Category: Refinancing

If you’ve had your existing home loan and mortgage for a little while, it’s only natural to wonder if you could get a better deal. A mortgage is a tremendous responsibility — so you need a reliable understanding of whether refinancing is a good or bad idea. The guide below will lay out some of the pros and cons to help you make sure you’re refinancing your home for the right reasons.

Should You Refinance Your Home?

Whether or not to refinance your home is a big decision. Your choice will likely hinge on several factors, including your goals, your current financial situation and the terms of the new loan you can get.

Is it good or bad to refinance your home? The answer is that it depends. You may hear excited chatter about home refinancing from friends or coworkers currently working their way through the process. If you know mortgage rates are low and your acquaintances are boasting about the low rates they got, you might feel tempted to look into refinancing for yourself. And certainly, refinancing your home can be the right decision as long as you educate yourself thoroughly about the process and know what benefits you can and cannot achieve.

Refinancing your home is often an attractive idea in specific scenarios. Say you need ready cash to tackle a financial emergency or want to pay off your mortgage more rapidly. In that case, refinancing can often give you the flexibility and security you need to weather a challenging time or meet your financial goals sooner.

Even though the idea of refinancing your home can be enticing and the results can bring you real benefits, you should also be aware of certain realities of the process. When you’re thinking about whether or not to refinance, here are a few considerations to keep in mind:

- Time requirements: With some lenders, refinancing your mortgage is often time-consuming and laborious — you’ll likely need to gather up documents like bank statements and pay stubs to demonstrate your financial stability and convince the lender that you’re a low-risk investment. Fortunately, with Assurance Financial, you can apply in as little as 15 minutes.

- Expenses: The expenses of refinancing a home also sometimes undo some of the expected financial advantages. Fees and closing costs could quickly add up, and the new loan may have a higher rate that increases the homeowner’s financial burden over time. A “no-cost” mortgage may come with a particularly high interest rate that negates the anticipated monetary benefits.

- Hit to your credit: In thinking about whether to refinance a mortgage or not, many people also wonder if the refinancing process will hurt their credit. The answer is that your credit may temporarily take a minor hit. Refinancing your home means the lender will pull your credit score. The pull will be a hard inquiry and may result in a temporary dip in your score. Closing out your old loan will also reduce your credit score slightly.

When you’re wondering whether to refinance or not, it helps to have clear, detailed information on the potential drawbacks and missteps so that you can make an informed decision.

Reasons Not to Refinance Your Home

Is refinancing bad for your financial goals? In some situations, refinancing’s disadvantages outweigh the potential gains. The next few sections will discuss several reasons why you may not want to refinance.

1. To Consolidate Debt

Refinancing your home in an attempt to consolidate debt can be a good financial move in some circumstances, but it isn’t always the most prudent strategy. Many homeowners who refinance to consolidate debt assume that doing so will lighten their financial burden. They may believe that by creating one payment plan with a reasonable rate, they’ll be able to make their budget more manageable.

Under the right circumstances, consolidating debt can be a smart financial move. Paying off high-interest credit card loans with a low-interest mortgage, for instance, is sometimes strategically sound because it reduces your overall payments. This strategy, however, comes with a few things you’ll need to keep in mind.

The first involves the difference between an unsecured loan and a secured loan. A secured loan requires collateral backing, whereas an unsecured loan does not. Credit card debt, for instance, is unsecured. If you fail to pay your credit card bills, the credit card company cannot come to your house and repossess any of your belongings. You may take a hit to your credit score, but that’s a far more manageable outcome than losing your car or home. In this sense, an unsecured loan is a relatively low risk, though the tradeoff is that it will probably come with much higher interest rates.

A mortgage, though, falls into the category of secured debt, with your home as collateral. If you consolidate extensive debts into your mortgage and then fail to make the required payments, you could well find yourself facing a home foreclosure.

An additional consideration is that many homeowners who refinance for debt-management reasons also end up creating a slippery financial slope for themselves. If they cannot manage their spending, they may quickly accumulate new credit card balances and have trouble paying them down along with the new mortgage payments. Remember that it’s always free to review your options with Assurance Financial — we can help you weigh the pros and cons of restructuring your debt.

2. To Save Money for a New Home

Some homeowners become interested in refinancing their mortgages because they want to save money for a down payment on a new home. However, a move like this can have significant drawbacks. Be prepared to crunch the numbers to figure out whether this strategy will help you save money or not. You’ll need to figure out how soon a mortgage refinance will help you start saving money and whether that timeline aligns with your time frame for moving.

Say that refinancing your home would give you lower mortgage payments each month. Say also that the upfront expenses of refinancing are significant enough that it would be four years before your monthly savings made the cost of the new loan worthwhile.

If you’re not planning to move for several years, this strategy will probably work out well. If you’d rather move within the next two or three years, though, refinancing your home in this way wouldn’t help you save enough money in time.

The bottom line is that even though refinancing a mortgage may seem like an attractive money-saving option, you’ll need to do the math. That way, you’ll know how soon you’ll see benefits and whether that timeline will align well with your financial priorities. You can use Assurance Financial’s refinancing calculator to investigate more specific numbers and calculate concrete refinancing costs and savings.

3. To Reduce Your Payments

One common reason for a homeowner to consider refinancing a mortgage is to gain lower interest rates and reduce monthly payments. Doing this gives you the immediate financial freedom to save, invest or have more cash on hand for expenditures each month. If your goal is to save money every month, this is a good strategy for you.

However, in terms of your overall financial planning, your monthly payments are less important than your loan’s total cost. Imagine that you refinance a 20-year mortgage into a 30-year mortgage — the mortgage terms that 90% of Americans tend to choose — to gain a slightly lower monthly payment.

While you’ll pay less per month, you’ll now be paying your mortgage for an extra 10 years. Say your mortgage payment is $1,500 per month. That adds an extra $180,000 to your mortgage’s total cost — $1,500 x 12 x 10. Even if you save $250 a month, in 25 years, that only adds up to $75,000 in savings. This scenario is another excellent example of a place you can use our mortgage calculators to take a closer look at the numbers for your home.

4. To Focus on Investments

Homeowners sometimes consider a mortgage refinance in hopes of saving money they can then put into their financial investments. In theory, this approach is sounder than refinancing merely to reduce monthly payments. After all, even if your monthly savings are modest, you can invest the extra money to significantly increase your funds.

This strategy has its drawbacks as well, though. If you’re not careful, you might end up putting your money into investments that yield a lower interest rate than the rate on your mortgage. Be sure to select investments with higher yields than your mortgage rate so you can ensure a profitable tradeoff.

Practically speaking, refinancing your mortgage to put the monthly savings into investments often creates an additional challenge. It’s all too tempting to spend the money instead of investing it. Despite your best intentions, you may end up siphoning off a little cash at some point to put toward a big purchase or pad your holiday budget a little. Each time you do it, you may tell yourself it’s all right because it’s not that much money — $20 here, $40 there.

Over time, those small splurges add up to a significant sum that you haven’t invested. Once that happens, if you’re not investing more than you’re paying in interest on your mortgage, you lose the benefit of having refinanced your home.

In some cases, though, refinancing to focus on strong investments may work out well. Talk to one of the knowledgeable professionals at Assurance Financial to figure out what strategy is right for you.

5. If You’re Planning on Moving

We’ve discussed how important it is to do the right calculations before refinancing your current home so you can save up to buy a new house. Be sure the timeline on which you’ll start recouping your refinancing expenses in monthly savings is compatible with your time frame for purchasing the new home.

If you’re planning on moving soon, refinancing your current home generally isn’t wise. In most scenarios, you won’t have time to reap the benefits of the refinanced loan before you have to start over with a loan for your new home purchase. Banks and lenders tend to front-load the interest costs into the early payments, so you’ll pay larger chunks at the beginning of your loan than at the end. If you know your tenure in your home is going to be short, paying so much upfront doesn’t make much sense.

You might also be considering switching from a fixed-rate to an adjustable-rate mortgage (ARM) if you are planning a move in the near future. An adjustable-rate mortgage sometimes seems appealing because its rate changes to reflect the current market rates. If market rates go down, you’ll be able to take advantage of those new, lower rates yourself instead of being locked in at your initial, higher rate.

However, adjustable-rate mortgages work the other way, too. If market rates go up, your interest rate will go up also when your ARM resets. If you’re planning to move, you might feel tempted to go with the ARM because you think you’ll move before the higher rates can kick in. This strategy can be a risky gamble, though. If your moving timeline gets delayed and your mortgage does reset to the new, higher market rates, you can find yourself paying much more in interest fees than you bargained for.

In some scenarios, refinancing even though you plan to move soon is a sound strategy because of the rate benefits you may gain. Talk to one of our experienced advisors to get more insight into what’s best for your situation.

6. If You Don’t Have Enough Equity in Your Home

Some homeowners consider refinancing their mortgages when they don’t have much equity built up in their homes. This plan is often a risky one as well.

