Category: Videos

When you’re shopping for a home, there’s more to consider beyond the number of bedrooms, size of the yard and the location. You also need to think about how you’ll pay for the house. For many homebuyers, that means applying for a mortgage.

Not all mortgages are created equally. Some offer a fixed interest rate, which remains the same throughout the life of the loan. Others have adjustable rates, which can change based on a schedule. Some mortgages need to be paid off within 15 years, and others give you 30 years to pay.

A 30-year fixed-rate mortgage is the most popular option among homebuyers. Learn more about what it means to take out a 30-year home loan, what a 30-year fixed mortgage rate means and whether this loan is the right option for you.

What Does a 30-Year Fixed Mortgage Mean?

A 30-year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan. When you decide to take out a 30-year home loan with a fixed rate, the payment you owe each month is the same until you’ve finished paying the loan.

If your first month’s payment is $1,000, your 12th month’s payment will be $1,000, your 36th month’s payment will be $1,000 and so on. If the interest was 5% during the first year of the loan, it would be 5% in year two, year six, year 15 and year 29.

A mortgage rate can either be a fixed interest rate or a variable rate. A fixed-rate does not change while you are paying back your loan, while a variable rate, also referred to as an adjustable-rate mortgage (ARM), can change throughout a loan.

What Is the Average 30-Year Fixed Mortgage Rate?

Many factors influence mortgage interest rates. The average interest rate has risen and fallen over the years as a result of market conditions and other factors. For example, in 1980, the average interest rate on a 30-year home loan was 13.74%. In 2000, it was 8.05% and 20 years later, in 2020, the annual average interest rate was 3.11%. In 2021, the average interest rate increased from 2.74% in January to 3.07% in November. Fannie Mae predicts that in 2022 the average mortgage rate will rise.

Some of the factors that affect mortgage interest rates are outside of the control of the average person. Supply and demand have an effect on rates, for example. When there is a lot of demand for mortgages, interest rates usually increase. When demand is low, rates drop to make getting a mortgage more appealing to consumers.

There are a few factors that influence interest rates that homebuyers can control. The amount of other debt you have can influence your interest rate. If you have a lot of debt already, a lender might consider you a higher risk compared to someone with less debt. To compensate for the additional risk, they are likely to offer a higher interest rate.

Your credit history and score also influence the interest rate on a 30-year mortgage. Usually, the higher your score, the lower your interest rate. If you don’t have favorable credit at the moment, it can be a good idea to work on improving it before you apply for a home loan.

Finally, how much you put down upfront can also affect your interest rate. The bigger your down payment, the less of a risk you seem to lenders. In exchange, they are likely to give you a lower interest rate compared to a person who is making a smaller down payment.

Can You Pay Off a 30-Year Mortgage Early?

Thirty years seems like a long time. If you buy a house when you’re 35-years-old and get a 30-year mortgage, your last payment will be scheduled for right around the time you reach retirement at age 65.

One thing worth knowing about a 30-year mortgage is that just because you can take 30 years to pay it off doesn’t mean you are obligated to do so. Many lenders may let you pay off your loan early. Some do charge a pre-payment or early payment penalty, however. Before you pay extra on your mortgage, double-check to confirm that your lender won’t penalize you for doing so.

If you are interested in paying off your mortgage early, there are multiple ways to do so. If you get paid biweekly, you can try making biweekly payments on your mortgage instead of monthly. Divide your monthly payment in half and pay one half when you get your first paycheck of the month and the second when you get paid the second time. Since there are 26 biweekly pay periods in a year, you’ll end up paying 13 months’ worth of your mortgage rather than 12.

Another option is to add on an additional amount when you schedule your monthly payment. Even paying an extra $100 or $200 per month consistently can shave years off your mortgage.

How a 30-Year Fixed-Rate Mortgage Works

When you apply and are approved for a 30-year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be broken down into a series of payments over the course of 30 years. The payments include interest and principal together and remain the same throughout the loan.

Many homeowners also pay their property tax and homeowners insurance premiums with their mortgage payments. If you put down less than 20% of the price of the home, you will also have to pay private mortgage insurance (PMI) premiums until you’ve paid off enough of the principal to equal 20% of the home’s value.

Principal and Interest

The mortgage principal is the amount you’ve borrowed to pay for your home. If you buy a $250,000 home, pay a 20% down payment of $50,000 and borrow $200,000, the $200,000 is the loan’s principal. As you make payments on your mortgage, the principal shrinks.

Interest is the fee charged by your lender for giving you the loan. One way to look at it is the cost of doing business with a particular lender. Just as you might pay a lawyer or a doctor a fee for their services, you pay your lender for their services in the form of interest.

The cost of getting a loan can vary considerably from person to person because of interest. One borrower might be offered a 5% rate on a $200,000 loan, while another borrower might be offered a 3% rate.

Since interest is a percentage of the loan amount, it tends to be higher at the beginning of your repayment period than it is at the end. For example, when you first start making payments on your $200,000 home loan, you are paying 5% interest on $200,000. As you chip away at the principal, it shrinks and so does the interest in proportion.

Although you start out paying more interest than principal on your mortgage and eventually begin paying more toward the principal and less in interest, the payment you are required to make each month remains the same due to something called amortization.

Amortization Schedule

Loan amortization is the process of paying off your debt over a defined period with fixed payments. When a mortgage is amortized, the principal and interest are combined. It differs from other types of mortgage payment schedules because you pay the same amount and know what you need to pay from month to month. In addition to mortgages, other types of installment loans, such as car loans and student loans, typically get amortized.

An example of a mortgage that does not amortize is a balloon mortgage. If you were to agree to a balloon mortgage, you would make small payments each month for a set amount of time. Often, the payments would only cover the interest due on the loan. At the end of the repayment period, the remaining balance is due in full.

When you close on your house and finalize the 30-year fixed-rate mortgage, your lender can provide you with an amortization schedule. The schedule breaks down each payment over the life of the loan and details how much goes toward the interest on the loan and how much goes toward the principal. It also lists the ending balance on the loan at the end of each payment period, so you can keep track of your mortgage as you pay it off. You’ll also find the total amount of interest paid on the amortization schedule. The total interest gives you an idea of how much your mortgage will cost you over time.

Who Needs a 30-Year Fixed Mortgage?

Although 30-year fixed-rate mortgages are the most popular option for homebuyers, they are far from the only choice available. Some mortgages have adjustable interest rates, for instance. Adjustable-rate mortgages (ARMs) offer an introductory rate for a set period, such as five years. At the end of the introductory period, the rate changes based on the market.

An ARM can decrease if rates have dropped or increase if they have spiked. Although an ARM can offer you a lower rate than a fixed-rate mortgage at the start, there is the risk that your rate may increase later on, and with it, your monthly payment.

Thirty years is also not the only term available for a home loan. Some loans have 15-year terms. Less common are 10-year, 20-year or 25-year mortgages. The longer the mortgage term, the smaller the monthly payments are, as you have more time to pay the loan. A person who might struggle to make payments on a $200,000, 15-year loan might find they are comfortable making payments on a $200,000 30-year loan.

A 30-year fixed-rate mortgage can be the right option for you if:

- You live in an area with expensive housing: A 30-year home loan can put buying a home within reach, even in areas where the price of housing is high. Another way of thinking about it is that you can get more house for your money if you get a 30-year mortgage instead of a 15-year loan.

- You want a predictable payment schedule: Your mortgage payment can be predictable if you get a 30-year fixed-rate home loan. The interest and principal payment stay the same for the entire repayment period.

- You want a lower monthly payment: Since you are going to take twice as long to pay down the loan, the monthly payment on a 30-year loan is usually considerably lower than the payment due on a 15-year mortgage, even if the principal balance is the same. Paying less toward housing each month can mean you have more money to put toward other financial goals, such as saving for retirement or for your children’s education.

