Category: Purchasing a Home

You’ll consider a wide range of factors when choosing a new home, one of those being where you’ll live. The city in which you decide to purchase a home will impact your lifestyle and financial situation, which is why Baton Rouge is a popular option for many buyers.

Assurance Financial helps people purchase comfortable homes in areas that match their needs. With loan officers stationed in the Baton Rouge community, we’re familiar with the local economy and what it’s like to live there. Work with us when making your move.

Life in Baton Rouge

This city’s proximity to New Orleans and the Mississippi River means there’s a great variety of entertainment and activities in Baton Rouge. Whether you enjoy fine dining, nightlife, collegiate sports or music, you can find a way to fill every weekend. The area is also bustling with family-friendly attractions like museums, the Baton Rouge Zoo and various parks along the river. Hot summers and moderate winters make it possible to enjoy time outdoors for most of the year.

You’ll also find economic opportunities in the Baton Rouge area. The medical and biotech industries are experiencing growth in the area, bringing and influx of well-paying jobs. Moving can be a great way to jumpstart or advance your career.

Financial Benefits

Baton Rouge’s strong local economy has many financial benefits. Beyond the area being full of job opportunities, the cost of living in Baton Rouge is 3% lower than the national average, so you can maximize your income’s value. Utilities, housing and groceries are all on par with or below the national average. These factors mean you can earn enough to support your lifestyle with funds remaining to grow your wealth.

The strong housing market is another key contributor to Baton Rouge’s livability. The same house would cost you less here than in larger cities like New Orleans. Homes sell for around $250,000 on average, which is more than $100,000 below the national median, and inventory is high enough to meet demand while preserving the market’s upward trajectory. When you’re ready to sell your Baton Rouge home, you’ll find comfort in a housing market with steady growth and a sale-to-list ratio of 95% or higher.

Find a Loan Officer in Louisiana

At Assurance Financial, we offer various types of loans that help buyers purchase property in Baton Rouge or refinance their home. As an independent, full-service financial institution, we are a dependable partner for one of life’s most important investments. Feel free to contact us online for more on our borrowing options.

Taking out your first mortgage is a huge life step. A mortgage is a critical tool to have — it allows you to become a homeowner without putting down hundreds of thousands of dollars on the spot, and it lets you pay off your loan over time. About 96% of first-time homebuyers finance the purchase with a mortgage.

But mortgages are immensely complex, and many homeowners have questions when they first get started. How do mortgage payments work, exactly? And what is included in your monthly mortgage payment? We’re here to answer your questions so you can approach your new mortgage with confidence.

Topics Covered

- What Are Mortgage Payments?

- How Does a Mortgage Loan Work?

- What Is Included in a Mortgage Payment?

- Mortgage Payment Formula

- Mortgage Vs Loan

- Frequently Asked Questions About Mortgage Payments

What Are Mortgage Payments?

What is a mortgage payment? Mortgage payments are the payments you make on a long-term loan that enables you to buy your home.

Almost everyone who owns a home has a mortgage and makes mortgage payments. Homeowners typically make these payments monthly, over a fixed period of years. Some standard options include 15-year and 30-year mortgages.

What are the advantages of spreading out mortgage payments across more or fewer years? Each approach comes with pros and cons:

- Shorter mortgages: Shorter mortgages tend to have lower interest rates and allow the homeowner to pay less interest overall. The tradeoff is that because the schedule becomes more compressed, these mortgages require higher monthly payments.

- Longer mortgages:Longer mortgages tend to have higher interest rates. So homeowners who choose these mortgages will pay more interest overall. The appealing tradeoff is that by spreading the payments over a longer term, homeowners can lower their monthly payments to more affordable sums. So extended options are often attractive to homeowners looking to create more room in their budgets each month.

Benefits of Making Regular Mortgage Payments

Paying down your mortgage provides you with a couple of different benefits. One is that it reduces the amount of debt you have. As you slowly, steadily make payments, you decrease your debt burden. You increase your debt-to-income ratio, making yourself a more attractive borrower if you decide to take out new loans. You also get a little closer to having your home paid off and having a bit more cash to spend each month.

The second benefit is that you accrue home equity. Home equity is the amount of your home that you have paid off. It equals the value of your home minus the value of your remaining mortgage. So the more of your mortgage you pay down, the more home equity you’ll have. Maintaining as much home equity as you can is an excellent strategy for maintaining financial stability. You can also borrow strategically against your equity by taking out home equity loans — to perform renovations, say, and boost the eventual resale value of your home.

How Does a Mortgage Loan Work?

A mortgage loan is a type of loan that is used to purchase a property, such as a home or a piece of land. You borrow money from a lender to purchase the property and the property serves as collateral for the loan. Here’s how it works:

- Application: You apply for a mortgage loan with a lender, which involves providing personal and financial information.

- Pre-approval: The lender evaluates your creditworthiness and pre-approves you for a certain loan amount.

- Property search: You search for a property to purchase within the pre-approved loan amount.

- Property appraisal: The lender hires an appraiser to determine the value of the property to ensure it is worth the amount being borrowed.

- Loan approval: The lender approves the loan, and you sign a mortgage agreement that outlines the terms and conditions of the loan.

- Down payment: You make a down payment on the property, which is a percentage of the purchase price.

- Closing: You meet with the lender to finalize the transaction. This involves signing a promissory note and a deed of trust, which gives the lender a security interest in the property.

- Repayment: You make monthly payments on the loan, which typically include principal, interest, taxes and insurance. The loan is usually repaid over a period of years.

- Ownership: Once the loan is fully repaid, you own the property outright.

What Is Included in a Mortgage Payment?

