Category: Loans

If you plan to buy a home or refinance an existing mortgage, you’ll likely encounter mortgage loan terms and definitions that may be unfamiliar — especially if you’re buying a house for the first time. Our mortgage glossary can help you better understand the terminology you’re likely to hear or read as you go through the loan application and homebuying process.

Use the home loan glossary below to get familiar with terms and definitions that might be new to you. As you go through the process of buying your home or refinancing a home loan, you can also ask your mortgage lender to explain any terms or phrases that are unclear to you.

Adjustable-Rate Mortgage (ARM)

An adjustable-rate mortgage has an interest rate that can change over the term of the loan. Often, the mortgage has an introductory rate that lasts for a defined period, such as five years. After the introductory period ends, the rate adjusts based on the market rate on a set schedule. You might see an adjustable-rate mortgage written as 5/1 or 7/1. The first number refers to the length of the introductory period, while the second is how often the rate can adjust.

Amortization

Amortization is the process of paying off a loan over a set period. As you make payments on the loan, the principal decreases, meaning the amount you owe drops. If you have a loan that amortizes, once you have made all the payments, you won’t owe anything on the mortgage anymore.

Annual Percentage Rate (APR)

The annual percentage rate is the cost of taking out the loan. It includes the interest rate charged on the mortgage as well as any fees, such as origination fees and closing costs. The APR is shown as a percentage rate and needs to be included on your closing disclosure.

Appraisal

Before you buy a home or refinance a mortgage, your property will most likely need to go through the appraisal process. During an appraisal, a professional will evaluate your home’s condition, how much similar homes have sold for recently and the overall market to determine the value of your home. The appraisal can be more than the price of the house or it can be less. If the property appraises for less than you are trying to borrow, there is a chance your mortgage will fall through.

Assessed Value

The assessed value of your home is how much it is worth in the eyes of the tax agency in your municipality. The assessed value is used to calculate your property taxes. It can be less than the market or appraised value of your home.

Balloon Loan

A balloon loan doesn’t fully amortize over the term of the mortgage. If you have a balloon loan, you can expect to have one large, or “balloon,” payment due at the end of the term. With a balloon loan, you still make monthly payments during the term, but they tend to be small and aren’t enough to pay down the principal fully.

Base Rate

A base rate is the interest rate used as a reference point when setting the rate for an ARM or another loan with a variable rate.

Cash to Close

Cash to close is the amount of money you need to bring with you to closing. Your cash-to-close amount will include the closing costs and the down payment. The closing disclosure you receive a few days before you close will let you know how much you need to bring. You don’t have to bring actual cash with you. A certified check or wire transfer is also permitted.

Certificate of Eligibility

If you are interested in a VA loan, your certificate of eligibility will verify that you are eligible for the loan. The federal government issues the certificate.

Closing Costs

Closing costs are the fees you pay to the lender to finalize the mortgage in addition to transfer fees paid to your local government, appraisal fees, attorney’s fees and title report fees. The exact amount of your closing costs depends on where you are buying and the value of your home.

Closing Disclosure

Your lender will provide the closing disclosure three business days before your closing date. The closing disclosure outlines the cost of the loan, including the amount you’re borrowing and the interest and APR. It also details the costs you’ll need to pay at closing. It’s important to review the disclosure before closing to make sure there are no errors or to correct issues if there are any.

Conforming Loan

A conforming loan meets the requirements set by Freddie Mac and Fannie Mae, two government-sponsored organizations that buy mortgages. The limit for a conforming mortgage varies by area, based on the cost of housing. A mortgage that is above the limit is known as a non-conforming or jumbo loan.

Credit Score

A credit score is a three-digit number that gives a lender an idea of your credit history and the likelihood that you will repay your loan. Several different methods exist for calculating credit scores, and they usually range from 300 to 850. Factors that affect a credit score include the length of credit history, repayment history, variety of credit, amount of credit and your activity, such as applying for credit cards and loans.

Default

Default occurs when a person stops making payments on their mortgage or is otherwise unable to keep up with the terms of the loan — for example, making partial payments instead of the total amount due each month. Defaulting on a mortgage can cause your credit score to drop. If you don’t resume payments or bring the account current, you could lose your home through foreclosure.

Down Payment

The down payment is a portion of the price of the home that you pay upfront. Although 20% is considered the “gold standard” down payment to make, you can get a mortgage and buy a home putting down a smaller amount, in some cases, as little as 3%. The bigger your down payment, the lower the cost of your mortgage.

Earnest Money

Earnest money is a portion of the sale price of the home that a buyer pays upfront, after the seller accepts their offer. The deposit shows that a buyer is serious and allows the seller to take the home off the market. If the buyer backs out of the sale, the seller gets to keep the earnest money. If the sale falls through because of the seller or because of an agreed-upon contingency, the buyer gets the earnest money back.

Equity

Equity is the difference between a home’s value and the amount a person owes on the mortgage. As homeowners pay down the mortgage principal, they can leverage their equity by borrowing against it.

Escrow

A lender might set up an escrow account where they hold money that goes toward your property tax payments and homeowners insurance premiums. Each month, your mortgage payment includes an amount that goes into escrow. When insurance or property taxes are due, the lender pays the insurance company or government with funds from your escrow account.

Fair Market Value

Fair market value is how much your home is likely to sell for if you put it on the market. The fair market value might be the same as appraised value, but it might also be higher.

Federal Housing Administration

The Federal Housing Administration (FHA) is a government agency created to guarantee mortgages and help people who don’t qualify for other types of mortgages to buy a home. Under the FHA loan program, the agency guarantees loans made by private lenders, offering to pay the loans if the borrower defaults. People who take out FHA loans need to pay an upfront mortgage insurance premium as well as a mortgage insurance premium for the life of the loan.

Fixed-Rate Mortgage

A fixed-rate mortgage has an interest rate that remains the same for the entire term of the loan. With a fixed-rate home loan, you can lock in a low rate when interest rates are low. If you buy when rates are higher, you might refinance later if rates drop.

Foreclosure

If a borrower stops making payments on the mortgage, the lender can foreclose on the loan, meaning the lender takes control of the property. During the foreclosure process, the lender will try to gain back the balance owed on the loan, often by selling the property.

Good Faith Estimate

A good faith estimate is a form a lender provides when a person applies for a mortgage or reverse mortgage. It provides a detailed list of the costs that might be connected to the loan.

Home Inspection

A home inspection is a visual inspection of the property that is often part of the homebuying process. The inspection can make the buyer aware of potential issues in a home. A buyer can use the information gleaned from the inspection to negotiate with the seller. Depending on the results of the inspection, a buyer can walk away from the property, the seller can offer to fix things or everything can proceed as normal.

Homeowners Insurance

If you have a mortgage, you will most likely have to get homeowners insurance, which provides coverage if the home is damaged by a storm or fire. Insurance also protects you against theft. You can purchase add-ons to your homeowners insurance coverage if you own a lot of jewelry or other high-value items or if your home is located in a flood plain.

Interest-Only Loan

With an interest-only loan, your payments only cover the cost of interest, at least for a few years. The principal balance remains the same. An interest-only loan can mean that you have a low monthly payment, at least for the first part of your repayment term. Since they are high-risk, it can be difficult to find lenders that offer interest-only loans.

Interest Rate

While the APR is the total cost of the loan, the interest rate is the annual cost. Usually, it is expressed as a percentage.

Jumbo Loan

A jumbo loan, or non-conforming loan, is a mortgage that has a value that is above the conforming limits Fannie Mae and Freddie Mac set. Jumbo loans usually cost more to the borrower than conforming loans and are often more difficult to qualify for.

Lien

A lien is a claim on a property, usually placed by a lender or creditor as a type of security in case a borrower defaults. When you have a mortgage, the lender puts a lien on the property. In some cases, liens can interfere with the sale of a home, which is why a title search and title insurance are often part of the sale process.

Mortgage Insurance

Mortgage insurance is designed to protect the lender in case a borrower stops making payments on the loan. People who put less than 20% down when buying a home usually have to purchase private mortgage insurance and need to make premium payments until they have paid down at least 20% of the value of the home.

