Category: Videos

Getting ready to purchase a house is an exciting and nerve-wracking journey. With so many steps on the road to becoming a homeowner, we know it’s easy to feel overwhelmed. There is one step you can take that will get you closer to your goal of owning a home. As a bonus, it helps you sort out your budget and boost your chances of sellers accepting your offer. The answer to some of your house hunting worries is pre-qualification for a mortgage.

Mortgage pre-qualification may seem like as big of a process as purchasing a home, but it is actually one straightforward step along the way. At Assurance Financial, we understand the pre-qualification process and want to help you achieve your dreams of homeownership. This article explains why you should get pre-qualified before looking for a home.

- What Is a Mortgage Pre-Qualification?

- Why You Should Get Pre-Qualified for a Mortgage

- When to Get Pre-Qualified for a Mortgage

- How to Get Pre-Qualified for a Mortgage

- Mortgage Pre-Qualification Process

- Get Pre-Qualified With Assurance Financial

What Is a Mortgage Pre-Qualification?

Mortgage pre-qualification means a lender is willing to provide you a certain amount of money to purchase a home. Pre-qualification doesn’t necessarily guarantee a mortgage. It does, however, provide a maximum loan amount that you could receive.

You may have heard the terms “pre-qualification” and “pre-approval” in the lending world. What you may not know is that there is a difference between the two:

- Pre-qualification: Consider pre-qualification to be an estimate. This number is not a guarantee because lenders base it on a simple financial overview. With an estimate of your credit score, monthly debts and a few other details, a lender provides a general number for what you pre-qualify. Pre-qualification does not have the same authority as pre-approval, but it will give you an idea of what you can get pre-approved.

- Pre-approval: Lenders base this on an in-depth analysis of your finances. Pre-approval is a hard number for a loan amount. You receive pre-approval after lenders conduct a credit check and review your completed mortgage application. While pre-approval still isn’t a guarantee, it is a more carefully estimated number than pre-qualification.

Why You Should Get Pre-Qualified for a Mortgage

You may think that getting pre-qualification adds another item on your house hunting to-do list. However, getting mortgage pre-qualified makes buying a house less stressful in the long run. By getting pre-qualified, you can:

- Know your budget: With pre-qualification, you can narrow down your pool of potential homes. Build your budget based on what a lender is willing to provide. You’ll have an upper limit that help you avoid looking at top-dollar homes that aren’t within your budget.

- Surpass other potential buyers: Having your pre-qualification in hand gives you an advantage over other possible buyers. It shows that you are ready and willing to purchase a home. Your competition may not have their pre-qualifications ready, so if you do, you’ll be more attractive to sellers than other buyers who aren’t as prepared.

- Make your offer more attractive: When you find your dream home and put in an offer, you want agents and sellers to pick you without hesitation. Mortgage pre-qualification helps put a seller’s mind at ease. Make them more likely to accept your offer with a simple step.

- Save time: Pre-qualification allows you to finalize your mortgage more swiftly after you’ve found the home of your dreams. There’s no need to fill out paperwork and wait for lenders to process it when you’re eager to get settled in your new house. Take care of everything beforehand so you have one less task to worry about as you buy a home.

- Solve any problems: As you obtain your pre-qualification, you may come across errors in your credit report or other documentation. Discovering these issues before purchasing a home will save you time and hassle.

- Plan other expenses: Having a price range to play in helps you map out additional costs that come with a home. Be sure to incorporate these into your budget so that you do not risk going over what the lender can provide. Calculate your current expenses in the mix, as well, for accurate numbers.

The above are all essential reasons to get pre-qualified for a mortgage. You wouldn’t make a substantial purchase without calculating your budget first, so why would you purchase a house without seeing how much a lender pre-qualifies for you? Ease some of your stress and get an idea of how much you can afford to put into a new house with mortgage pre-qualification.

When to Get Pre-Qualified for a Mortgage

If you’re wondering, “When should I get pre-qualified for a mortgage?” the answer is simple. As we’ve explained above, the best time to get pre-qualified is before house hunting. You shouldn’t jump right in and apply for pre-qualification without a timeline, though. Other factors contribute to when you should try to obtain mortgage pre-qualification.

- After you’ve checked your credit score: Check your score months in advance to have an idea of how a lender will respond to your application. While checking your score may cause an initial change, over time, it will return to its previous number or improve. Use this time to get your finances in order before you seek pre-qualification.

- Not long before beginning your house hunt: Especially if you think the process of searching for a home could take a couple of months, you’ll want to make sure your pre-qualification doesn’t expire before your search is over. Knowing your timing is a crucial part of when to get mortgage pre-qualification.

While we’ve said before that obtaining a pre-qualified mortgage makes your offer more attractive to sellers, it’s helpful to know why. Get pre-qualified before looking into a home because:

- Agents may not work with you unless you’re pre-qualified.

- It shows there will be little to no problems finalizing a mortgage.

- It tells sellers a bank has verified your information.

- Agents and sellers see that you’re serious about buying a home.

- Sellers may accept offers under asking price when submitted with pre-qualification.

- It strengthens your offer if you’re self-employed.

Mortgage pre-qualification says a lot to agents and sellers. Acquiring it can be a great tool to keep in your back pocket when negotiating pricing, competing with other potential buyers, or submitting an offer on your dream home. Such an impressive part of your application may seem like it would be difficult to acquire, but many processes for pre-qualification are more straightforward than you might expect.

[download_section]

How to Get Pre-Qualified for a Mortgage

Knowing the importance of mortgage pre-qualification may leave you wondering how to get pre-qualified in the first place. Your pre-qualification status and amount depend on different factors that lenders see from various documents you submit. Lenders verify certain aspects of your finances and your history, such as:

- Income and employment verification: To pay off the loan a lender pre-qualifies you for, you’ll need to have a source of income. Lenders want an idea of your annual income so they may properly evaluate how much to pre-qualify for you. Lenders may contact your place of employment to confirm your status there, as well.

- Assets: In addition to the money you have coming in, lenders also like to see what money, property or other assets you already have. Like income, assets contribute to how much you could potentially receive from a lender since they represent what payments you could handle.

- Credit: Specifically, lenders want to see a good credit score. Lenders evaluate credit scores because they factor your payment history, current debts, types of credit, length of history and any new credit accounts. These details all represent your financial ability and trustworthiness, among other qualities, that will assure a lender they can confidently provide you a loan.

Lenders look into your credit score and other aspects of your financial background when you apply. Rather than provide the lender with these numbers, you simply need to gather documentation. To confirm your employment, income, assets and debt, a lender will ask you to submit the following documents and information when you seek pre-qualification:

- Social Security number

- Form of identification, either your passport or driver’s license

- Federal and state tax returns, typically the two most recent

- W-2 forms and your two most recent pay stubs

- Two years of records and 1099 forms if you are self-employed, a freelancer or independent contractor

- Real estate income and rental property information

- 60 days of bank statements for the accounts you’re using to qualify

- Two months of statements from retirement and brokerage accounts

- Monthly and real estate debt statements

You may be asked to include relevant names, addresses and account numbers with the information you provide. Lenders may also ask for records of rent payment, divorce decrees or related court orders and documents from bankruptcy or foreclosure.

From the information above, a lender will determine if they can pre-qualify you and how much they can offer you. You’re more likely to get an offer if your credit score is a minimum of 600, so be sure to check and correct your score if necessary.

Mortgage Pre-Qualification Process

If you’ve got the documentation above ready to go, you’re almost ready to begin the mortgage pre-qualification process. Be sure to consider what to do before getting pre-qualified for a mortgage first.

You may want to check your credit score and credit reports before applying to know what loans you can apply for and solve any issues with your score. You should also consider your debt-to-income ratio. Calculate this using what you make per month and how much you owe back in debt or loans. Think about how your mortgage will factor into that number for an idea of what a lender could offer you.

Once you’ve evaluated your income, assets and credit, it’s time for the lender to do so. Every lender has an application for mortgage pre-qualification, and some offer convenient online forms to speed up this step. After you’ve applied, the length of the mortgage pre-qualification process depends on the lender. Here are the basics of that time frame:

- Sometimes, it may take as little as 24 hours or up to three days for a lender to pre-qualify you.

- If you are self-employed, it may take the full three days for a lender to calculate your pre-qualified rate.

- The lender’s workload and the availability of your information also influence how long mortgage pre-qualification takes.

- Gather the documents and information listed above and have them ready for the lender so the process is swift.