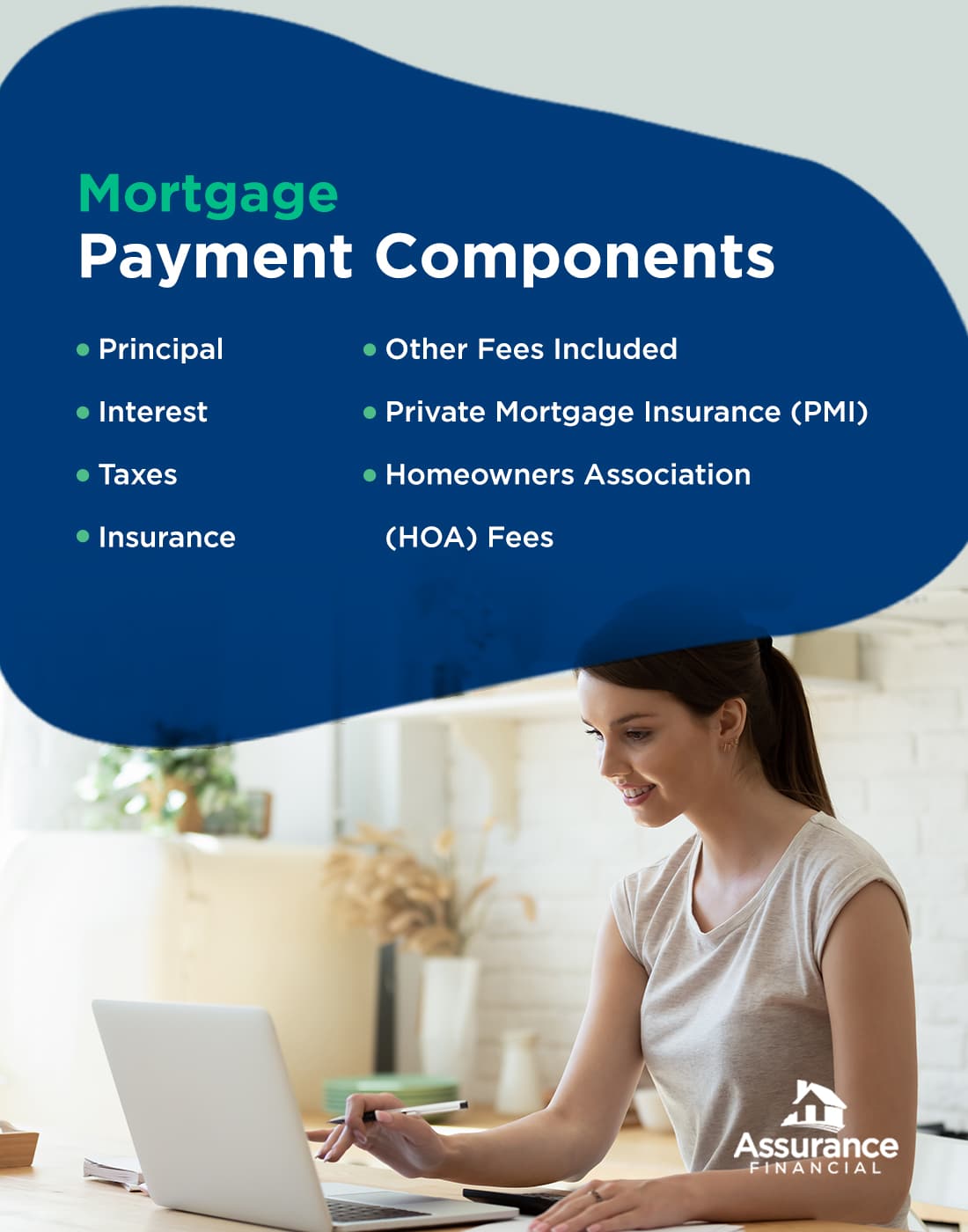

Your mortgage payments consist of many different components that all combine into a single sum. Four main components — principal, interest, taxes and insurance (PITI) — go into the makeup of your mortgage payments, and additional fees may be included as well.

Below is a breakdown of those components:

1. Principal

The principal is the amount of money you borrowed from your mortgage lender and have to pay back. Generally, that sum is the price of your home minus your down payment. Say you bought a $300,000 house and put down a 20% down payment of $60,000. Your principal is then $300,000 – $60,000, or $240,000.

Most of your mortgage payment each month goes toward paying down the principal and interest. The part of your monthly payment that goes toward your mortgage principal is what pays down your loan and builds your home equity. Most mortgage structures favor paying down more of the interest at the beginning of the loan and more of the principal at the end.

2. Interest

Interest is the amount charged on the principal because the lender is loaning you the money. The purpose of interest is to reward the lender for taking the risk of lending to you. Charging interest is how lenders make money, keep their businesses running and pay their employees.

Interest rates vary from mortgage to mortgage, and conditions can change quickly. Interest rates decreased between 2018 and 2021, with average interest rates on a 30-year fixed-rate mortgage falling to as low as 2.65% in January 2021. Interest rates in 2023 are somewhat elevated, but many experts predict decreases as the year goes on.

The amount of interest included in your monthly mortgage payment varies inversely with the amount of principal included. At the beginning of your home loan, your payments will include a higher proportion of interest. Toward the end of your loan, that proportion will be much lower.

3. Taxes

Some mortgage payments also include real estate taxes, also known as property taxes.

Local governments assess property taxes to fund public services like schools, fire and police departments and the public works departments that maintain municipal infrastructure. The government requires these taxes annually, but homeowners typically pay them in monthly installments as part of their mortgage payments.

How does the local government receive those funds if it collects them only once per year? Your lender will hold the taxes for you in escrow and pay them once they come due.

If you’re looking at your property taxes and wondering why they don’t line up with the price of your home and your tax rate, remember that counties usually base property taxes on the assessed value of your home rather than on the purchase price. A property assessor looks over your house and then tells the local government its value.

So if you got a massive house at a great price, you might still have hefty property taxes incorporated into your mortgage payments. Say you bought a $600,000 home for $500,000. If the county property tax rate is 1.5%, you’ll pay $9,000 in property taxes for the year — $600,000 x 0.015. Divided by 12 months, that’s $750 in taxes on your mortgage payment.

4. Insurance

Does a mortgage payment include insurance? Usually, though not always. Your mortgage payment generally includes your property insurance payment and your private mortgage insurance (PMI) payment if applicable.

Property insurance is the insurance that covers your home in the event of a disaster like a fire, hurricane, tornado or even a burglary. It can include homeowners insurance as well as additional riders like flood and earthquake insurance.

Property insurance takes most of the risk from the homeowner and transfers it to the insurance company. So you’ll pay a little more each month, but you’ll pay a lot less in repair and replacement costs if disaster strikes.

Insurance payments work similarly to property tax payments. You’ll include them as part of your monthly mortgage payment even though they’re due only once a year. Your lender will hold the insurance money in escrow for you and pay it when the insurance company requires it.

5. Other Fees Included

Your mortgage payments may also include miscellaneous other fees, such as loan processing fees. These fees are likely to account for a minimal percentage of your overall monthly payment.

6. Private Mortgage Insurance (PMI)

If you make a down payment of less than 20% when you buy your home, your lender will likely require you to take out private mortgage insurance (PMI). Lenders use your down payment amount as a proxy to assess the risks associated with lending to you. Your PMI costs add a little to your mortgage payment each month.

Unlike property insurance, which protects you in case of a disaster, PMI protects your lender. It covers your lender if you become unable to make your monthly mortgage payments. If you miss payments, your PMI will kick in to cover the costs so your lending company doesn’t lose its investment. PMI will not protect you, however. If you fall behind on payments, you can still lose your home to foreclosure even though you have PMI coverage.

PMI is also important to many lenders because it enables them to sell loans to other investors. Having insurance backing minimizes these investors’ risk and makes them more willing to take on the loans.

PMI is relatively easy to remove from your mortgage payments after a while. Generally, once you’ve accumulated 20% home equity, you’ve convinced your lender of your fiscal reliability and can request to drop your PMI. Alternatively, you can sometimes stop your PMI at the midpoint of your amortization schedule — after the 20th year of a 40-year mortgage, for instance.

Additionally, once you pay off more of your loan, your mortgage insurance should drop automatically — usually once the balance reaches 78% or less of the original mortgage amount.

7. Homeowners Association (HOA) Fees

If you belong to an HOA, your mortgage payment sometimes includes HOA fees. These fees keep you in good standing with your HOA and, as with the lumped-in insurance and tax payments, offer convenience by minimizing the number of separate payments you must make.

Check out our mortgage calculators to help you better prepare for your loan.