Leveraging your home’s equity can sometimes be a wise strategy. If you have sufficient equity built up in your home — say you’ve been making a steady stream of mortgage payments and paid off a substantial part of your home’s value — it becomes easy for you to borrow against that value through a home equity loan. You might take out a home equity loan for a renovation project, for instance, so you can upgrade your home and increase its resale value.

However, not having enough equity in your home can make refinancing risky, especially if you do plan to take out home equity loans. Most lenders want you to have a reasonably low loan-to-value (LTV) ratio before they’ll consider refinancing your mortgage. LTV refers to the amount of your remaining loan in proportion to the value of your home. If you haven’t paid off much of your loan — and, therefore, haven’t built up much equity — many lenders will pass on giving you a new loan for refinancing.

The specific number will vary among different banks and lenders. On average, many lenders will look to see whether you have at least 20% home equity before they’ll consider you a strong candidate for refinancing. If you haven’t yet hit that 20% threshold, you may need to spend a few years making interest payments before you qualify for favorable refinancing terms.

Remember, too, that if you refinance and take out a home equity loan simultaneously, you’ll end up paying interest on both. This increases your monthly expenditures and cuts significantly into the savings you might have received from refinancing your mortgage.

Keeping as much equity in your home as you can is often the best approach to take for your financial security. But in many cases, homeowners cash in some of their home equity to cover the closing costs and other fees associated with refinancing. If you don’t have much home equity to begin with, doing so can put you right back where you started in terms of your progress toward paying off your loan.

As you weigh your options, try plugging some numbers into our refinancing calculator, or reach out to one of our friendly advisors for help.

When Is the Right Time to Refinance?

So far, we’ve primarily discussed reasons you might opt not to refinance your home. In light of these potential drawbacks, is refinancing ever a good idea?

Despite the cautions laid out above, refinancing your home can be beneficial in some scenarios. Here are some examples.

1. You Can Secure a Lower Interest Rate and Long-Term Financial Savings

Refinancing for a lower interest rate is a common strategy among homeowners. If you can refinance your home to get a lower interest rate without incurring costs that wipe out your interest savings, this is often a smart way to go.

Recent evidence suggests more homeowners should take advantage of this option — a 2016 paper in the Journal of Financial Economics reported that in a sample of Americans for whom refinancing would have been favorable, 20% failed to pursue the possibility. These homeowners forfeited savings of about $11,500 on average, the paper concluded.

Restructuring your mortgage so you can get a lower interest rate is a sound idea — just be sure you’ve done the right calculations to ensure you won’t be paying more elsewhere. If you’ll incur hefty fees or end up making payments over a significantly extended time frame, this strategy may not pay off. You should still refinance your mortgage if reducing your interest rate ends up giving you a better overall deal — just put in the extra work to check out the details to make sure it does.

[download_section]

2. You Can Shorten the Terms of Your Loan

In some cases, you’ll be able to restructure your loan so you’re paying about the same interest rates over a much more condensed amount of time. In this scenario, refinancing your home can be an excellent financial boon. If you can get similar rates, your monthly payments won’t increase too much, and making fewer payments will give you substantial savings in the long run.

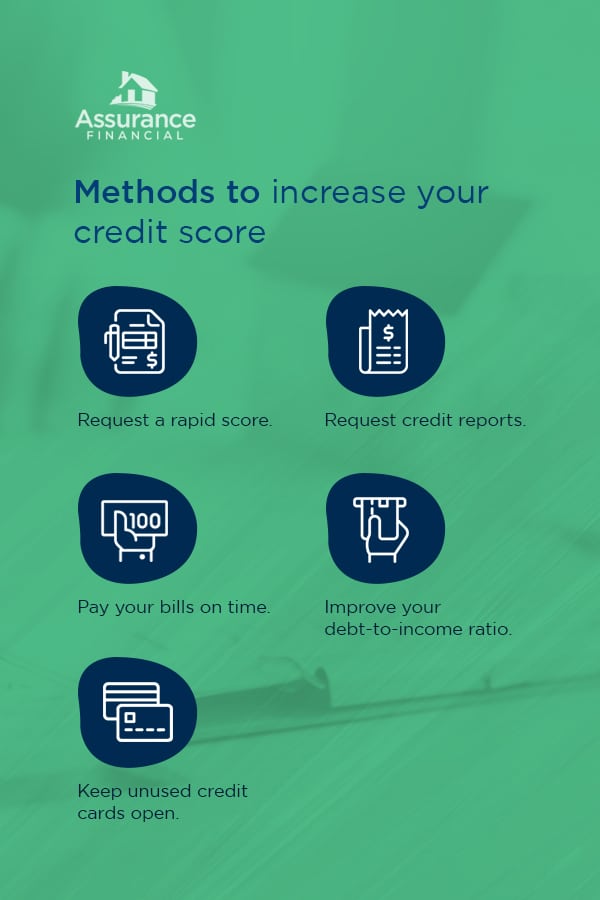

3. Your Credit Score, Income or Home Value Has Increased

An increase in your credit score, income or home value is often a signal that refinancing your mortgage will result in a favorable financial outcome:

- Credit score: If your credit score increases significantly, lenders will likely view you as a more secure and attractive risk. With a better credit score, you can often qualify for better loan terms, including lower interest rates, that make refinancing your home a worthwhile option.

- Income: If you change jobs, get a raise or otherwise boost your household income, you’ll also become a more attractive prospect for lenders. Providing proof of a higher income can often get you more favorable interest rates if you choose to refinance.

- Home value: If the housing market in your area is hot, the value of your home may rise over the years. In that case, you can leverage that value to your benefit. You may also be able to get cash-out refinancing, which allows you to apply for a larger mortgage and then receive the difference between your old and new mortgages in cash.

Partner With Assurance Financial for Help With Refinancing Your Home

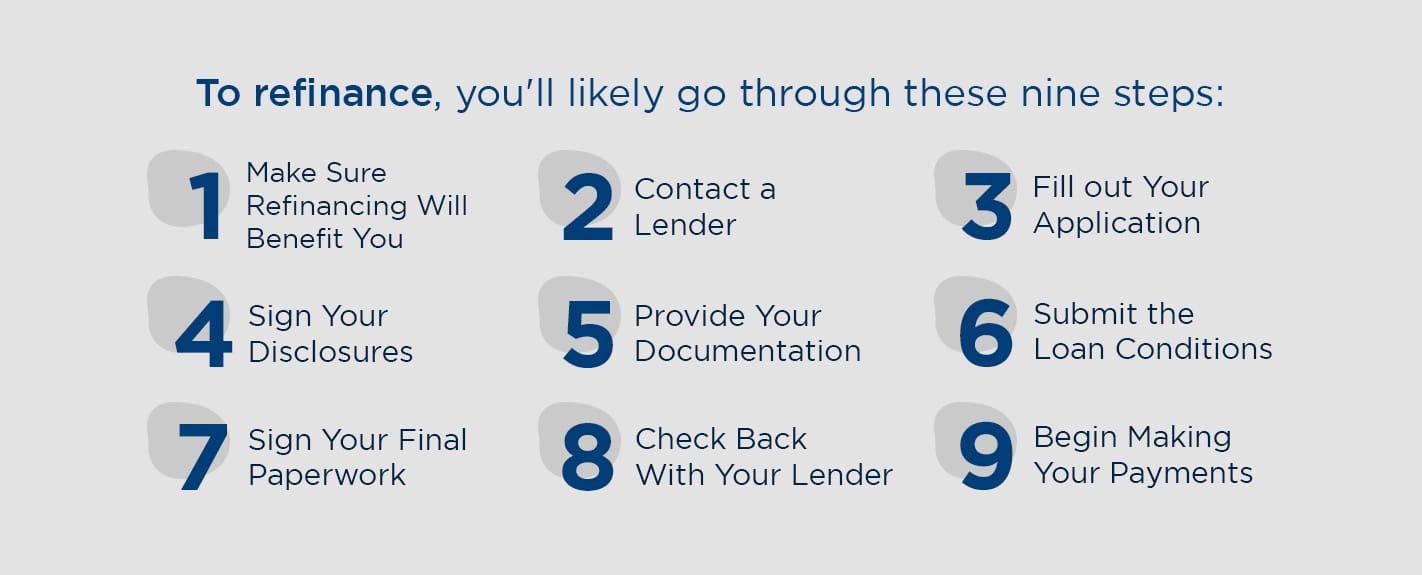

Once you’ve gone through the pros and cons and decided refinancing is the right choice, what’s the next step?

For reliable, knowledgeable assistance with refinancing your home, contact Assurance Financial. We can give you a free rate quote and then help you gain a custom, competitive rate that makes refinancing an ideal option for you.

At Assurance Financial, we make it easy to apply for a mortgage and estimate costs during the process. When you work with us on refinancing your home, you’ll gain quick, dependable service and be able to determine right away which options make sense for your needs and budget. We also have every type of loan available on the market — from conventional mortgages and Veteran’s Affairs (VA) loans to Federal Housing Administration (FHA) loans and loans tailored specifically to modular and jumbo homes.