Apply Now

Your mortgage pre-qualification does not last forever. Because your credit score and other factors fluctuate, the average mortgage pre-qualification lasts between 60 to 90 days, though that number may change depending on the lender. Give yourself enough time to get pre-qualified before looking for a home, but be sure to keep the expiration date in mind as you search.

In addition to an expiration, paperwork from a lender can include other information, such as:

- The loan amount

- The type of loan

- The terms of the loan

- Estimated payments and interest

- Approximate closing costs

The details of your pre-qualification help you sort out your finances and plan how you will purchase your dream home. Remember that these numbers are not a guarantee of a mortgage.

Once you are pre-qualified, you must still go through the process of underwriting and finalizing a mortgage. Receiving the funds that a lender calculated in a mortgage pre-qualification depends on a few factors such as:

- A home inspection

- An acceptable home appraisal

- Adequate homeowner insurance

It may feel like a lot rides on obtaining mortgage pre-qualification, but the process is worth it since it gets you one step closer to your dream home. With all the benefits of organizing your budget and looking more appealing to sellers, getting pre-qualified is one step of home buying you should be sure to take.

Get Pre-Qualified With Assurance Financial

If you’re getting ready to purchase a home in the future, be sure to get pre-qualified for a mortgage. With us at Assurance Financial, you can get pre-qualified in 15 minutes for an idea of your pre-qualification rate. We have the latest in application technology to make the process smooth, fast and straightforward. If you’d prefer to meet with someone, you can also find a loan officer today to begin your journey of mortgage pre-qualification and home buying.

Do the benefits of mortgage pre-qualification have you ready to get the process started? Fill out our 15-minute online application for instant verification of your income and assets. We’ll provide a quote to start you on your home-buying journey. Contact us with any other questions you may have about the mortgage pre-qualification process. We’ll put your needs first and work with you to help your homeowner dreams come true!

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing

Additional Resources You May Also Like

For many in the U.S., home buying is an essential component of the American dream. A home is also one of the most significant investments you’ll make during your lifetime, and isn’t a decision to make hastily. If you’re feeling overwhelmed at the idea of buying a home, you’re not alone. At Assurance Financial, we know how stressful the process of home buying can initially seem, and we want to make this exciting step in your life as easy and enjoyable as possible.

Before buying a home, there are a few external factors you’ll want to consider, questions you’ll want to ask yourself to determine whether you’re ready to purchase a home and pros and cons you’ll want to weigh when you find a house you’re interested in. Once you’ve run through your checklist of what to ask when buying a house and what to know before making an offer on a house, we can help you acquire your dream mortgage.

- Can I Afford the Down Payment?

- Am I Financially Stable?

- How Much House Can I Afford?

- Can I Secure a Good Mortgage Rate?

- How Long Do I Plan to Stay Here?

- Am I Ready for the Challenges of Owning a Home?

- What Do I Want in a Home?

External Factors in The Home Buying process

Outside of your financial situation, there may be external factors to consider before you decide to buy a home. What are the market’s current interest rates? How is the economy performing? How has nature affected the market? These are all things you should look into before buying a home.

1. Interest Rates

The economy, politics and banks can influence interest rates. The Federal Reserve also regulates these rates in part, though human control of interest rates can sometimes spell trouble for the housing market.

2. The Economy

Various factors, such as politics, employment levels and consumer confidence, compose the economy. When looking for a home in a specific region, you’ll want to look at the market nationally, as well as regionally. The real estate market and economy in Texas may be quite a bit different from the market in Maine, for example. The market may even vary between cities in the same state, so it can be beneficial to do some research into your potential home’s area before jumping in.

3. Impacts of Nature

Natural disasters can significantly affect the real estate market. A devastating storm can cause a thriving market to completely turn around in a matter of days. People may abandon the area, and homeowners may become renters. Listings may increase, but prices may drop and it could take quite some time for the market to rebound.

Plenty of factors from your situation come into play when looking to buy a house, but be sure you don’t overlook external factors such as interest rates, the economy and the impacts of nature when making your decision about when to enter the market.

Questions to Ask Before Buying a House

Before choosing to buy a home, there are a few questions you may want to ask yourself to determine whether homeownership is the right next step for you. Here are seven of these to get you started.

1. Can I Afford the Down Payment & Closing Costs?

The standard rule of thumb when it comes to a down payment on a home is 20%. However, you can also put a down payment of as low as 10% for a conventional loan and 3.5% for a Federal Housing Administration loan. Depending on the type of loan you’re looking to get, do you have enough money to make the down payment? You’ll also need to factor in closing costs, which can cost between 2 and 5% of the home’s value. Though the seller may sometimes contribute to these closing costs depending on the deal you get and the state of the market, you may still want to ensure you’ve saved up enough to cover these costs.

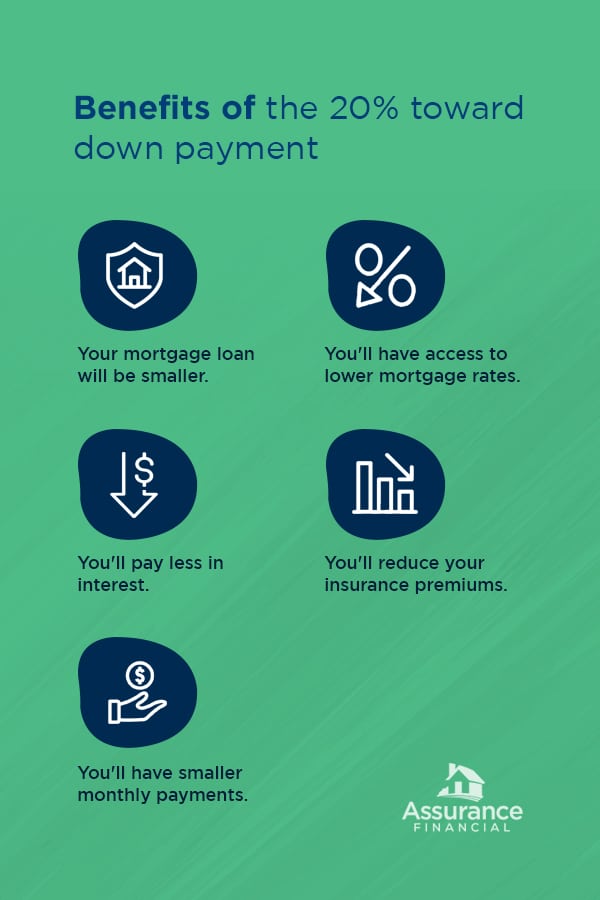

Putting a down payment of 20% toward your house can offer a range of benefits:

- Your mortgage loan will be smaller.

- You’ll have access to lower mortgage rates.

- You’ll pay less in interest.

- You’ll reduce your homeowner insurance premiums.

- You’ll have smaller monthly payments.

The more you can put down on your house up front, the more money you’ll save in the long run.

2. Am I Financially Stable?

Are you currently able to meet your other financial obligations and goals? Are you paying your bills on time every month? Are you consistently achieving your goal for retirement savings? Do you have an emergency fund? Before introducing a mortgage into the mix, you’ll want to ensure you’re covering all your other financial goals and obligations. If you’re able to say you do meet all of your other financial obligations, you may be able to comfortably fit a house into your budget.

A mortgage is a long financial commitment. Even most shorter-term mortgages are at least 10 years. The standard mortgage term is 30 years, so ideally, you’ll want to be financially stable for the duration of your mortgage, which could be several decades. Job security and a steady income are great ways to ensure financial stability, but since job loss can happen to anyone, you’ll want to ensure you can continue paying your mortgage even in the face of losing your source of income.

To prepare for this possibility, you may want to save several months’ worth of living expenses to cover you during your gap in employment. If you work in a field with high demand and you can reasonably expect to get hired in a short amount of time, you may only plan to save up for three to four months of living expenses. If you don’t work in a field with high demand and you anticipate a job loss may leave you unemployed for several months, consider saving up an emergency fund of six to 12 months of living expenses. That way, even if you remain unemployed for an entire year, you won’t have to worry about making the payments on your mortgage and bills every month.

3. How Much House Can I Afford?

Take your existing budget and input the new monthly expenses you can expect after you acquire a mortgage. You’ll want to estimate your principal, interest, taxes and insurance to plug into your budget.