Mortgage Payment Formula

The formula to calculate the monthly mortgage payment is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1 ]

Where:

M = Monthly mortgage payment

P = Principal amount borrowed (the loan amount)

i = Monthly interest rate

n = Number of monthly payments (loan term in years multiplied by 12)

For example, let’s say you take out a $200,000 mortgage loan with a 4% annual interest rate and a 30-year loan term. To calculate the monthly mortgage payment:

P = $200,000

i = 4% / 12 = 0.003333 (monthly interest rate)

n = 30 x 12 = 360 (number of monthly payments)

M = $200,000 [0.003333(1 + 0.003333)^360] / [(1 + 0.003333)^360 – 1]

M = $954.83 (rounded to the nearest cent)

Therefore, your monthly mortgage payment would be $954.83. Note that this formula does not include taxes, insurance or any other additional fees that may be included in the monthly mortgage payment.

Mortgage vs. Loan

A mortgage is a type of loan that is specifically used to purchase a property, such as a home or a piece of land. The property serves as collateral for the loan, which means that if you don’t make the mortgage payments, the lender can foreclose on the property and sell it to recoup their losses.

On the other hand, a loan is a more general term that can refer to any type of borrowing, such as a personal loan, a car loan or a business loan.

The main differences between a mortgage and a loan are:

- Purpose: A mortgage is used to purchase a property, while a loan can be used for a variety of purposes.

- Collateral: A mortgage is secured by the property being purchased, while a loan may or may not require collateral.

- Repayment period: Mortgages typically have longer repayment periods than other types of loans, often spanning decades.

- Interest rates: Mortgage interest rates are typically lower than interest rates for other types of loans due to the fact that they are secured by the property being purchased.

Frequently Asked Questions About Mortgage Payments

Below are a few commonly asked questions about mortgage payments and how they work:

1. When Are Mortgage Payments Due?

Mortgage payments are typically due on the first of every month, but they work differently from rent payments in terms of what month they cover. With rent payments, you typically pay upfront, putting down money on the first of the month for the upcoming month. With mortgage payments, on the other hand, you generally pay in arrears — paying for the previous month instead of the upcoming one.

2. When Do Mortgage Payments Start?

When new homeowners close on a house, paying the closing fees as they do, they often wonder how soon their mortgage payments will kick in, hoping for a little breathing room.

And they typically get it. Because you pay in arrears, your first mortgage payment is usually due on the first day of the month after the month you closed. Say for example that you closed on your house on January 19. Your first mortgage payment would be due on March 1 and would cover February.

What about the interest due for January? That interest generally rolls into your closing costs. You’ll be able to see the exact amount in your closing disclosure forms, along with your interest rate, loan amount and monthly payments.

3. Do Mortgage Payments Go Down Over Time?

If you have a fixed-rate mortgage, your mortgage payments will not drop over time.

However, the amounts that comprise your loan do change over time due to your amortization schedule — the schedule of your payments. This schedule impacts how interest payments and principal payments are distributed. Generally, your initial mortgage payments favor your interest. You’ll be paying off more of your interest at first and less of the principal. Over time, as you pay down your home loan, your payments start to include more principal and less interest.

The result is that you pay down your interest faster than you pay down your principal. Why?

At the beginning of your loan, you naturally have a higher loan balance. So you owe more interest every month once you apply your interest rate to that loan balance. As time goes by and your loan balance decreases, you’ll owe less interest every month. So most of your payment will then go toward the principal, even though your total payment stays the same.

All that said, your mortgage payments may change slightly because of alterations in your insurance or tax rates. If your home’s value rises, for instance, your property taxes will likely rise as well, increasing your overall mortgage payment.

4. What Happens if I Make a Large Principal Payment on My Mortgage?

If you make a large payment on your mortgage, the extra payment goes toward paying down your principal. So in many cases, making a large payment is advantageous if you can afford it. It enables you to pay down your mortgage sooner and build equity faster.

And paying down the principal also helps you reduce your interest. The reason is that your lender calculates your interest from the amount of your principal. So if you lower your principal, you’ll lower your remaining interest as well.

With some mortgages, though, your lender will assess a prepayment penalty if you pay your mortgage down early. The prepayment penalty exists to compensate the lender for the interest it loses if you pay off your mortgage more quickly than expected. So you’ll probably want to sit down and do the calculations to figure out the best option for your finances. Determine whether your finances will benefit more if you pay your mortgage early and lower its overall cost or if you pay it slowly and steadily to avoid the prepayment penalties.

5. What Happens if I Miss a Mortgage Payment?

If you miss a mortgage payment, the penalties you’ll face depend on how late you were and how often you’ve missed payments in the past.

First Payment

Generally, the first time you miss a payment, you’ll receive a short grace period in which to get your payment up to date. That grace period is often about 15 days. Mortgage lenders need to receive their money — still, they understand that life happens, and they don’t want to penalize otherwise good, reliable clients. If you make your payment within that grace period, you probably won’t incur any penalties.

Second Payment

If you miss a second payment, or if the grace period goes by and you still haven’t made your first missed payment, you’ll start to feel the consequences. The first thing your lender will do if you miss mortgage payments or don’t pay within the allotted grace period is to impose a late fee. You’ll still be responsible for the missed payment, and you’ll have to pay a little extra as well. The late fee acts as a deterrent to discourage you from missing future payments. Depending on its policies, your lender may also report your delinquency to the credit bureaus. If your lender reports the late payment, you’ll take a hit to your credit score.

Once you miss two payments, your lender considers you to be in default on your mortgage. At this point, the lender is likely to become stricter and more forceful in its communications with you about making payments. However, most lenders don’t want to foreclose on a home unless they have no other options, so you can very likely still work out a payment deal at this point.

Third Payment

After three missed payments, you will receive a letter from your lender advising you that you have 30 days to make the missed payments, and then your lender will begin foreclosure proceedings. If you don’t make payments during that 30 days, foreclosure will start.

The upshot is that you’ll need to ensure you make your mortgage payments on time each month so you can stay in the home you love. Remember that your mortgage is a secured loan — your house and property make up the collateral to secure it. If you fail to make mortgage payments, you could lose your home to foreclosure.

6. Can I Change My Mortgage Payment Amounts?

If you have a fixed-rate mortgage, you’d usually need to refinance your home to change your mortgage payment amounts.

Many homeowners refinance their homes at some point to lower their interest rates, increase or reduce the mortgage length, or reduce their monthly bills. Refinancing is a considerable undertaking since you’re applying for a mortgage all over again. Still, it is well worth the trouble in many scenarios.

To obtain changeable mortgage payments, you can also take out an adjustable-rate mortgage. If you have an adjustable-rate mortgage, your monthly payments will change often as your interest rates fluctuate.

With an adjustable-rate mortgage, the interest rate remains fixed for a determined time and then adjusts at predictable intervals — every five years, every year, even every month. At the end of the predetermined period, the interest rate adjusts to reflect the current market rate.

Adjustable-rate mortgages can be a risky gamble — you can’t be certain how your rates will change. If you feel confident that interest rates will drop over time, though, you might consider taking out an adjustable-rate mortgage to reap the benefits of market changes.

Apply for a Mortgage With Assurance Financial

When you’re ready to take the exciting step of purchasing a new home, work with Assurance Financial to take advantage of historically low rates.