Some mortgage companies promise quick, digital service. With Assurance Financial, you’ll get something better: personal service that takes your individual goals into account. We never outsource your loan details, either — we underwrite everything in-house. You’ll gain the peace of mind of knowing your information is secure and that we’re handling everything with a personal, knowledgeable touch.

Contact us today to start a conversation about refinancing your home, or start a loan application online.

Sources:

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://sf.freddiemac.com/articles/insights/why-americas-homebuyers-communities-rely-on-the-30-year-fixed-rate-mortgage

- https://assurancemortgage.com/calculators/

- https://www.investopedia.com/terms/l/loantovalue.asp

- https://www.forbes.com/advisor/refiroadmap/

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://www.sciencedirect.com/science/article/abs/pii/S0304405X16301507

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

Each time you make a payment on your mortgage, you gain equity in your home. The difference between your property’s value and the amount you still owe on your mortgage is your home equity. You may be able to use this equity to borrow money, but is it better to get a second mortgage or refinance? How do you determine which is the best option for you? We compiled this guide to a second mortgage vs. refinance to define each option and help you compare their advantages and disadvantages.

Topics Covered

- What Is a Second Mortgage?

- When to Get a Second Mortgage

- What Is Refinancing?

- When You Should Refinance

- What Is the Difference Between a Second Mortgage and Refinance?

What Is a Second Mortgage?

When you obtain a second mortgage, you’re borrowing against the equity in your home. This cash is given to you in a lump sum or in installments via a credit line, depending on your preference.

Types of Second Mortgages

There are two kinds of second mortgages. These are known as a home equity line of credit (HELOC) and a home equity loan:

- Home equity line of credit: Another kind of second mortgage is a HELOC, which gives you continual access to your equity at a variable rate. When you take out a home equity line of credit, you’ll begin with a draw period. During this period, you typically can spend up to your credit limit and pay only your accumulated interest. After the draw period, you’ll pay back your remaining balance via monthly installments.

- Home equity loan: With this type of loan, you borrow against your home equity and receive a lump sum payment. You’ll pay back this loan in monthly installments at a fixed interest rate.

How Does a Second Mortgage Work?

Along with your monthly payment for your primary mortgage, you’ll make repayments on your second mortgage. If you obtain the primary mortgage and the second mortgage from different companies, you’ll pay each lender separately. As you make payments on both loans, you will regain equity in your home.

Keep in mind that you won’t be able to access all of your home equity when you choose a second mortgage. For instance, if you have $90,000 worth of equity, you may only be given access to $80,000. The amount of equity you may need to leave in your property can vary based on several factors, including your current debt, your credit score and your lender.

What Are the Requirements of a Second Mortgage?

One condition that comes with a second mortgage is that your mortgage lender will put a lien on your house when you’re given a loan or cash. Liens are legal claims to properties that allow a lender to seize the property under certain conditions. When you secure a second mortgage, you’ll have two liens — one with the lender of your primary mortgage and one with the lender of your second mortgage.

In this scenario, if you default on your home and the property goes into foreclosure, your primary lender will get their money first and the rest will go to your secondary lender. As a result, your secondary lender bears more risk and will likely offer you a higher interest rate.

Ensure you can comfortably make both payments each month. If you run into financial hardship, such as a job loss, you could be more likely to lose your house.

What Are the Advantages of a Second Mortgage?

When you take on a second mortgage, you may enjoy several advantages, including:

- Keeping current loan terms: If your primary mortgage has a great interest rate, you can keep this rate when you secure a second mortgage, as a second mortgage won’t replace your existing loan. Rather than change your current loan terms, a second mortgage will add an extra payment to your monthly expenses.

- Paying fewer closing costs: With a second mortgage, a home equity loan lender tends to cover most or all of your closing costs. Since you may not have to pay closing costs at all, you can save thousands of dollars.

- Deciding how you get the money: You can select whether you want a HELOC or a home equity loan. If you want a lump sum, you may want to select a home equity loan. If you want to tackle a home renovation or another ongoing project and you don’t know exactly how much money you may need, you may want to choose a HELOC instead.

What Are the Disadvantages of a Second Mortgage?

You may also deal with some drawbacks if you choose to take on a second mortgage, such as:

- Stuck with original mortgage terms: When you get a second mortgage, this won’t impact your original mortgage. With a second mortgage, you can’t change your primary mortgage’s interest rate or term.

- Additional monthly payment: On top of paying your primary mortgage each month, you’ll also have a monthly payment for your second mortgage. Missing a payment may risk the loss of your home.

- Another lien on your home: Having another lien on your home can put you at greater risk of foreclosure if you are unable to consistently pay your lenders.

When to Get a Second Mortgage

While a second mortgage isn’t right for everyone, it may be the right option for you. The following are some situations in which you may want to obtain a second mortgage:

- You want to keep your mortgage terms: Getting a second mortgage may be the right option for you if you want a lump sum of cash without changing your mortgage terms. While you may pay more interest on your second mortgage, you will keep your interest rate on the primary mortgage. This may not be an option if you choose to refinance instead.

- You don’t know how much money you’ll need: If you have an ongoing home project and you’re unsure how much money you will need upfront, a HELOC may be useful. With a home equity loan, you need to know how much you’ll need when you apply for this loan. When you secure a HELOC, you can make your payments as you go and use your line of credit up to the limit.

- You want to pay credit card debt: Compared to credit cards, second mortgages tend to have lower interest rates. If you have multiple credit card balances, you may want to take out a second mortgage to consolidate your credit card debt.

- You aren’t able to get a cash-out refinance: If you are rejected for a refinance, which tends to have a lower interest rate, you may be able to secure a second mortgage instead.

If you believe you can handle two monthly payments, a second mortgage may be the right option for you.

APPLY TODAYWhat Is Refinancing?

Refinancing is the process of replacing your primary mortgage with a new loan. When you refinance or remortgage, you can select a new lender, get a new interest rate, change your loan term or obtain a new loan type. With a refinance, you can:

-

- Cover family expenses: Do you want to offer financial support to an older relative? Are you planning to start a family? Do you have a child heading to college soon? No matter what your goals are, having extra cash each month can help you adapt to major life changes.

- Make home improvements: If you want to invest in a new roof or an addition, refinancing can free up cash that you can use for renovations.

- Manage your cost of living: Your cost of living may have changed since you got your mortgage. You may have a new job or kids, and refinancing can make your mortgage more affordable so you can manage your new cost of living.

- Enjoy extra cash in your pocket: Whether you want to save, spend or invest, refinancing can help put extra cash in your pocket.

[download_section]

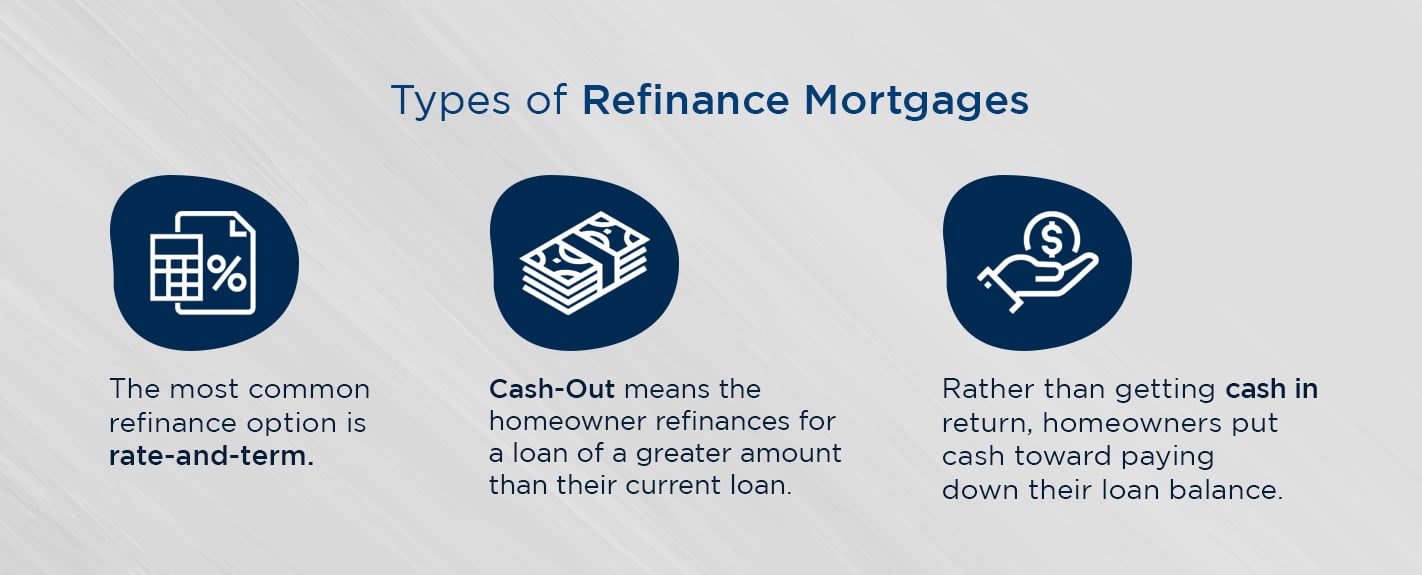

The Types of Refinances

There are two types of refinances known as a cash-out refinance and a rate and term refinance:

- Cash-out refinance: A cash-out refinance lets you access your equity in exchange for a higher principal. For instance, if you have a mortgage with a $120,000 principal balance and you want to do $30,000 worth of repairs on your home, you would accept a loan of $150,000. You’ll then receive the $30,000 in cash after you close.