Use a Mortgage Calculator

To determine the numbers for your principal and interest, you can use an online mortgage calculator. Experiment to see how much you could comfortably fit into your budget and what amounts would be stretching your budget uncomfortably thin. You can also look at the current rates from a lender like Assurance Financial for different types of loan terms, such as 15-year versus 30-year or conventional versus FHA. Try out of our Assurance Financial mortgage calculators today! Several payoff calculators also exist on many real estate websites. This can help with long-term planning which could help you avoid mistakes.

Taxes and Homeowner Insurance

To determine the approximate cost of your property taxes, you can look online for homes for sale in the area you’re interested in and find examples of what the approximate taxes might be. Usually the home you are purchasing includes historical property tax information as part of the buying process. Estimating your homeowner insurance may be a little trickier without an address to give your insurance company, but they may still be able to provide you a with reasonable estimate or range. We also recommend looking into past insurance claims on the home. Understanding the history of past insurance can open your eyes to a wealth of information on your potential new home, and may give you the information needed to change your total budget requirements.

A Quick Note On Homeowners’ Association Dues and Other Expenses

Other costs potential homeowners may overlook include fees for a homeowners’ association, an alarm system, condo fees or utilities. To get estimates for these services, especially homeowners’ association dues, you can research what residents in the area tend to pay for these expenses or contact the utility company to ask about the costs in that specific neighborhood or area. If you’re upscaling from a small apartment to a larger space, you may also want to increase other living costs that tend to go up when you have more space, like furniture, decor and property maintenance.

4. Can I Secure a Good Mortgage Rate?

First, do you know what you should consider to be a good mortgage rate? In short, a reasonable rate is one you can afford and that works with your budget. Here’s a closer look at the factors that will help you find or qualify for a fair mortgage rate.

- Credit score: Your credit score is probably the most critical factor when it comes to securing a mortgage. A high credit score tells lenders you’re likely someone who will repay them. Lenders will look at your credit history to determine whether you’ll be able to afford your mortgage and consistently make your payments. Higher scores generally result in the lowest rates, but you’re also likely to qualify for a favorable rate with a score in the mid-range. However, if you want to secure an FHA loan, you could get a mortgage with a lower score. You can request a free credit report every year from the three major credit bureaus. Choose from TransUnion, Equifax and Experian to request your credit report to determine whether your credit score could already secure you a good mortgage rate. You may find you need to do a little more improvement before applying for a mortgage.

- Employment history and income: Lenders also look at your employment history. They want to see you’ve held a job for at least two years and what your income is. If you are not employed, you’re unlikely to get a mortgage at all, let alone a mortgage with a good rate. Lenders may also look at your debt-to-income ratio and your assets. They want to feel confident you have the means to pay them back the money you’re borrowing.

5. How Long Do I Plan to Stay Here?

If you aren’t planning on staying in an area for long, buying a home may not the best option for you. Generally, it’s best to buy a house only if you plan on staying in it for at least five years. This length of time allows you to build up equity in your home and make up for the costs that went into buying, selling and moving.

If you plan on moving within a few years, you may want to consider an ARM — adjustable-rate mortgage — which have rates that adjust every year, unlike fixed-rate mortgages. If market conditions are optimal and rates are consistently dropping, an ARM may be the right option for you in a relatively short-term living situation.

6. Am I Ready for the Challenges of Owning a Home?

A significant difference between owning and renting is that when you own a home, you’re entirely responsible for everything inside it. When the refrigerator stops working or the air conditioning system fails, the cost of making these repairs comes out of your pocket. Before buying a home, you may want to have money set aside in anticipation of property and household damages.

The cost of a home isn’t only what you pay up front, but your continued maintenance and upkeep as well. Yard and outdoor maintenance can include mowing the lawn, raking leaves, clearing debris, cleaning out the gutters, power washing the house or resealing the deck. You may need to worry about paying an exterminator to remove bugs or rodents that enter your house. It’s also smart to get your air conditioning and heating systems inspected at least once a year, along with changing air filters a few times throughout the year. These costs are ongoing, so you’ll want to keep these in mind as you make your yearly or multi-year budget.

As with an emergency fund, you may want to consider specifically earmarking some cash for unexpected repairs that might pop up. You may want to follow one of two rules of thumb when deciding how to save up for these potential expenses.

- Save $1 per square foot: Every year, set aside $1 for every square foot of your house. If your home is 2,500 square feet, for example, you should save $2,500 every year.

- Save 1% of the sales price of the house. This percentage is not the amount of your mortgage, but the value of the home if you put it on the market today. If your home is currently worth $500,000, that means you would save $5,000.

If you want to save the minimum toward home repairs every year, you may follow the first rule of thumb. If you’d rather err on the side of caution, you may want to follow the second rule of thumb.

7. What Do I Want in a Home?

When compiling your list of questions to ask when buying a home, don’t forget to ask yourself what qualities you find desirable in a house. Make a list of your potential home’s must-haves, what you would like it to have and what your dealbreakers might be.

Your must-haves are any factors your home needs to have for you to buy it. Maybe on your must-haves list, you want central heat and air, rather than having to maintain separate heating and A/C units for each room. Or, perhaps your home needs to be one-story so you don’t need to deal with as much daily upkeep and cleaning. Many parents prioritize finding homes in a good school district to benefit their children. Being in a good school district not only improved your child’s education, but also makes for a better long-term investment. Most real estate websites, such as Zillow and Realtor.com, include school district and rating with each home listing.

Regardless of what you put on your list, you won’t buy a home lacking any of these items.

Your nice-to-haves are perks you would enjoy, but aren’t crucial enough that you would turn down a home that doesn’t have them. These might include a two-car garage or a nice view from the property or new appliances and major systems. If the home does not have these qualities, you’ll still consider purchasing it if it checks all the boxes on your must-have list.

Your list of dealbreakers is anything that would make you not want to buy a home. If you live with multiple people, for example, a dealbreaker for you may be a house with fewer than two bathrooms. Or, maybe you can’t stand the idea of living on a loud, busy street.

If you’ve answered positively to most of these questions, you may be ready to buy a home.

What to Consider Before Making an Offer on a House

Before making an offer on a home, there may be a few factors specific to that house to consider. These factors can include a home inspection, other offers and any work you need to get done based on the condition of the home. Here’s what to know before making an offer on a house.

1. Home Inspection

When you’ve found a house and you want to put an offer in, you will need to get it inspected. Typically, you can take advantage of a 10-day inspection period by bringing in a home inspector to assess the house. You may also want to consider hiring people who work in other trades, such as roofing, plumbing and electricity. A home inspector may not be able to catch everything. Bring in someone who is licensed in a specific profession and who will know what to check in a house before buying, tell you what might be wrong with the system and estimate how much it would cost to fix it. We also recommend using your own home inspector, and not one that your real estate agent works with. Can friends and family for recommendations. When negotiating the sales price of your home with the seller, having this information can work well in your favor.

2. Other Offers

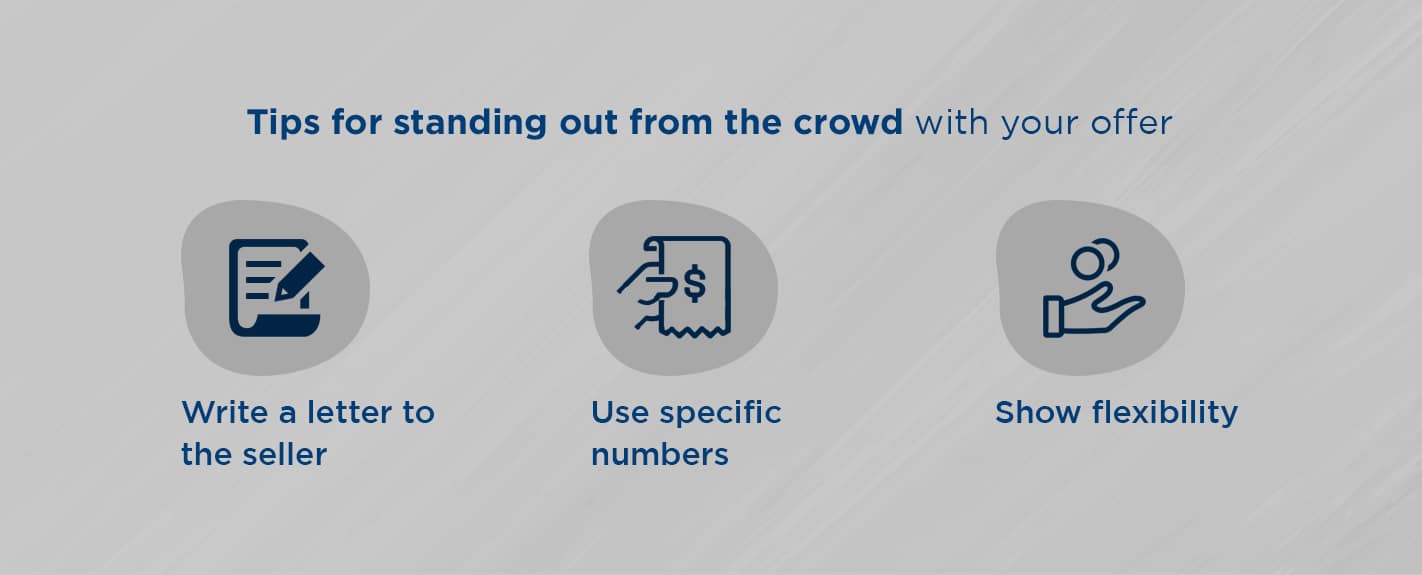

Competition for a home can strike fear into the hearts of homebuyers, especially those who are entering the market for the first time. They worry about offering more than they can reasonably afford or missing out on their dream home. Here are a few tips for standing out from the crowd with your offer.

