Massachusetts Home Loans

Since the earliest days of our country’s history, Massachusetts has been a remarkable place to live. From the economic metropolis of Boston to peaceful, small-town life in the Berkshire Mountains, this state has something for every type of homeowner. Assurance Financial has loan officers in Massachusetts to simplify the mortgage application process.

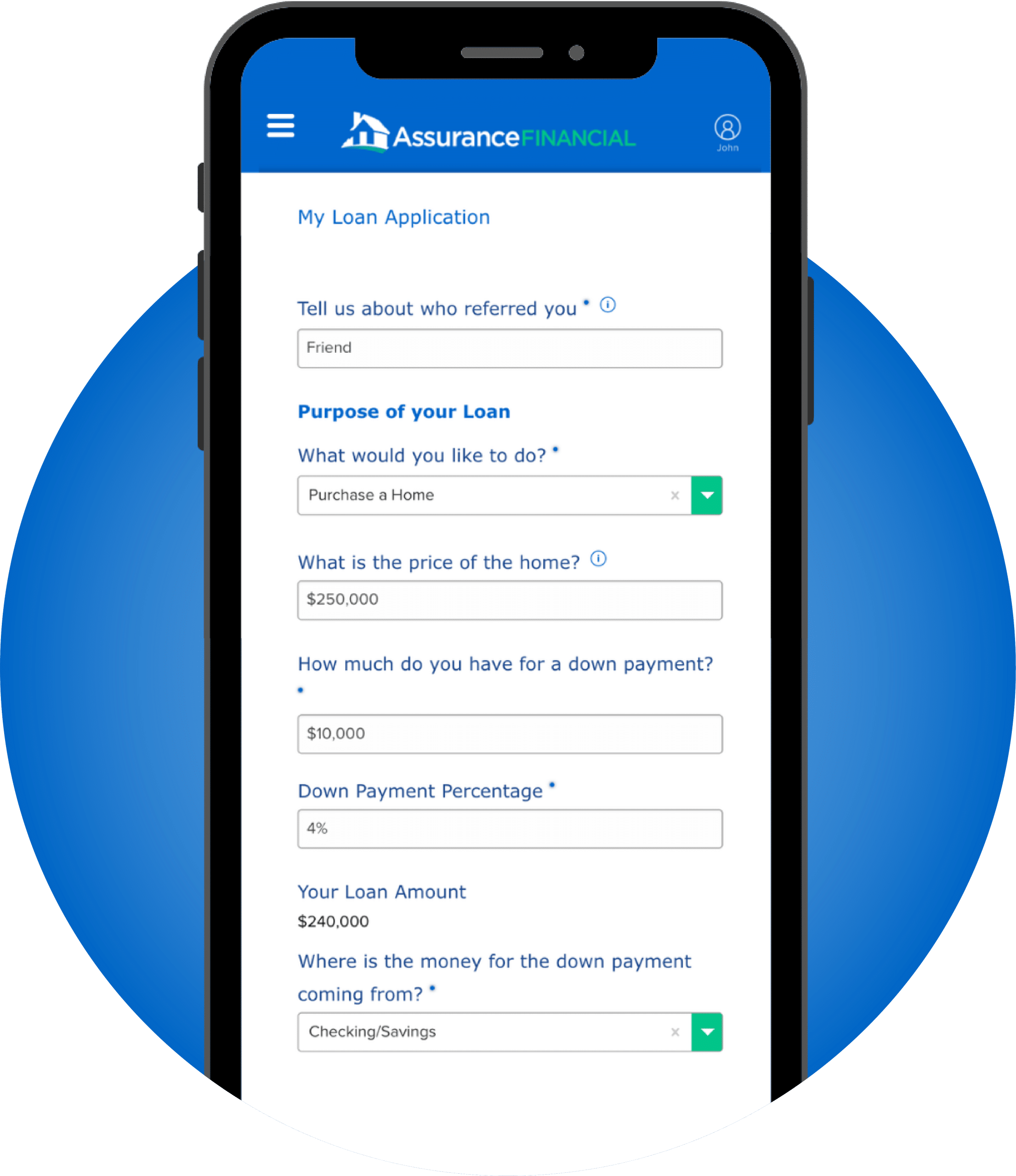

Get prequalified online in as little as 15 minutes — then turn to the friendly people at Assurance Financial to help make your dream of owning or refinancing your home a reality.

Get Help Near You

At Assurance Financial, we offer the convenience of an easy, online application process with the personalized advice of a real person to guide you through loan approval. Find help in the following Massachusetts cities:

Loan Types We Offer in Massachusetts

Whether you’re a first-time Massachusetts home buyer, investing in real estate or remodeling your beloved property, we have a financial option to suit you. Let us guide you toward the proper loan for your life stage.

Conventional Mortgages

If you have a strong credit score and a stable debt-to-income ratio (DTI), a conventional loan allows for great flexibility in terms of down payments, loan terms and competitive rates.

FHA Loans

Don’t let past financial challenges stop you from owning a home. FHA loans are insured by the Federal Housing Administration, making it easier to get qualified, even for those with lower credit scores.

VA Loans

Massachusetts is home to hundreds of thousands of veterans who have served this country. VA loans offer eligible veterans and active-duty military significant advantages when it comes time to purchase, build or refinance a home.

USDA RD Loans

Are you looking to settle in one of the smaller towns or rural communities of Massachusetts? The United States Department of Agriculture sponsors USDA loans, which offer great benefits like zero down payment requirements and low interest rates.

Jumbo Loans

If you have your sights set on a home that’s more expensive than the Federal Housing Finance Agency (FHFA) limits for conforming loans, we can help you explore jumbo loan options.

Programs for First-Time Massachusetts Homebuyers

Is this your first time purchasing a home? Massachusetts offers several statewide programs for first-time homebuyers, including:

- MassHousing mortgages: These affordable Massachusetts home loans offer competitive, fixed interest rates, down payment assistance and job loss protection through MI Plus.

- MassHousing down payment assistance (DPA): DPA provides up to $30,000 in assistance with no or low interest rates to cover down payment and closing costs.

- ONE Mortgage Program: Offered by the Massachusetts Housing Partnership (MHP), this 30-year fixed-rate loan features a 3% down payment and eliminates private mortgage insurance (PMI).

- MassDREAMS Grant Program: This program offers $50,000 in down payments and closing costs to first-time buyers living in disproportionately impacted communities.

Move From House-Hunting to Homecoming in Massachusetts

Assurance Financial is more than an online mortgage lender. We connect you with nearby loan officers licensed in Massachusetts with the localized expertise to help you find the right loan for your homebuying, refinancing or renovation goals.

Get prequalified online to start your mortgage journey with The People People — bringing a personal, person-centric approach to the mortgage process.