You may want to follow one of two rules of thumb when deciding how to save up for these potential expenses.

- Save $1 per square foot: Every year, set aside $1 for every square foot of your house. If your home is 2,500 square feet, for example, you should save $2,500 every year.

- Save 1% of the sales price of the house. This percentage is not the amount of your mortgage, but the value of the home if you put it on the market today. If your home is currently worth $500,000, that means you would save $5,000.

If you want to save the minimum toward home repairs every year, you may follow the first rule of thumb. If you’d rather err on the side of caution, you may want to follow the second rule of thumb.

7. What Do I Want in a Home?

When compiling your list of questions to ask when buying a home, don’t forget to ask yourself what qualities you find desirable in a house. Make a list of your potential home’s must-haves, what you would like it to have and what your dealbreakers might be.

Your must-haves are any factors your home needs to have for you to buy it. Maybe on your must-haves list, you want central heat and air, rather than having to maintain separate heating and A/C units for each room. Or, perhaps your home needs to be one-story so you don’t need to deal with as much daily upkeep and cleaning. Many parents prioritize finding homes in a good school district to benefit their children. Being in a good school district not only improved your child’s education, but also makes for a better long-term investment. Most real estate websites, such as Zillow and Realtor.com, include school district and rating with each home listing.

Regardless of what you put on your list, you won’t buy a home lacking any of these items.

Your nice-to-haves are perks you would enjoy, but aren’t crucial enough that you would turn down a home that doesn’t have them. These might include a two-car garage or a nice view from the property or new appliances and major systems. If the home does not have these qualities, you’ll still consider purchasing it if it checks all the boxes on your must-have list.

Your list of dealbreakers is anything that would make you not want to buy a home. If you live with multiple people, for example, a dealbreaker for you may be a house with fewer than two bathrooms. Or, maybe you can’t stand the idea of living on a loud, busy street.

If you’ve answered positively to most of these questions, you may be ready to buy a home.

What to Consider Before Making an Offer on a House

Before making an offer on a home, there may be a few factors specific to that house to consider. These factors can include a home inspection, other offers and any work you need to get done based on the condition of the home. Here’s what to know before making an offer on a house.

1. Home Inspection

When you’ve found a house and you want to put an offer in, you will need to get it inspected. Typically, you can take advantage of a 10-day inspection period by bringing in a home inspector to assess the house. You may also want to consider hiring people who work in other trades, such as roofing, plumbing and electricity. A home inspector may not be able to catch everything. Bring in someone who is licensed in a specific profession and who will know what to check in a house before buying, tell you what might be wrong with the system and estimate how much it would cost to fix it. We also recommend using your own home inspector, and not one that your real estate agent works with. Can friends and family for recommendations. When negotiating the sales price of your home with the seller, having this information can work well in your favor.

2. Other Offers

Competition for a home can strike fear into the hearts of homebuyers, especially those who are entering the market for the first time. They worry about offering more than they can reasonably afford or missing out on their dream home. Here are a few tips for standing out from the crowd with your offer.

- Write a letter to the seller: A personal letter may help you be more memorable as a potential buyer. Selling a home can be a stressful and highly emotional time, and a letter with sentimental value can push you over the edge into their favor.

- Use specific numbers: Specific, rather than round, numbers will stick out more in a seller’s mind and may also put your offer just ahead of other buyers, even if only by a couple hundred dollars.

- Show flexibility: Develop your offer around the seller’s specific needs. A seller moving out of the state may want a sooner closing date, so being flexible with the seller may earn you the bonus points that get you the home of your dreams.

Remember, even if you lose out on a bid, you’ll eventually find the right house at the right time with the right bid, and making an offer doesn’t cost anything.

3. Necessary Home Improvements

If you need to do work or make improvements to the home, you’ll want to consider whether the costs of these improvements can fit into your budget. If you anticipate the costs will be too high, you may want to reconsider purchasing the house. On the other hand, if the improvements are minor and the costs can reasonably fit into your budget, you may want to move forward with purchasing. Replacing the roof, for example, could be a pricey home improvement. In contrast, painting a few rooms or installing a new faucet might be a remodeling project that’s within your budget.