[download_section]

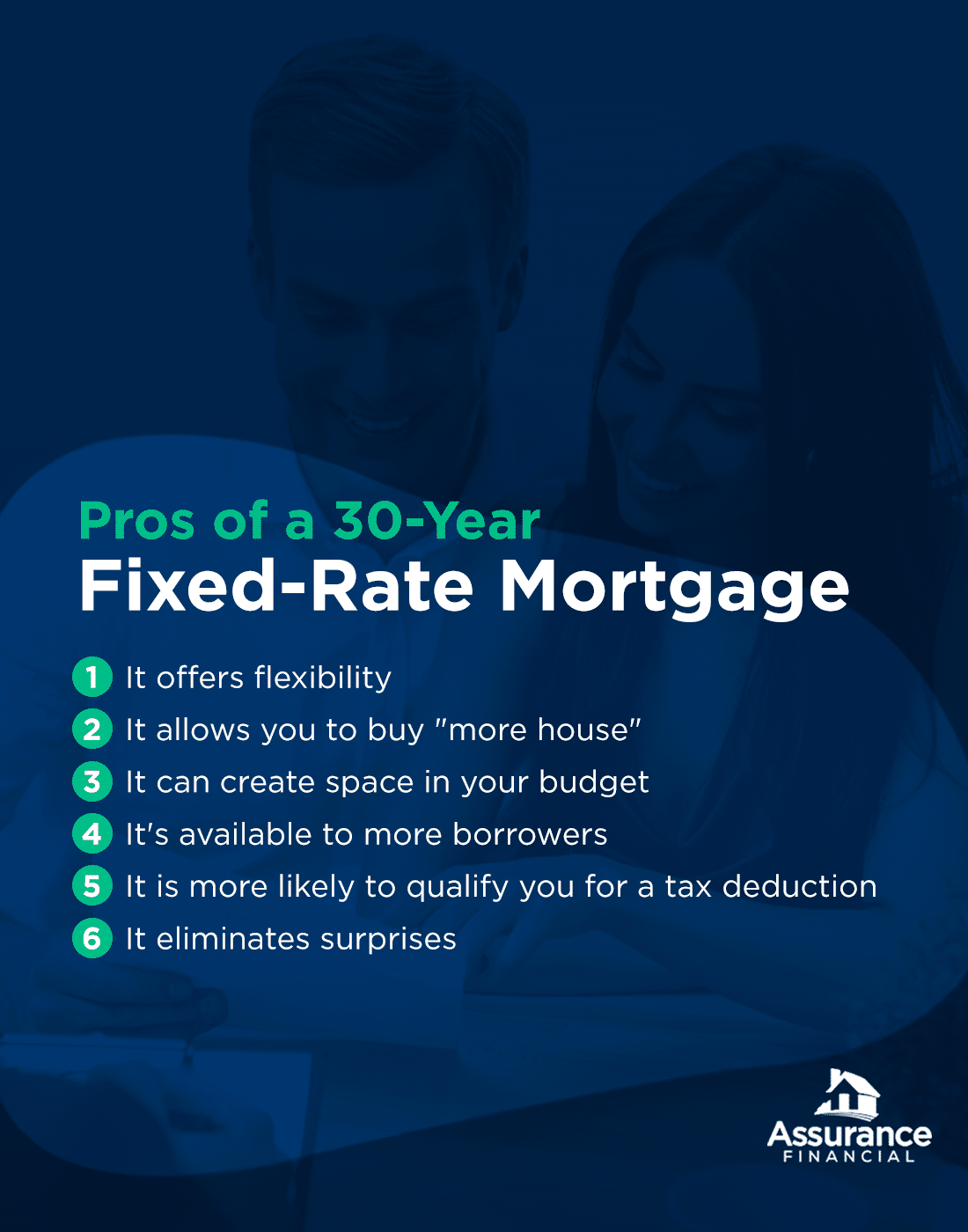

Pros of a 30-Year Fixed-Rate Mortgage

For many borrowers, the pros of a 30-year fixed-rate mortgage make it worthwhile.

1. A 30-Year Fixed-Rate Mortgage Offers Flexibility

When you take out a 30-year fixed-rate mortgage, you can stick to the amortization schedule provided by your lender or you can choose to pay extra on the loan, reducing your debt and speeding up the process of owning your home outright.

For example, you may decide to pay several hundred dollars more than you owe each month when you have the space in your budget to do so. But if your expenses increase or your income drops, you have the option of paying what’s due on the loan and holding off on making extra payments until you can afford it again.

2. A 30-Year Fixed-Rate Mortgage Allows You to Buy “More House”

You can often afford to buy a more expensive home with a 30-year mortgage compared to a 15-year loan, depending on your income. If you live in an area with high housing costs, a 30-year mortgage can make it easier to buy a home that meets your family’s needs and fits within your budget.

3. A 30-Year Fixed-Rate Mortgage Can Create Space in Your Budget

Since the monthly payment on a 30-year mortgage is often lower than the payment due on a 15-year loan, it can give you some wiggle room in your budget. You can use any additional income you have to pay down your home loan more quickly, or you can choose to save it for a rainy day or for another financial goal.

4. A 30-Year Fixed-Rate Mortgage Is Available to More Borrowers

Depending on your income and other financial circumstances, you might find it easier to qualify for a 30-year mortgage compared to other options. Since the monthly payments are lower for a 30-year compared to a 15-year mortgage, you can qualify for a 30-year loan with a lower income.

5. A 30-Year Fixed-Rate Mortgage Is More Likely to Qualify You for a Tax Deduction

You can deduct the interest you pay on your mortgage from your income each year, but it’s not always the most appropriate option. For itemizing your deductions to make sense, the amount needs to be more than the standard deduction.

In 2022, the standard deduction is $12,950 for single tax filers and $25,900 for married couples who file a joint return. For a head of household, the standard deduction is $19,400. Since you often pay more interest on a 30-year mortgage during the early years of repayment, it can make you more likely to save on your tax bill.

6. A 30-Year Fixed-Rate Mortgage Eliminates Surprises

A 30-year fixed-rate mortgage can be an ideal option for people who like predictability. You know what your payments are, so you can create a dependable budget. You don’t have to worry about costs increasing year after year, so it can eliminate some stress from your life.

Cons of a 30-Year Fixed-Rate Mortgage

A 30-year fixed-rate mortgage does have some drawbacks that are important to think about.

1. You’ll Pay More in Interest

Over the course of 30 years, you are likely to pay considerably more in interest on your mortgage than you would on a loan with a shorter term. For example, if you borrowed $160,000 with a 3.37% interest rate, you would pay $94,726.03 in interest over the 30 years. If you borrowed the same amount with the same interest rate for 15 years, you would pay $44,086.16 in interest over 15 years.

2. Interest Rates Are Usually Higher

You don’t just end up paying more interest over the life of your home loan when you have a 30-year mortgage. You might also have to pay a higher interest rate. Lenders consider risk when they set interest rates. A 15-year mortgage is typically considered a lower risk to a lender, as the term is shorter and there is less of a chance of a borrower defaulting. While 30-year mortgages are very common, they are also considered higher-risk and usually have somewhat higher interest rates.

3. Thirty Years Is a Long Time

Another thing to consider before applying for a 30-year mortgage is that 30 years is a relatively long time. It’s difficult to envision what your life will be like at the end of your mortgage term.

One thing to remember is just because your mortgage will be paid off in 30 years, it doesn’t mean you need to keep the loan for that long. If you can afford to pay extra toward the mortgage, you are free to do so. You can also sell your home before the 30 years is up and use the proceeds from the sale to pay off the mortgage.

4. It Will Take Longer to Build Up Equity in Your Home

Your home’s equity is the difference between the value of your home and the amount you owe on the mortgage. When you take out a mortgage with a shorter term, you pay down the principal relatively quickly, building up more equity in your home. With a 30 year loan, it takes longer to chip away at the principal, meaning you have less equity.

The longer it takes to build up equity, the greater the chance you may end up upside-down on the mortgage if the market takes a hit. When you’re upside-down, you owe more on the home loan than the house is worth.

5. It Can Be Harder to Put 20% Down

You might qualify for a bigger loan with a 30-year term compared to a 15-year term. But it can also be more challenging to come up with a sizable down payment when you’re buying a more expensive house.

For example, you’ll need $40,000 to put 20% down on a $200,000 house. The amount jumps to $60,000 for a $300,000 house. Not having 20% to put down doesn’t mean you can’t buy a house. It simply means you’ll have to pay PMI and you may not get the best possible interest rate.

6. You Might Buy More Home Than You’re Comfortable With

Another thing to consider when getting a 30-year mortgage is that you might end up buying more house than you can take care of or manage. Bigger houses tend to have higher upkeep costs. They also tend to require more care and attention compared to smaller, less expensive homes. For example, if you buy a home with a large yard, someone will need to take care of the yard.

Apply for a 30-Year Fixed-Rate Mortgage

When you find the home of your dreams, your next step is obtaining the right mortgage to fund your purchase. For many homebuyers, a 30-year fixed-rate mortgage is the best option, especially if you can secure a low interest rate and low monthly payments. At Assurance Financial, our team can help you achieve your dream of homeownership, and our services can offer you customized options to cover your home purchase.

We know that every homebuyer has individual needs, and as mortgage experts, we can help you identify the right solution for your unique financial needs. While buying a home is an exhilarating experience, it also requires a firm grasp of your financial situation, a thorough understanding of the terms you’re agreeing to and a long-term commitment to paying back a loan. Assurance Financial can help make sure you don’t run into any unexpected surprises on your homebuying journey and deliver the following advantages when you choose to work with us:

- Large range of mortgage loan options: To serve each of our homebuyers, we offer a variety of loan options, including conventional loans, FHA loans, VA loans and construction loans.

- Comprehensive approach to lending: We complete the entire lending process under a single roof, from application to closing.

- Versatile application process: You can choose whether you want to complete your application online or with the assistance of one of our loan officers.

- Recognition: We are approved by Fannie Mae, Freddie Mac and Ginnie Mae to service and issue mortgages.