We make it easy to apply for a mortgage and estimate costs during the process, and you can get pre-qualified in 15 minutes. Our licensed, approachable, trustworthy loan officers have the industry knowledge and expertise to get you custom competitive rates. And we have just about every type of home loan available, from conventional loans to FHA and VA loans to loans designed specifically for jumbo or modular homes.

Whether you’re a first-time homeowner, downsizing, dreamsizing or looking for an investment property or a vacation home, we can make getting started with your loan quick and convenient. And because we’re an independent lender rather than a mortgage broker, we give you the security and peace of mind of knowing we’ll never pass your loan or personal data on to anyone else.

Apply online, or contact us today for a no-obligation quote.

Sources:

- https://files.consumerfinance.gov/f/documents/cfpb_market-snapshot-first-time-homebuyers_report.pdf(4)

- https://assurancemortgage.com/everything-you-need-to-know-about-30-year-fixed-rate-mortgages/

- https://assurancemortgage.com/how-to-get-a-mortgage-loan/

- https://assurancemortgage.com/does-pre-approval-affect-credit-score/

- https://assurancemortgage.com/loan-application-process/

- https://assurancemortgage.com/what-is-down-payment-home-loan/

- https://assurancemortgage.com/what-are-closing-costs/

- https://assurancemortgage.com/what-is-a-mortgage-payment/

- https://fred.stlouisfed.org/graph/?g=NUh

- https://www.forbes.com/advisor/mortgages/mortgage-rates/

- https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

- https://www.consumerfinance.gov/ask-cfpb/when-can-i-remove-private-mortgage-insurance-pmi-from-my-loan-en-202/

- https://assurancemortgage.com/calculators/

- https://assurancemortgage.com/how-do-you-calculate-your-estimated-mortgage-payment/

- https://www.investopedia.com/ask/answers/081516/how-many-mortgage-payments-can-i-miss-foreclosure.asp

- https://assurancemortgage.com/refinance-your-home/

- https://assurancemortgage.com/purchase-your-home/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

What Is a Home Equity Line of Credit?

Homeownership comes with a wide range of benefits. One significant advantage is that you can build equity as you pay off your mortgage over time. You can leverage home equity to access cash for major purchases, alternative debt repayment, retirement plans or home renovations. You can also use it to obtain funds via a second mortgage like a home equity line of credit, or HELOC.

When you obtain a HELOC, you are securing it against your home equity value. As such, lenders may offer lower rates compared to other personal loans. At Assurance Financial, we offer HELOCs to homeowners who qualify.

What Does HELOC Mortgage Mean?

A home equity line of credit is a revolving fund source you can obtain when you have equity in your home. Your home equity is the difference between your home’s value and your current mortgage balance. For example, if your home is worth $200,000 and your current mortgage balance is $150,000, your home equity would be $50,000.

There are a few ways to build equity in your home, including refinancing, renovating, paying down your mortgage and making a sizeable down payment. Your home’s value may also increase with an upward trend in the housing market.

If you own your home and have already paid off your mortgage, you may also be able to obtain a HELOC. In this case, the HELOC will be your primary mortgage rather than a second mortgage. Like a credit card, you can access this source of funds as needed. You may have several different ways to do so, such as by writing a check, making an online transfer or using a credit card associated with your account.

A HELOC mortgage may have few or no closing costs and usually comes with a variable interest rate, though you may be able to get a fixed rate for a few years. A HELOC is not the same as a home equity loan, which is cash that comes to you in a lump sum. Homeowners are more likely to opt for a home equity loan for a one-time purchase or expense like a major renovation.

What Can You Use a HELOC For?

HELOCs are versatile because you can use yours however you want without restrictions. The following are some of the expenses you can use a HELOC for.

- Educational costs: If you want to return to college to get a degree, you can use a HELOC to cover your college expenses.

- Emergency funds: You can also use a HELOC to cover emergency expenses, such as damage to your home not covered by insurance, a medical emergency or the loss of a vehicle.

- Debt consolidation: Credit card debt can quickly become overwhelming, costing thousands every year in interest alone. You can use a HELOC to consolidate and pay off your debt.

- Home improvements: You can leverage your home equity to make improvements, such as renovating your kitchen or installing new windows. Remodeling projects are among the most popular uses of a HELOC.

How Does a Home Equity Line of Credit Work on Your House?

With a HELOC, your home equity is collateral. As such, a lender may be able to offer competitive interest rates comparable to rates for first mortgages. A HELOC will likely have an adjustable interest rate that rises and falls with market conditions. Your lender begins with an index rate to set your interest rate, and depending on your credit, will then add a markup. The better your credit, the lower your markup is likely to be. Before you sign for a HELOC, be sure to ask about this amount.

If you are still paying off your first mortgage, your HELOC will be a second mortgage, which is any type of loan borrowed against your home’s equity. You can borrow funds against your credit line whenever you want, and if you do not use funds, you will not owe interest.

You can repay all or a portion of what you draw from your line of credit each month. When you pay off the balance, you will have access to your full credit line again. For example, if you have a $40,000 line of credit and you spend $5,000, you will need to repay that $5,000 before you can access the full amount of $40,000.

If your lender does not require minimum withdrawals, a HELOC can be a source of emergency funds. For example, if you lose your job, you can take out a HELOC for extra cash as long as you have equity in your property. Your lender will specify how many years you can withdraw from your credit line while only paying back interest and how many years you have to repay the principal and interest.

There are two phases of a home equity credit line, which we’ll explain below.

Draw Period

The first stage of a HELOC is the draw period. During this phase, you can access the credit available to you as needed. You typically only need to make interest payments in the draw period. However, if you choose, you can pay extra and apply it toward the principal. In some cases, you can ask for an extension after the draw period is over. If you do not want an extension, your HELOC will move into the next stage.

Repayment

The second phase of a HELOC is the repayment period. During this stage, you cannot access additional funds. You will also be making payments of principal and interest rather than interest-only. You will continue paying until you have repaid your balance. Repayment options during this phase vary from lender to lender. Remember, payments in this stage could be much higher than they were during the draw period, so be sure to create a repayment plan and include this expense in your budget.

Do You Have to Pay Back a HELOC?

Yes, as with other forms of debt, you have to pay back a HELOC. When you repay a portion of your principal, these funds will return to your home equity line of credit. You must pay off the rest of your principal and interest during the repayment period.

Can You Repay Your Debt Early?

If you’re already making regular payments, you may want to repay your debt more quickly to pay less total interest. During the draw period, you can opt to make principal payments, even if the agreement’s terms only require you to make interest payments.

Review your budget to determine how much you can put toward repaying your HELOC each month. If you are concerned about how much interest you’ll be paying, you may want to look for opportunities to make additional payments toward the principal and lower your overall monthly payments.

Is There a Prepayment Penalty?

Some lenders charge penalties for paying off a HELOC early. Whether you want to get ahead or you’re planning to sell or refinance your home, prepayment penalties can throw your plans for a loop if you’re not expecting the charge. Before you pay back your HELOC early, be sure to ask your lender about these penalties. Typically, small amounts beyond your required monthly payment will not incur a prepayment penalty, but you should carefully review your agreement and terms before moving forward.

What Are the Advantages of a HELOC?

If you qualify for a HELOC, there are a few reasons you may want to apply for this line of credit. The following are some of the advantages of a HELOC.