- Rate and term refinance: This type of refinancing lets you adjust how your mortgage is set up without impacting your principal balance. If you want to lower your monthly payment, you can accept a longer term. If you want to save on interest and own your house faster, you can shorten your loan term. You may also be able to refinance to a lower rate if market rates are now lower than when you obtained your mortgage.

How Does Refinancing Work?

The application for a refinance is similar to your original mortgage application. First, you’ll submit your financial documentation to the lender, and then the lender will underwrite your loan. In most cases, before you can refinance, you may also need an appraisal. With a refinance, you may need to pay for some of the same items as during your original mortgage process, including:

- Application fees

- An appraisal

- A home title search

After the underwriting and appraisal are completed, the next steps are closing and signing your new loan. If you obtain a cash-out refinance, you’ll likely receive your money a few days after you close on your loan.

As with a second mortgage, keep in mind that you may not be able to access all of your home equity when you choose a refinance.

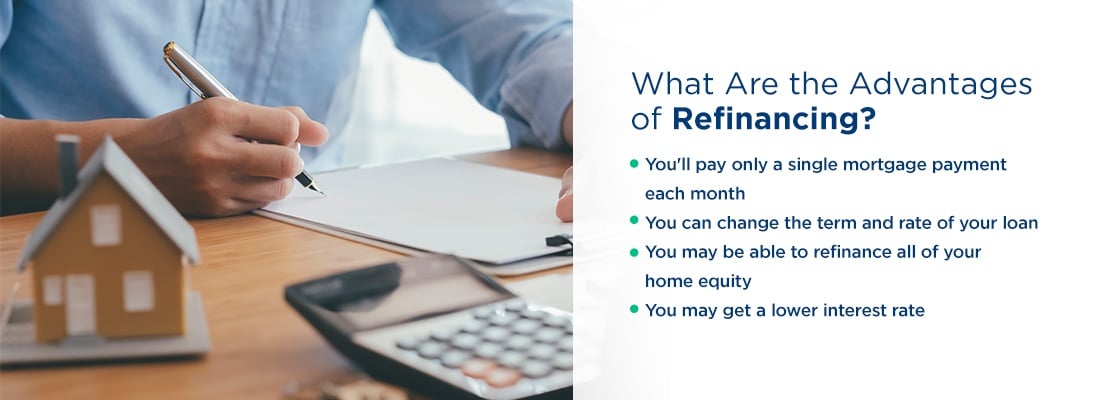

What Are the Advantages of Refinancing?

Should you refinance your mortgage? When you take on a refinance, you may enjoy several advantages:

- You’ll pay only a single mortgage payment each month: You’ll replace your current mortgage with your new loan when you refinance, so you’ll only make one mortgage payment each month.

- You can change the term and rate of your loan: With a refinance, you may be able to adjust your term and rate, which can be useful if you are struggling to make your monthly mortgage payments. You may be able to replace an ARM with a fixed-rate mortgage or vice versa. If you secure a second mortgage, you may not have this option.

- You may be able to refinance all of your home equity: If you are eligible for a VA loan, you may be able to borrow all of your home’s equity.

- You may get a lower interest rate: You’ll face less risk when you have only one lien on your home. This means you may have a lower interest rate with a cash-out refinance than you would with a second mortgage. Market rates may also be lower now than when you secured your original loan.

What Are the Disadvantages of Refinancing?

If you choose to take on a refinance, you may also deal with some drawbacks, such as:

- You may be offered a different interest rate: You may be required to accept a different interest rate depending on the current market rates. If rates are higher now than when you secured your mortgage and you are forced to take on a higher rate, you may lose money.

- You may have to pay higher closing costs: When you refinance, you are responsible for paying your closing costs. This means you may need a few thousand dollars in cash when you close on your loan. You may be able to roll the closing costs into your loan, but this will increase your monthly payment.

When You Should Refinance

How do you know if refinancing is the right choice for you? There are many reasons you may choose to refinance, including:

- You want to change your term or rate: If you want to change the term or rate of your loan, you may want to choose a refinance. With a second mortgage, you cannot change your primary loan’s terms.

- You want to pay your mortgage faster: The sooner you can free yourself of a monthly mortgage payment, the more money you’ll be able to allocate to your other financial goals like retirement, vacations and renovations. If your mortgage is your only debt, paying it off will leave you debt-free.

- You want to eliminate private mortgage insurance (PMI): If you build up enough equity in your home you may be able to eliminate PMI.

- You want to take cash out of your equity: If you unlock the equity in your home, you can increase your cash flow and tackle those long-anticipated home renovations.

- You want to consolidate debt: If you have plenty of home equity and your aim is to consolidate debt, a cash-out refinance may be the right choice for you. When you reduce the number of bills you pay each month, you can simplify your finances.

- You want a lower monthly payment: With a lower monthly payment, you can keep more money in your pocket to save for other financial goals, such as your next family vacation or your kid’s college tuition.

Typically, you’ll have to cover closing costs, but compared to second mortgages, interest rates tend to be lower for cash-out refinances. To determine whether refinancing is right for you, try our refinancing calculator.

What Is the Difference Between a Second Mortgage and Refinance?

A home is a place to live, an asset and a potential source of cash to cover upgrades, repairs or emergencies. If you want to leverage your home’s equity to cover major costs, you may want to refinance your mortgage or secure a second mortgage. When you are considering a second mortgage vs. a cash-out refinance, weigh the pros and cons of both to determine which may be the right option for you.

Similarities Between Second Mortgages and Refinancing

With both a second mortgage and a cash-out refinance, you can use the cash as you choose. However, you may only want to borrow against the equity in your home if you want to consolidate debt or make home improvements. In each scenario, your house is considered the collateral. This means if you fail to make your payments, it may lead to foreclosure on your home.

Differences Between Second Mortgages and Refinancing

Second mortgages tend to have higher interest rates than cash-out refinances. However, closing costs are typically higher for a cash-out refinance than for a HELOC or home equity loan.

While a second mortgage is an additional loan to your first mortgage, a cash-out refinance is a single, larger loan. You will have another payment to make when you get a second mortgage. And with a second mortgage, equity in your home may be only partially accessible. With a cash-out refinance, you may have the option to access all of your home’s equity.

Apply at Assurance Financial

Is a remortgage or second mortgage right for you? At Assurance Financial, we can help you finance your dream home at any stage of life. We can help you get the mortgage loan you need efficiently and offer end-to-end support to ensure the process goes smoothly. Our mortgage options for homebuyers include:

- Conventional mortgage loans: If you have a stable income, good credit and a down payment, a conventional mortgage may be the right option for you.

- Second mortgages: If you are already a homeowner and want to borrow against the equity in your home without affecting your primary mortgage, you may want to apply for a second mortgage.

- FHA mortgage loans: These loans are available to moderate-income and low-income households. If you qualify for an FHA loan, you may be able to put down a lower down payment.

- VA mortgage loans: These loans are available for veterans or active service members. These loans are secured via the U.S. Department of Veterans Affairs.

- Construction loans: If you are building a new home, you may want to obtain a construction loan.

- Jumbo mortgage loans: Sometimes your dream home exceeds the limits for conforming loans. This means you may need a jumbo mortgage to finance a more expensive property.

- USDA RD mortgage loans: If you want to purchase a home in a designated rural or suburban area, you may qualify for a USDA RD

- First-time homebuyer loans: If this is your first time purchasing a home or you haven’t owned a home in the last three years, you may be eligible for a first-time home loan.

- Modular home loans: If you are purchasing a manufactured or prefabricated home, you may be able to obtain a modular home loan.

- Non-qualified loans: Also known as non-QM loans, these are available to homebuyers with lower credit scores.

Our loan advisors at Assurance Financial want to help you with your mortgage today. Contact us to learn more about the best option for you.

Sources

- https://assurancemortgage.com/second-property-mortgages/

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

- https://assurancemortgage.com/conventional-loans/

- https://assurancemortgage.com/second-property-mortgages/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/construction-loans/

- https://assurancemortgage.com/jumbo-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/guide-to-cash-out-refinancing/

- https://assurancemortgage.com/how-soon-can-i-refinance-my-mortgage/

- https://assurancemortgage.com/what-are-closing-costs/

- https://assurancemortgage.com/what-kind-of-home-loan-should-i-get/

Purchasing a home is one of the largest investments you’ll make. As such, you probably want to do what you can to ensure your home is as up-to-date and comfortable as possible. However, it can be challenging to save up enough to complete home repairs and renovations. If you’ve found yourself in this situation or another situation where you need a large amount of cash, the answer may be a cash-out refinance.