If a 30-year mortgage with a fixed rate seems like a good option for you, applying for a home loan can be simple. Get started on your application today or schedule an appointment with a loan officer at a time that works for you.

Temporary setbacks can prevent you from being able to make your mortgage payments for a couple of months. In the wake of unexpected events such as COVID-19, a flood or other natural disasters, many Americans face unemployment, furloughs, illness and the death of family members. This challenging time may heavily impact your finances, and you may be wondering what to do if you can’t pay your mortgage.

While many homeowners may expect that an inability to make a monthly mortgage payment will immediately result in a default on the mortgage loan or foreclosure on their property, the reality is not so cut and dried. Fortunately, another possibility is mortgage forbearance.

What Is Mortgage Forbearance?

Mortgage forbearance refers to an agreement between you and your mortgage servicer to temporarily reduce or suspend your mortgage payments for a specific period. The option of mortgage forbearance can allow you to cope with your short-term financial difficulties by giving you some time to recover after a hardship. In some cases, there is government mortgage relief, and in others, the servicer may offer a special program of mortgage forbearance.

As part of this agreement, you agree to a plan for your mortgage that will bring you up-to-date on your payments over a set time. Essentially, you will need to repay these paused or lowered payments down the road after the temporary hardship has ended.

If you are dealing with a temporary hardship or are behind on your monthly mortgage payments or may soon miss a payment, mortgage forbearance may be an option for you.

Benefits of Mortgage Forbearance

What benefits can mortgage forbearance offer you during a time of temporary hardship? The following are a few of the benefits of mortgage forbearance:

- Suspends or lowers your monthly mortgage payment temporarily

- Allows you to avoid foreclosure or damage to your credit score

- Enables you to remain in your home

- Gives you time to get back on your feet and improve your current financial situation

Mortgage forbearance, then, is essentially pausing your payments. If you have been dealing with hardships due to COVID-19 and you can’t pay the mortgage this month, you may be able to pursue mortgage forbearance.

Frequently Asked Questions About Mortgage Forbearance

Here are a few of the frequently asked questions we receive about mortgage forbearance from homeowners:

- Do I have to repay missed payments? If your mortgage is in forbearance, you must repay your missed payments. Forbearance delays your payments, rather than forgiving them.

- Will interest on my mortgage continue accruing? Yes, interest on your mortgage will likely continue accruing while your mortgage is in forbearance, though this varies by

- Will mortgage forbearance affect my credit? No, opting for mortgage forbearance is unlikely to adversely impact your credit score unless your servicer reports it to a credit bureau. However, you may have trouble getting approved if you try to refinance your mortgage shortly afterward. Also, it’s a good idea to check your credit report each month to quickly resolve any issues that could arise.

- Can I pay my missed payments whenever I want? No, you cannot repay your missed mortgage payments whenever you want. Servicers handle mortgage modifications differently, so you may have to pay all of your missed payments in a lump sum or add them to the end of your loan term.

- Where should I apply for forbearance? You should apply for mortgage forbearance where you currently make monthly payments.

Mortgage forbearance is for homeowners who are dealing with a situation that causes financial hardships. In uncertain times, you may be worried about making your monthly mortgage payments, but before you stress, you should reach out to your servicer to discuss your options.

How Does Mortgage Forbearance Work?

To request mortgage forbearance, you should first contact your servicer. The exact specifics of how mortgage forbearance works depend on a few factors, such as your servicer, the type of mortgage you have, the underlying circumstances and how long you have been making monthly mortgage payments. Most terms for mortgage forbearance fall under one of two agreements.

- Suspended payments: Your servicer will agree to a mortgage pause for a specific period.

- Lowered payments: Your servicer will reduce your monthly mortgage payments, but you’ll need to pay them on the same schedule.

The goal of these agreements is to keep the bank from foreclosing on your home if you’re temporarily incapable of paying your monthly mortgage payments in full.

Mortgage Forbearance Terms

If you are eligible for mortgage forbearance, you and your servicer will discuss the terms, such as:

- The length of time your mortgage forbearance will last

- How you will repay your payments to your servicer after your mortgage forbearance ends

- Your reduced mortgage amount if you need to keep making monthly payments

- Whether your servicer will report your mortgage forbearance to credit bureaus

Speak with your servicer to determine how these terms will affect your monthly payments and total mortgage amount.

How Long Mortgage Forbearance Lasts

The length of the forbearance period depends on the amount of time you and your servicer agree upon, as well as what caused the setback and your likelihood of being able to return to making your full monthly mortgage payments. As such, a mortgage forbearance period may last for a couple of months or up to a year. Since the goal of mortgage forbearance is to provide relief to homeowners with short-term financial difficulties, it usually does not last for more than a year.

Your servicer may also ask you to provide updates during your mortgage forbearance period. If it seems like you’ll need a different type of assistance or an extension on your forbearance, you can speak to them and discuss your options.

Mortgage Forbearance Repayment Options

While your mortgage is in forbearance, your loan will likely continue accruing interest. After your mortgage forbearance period ends, you must repay the reduced or suspended amount. You will repay your servicer according to the forbearance terms you previously arranged.

With a mortgage forbearance, you may be able to choose from the following repayment options.

- Reinstatement: One of your repayment options is a one-time lump sum payment for your reduced or suspended amount.

- Added amount to subsequent mortgage payments: Another option for repayment is adding a specific amount to each of your monthly payments until you have repaid the full forbearance amount.

- Tack on missed payments: Finally, you may also be able to add the amount of your repayment to the end of your loan. Doing so will lengthen the term of your mortgage.

You may also be able to modify your past-due mortgage amount, which will change the terms of your loan so your payments can be more manageable. Modification is an option may be available to you if you do not have the funds to cover a repayment plan or reinstatement or if your financial hardship continues for a longer period than initially anticipated.

To qualify for mortgage forbearance, you may have to pay a higher interest rate on your monthly payments once they resume, or you may have to pay a one-time fee.

How to Apply for Mortgage Forbearance

As soon as you realize you are in danger of missing a mortgage payment, you may want to reach out to your mortgage servicer, which is the company you send your monthly mortgage payments to. If you are unsure who services your mortgage, you can find the company’s contact information on your mortgage statement.

Events like natural disasters may have time limitations related to initiating a mortgage forbearance, so you may want to contact your servicer as soon as possible. When you do so, keep in mind that during unpredictable times, servicers will be dealing with a high call volume and may also be struggling with upheaval.

When you reach out to your servicer, prepare to discuss the following.

- The event that led to the request: You will likely discuss with your servicer what event or circumstances caused you to request mortgage forbearance.

- Length of inconvenience: You may also discuss with your servicer whether you expect the problem to be short- or long-term.

- Actions you have taken: Another point of discussion may be what you have already done to rectify or avoid this situation.

It may be helpful to request that your servicer note your history of on-time payments. Aim to continue making your monthly payments while you are waiting for a decision from your servicer on mortgage forbearance.

While a bank does not have to approve your request for mortgage forbearance, during a time of nationwide difficulty, a servicer may be more inclined to help with your mortgage payments and approve your application so you can keep your home.

Who Qualifies for Mortgage Relief?

How do you know if you are an ideal candidate for mortgage relief programs? Though eligibility requirements for mortgage forbearance depend on the servicer, you will most likely start your request for mortgage forbearance by filling out an application. Depending on the servicer, you may apply online or by calling.

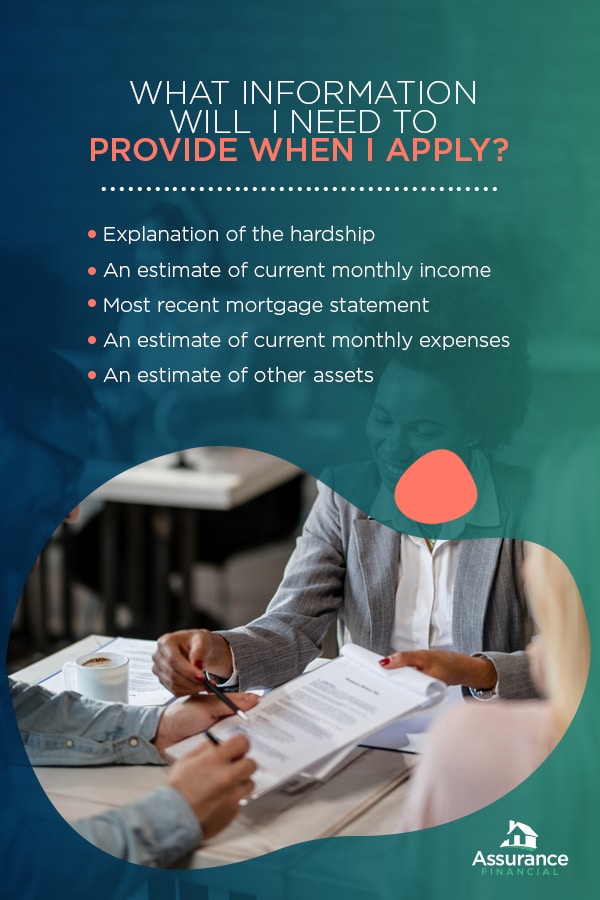

What Information Will I Need to Provide When I Apply?