- Skip the fees: While credit cards tend to charge cash advance fees, you likely won’t have these when you draw funds from your HELOC. If a lender charges a fee every time you draw money, you may want to look for another lender.

- Improve your credit: Two factors that affect your credit score are your credit mix and payment history. You can increase your credit score by securing different types of credit — such as loans and credit cards — and making consistent, on-time payments. Obtaining a HELOC may boost your score if you steadily pay off the loan.

- Get a low interest rate: Even when mortgage interest rates are higher, a HELOC typically has a lower rate. HELOCs often come with adjustable interest rates, and though these can fluctuate, there are limits on how much the rate can rise while you have your loan.

- Pay lower initial costs: Similarly, HELOCs tend to come with lower initial costs than credit cards. That makes a HELOC ideal for ongoing projects or debt consolidation.

- Get a higher credit limit: You can likely get a much more generous credit line from a HELOC than from a credit card. Remember, the amount you can receive depends on the equity in your home and your credit score.

- Convert to a fixed rate: You may be able to convert your adjustable interest rate to a fixed rate, which can make your payment and interest rate more consistent and predictable. Though this may happen automatically when your HELOC enters the repayment phase, you may be able to convert it to a fixed rate earlier.

- Pay low or no closing costs: While you likely have to pay closing costs for your first mortgage, when you get a HELOC, you may not have to pay any at all if you have good credit. Any required closing or appraisal costs are likely to be low.

- Borrow the funds you need: With a HELOC, you’ll use the funds you need when you need them. You can borrow cash as you go, and if you eventually need less than you anticipated, you will pay a lower monthly payment. This flexibility is one significant advantage for borrowers who apply for a HELOC.

- Use the funds as you see fit: A HELOC imposes few restrictions on how borrowers can use the loan. Though many homeowners renovate or update their properties, you don’t have to. You can put the money toward various expenses, such as travel, higher education or debt consolidation.

- Deduct interest on your taxes: According to the IRS, you can deduct interest payments if you use your HELOC to substantially improve, build or buy the home that secures your loan. There is a limit on how much you can deduct, combined with the interest on your first mortgage.

- Enjoy flexible options for repayment: Many HELOCs come with flexible repayment options, including the timeline and interest-only payments versus payments that include principal and interest. Your timeline for repayment can vary depending on your lender and the amount you borrow. You can likely make additional payments to lower your remaining balance.

What Are the Disadvantages of Home Equity Lines of Credit?

While there are many advantages to securing a HELOC, you may want to consider some drawbacks before you apply.

- Fees: While lenders make money from the interest you pay, you may also owe some fees, such as an annual fee, transaction fee, appraisal fee or a fee if you refinance or cancel your HELOC before the end of the draw period. Some lenders may also charge fees if you do not borrow a specific amount or maintain a given loan balance. Be sure to review these fees before moving forward with a HELOC.

- Upfront costs: Some lenders charge upfront costs to get a HELOC, such as an application fee, home appraisal, title search and real estate attorney fees. Consider these to determine whether a HELOC is the right option for you.

- Loss of equity: With a HELOC, you borrow against your home equity. If your home’s value drops with a dip in the housing market, you could owe more than your property is worth. When you have an outstanding HELOC, you may also be ineligible for other opportunities to borrow against your home’s equity.

- Payment increase: While the low payment during the draw period can be tempting, your minimum monthly payment will increase in your repayment period to include principal and interest. To avoid an unwelcome surprise, plan for your monthly payment to go from a small sum to hundreds of dollars.

- Limited draw period: Every HELOC has a draw period, which is the only time you can draw funds. After this phase, you will need to repay your HELOC.

- Variable interest rate: A HELOC often comes with a variable rate, so it can rise or fall depending on the market. Even if the HELOC has a low interest rate when you obtain it, that could go up when your HELOC enters the repayment period.

- Risk of overspending: Though overspending is not an inherent disadvantage of HELOCs themselves, you should be aware of the risk. Since you only need to make interest-only payments in the draw period, you can easily access more cash than needed, which could lead to financial ramifications.

- Minimum withdrawals: Some HELOCs may come with minimum withdrawal requirements, which means you’ll need to borrow a specific amount and keep your credit line open for a given period.

- Use of your home as collateral: Since you are using your home as collateral, you risk losing the house if you can’t repay your HELOC. That’s why it’s wise to only use a HELOC to increase your emergency funds or cover expenses that can help you accumulate wealth, such as home renovations and improvements.

If your income is not stable and you can’t make your monthly payments, a HELOC may not be the right option for you. Additionally, if you aren’t looking to borrow a large amount of money, you may want to opt for a low-interest credit card instead.

How Do I Get an Equity Line of Credit?

Once you’ve decided you want to obtain a HELOC, begin the application process. Follow the steps below to get an equity line of credit.

- Ensure you have sufficient home equity: Use a HELOC calculator or discuss your situation with our team at Assurance Financial to determine whether you have enough equity in your home to qualify for a HELOC.

- Review your credit score: You may be more likely to get approved for a HELOC and qualify for a better interest rate if you have a higher credit score. If you want to improve your credit score before you apply, you can plan to pay off some of your debts and make on-time payments. You can also review your credit report to ensure there are no errors you need to dispute.

- Speak to several lenders: Shop around at several lenders to make sure you can get the best terms and rate. Research lenders and ask about pre-qualification offers that may be available to you. At Assurance Financial, we offer historically low rates.

- Collect your application materials: Once you find your lender, you will need to provide your application materials — such as your identification, employment and salary information — plus your estimated home value and your outstanding mortgage balance.

- Provide verification documents: After you accept a HELOC offer, you will need documentation to verify the information you have provided. This paperwork may include tax returns, W-2s or pay stubs. The lender may also require an appraisal for your home and will complete a hard credit check, which will temporarily affect your credit score.

- Wait through the underwriting process: As with your first mortgage, you will have to wait for the underwriting process. For a HELOC, the underwriting is less extensive.

- Receive your funds: Finally, you will sign your paperwork and receive your money, which you can then start drawing from. The amount of time between approval and funds disbursement will depend on your lender.

Apply for a HELOC Loan With Assurance Financial Today

When you apply for a HELOC loan with Assurance Financial, we only need your asset information, proof of income, two most recent tax returns, proof of identification and credit score. We can review your application faster when you use our secure bank connector, and you can take a simple snapshot of a pay stub as proof of income. On the other hand, if your employer uses ADP, all you’ll need is your payroll login.

Contact us at Assurance Financial if you want to learn more about getting a HELOC or apply for a HELOC loan with Abby, our virtual assistant that can help guide you through the loan process.

Potential homebuyers, especially first-time homebuyers, often wonder how much money they should save to purchase a home. There are a number of costs associated with the process, including a down payment and closing costs. Fortunately, 100% financing options are available for home loans that may allow you to purchase a home with no money down. If you are looking for a home loan with 100% financing, meaning a home loan that doesn’t require a down payment, we cover what you need to know.

What Is a 100% Financing Home Loan?

A 100% financing home loan is a type of mortgage loan that allows you to finance the entire purchase price of a home without making a down payment. With this type of loan, you don’t need to put any money down, which can make it easier for you to purchase a home if you do not have a large amount of savings or want to keep your savings for other purposes.