With cash-out refinancing, you can accomplish your financial goals without relying on a second mortgage, personal loan or credit cards. A cash-out refinance can allow you to borrow from the equity you’ve built in your home and receive cash that can be used for just about anything like paying off high-interest debt, student loan debt or home renovations. At Assurance Financial, we have developed these cash-out refinance guidelines to help you determine if this is the right option for you.

Topics Covered

- What Is a Cash-Out Refinance?

- Uses for a Cash-Out Refinance

- How Much Cash You Can Get With a Refinance

- Benefits of Cash-Out Refinancing

- Things to Consider With a Cash-Out Refinance

- How a Cash-Out Refinance Works

- Cash-Out Refinance FAQ

What Is a Cash-Out Refinance?

While your mortgage matures, you continually gain equity in your property. Your home’s equity is the amount of your home’s value that you have already paid off. Gaining equity can happen in two ways:

- Your mortgage principal decreases as you pay your monthly payments. Each time you make a mortgage payment, you gain equity in your home.

- The value of your home increases.

To use cash-out refinancing, you must have equity built up. With a cash-out refinance, you can take advantage of your home’s equity and use the cash in exchange for a larger mortgage. When you decide to pursue cash-out refinancing, you’ll borrow more than what you owe on your current mortgage and receive the difference in cash.

Unlike taking out a second mortgage, when you decide on a cash-out refinance, you won’t be adding another payment to your monthly bills. With a cash-out refinance, you’ll pay your old mortgage, and it’ll be replaced with a new mortgage.

For instance, if you purchase a home for $300,000 and you pay off $100,000, you still owe $200,000 on your home. However, you want to make $30,000 worth of renovations. With cash-out refinancing, you’ll take a portion of your home’s equity and add what you take out of the equity to your new mortgage’s principal. As a result, your new mortgage will be worth $230,000 – the $200,000 you owe plus the $30,000 for the renovations. After closing on the loan, you will receive the $30,000 in cash from your lender.

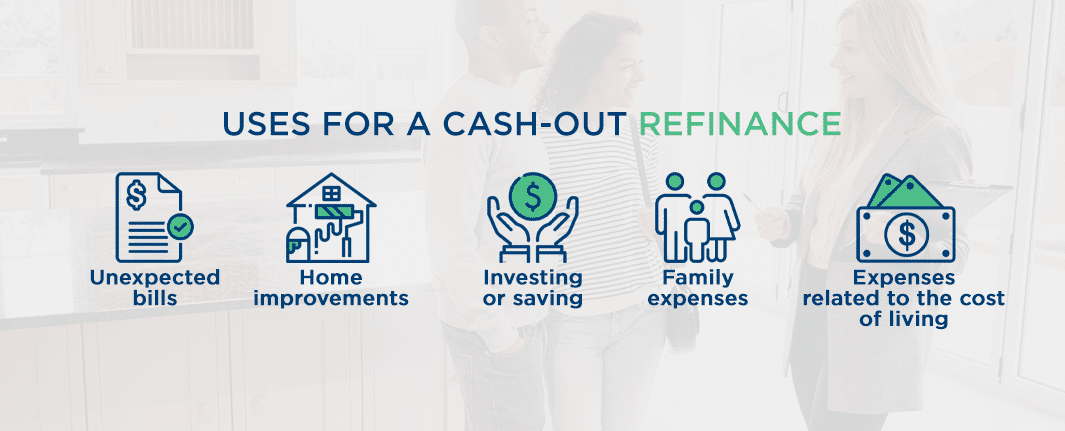

Uses for a Cash-Out Refinance

With cash-out refinancing, you can use the money from your home’s equity for anything you want. You can use it to meet various financial needs, such as:

- Unexpected bills: If you get an unexpected car bill or medical bill, you can use your cash-out refinance to cover these unexpected expenses.

- Home improvements: With cash-out refinancing, you can make home repairs and renovations like constructing an addition or building a new roof. By refinancing, you’ll free up cash each month to put toward these improvements.

- Investing or saving: By refinancing, you’ll have more cash in your pocket that can be saved, invested or spent as you choose. If you want to take advantage of the market to build your retirement savings, for example, you can use your home’s equity to invest in your 401(K).

- Family expenses: If you are planning to start a family, your kids are heading to college or you need to support an elderly family member or a relative with medical bills, then you may want to free up some extra cash each month.

- Expenses related to the cost of living: When you purchased your home, you may have had a different cost of living due to a new job, a growing family or more expenses. Refinancing may help make your current financial reality more affordable.

How Much Cash You Can Get With a Refinance

A cash-out refinance also typically gives you access to a lower interest rate monthly than a credit card. Keep in mind that you may not be able to pull out all of your home’s equity, though you can pull out a large percentage. One exception is a VA loan, which allows you to take out the full amount of your home equity.

The amount you can take out generally depends on the value of your home. Before you can find out how much you qualify for in a cash-out refinance, your home may need to be appraised. The percentage you can take out depends on your circumstances and varies from lender to lender. Some lenders may allow you to take out all of your home equity depending on your credit score, for example, but others may not.

With cash-out refinancing, you’ll be withdrawing some of your home equity in one lump sum. After you complete a cash-out refinance, you also may pay more in interest since you’re increasing the amount of your loan.

Benefits of Cash-Out Refinancing

Homeowners choose a cash-out refinance for many reasons. If you determine that cash-out refinancing is the right option for you, you can enjoy the following benefits:

1. Renovations and Home Improvements

From a broken HVAC system to a leaky roof, upgrades are often needed at some point during homeownership. With cash-out refinancing, you can use the equity in your home to fund the renovations and home improvements needed. Whatever improvements you decide on, you may want to choose safe projects that future buyers will value.

2. Increased Credit Score

By using the cash from this type of refinancing, you may be able to increase your credit score. This is because a cash-out refinance can reduce your credit utilization, as you will now have a greater amount of credit available to you. Additionally, you can use your cash to pay off debt, further improving your credit utilization and positively impacting your credit score.

3. Debt Consolidation

Cash-out refinancing can provide you with the money needed to pay off outstanding debts. You can also transfer debts to a lower-interest payment. When you choose cash-out refinancing to pay off your high-interest credit cards, this can save you thousands in interest. Tapping the equity in your home may be less expensive than other forms of financing, such as credit cards or personal loans.

4. Lower Interest Rates

Getting a lower interest rate is one of the most common reasons homeowners choose to refinance. If you originally purchased your property when mortgage rates were higher, a cash out-refinance may offer you a lower interest rate.

Additionally, if you are suddenly hit with an unexpected bill, you may have to pay a higher interest rate, especially if you pay the bill with a home equity line of credit or a credit card. Credit cards typically have higher interest rates than mortgages. If your home’s equity is enough to cover an unexpected bill, using a cash-out refinance could save you thousands of dollars in interest.

5. Lower Monthly Payments

With cash-out refinancing, you may be able to enjoy lower monthly payments. When you have lower monthly payments, you can put more money toward other financial needs, such as a parent’s medical bills, your child’s college tuition or a special vacation.

Additionally, if something like your child’s student loan rate is higher than the rate for your new mortgage, then tapping your home’s equity to help pay for your child’s college education may be a smart financial move.

6. Tax Deductions

Additionally, you may be able to deduct your mortgage interest from your taxes with a cash-out refinance if you use the cash to purchase, build or significantly improve your home. Eligible projects for tax deductions may include:

- Installation of a home security system.

- Construction of a fence around your home.

- Replacement of windows with storm windows.

- Construction of a new bathroom or bedroom.

- Addition of a central heating or air conditioning system.

- Addition of a hot tub or swimming pool in your backyard.

- Improvements to your roof that allow it to more effectively protect you and your belongings from the elements.

Home improvements should make your home more accessible or add value to it to qualify for tax deductions.

Things to Consider With a Cash-Out Refinance

Before you commit to cash-out refinancing, there are a few considerations to be made. The following are various aspects of a cash-out refinance for you to consider if you are interested in this option:

Leaving Equity in Your Home

Depending on your loan, you may need to leave a certain percentage of equity in your home. Conventional loans and FHA loans both require homeowners to leave some equity in their homes after cash-out refinancing. The only exception is for a VA loan for which you are not required to leave any equity following a cash-out refinance.

Cash Isn’t Immediately Accessible

As when you purchase a home, you may need to submit to appraisal and underwriting processes before the lender can approve your cash-out refinance. Even after closing, you have a few days to cancel the loan. You also won’t receive your cash immediately after closing. Instead, it will take a few days after closing before you receive your cash, so if you need money immediately, then cash-out refinancing may not be the best option for you.

At Assurance Financial, you can cancel your cash-out refinance for no cost within three days after closing. After these three days, your new loan will be funded, and your previous loan will be paid.

Closing Costs

Similarly to purchasing a home, you will pay closing costs if you refinance. Common closing costs include:

- Appraisal fees

- Lender origination fees

- Credit report fees

- Attorney fees

If you only need a small loan, review whether the closing costs may negate what you will be saving with a lower interest rate.