Negative Amortization

When a mortgage has negative amortization, the monthly payments aren’t sufficient enough to pay off the interest owed. The remaining interest gets added to the principal balance, making it possible for the amount owed to increase.

No-Closing-Cost Loan

A no-closing-cost loan displaces the closing costs, it doesn’t eliminate them. Instead of paying upfront during closing, the closing costs are rolled into the loan. The lender might add the costs to the loan’s principal or they might charge a slightly higher interest rate.

Owner Financing

Owner financing means that the seller of the home is offering a loan to the buyer, not a traditional bank or lender. The seller might offer to finance the entire purchase or offer partial financing.

Points

Points refer to an amount the buyer pays the lender at closing to reduce the interest rate. They are sometimes called mortgage points or discount points. Essentially, they are a way to prepay interest.

Preapproval

The preapproval process gives you an idea of how much a lender will let you borrow and what your interest rate will be. If you go through preapproval, you’ll get a letter from the lender verifying they have reviewed your financial details and that they are likely to let you get a mortgage.

Prepayment

If you pay more on your mortgage than the required monthly payment, you are making a prepayment. Some, but not many, mortgages charge a prepayment penalty, meaning you might have to pay a fee if you make higher than the minimum payment. Prepayment can reduce the total cost of your mortgage and allow you to own your home outright sooner.

Prequalification

Prequalification is an early estimate of the amount you can borrow or if you’d be approved for a mortgage. It’s less formal than a preapproval and doesn’t represent a commitment by the lender. It can be a good starting point to see if buying a home is a possibility.

[download_section]

Principal

The principal is the amount of money you’ve borrowed and owe on your mortgage. As you make payments, some of the payment goes toward the principal each month, lowering the amount you owe. If you pay extra on your mortgage, you can designate the additional payment to go toward the principal to speed up the time it takes to pay off your loan.

Rate Lock

When a lender makes you an initial offer to lend, they will also likely give you a rate lock, meaning the rate offered won’t change between the day of the offer and the day of closing. A rate lock helps you avoid paying a higher than expected interest rate or APR on your mortgage.

Refinance

When you refinance, you take out a second mortgage and use the proceeds from it to pay off your initial home loan. You can refinance for a variety of reasons, such as reducing your interest rate, shortening the term of your loan or getting cash for another project. During the refinancing process, your home will most likely be appraised again and you’ll need to go through the closing process again.

Seller Concessions

One way to reduce your closing costs is to get the seller to agree to seller concessions, or paying some of the costs. You can ask a seller to pay a percentage of the closing costs or to cover specific costs. Depending on the market, some sellers might offer concessions upfront to make their property more desirable.

Term

The term of a mortgage refers to its duration. The most common mortgage term is 30 years, but 15-year mortgages are also fairly common. It’s also possible to get a 10-year or 20-year mortgage. The longer the term of a mortgage, the lower your monthly payment, but the more you’ll pay in interest over the length of the loan. Shorter-term mortgages also usually have lower interest rates.

Title

The title of a home is a record of who has owned it. Before you buy a property, it’s essential you make sure it has a free and clear title. If someone else has claim to the title, they could step in and interfere with the sale or complicate things after closing. To prevent title disputes, most lenders will require you to buy title insurance and to have a title check completed before closing.

Title Insurance

Title insurance protects the lender or the buyer of a property from claims on the title of a home after the sale. It’s usually required before you get a mortgage.

Underwriting

When a lender reviews your credit, checks your bank accounts and otherwise looks into your employment and financial history, they’re performing underwriting. The underwriting process is a critical part of the mortgage approval process. It allows a lender to finalize the amount of your loan and the interest rate charged. If anything unusual comes up during the underwriting process, a lender might decide not to give you a mortgage.

USDA Loan

A USDA loan is a mortgage either directly from the U.S. Department of Agriculture (USDA) or guaranteed by the USDA. The mortgages are designed to help people buy properties in rural or suburban areas.

VA Loan

VA loans are guaranteed by the Department of Veterans Affairs. They are designed to help people who are veterans or are currently serving in the armed forces to purchase a home. VA loans offer up to 100% financing, meaning a person who is eligible for the mortgage can secure a loan without a down payment.

Walk-Through

A walk-through is the last inspection of a home, made right before closing. During it, the buyer can verify that the seller has made any repairs agreed upon and that the home is otherwise in the same condition it was in when the buyer made their offer.

Wire Transfer

A wire transfer is a way to send money from one bank account to another electronically. It’s an option for paying for closing costs during settlement.

Apply for a Mortgage in Just 15 Minutes With Assurance Financial

Knowing the definition of commonly used mortgage terms can help you through the homebuying process. If you’re ready to get started buying your home or refinancing an existing home, Assurance Financial can help. Apply online today or find a loan officer near you.

Linked:

- https://assurancemortgage.com/what-is-an-amortization-schedule/

- https://www.consumerfinance.gov/owning-a-home/closing-disclosure/

- https://assurancemortgage.com/jumbo-loan-vs-conforming-loan/

- https://assurancemortgage.com/how-to-build-credit-to-get-loan/

- https://assurancemortgage.com/what-to-expect-closing-day/

- https://assurancemortgage.com/what-to-expect-during-a-home-inspection/

- https://assurancemortgage.com/why-get-pre-qualified-before-looking-for-home/

- https://assurancemortgage.com/everything-you-need-to-know-about-30-year-fixed-rate-mortgages/

- https://assurancemortgage.com/15-year-fixed-mortgage-rate/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/find-a-loan-officer/

If you’ve served in the armed forces, the VA loan program can help make your dream of becoming a homeowner come true. The VA loan program is one of the most generous government-backed mortgage programs available, as it doesn’t require a down payment or mortgage insurance.

You might have a lot of questions about VA loan requirements before you apply. Here’s everything to know about VA home loans so you can decide if it’s the right step to take on the path toward homeownership.

What Is a VA Loan?

A VA loan is a type of mortgage. The loan usually comes from a private lender, such as Assurance Financial, but is backed by the Department of Veterans Affairs. VA loans have several features that set them apart from conventional mortgages or other types of government-sponsored home loans:

- They usually don’t require a down payment.

- They don’t require private mortgage insurance.

- They typically have lower interest rates and lower closing costs.

- They are only available to people who have a connection to the U.S. armed forces.

Why Do VA Loans Exist?

The VA loan program was created after World War II, in the mid-1940s, as part of the Servicemen’s Readjustment Act. The goal of the loan program was to help soldiers who were returning home from the war or their widows purchase a home. The Act aimed to smooth soldiers’ readjustment into civilian life. Since the program got started, more than 18 million VA loans have been created.

How Does a VA Loan Work?

One common source of confusion about VA loans is the origination of the loan. Many people assume that the U.S. government issues the loans directly to borrowers. While there are VA direct loan programs, most VA loans come from private lenders.

Private lenders, including banks, credit unions and mortgage companies, issue the loans to eligible veterans or active-duty service members with a guarantee from the Department of Veterans Affairs. If the borrower should stop making payments, the VA guarantees the loan and will step in and make the payments.

Having the VA’s guarantee doesn’t mean the borrower is free and clear if they have to default on their mortgage or fall behind on payments. Their credit score will still take a hit, and it is possible to foreclose on the home if the borrower can’t get current on their payments.

Instead, the VA’s guarantee helps protect the lender. The company issuing the loan can feel confident that the VA will step in and make the payments if the borrower falls behind. The VA’s guarantee reduces the lender’s risk, meaning it can offer better interest rates to borrowers.

Can You Foreclose on a VA Loan?

A VA loan can go into foreclosure. The VA has programs in place to help borrowers avoid foreclosure, though. A veteran struggling to repay their mortgage can get help from the VA, whether they have a VA loan or not.

If a veteran does have a VA loan, they can request assistance from a VA loan technician if they are concerned about missing payments or falling behind. Once a borrower falls more than 61 days behind on payments, the VA automatically assigns a technician to their case.

A VA loan technician will review a borrower’s options with them to help them avoid foreclosure. Options might include:

- Modifying the loan to reduce monthly payments.

- Moving the loan into forbearance so a borrower has additional time to make payments.

- Creating a repayment plan to help the borrower make up any missed payments.