There are a few different types of 100% financing home loans available, including United States Department of Agriculture (USDA) loans and Veterans Affairs (VA) loans. These loans are backed by the government and are designed to help make homeownership more affordable and accessible to a wider range of people.

While a 100% financing home loan may appeal to some borrowers, this option may also come with higher interest rates and fees. Carefully consider your options and work with a reputable lender to ensure you are getting the fairest loan terms possible.

What Options Are Available for No Money Down Home Loans?

There are two government-backed home loan options that do not require a down payment — a USDA loan and a VA loan.

USDA Home Loan

This type of mortgage loan is guaranteed by the United States Department of Agriculture (USDA). A USDA home loan is designed to help low- to moderate-income borrowers in rural areas purchase a home or make home repairs. USDA loans typically offer favorable terms, including low-interest rates and zero down payment requirements. They are also available to borrowers with lower credit scores than other types of loans.

To qualify for a USDA loan, the property you plan to purchase or renovate may need to be located in a designated rural or suburban area as defined by the USDA. Additionally, you may need to meet certain income limits based on the area you are buying in and your household size. USDA loans are administered by approved lenders, and since the USDA guarantees these loans, lenders are protected from losses if you default on your loan.

VA Home Loan

This type of mortgage loan is guaranteed by the U.S. Department of Veterans Affairs (VA). A VA loan is designed to help current and former members of the U.S. military and their qualifying surviving spouses buy or refinance a home. VA loans typically offer favorable terms, such as no down payment requirement and no private mortgage insurance requirements, making them an attractive option for eligible borrowers.

To qualify for a VA loan, you may need to obtain a Certificate of Eligibility (COE) from the VA. The COE verifies that you meet the VA’s service requirements and are eligible for the loan. Like USDA loans, VA loans are administered by approved lenders, and the guarantee from the VA protects lenders from losses if you default on the loan.

Benefits of 100% Financing for Home Loans

Receiving 100% financing for home loans, also known as zero-down payment loans, can offer you several benefits. The following are some of the potential benefits:

- Increased flexibility: If you have saved up a down payment, you can use these funds for other expenses, such as home renovations, moving costs or emergency expenses.

- No down payment required: With 100% financing, you are not required to come up with a large down payment to purchase a home, which can be a significant financial burden.

- Faster path to homeownership: With 100% financing, you can achieve your dream of homeownership sooner.

- Affordable monthly payments: With no down payment, the loan amount is higher, but the monthly payments may still be manageable, especially with competitive interest rates.

100% financing may not be available for all types of home loans, and we recommend that you carefully consider the terms and conditions of any loan before making a decision. Additionally, you may be required to have strong credit scores and income to qualify for this type of loan.

How to Buy a House With No Money Down

Buying a house with no money down is possible, but it may require careful planning and a good understanding of your options. The following are some potential ways you can buy a house with no money down:

- Gift funds: If you have friends or family who are willing to help you purchase a home, they can give you a monetary gift that you can use as a down payment.

- Negotiate with the seller: In some cases, you may be able to negotiate with the seller to cover some or all of the down payment as part of the sale agreement.

- Apply for a VA loan or USDA loan: If you are a current or former member of the U.S. military or a qualifying surviving spouse, you may be eligible for a VA loan, which requires no down payment. If you are looking to buy a home in a rural area, you may be eligible for a USDA loan, which also requires no down payment.

- Down payment assistance programs: Some state and local governments offer down payment assistance programs to help you buy a home with little or no down payment if you are a low- to moderate-income earner.

Keep in mind that even if you are able to buy a house with no money down, you may still be responsible for other costs associated with the home purchase, such as closing costs and appraisal fees. Carefully consider all of your options and speak with a qualified mortgage professional to help you navigate the homebuying process.

What if I Don’t Qualify for 100% Financing for a Home Loan?

If you don’t qualify for 100% financing for a home loan, you may have some other options, such as applying for a conventional loan, applying for an FHA loan, applying for down payment assistance, applying for closing cost assistance or saving for a down payment.

Apply for a Conventional Loan

This type of mortgage loan is not guaranteed or insured by a government agency like the U.S. Department of Veterans Affairs (VA) or the Federal Housing Administration (FHA). Conventional loans are backed instead by private lenders and investors. Typically, conventional loans come with stricter credit and income requirements than government-backed loans. They are often a good option for borrowers who have good credit scores and sufficient income to qualify for a loan.

Conventional loans can be conforming or nonconforming. Conforming loans are those that meet the guidelines set by Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy and sell mortgage loans. Nonconforming loans, also known as jumbo loans, exceed the conforming loan limits set by Fannie Mae and Freddie Mac.

Conventional loans typically require a down payment of at least 3% of the purchase price, although some lenders may want a larger down payment depending on your credit score and other factors. You may also be required to pay private mortgage insurance (PMI) if you make a down payment of less than 20%. Conventional loans are a popular option for homebuyers who meet the credit and income requirements and want to avoid the mortgage insurance requirements of government-backed loans.

Apply for an FHA Loan

This type of mortgage loan is backed by the Federal Housing Administration (FHA), a government agency that belongs to the Department of Housing and Urban Development (HUD). An FHA loan is designed to help lower-income and first-time homebuyers who may have difficulty qualifying for a conventional mortgage loan. The FHA insures the loan, which means that if you default on the loan, the lender is protected against losses.

FHA loans typically have more lenient credit and income requirements than conventional loans, and they may require a lower down payment. The down payment for an FHA loan can be as low as 3.5% of the purchase price, although you may be required to make a down payment of at least 10% if your credit score is lower than 580.

One of the key benefits of an FHA loan is that it allows you to qualify for a loan with a lower credit score than would typically be required for a conventional loan. Additionally, FHA loans may offer lower interest rates and more flexible repayment terms than conventional loans. However, FHA loans may also require you to pay an upfront mortgage insurance premium (MIP), as well as an annual MIP that is added to the monthly mortgage payment. The MIP is used to fund the FHA loan program and protect lenders against losses.

Apply for Down Payment Assistance

Down payment assistance (DPA) is a type of financial assistance that is designed to help homebuyers cover the upfront costs associated with purchasing a home, specifically the down payment and closing costs. Down payment assistance programs are often administered by state and local housing agencies and nonprofit organizations.

Down payment assistance can take many forms, such as grants, loans or forgivable loans. The funds can be used to cover all or a portion of the down payment and closing costs, depending on the program’s guidelines and your qualifications. DPA programs are typically targeted at low-income homebuyers and first-time homebuyers who may struggle to save for a down payment. They can also be available to certain groups, such as first-time homebuyers, veterans or teachers.

The goal of down payment assistance is to make homeownership more accessible and affordable to a wider range of people. By reducing the upfront costs of buying a home, DPA programs can help you get into a home faster and with less financial strain. Down payment assistance programs may have specific requirements and qualifications that you may need to meet to be eligible. Carefully review the guidelines of any DPA program you are considering to ensure that you meet the qualifications and understand the terms of the assistance.

Apply for Closing Cost Assistance

Closing cost assistance is a type of financial assistance that can help you cover the closing costs associated with purchasing a home. Closing costs are expenses that are incurred during the homebuying process, such as lender fees, appraisal fees and title fees. Closing cost assistance programs are often administered by state and local housing agencies and nonprofit organizations. The assistance can be used to cover some or all of the closing costs.