Find Your Financing With Assurance Financial

At Assurance Financial, we want to help you achieve your American dream of homeownership. With us, you can find the home of your dreams with the ideal mortgage terms. Buying a house doesn’t have to be overwhelming when you work with the Assurance Financial team.

When applying for a mortgage, you’ll want to have a licensed loan officer to help you through the process. Our application technology and end-to-end processing under one roof will make your loan process quick and straightforward.

Find a loan officer near you today at Assurance Financial to get started, and discover why we’re one of the best lenders for financing a home mortgage.

You’ve been with your significant other for a while, and now you’re planning on spending the rest of your lives together. Marriage should be a cause for celebration, not for stress, but thinking about buying a home as you begin your new life together can be intimidating. Should you buy a home before or after marriage? Does marriage status affect mortgage rates? What factors should you consider when making your choice?

Don’t get overwhelmed by the questions you have about buying a home before or after marriage. We’ll help you evaluate the pros and cons of either situation to get a better understanding of buying a house before vs. after marriage.

- Pros and Cons of Joint Tenancy

- Factors to Consider

- Does Marriage Status Affect Mortgage Rates?

- Property Rights

- Tax Considerations

- Why Wait to Buy a House Until After the Wedding?

- Take Your Time With Your Decision

Pros and Cons of Joint Tenancy

Joint tenancy allows two or more people to access an account or have an undivided share in the property. It is a practice couples and business partners alike take part in, and unmarried couples commonly seek joint tenancy. If you’re considering buying a home before marriage, you will want to evaluate the pros and cons of joint tenancy. You can also find joint tenancy with rights of survivorship (JTWROS), which allows living owners to pass on their share to someone else when the owner is still alive.

Here are some of the benefits of joint tenancy to consider.

- Share assets and debt: Share any rent or profit you see as a result of your property between you and your partner. While we hope you only experience the positive gains, it may be comforting to know that you must handle debt together. It could lead to quicker elimination of your debt if you both work together to solve it. Shared debt also protects individuals should the relationship end. One joint tenant cannot leave the other with all of the financial obligations.

- Skip probate: When an individual dies, a probate court reviews the will to determine its validity. In a joint tenancy, if one of the joint tenants dies, there is no need for this process. Assets, like a home, will go to the surviving joint tenant as long as the individuals are married. If they are not married, they may choose a JTWROS to ensure they do not need to go through probate if one of them passes away.

- Implement it easily: You can achieve joint tenancy with a clause in your property’s title. Be sure to work out the legal details even before implementing this choice.

- Financial security: No matter how you go about purchasing a home, it is a smarter financial decision than renting with your partner for an extended period. You can build your assets together and improve your credit. Since the two of you are coming together to purchase a home, you will have two salaries to help cover costs.

With joint tenancy, you must make decisions about your property with each other’s consent. Working together could be either a pro or a con depending on the stability of a relationship. Open communication about the property can help strengthen a relationship, but choices can be difficult if the relationship is on rocky ground.

Of course, with the positives of joint tenancy come the negatives. The cons of joint tenancy include:

- The court may freeze the assets due to excessive debt after one of the joint tenants passes away.

- Unless you are married, you may have to pay gift taxes as a joint tenant.

- The property cannot go to an inheritor since it goes to the other joint tenant when one passes away.

If you want to purchase a home as joint tenants, evaluate your credit scores. If one of you has a better credit score, it may be best for that individual to purchase the home with their stronger credit. Remember if you go that route, your mortgage application will only include one person’s income.

[download_section]

Factors to Consider

When you and your significant other plan to buy a home, evaluate certain aspects of your situation. Determining these factors will help you choose between buying a house before versus after marriage.

- Income: Take both of your salaries into account when deciding when to buy a home. You should have a stable job and some money saved up if you can before venturing into the housing market.

- Location: Whether you buy a home before or after marriage, look into the area you’ll be living in, since laws vary from state to state. Some states allow community property titles, which we will explain later on, but other property and tax laws differ between states.