To avoid paying closing costs upfront, you may be able to roll them into your new mortgage. However, in this case, you may pay a higher interest rate. If you take out another 30-year mortgage or you refinance at a higher interest rate, you may pay more interest in total. Shop multiple lenders to make sure you are getting the most competitive terms and rates.

Changing Loan Terms

With cash-out refinancing, you will pay your original mortgage and then replace it with a new mortgage. As a result, since your new mortgage may take you a longer amount of time to pay off, your interest rate may change, and your monthly payment may be adjusted.

For example, if you have an adjustable-rate mortgage (ARM), you may want to replace it with a fixed-rate mortgage. Alternatively, you may want to switch to an ARM if you began with a fixed-rate mortgage. Whatever you choose, make sure you review your lender’s Closing Disclosure and analyze the new loan terms.

How a Cash-Out Refinance Works

The steps involved in the cash-out refinancing process are similar to the steps of purchasing a home. After determining that you meet the requirements for a cash-out refinance, you select a lender, submit your application, get approval and receive your check.

How to Qualify for a Cash-Out Refinance

Since lenders take on more risk with cash-out refinancing, it can be a bit harder to qualify. However, every lender sets their own requirements for determining which homeowners qualify for a cash-out refinance. The following are some of the common requirements for a cash-out refinance:

- Equity in your home: If you want to pursue a cash-out refinance, you need to have equity in your home. Unless you are eligible for a VA refinance or another exception, you may not be able to cash out all of your home equity, so you may want to carefully review your current equity before committing to a refinance and ensure you can convert enough to meet your goals.

- High or improved credit score: For a cash-out refinance, you typically need a score of at least 600. If you have a high credit score, you’re more likely to qualify for a cash-out refinance and more likely to get a lower interest rate.

- Low credit utilization: If you are concerned about your credit score, you may want to review your credit utilization. Generally, it is recommended to keep your credit utilization below 30%. This means you use less than 30% of your total credit limit. If you have a credit limit of $3,000, this means spending less than $900.

- Low debt-to-income ratio: Your debt-to-income (DTI) ratio refers to the total amount of your monthly payments and debts divided by your monthly income. If you pay a total of $2,000 per month in bills, for instance, and your total income per month is $5,000, your debt-to-income ratio is $2,000 divided by $5,000, which is 40%. Keeping your DTI ratio as low as possible can make you more likely to qualify for a cash-out refinance.

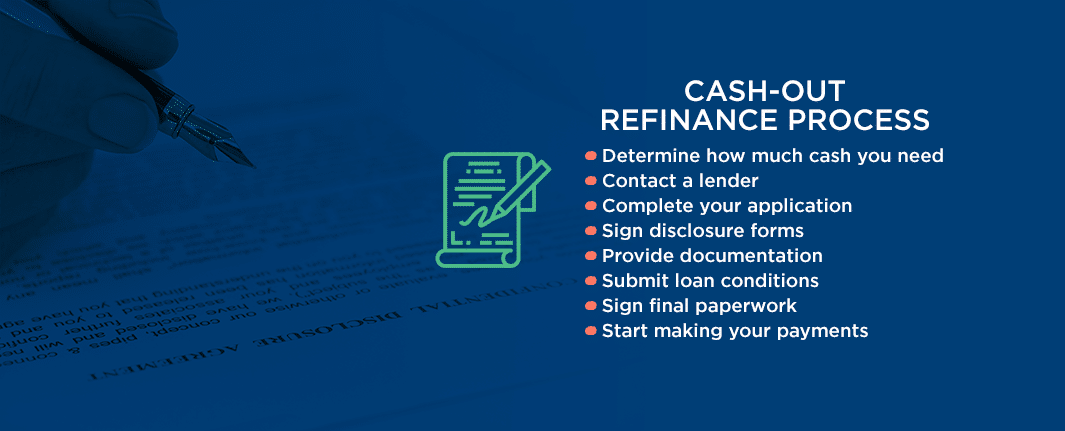

Cash-Out Refinance Process

The following are the steps in the cash-out refinancing process:

- Determine how much cash you need: After you determine that you meet the requirements to qualify for cash-out refinancing, you may want to do some math to determine how much you need for your goals. If you want to perform renovations or repairs, for example, you may want to get estimates from contractors. If you plan on consolidating your debt, you may want to review your bank and credit card statements to determine how much cash you’ll need to pay your debts.

- Contact a lender: At Assurance Financial, we strive to make your refinancing process as fast and painless as possible. You can get pre-qualified in as little as 15 minutes and receive a no-obligation quote. We offer every type of mortgage loan available, and we can provide you with a credit check and a rate quote for free.

- Complete your application: When you’re ready to pursue a cash-out refinance, you can start your application with us by speaking with one of our loan officers.

- Sign disclosure forms: At Assurance Financial, we will send your initial disclosures to sign. You can also use this opportunity to ensure you’re achieving your goal and to verify your loan terms.

- Provide documentation: After you sign your disclosures, you will provide your documentation, such as income and asset verification.

- Submit loan conditions: Next, we will send your paperwork to an in-house underwriter who will inform us about any additional items that are needed.

- Sign final paperwork: After you are approved for your cash-out refinance, you will sign your final paperwork with a notary.

- Start making your payments: At this point, the refinancing process is complete. After the funding process, you’ll start making payments in 30 to 60 days on your new mortgage.

Getting Approved for a Cash-Out Refinance

After applying for cash-out refinancing, you will receive the decision from your lender about whether you have been approved for the refinance. Your lender may request financial documents, such as W-2s, pay stubs or bank statements as proof of your debt-to-income ratio. After you are approved, your lender will guide you through the next steps.

Cash-Out Refinance FAQ

Do you have additional questions or concerns about cash-out refinancing? The following are a few of the most frequently asked questions we receive about cash-out refinancing:

1. Can I refinance and roll auto loans into my mortgage?

Yes, any debt can be paid off with cash out of your home. You cannot necessarily “roll” the debt, but you will get an account, like a checkbook, and you can make it payable to anything you want.

2. If I have a home equity loan, can I consolidate that into my mortgage if I refinance? What about with HELOC?

Yes, a lot of homeowners choose to do this, and some choose to open another equity line.

3. Can I consolidate student loans into a mortgage?

Yes, you can consolidate your student loans into your mortgage. This is also referred to as debt reshuffling, and it can be particularly attractive to those who have sufficient home equity.

4. Do I need to pay taxes on a cash-out refinance?

Since the cash you take out through a cash-out refinance is a loan, it is not considered income by the IRS. As a result, you don’t need to report it when filing your taxes, though you may get a beneficial tax deduction if you do report it. To better understand your options, speak with a tax professional.

Learn More About Cash-Out Refinancing From Assurance Financial

Are you ready to refinance? At Assurance Financial, we have been servicing loans to customers since 2001. When you choose to work with us, you can speak with one of our loan officers. Our loan officers are available across multiple states, and they have the expertise and knowledge needed to guide your cash-out refinancing and find the best deal available to you.

We will aim to find you a competitive rate or a deal that lets you draw on your equity. Contact us at Assurance Financial to learn more about cash-out refi requirements or apply for a new loan today.

Sources

- https://assurancemortgage.com/four-signs-you-should-refinance-your-mortgage/

- https://assurancemortgage.com/about-us/

- https://assurancemortgage.com/find-a-loan-officer/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/apply/

As the 2024 election approaches, you might wonder what kind of impact it will have on the mortgage interest rate you pay. Learn more about what factors determine the rate you get on a loan and what you can do to make sure you get the lowest rate possible when you apply for a mortgage.

When you take out a mortgage to buy a house, you become responsible for paying back the amount you borrowed, or the principal, as well as interest on the loan. The amount you pay in interest can vary depending on multiple factors. When buying a home, your personal credit history and the current economic situation can all impact interest rates on your home loan. The situation in the world around you, such as if it is an election year, might also have some effect on interest rates.

How Have Presidential Elections Affected Mortgage Rates in the Past?

Since politics and social conditions can play a role in influencing mortgage rates, it’s natural to wonder if an upcoming election will have an impact on mortgage rates. Freddie Mac began keeping track of average monthly mortgage interests for 30-year fixed-rate home loans in April of 1971. With this data, it’s possible to look at the numbers to see if there are discernable patterns or changes in interest rates during election years.

The year after Freddie Mac started tracking mortgage rate averages, 1972, was an election year. In 1972, the annual average interest rate was 7.38%, slightly lower than the average from April to December 1971, which was 7.55%. There was a slight dip in rates to 7.29% in April 1972, but otherwise, interest rates hovered around 7.4% for much of the year.

Four years later, in 1976, the average interest rate was 8.87% — not much different from the average rate of 9.05% in 1975 or 8.85% in 1977. Inflation was a big issue in the late 1970s, so by 1980, the average rate had climbed to 13.74% at 2.5 percentage points higher than it was in 1979. The next year, the rate had reached 16.63%, so it’s not clear whether the rise was due to the election or to other economic factors at play.

In 1984, the average rate was 13.88%. From then on, rates started to fall as the economy improved. By the next election year, 1988, the average interest rate on a 30-year mortgage was 10.34%. During the next four years, it continued to fall. In 1992, the average rate was 8.39%. Although rates were falling year after year, over the course of a 12-month period, there weren’t significant changes in interest rates.

