Pennsylvania Home Loans

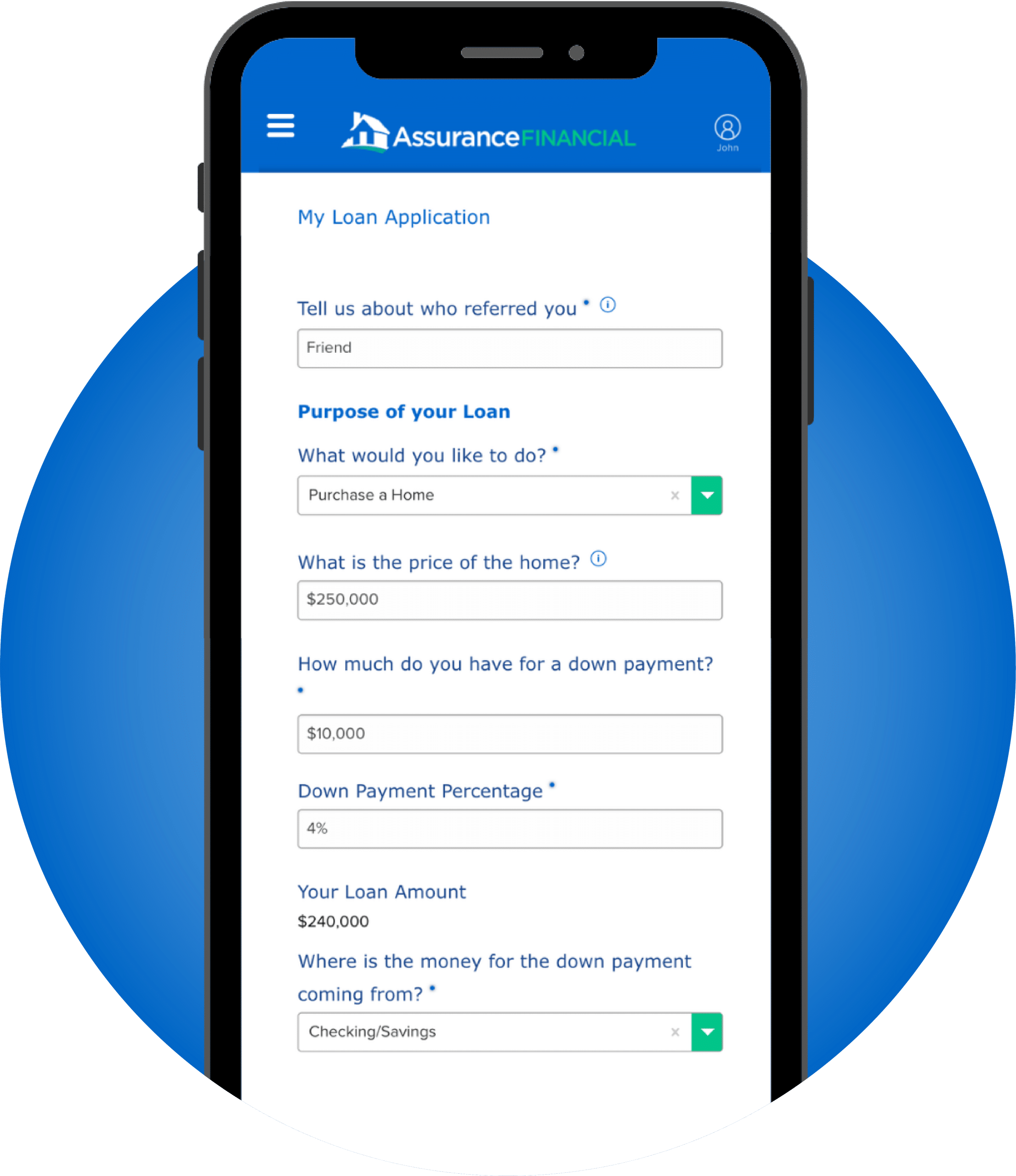

Our team is happy to help you purchase a home in Pennsylvania. With Assurance Financial, you gain all the convenience of online application processes combined with the personalized service of local experts.

We have loan officers in your state ready to assist you through every stage, from prequalification to purchase. Our wide variety of loan options helps you find the ideal one for your situation. Get prequalified in as little as 15 minutes.

Get Support Nearby

While online loan services are helpful, sometimes it pays to have dedicated support from a local expert. We serve the following Pennsylvania cities:

The Loan Types We Offer in Pennsylvania

With a rising inventory of home options available in the Keystone State, start exploring your financial options. Assurance Financial offers loans for every type of homebuyer, from first-time buyers to seasoned experts.

Conventional Loans

These mortgages aren’t government-backed, meaning you often get additional flexibility with terms up to 30 years, which can influence your monthly payment. To qualify, you must have strong credit and a stable income.

First-Time Homebuyer Loans

Remove some of the barriers and costs associated with homeownership using a first-time homebuyer loan. These lending options apply to those who have never purchased a home or haven’t owned a home within the past three years.

USDA RD Loans

The United States Department of Agriculture (USDA) Rural Development (RD) loan rewards those who seek to purchase homes in rural or suburban areas. It gives you great benefits, such as low rates and the opportunity to buy a property with zero down.

VA Loans

These loans from the United States Department of Veterans Affairs give you the opportunity to buy a home after serving your country. You gain benefits like lower down payments and no need for mortgage insurance.

FHA Loans

Get a second chance at homeownership, even if you’ve faced past financial challenges. These loans, secured by the Federal Housing Administration (FHA), offer lower credit score and down payment requirements.

Construction Loans

Build or renovate a home with a loan that covers expenses, including labor costs and construction materials. Once you complete the work, you can roll financing over into a more traditional mortgage.

Non-QM Loans

With a nonqualified mortgage, you can find financial options even if you fall outside the traditional borrowing requirements. These mortgages benefit self-employed business owners with unique income streams.

Jumbo Loans

If the home you want to purchase falls outside the limits set by the Federal Housing Finance Agency (FHFA), we offer jumbo loan options to help you buy the property.

Home Equity Loans

You can use your home’s equity as collateral to finance major expenses, especially related to your home, such as repairs or renovations.

Move From House-Hunting to Homecoming in Pennsylvania

Assurance Financial is a PA mortgage lender that offers local support to make your homebuying dreams a reality. We stand out for several reasons, including:

- In-house services: We process all loans in-house for convenience and enhanced customer service.

- Licensed advisers: Our loan officers are licensed in 28 states, including Pennsylvania, offering the localized expertise you need.

- Extensive service record: We’ve been serving homebuyers since 2001, so we have years of expertise regarding mortgages and lending.

Discover Your Homebuying Power

Start your mortgage journey by getting prequalified online. Our team will reach out to guide you through the next steps in buying a home in Pennsylvania.