When you fill out your online application or call your servicer, you may want to have the following information on hand.

- Explanation of the hardship: When you apply online or call your servicer, you may need to explain the hardship you are facing. If possible, you may also need to supply documentation that can substantiate your claim.

- An estimate of current monthly income: You may need to supply an estimate of your monthly income when you apply online or call your servicer. To demonstrate your income, you may need to provide your servicer with your income tax returns and paystubs.

- Most recent mortgage statement: When you call or apply, you may need to provide the most recent statement from your mortgage payments.

- An estimate of current monthly expenses: Along with your monthly income, you may also need to provide your servicer with an estimate of your monthly expenses, which include your monthly debt payments, such as student loans, car loans or credit card payments.

- An estimate of other assets: You may also need to provide your servicer with information about your other assets, such as how much cash you have in the bank.

Keep in mind that to qualify, you may need to put in your request for mortgage forbearance within a specific period after the natural disaster or change in circumstances. For example, your servicer may mandate that you request mortgage payment assistance within a month of filing for unemployment.

What If My Mortgage Forbearance Request Gets Denied?

If your servicer denies your application for mortgage forbearance, you may be able to appeal the decision. When you do so, a different loan officer who was not involved in the original decision will review the application you submitted. After this person goes over your application, you will receive an updated decision.

If you are still facing difficulty in reaching an agreement with your loan servicer, you may be able to find help elsewhere.

- Housing counselors approved by HUD: You may be able to discuss your situation with a housing counselor who has received approval from the U.S. Department of Housing and Urban Development. A housing counselor may discuss your options with you, such as a modified payment program.

- Lawyers: One option you may want to consider is reaching out to an attorney who may be able to provide you with legal resources and assistance.

- Credit counselors: If you are struggling to come to an agreement with your servicer, you may want to contact a credit counselor. Counselors typically work for nonprofit organizations and can advise you on your debts, money and budget. You may also receive assistance in negotiating with creditors.

During times of worldwide uncertainty, business shutdowns and staggering unemployment rates, you should pursue every option at your disposal for mortgage relief.

What Mortgages Qualify?

Which types of loans can you use mortgage forbearance for? To qualify for forbearance, mortgages must have backing from a federal agency or be federally owned. The new federal law known as the Coronavirus Aid, Relief and Economic Security Act, abbreviate as the CARES Act, has put new protections in place for homeowners who have federally backed mortgages. These protections are:

- A right to mortgage forbearance for the homeowners who are dealing with financial hardship as a result of COVID-19

- A foreclosure moratorium

If you are unsure who backs or owns your mortgage, you can take action using the following methods.

- Contact your loan servicer: You can ask the servicer of your mortgage about who backs your loan. Your servicer may be able to provide you with the name, address and contact information of the agency that owns your mortgage loan.

- Check online: You can use a lookup tool online via Fannie Mae or Freddie Mac to determine if one of these entities is backing your mortgage.

Government-Backed Mortgages

One of the following federal agencies may back mortgages that qualify for mortgage forbearance:

- Fannie Mae or Freddie Mac

- The U.S. Department of Veterans Affairs for VA loans

- The Federal Housing Administration for FHA loans

- The U.S. Department of Agriculture for USDA Rural loans

- The U.S. Department of Housing and Urban Development, also known as HUD

Mortgages the Government Doesn’t Back

What if you don’t have a federal agency backing your mortgage? Although the CARES Act may not require private servicers to offer relief, you may still be able to successfully apply for mortgage forbearance.

In the case of a natural disaster or national uncertainty, private mortgage servicers may adopt similar policies to those of federally backed loans. If a federal agency doesn’t back your loan, you can contact your servicer to ask what home loan relief programs they have available.

Similarly to a federally backed loan, if you and your servicer agree to mortgage forbearance or a loan modification, your bank will probably not report your paused or reduced payments to the credit bureaus.

Requesting Mortgage Forbearance or Relief

Under the CARES Act, you may have two relief options for a federally backed mortgage. Beginning March 18, 2020, the law has prohibited your servicer from foreclosing on your home for 60 days. If you are experiencing financial hardship as a result of COVID-19, you have the right to put in a request for mortgage forbearance for up to 180 days.

Beyond the scheduled amounts, you will not need to worry about penalties or additional interest or fees. The CARES Act also does not require you to submit additional documentation to your servicer to qualify for mortgage forbearance, other than your claim of financial hardship related to the pandemic.

You may also have other mortgage relief options from your state. Several states are considering or are implementing various options for home loan relief, so check your state’s website for further details.

What should you do after you have received mortgage forbearance or another mortgage relief option? Consider doing the following to further protect yourself.

- Monitor your mortgage statement: Monitor your mortgage statements every month to determine whether there are any errors.

- Store your written documentation: In case any errors arise on your mortgage statements, you may want to keep the written documentation available.

- Pay attention to your credit: You may also want to pay attention to your credit score to ensure that are no inaccuracies or errors.

- Contact your servicer once your income returns to normal: When your mortgage is in forbearance, you will need to pay your missed payments. However, with fewer missed payments, you will owe less later, so you should let your servicer know as soon as your income levels get back to normal.

If you can save money now, you may want to consider putting it away for later, when your payments are due.

Learn More About Mortgage Forbearance From Assurance Financial

At Assurance Financial, we can assist you with all of your mortgage needs. We use the technology that can help you get the mortgage loan you need as soon as possible, and we will provide you with end-to-end support so you can go through the entire process of applying for a mortgage loan under a single roof.

During times of global uncertainty, we still strive to provide you with stability and missed payment forgiveness. Our loan officers at Assurance Financial have a presence across the nation in 28 states and can assist you with any of your mortgage needs. To learn more about mortgage forbearance, reach out to a local loan officer or contact us at Assurance Financial.

Sources

In the U.S., nearly 10 million people are self-employed, and the number is expected to increase by nearly eight percent over the next few years. If you’re among the self-employed, you know things work slightly differently for you than for people who hold traditional W-2 jobs. Your income stream is different, and your tax situation is different. When it comes time to go through the mortgage process and buy a home, you might find things are different for a self-employed person, too.

There’s good news about buying a home with self-employment: It is possible. In fact, if you have good or excellent credit and can prove you have a steady stream of income, you might find your mortgage experience is similar to that of your traditionally-employed friends and family.

Best Mortgages for Self-Employed First-Time Buyers

Whether self-employed or not, multiple mortgage options are available to you. The type of mortgage that will best suit you depends on your credit, the amount you have saved for a down payment and where you’re hoping to purchase a home. Some mortgages are backed or guaranteed by the federal government, while others are not. If you’re self-employed and looking for a mortgage, consider these options:

1. Conventional Mortgage

The simplest way to describe a conventional mortgage is as a home loan that isn’t guaranteed by the government. When a lender issues a conventional mortgage, they are taking on more risk because the government isn’t there to pay back some or all of the loan balance if the borrower can’t.

Typically, conventional mortgages have tougher qualification requirements compared to other home loans. Borrowers typically need to have a very good credit score to qualify for a conventional loan. There’s also the issue of the down payment. Although people often think you need to put 20 percent down to get a conventional mortgage, you can put down less and still qualify.

If you put down any amount below 20 percent of the value of the home, you’ll have to pay private mortgage insurance, in addition to the principal and interest due each month. Once you’ve paid off at least 20 percent of the home’s value, you can ask the lender to remove the private mortgage insurance premium from your loan.

The term of a conventional mortgage can be up to 30 years. The longer the mortgage term, the more you’ll pay in interest over the life of the loan, but the lower your monthly payment will be. Conventional mortgages also offer the option of having a fixed interest rate, which stays the same for the life of the loan, or an adjustable rate, which fluctuates with the market.

2. FHA Loan

FHA loans are insured and guaranteed by the Federal Housing Administration (FHA). The FHA itself doesn’t make the loans. Instead, a mortgage lender or bank does. If a borrower defaults or isn’t able to pay back their mortgage, the FHA will step in. Since the FHA loan program offers extra protection to a lender, borrowers who might not have the best credit are often able to qualify for them.

FHA loans require a minimum down payment of 3.5 percent. If you have a higher credit score and can afford to make a bigger down payment — at least 10 percent — getting an FHA loan might not make sense for you, because of the fees and mortgage insurance requirements.

The loans require the borrower to pay mortgage insurance, in the form of a 1.75 percent fee at closing and a fee between 0.45 and 1.05 percent every year. Unlike a conventional mortgage, the annual mortgage insurance payment is often required for the life of the loan, even after a borrower has paid 20 percent of the value of the home. The only way to remove the mortgage insurance premium is to refinance to a conventional mortgage.