The average interest rate in 1996 was 7.81%. That year, rates rose slightly from an average of 7.03% in January to 8.32% in June before dropping to 7.6% in December. In 2000, an election year with a particularly dramatic election, rates remained relatively constant, with an annual average of 8.05%. Rates showed a similar pattern in 2004, remaining relatively stable. Even in 2008, in the midst of the Great Recession, interest rates hovered between 5.29% and 6.43%, which isn’t a lot of movement.

Rates have been near record lows in the most recent election years. In 2012, the average was 3.66%. In 2016, it was 3.65%. Interest rates dropped to record lows in 2020, but those changes were due more to the pandemic and economic concerns than the election.

What Happens to Mortgage Rates After an Election?

Does an election have an effect on mortgage rates after the fact? Just as there doesn’t seem to be much impact on rates due to a pending presidential election, the results of the vote also don’t seem to bring about much of a change. What might be more important for interest rates are other social and political factors that accompany an election year. If anything, these fluctuations may be more likely to affect people’s decision to buy a home or not more than who might be elected the next president.

If you are considering buying a home and are in the process of shopping for a mortgage, it may be favorable to take the loan with the best rate you are offered now, rather than wait to see what may or may not change in November.

What Are Mortgage Interest Rates?

Lenders charge interest both to make money on a loan and as a form of protection. A lender is taking a risk when it issues a mortgage. It’s giving you, the borrower, a lump sum of cash and then waiting 15, 20 or 30 years for you to pay it back. Even if you have a steady job, high income and excellent credit history when you take out the loan, there’s a risk that your situation will change and you might become unable to repay your loan. Charging interest ensures that the lender will make a least some money on the mortgage, even if a borrower ends up defaulting on the loan.

Types of Mortgage Interest Rates

When you apply for a mortgage, you can generally choose between two types of interest rates: fixed and adjustable. A fixed interest rate remains the same for the entire term of the loan. If you apply for a 30-year mortgage with a 4% interest rate, you will pay 4% in year one and in year 30. Your monthly mortgage payment will stay the same for the entire term of the loan with a fixed rate.

An adjustable-rate mortgage (ARM) has an interest rate that changes over time based on market rates. Often, the rate on an ARM is lower than the rate on a fixed-rate mortgage to make it more enticing for the borrower. The initial rate might last for a year or several years. When the initial rate expires, it resets to reflect the current market rate. Depending on circumstances, your monthly payment could rise considerably from one year to the next with an ARM, or it could drop.

The initial rate on an ARM often lasts for a period of three, five or seven years. Once that period ends, the rate might change every year or on another pre-determined schedule. Some ARMs have adjustment caps, which prevent the rate from increasing too much. For example, you might take out a loan with an ARM that has a 5/3/5 cap. The first five means that your interest rate can’t increase by more than five percentage points over the initial rate. Each time the interest rate adjusts, it can’t increase more than three points over the current rate. Over the course of the loan, the rate can’t ever be more than five points above the initial rate.

An ARM can seem appealing, as the initial rate on the loan is often lower than the rate on a mortgage with a fixed interest rate. As a borrower, it helps to think about how long you plan on living in your new home and whether you can afford an increase in your monthly mortgage payment if the interest rate goes up.

What Has an Impact on Mortgage Rates?

Whether an interest rate is adjustable or fixed is just one factor that determines what a lender might charge you when you apply for a mortgage. Multiple factors influence mortgage rates. Some of those factors are within the control of the borrower, while others are not. Factors that you can’t control include the economy and the Federal Reserve’s monetary policy.

Knowing what you can control when it comes to the rate you’re offered and understanding how the larger world affects mortgage rates can help you get the timing right when you apply for a home loan. The following are some of the factors that might affect your rate:

1. Credit History

When a lender gives you a mortgage, they are taking on a risk, which is part of the reason why you need to pay interest on the loan. A lender uses your credit history and score to assess how risky it would be to lend you money. The lower your credit score or the weaker your credit history, the more interest a lender is likely to charge. If you have a history of stellar credit and a score in the excellent range, you are more likely to get a better interest rate.

2. Down Payment Size

The size of your down payment also affects the perceived risk level of your mortgage. The more you pay upfront in comparison to the amount you borrow, the less risk there is to the lender. Putting 20% down is likely to get you a lower rate than if you were to put down 5% or 10%.

3. Loan Type and Length

The type of mortgage you get also affects your interest rate. VA loans and FHA loans often charge different interest rates compared to conventional loans. In some cases, the rates on a VA or FHA loan might be lower than the rate on a conventional loan.

How long you have to repay the mortgage influences the interest rate, too. Generally, shorter loan terms are lower risk for lenders, so the interest rate is lower.

4. Local Housing Markets

The state of the housing market in the area where you hope to buy can also affect the interest rate on your mortgage. If there is a lot of competition for houses in your area, interest rates can go up due to overall supply and demand. Lenders only have so much money to lend, so when there is a high demand for mortgages, they may increase the rates they charge.

5. Inflation

Mortgage rates can increase as inflation increases, allowing lenders to continue to earn a profit. If you take out a loan with a monthly payment of $1,000, the $1,000 per month that you pay in five years won’t be worth as much as the $1,000 per month you pay now, as a result of inflation.

6. 10-Year Treasury Bonds

Broadly speaking, mortgage rates tend to track the rates on 10-year Treasury bonds. When rates on Treasury bonds drop, mortgage rates tend to drop. When Treasury bond rates go up, mortgage interest rates typically go up. Treasury bonds and mortgage rates are connected because investors who are considering purchasing mortgage-backed securities typically look to the rate on long-term Treasury bonds to get an idea of what they can charge.

Mortgage-backed securities can be risky for investors, so they often want to get the highest rate possible when purchasing them. The actions of investors and the fluctuations in the bond market can push mortgage rates up or down.

7. The Federal Reserve

Mortgage interest rates often seem to move in relation to the actions of the Federal Reserve, or Fed. When the Fed announces it is lowering rates, mortgage rates tend to decrease, too. The Fed’s decisions can have an effect on the yield of Treasury bonds, but not always. The Fed also issues monetary policies, such as deciding to buy or sell debt securities, which can affect interest rates on mortgages.

8. State of the Economy

When unemployment is low and gross domestic product (GDP) is high, the demand for mortgages often increases. People feel more secure, so they are more likely to buy a home. In times of economic growth, interest rates often go up. When unemployment is high and production is down, mortgage rates often drop, since people are usually more hesitant to purchase a home.

What Is the Federal Reserve?

When people talk about interest rates, one institution they often mention is the Federal Reserve. Although the Fed gets mentioned a lot in discussions of the economy and the financial state of the U.S., many people don’t know what it is or what it does. The Fed is the U.S. central banking system. Its main mission is to keep the financial system in the U.S. stable and secure. To do that, it performs four functions:

- Establishing monetary policy: The Fed aims to keep employment high and inflation low. It sets a federal funds target rate to keep inflation down. The target rate is the amount of money each bank in the U.S. needs to have deposited with one of the Fed’s 12 banks. During a recession, the Fed might lower the target rate. In the midst of a good economy, it might raise the rate to keep inflation at bay.

- Providing payments: The Fed acts as the bank of the government and is responsible for the checking account of the Treasury Department. It also controls the amount of money in circulation. When needed, it can increase the amount of currency and coins out in the world.

- Regulating banks: Banks that are part of the Federal Reserve system need to follow the rules and regulations set by the Fed to keep financial markets stable.

- Maintaining stability: In extraordinary circumstances, the Fed might take additional actions to ensure the stability of U.S. banks. For example, after September 11, 2001, the Fed gave several banks loans to keep them from going under.

The Federal Reserve dates back to 1913 when President Woodrow Wilson signed the Federal Reserve Act into law. In the more than 100 years since its creation, the roles and responsibilities of the Fed have evolved based on the needs of the country.

Who Is on the Federal Reserve?

The Fed consists of three components: the Board of Governors, the 12 Federal Reserve Banks and the Federal Open Market Committee (FOMC).

Seven people serve on the Federal Reserve Board of Governors. The current U.S. president names each member to the board for a term of 14 years. The board members’ terms are staggered so that each president has the chance to name two new members during a four-year term. Staggering the terms helps to keep the board politically neutral. Since one term ends every two years, a president won’t have the chance to stack the board. A president who serves one four-year term can name two members, while a two-term president can name four board members.

A president might use several criteria to decide who to name to the Board of Governors. Each board member needs to come from a different Federal Reserve district. They should also somehow reflect the commercial, industrial, agricultural or financial interests of the U.S.

The FOMC consists of the seven board members and five presidents of Federal Reserve banks. The president of the Federal Reserve Bank of New York is always on the FOMC. The remaining four bank presidents can be from any of the other 11 banks. Each bank president serves a one-year term on a rotating basis. The FOMC meets eight times a year, during which it discusses the state of the economy and financial situation in the U.S. and what it can do to promote stability and sustainable growth.