- Delaying foreclosure so a borrower can sell the home.

- Arranging a short sale of the home if the loan amount is more than the home’s value.

- Transferring the deed instead of foreclosure.

Generally speaking, borrowers who purchased their home after 1990 will not have to repay the government if they foreclose on the house.

How Is a VA Loan Different from Other Government-Backed Mortgages?

A VA loan differs from other government-backed mortgages, such as an FHA loan or USDA loan, in a few different ways. Like VA loans, FHA and USDA loans are guaranteed by the federal government — either the Federal Housing Administration or the U.S. Department of Agriculture.

The main difference between VA loans and FHA loans is that FHA loans usually require a borrower to take out mortgage insurance. The borrower has to pay the mortgage insurance for the life of the loan. FHA loans also have higher down payment requirements than VA loans.

A significant difference between VA loans and USDA loans is the type of home you buy. USDA loans are designed to encourage homeownership in rural or suburban areas. If you apply for a USDA loan, you can’t buy a house in the city or a highly developed area.

The source of the loans can also vary. Some USDA loans come directly from the government, while private lenders generally issue VA and FHA loans.

Do VA Loans Take a Long Time to Close?

The VA lending process doesn’t take longer than the conventional mortgage process. The average time to close for conventional and VA loans is the same — about 44 days. VA loans also have a slightly higher closing rate than conventional loans, at 70% versus 67%.

What Are the Requirements and Terms for a VA Loan?

VA loans aren’t available to all borrowers. Beyond meeting the service eligibility requirements, you might also have to meet financing requirements to qualify for a loan. Financing requirements can vary from lender to lender.

What Are VA Financing Requirements?

Since the VA approves private lenders to issue most VA loans rather than issuing the loans directly, those private lenders usually establish any financing requirements for borrowers. However, they may base their financing requirements on recommendations from the VA.

For example, a lender is likely to look at your income when determining how much you can borrow. They’ll use a debt-to-income (DTI) ratio to determine if you can afford to make payments on the mortgage. The ratio compares the amount of money you bring in to the amount you pay towards obligations, such as your mortgage, car loans and other debts monthly.

While there’s no actual upper limit on the debt-to-income ratio, 41% seems to be the magic number for most VA lenders. If a lender agrees to let someone borrow enough that their debt-to-income ratio is more than 41%, the lender needs to provide a compelling reason why.

Similarly, the VA doesn’t have strict requirements regarding a borrower’s credit history and score. But a lender might. For example, a lender might decide not to approve a veteran with a credit score below 600.

Do VA Loans Have a Down Payment?

Generally speaking, VA loans do not require a down payment since the VA itself guarantees the loans. Although a borrower can decide to put some money down when purchasing a home, many don’t. Almost 90% of all VA loans are issued without a down payment.

With conventional mortgages, the recommended down payment is usually 20%. While it’s possible to get a conventional loan with less money down, borrowers who put down less typically have to pay private mortgage insurance (PMI) and higher interest rates. That’s not the case with a VA loan.

Do You Need Mortgage Insurance for a VA Loan?

Some lenders require a borrower to take out private mortgage insurance in certain situations, such as a conventional loan when a person puts down less than 20% or an FHA loan. PMI protects the lender, as it backs the loan and will cover payments if a borrower defaults.

When a person puts down a smaller down payment, the lender considers them a riskier borrower. PMI helps to mitigate that risk. In the case of a conventional loan, PMI is no longer required once a person has made enough payments to build up 20% equity in their home. FHA insurance payments are for the life of the loan.

There are no VA loan PMI requirements, fortunately. Even with zero percent down, a VA loan borrower can skip the PMI because the VA is essentially acting as mortgage insurance.

How Much Are Closing Costs on a VA Loan?

VA loans often have lower closing costs than conventional mortgages or other government-backed home loans. The VA puts certain limits on lenders that restrict the fees they can charge. For example, the lender can’t charge you settlement or attorney’s fees at closing, nor can they charge prepayment penalties. A lender can charge a loan origination fee, title fee and appraisal fee, among others.

One closing cost you’ll encounter with a VA loan but not with other types of mortgage is the VA funding fee. The VA funding fee helps to reduce the tax burden of the VA loan program. The size of the fee is directly tied to the size of your down payment. If you put less than 5% down, the fee is 2.3% for your first VA loan. If you put more than 5% down, the fee ranges from 1.4% to 1.65%.

What Is the Interest Rate on a VA Loan?

Often, borrowers who qualify for a VA loan can get a lower interest rate than they would on a conventional mortgage. VA loans usually have lower interest rates than other mortgages because of the government guarantee.

However, there’s no set interest rate for VA loans. One lender might have slightly higher or lower rates than another. Shopping around allows you to compare rates before committing to one lender.

Is there a Loan Limit for a VA Loan?

Unlike some mortgages, there’s no hard and fast limit for the amount you can borrow with a VA loan. Instead, borrowers receive entitlements based on the price of the home they are buying. If a veteran has full entitlement, they don’t have a loan limit.

What might restrict the amount a person borrows is their income compared to their debt. Ideally, the debt-to-income ratio will stay below 41%, meaning some homes might be out of a borrower’s budget.

What Type of Property Can You Buy With a VA Loan?

You need to use a VA loan to buy a property you’ll live in. You can’t use the mortgage to buy a second home or investment property. However, you can buy a property with up to four units and rent out some of the units. You can also buy a property such as a condo, as long it’s in a VA-approved development.

[download_section]

Who Qualifies for a VA Loan?

To qualify for a VA loan, you need to be a veteran or active duty member of the U.S. armed forces or the surviving spouse of a service member. Whether you can get a VA loan or not depends on how long you’ve served.

What Are the Service Requirements for a VA Loan?

As a general rule of thumb, the service requirements to qualify for a VA loan are either 90 or 181 days. If you’re currently on active duty or served during wartime, the requirement is 90 days. If you served during a time of peace, the 181-day requirement applies.

There are some exceptions to the 90- or 181-day requirements. If you received a hardship discharge, had a disability connected to service or had certain medical conditions, you might qualify for a VA loan without fulfilling the 90 or 181 days. You aren’t eligible for a VA loan if you were dishonorably discharged or discharged for bad conduct.

How Do You Get a Certificate of Eligibility?

Applying for the Certificate of Eligibility (COE) is the first step toward proving your eligibility for a VA loan and getting approved for the loan. You can apply for a COE online. Before you apply, make sure you have the appropriate paperwork, such as your discharge papers or a signed statement of service.

If you are applying for a VA loan because you are the surviving spouse of a service member who died, you also need to get a COE, but the application process is slightly different.

Can a Civilian Get a VA Loan?

Generally speaking, civilians can’t get VA loans. You need to be a current service member or a veteran to qualify for the loan program. The one exception is if your spouse was in the armed forces and died or was disabled while in the line of duty.

While you can’t qualify for a VA loan if you have no connection to the armed forces, you do have other government-backed loan options available, such as the USDA loan program or FHA loans. You can also take advantage of programs designed for first-time homebuyers that might not be connected to the federal government.

Do You Have to Get Pre-Qualified for a VA Loan?

When you’re in the market to buy a home, it’s a good idea to get pre-qualified before you start the official house hunt. That’s true whether you’re applying for a conventional mortgage or a VA loan.

During the pre-qualification process, the lender will review your credit, income and assets and give you an idea of the interest rate you’d get on a loan and the amount you can borrow. Going through the pre-qualification process helps you feel confident that you can get approved for a loan and buy the home of your dreams.

Can You Get a VA Loan After Bankruptcy?

Yes, it’s possible to qualify for a VA loan after filing bankruptcy or having other credit difficulties. You’re likely to be eligible for a VA loan sooner after bankruptcy than other mortgage types. Depending on the type of bankruptcy, you can apply for a VA loan between one and two years after filing.

If you’ve had to foreclose on a home in the past, you can still qualify for a VA loan later. Usually, you’ll be eligible for a VA loan two years after a foreclosure, provided you meet other qualification requirements.

What Types of VA Loans Are Available?

The VA has several loan programs. The type of loan that works for you depends on where you are in the home buying or owning process and if you meet specific eligibility requirements. Get to know the various types of VA loans.