- Write a letter to the seller: A personal letter may help you be more memorable as a potential buyer. Selling a home can be a stressful and highly emotional time, and a letter with sentimental value can push you over the edge into their favor.

- Use specific numbers: Specific, rather than round, numbers will stick out more in a seller’s mind and may also put your offer just ahead of other buyers, even if only by a couple hundred dollars.

- Show flexibility: Develop your offer around the seller’s specific needs. A seller moving out of the state may want a sooner closing date, so being flexible with the seller may earn you the bonus points that get you the home of your dreams.

Remember, even if you lose out on a bid, you’ll eventually find the right house at the right time with the right bid, and making an offer doesn’t cost anything.

3. Necessary Home Improvements

If you need to do work or make improvements to the home, you’ll want to consider whether the costs of these improvements can fit into your budget. If you anticipate the costs will be too high, you may want to reconsider purchasing the house. On the other hand, if the improvements are minor and the costs can reasonably fit into your budget, you may want to move forward with purchasing. Replacing the roof, for example, could be a pricey home improvement. In contrast, painting a few rooms or installing a new faucet might be a remodeling project that’s within your budget.

Find Your Financing With Assurance Financial

At Assurance Financial, we want to help you achieve your American dream of homeownership. With us, you can find the home of your dreams with the ideal mortgage terms. Buying a house doesn’t have to be overwhelming when you work with the Assurance Financial team.

When applying for a mortgage, you’ll want to have a licensed loan officer to help you through the process. Our application technology and end-to-end processing under one roof will make your loan process quick and straightforward.

Find a loan officer near you today at Assurance Financial to get started, and discover why we’re one of the best lenders for financing a home mortgage.

After the hassle of buying a home, does refinancing make sense? In some situations, you may benefit from refinancing your home, but you need to know more about these particular instances as well as when refinancing may not benefit you. Do not lightly make your decision to refinance your home. Careful consideration of your finances and your current situation will help you choose when to refinance your home.

- Why Would You Want to Refinance a Mortgage Right After Purchase?

- How Often Can You Refinance a Mortgage?

- What to Know Before Refinancing

- How to Know When Refinancing a Mortgage Is Right for You

Why Would You Want to Refinance a Mortgage Right After Purchase?

When someone asks us, “Can I refinance right after buying a home?” the answer is yes, but with reservations. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within 120 to 180 days of issuing the loan. The more money you put into your home, the easier it will be to refinance, regardless of when you do it. Ideally, you should pay at least 20% of the home’s value before you seek to refinance to make qualifying a more straightforward process.

Only a couple of situations justify refinancing soon after you buy your home. These typically deal with major changes in your life or finances. Even if you experience a change that might warrant a rapid refinance of your mortgage, always talk to your lender, first to get personalized advice. Here are some reasons you might need to refinance soon after buying:

1. Interest Rates Changed Dramatically

The economy can change in the blink of an eye, and if mortgage interest rates in your area have plummeted since you bought your home, you may consider refinancing. Unless interest rates drop more than 0.5%, refinancing for lower payments does not make sense.

A study done in December 2010 showed that households eligible for refinancing could save $160 monthly on their mortgage payments thanks to lower interest rates. Unfortunately, at the time, 20% of families that could have refinanced to take advantages of the savings did not, leaving behind an average of $11,500 on their homes they could have saved.

If the interest rates decline significantly, you will save more money the sooner you refinance. However, don’t forget about closing costs. The amount you save should cover the closing costs for refinancing, which could be 3% to 6% of your home’s value. If you cannot justify the closing costs in monthly savings from the lower interest rate, you may not need to refinance.

2. Life Changed Your Ability to Pay Higher Rates

Occasionally, unexpected life events will sometimes get in the way of your ability to pay your mortgage. If you initially took out a 15-year loan, you can stretch out the payments by refinancing to a 30-year loan. You will still need to pay the closing costs, but the option of changing to a longer-term loan could help save money if an unexpected circumstance leaves you unable to afford your higher mortgage payments. The downside to this option is the increased amount of interest you will pay over time, but you may need the lower rates more than the lower total cost.

3. Your Credit Rating Rose

The interest rates you get for your mortgage depend mainly on your credit score. While your credit score may not usually change quickly, it could surge after clearing disputed charges or paying off large debts. Also, the more time that passes after a bankruptcy, the less of an effect the event has on your credit. Talk to your lender if your credit score has risen significantly since you took out your home loan to see if you can qualify for lower rates through refinancing with your new, better credit score.

4. You Divorced

When you signed your home loan, if you did so with your spouse, refinancing is the only way to get that person off your mortgage if you divorce. When refinancing, your individual income may change rates unless you have a cosigner on the loan whose assets can ensure you get the same or lower interest than before.

When refinancing, you may be able to request a loan to include your spouse’s half of the equity to pay her for half the house. For example, if you have a $200,000 home loan, and have paid $60,000 of it, you will owe your spouse $30,000 for his portion of the home. You should then refinance for $170,000 to cover the remaining $140,000 in the house plus your spouse’s $30,000.

Since this matter also has legal implications, talk to your lawyer about property and divorce laws in your area if you have any questions about your specific situation.

5. You Want to Get Rid of PMI

Personal mortgage insurance, PMI, ensures your lender that you will make mortgage payments. Usually, you will need this if you get a loan with a down payment of less than 20% of the home’s value. However, did you know that when you make enough payments to have 20% of your home’s value in equity, you can drop PMI? In some cases, you can call the lender, but just a phone call may not be enough. If rates have also changed, you may want to refinance to get rid of the PMI monthly payments and take advantage of better rates. Doing so can save you money each month.

How Often Can You Refinance a Mortgage?

Technically, American law doesn’t officially limit the number of times you can refinance your home. Since you have no legal restrictions, you could seek new loan terms as many times as you want. Certain factors will play into when and how often you should refinance, including when you can break even and how many properties you have.

Some people refinance more than once. One couple did it twice on the same property in the same year, but this may not make financial sense for you. If you need to know how soon you can refinance after refinancing, look at the numbers. The savings must make up for the payments and any penalties. When the figures show you can recoup your losses quickly, you can refinance as often as you like.

Decide your break-even time. This time will be when you recover the costs you paid from your refinance in savings you’ve made. Compare your current loan payments and subtract the amount after refinancing. Divide the closing costs and fees by this number to find out how many years it will take for your investment to pay for itself.

For instance, if you have a $200,000 mortgage and closing costs to refinance cost 4% of the total, you will pay $8000 in closing fees. If you reduce your payment by 1%, you will save $2000 each year. To recover the closing amount, you will need to make payments on your newly refinanced loan for four years.

What to Know Before Refinancing

Before you refinance, you need to understand about the possible drawbacks of the process as well as the steps of the ordeal itself. Pay attention to these factors:

1. Prepayment Penalties

Paying off your mortgage early by refinancing or selling your home may come with prepayment penalties. Some mortgages come with prepayment penalties. Talk to your lender about the policy on early payment for your current home loan before refinancing. Your lender should inform you about prepayment penalties when you close on your mortgage.

Mortgages may have one of two types of prepayment penalties, also known as prepays. Both types penalize you if you refinance before paying off the loan. Hard prepays penalize buyers for both selling and refinancing, whereas soft prepayment penalties only cost borrowers a fee after selling the home.

While these penalties only happen during the first one to three years of the loan, they can add up. For instance, some lenders may charge 80% over six months of interest-only payments. You will most likely want to read the information about prepays in your closing information carefully and discuss any questions you have with your lender.