Is the Federal Reserve Connected to the President?

Aside from having the current president of the U.S. name members to the Federal Reserve Board of Governors every two years, the Fed has limited connection to the president. The U.S. president cannot tell the Board of Governors what to do and shouldn’t try to influence the policy and other decisions the board makes.

Does the Fed Set Mortgage Rates?

A common misconception people have is that the Fed sets mortgage rates or defines interest rates. The Fed sets the target fund rate, which is the interest banks charge each other when they lend to each other. Many banks use the target fund rate as a benchmark when deciding their own interest rates to charge. Mortgage rates can track the rates charged by banks on other loan products, such as credit cards.

Apply for a Mortgage With Assurance Financial Today

Ready to get the ball rolling and see what interest rate you qualify for on a mortgage? Get started on your mortgage application with Abby, our digital assistant, today. You can apply online from the comfort of your home at any time of day or night. The process takes just 15 minutes. Apply today to take the next step in your homebuying journey.

Sources:

- https://www.bankrate.com/mortgages/current-interest-rates/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/fha-loans/

- https://www.policygenius.com/mortgages/how-does-mortgage-interest-work/

- https://www.hsh.com/first-time-homebuyer/what-moves-mortgage-rates-the-basics.html

- https://www.thebalance.com/treasury-note-and-mortgage-rate-relationship-3305734

- https://www.stlouisfed.org/in-plain-english/federal-reserve-board-of-governors

- https://www.investopedia.com/mortgage/mortgage-rates/fixed-versus-adjustable-rate/

- https://www.thebalance.com/what-is-a-mortgage-interest-rate-4584864

- http://www.freddiemac.com/blog/homeownership/20160201_hiw_arm.page

- https://www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/

- https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

- https://www.federalreserve.gov/monetarypolicy/fomc.htm

- https://www.federalreserve.gov/faqs/how-is-a-federal-reserve-bank-president-selected.htm

- https://www.federalreserve.gov/releases/h15/

- https://www.federalreserve.gov/faqs/credit_12846.htm

- https://www.federalreserve.gov/faqs/what-economic-goals-does-federal-reserve-seek-to-achieve-through-monetary-policy.htm

- http://www.freddiemac.com/pmms/pmms30.html

- https://www.creditkarma.com/advice/i/what-is-the-federal-reserve

- https://www.bankrate.com/mortgages/federal-reserve-and-mortgage-rates/

- https://mygatormortgage.com/presidential-election-affect-on-mortgage-rates/

- https://themortgagereports.com/59520/forecast-mortgage-rates-after-2020-election

- https://www.newamericanfunding.com/blog/how-do-elections-affect-mortgage-rates/

- https://www.nerdwallet.com/blog/mortgages/fed-mortgage-rates/

- https://assurancemortgage.com/meet-abby/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/conventional-loans/

- https://www.federalreserve.gov/aboutthefed/structure-federal-reserve-system.htm

You purchased your home a few years ago and have been enjoying living in it for a while now. After making payments on your home’s FHA loan for some time, you’re starting to wonder, “Can I refinance from an FHA to a conventional loan and get a better interest rate, lower monthly payments or a combination of the two?” In 2020, repeat refinances accounted for 10.1% of all refinances. In some of those cases, people who had initially taken out an FHA mortgage decided to switch to a conventional loan.

While FHA loans have their benefits, they can end up costing a homeowner more over the long run. Learn more about the difference between an FHA loan and a conventional mortgage, and see if it’s time for you to refinance an FHA loan to a conventional one.

What Is the Difference Between an FHA Loan and a Conventional Loan?

For many buyers, getting an FHA loan makes sense. These loans are designed to help people buy homes by removing some of the typical barriers to homeownership, such as the need to have a significant down payment and an excellent credit score.

There’s a common assumption that FHA loans are only for first-time buyers and that conventional loans are for people who have experience purchasing a property. The reality is that both first-time and repeat buyers can obtain either an FHA loan or a conventional loan. Learn more about the differences between the two types of mortgages.

What Is an FHA loan?

An FHA loan is a mortgage that is guaranteed or insured by the Federal Housing Administration (FHA). The program began in the mid-1930s, and since then, the FHA has insured more than 40 million mortgages.

One common misconception about FHA mortgages is that they come from the government itself. While the FHA acts as the guarantor on the loans, private banks and lenders issue the mortgages themselves. As long as the government approves the lender you’re considering, you can get an FHA loan.

Buyers who apply for an FHA loan may have the option of putting down as little as 3.5% when they buy their home. They may also be allowed to have a lower credit score compared to people applying for conventional loans. FHA loans offer the option of choosing a fixed-rate mortgage or an adjustable-rate loan. Borrowers may also choose from a variety of loan terms, such as 15 or 30 years.

How Do FHA Loans Work?

While the federal government doesn’t make FHA loans, it does insure them. That means if a borrower has trouble making mortgage payments and falls behind, the lender can file a claim with the FHA. After the lender forecloses on the buyer’s home, the FHA pays the lender the loan’s balance. Since lenders know they are likely to get paid no matter what, they are more willing to lend money to people who would otherwise be considered too risky for a home loan.

The FHA’s guarantee does come at a cost, though, and it’s usually the borrower who pays the price. FHA loans typically have two forms of mortgage insurance. The first is an upfront mortgage insurance premium payment typically around 1.75% of the loan’s principal amount. You pay this amount at closing.

The second form of mortgage insurance is a monthly insurance payment, which can be anywhere from 0.45% to 1.25% of the initial principal. The monthly insurance payment usually remains for the life of the loan and can add several hundred dollars to a person’s monthly mortgage payment.

What Is a Conventional Loan?

A conventional loan is a mortgage that is not guaranteed by a federal agency such as the FHA. Since conventional loans don’t offer lenders the guarantee that the loan will get paid, they often have stricter requirements compared to FHA loans. Despite that fact, the majority of home buyers use conventional loans to purchase a home. In 2020, 69% of new houses sold using a conventional loan as the source of financing.

Usually, if a person is interested in applying for a conventional loan, they need to make a down payment of at least 3% and have a credit score of at least 620. The more a person can put down, the better the terms of the mortgage. The higher a person’s credit is, the lower the interest rate. While you can get a conventional loan with a lower credit score, many lenders offer the best rates to people with scores in the 700s.

You might have heard the traditional advice to put down at least 20% of the value of the home when you apply for a conventional mortgage. Generally, making a down payment of at least 20% eliminates the need to pay private mortgage insurance each month.

If a buyer puts down less than 20%, they are usually responsible for paying a private mortgage insurance premium every month. The amount of the premium can vary based on the value of the home compared to the amount of the loan and a person’s credit score. Once the loan-to-value ratio on a mortgage has reached 80%, you can ask the lender to remove the mortgage insurance. The lender should remove mortgage insurance automatically once your loan-to-value ratio reaches 78%.

Understand What Separates an FHA and a Conventional Loan

There are some notable differences between an FHA loan and a conventional mortgage. The list below should help you compare the differences at a glance.

1. Credit Score

Your credit score will influence which type of loan you are eligible to receive. Your credit score should be:

- FHA: As low as 500 with a 10% down payment, and 580 for a 3.5% down payment.

- Conventional: Your credit score should be at least 620 to apply for a conventional mortgage. The higher your score, the lower your interest rates, and the better your loan terms.

2. Down Payment Requirements

You will only be able to secure a loan if you meet the down payment requirement, which is:

- FHA: At least 3.5%, usually between 3.5% and 5%. People with credit scores between 500 and 579 need to put 10% down.

- Conventional: The required down payment for a conventional loan is at least 3%, but it varies based on the lender. Putting down 20% eliminates the need to pay private mortgage insurance.

3. Mortgage Insurance Payments

For mortgage insurance, you can expect to pay:

- FHA: There are two insurance types required — an upfront mortgage insurance premium of 1.75%, then a monthly mortgage insurance premium (MIP). The MIP is typically for the life of the loan, even once the loan-to-value ratio is 80%.

- Conventional: Private mortgage insurance premiums are usually required when the down payment is less than 20%. Once the value of the loan is 80% of the value of the house, you can ask the lender to remove the premium.

4. Loan Limits

Loan limits will depend upon what kind of loan you have. Limits include:

- FHA: Loan limits vary widely based on the area of the country, but they were usually around $331,760 in 2020.

- Conventional: Loan limits for a conforming conventional mortgage vary based on location. The ceiling limit for a single-family home was increased to $548,250 in 2021 in some areas. Limits are higher in areas with a higher cost of living. Borrowers also have the option of applying for a jumbo or non-conforming loan if they want to buy a particularly expensive house.

5. Closing Costs and Down Payment Assistance

When you need payment assistance, you can expect:

- FHA: The seller can contribute up to 6% of the closing costs with an FHA loan. The borrower can also get down payment assistance of up to 100% with an FHA loan, which means a family member or other source can give them the money for the down payment.

- Conventional: The seller can usually contribute up to 3% of the closing costs on a conventional loan.

Pros and Cons of Refinancing an FHA Loan to a Conventional Loan