Like conventional loans, FHA loans are available in terms of up to 30 years. Interest rates can be fixed for the life of the mortgage or adjustable.

3. USDA Loan

If you’re self-employed and have always dreamed of living in the country or a relatively rural area, a USDA loan might be the mortgage that works for you. The USDA loan program provides mortgages with zero percent down on homes in designated areas. Two types of USDA loans are available: direct loans, which come right from the USDA, and guaranteed loans, which are made by a private lender. The guaranteed loan program is backed by the U.S. Department of Agriculture and guarantees up to 90 percent of the value of the loan.

Along with buying a home in an eligible area, you need to meet certain income requirements to qualify for a USDA loan. The mortgages are intended for people who have low to moderate incomes. The USDA provides an income eligibility calculator to use to see if your household falls below the maximum income threshold. Income maximums are based on the type of loan program. The maximum allowed income is lower for direct loans than it is for guaranteed loans.

It’s worth pointing out that although you can’t use a USDA loan to purchase a home in the middle of a major city or urban area, the “rural” requirements might not be as rural as you think. Many homes in suburban areas qualify for USDA loans.

4. VA Loan

A Veterans Affairs loan is a type of mortgage available to people who are either currently serving in the armed forces or who have in the past. How long you need to have served with the armed forces depends on when you were on active duty, usually anywhere from 90 days to 24 months. If you were married to someone who died while on active duty, you can also qualify for a VA loan.

Like USDA loans, VA loans allow you to buy a house without a down payment. Unlike FHA loans, there is no mortgage insurance premium required for VA loans. Interest rates on a VA loan also tend to be lower compared to other mortgages. Closing costs are also often lower, as well.

5. Bank Statement Loan

Unlike an FHA, VA or USDA loan, a bank statement loan isn’t a type of mortgage program. Instead, it’s a process of approving a person for a loan without requiring them to provide proof of income, such as a tax return. When issuing a bank statement loan, a lender looks at anywhere from one to two years worth of your bank statements to get a sense of your total incomings and outgoings.

A bank statement loan can be a viable option for a self-employed person who doesn’t have income tax returns or other verifiable proof of income. The trade-off is that the interest rate on the loan tends to be higher than for other options since the lender is taking on somewhat greater risk.

Self-Employed Mortgage Checklist

What You Need to Have When Applying for a Home Loan

Whether you go for a government-backed loan, a bank statement loan or a conventional mortgage, a lender is going to require a fair amount of documentation before approving you for a home loan. Some of the paperwork you will need to show a mortgage lender includes:

- Tax returns: You’ll need to submit business and personal tax returns if you have them. Your lender will look at your net business income to determine your eligibility. Depending on how long you have been self-employed, you might need to provide at least one or two years’ worth of returns.

- List of current debts and monthly payments: If you have any additional debts, you will have to let your lender know about them, including how much you pay toward your debt monthly. Having additional debt can affect the size of the mortgage you’re eligible for.

- Bank statements: If you decide to get a bank statement loan, you might need to provide up to 24 months’ worth of bank statements. Even if you verify your income using your tax returns, your lender will most likely still ask to see at one month’s worth of bank statements.

- Declaration of assets: Lenders also want to see proof that you have enough money for a down payment. You might need to submit a list of your assets, including money in savings account and investment accounts, when you apply for a mortgage.

- Additional sources of income: If you have other sources of income, such as alimony, Social Security or income from a job, your lender might want to see it, especially if it will affect your eligibility.

- Proof of current housing payment: You might need to give your lender canceled checks or other proof of payment for your current mortgage or rent.

- Verification of your business or employment: It’s not enough to say you’re self-employed. A lender will often want to see proof. The proof can be in the form of a business license, membership in a professional organization, letters from clients or a statement from your accountant.

In addition to documentation verifying your income, assets and debt, lenders might also ask that you fill out several forms, giving them permission to access certain information. For example, you might need to complete Form 4506-T, which gives the lender permission to access transcripts of your tax returns from previous years.

The exact documents required might vary from lender to lender. In some cases, there might be some flexibility from a lender. For example, if you don’t have one document, they might be willing to accept another in its place. What you need to provide might also vary based on your income and how long you’ve been self-employed. Usually, the higher your income and the longer your history of stable self-employment, the smoother the mortgage process will be.

What Lenders Like to See From Self-Employed Loan Applicants

Some self-employed mortgage candidates are more attractive to lenders than others. Buying a house if self-employed can be an easier process if you can show the lender what they want to see. A few things that will make your application more appealing and more likely to be approved include:

1. Good or Excellent Credit

The higher your credit score, the better, if you want to buy a house as a self-employed person. A good credit score is one that’s over 670, while an excellent score is one that’s over 800. Having a good to excellent credit score shows a lender that you have a history of making payments on time, of not taking on excessive amounts of debt and a decently long history of using credit.

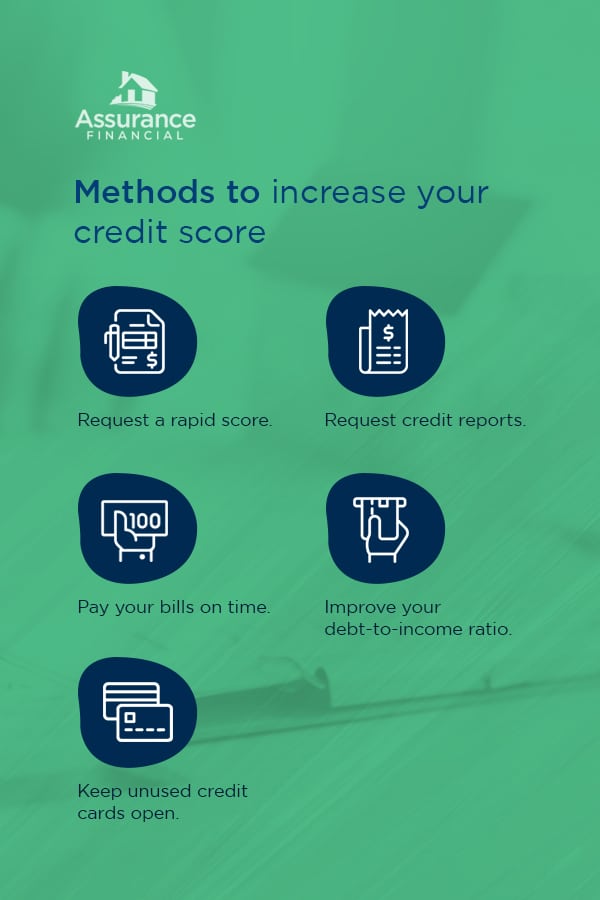

If you aren’t sure what your credit is, it’s a good idea to request your score before you start the mortgage process. If it’s not good, you have time to raise it before you apply or begin looking for a house. Some things you can do to increase your score include paying on time, paying off high amounts of debt and avoiding opening new accounts.

Usually, lenders will check your personal credit before approving or denying your mortgage application. If your business has a credit rating, they will also look at that.

2. Stable Income

For the most part, your business or self-employment track record should be on the up-and-up. A lender not only wants to see proof of steady income over the years, but they also want to see some evidence that your income has grown over time. If your income has dropped in recent years, that can be a red flag or cause for concern for a lender and can affect your ability to be approved or can affect the size of the loan you qualify for.

If you had one or two bad years but an equal number or more good ones, you probably don’t have too much to worry about when it comes to getting approved for a mortgage. Your lender is likely looking at the big picture, not at micro trends. If one bad year is followed up by several years of increasing or steady income, a lender will most likely still approve your application.

3. Money in the Bank

In addition to the money you are using for a down payment, a lender might want to see that you have a reserve of cash to use in case times are tight. Having a sizeable emergency fund, such as several months to a year’s worth of mortgage payments set aside can make you more attractive as a borrower.

Another reason why it’s a good idea to have money in the bank is that you might need it to cover the cost of repairs or other surprise expenses as a homeowner. Ideally, you’ll be able to avoid taking on additional debt after you buy your house to keep it in good condition.

4. Steady Work

Someone who works a full-time, salaried or hourly wage job usually gets up and goes to work for 40-hours a week. Self-employment work can be a little more difficult to quantify, but generally speaking, a lender wants to see that you have steady work available to you. There are a few ways you can show a lender that you have regular work. If you’ve been self-employed for a few years, your tax returns might be proof enough.

If you’re relatively new to self-employment, you might show a lender any contracts you have with clients or letters from clients that state that you are doing work for them. The contracts or letters could describe the nature of the work, including how long it might last.

5. Ample Down Payment

You don’t need to put down 20 percent to get a mortgage and a home as a self-employed person. But being able to make a larger down payment can improve your chances of approval. Generally speaking, people who can pay 20 percent upfront are seen as a lower risk compared to people who make a five or 10 percent down payment.

A bigger down payment shows a lender that you’ve been capable of saving up a considerable amount of money. It also sends the message that you’re invested in your new home and might be less likely to default, since you’re putting so much into it from the beginning.