- Credit: Compare yours and your partner’s credit scores to determine your course of action. If your scores are similar, you can apply together for a mortgage. If one of you has a stronger score, you may decide for that individual to apply.

- Debts: Since lenders evaluate your credit score and any liabilities you have, you and your partner should consider your debts from student loans or other sources. If one of you has less debt and good credit, you could opt for sole ownership of property. You may also choose to wait until you’ve paid off your student loan debt or other liabilities before purchasing a home.

While a tricky part of the home-buying journey is taking some “what ifs” into account, it’s best to have these conversations early. If you are purchasing a home before marriage, work out a legal agreement that outlines what you’ll do if your relationship ends or one of you passes away. Depending on how you will go about purchasing your home, you will also want to think about:

- Who will apply for the mortgage

- How you will split ownership, if applicable

- How you will protect both parties with the property title

- Whether or not you will evenly split additional costs

- What happens if the relationship ends

It may seem overwhelming to have these discussions, but getting organized and figuring out a plan can help you as you move forward with your relationship and the home-buying process.

Does Marriage Status Affect Mortgage Rates?

If you want to buy a house after marriage, you’ll want to know if marriage status affects your mortgage rates. No matter your relationship status, details like your credit score, income, debt and other financial factors influence mortgage rates. While you won’t see a direct impact from your marital status on the rates lenders offer you, related factors of your relationship status can have an effect.

- Single: Before you began your relationship, being a single-income household would have affected your mortgage rates. While lenders don’t penalize you for being single, making less than a married or dating couple may mean you get approved for less.

- In a committed relationship: If you and your partner are serious about your relationship and moving in together, consider what happens when applying for a mortgage before marriage. If you apply together, a lender will take the lower credit score into account. Applying together while not yet married can involve a bit more complex paperwork than if you applied as a married couple or an individual. You or your partner may decide to apply as an individual if your credit scores are drastically different.

- Married: As you would in a committed relationship, you and your spouse likely have a two-income household. Calculate your debt-to-income ratio, as you should no matter your relationship status, to determine how your incomes will combine.

As long as you and your partner have strong credit scores, good incomes and minimal debt, you will likely receive the best mortgage rates as a married couple. For the best outcome, marry before buying a house if your finances are in order. Take into account the factors we mentioned earlier as well as what is best for you as a couple to determine what type of ownership suits your needs.

Property Rights

As you and your partner plan to purchase a home, consider what title works best for you. Potential ownership options work with the different factors above, such as how you will divide the property. Consider these possibilities whether you’re buying a home before or after marriage.

- Sole ownership: One individual owns 100% of the property in sole ownership. When that owner dies, the property goes to someone else through transfer documents, such as a will. The decision may also go through probate. For a married couple or a couple seriously considering marriage, sole ownership may not be the best choice. Unless one of you has a significantly better credit score, you may think about one of the other title options.

- Joint tenancy: Depending on where you live, joint tenancy usually allows the surviving joint owner in the event of another’s passing ownership of the property. Married couples can find tax benefits with qualified joint tenancy, but anyone can enter into this title.

- Tenancy in common: Unlike joint tenancy, which involves an undivided share of the property, tenancy in common allows for different percentages for each owner. The ownership percentage helps determine how much in mortgage interest and property taxes an individual pays. Upon death, an individual’s will can pass the property onto someone other than their spouse, also unlike joint tenancy. With tenancy in common, you can sell your share of assets without the other tenancy in common’s consent. If you seek joint ownership of the property before marriage, it may default to tenancy in common unless you opt for a different ownership method.

- Community property: Available in certain states, community property involves an equal share between spouses. Unlike joint tenancy, individuals can leave their portions of their property to heirs after they pass away. Community property begins at marriage and ends should the couple decide to separate. Any property an individual owned before marriage is called separate property. The individual can maintain control over the separate property or share it with a spouse once married.

With these options, you and your partner can find the title option that suits your needs. Before choosing one, you should also take into account how buying a house before or after marriage can affect your taxes.