2. Appraisal Process for Refinancing

Your home will need reappraising as a part of the refinancing process. The appraisal process protects the lender by ensuring the value of the house is close to the mortgage value. Since so much of your mortgage payment comes from the home’s value, having an accurate appraisal will help you, too. You won’t overpay for your home.

You must schedule the appraisal and pay for it yourself. These inspections can cost between $300 and $400. If you have a large property or multiple units, the cost and time to conduct the appraisal will rise. Standard times for the assessment can take between three and ten business days.

3. Closing Costs

Just as you had to pay closing costs with your original home loan, you will need to cover these for your refinancing. Essentially, refinancing is transferring your old mortgage to a new rate. It still requires the same steps required for you to take out a loan, including paying 2% to 5% of the home’s value in fees.

4. Impact on Credit Score

Each time you refinance, the lender will conduct a hard inquiry of your credit. Too many of these types of examinations can negatively impact your credit score, even if you make regular on-time payments. Refinancing once or twice is fine, but the shorter the time between these loans or your original borrowing and refinancing, the more significant the impact you will see on your credit score.

5. Process of Refinancing a Mortgage

The process of refinancing has multiple steps. You will need to prepare yourself for the process, so you don’t feel surprised or unprepared by anything. Researching the process and your options will make you better prepared for choosing the right lender and finding the best interest rates.

First, get an idea of your home’s worth and determine how much equity you have. Generally, lenders won’t refinance if you have less than 5% equity in your home. Ideally, you want 20% equity or more in your home for the best chances at qualifying for a refinance.

A lot of the refinancing process requires research. Not all lenders offer the same interest rates, and your credit score and other personal factors will affect how much you pay. You need to compare rates from several lenders and find out what fees they charge. Check with the mortgage companies to see what paperwork they need hard copies of. Many can connect electronically to various financial institutes, so you don’t require printouts of financial documents.

Once you’ve done your research, apply for a loan to get an estimate for refinancing. You should get an estimate within three days. If you approve of the terms, the loan process continues with the lender carefully reviewing your application documents.

At this stage, you need to get an appraisal. In some cases, your lender may set up this inspection or ask you to do it. After appraising the home, the reviewer will send a report about the home’s value to both you and the lender.

The lender will have an underwriter comb over the paperwork and your home’s appraisal. You may need to answer questions about your refinancing application. Address these quickly to keep the process moving forward.

Lock in the rate at any time, but you should do it before closing. At closing, you will sign the needed documents and make any fee payments. Once closed, your new loan takes over for covering your home’s mortgage.

How to Know When Refinancing a Mortgage Is Right for You

Several situations make refinancing a good option. Don’t just go through the process if mortgage rates drop a little. Wait for a significant drop or any of these other signs that you will save a considerable amount of money. Refinancing is a good idea if you:

- Move from an adjustable rate mortgage to a fix-rate loan

- Change from a 30 or 40-year term to a shorter 15-year term

- See interest rates drop at least 0.5%

- Have an interest-only loan that will decrease

These situations could make refinancing a valuable way to save money. While you don’t want to enter the process needlessly, you also don’t want to leave money on the table by failing to refinance at the proper time.

Does Refinancing Make Sense for You?

Having a close relationship with your lender is critical to working through the refinancing process. At Assurance Financial, we have people and technology to work for you and with you. If you think it’s the right choice for you at this stage in your life, contact us at Assurance Financial about refinancing your home. Through a refinance, you may be able to lower your payments or get cash from your home’s equity.

To see if you qualify, meet with one of our loan advisors in person. You can find out more about our rates and whether you qualify for refinancing. No matter how you work with us, we’ll help you find your ideal home loan options. We’re the people you can trust.

You make better decisions when you fully understand your mortgage. Taking some time to crunch the numbers can help you develop an accurate assessment of your loan situation so you’re more likely to pay it off in the long run. Here at Assurance Financial, we have the information you need to estimate your mortgage payment and provide a mortgage lending calculator that can make the task a little easier. If you know what type of mortgage you’ll be applying for, you may also be able to use a calculator designed for that loan type, like a conventional mortgage calculator or a jumbo mortgage calculator.

Need to quickly calculate your estimated mortgage payment? Use our mortgage payment calculator to determine how much you may need to pay.

Want to learn more? Below we’ve mapped out how to calculate your estimated mortgage payment and highlighted a few details to pay attention to during the process.

- Why Is It Important to Calculate My Estimated Mortgage Payment?

- What Information Do I Need to Get Started, and Where Can I Find It?

- What Is a Fixed-Rate Loan? How Do I Calculate It?

- How Do I Calculate an Interest-Only Loan Estimate?

Why Is It Important to Calculate My Estimated Mortgage Payment?

Most people who buy a home secure a mortgage to finance their purchase. The mortgage includes both the principal and the interest, which is paid to the lender in monthly installments for the duration of your loan’s term. A home is generally the largest purchase a person makes during their lifetime, so you’ll want to know exactly what you’re getting yourself into before you take the leap.

Calculate your estimated mortgage payment to determine whether you can actually afford the home you’re looking to buy. Here are a few reasons why it’s important to calculate your estimated mortgage payment:

1. You Can Plan Your Financial Future

Calculating an estimated payment will also help you when you’re planning out your financial future. Because most mortgages last for many years, often up to 30 years, having a solid estimate of what your cost of living will be every month for the coming years or decades will give you the freedom to plan how much money you can allocate to other expenses and financial goals.

2. You’ll Determine How Much Home You Can Actually Afford

Calculating your estimated payment will also give you an idea of how much house you can comfortably afford. Can you afford a $300,000 home? Or can you only comfortably afford a home valued at $150,000? Knowing early on how much you can actually afford will save you a lot of time and potential heartbreak when you don’t waste your time considering houses out of your price range.

When you calculate your estimated mortgage payment, you may want to ensure that your monthly payment won’t keep you from meeting your other financial obligations and goals. With this mortgage payment, can you still afford your other monthly bills? Will you still be able to hit your target savings rate for retirement and your emergency fund? Is this a payment that can comfortably fit into your budget?

If the answer is no, then you may want to consider another home or a mortgage with different terms. Or you may simply want to put off buying a home until it’s an expense you can comfortably cover.

If the answer is yes, and you are comfortable with your estimated mortgage payment, then buying a home may be the right next step for you.

What Information Do I Need to Get Started, and Where Can I Find It?

To begin calculating your estimated mortgage payment, think about the following information for the potential mortgage loan:

- Your monthly income

- The market value of the home

- The loan amount

- The type of loan

- The interest rate on the loan

- The number of years you have to repay

1. Your Monthly Income

If you have a budget, you should already know exactly what your monthly income is. If you don’t have a budget yet, you may want to create one so your calculations for home affordability will be easier. If you don’t know your monthly income, check your pay stubs from the past few months. Add up your paychecks for each month to calculate your monthly income.

If you have a large monthly income that consistently gives you a huge surplus in your budget, that may affect the loan terms you choose. With a large income, maybe you feel comfortable with larger monthly mortgage payments and want to opt for a 15-year term that will result in you repaying your loan much faster than you would for with a 30-year term.

2. The Market Value of the Home

To figure your mortgage payment, you’ll need to know the market value of the home you’re interested in purchasing. How much is your home going to cost you? Though the median listing price for a home in the U.S. is about $300,000, the market varies in different areas. The median home price in some California cities, for example, is nearly $1 million. In other areas, the median home price may be closer to $100,000 or even less.

3. The Loan Amount

To calculate your estimated mortgage payment, you’ll also need to factor in the total loan amount. The amount of money you borrow for the loan is also known as the principal. When estimating your mortgage payment, experiment with the loan amount to determine how much of a loan you can comfortably afford. You may only qualify for a maximum loan amount, so knowing how much you can expect to get from a lender can help you determine whether you can finance the home you’re interested in.