What Is a VA Purchase Loan?

A VA purchase loan is probably the mortgage that comes to mind when most people think of the VA loan program. It’s designed to help veterans or active-duty service members buy a home. The loan comes from a private lender and is guaranteed by the VA. You can use a VA purchase loan to buy or build a home or to make an existing home more energy-efficient.

What Is a Native American Direct Loan?

While VA purchase loans come from private lenders, Native American Direct Loans (NADL) come directly from the VA. Like purchase loans, NADLs don’t require a down payment or private mortgage insurance. The closing costs on NADLs are also low, though you will need to pay the VA funding fee.

To qualify for a NADL, you need to be a veteran and you or your spouse needs to be Native American. The home you purchase with a NADL needs to be on federal trust land. You can also use the loan to refinance a NADL or to improve or build a home on federal trust land.

What Is a VA Cash-Out Refinance Loan?

If you already have a home loan but qualify for a VA loan, refinancing might make sense for you. The VA has two refinancing options. The first is a cash-out refinance loan. When you get a cash-out refinance, you generally borrow against the equity in your property. The refinancing process lets you get some cash, which you can use to renovate the home or for any other purpose.

One benefit of a VA cash-out refinance loan is that it lets you switch a non-VA loan to a VA loan so you can take advantage of a potentially lower interest rate, low closing costs and as little as zero down.

What Is a VA Interest Rate Reduction Refinance Loan?

The second refinancing option from the VA is the interest rate reduction refinance loan (IRRRL). With the IRRRL, you can switch from a loan with a higher interest rate to one with a lower rate or switch from an adjustable to a fixed-rate loan.

To get an IRRRL, you need to have a VA purchase loan already.

Apply for a VA Loan With Assurance Financial in 15 Minutes or Less

A VA loan can put homeownership within your grasp if you’re a veteran or otherwise meet the loan’s eligibility requirements. With Assurance Financial, finding out if a VA loan is right for you can take less than 15 minutes. Start the application process today to get ready to buy your dream home tomorrow.

Sources:

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/conventional-loans/

- https://www.military.com/money/va-loans/history-of-the-va-loan.html

- https://www.va.gov/housing-assistance/home-loans/trouble-making-payments/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/fha-vs-va-loans/

- https://www.benefits.va.gov/BENEFITS/factsheets/homeloans/VA_Guaranteed_Home_Loans.pdf

- https://www.va.gov/housing-assistance/home-loans/loan-types/

- https://www.va.gov/housing-assistance/home-loans/funding-fee-and-closing-costs/

- https://www.va.gov/housing-assistance/home-loans/loan-limits/

- https://www.va.gov/housing-assistance/home-loans/eligibility/

- https://www.va.gov/housing-assistance/home-loans/how-to-apply/

- https://www.va.gov/housing-assistance/home-loans/surviving-spouse/

- https://assurancemortgage.com/why-get-pre-qualified-before-looking-for-home/

- https://blogs.va.gov/VAntage/19931/va-busts-four-home-loan-myths-that-hurt-veteran-homebuyers/

- https://assurancemortgage.com/guide-to-cash-out-refinancing/

- https://assurancemortgage.com/apply

You plan on buying a house in the near future, and you know you’ll need a mortgage to do so. The question is, which type of mortgage may be best for you? Mortgages vary in term length, type of interest rate and the amount of interest charged. One available option is a 15-year, fixed-rate mortgage.

APPLY WITH ABBY IN UNDER 15 MINUTESStill have questions or need more information? Below is an overview of what this article covers!

Topics Covered

Frequently Asked Questions

- What Is a 15-Year Fixed Mortgage?

- How Does a 15-Year Fixed-Rate Mortgage Work?

- What Makes up Your Mortgage Payment?

- How Much Can You Afford to Borrow?

- Is a 15-Year Fixed Mortgage Right for Me?

- Apply for a Home Loan Online

As you weigh your mortgage options, it’s important to understand how getting a 15-year home loan will affect your monthly payments and how much you end up paying for your home over the long run. It’s also important to understand how a fixed interest rate differs from an adjustable rate. Get all the details on a 15-year fixed mortgage so you can determine if it’s the right option for you.

What Is a 15-Year Fixed Mortgage?

A 15-year fixed mortgage is a loan with a repayment period of 15 years and an interest rate that remains the same throughout the life of the loan. Like other types of mortgages, you use a 15-year, fixed-rate mortgage to buy property. Many people obtain a mortgage to buy their primary residence, while others obtain a mortgage to buy a vacation home or property to rent out to others.

To understand what a 15-year fixed mortgage is, it helps to break down some commonly used terms in the mortgage business:

- Term: The mortgage term is the length of time you have to repay the loan. At the end of the term, the entire loan needs to be repaid to the lender. The length of the term influences the size of the monthly payments, as well as the interest charged on the loan. Mortgages with shorter terms, like a 15-year home loan, are considered less risky to the lender, so they often have slightly lower interest rates compared to longer-term mortgages, like a 30-year loan.

- Interest: Interest is the price you pay to borrow money, usually a percentage of the loan, such as 3% or 4%. A lender determines your interest rate based on factors such as your credit score, income, the loan term and the market. The type of interest rate — whether it’s fixed or adjustable — also plays a part in determining when you pay.

- Fixed-rate: Some mortgages have a fixed interest rate. With a fixed-rate mortgage, you pay the same interest rate throughout the life of your loan. For example, a 15-year mortgage with a 5% fixed rate will have a 5% rate until the borrower pays off the mortgage or refinances. One advantage of a fixed-rate mortgage is that it allows you to lock in a rate when they are low. You can rest assured that your mortgage principal and interest payment will stay the same month after month, no matter what happens in the market. On the flip side, if you get a fixed-rate home loan when rates are high, you could be stuck paying a high interest rate for years.

- Adjustable-rate: Unlike a fixed-rate home loan, the interest rate on an adjustable-rate mortgage (ARM) changes at various points throughout the repayment period. Often, an ARM may have an introductory rate. The introductory rate tends to be lower than the interest rate available on a fixed-rate loan. After the introductory period ends, the rate may change based on whatever is going on in the market. It can go up, meaning your monthly payments may go up. It can also drop, meaning you may pay less each month. Some borrowers take out an ARM initially and later refinance to a fixed-rate loan.

- Principal: The principal is the amount of money you’ve borrowed to buy your home. If you purchase a $250,000 house, pay a 10% down payment of $25,000 and borrow $225,000, the $225,000 would be the loan’s principal. If you can pay extra against the principal as you pay down your mortgage, you can shorten the length of time it takes to pay off the loan completely.

- Mortgage insurance: Depending on the size of your down payment, you may have to pay mortgage insurance on top of the principal and interest charged on the loan. Mortgage insurance offers an additional layer of protection to the lender, in case the borrower struggles to make payments. It is usually required when a person makes a down payment under 20% of the home’s value. You can cancel the mortgage insurance payment once you have paid off enough of the principal to have 20% equity in your home.

How Does a 15-Year Fixed-Rate Mortgage Work?

A 15-year fixed-rate mortgage works similarly to other types of mortgages. You apply for the loan by providing proof of income, employment, assets and your credit history. If approved, you put down a certain amount of money, then make payments on the loan each month until it is paid off. The amount you can afford to borrow when you apply for a 15-year fixed mortgage depends on a variety of factors.

When you apply for a 15-year fixed-rate mortgage, you will typically take the following steps:

- Request a loan estimate from a lender: A loan estimate lets you know how much you can borrow, the interest rate and the anticipated closing costs. You can request estimates from multiple lenders to get a sense of what’s available.

- Indicate your intent to proceed: If you decide to move forward with one lender, you need to let them know. Lenders must honor the estimate for 10 business days, so you should decide if you’re moving forward within that time.

- Begin the application process: After you tell the lender you want to go ahead with the mortgage, you’ll need to submit documents, such as proof of income and bank statements, to start the formal application process.

- Prepare for closing: If all goes well with the application, home inspection and process as a whole, you can get ready for the closing date. It’s important to keep things moving as scheduled, as a delay in closing can mean you lose the rate you locked in or that you have to start over.

What Makes up Your Mortgage Payment?