Tax Considerations

Evaluate how your marriage affects your taxes to help you decide if you should marry before buying a house. Typically, married individuals have more tax benefits than couples.

As an unmarried couple, you cannot file joint taxes. You will have to organize how you will file separately. Only one homeowner, for example, can claim the deduction on mortgage interest, so two individuals filing separately cannot both claim that deduction. If the relationship ends before marriage, the individuals will have to sort out who covers taxesand other costs.

While tax and property law vary between states, there are more factors to consider as an unmarried couple than a married one. You may find it’s easier to get married before purchasing a home. That way, you can focus on learning about these laws specifically for married couples.

Whichever title you choose for your home, be sure to watch for any liability to pay the taxes due on your property. Even if the responsibility belongs to the other owner, you may be legally responsible if taxes go unpaid. Learn the law where you live and choose your best course of action, which may be purchasing a home after marriage.

Why Wait to Buy a House Until After the Wedding?

While you may have planned on buying a house before marriage, you may want to consider getting married and then buying a home. Marry before buying a house for benefits such as:

- Filing joint taxes

- Ease of applying for a mortgage

- Saving on the stress of house hunting and planning your marriage

- Flexibility with mortgage applications and title options

Though buying a home after marriage makes more financial sense, it is still something you should have a conversation about with your spouse-to-be. You want to be on the same page in terms of buying a home and your goals before you get married to avoid any surprises later.

Take Your Time With Your Decision

Like marriage, buying a house is a big decision. With so many factors to consider, you won’t want to rush into a choice. Evaluate aspects of you and your partner’s life, such as the following.

- Your income and finances: Do you and your spouse have stable jobs? Have you been saving for some time? Take the time to go over your finances and sort out your budget before you begin house hunting. From there, you can make informed decisions about how you will split the property or who will apply for the mortgage if one of you has a better credit score.

- Your long-term goals: Think about your jobs and where you see yourself in the future. Do you plan on moving? Are you going to have children?

- Your relationship: It’s difficult to talk about with your partner, but ensuring your relationship will last a long time creates a secure foundation for buying a home. Work out what your options are should the relationship end. Know that the conversation doesn’t mean it’s going to happen. It means you and your partner have prepared for the future.

- The distant future: Preparing for the future also, unfortunately, means you must think about what happens when one individual in the relationship passes away. Consider the title you obtained when purchasing your home as that influences who the share of the property goes to or if you need to go through probate.

Figuring out the course of your relationship and future will help you and your partner forge a plan. Move forward confidently with your marriage and buying a home after you’ve evaluated your finances and goals.

Purchase a Home With Help From Assurance Financial

Buying a home can be as exciting of a journey as marriage if you know how to approach it correctly. Communicate with your significant other about what both of you want now and what could be best for your shared future. Don’t delay the tough conversations, either. It may be hard to think about what you would do if one of you passes away or if your marriage ends, but preparing for those unfortunate possibilities makes your relationship stronger.

No matter when you decide to purchase a home, contact us at Assurance Financial. Apply online or meet with one of our licensed experts to plan a bright future with your spouse.

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing

Additional Resources You May Also Like

When you’re shopping for a phone or a new pair of jeans, the process is relatively straightforward. You probably check out your options online, maybe try a few out in the store, pick the best fit and get on your way.

It’s not that simple with homebuying, though. Buying a home is an enormous investment. The process takes time, and especially for first-time buyers, it can be overwhelming.

Having a checklist to move through gives first-time homebuyers a sense of control and purpose. Being able to map out the process makes everything a little less daunting.

- It Helps Buyers Make Sense of an Unfamiliar Process

- It Helps Buyers Understand the Homebuying Timeline

- It Provides Valuable Information

- Check Your Credit Score

- Raise Your Credit Score

- Establish a Realistic Price Range

- Establish Your Priorities

- Check out Different Mortgage Lenders

- Scrape Together a Down Payment

- Get Pre-Approved for a Mortgage

- Shop Around for the Right Real Estate Agent

- Attend Open Houses

- Put in an Offer

- Negotiate

- Go Through Inspection

- Go Through Appraisal

- Renegotiate

- Close on the Home

Why It Helps to Have a Checklist Before Buying a Home

Buying a home can be a long, demanding process. According to the National Association of Realtors, the median buyer looks for 10 weeks before finding a place, and sees an average of 10 homes during that time.