Closing cost assistance is typically targeted at low- to moderate-income homebuyers who may struggle to cover the upfront costs of buying a home to make homeownership more accessible and affordable. Check if there are any closing cost assistance programs available in your area.

Save for a Down Payment

Trying to save for a down payment on a home can be a significant challenge, especially if you’re starting from scratch. However, there are several strategies that can help you save money more effectively and reach your down payment goal faster, such as:

- Reduce debt: Pay off high-interest debt, such as credit cards, as quickly as possible. This will free up more money for savings.

- Create a budget: Make a budget that takes into account your income and expenses and look for areas where you can cut back on spending. Consider reducing discretionary expenses like eating out, entertainment and subscriptions.

- Set a savings goal: Determine how much you need to save for a down payment and set a specific savings goal. This will help you track your progress and stay motivated.

- Consider a side hustle: Look for ways to earn extra income, such as freelancing, tutoring or selling items you no longer need. Put this extra income directly into your down payment savings account.

- Automate your savings: Set up automatic transfers from your checking account to a savings account each month. This will help you save money consistently and avoid the temptation to spend it elsewhere.

Saving for a down payment can take time and discipline, but if you don’t qualify for 100% financing, this can be an important step toward achieving homeownership.

Where to Start

Every homebuyer has different needs, which is why we offer so many different home loan options at Assurance Financial. We can help regardless of your life stage or homebuying goal, whether you are:

- First-time homebuyers.

- Vacation homebuyers.

- Experienced homebuyers.

- Self-employed homebuyers.

We can also assist if you’re downsizing your home, remodeling or building a home, or investing in real estate. Use a 100% financing mortgage calculator to determine how this mortgage may impact your finances.

Apply for a Loan Today With Assurance Financial

At Assurance Financial, we have been servicing the loan industry since 2001. We combine superior customer service with technology-focused solutions to bring you the most seamless homebuying experience possible. We handle the entire home loan process in-house, so you can rest assured that the process will go smoothly. If you are seeking 100% financing for a conventional loan or another type of home loan, apply for a loan with us at Assurance Financial today.

During home shopping, most homebuyers want to know whether the current housing market is a seller’s market or a buyer’s market, along with how to get a good deal in a seller’s market. Though certain seasons tend to be busier, fluctuations in the housing market are more likely influenced by supply and demand than the season. As such, it’s essential for buyers to be aware of the state of the housing market and whether the area is currently experiencing a seller’s market or a buyer’s market.

To help you navigate the homebuying process, we cover how to identify whether you’re shopping in a buyer’s or seller’s market, what the current housing market is in 2024 and how to negotiate buying a house in a seller’s market.

Buyer’s vs. Seller’s Market

The housing market is either a buyer’s market or a seller’s market. These terms mean that the market either favors buyers or sellers.

What Is a Buyer’s Market?

When the supply of properties exceeds demand, this is known as a buyer’s market. When many homes are available for purchase yet there is a low number of interested buyers, buyers have an advantage. A buyer has leverage over the seller because there is less competition over a home.

In a buyer’s market, homes are on the market for longer periods and real estate prices drop. Essentially, sellers are competing with one another to attract buyers. A seller may be forced to drop their asking price to make the sale, and they may be more open to negotiating offers.

When you’re home shopping, a buyer’s market is the ideal time to buy. You can take your time, visit as many homes as you want before making an offer and negotiate with the seller to bring the price down. In a buyer’s market, sellers need to make repairs, market their property and price it competitively.

What Is a Seller’s Market?

On the other hand, when demand for homes exceeds supply, this is known as a seller’s market. Though many individuals are interested in purchasing a home, the inventory of available properties is low. Sellers have an advantage in this housing market since the lack of available homes creates more competition among buyers. Homes sell more quickly in a seller’s market, and because buyers are competing over the same properties, sellers can increase asking prices.

With this price increase, buyers may need to be willing to spend a greater amount of money on a property. When there are many parties interested in a home, buyers rarely have negotiating power and may need to accept a property as-is. A housing shortage can lead to a bidding war, and the competing offers can drive the price above the seller’s asking price. Sellers can take time to carefully consider their offers and only consider pre-qualified buyers.

Even though sellers have an advantage in a seller’s market, you can still succeed as a homebuyer and find the home of your dreams in this market.

Signs of a Seller’s Market

Before you start home shopping, you may want to determine whether your local area is currently experiencing a seller’s market or a buyer’s market. The following are some signs of a seller’s market:

- Lack of price cuts: Sellers are more likely to drop their asking prices in a buyer’s market, so several price cuts to listed homes could indicate a buyer’s market. On the other hand, a lack of price cuts can indicate a seller’s market. Keep in mind, however, that sellers can have unrealistic expectations about the value of their properties, so look for a trend in pricing rather than a single occurrence.

- Sales over asking price: Check the recent sales of the property you’re interested in and homes comparable to it. If homes have usually been selling above the asking price, this may indicate a seller’s market. Homes selling below the asking price, on the other hand, may indicate a buyer’s market.

- Bidding wars: A bidding war occurs when multiple buyers present competing offers for the same property. Buyers attempt to outbid each other by gradually increasing their offer. If you keep getting into bidding wars or you know friends or family who are home shopping and getting caught in bidding wars, this could indicate that the housing market is currently a seller’s market.

- Market trends: One of the strongest indicators of the current housing market is determining whether home prices in your area have been decreasing or increasing. Look at market trend reports to review the homes in your local area to get information on the median sale price, the number of properties on the market and how the numbers have changed during the last year. Increasing prices and decreasing inventory often indicate a seller’s market.

- Shorter time on the market: How long a home sits on the market is another factor that could indicate whether the housing market is currently a seller’s or buyer’s market. In a seller’s market, homes sell faster than in a buyer’s market. So if you notice a lot of quick sales, this could indicate a seller’s market.

- Fewer houses on the market: Consider the homes currently for sale. If the inventory is large, your local area may be in a buyer’s market. However, if the inventory is limited, then your local area may be in a seller’s market. Divide the number of properties for sale by the number of properties that were purchased in the past month. If you come up with a low number, this could indicate a seller’s market.

Is It a Buyer’s or Seller’s Market in 2024?

The current housing market is a seller’s market. The pandemic has had a dramatic impact on the housing market and ushered in new rules and processes, such as virtual open houses and tours.

The typical seasonality of home buying has changed in the past couple of years. While spring and summer used to be the height of the home buying season and turn to a seller’s market, the pandemic has led to a highly competitive seller’s market that has endured and made buying a home challenging, even during the slower winter season.

Current Trends in the Housing Market

Keep the following trends in mind if you are buying in the current seller’s market:

Virtual Home Tours

Many real estate agents are conducting virtual tours and walkthroughs as the buyer’s first view of the home. As a buyer, you may encounter everything from a simple video walkthrough to a more immersive experience with 3D technology.

A virtual tour can save you time that you would’ve otherwise spent traveling to and from the property, especially if you looking to buy in a different city or state. Before the virtual home tour, make sure you download the appropriate app, charge your device and have a good internet connection. You should also ensure you’re in a quiet place where you can hear the real estate agent.

Take advantage of this opportunity to view the home virtually by asking the agent to zoom in on certain areas, open closet doors and describe specific features.