One miscalculation many aspiring homebuyers make is to assume their monthly mortgage payment only includes the principal and interest. In reality, your mortgage payment includes multiple components. When you take out a 15-year home loan, your monthly payments can be divvied up in the following ways:

- Principal payment: This portion of your monthly payment goes toward the amount you’ve borrowed. As you pay down your mortgage, you’ll likely see the amount of your payment that goes to the principal increases while the amount you pay in interest decreases. Many lenders also let you pay additional amounts toward the principal to help pay off your mortgage more quickly. Paying more than the minimum due toward the principal monthly can help you get out of debt sooner.

- Interest: Think of the interest rate on your mortgage as the money you pay the lender in order to use their service. The lower your interest rate, the more affordable the loan is. As you pay down the principal, the amount you pay in interest each month shrinks.

- Homeowner’s insurance premiums: Your lender may also collect your homeowner’s insurance premiums and put them in an escrow account to be paid to your insurer. The size of your premiums depends on the value of your house and the amount of insurance you buy.

- Property taxes: Your lender may also collect your property tax payments and put them in an account to be paid to your local government by the due date each year. Property tax amounts vary widely from location to location.

- Private mortgage insurance: If you put down less than 20%, your lender may require private mortgage insurance. The amount varies based on the size of your down payment. The more you put down, the lower the insurance premium. Once you’ve made enough payments to equal 20% of the value of your home, you can ask the lender to remove the insurance.

How Much Can You Afford to Borrow?

You want to have a sense of how much you can afford to borrow before you start looking for a home and applying for a mortgage. Usually, since you pay off a 15-year home loan in half the time it takes to pay off a 30-year loan, the amount you can afford to borrow is less. You might be able to purchase a $200,000 home by putting 20% down if you apply for a 30-year loan. Since the monthly payments on a 15-year loan are often about twice as much as those on a 30-year loan, you might be able to purchase a $150,000 home with a 15-year loan.

You can use a mortgage calculator to compare the monthly payments on a 15-year versus a 30-year mortgage.

To determine how much you can borrow with a 15-year mortgage, pay attention to how much you can afford to pay each month. Look at your total debt compared to your total income. When getting a mortgage, your ideal housing ratio, also known as a front-end debt-to-income ratio, is 28%. With insurance and property taxes included, your housing payments should be within 28% of your total income.

Lenders also use the back-end ratio, which is all your debts compared to your income. An ideal back-end ratio is 36%. If you have other significant debts, such as student loans or car loans, your ideal monthly mortgage payment can end up being much lower than 28% of your total income.

While the 28 and 36% ratios are ideal, lenders understand that life can be complicated. Depending on your income or credit score, you might be able to borrow as much as 43% of your monthly income.

To get your monthly payments under the desired percentage of your income, you may need to either pay off some debts before applying for your mortgage or find a way to increase your earnings.

Is a 15-Year Fixed Mortgage Right for Me?

Paying off your mortgage in half the time can seem pretty appealing. Before you decide to apply for a home loan with a 15-year term instead of a 30-year term, it’s important to consider your personal situation. You’ll pay the loan off sooner, but that usually means a higher monthly payment or buying a less expensive house. Some things to consider before applying for a 15-year fixed-rate home loan include:

- Your income stability: Since a 15-year mortgage typically means higher monthly payments compared to a 30-year home loan, it’s vital that you have the income needed to afford those payments. It’s also helpful if you have a steady record of earning either the same amount or increasing amounts of income each year. If there’s a lot of up-and-down in terms of what you bring in or if you aren’t sure how long your current employment and income situation may last, it may not be the right time to get a 15-year mortgage.

- Current interest rates: Take a look at the current interest rates. If they are low, getting a mortgage with a fixed rate is likely to be in your favor, as you’ll get to keep that rate for years to come. If rates are on the high side, you might consider an ARM instead. When it comes time for the rate on your loan to adjust, you can refinance to a fixed-rate loan or keep the ARM.

- Your age: Your age or season in life can help you determine if a 15- or 30-year loan makes more sense. If you are older and approaching retirement, a longer term may have you making payments on your loan after you’re no longer working. If you don’t want to have a mortgage throughout retirement, choosing one with a shorter term can make more sense.

- Your other financial goals: Consider your other financial goals in light of your mortgage. If you are trying to save for retirement or save for your child’s education, you may not want to pay a considerable amount of your monthly income toward your home. On the other hand, if you have already achieved other financial goals or have a high amount of disposable income each month, putting that toward your housing payment can be a good move.

- The price of homes in your area: The average price of houses in your area may influence whether you can afford a 15-year mortgage or not. The more expensive homes are, the higher your payment may be. But if homes are relatively affordable, getting a 15-year loan can help you own your home outright in less time and for less money.

[download_section]

Pros of a 15-Year Fixed-Rate Mortgage

If you’re still not sure if a 15-year fixed-rate mortgage is right for you, it helps to look at a few advantages of this type of home loan:

- You build up equity more quickly: Equity is the difference between the value of your home and the amount you still owe on the mortgage. Having equity in your home gives you leverage. When you sell the home, you get more money from the sale if you have more equity in it. You can also use equity to borrow against your home to cover the cost of renovations or other repairs.

- You own your home faster: With a 15-year mortgage, you can own your home completely in half the time it would take if you were to get a 30-year loan. Once your home is fully paid off, your cost of living can drop significantly.

- You pay less in interest: Since you have a 15-year mortgage for less time than a 30-year loan, you usually end up paying considerably less in interest. More of your monthly payment goes toward the principal sooner. Although you have bigger monthly payments, the total cost of a 15-year loan is often much less than the cost of a longer mortgage.

- You might get a better interest rate: The less time you need to pay off a loan, the less of a risk you are in the eyes of a lender. Depending on other factors, many lenders are likely to offer lower interest rates on 15-year mortgages compared to 30-year loans.

- You don’t have to worry about interest rates changing: With a fixed-rate loan, the rate you pay on day one is the same as the rate you pay on day 5,000. You don’t have to worry that your payment may suddenly balloon or that you’ll be left with an unexpectedly high mortgage bill.

- You have the same payment month after month: A 15-year, fixed-rate mortgage eliminates one uncertainty from your life: How much your housing payment will be. When you rent, your monthly obligation can increase from year to year if your landlord decides to raise the rent. With an ARM, your payment can go up, as well. Your fixed-rate mortgage payment stays the same year after year, even if you begin to earn more money or other costs increase.

- You might be able to make a larger down payment: Since the price of the home you can buy with a 15-year mortgage could be lower than what you can afford with a 30-year mortgage, you may be able to put down more upfront — potentially saving you the cost of private mortgage insurance. For example, if you can afford a $200,000 home with a 30-year mortgage and have $30,000 to put down, your down payment would be 15% and you’ll have to pay mortgage insurance. If you can afford a $150,000 home with a 15-year mortgage and put $30,000 down, your down payment is 20%. Putting down 20% upfront can also make you more likely to get a lower interest rate, helping you save even more.

Cons of a 15-Year Fixed-Rate Mortgage

While a 15-year fixed-rate mortgage can have several benefits for the right borrower, there are also some potential drawbacks to consider:

- You have a higher monthly payment: Usually, the monthly payment required on a 15-year mortgage is higher than that required by a 30-year mortgage since you are paying the loan in half the time. If your income is high enough and you have enough financial stability, the extra monthly payment in exchange for saving more overall might not be a concern. But if you struggle to make ends meet each month or have other financial obligations, a high mortgage payment can be a challenge.

- You could end up “house poor”: You build up equity more quickly with a 15-year loan. This can also mean you end up house poor, meaning most of your net worth is tied up in your home. Day-to-day, that might not be an issue. But if you need cash quickly and don’t have a lot of savings or liquidity, it can pose a problem.

- You might have to buy a less expensive house: Depending on where you live, you might not be able to afford to buy a house with a 15-year mortgage. If housing prices are high, a 30-year loan might be a necessity to keep your monthly payment within reach. Another option may be to buy a smaller, less expensive home, such as a two-bedroom instead of a three-bedroom or a house in a neighborhood that offers fewer amenities.