First-time homebuyers are a large cohort, making up over a third of all buyers. But sometimes first-time buyers don’t have all the information they need to take the proper steps or make the right decisions at every turn.

A first-time buyer checklist, then, is useful for a few reasons.

1. It Helps Buyers Make Sense of an Unfamiliar Process

If you’re a first-time homebuyer, many of the terms and procedures involved in home buying will be new to you. You’ll have to learn what closing costs and fixed-rate mortgages are. You’ll face moments of uncertainty about all the different people and negotiations involved in the process. You’ll need to know what steps to take when, and you’ll need to be aware of what difficulties could arise so you can prepare to head off problems before they throw a wrench into your search.

Having a checklist provides you with a practical sense of how the homebuying process works. That way, you’ll understand exactly what needs to happen before you have the keys to your new home securely in your pocket.

2. It Helps Buyers Understand the Homebuying Timeline

“When should we apply for a mortgage loan?” “When should we get an appraisal?” “Should we have talked to a real estate agent already?” Questions like these can muddy the waters of the homebuying timeline, leading to doubt and frustration.

The virtue of a first-home checklist is that it provides visual orientation. That way, buyers can address these questions at a glance, and quickly figure out what needs to happen when. This clarity helps buyers focus their energy where it needs to be, instead of worrying about escrow when they haven’t even figured out a budget yet.

3. It Provides Valuable Information

Being armed with knowledge and information gives first-time homebuyers a leg up on the competition — and the housing market can be competitive for sure. You’ll need to keep many essential items in order, or a sudden setback could derail the process just when you think you’re all set.

How to qualify for a home loan as a first-time buyer is one of the first, most critical questions. Having a first homebuyer’s checklist as part of the mortgage process provides valuable tips and tricks to make sure everything goes smoothly and you end up with favorable loan rates.

First-Time Homebuyer Checklist

The checklist below will help with what first-time homebuyers need to know before buying a home.

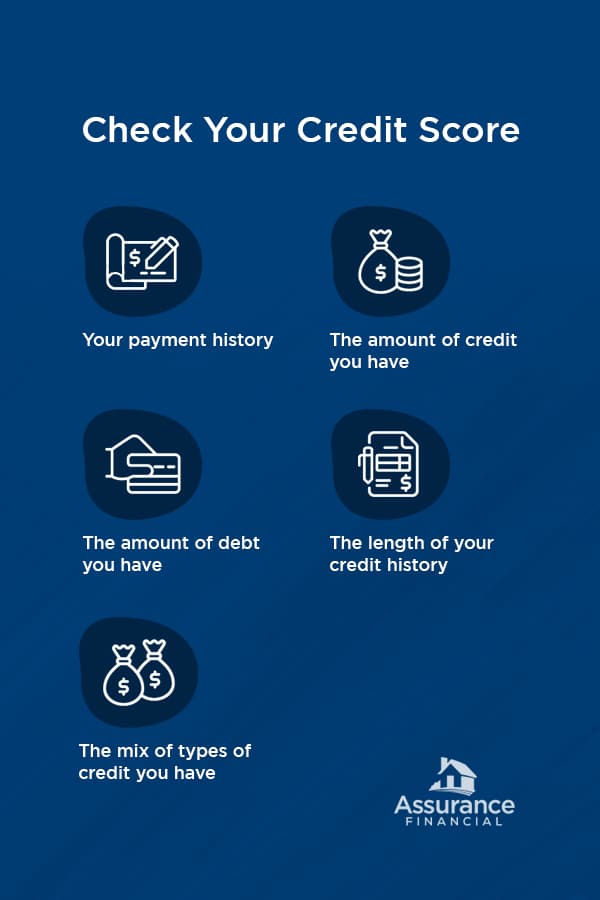

1. Check Your Credit Score

Your credit score is crucial, because mortgage lenders look at it to determine your creditworthiness and loan eligibility. Your credit score determines the rates you’ll receive. A better credit score leads to lower interest rates, whereas a lower score leads to higher rates.