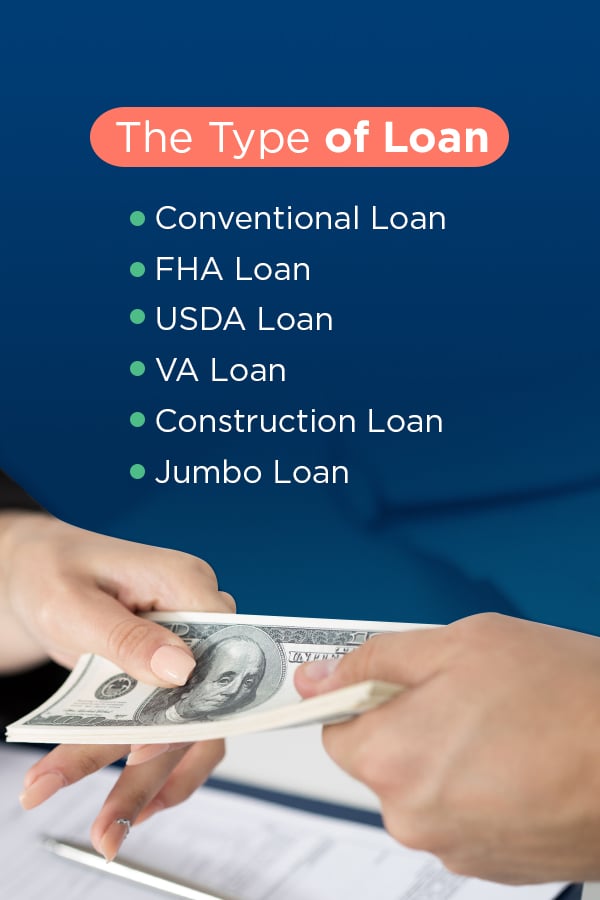

4. The Type of Loan

It may also be helpful to have an idea of which type of mortgage loan you’ll be securing to calculate your estimated mortgage payment. There are six major types of mortgage loans:

- Conventional loans

- FHA loans

- USDA loans

- VA loans

- Construction loans

- Jumbo loans

Conventional Loan

A conventional loan is the most common type of mortgage in the U.S. The down payment necessary for a conventional loan tends to be higher than other mortgage options. You can choose either a fixed or adjustable interest rate. A conventional loan is great for new homebuyers, and you may be able to eliminate private mortgage insurance premiums by paying a large enough down payment.

To be eligible for a conventional loan, you should have a moderate credit score and a low debt-to-income ratio. You’ll probably also want a 20 percent down payment. For a loan of $100,000, that amounts to $20,000 for a down payment.

FHA Loan

An FHA loan is insured by the Federal Housing Administration. If you don’t have great credit or a large income, then an FHA mortgage may be a great option for you. They tend to be popular with first-time homebuyers, and you can get a fixed interest rate for a 15-year or 30-year term.

To be eligible for an FHA loan, you need a credit score of at least 500, an employment history from the last two years and verifiable income. You could put as little as 10 percent down if your credit score falls between 500 to 579. If your credit score is at least 580, your down payment may be as low as 3.5 percent.

USDA Loan

A USDA loan can be secured by borrowers who live in qualifying areas designated by the Department of Agriculture. For this loan type, you don’t need to have an excellent credit score or a high income. In fact, to qualify for this loan type, you need to have a low income relative to your area. You also must be a citizen or eligible non-citizen, and you must make the home you’re purchasing your primary residence.

VA Loan

A VA loan is specifically for veterans and is backed in part by the Department of Veterans Affairs. These loans generally have the lowest rates of the major mortgage types and can be secured by members of the military, Reserves, National Guard or their spouses.

You can qualify by:

- Serving for 90 consecutive days during wartime

- Serving for 180 days during peacetime

- Serving for six years in the Reserves or National Guard

- Being the spouse of a service member who died on active duty

Construction Loan

A construction loan pays for buying land and building a house. Generally, these loans come with a maximum one-year term, and the lender will distribute the money to the borrower as construction progresses rather than in a lump sum. Rates tend to be higher for this loan type than for others because of its high risk for lenders.

To qualify for a construction loan, you’ll want a good credit score, a stable income, a large down payment and a low debt-to-income ratio.

Jumbo Loan

A jumbo loan is for homes that are particularly pricey. If you’re looking to purchase a home that will cost more than $424,100, and you’re a high-income earner, you may want to consider a jumbo loan.

Qualifying for a jumbo loan is more difficult than other loans. You’ll need a higher credit score, a low ratio of debt-to-income and a significant down payment. You’ll also need to provide proof of cash reserves, employment history and income. Because requirements can vary from lender to lender, you’ll want to check with your lender to see the exact requirements for a jumbo loan.

Everyone has their own individual financial situation and goals, which is why there are multiple loan options to meet the various needs of borrowers.

[download_section]

5. The Interest Rate on the Loan

Your loan’s interest rate is another piece of information you’ll need to calculate your estimated mortgage payment. Mortgage interest rates fluctuate with the market and are affected by factors such as the U.S. Federal Reserve’s monetary policy, the market, the economy and inflation.

The interest rate will determine what the total cost is of borrowing your loan from the lender. Interest is essentially a fee the lender charges for loaning you the money to purchase your home. In the early years of paying off your loan, your monthly payment will primarily be interest.

For borrowers, the interest rate you can secure depends on your credit score and history. Generally, borrowers with higher credit scores tend to receive the lowest interest rates. However, you likely will still receive a good interest rate if your score falls between is mid-range. Use your credit score in your calculations to help you determine what interest rate you may qualify for and how that affects your overall financial obligation. If your credit score is low and results in a high-interest rate, you may want to take some steps to improve your credit score before pursuing a mortgage loan.

6. The Number of Years You Have to Repay

The final piece of information you’ll need to calculate your estimated mortgage payment is the length of your loan. How many years will you have to repay your loan? Most loans have a 30-year term but some are 15 years.

If you’re interested in lowering your monthly payment, you might consider increasing the term of your loan. Monthly payments for a $200,000 mortgage will be higher for a 15-year loan term than for a 30-year term, for example.

If you consistently have a surplus in your monthly budget, however, you may feel comfortable with a higher payment if it means you’ll pay off your mortgage in half the time. A 15-year fixed loan also tends to offer a lower interest rate than a 30-year fixed loan.

For example, on a 30-year loan of $160,000 at a fixed rate of 4.125 percent, your total interest paid would be approximately $119,000. For a 15-year fixed loan of the same amount at an interest rate of 3.52 percent, you’ll pay only about $46,000 in interest. That amounts to $73,000 saved by repaying your mortgage in half the time.

When calculating your estimated mortgage payment, you’ll want to have these important pieces of information on hand. For any information you don’t have exact numbers for, experiment with the numbers in your calculations to see what might work for you.

What Is a Fixed-Rate Loan? How Do I Calculate It?

A fixed-rate loan has an interest rate that doesn’t change at all over the course of the loan term. The monthly payment stays the same every month, which makes monthly or yearly budgeting easy and predictable for borrowers. Fixed-rate mortgages generally have higher rates than variable rate loans, but they also protect homeowners from fluctuations in the housing market. Further, since the housing crisis of 2008, the gap between adjustable rates and fixed rates has virtually closed, meaning fixed interest rates can be just as low as variable rates.

If interest rates in the market increase, you won’t be affected and won’t have to worry about your interest costs or mortgage payments increasing. You can find a fixed interest rate for several term options, including 15-year and 30-year terms. With a fixed rate, when you initially begin paying your mortgage, your early payments tend to be mostly interest rather than principal. Over the years, your payment will gradually comprise more principal than interest. This process is known as loan amortization.

This does not affect the size of your monthly payment, which remains consistent month to month until the loan balance is completely repaid.

A fixed-rate loan is a great option for a borrower who wants the stability of a consistent monthly payment and wants to avoid the risk of a variable interest rate that may cause increased payments.

So how do you calculate your fixed-rate loan? You need to know the amount of the loan and the mortgage payment factor. The formula for those loans is: Loan Payment = Amount/Discount Factor.

Before you begin, you’ll need to calculate the discount factor using the following formula:

- Number of periodic payments (n) = payments per year times number of years

- Periodic Interest Rate (i) = annual rate divided by the number of payments per

- Discount factor (D) = {[(1 + i) ^n] – 1} / [i(1 + i)^n]

Seem complicated? Check out Assurance Financial’s Mortgage Calculator Tool and we can help.

To use the calculator, you’ll first input your mortgage loan information. This includes your mortgage loan amount, your annual interest rate, the number of months of your loan term and your desired amortization schedule.

Next, you’ll fill in your property information. This includes the sale price of the property, your annual property taxes, your annual hazard insurance and your monthly private mortgage insurance. You may also opt to let our system estimate your property taxes, hazard insurance and private mortgage insurance for you.

After you’ve filled in all the applicable information, hit Calculate, and we’ll give you your estimated monthly payments and an estimate of how much you’ll pay in interest over the life of the loan. Check to see how close you came when you calculated the estimates yourself.