- You might get stuck with a high interest rate: Interest rates fluctuate from year to year, so depending on when you buy your home, you may end up getting a higher rate compared to someone with similar income or credit who buys a home a year before or after you. Since the interest rate on a fixed-rate mortgage is the same for the life of the loan, you could be stuck with a high rate unless you refinance.

Apply for a Home Loan Online

Assurance Financial aims to help people achieve the American dream of homeownership. If you’re ready to make the first step towards buying your home, we’re here to help. Abby, our online mortgage assistant, can walk you through the process of putting together your application.

You can get started with Abby today or set up an appointment to put together your application at a time that works for you. If you’d rather talk to a representative right away, you can connect with a loan advisor in your state who can help you review your mortgage options and choose the one that works for you.

Sources

- https://assurancemortgage.com/purchase-your-home/

- https://www.consumerfinance.gov/ask-cfpb/on-a-mortgage-whats-the-difference-between-my-principal-and-interest-payment-and-my-total-monthly-payment-en-1941/

- https://www.lendingtree.com/home/mortgage/common-mortgage-terms/

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791/

- https://www.phila.gov/services/property-lots-housing/property-taxes/real-estate-tax/

- https://www.mortgageloan.com/why-you-should-and-shouldnt-get-a-15-year-mortgage

- https://www.credit.com/blog/can-you-qualify-for-a-15-year-mortgage-113487/

- https://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

- https://www.nerdwallet.com/mortgages/mortgage-calculator/calculate-mortgage-payment

- https://www.bankrate.com/mortgages/arm-vs-fixed-rate/

- https://www.rocketmortgage.com/learn/15-vs-30-year-mortgage

- https://www.fool.com/mortgages/4-reasons-to-get-a-15-year-mortgage.aspx

- https://www.bankrate.com/finance/mortgages/fixed-rate-mortgages-1.aspx

- https://www.quickenloans.com/learn/home-equity-and-how-to-use-it

- https://www.nerdwallet.com/article/mortgages/pros-cons-15-year-mortgage

- https://www.daveramsey.com/blog/what-is-a-15-year-fixed-rate-mortgage

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/find-a-loan-officer/

When you’re shopping for a home, there’s more to consider beyond the number of bedrooms, size of the yard and the location. You also need to think about how you’ll pay for the house. For many homebuyers, that means applying for a mortgage.

Not all mortgages are created equally. Some offer a fixed interest rate, which remains the same throughout the life of the loan. Others have adjustable rates, which can change based on a schedule. Some mortgages need to be paid off within 15 years, and others give you 30 years to pay.

A 30-year fixed-rate mortgage is the most popular option among homebuyers. Learn more about what it means to take out a 30-year home loan, what a 30-year fixed mortgage rate means and whether this loan is the right option for you.

What Does a 30-Year Fixed Mortgage Mean?

A 30-year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan. When you decide to take out a 30-year home loan with a fixed rate, the payment you owe each month is the same until you’ve finished paying the loan.

If your first month’s payment is $1,000, your 12th month’s payment will be $1,000, your 36th month’s payment will be $1,000 and so on. If the interest was 5% during the first year of the loan, it would be 5% in year two, year six, year 15 and year 29.

A mortgage rate can either be a fixed interest rate or a variable rate. A fixed-rate does not change while you are paying back your loan, while a variable rate, also referred to as an adjustable-rate mortgage (ARM), can change throughout a loan.

What Is the Average 30-Year Fixed Mortgage Rate?

Many factors influence mortgage interest rates. The average interest rate has risen and fallen over the years as a result of market conditions and other factors. For example, in 1980, the average interest rate on a 30-year home loan was 13.74%. In 2000, it was 8.05% and 20 years later, in 2020, the annual average interest rate was 3.11%. In 2021, the average interest rate increased from 2.74% in January to 3.07% in November. Fannie Mae predicts that in 2022 the average mortgage rate will rise.

Some of the factors that affect mortgage interest rates are outside of the control of the average person. Supply and demand have an effect on rates, for example. When there is a lot of demand for mortgages, interest rates usually increase. When demand is low, rates drop to make getting a mortgage more appealing to consumers.

There are a few factors that influence interest rates that homebuyers can control. The amount of other debt you have can influence your interest rate. If you have a lot of debt already, a lender might consider you a higher risk compared to someone with less debt. To compensate for the additional risk, they are likely to offer a higher interest rate.

Your credit history and score also influence the interest rate on a 30-year mortgage. Usually, the higher your score, the lower your interest rate. If you don’t have favorable credit at the moment, it can be a good idea to work on improving it before you apply for a home loan.

Finally, how much you put down upfront can also affect your interest rate. The bigger your down payment, the less of a risk you seem to lenders. In exchange, they are likely to give you a lower interest rate compared to a person who is making a smaller down payment.

Can You Pay Off a 30-Year Mortgage Early?

Thirty years seems like a long time. If you buy a house when you’re 35-years-old and get a 30-year mortgage, your last payment will be scheduled for right around the time you reach retirement at age 65.

One thing worth knowing about a 30-year mortgage is that just because you can take 30 years to pay it off doesn’t mean you are obligated to do so. Many lenders may let you pay off your loan early. Some do charge a pre-payment or early payment penalty, however. Before you pay extra on your mortgage, double-check to confirm that your lender won’t penalize you for doing so.

If you are interested in paying off your mortgage early, there are multiple ways to do so. If you get paid biweekly, you can try making biweekly payments on your mortgage instead of monthly. Divide your monthly payment in half and pay one half when you get your first paycheck of the month and the second when you get paid the second time. Since there are 26 biweekly pay periods in a year, you’ll end up paying 13 months’ worth of your mortgage rather than 12.

Another option is to add on an additional amount when you schedule your monthly payment. Even paying an extra $100 or $200 per month consistently can shave years off your mortgage.

How a 30-Year Fixed-Rate Mortgage Works

When you apply and are approved for a 30-year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be broken down into a series of payments over the course of 30 years. The payments include interest and principal together and remain the same throughout the loan.

Many homeowners also pay their property tax and homeowners insurance premiums with their mortgage payments. If you put down less than 20% of the price of the home, you will also have to pay private mortgage insurance (PMI) premiums until you’ve paid off enough of the principal to equal 20% of the home’s value.

Principal and Interest

The mortgage principal is the amount you’ve borrowed to pay for your home. If you buy a $250,000 home, pay a 20% down payment of $50,000 and borrow $200,000, the $200,000 is the loan’s principal. As you make payments on your mortgage, the principal shrinks.

Interest is the fee charged by your lender for giving you the loan. One way to look at it is the cost of doing business with a particular lender. Just as you might pay a lawyer or a doctor a fee for their services, you pay your lender for their services in the form of interest.

The cost of getting a loan can vary considerably from person to person because of interest. One borrower might be offered a 5% rate on a $200,000 loan, while another borrower might be offered a 3% rate.

Since interest is a percentage of the loan amount, it tends to be higher at the beginning of your repayment period than it is at the end. For example, when you first start making payments on your $200,000 home loan, you are paying 5% interest on $200,000. As you chip away at the principal, it shrinks and so does the interest in proportion.

Although you start out paying more interest than principal on your mortgage and eventually begin paying more toward the principal and less in interest, the payment you are required to make each month remains the same due to something called amortization.

Amortization Schedule

Loan amortization is the process of paying off your debt over a defined period with fixed payments. When a mortgage is amortized, the principal and interest are combined. It differs from other types of mortgage payment schedules because you pay the same amount and know what you need to pay from month to month. In addition to mortgages, other types of installment loans, such as car loans and student loans, typically get amortized.

An example of a mortgage that does not amortize is a balloon mortgage. If you were to agree to a balloon mortgage, you would make small payments each month for a set amount of time. Often, the payments would only cover the interest due on the loan. At the end of the repayment period, the remaining balance is due in full.

When you close on your house and finalize the 30-year fixed-rate mortgage, your lender can provide you with an amortization schedule. The schedule breaks down each payment over the life of the loan and details how much goes toward the interest on the loan and how much goes toward the principal. It also lists the ending balance on the loan at the end of each payment period, so you can keep track of your mortgage as you pay it off. You’ll also find the total amount of interest paid on the amortization schedule. The total interest gives you an idea of how much your mortgage will cost you over time.