Credit bureaus typically base your credit score on a combination of factors such as:

- Your payment history

- The amount of credit you have

- The amount of debt you have

- The length of your credit history

- The mix of types of credit you have

For example, a person with a blend of student loans and credit cards likely has a better credit score than a person who owes the same amount on credit card debt alone.

It takes time to raise your credit score, so it’s wise to assess it early. You can check your credit score for free online. Some credit card companies offer a free credit score once a year, or you can check for free at sites like CreditKarma.com or AnnualCreditReport.com.

2. Raise Your Credit Score

One critical part of your credit score is the amount of credit available on the amount of credit you have. If you can do so, pay off some debts. If you have any outstanding bills, prioritize paying them before they get too far past due. Creditors don’t typically report missed payments until 30 days past the due date, but after that, unpaid bills will lower your score. If you see any errors in your credit report — it does happen — contact the credit bureau with proof of the mistake, so they can issue a correction. Even if you have excellent credit, a small boost may help you qualify for better loan rates.

Raising your credit score can help you secure the lowest interest rates on your mortgage loan. Many traditional lenders require a score 660 or higher to qualify for a mortgage loan, and you’ll likely need a score of 740 or higher to get the best interest rates. If you have poor credit of 580 or above, though, you may be able to get a mortgage loan through government programs like the Federal Housing Administration (FHA), which will consider lower scores if you’re willing to put down a larger down payment. Active-duty and retired military personnel are eligible for Department of Veterans Affairs (VA) loans, which also tend to be lenient with poor credit.

3. Establish a Realistic Price Range

While you’re waiting for your credit score to go up a few points, think realistically about what your budget has room for. What down payment can you afford, and what mortgage payment can you afford? You can use online calculators to figure out monthly mortgage payments and play around with variables like the amount of the down payment and fluctuating interest rates.

Don’t forget the mortgage won’t be your only payment — homeowner insurance and property taxes can add up to to a hefty chunk.

4. Establish Your Priorities

Maybe having three bedrooms and two bathrooms is a hard-and-fast requirement. Perhaps you’re firm on having a manageable commute to work and not buying a house in the floodplain. Maybe you’d love a yard with a river view and a big patio to grill on, or an interior with exposed brick and crown moldings, but you can live without those things. Or, perhaps your 5-year-old insists on an in-ground swimming pool and unicorn paddock, but would be OK as long as there is treehouse potential.

No matter what your priorities are, make sure you’ve thought seriously about them before you start looking. If you and your spouse or partner are looking together, be sure to put together a wishlist that reflects the priorities you both have. You’ll both be substantially invested in your new home, financially and otherwise, so you both need to be happy.

Be prepared for some of your priorities to shift during the house-hunting process, though. If you find a house that checks all the boxes, but you can’t see your kids growing up there, it’s OK to listen to your gut. If you always thought the north side of town was too far away from work, but discover the perfect house right on the bike trail, don’t write it off because it doesn’t fit with the list you originally made.

5. Check out Different Mortgage Lenders

Call and ask about your options with different banks, credit unions and mortgage brokers, or speak with the VA if that option applies to you. See if you qualify for a mortgage and what rates your credit score makes you eligible for. Treat your potential mortgage the same way you’ll treat your potential home: Don’t choose the first one you see. Look at several to figure out their advantages and drawbacks.

It’s vital to compare rates across different lenders. For example, you may find two lenders that both offer 30-year fixed-rate mortgages. If one offers a 4% interest rate and another offers a 4.4% interest rate, that extra 0.4% adds up to a lot more extra money than you might think over the 30 years of the mortgage. Especially if you have a so-so credit history, different lenders may offer you markedly different rates, so shopping around can lead to significant savings.