How Do I Calculate an Interest-Only Loan Estimate?

Interest-only loan estimates are far less complicated to calculate. With each payment, you aren’t actually paying down the loan. Lenders generally list interest rates as annual figures, so you’ll divide the rate by 12 for each month of the year to calculate what your monthly rate will be. The formula for an interest-only loan is:

Loan Payment = Amount x (Interest Rate/12)

or

P = A x I

For example, if your interest rate is 6 percent, you would divide 0.06 by 12 to get a monthly rate of 0.005. You would then multiply this number by the amount of your loan to calculate your loan payment. If your loan amount is $100,000, you would multiply $100,000 by 0.005 for a monthly payment of $500.

A simpler calculation may be first multiplying the loan amount of $100,000 by the interest rate of 0.06 to get $6,000 of yearly interest, then dividing that $6,000 by 12 to get your monthly payment of $500. Regardless of which method you choose, you’ll still end up with the same value.

Your payment amount will stay the same until you make an additional payment, after a certain period when you’re required to make an amortizing payment or you pay off the entire loan.

Finance Your Home With Assurance Financial

Still confused about how to calculate your estimated mortgage payment? Contact Assurance Financial today or check out our Mortgage Calculator Tool. Our team of loan officers is dedicated to making the loan process as easy as possible for you.

At Assurance Financial, we want to help you secure the right mortgage for your dream home. Financing your home should be an exciting, memorable time in your life, and we want to make every step in the process as smooth and enjoyable for you as possible. When you contact us, we’ll put you in touch with a loan officer who will help you secure the right mortgage for your dream home.

No, it’s not just you. Understanding conventional versus federal housing administration (FHA) loans can feel like learning another language. Throw in terms like private mortgage insurance, debt-to-income ratios, interest accrual and insurance premiums and suddenly you feel like calling to give Fannie and Freddie a piece of your mind.

Understanding these two home mortgage options is key to making an informed decision. Let’s break down the ins and outs of conventional versus FHA loans so you can feel empowered in choosing the right loan for your financial health.

- What Are FHA Loans?

- What Are FHA Loan Requirements?

- Other Questions to Consider Before Getting an FHA Loan

- Are There Any Purchasing Restrictions or Limitations on FHA Loans?

- Who Is an FHA Loan Best For?

- Who Should Not Get an FHA Loan?

- What Is a Conventional Loan?

- Conventional Mortgage Requirements

- How Do Purchasing Restrictions and Limitations Compare to FHA Loans?

- Other Questions to Consider Before Getting a Conventional Mortgage

- Comparing FHA Versus Conventional Loans Limitations

- Comparing Credit Score Requirements for FHA Versus Conventional Loans

- Are Down Payments Different for Conventional Loans Versus FHA Loans?

- How to Choose the Right Mortgage for You

What Are FHA Loans?

Federal Housing Administration (FHA) loans are home mortgages insured by the federal government. Generally speaking, it’s a mortgage type allowing those with lower credit scores, smaller down payments and modest incomes to still qualify for loans. For this reason, FHA loans tend to be popular with first-time homebuyers.

The goal of FHA mortgages is to broaden access to homeownership for the American public. While FHA loans are insured by the federal agency with which it shares its name, you still work with an FHA-approved private lender to procure this mortgage type.

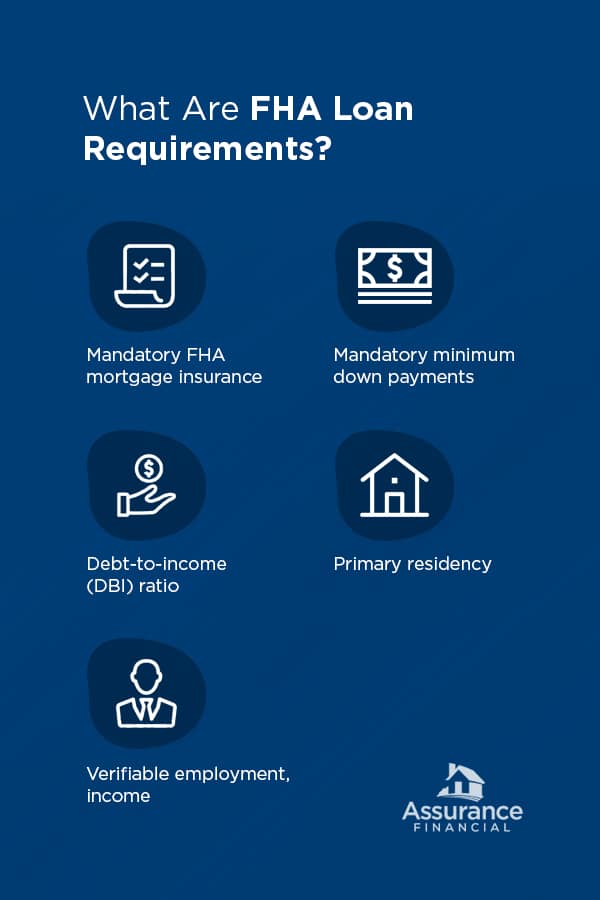

What Are FHA Loan Requirements?

Every year, the Federal Housing Administration, along with a slew of assisting government agencies, publishes their 1,000-plus-page FHA loan handbook.

If federal loan manuals (or should we say manifestos) don’t make your reading list cut, no problem. We’ve summed up the top FHA loan requirements applicable to today’s prospective home buyers:

- Mandatory FHA mortgage insurance: Borrowers with FHA loans must also pay FHA mortgage insurance. With conventional loans, mortgage insurance is optional and only mandatory when your down payment is less than 20 percent of the home’s value. However, this rule is less of a “gotcha” tactic and more of a market stabilizer, since FHA mortgage insurance covers your lender if you end up defaulting on your loan.

- Mandatory minimum down payments: FHA loan qualifiers pay down payments partially dictated by credit score. Credit scores on the lower end of the spectrum typically require a 10 percent down payment. Mid-range to high credit scores typically are able to put down around 3.5 percent.

- Debt-to-income (DTI) ratio: DTIs calculate the amount of money you spend every month on outstanding debts compared to your total income. To secure an FHA loan, qualifiers typically have a DTI of 30 to 50 percent. Generally, the lower the DTI, the more competitive the borrower.

- Primary residency: All properties a buyer intends to use their FHA loan on must be considered their primary place of residence, not a vacation or rental property.

- Verifiable employment, income: Like most loan types, you must provide a minimum of two years of employment history or verifiable income to qualify for an FHA loan. (Think pay stubs, federal tax returns or bank statements to name a few.)

Note: FHA’s mandatory mortgage insurance requires borrowers to pay not one but two mortgage insurance premiums: Upfront premiums and annual premiums.

- Upfront mortgage insurance premium: Currently, upfront insurance premiums for FHA loans are a small percentage of the total loan amount. It is paid as soon as the borrower receives their loan.

- Annual mortgage insurance premium: Like upfront mortgage insurance premiums, annual mortgage insurance premiums are calculated based off of a small percentage of the total loan amount.However, variables like loan terms (15 or 30 years) also influence rates. This premium is paid monthly, with installments calculated by taking the premium rate and dividing it by 12 months.

Other Questions to Consider Before Getting an FHA Loan

FHA loans are designed to be a more generous pathway to homeownership. Its underwriting standards are geared toward buyers who may not have traditionally lender-attractive credit scores or incomes but can still prove limited liability.

With that said, there are a handful of questions to ask before securing an FHA mortgage.

1. Are There Any Purchasing Restrictions or Limitations on FHA Loans?

Yes. Your FHA loan terms will maintain the following stipulations:

- Loan amounts: FHA loan amounts are dictated by a county’s median home price. While some exceptions exist, your qualifying FHA loan amount will fall near that median county value, known as its floor or ceiling amount. Also note: For the majority of U.S. home markets, FHA loans have limits on the cost of the home purchased — making a home outside this price range generally unattainable.

- Fixed interest rates: FHA loans only carry fixed, not variable, interest rates.

- Premiums: Remember those two types of FHA mortgage insurance premiums described earlier? Annual premiums can be refinanced, but only by turning the loan into a non-FHA mortgage or after you sell your home.

2. Who Is an FHA Loan Best For?

Since FHA mortgages are easier to qualify for, they’re particularly attractive for individuals in the following circumstances:

- Young or first-time homebuyers: Over 80 percent of all FHA loans lent in the past two years have been to first-time homeowners.