Who Needs a 30-Year Fixed Mortgage?

Although 30-year fixed-rate mortgages are the most popular option for homebuyers, they are far from the only choice available. Some mortgages have adjustable interest rates, for instance. Adjustable-rate mortgages (ARMs) offer an introductory rate for a set period, such as five years. At the end of the introductory period, the rate changes based on the market.

An ARM can decrease if rates have dropped or increase if they have spiked. Although an ARM can offer you a lower rate than a fixed-rate mortgage at the start, there is the risk that your rate may increase later on, and with it, your monthly payment.

Thirty years is also not the only term available for a home loan. Some loans have 15-year terms. Less common are 10-year, 20-year or 25-year mortgages. The longer the mortgage term, the smaller the monthly payments are, as you have more time to pay the loan. A person who might struggle to make payments on a $200,000, 15-year loan might find they are comfortable making payments on a $200,000 30-year loan.

A 30-year fixed-rate mortgage can be the right option for you if:

- You live in an area with expensive housing: A 30-year home loan can put buying a home within reach, even in areas where the price of housing is high. Another way of thinking about it is that you can get more house for your money if you get a 30-year mortgage instead of a 15-year loan.

- You want a predictable payment schedule: Your mortgage payment can be predictable if you get a 30-year fixed-rate home loan. The interest and principal payment stay the same for the entire repayment period.

- You want a lower monthly payment: Since you are going to take twice as long to pay down the loan, the monthly payment on a 30-year loan is usually considerably lower than the payment due on a 15-year mortgage, even if the principal balance is the same. Paying less toward housing each month can mean you have more money to put toward other financial goals, such as saving for retirement or for your children’s education.

[download_section]

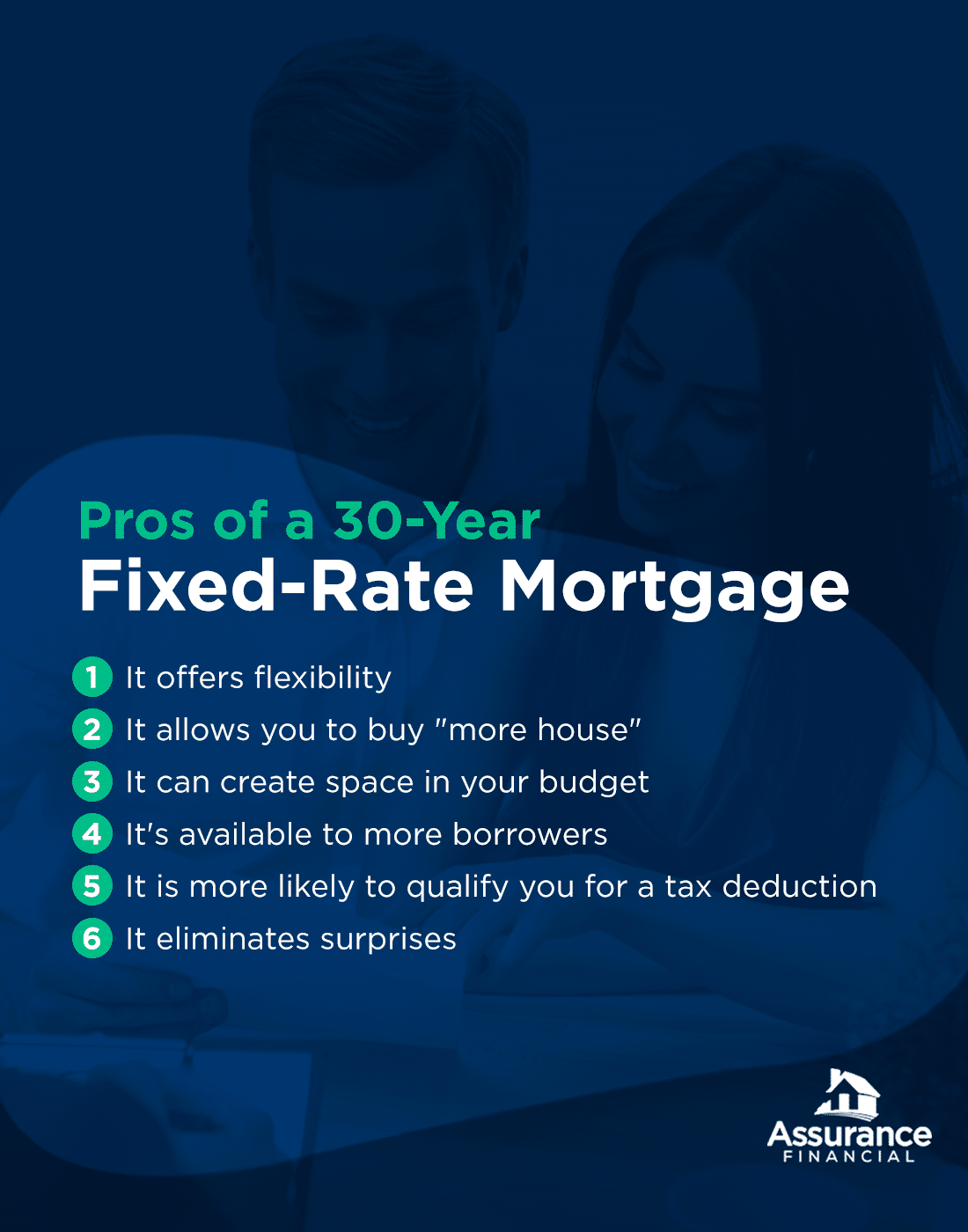

Pros of a 30-Year Fixed-Rate Mortgage

For many borrowers, the pros of a 30-year fixed-rate mortgage make it worthwhile.

1. A 30-Year Fixed-Rate Mortgage Offers Flexibility

When you take out a 30-year fixed-rate mortgage, you can stick to the amortization schedule provided by your lender or you can choose to pay extra on the loan, reducing your debt and speeding up the process of owning your home outright.

For example, you may decide to pay several hundred dollars more than you owe each month when you have the space in your budget to do so. But if your expenses increase or your income drops, you have the option of paying what’s due on the loan and holding off on making extra payments until you can afford it again.

2. A 30-Year Fixed-Rate Mortgage Allows You to Buy “More House”

You can often afford to buy a more expensive home with a 30-year mortgage compared to a 15-year loan, depending on your income. If you live in an area with high housing costs, a 30-year mortgage can make it easier to buy a home that meets your family’s needs and fits within your budget.

3. A 30-Year Fixed-Rate Mortgage Can Create Space in Your Budget

Since the monthly payment on a 30-year mortgage is often lower than the payment due on a 15-year loan, it can give you some wiggle room in your budget. You can use any additional income you have to pay down your home loan more quickly, or you can choose to save it for a rainy day or for another financial goal.

4. A 30-Year Fixed-Rate Mortgage Is Available to More Borrowers

Depending on your income and other financial circumstances, you might find it easier to qualify for a 30-year mortgage compared to other options. Since the monthly payments are lower for a 30-year compared to a 15-year mortgage, you can qualify for a 30-year loan with a lower income.

5. A 30-Year Fixed-Rate Mortgage Is More Likely to Qualify You for a Tax Deduction

You can deduct the interest you pay on your mortgage from your income each year, but it’s not always the most appropriate option. For itemizing your deductions to make sense, the amount needs to be more than the standard deduction.

In 2022, the standard deduction is $12,950 for single tax filers and $25,900 for married couples who file a joint return. For a head of household, the standard deduction is $19,400. Since you often pay more interest on a 30-year mortgage during the early years of repayment, it can make you more likely to save on your tax bill.

6. A 30-Year Fixed-Rate Mortgage Eliminates Surprises

A 30-year fixed-rate mortgage can be an ideal option for people who like predictability. You know what your payments are, so you can create a dependable budget. You don’t have to worry about costs increasing year after year, so it can eliminate some stress from your life.

Cons of a 30-Year Fixed-Rate Mortgage

A 30-year fixed-rate mortgage does have some drawbacks that are important to think about.