With a $300,000 mortgage at a 4% interest rate, for example, you might have a monthly payment of $1,289 a month and $164,040 in interest paid over 30 years. For that same mortgage at a 4.4% interest rate, you might pay $1,352 a month and $186,720 interest over 30 years. That’s a difference of over $22,000 over the span of the loan, from a variance of only 0.4% in interest rates.

It’s also essential to figure out the pros and cons of different lenders. If they sincerely want your business, some lenders may offer an expedited process or be amenable to paying your closing costs. But lenders also charge different fees: loan application fees, rate lock fees and many more.

6. Scrape Together a Down Payment

In recent studies, 13% of all buyers reported saving for the down payment proved their most significant hurdle to homeownership. To get the best rates, you’ll likely have to put down 20% of the list price, though it is possible to buy a home with a smaller downpayment. For a $300,000 home, that 20% comes to $60,000 — not a trifling amount. With federally-backed VA and FHA loans, people typically put down much less. The average down payment percentage also varies by region, soaring higher in areas where housing costs more.

Make sure you’ve saved up, and think about how you can save more if you’re serious about reaching your goal. To this end, you’ll want to keep your financial life stable. If you’re planning to buy a home, it’s probably not the right time to quit your job, go back to school, buy a brand-new car or open new lines of credit — unless doing so will help your credit score. Find ways to save instead of spending. If you can’t comfortably cut back, that may be a sign your homebuying budget is unrealistic.

7. Get Pre-Approved for a Mortgage

Pre-approval means a lender looks over your income information, assets and credit score. The lender tells you what loans you qualify for and what interest rates you can expect to receive, and provisionally agrees to lend you a specific sum.

Especially in competitive markets, pre-approval is almost a necessity. A mortgage pre-approval statement provides sellers with specific details of the loan you will get, so the seller can feel confident your offer won’t fall through.

8. Shop Around for the Right Real Estate Agent

Studies show that in all demographics except for buyers aged 71 and up, the majority of people search online listings first before contacting a real estate agent. Online searches are a beneficial first step. At some point, though, you will probably want to reach out to a professional.

Your agent will be your negotiator, the person who helps you navigate offers and counteroffers and deal with the closing process. You need someone savvy, so do your homework by reading online reviews or speaking to past customers if you can. When you’re choosing a real estate agent, a friendly, laid-back person you get along with is a plus. However, don’t discount someone just because that person seems blunt or aggressive. A bulldog of an agent can help you at negotiation time.

Studies show 88% of buyers purchase a home through an agent, and a whopping 92% of buyers 36 and younger do so. Not seeking out a real estate agent can put first-time buyers, especially younger buyers, at a significant disadvantage.

9. Attend Open Houses

Sometimes a house looks great in photos, but once you get there, you realize strategic uplighting worked magic on rooms that are gloomy in real life, or that despite the grassy expanse of lawn you saw, the neighbors are only six feet away. Sometimes the opposite is true, and a home that doesn’t photograph well shows up stately and charming in real life. Going to open houses lets you see real homes in all their quirks and glory. It’s a good idea to take photos yourself, so you can keep details straight.

Keep in mind you’re not just seeing the homes — you’re scoping out the locations, too. If you love the gingerbread trim, but the neighborhood seems unsafe, or you wanted to be near the university, but the noise from the stadium is overwhelming, chances are those homes may not be the right fit.

10. Put in an Offer

Browsing listings and seeing open houses is fun and exciting, but at some point, you’ll have to pull the trigger. If you’ve found a home you love and are serious about, your real estate agent can help you get your offer together. Preparing an offer typically includes setting your offer price, receiving disclosures, figuring out contingency clauses and setting a time frame for closing.

Make sure your offer is timely. If you don’t act fast, others will submit their offers first, and the seller may choose one before you’ve had a chance to add yours to the mix. It’s also essential to make sure your offer is realistic and well-calculated. If your offer is too low, you won’t stand a chance against the competition. If it’s too high, even if you love the house, you may feel you made a bad deal.