6. Minimal Additional Debt

Ideally, you won’t be going into the process of applying for a mortgage as a self-employed person with a lot of other debt. Your debt-to-income ratio, or the amount of debt you have each month compared to your monthly income, should be on the low side. If you’re applying for a mortgage, 43 percent is usually the highest allowable debt-to-income ratio. As a self-employed person with a variable income, you might want to aim for an even lower percentage.

If you have a lot of debt, whether it’s credit card debt, student loans or a car loan, you might want to focus on paying it down before you apply for a loan, especially if you are self-employed.

APPLY TODAYCommon Misconceptions About Getting a Mortgage While Self-Employed

There are some misconceptions and myths out there about the process of getting a home loan as a self-employed person. Small business owners might need to provide a lender with more or a different set of paperwork compared to employees, but overall, the process of getting approved is very similar for each type of person. Here are a few common sources of confusion when it comes to mortgages for the self-employed:

1. Lenders Look at Your Gross Revenue

For many self-employed people, it’s not quite clear what income a lender will use when deciding the size of loan someone is eligible for or if they’re even eligible at all. Lenders don’t look at your gross income or revenue — the amount you bring in before expenses and other deductions. They also don’t use your adjusted gross income on your tax return. Instead, they look at your net business income — the amount you bring in after you subtract relevant business expenses. That can mean the size of the loan you qualify for is smaller, but also that you’ll be more comfortable paying it back.

2. You Always Need a Co-Signer If You’re Self-Employed

You can be the only person on a mortgage, even if you’re self-employed. As long as you have good or excellent credit and a verifiable source of income, you should be good to go getting your own mortgage. There might be times when having a co-signer can be helpful, such as if you don’t have adequate proof of income, but they aren’t a requirement.

3. You’ll Get Stuck With a Higher Interest Rate

The interest rate a self-employed person pays on their mortgage can be the same or even lower than the rate a traditionally-employed person pays. The factors that influence interest rates include your credit score, how much you put down and the length of the mortgage. If you have an excellent credit score, put down 20 percent and get a 15-year mortgage, you might end up with a rate that’s lower than an employed person with a lower credit score gets by putting down 10 percent on a 30-year mortgage.

Get Started on Your Self-Employed Mortgage Application Today

Ready to see what type of mortgage is right for you or if you qualify for a mortgage as a self-employed person? Assurance Financial can help. We’re a team of loan advisors who can help you find the right mortgage and walk you through the process from beginning to end, step by step.

You can apply online in 15 minutes with us 24 hours a day, seven days a week.

The amortization schedule is a record of your loan payments that shows the principal amounts and the interest included in each payment. The schedule shows all payments until the end of the loan term. Each payment should be the same per period — however, you will owe interest for the majority of the payments. The bulk of each payment will be the loan’s principal. The last line should show the total interest you paid and your principal payments for the full term of the loan.

The process of obtaining a mortgage can feel overwhelming, especially for first-time homebuyers. Many of the mortgage-related terms may be new to you, such as conforming loans, non-conforming loans, fixed interest rates, adjustable interest rates, and loan amortization schedules.

The amortization schedule for a mortgage is an essential component to understanding the breakdown of your payments during the term of your mortgage.

Still have questions or need more information? Below is an overview of what this article covers!

Topics Covered

- Loans That Get Amortized

- Loans That Don’t Get Amortized

- Pros and Cons of Amortized Loans

- Pros and Cons of Unamortized Loans

- Amortized vs. Unamortized Loans

Frequently Asked Questions

- Loan Amortization Definition

- What Is an Amortization Schedule?

- How Do Amortization Schedules Work?

- How to Calculate Amortization?

- What Are the Amortization Schedule Uses?

- What Are a Few Things to Keep In Mind About Amortization?

- Secure the Right Loan With Assurance Financial

Loan Amortization Definition

What is loan amortization? Loan amortization is the schedule of periodic payments for a loan and gives borrowers a clear picture of what they’ll be repaying in each repayment cycle. You’ll have a fixed, consistent repayment schedule over the entire period of your loan term.

1. Loans That Get Amortized

Amortization schedules are typically used for installment loans with known payoff dates, fixed interest rates and fixed monthly payments, such as:

- Mortgage loan: Most conventional home loans are 15-year or 30-year terms with a fixed interest rate. Though many homeowners may not keep their mortgage that long, such as if they sell their home or refinance, the loan functions as if you are going to keep it for the entire 15-year or 30-year term.

- Car loan: Many car owners obtain an amortized auto loan for a term of five years or less. Some drivers decide whether they can afford a car based on what their fixed monthly payment will be.

- Personal loan: A personal loan you can obtain from a credit union, bank or an online lender also tends to be amortized. Typically, personal loans are given for a term of three years at a fixed interest rate with a fixed monthly payment. Personal loans are generally used for debt consolidation or small personal projects.

You will pay these loans off with consistent payments until the balance is zero.

2. Loans That Don’t Get Amortized

Not every type of loan is amortized. The following are examples of loans that don’t get amortized:

- Mortgage loan: Most conventional home loans are 15-year or 30-year terms with a fixed interest rate. Though many homeowners may not keep their mortgage that long, such as if they sell their home or refinance, the loan functions as if you are going to keep it for the entire 15-year or 30-year term.

- Car loan: Car owners typically get an amortized auto loan for a term of five years or less. Some drivers decide whether they can afford a car based on what their fixed monthly payment will be.

- Personal loan: A personal loan you can obtain from a credit union, bank or an online lender also tends to be amortized. Typically, personal loans are given for a term of three years at a fixed interest rate with a fixed monthly payment. Personal loans are generally used for debt consolidation or small personal projects.

If you apply for any of these types of loans, don’t expect an amortization schedule.

3. Composition of an Amortized Loan Payment

Payments for your loan go toward:

- Principal: This portion of your payment goes toward reducing the balance of your loan.

- Interest: This portion of your payment is what you pay your lender for loaning you money.

You make payments in regular installments of a set amount, though the ratio of interest to principal changes over the repayment period. This change in the ratio of interest to principal is detailed further in a loan amortization schedule.

What Is Amortization?

Amortization lowers the book value of a loan by spreading regular payments out over a set period of time. Amortization can also apply to an intangible asset, and in this case, works similarly to depreciation. You make consistent payments on a loan, gradually lowering its total value until the loan is completely paid off.

Getting a loan is much more appealing than having to save for the full price of a house or car, and amortization is the process of breaking up the loan, making it an accessible payment method. Calculating how long it will take to pay off the loan with amortization can help you forecast your monthly costs.

What Is an Amortization Schedule?

A table that shows periodic loan payments is referred to as an amortization schedule. You may also hear this referred to as a mortgage amortization schedule or mortgage amortization table. This amortization schedule includes the amount of principal and interest within each payment. Each monthly payment is listed to the end of the loan term, when the loan will be paid off. Each payment is the same throughout the amortization schedule.

Early in the amortization schedule, the payments are applied mostly to the interest of the loan, whereas the payments later in the schedule are applied mostly to the principal of the loan. The percentage of every payment that is paid toward interest continually decreases, while the percentage of each payment that goes toward the principal of the loan continually increases. This means the balance of the principal of your loan will not decrease much in the earlier part of your repayment schedule.

Though the amount of interest and principal you’ll be paying off differs each month, your total payment will be the same month to month. This makes budgeting easier for the years that you have the loan. You can also find the total of the principal payments and interest for your entire loan balance in the last line of your amortization schedule.

How Amortization Schedules Work

What is included in an amortization schedule?

- Interest costs: For every payment, a portion goes toward paying off interest. The interest of each payment is calculated by multiplying the remaining balance of your loan by the interest rate.

- Principal repayment: After applying the interest charge, the rest of the payment goes toward paying down the principal of the loan.

- Scheduled monthly payments: Each of your monthly payments is listed individually for the entire duration of your loan.

The interest of a loan is calculated based on the loan’s most recent balance. When a payment exceeds the amount of interest, this payment reduces the principal. The interest rate is then applied to this new principal balance, and because the balance is lower, the amount of interest will also be lower. This is why the interest and principal in an amortization schedule have an inverse relationship. As the portion of interest in a payment decreases, the portion of principal in the payment increases.

The amortization schedule will generally contain seven columns:

- Month: This is simply a number that denotes each month of your repayment period.

- Beginning balance: This is the principal balance you have at the beginning of each new month before you make a loan payment.

- Scheduled payment: This is your monthly loan payment. This number will be the same every month.

- Principal: This is the amount paid toward your principal with every payment. Each month, this number will increase.

- Interest: This is the amount paid toward your interest with each payment. Every month, this number will decrease.

- Ending balance: This is the balance of your loan after you make your monthly payment.

- Total interest: This column keeps track of how much you have paid toward interest so far. The final row will show you how much interest you’ll pay in total over the duration of the loan. Your amortization table may or may not include this cumulative interest amount.