1. You’ll Pay More in Interest

Over the course of 30 years, you are likely to pay considerably more in interest on your mortgage than you would on a loan with a shorter term. For example, if you borrowed $160,000 with a 3.37% interest rate, you would pay $94,726.03 in interest over the 30 years. If you borrowed the same amount with the same interest rate for 15 years, you would pay $44,086.16 in interest over 15 years.

2. Interest Rates Are Usually Higher

You don’t just end up paying more interest over the life of your home loan when you have a 30-year mortgage. You might also have to pay a higher interest rate. Lenders consider risk when they set interest rates. A 15-year mortgage is typically considered a lower risk to a lender, as the term is shorter and there is less of a chance of a borrower defaulting. While 30-year mortgages are very common, they are also considered higher-risk and usually have somewhat higher interest rates.

3. Thirty Years Is a Long Time

Another thing to consider before applying for a 30-year mortgage is that 30 years is a relatively long time. It’s difficult to envision what your life will be like at the end of your mortgage term.

One thing to remember is just because your mortgage will be paid off in 30 years, it doesn’t mean you need to keep the loan for that long. If you can afford to pay extra toward the mortgage, you are free to do so. You can also sell your home before the 30 years is up and use the proceeds from the sale to pay off the mortgage.

4. It Will Take Longer to Build Up Equity in Your Home

Your home’s equity is the difference between the value of your home and the amount you owe on the mortgage. When you take out a mortgage with a shorter term, you pay down the principal relatively quickly, building up more equity in your home. With a 30 year loan, it takes longer to chip away at the principal, meaning you have less equity.

The longer it takes to build up equity, the greater the chance you may end up upside-down on the mortgage if the market takes a hit. When you’re upside-down, you owe more on the home loan than the house is worth.

5. It Can Be Harder to Put 20% Down

You might qualify for a bigger loan with a 30-year term compared to a 15-year term. But it can also be more challenging to come up with a sizable down payment when you’re buying a more expensive house.

For example, you’ll need $40,000 to put 20% down on a $200,000 house. The amount jumps to $60,000 for a $300,000 house. Not having 20% to put down doesn’t mean you can’t buy a house. It simply means you’ll have to pay PMI and you may not get the best possible interest rate.

6. You Might Buy More Home Than You’re Comfortable With

Another thing to consider when getting a 30-year mortgage is that you might end up buying more house than you can take care of or manage. Bigger houses tend to have higher upkeep costs. They also tend to require more care and attention compared to smaller, less expensive homes. For example, if you buy a home with a large yard, someone will need to take care of the yard.

Apply for a 30-Year Fixed-Rate Mortgage

When you find the home of your dreams, your next step is obtaining the right mortgage to fund your purchase. For many homebuyers, a 30-year fixed-rate mortgage is the best option, especially if you can secure a low interest rate and low monthly payments. At Assurance Financial, our team can help you achieve your dream of homeownership, and our services can offer you customized options to cover your home purchase.

We know that every homebuyer has individual needs, and as mortgage experts, we can help you identify the right solution for your unique financial needs. While buying a home is an exhilarating experience, it also requires a firm grasp of your financial situation, a thorough understanding of the terms you’re agreeing to and a long-term commitment to paying back a loan. Assurance Financial can help make sure you don’t run into any unexpected surprises on your homebuying journey and deliver the following advantages when you choose to work with us:

- Large range of mortgage loan options: To serve each of our homebuyers, we offer a variety of loan options, including conventional loans, FHA loans, VA loans and construction loans.

- Comprehensive approach to lending: We complete the entire lending process under a single roof, from application to closing.

- Versatile application process: You can choose whether you want to complete your application online or with the assistance of one of our loan officers.

- Recognition: We are approved by Fannie Mae, Freddie Mac and Ginnie Mae to service and issue mortgages.

If a 30-year mortgage with a fixed rate seems like a good option for you, applying for a home loan can be simple. Get started on your application today or schedule an appointment with a loan officer at a time that works for you.

Many people are turning to real estate investments these days. But how do you know if this is the right investment strategy for you? Is property a good investment now?

Real estate can be a good investment for anyone looking to diversify their portfolio and gain additional income. Though investing in real estate may not be the right option for everyone, many investors can get the most out of investing in real estate by following some simple tips. We have compiled this guide to show you why real estate is a good investment for some.

What Is Real Estate Investing?

There are actually quite a few ways to invest in real estate. While most people tend to assume real estate investing refers to buying rental properties to gain cash flow and appreciation over the long term, there are other ways to make money in real estate investment besides becoming a landlord.

The following are a few other methods of real estate investing:

- Flipping houses

- Wholesaling properties

- Buying and holding rental properties

- Becoming a limited partner in syndications

- Investing in a real estate investment trust (REIT)

The real estate investment strategy you choose will depend on how passive you want investing to be. Investing can be as simple as moving money into a REIT with a click of a button or as involved as flipping houses — which is more like starting your own business than investing in the stock market.

Because real estate investment can take several different forms, investing in real estate can be accessible to many investors regardless of their preferred investment strategy. Whether you want a passive or active investment, real estate investing can be the right choice for you.

Is Real Estate Investment Right for You?

You’ll need to consider your situation to determine if investing in property a good idea for you. Real estate can generate regular passive income for you and can be a long-term investment that increases in value over time. Many investors use real estate investment to begin building their wealth.

However, depending on what strategy you choose, real estate investment can require a significant amount of money and ongoing maintenance. Buying an apartment complex, house or piece of land can be quite expensive. If you purchase a property, you will also need to have enough income or savings to protect you financially from income gaps if you go a few months between tenants.

The Process of Real Estate Investment

Consider the following information you need to know about real estate investment to determine if this investment strategy is right for you:

1. Determine Your Funding Method

Financial experts tend to warn against investors borrowing money to buy investments. You may want to consider whether you can pay with cash before you buy a piece of real estate for investment purposes. If you cannot afford to buy the home with cash, you should at least be able to afford your mortgage payments for the home without rental income.

When you invest in rental properties, there is a chance you may experience high turnover with renters. In fact, you may experience a period of time in which you have no renters for the property. If you cannot afford to pay the monthly mortgage without the rental income, this may become more of a financial burden than an investment. If you cannot pay your mortgage payment, this could damage your credit and cost you more money in the long term.

2. Start Small

Many investors begin investing in real estate by starting small. You may want to start by buying a home with a basement apartment or purchasing a duplex, which can allow you to live in one unit and rent out the other to a tenant. If you are comfortable living in the same building as a tenant, this can be a good way to dip your toe into real estate investment while also mitigating your risk.

When you create your budget, ensure you can live comfortably while paying the entire mortgage without the need for rent payments. If you grow more comfortable with investing in real estate and managing a property, you may want to purchase a larger property that can increase your income potential.

Owning several properties makes it easier to buy and manage more properties, which means you will earn an even greater return on your real estate investments.

3. Research the Property

Doing your research is an important part of the home or land buying process. For example, if you have decided to purchase land to sell at a future date, you may want to research the deed for the land thoroughly. Are there new roads planned near the land you are purchasing? How might this affect the value of the property?

You may also want to determine whether there is a lien on this property. Consider the comparables in the area, particularly if there are any factors that may affect the value of the property. After you complete your research, you can more easily determine whether purchasing this property is the right investment for you.

4. Plan Your Expenses for the Property

Before you purchase a property for real estate investment, you may want to consider the additional costs of owning a property, such as repairs, utilities, taxes, homeowners’ insurance and upkeep.

You may also want to consider going through a rental company that can handle the ongoing maintenance of your property, such as rent collection and repairs. While working with a rental company will cost you money, it can also make owning and managing a rental property easier. If you do not have time to manage the property but you want to use this investment strategy, using an agency may be a good option for you.

When pricing your rental property, consider these fees and additional expenses. You may want to include these expenses in the price of the property to ensure you are fully covered. You may also want to save the surplus income from your first few months of rental property ownership to cover the costs of property repairs.

While every investment comes with some level of risk, you can help minimize your risk by doing your research and planning for the entire cost of a property ahead of time.

Where Should I Invest in Real Estate?

Figuring out where to invest in real estate can be tricky for first-time investors. Here is a list of some common places to invest in real estate:

1. Rental Properties