11. Negotiate

If the sellers choose your offer, that’s great news. You’re not quite done, however. The sellers may make a counteroffer, perhaps asking for a thousand dollars more or dropping the price by a grand or two if you agree to pay their closing costs on top of yours.

At this point, your real estate agent can be an excellent source of insight about how to proceed. If you love the house, you may accept what the sellers ask for, or if you can’t live with the new terms, you may want to counter for yourself.

12. Go Through Inspection

This step of the first home checklist process often leads to a few days of worrying. What if the inspector finds something severely wrong with the house, and you have to give it up? There’s nothing to do at this point but wait and see.

During a home inspection, a professional walks through the home and looks for any structural or environmental problems that might impact the sale. These can range from minor issues, like clogged gutters or a damp basement, to more serious problems, like a cracked foundation, faulty wiring or the presence of black mold, that would make the house too hazardous to be a wise investment.

13. Go Through Appraisal

Most mortgage lenders require an appraisal before they will officially approve a mortgage. During this process, a professional appraiser assesses the actual value of the home. They will consider factors such as the home’s condition, its features and amenities and its square footage, as well as its comps, or the sale prices of homes of comparable value.

If the sellers have listed a home at a price too far above its actual worth, the mortgage lender will issue a mortgage only for the appraised amount, leaving you to cover the rest or move on to a home whose listed price and appraised value align.

14. Renegotiate

After the inspection and appraisal, if you’re still on board with the sale, you can ask the sellers to perform any necessary repairs, or you can use the discovered problems as a bargaining chip to negotiate a lower price if you’re prepared to tackle some home-improvement projects after closing.

Your agent can advise you about what to ask for to bring the house up to a reasonable standard and what concessions to make in the interest of a quick closing process.

15. Close on the Home

When you’ve settled all the major issues and you and the sellers have agreed on final costs, the last step is to close. Once you’re there, you’ve made it! At closing, you will sign final paperwork to seal the deal. You’ll receive the deed to the property — and, after a long and sometimes grueling process, you’ll finally own your first home.

Get Started Buying Your First Home With Assurance Financial

Now that you have your first-time homeowner checklist, you’re ready to get started.

At Assurance Financial, we understand first-time homebuying can be a daunting and complicated process. Our trusted advisers will be with you every step of the way. We’ll answer your questions and make sure you get the right loan for your situation, so you can own the home of your dreams without financial worry.

As full-service residential mortgage bankers, we have the knowledge, insight and resources to help you obtain the loan that works for you. We treat all our customers with compassion and respect because we want to help them get into the homes of their dreams. Search for a loan officer using our online tool, or contact us today.

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing

Additional Resources You May Also Like

Buying a home is a big deal, and most likely the most expensive purchase you’ll make in your lifetime. Thankfully, your purchase comes with a few perks. There are several tax deductions available when buying a home that can put a good chunk of cash back in your pocket. Here are a few tax advantages that make your home a great investment.

Mortgage Tax Deduction Benefits when Buying a Home

Tax codes give homeowners the choice to deduct the mortgage interest from their tax obligations. This can equal to a huge deduction for many owners since interest payments make up a large amount of your mortgage payment.

Also, when buying a home you can begin claiming points on your loan the first year. These points are called origination fees and can be claimed even if the seller pays for them. Origination fees of one percent, or more, are common and can add up to big savings for buyers.

Property tax is also deductible. Real estate property taxes paid on your home are fully deductible for income tax purposes.

Tax Deduction on Home Equity Lines

You can also deduct the interest paid on a home equity loan. This gives you the chance to shift your credit card debts to your home equity loan. You’ll pay a much lower interest rate than those offered by credit card companies and get a deduction on the interest as well.

Home-office deductions

If you are buying a home and self-employed or do freelance work in a home office, deductions can save you money on your taxes. The IRS allows you to write off a portion of your regular expenses that you spend to conduct business at home. This includes electricity, water, Internet, and other costs. When calculating your home office deduction, measure what percentage of your living space your offices takes up and how much you spend each year.