The number of rows in your amortization table depends on the term of your loan. For example, if you have a 30-year mortgage, you’ll pay your loan off over the course of 360 months. This means your amortization table will have 360 rows.

Alternatively, the columns of your amortization schedule may be each month of your loan term, while the rows are your beginning balance, payment, principal, interest, ending balance and total interest.

When you calculate the amortization of your loan, you can create your own table with this information for the duration of your loan.

APPLY TODAY

How to Calculate Amortization

How do you calculate amortization? To create an amortization table, you have a few options:

- Use an online loan amortization calculator that will create the amortization schedule.

- Use a spreadsheet to create an amortization table and analyze your loan.

- Create an amortization table by hand.

If you want to set up your own amortization table, whether by hand or on a spreadsheet, you’ll need to know how to perform the calculations.

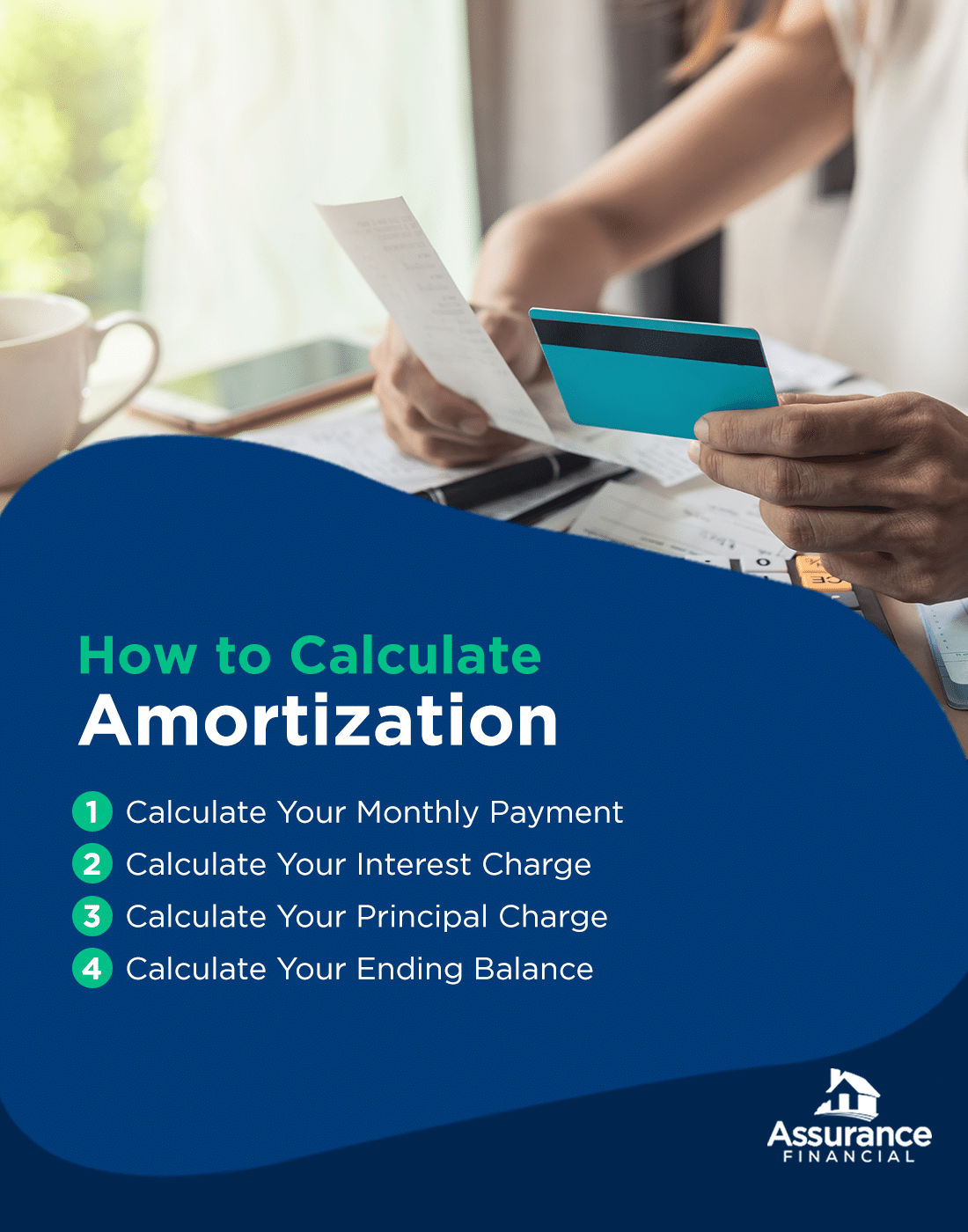

To calculate the amortization of your loan, follow these steps:

- Calculate your monthly payment: This number will be the same every month.

- Calculate your interest charge: To do this, multiply your beginning balance by your monthly interest rate. Your interest charge will decrease every month.

- Calculate your principal charge: To do this, subtract your interest charge from the monthly payment. This number will show how much you’ll pay toward the principal that month.

- Calculate your ending balance: To do this, subtract the beginning balance by the amount of principal paid that month. This number will be your ending balance for that month.

- Repeat steps 2 to 4: Use the ending balance from step 4 as your beginning balance for the next month.

1. Calculate Your Monthly Payment

To calculate your monthly payment, you’ll need to know the amount of your loan, the term of your loan and your interest rate. These three factors will determine how much your monthly payment is and how much interest you’ll pay on the loan in total.

If you lower the principal or interest rate of your loan, you’ll also lower your monthly payment and save money. You can also lower your monthly payment by increasing the term of your loan, but you’ll ultimately pay more in interest.

You can calculate your monthly loan payments using this formula: M=P[r(1+r)^n/((1+r)^n)-1)]. If this formula seems overwhelming, don’t worry. The calculation is actually pretty simple:

- M: This denotes your monthly mortgage payment.

- P: This denotes the principal amount of your loan. For example, if your loan is $100,000, this is the number you would plug in for P.

- r: This denotes the monthly interest rate for your loan. The interest rate you’re given for your loan is an annual rate, which means you’ll need to divide this number by 12, as there are 12 months in a year. This will give you your monthly rate. For example, if your interest rate is 4.5%, your monthly rate is 0.045/12=0.00375.

- n: This denotes the total number of payments you’ll make on your loan. For example, a 30-year mortgage will have 360 payments. You can calculate this number by multiplying the number of years for your loan term by 12, which is how many months there are in a year. 30×12=360.

For example, use the numbers above:

- Starting balance: $100,000

- Monthly interest rate: 0.00375

- Total number of payments: 360

M=100,000[0.00375(1+0.00375)^360/((1+0.00375)^360)-1)]

The monthly payment for a $100,000 mortgage at an annual interest rate of 4.5% for a 30-year term is $506.69.

2. Calculate Your Interest Charge

The next step is calculating the interest charge. Multiply your beginning balance by your monthly interest rate. Again, to calculate your monthly interest rate, divide your annual interest rate by 12.

- 4.5%/12=0.00375

For the first payment of the above example, you’ll multiply $100,000 by 0.00375. This gives you an answer of $375.

- $100,000×0.00375=$375

This is the interest you’ll pay the first month. Keep in mind that your interest charge will decrease every month.

3. Calculate Your Principal Charge

Then, to figure out your principal charge, subtract your interest charge from your monthly payment. For the above example, subtract your interest charge of $375 from your monthly payment of $506.69.

- $506.69-$375=$131.69

This remainder of $131.69 is what you’ll pay in principal the first month.

4. Calculate Your Ending Balance

Finally, you’ll calculate your ending balance for that month. To calculate this ending balance, subtract the amount of principal you paid that month from the balance of your loan.

For the first month of the above example, subtract your loan balance of $100,000 by the principal charge of $131.69.

- $100,000-$131.69=$99,868.31

This ending balance will be the beginning balance of the next month. Repeat steps two through four for each month of your amortization schedule. If you’re calculating your amortization table yourself, you can check your math with an amortization schedule calculator.

Amortization Schedule Uses

An amortization schedule can help you understand exactly how borrowing a loan will work and how it will impact your finances.

1. Figuring Out What Borrowing Will Truly Cost

An amortization schedule provides you with details about your loan. You’ll get a comprehensive picture of your loan beyond your monthly payment. You can track exactly how much of your payments are going toward principal versus interest and how much you’ll be paying for interest in total.

Though many consumers base the affordability of a mortgage or a car loan on the monthly payment, the interest expense is a better way to assess the true cost of what you’re buying. In fact, lower monthly payments can actually mean you’re paying more in interest.

For example, a $100,000 mortgage will have a higher monthly payment at a 15-year term than a 30-year term, but you’ll pay much more in interest for a 30-year term than a 15-year term. With an amortization table, you’ll know how much interest you’ve paid so far or during a certain year, along with how much principal you still owe. Additionally, an amortization schedule will also help you calculate how much equity you currently have in your home.