- Househunters with smaller savings: FHA loans statistically court lower down payments. Buyers with less competitive down payment capabilities may find FHA terms more favorable.

- Househunters with modest or variable income: The lower interest rates on most FHA loans can provide breathing room for buyers with tighter budgets or variable income, including freelancers or those who are self-employed.

3. Who Should Not Get an FHA Loan?

Borrowers turned off by the loan limit may find FHA mortgages too restrictive.

Likewise, most lenders recommend your monthly mortgage payments should not exceed 31 percent of your gross monthly income. Some private lenders offering FHA loans may allow up to 40 percent. If either of those rates proves to siphon too much of your monthly income, an FHA loan still may not be right for you.

FHA Loan Benefits

FHA loans carry several unique advantages.

1. Thoroughness of Property Appraisals

Property appraisals for FHA loans are extensive. Compared to conventional loan property assessments, inspectors will conduct a detailed analysis of the safety, structural integrity, design, HUD property guideline alignment and true value of your desired home, as well as compliance with local ordinances and standards.

2. Easier Approval

FHA-approval standards involve lower credit scores and more forgiving debt-to-income ratio allowances. Data from the Department of Housing and Urban Development show that a significant portion of FHA qualifiers maintain average credit scores or above.

3. Fixed Interest Rates

When it comes to fixed versus variable interest rates, one isn’t necessarily superior to the other. Depending on your financial situation and general risk tolerance, though, the fixed interest rates of most FHA loans may provide more budget stability than fluctuating ones.

4. Closing Costs

FHA loans typically have lower closing costs due to restrictions on the amount the lender can charge. This restriction works as a cost control for new home buyers.

What Is a Conventional Loan?

Conventional loans are mortgages issued through private lending institutions, such as banks and mortgage lenders.

Unlike FHAs, conventional loans are not insured by the federal government. They also can have fixed or variable interest rates, higher qualifying credit scores and more competitive down payment amounts affecting those interest rates.

Conventional Mortgage Requirements

Borrowers considering conventional loans have stricter qualifications to meet private lender requirements. Some of these qualifications include:

- Private mortgage insurance: If a borrower provides a down payment of less than 20 percent, then they must additionally purchase mortgage insurance paid in monthly installments. However, down payments higher than 20 percent do not require private mortgage insurance.

- Credit scores: Most private lenders require a minimum credit score to be an attractive loan candidate.

- Debt-to-income ratio: Conventional lenders look favorably on lower DTIs. Conventional loan DTIs are also capped at a moderate or mid-range credit score, though exceptions exist for those with credit scores higher than 700, though exceptions may exist for borrowers with very high or even perfect credit.

- Verifiable employment, income: Like FHA loans, borrowers must provide proof of steady income and employment to qualify for a conventional mortgage. After-tax income requirements may be higher as well, depending on the lending institution.

How Do Purchasing Restrictions and Limitations Compare to FHA Loans?

Generally speaking, conventional mortgages carry more restrictions than their FHA counterparts. Private mortgages tend to require:

- Higher credit scores

- Higher monthly income

- Higher down payment amounts, namely to access lower interest rates

It’s important to remember that one mortgage type is not better than the other. Rather, FHA and conventional loans fit particular situations that are always best reviewed with a local loan officer.

Other Questions to Consider Before Getting a Conventional Mortgage

Conventional mortgages do involve several unique processes, both before qualifying and after you’ve been approved. Consider the following questions if weighing a conventional loan against an FHA mortgage.

1. Who Is a Conventional Loan Best For?

Conventional loans work best for people in the following circumstances:

- People with high credit scores: If your credit score is 640 or above, conventional loans are advantageous.

- People house-hunting for vacation or rental properties: Conventional loans can be used on secondary properties or homes the owner does not occupy.

- People with a 20 percent down payment: Generally, putting down at least 20 percent lets you avoid private mortgage insurance — and the thousands of dollars PMI can cost over the course of your loan.

2. Who Should Not Go With a Conventional Loan?

Prospective homeowners with variable income or low debt-to-income ratios tend to have a harder time securing a conventional loan with favorable terms. Low debt-to-income ratios — meaning your monthly debt payments eat a larger portion of your income — make it particularly difficult to present as an attractive borrower to private lending institutions.

Conventional Loan Benefits

Borrowers who qualify for conventional mortgages experience several advantages:

1. No Upfront PMI, Optional Annual PMI

Conventional loans do not require upfront mortgage insurance. What’s more, annual PMI is not typically required if you meet the minimum down payment requirements, and in most situations PMI falls off your loan once you have paid off a certain percentage of the loan.

2. Flexible Loan Terms

Not only are conventional loans granted in higher values, but they come in more flexible timelines, too. Homebuyers can negotiate 10, 15, 20, 25 and 30-year conventional loans. Plus, any private mortgage insurance the buyer did take cancels once the loan’s total value (LTV) is 78 percent or less of the current value of the property.

3. Higher Loan Values

Private, conventional loans have higher ceilings than FHA loans. Mortgages backed by Fannie Mae and Freddie Mac can be secured a single-family home and reach up to higher amounts in higher housing markets.

Comparing FHA Versus Conventional Loans Limitations

There are a few major takeaways when comparing conventional loans versus FHA loans’ uses and restrictions.

- Owner Occupation: Conventional loans do not require the borrower to live in the property. FHA mortgages do.

- Refinancing: Refinancing is available for both FHA and conventional loans. However, conventional loans’ refinancing is more detailed, requiring a credit check, home reappraisal, income verification and more.

- High-cost and low-cost areas affecting loan values: Both FHA and conventional mortgages have loan floors and ceilings, i.e., the minimum and maximum values you can receive. FHA loans are determined by the median home value in a county. Conventional loans vary by county, state and lender but will generally follow Fannie Mae and Freddy Mac protection standards.

- Debt-to-income ratios: The lower your debt-to-income ratio (a.k.a. the closer the two numbers), the harder it will be to secure a conventional loan. Conventional loans typically accept DTIs in the 30-43 percent range; FHA mortgages can go up to 50 percent.

Comparing Credit Score Requirements for FHA Versus Conventional Loans

Credit scores are instrumental when determining loan eligibility for both types of mortgages.

- FHA loans generally accept modest credit scores: Borrowers with lower credit scores or credit challenges are frequently approved.

- Conventional loans generally favor higher credit scores: Borrowers tend to need moderate to high credit scores to receive opportune loan terms and rates.

Do remember, though, that for both types of mortgages, the lower your credit score, the higher your interest rates will be.

Are Down Payments Different for Conventional Loans Versus FHA Loans?

Yes. Conventional loans allow down payments of anywhere from 3-20 percent, with those above 20 percent receiving more favorable interest rates and no mortgage insurance.

FHA loans allow lower down payments for borrowers who meet credit requirements

How to Choose the Right Mortgage for You

There is no single “best” type of mortgage. Instead, prospective homebuyers should review their complete finance portrait to get an accurate representation of their homeownership maturity, then begin determining loan type from there.

- Know your credit score: Don’t beat yourself up if the number you discover isn’t where you want it to be. There are plenty of ways to raise your credit score and open the doors to more competitive mortgaging options.

- Be realistic about your down and monthly payment capabilities: Whether you rent or own, the budgeting golden rule is that your housing costs shouldn’t exceed 30 percent of your income. As you home shop, be realistic about what you can genuinely afford to spend on monthly mortgage payments as well as that initial down payment. Make calculations and set an actionable budget. This is one of the most important steps to take not only when house hunting but also when choosing a loan type for that home.

- Do your housing market research: FHA and conventional loan values are tied to their immediate markets. Familiarize yourself with the pricing structures and values of neighborhoods you’re considering before contacting a loan agent.

- Calculate the total cost of ownership: Consider the “hidden” costs associated with the mortgage and homebuying process, including insurance, fees, closing costs and mandatory premium payments. When tallied, these add considerably to your total monthly housing expenditures. It can also mean the loan offer with the lower interest rate might not be the savviest option in the long term.

- Consider consulting a mortgage broker or loan officers: These are individuals who have made a career navigating the complexities of the mortgage world. If you have questions, they’ll have answers.

The Bottom Line?

Buying a home is one of life’s greatest achievements — but for many, it’s also one of its most daunting.

Don’t be intimidated! Choosing between an FHA or conventional loan is a significant process but one with many options for guidance and assistance.

If you’re looking into getting a mortgage, reach out. Assurance Financial supports online applications for both FHA and conventional loans and has loan officers on staff who are ready to walk you through every step of the process.

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing