6000 Fairview Road, Suite 1200A

Charlotte, NC 28210

225-448-2680

North Carolina Mortgage Lenders

Hello, and welcome to Assurance Financial, your source for extensive mortgage options in North Carolina. We are an independent, full-service residential mortgage provider that gives you the financial backing you need to buy a home in the state.

As this southeastern state grows, many new residents seek to buy homes. People choose it for its rich natural beauty, big cities and beautiful beaches.

Come to us for whatever type of home loan you need in North Carolina. We deliver solutions for everyone, from retirees looking for second homes to those in agriculture who want a rural property. Our blend of personalized service and advanced technology solutions enhances the homebuying process.

Where to Find Us

We’re conveniently located in North Carolina’s biggest city. Our office in Charlotte supplies mortgage options to those in and around the area. The location has a dedicated, professional team that’s always ready to serve you.

Choose a Suitable Mortgage Type

Charlotte has a competitive homebuying market but plenty of options for homeowners, ranging from single-family to multifamily. Whether you prefer urban or suburban living, we can help you get a home loan in North Carolina to move into your desired property.

Non-Qualified Mortgage

Our loan officers find financial options even for those in nontraditional situations. These solutions are great for self-employed business owners and investors.

First-Time Home Loan

Settle down in a place you can call your own with options that lower the barriers to entry. You may gain benefits like discounted private mortgage insurance and a 30-year fixed rate.

Conventional Loan

If you’ve bought a few homes, you’re familiar with the process and have the necessary credit and income for a traditional loan. We can help you get a suitable mortgage for your situation.

USDA RD Loan

Rural Development (RD) loans from the U.S. Department of Agriculture (USDA) create advantages for those seeking suburban or rural property.

FHA Loan

This alternative financing option gives you more flexibility. Consider a Federal Housing Administration (FHA) loan for a lower down payment and more flexible credit options.

Jumbo Loan

As a private North Carolina mortgage lender, we offer lending options for luxury homes and more adaptations to tailor the mortgage to your situation.

Construction Loan

If you can’t find the perfect house, build your own with a construction loan. We also lend to those seeking to remodel their current homes.

VA Loan

The Department of Veterans Affairs (VA) offers this loan to help service members and their families buy homes. We’re proud to honor military personnel through this lending option.

Home Equity Loan

With home equity loans or lines of credit, you can transform your home value into cash to use for other purposes, such as paying off debt or funding retirement.

Giving You the Keys to Homeownership

We’ve been a reliable, independent lender since 2001, funding homeownership for people in various situations. We contribute numerous advantages that make us stand out, including:

- A history of exceptional service with an average of 4.98 stars on thousands of customer reviews

- End-to-end support to keep everything under one roof

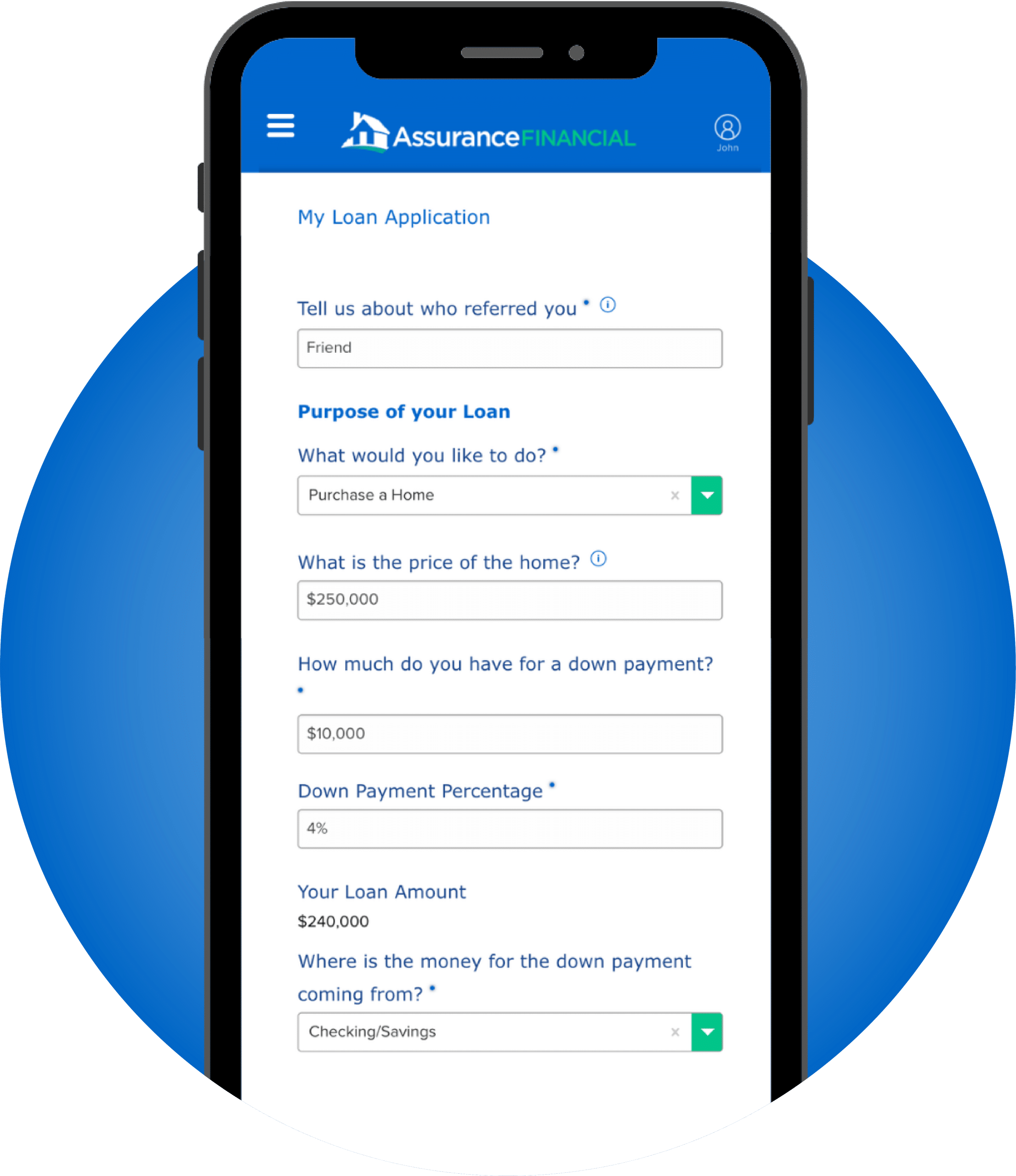

- Quick online application technology and tools like a mortgage calculator to inform financial decisions

Get Started With Prequalification

Apply online to get prequalified. Once you do, our team can guide you through the loan process.