2. Making the Right Decision

Having the full picture of your loan will also help you decide which loan is right for you. You can compare different loan options and terms, such as how much you may be able to save if you obtain a lower interest rate.

With an amortization schedule for your mortgage, you can also calculate how much you might save by making early payments. When you pay off your debt early, you’ll save money by paying less in interest. You can also calculate how much more you’ll need to pay every month to pay off your mortgage early, such as in 20 years rather than 30 years.

Amortized vs. Unamortized Loans

For most borrowers, amortized loans are the better, more common option, though whether an amortized loan is right for you depends on your circumstances.

1. Pros and Cons of Amortized Loans

Amortized loans allow borrowers to pay principal and interest at the same time, so you’ll gain equity in your asset while you’re paying off your loan. You also know exactly how much you’ll be paying each month for the duration of the loan repayment period, which makes financial planning much easier. With an amortized mortgage schedule, you’ll know how much your mortgage will cost you every month this year, next year and 30 years from now.

Because borrowers pay both principal and interest at the same time, monthly payments can be higher. With an amortized loan, some borrowers may also be unaware of the loan’s real cost, as they focus more on the monthly payment and disregard the total interest the loan will cost them.

2. Pros and Cons of Unamortized Loans

Unamortized loans, on the other hand, are attractive to borrowers because of their interest-only payments, which tend to be lower than amortized loan payments of combined principal and interest. The monthly payments for unamortized loans are also easier to calculate since you only have to worry about the interest. These lower, interest-only payments allow borrowers of unamortized loans to save up enough to make a large lump sum payment.

For consumers who rely on lump-sum income, such as commission, bonuses or payment from contracts, unamortized loans tend to be a better financial option.

However, since you’ll be paying lower payments of interest-only, you’ll have to make a large payment toward the end of your repayment period, known as a balloon payment. This lump-sum payment will go toward the principal of your loan. Planning ahead with an unamortized loan is crucial to ensure you save up enough to make that large payment down the road. Additionally, because you aren’t initially paying any principal of the loan, you’re also not gaining any equity in your home or vehicle while making your interest-only payments.

For many borrowers, amortized loans are a better option. Home loans, car loans and personal loans tend to be amortized, but some mortgages, like balloon loans, can also be unamortized. Compare costs and take a good look at your personal finances to determine which is the right option for you.

Things to Keep In Mind About Amortization

Keep in mind the information that amortization tables don’t account for. This information includes:

- Fees: An amortization table generally doesn’t include additional fees for your loan, such as closing costs on a mortgage or origination fees.

- Additional expenses: Your amortization schedule doesn’t include every cost related to your home. You may also have to pay expenses such as property taxes or private mortgage insurance (PMI) that aren’t included in your amortization schedule.

- Extra payments: A standard amortization schedule won’t account for extra payments. You can make an extra payment on your mortgage to pay your debt down early, but you may have to use your own amortization schedule to calculate the benefit of making an extra payment and how this will affect your remaining loan payments.

Though an amortization schedule breaks down your loan payments by month and illustrates exactly what you’ll be putting toward principal and interest in each payment, this amortization table may not provide a complete picture of how much your asset will cost you. When deciding how much home you can afford, for example, keep in mind that there are costs beyond monthly payments and interest to consider.

Amortization Schedules FAQ

Below are some commonly asked questions about amortization schedules:

1. What Is the Purpose of an Amortization Schedule?

Looking at individual payments will allow you to compare loan options more easily. You will be able to tell how much the accrued interest of each loan would cost each month. You will understand the interest rates of each type of loan better, and without having to visualize that information, you can select the option that works best for you.

Amortization schedules also help you stay on track for completing your payments once you secure a loan. They are handy if you ever need to refinance, and they continue to be useful for tax purposes, if needed.

2. What Does an Amortization Schedule Show?

The amount you borrow is the principal amount, and the interest is what the lender charges for their services. Your schedule should show both values, so you will see how much the interest costs. It’s easier to look at an amortization schedule than to estimate how much you will pay monthly or to calculate the numbers on your own.

3. How Do I Get an Amortization Schedule?

An amortization schedule will be provided when you close on a loan. You can also use an online calculator tool. With the right information, creating one yourself in Excel or a comparable program can save you some time when you’re still deciding on a loan.

Secure the Right Loan With Assurance Financial

Are you comparing your loan options? Want to make sure your loan is affordable over a long-term period? Find a loan officer who can help you create your ideal amortization schedule with Assurance Financial.

[download_section]

Popular Loan Types

- First Time Home Buyer Loans

- FHA Loans

- Conventional Loans

- Construction Loans

- VA Loans

- Jumbo Loans

- Refinancing

Additional Resources You May Also Like

You purchased your home a few years ago and have been enjoying living in it for a while now. After making payments on your home’s FHA loan for some time, you’re starting to wonder, “Can I refinance from an FHA to a conventional loan and get a better interest rate, lower monthly payments or a combination of the two?” In 2020, repeat refinances accounted for 10.1% of all refinances. In some of those cases, people who had initially taken out an FHA mortgage decided to switch to a conventional loan.

While FHA loans have their benefits, they can end up costing a homeowner more over the long run. Learn more about the difference between an FHA loan and a conventional mortgage, and see if it’s time for you to refinance an FHA loan to a conventional one.

What Is the Difference Between an FHA Loan and a Conventional Loan?

For many buyers, getting an FHA loan makes sense. These loans are designed to help people buy homes by removing some of the typical barriers to homeownership, such as the need to have a significant down payment and an excellent credit score.

There’s a common assumption that FHA loans are only for first-time buyers and that conventional loans are for people who have experience purchasing a property. The reality is that both first-time and repeat buyers can obtain either an FHA loan or a conventional loan. Learn more about the differences between the two types of mortgages.

What Is an FHA loan?

An FHA loan is a mortgage that is guaranteed or insured by the Federal Housing Administration (FHA). The program began in the mid-1930s, and since then, the FHA has insured more than 40 million mortgages.

One common misconception about FHA mortgages is that they come from the government itself. While the FHA acts as the guarantor on the loans, private banks and lenders issue the mortgages themselves. As long as the government approves the lender you’re considering, you can get an FHA loan.

Buyers who apply for an FHA loan may have the option of putting down as little as 3.5% when they buy their home. They may also be allowed to have a lower credit score compared to people applying for conventional loans. FHA loans offer the option of choosing a fixed-rate mortgage or an adjustable-rate loan. Borrowers may also choose from a variety of loan terms, such as 15 or 30 years.

How Do FHA Loans Work?

While the federal government doesn’t make FHA loans, it does insure them. That means if a borrower has trouble making mortgage payments and falls behind, the lender can file a claim with the FHA. After the lender forecloses on the buyer’s home, the FHA pays the lender the loan’s balance. Since lenders know they are likely to get paid no matter what, they are more willing to lend money to people who would otherwise be considered too risky for a home loan.

The FHA’s guarantee does come at a cost, though, and it’s usually the borrower who pays the price. FHA loans typically have two forms of mortgage insurance. The first is an upfront mortgage insurance premium payment typically around 1.75% of the loan’s principal amount. You pay this amount at closing.

The second form of mortgage insurance is a monthly insurance payment, which can be anywhere from 0.45% to 1.25% of the initial principal. The monthly insurance payment usually remains for the life of the loan and can add several hundred dollars to a person’s monthly mortgage payment.

What Is a Conventional Loan?

A conventional loan is a mortgage that is not guaranteed by a federal agency such as the FHA. Since conventional loans don’t offer lenders the guarantee that the loan will get paid, they often have stricter requirements compared to FHA loans. Despite that fact, the majority of home buyers use conventional loans to purchase a home. In 2020, 69% of new houses sold using a conventional loan as the source of financing.

Usually, if a person is interested in applying for a conventional loan, they need to make a down payment of at least 3% and have a credit score of at least 620. The more a person can put down, the better the terms of the mortgage. The higher a person’s credit is, the lower the interest rate. While you can get a conventional loan with a lower credit score, many lenders offer the best rates to people with scores in the 700s.

You might have heard the traditional advice to put down at least 20% of the value of the home when you apply for a conventional mortgage. Generally, making a down payment of at least 20% eliminates the need to pay private mortgage insurance each month.

If a buyer puts down less than 20%, they are usually responsible for paying a private mortgage insurance premium every month. The amount of the premium can vary based on the value of the home compared to the amount of the loan and a person’s credit score. Once the loan-to-value ratio on a mortgage has reached 80%, you can ask the lender to remove the mortgage insurance. The lender should remove mortgage insurance automatically once your loan-to-value ratio reaches 78%.

Understand What Separates an FHA and a Conventional Loan

There are some notable differences between an FHA loan and a conventional mortgage. The list below should help you compare the differences at a glance.

1. Credit Score

Your credit score will influence which type of loan you are eligible to receive. Your credit score should be:

- FHA: As low as 500 with a 10% down payment, and 580 for a 3.5% down payment.