Increased Buying Activity

Buyers are showing continued interest in purchasing properties, even as mortgage rates and home prices steadily rise. While the number of homes for sale on the market hit a record low, sales and median home listing prices shot up.

A slight majority of buyers have owned a home previously, and those that have been renting before buying cite the desire to own a home as their decision for buying. Others want a larger property or want to move to be closer to family or friends.

Bids Above the Asking Price

With so many competitive buyers bidding on homes, many offers are coming in above the asking price. As we approach the spring and summer seasons, this flurry of homebuying activity is likely to only get more hectic. Buyers have been lining up to purchase homes for months, even in the winter, which has led to an unusually low real estate inventory and greater competition over homes.

This increase in demand drives up prices, and other buyers are likely to put in offers on the same property, so if you want to get your dream home, you may have to place a bid above the asking price.

How To Buy a House in a Seller’s Market

If you want to buy now, in a seller’s market, you should know how to navigate this housing market and get a good deal even when there is a limited supply of homes. Though you probably shouldn’t expect to negotiate for repairs or convince a seller to accept less than their asking price, you can utilize some methods and strategies to successfully compete in this ultra-competitive housing market. Follow these tips for buying in a seller’s market:

1. Be Aware of the Current Market

While home shopping and making an offer, keep in mind what kind of housing market you’re shopping in and know that you are at a disadvantage. In a seller’s market, you may not have the leverage to push for concessions, contingencies, repairs or a strict closing date. Be sure to focus on what matters most to you, and consider whether the stipulations you want to be included in the contract are worth losing the home over.

2. Get Pre-Qualified for a Home Loan

Getting pre-qualified for a mortgage means a lender is willing to lend you a certain amount for the purchase of a home. Though this isn’t a guarantee of a mortgage, it gives you a maximum loan amount to work with. Many sellers only want to consider offers from pre-qualified buyers, especially in a seller’s market. Apply to get pre-qualified with Assurance Financial when you’re ready.

[download_section]

3. Get Pre-Approved for a Mortgage

After getting pre-qualified, your next step is getting pre-approved for a mortgage. A pre-approval is based on an analysis of your finances. The pre-approval offers a more concrete number for a loan amount. The lender will review your completed mortgage application and conduct a credit check. Though pre-approval is also not a guarantee of a mortgage, it’s a more accurate estimate than pre-qualification.

4. Work With a Real Estate Agent

Whether you’re buying in a seller’s market or a buyer’s market, working with a real estate agent can ensure you navigate the current housing market successfully. Real estate agents can give you an advantage over other competitive buyers, as they have the skills and knowledge you need on your side. Real estate agents may also have connections allowing them to identify and view homes before they’re even on the market or before the final bids are considered.

To choose the right real estate agent, read their reviews, find out what their experience is and speak with buyers they’ve worked with. After you narrow down your list to a few options, there are a few important questions you can ask to choose the right agent for you:

- What are your fees?

- How familiar are you with this area?

- What’s the most difficult deal you facilitated?

- Do you have access to properties that aren’t listed yet?

- How can you strengthen my offer in a competitive seller’s market?

Your real estate agent can help you strengthen your offer by looking beyond price. Consider what else the seller values to give you an advantage, such as conveniences or contingencies. For example, if you can close earlier or you don’t need to move immediately and can give the seller more time to find their next home, this could give you an advantage when the seller is considering their offers.

5. Have Your Down Payment Ready

Be sure to save up enough for a down payment. If someone is giving you the money for your down payment in the form of a gift, discuss this process with your lender. The person giving you this money may need to write a gift letter that explains you don’t need to repay the money. Many lenders will also want to see the bank statements from the account with your down payment funds, and they may want to see that the funds have been in the account for a couple of months.

6. Look at Homes Under Budget

In a seller’s market, many sellers receive multiple offers on their homes. As a buyer in a seller’s market, you should look for homes that fall below your spending limit. Other buyers are likely to bid higher than the asking price, so you want to look at homes on which you can afford to bid higher than the asking price. With this strategy, you can afford to bid up without exceeding your comfortable spending limit or needing to dip into your savings.

7. Act Quickly

When you find your dream home in a seller’s market, it’s important to act quickly. Hesitating to make an offer on a home you know you love and want to purchase may mean losing your dream home. By the time you make your offer, the home may no longer be available. Ensure you get preapproved for a home loan before you start shopping so you can make an offer immediately.

8. Stay Patient

In a competitive seller’s market, it’s normal to lose out on homes you’re interested in. Try not to get discouraged, and stay patient. Inexperienced buyers could get frustrated, find themselves caught up in a bidding war and offer more on a home than they’re comfortable spending or more than the property is actually worth.

Keep in mind, though, that you don’t have to give up as soon as you sense someone could outbid you or has an all-cash offer. Deals fall through all the time, as your real estate agent can attest, so being the second-choice offer can still work out in your favor.

9. Widen Your Search

The most popular neighborhoods understandably come at the highest prices. If you want to own a home in a specific ZIP code but homes in the area are not within your budget, you may want to consider widening your search. Identify what you like about this neighborhood, such as the school, parks, public transportation or local businesses and restaurants. Once you determine what features you want in your neighborhood, you can try to find them in locations you haven’t explored or considered before.

10. Avoid Settling

When a homebuyer grows tired of losing out on homes, they may make an offer on a home they wouldn’t be interested in otherwise. Try to avoid this situation, and keep in mind that purchasing a property is a huge, long-term investment. You may be living in and paying for this home for decades, so don’t settle for a home you don’t love unless you need to move immediately.

Similarly, try to avoid fixating on the first home you fall in love with. This can lead to a huge disappointment, or even worse, a bad financial decision made during a moment of desperation.

Contact Us at Assurance Financial to Learn More

As a mortgage lender, Assurance Financial is a home loan expert. We want to help you realize your dreams of owning a home, and our team can assist you through every step of the process, regardless of whether you want to buy a starter home or a vacation home. You have several different loan options for your mortgage, including conventional loans, FHA loans, VA loans and jumbo loans.

With our financial mortgage services, we can offer you a customized option for paying for your home. Contact us at Assurance Financial to learn more about how to find a house in a seller’s market and get the mortgage loan option that’s right for you.

Every year, your family enjoys a getaway in the mountains, at the beach or in a cabin in the woods. And, every year, you wonder if it’s finally time to buy a vacation property.

If you already have a primary residence, purchasing a second home can be an excellent investment. You have a guaranteed vacation spot each year and can rent the house out to bring in some extra income.

The process of buying a vacation home has some things in common with buying your first house. You want to put as much time and effort into finding your dream vacation spot as you did in finding the place you call home. There are a few differences between a vacation property and your primary home when it comes to financing a second property.

Why Buy a Vacation Home?

Buying a vacation home can make good financial sense for a few reasons. One reason is that it sets you up with a vacation spot for as long as you own the home. When you already own your vacation spot, you don’t have to pay for travel expenses such as hotels or rentals anymore, which can save you money over time.

Another reason is that buying a vacation home can give you a source of passive income. You can rent the home out to others when you’re not using it. Renting the property out can help you cover the cost of the mortgage or give you a little extra spending money.

Some people like to buy a property to use as a vacation home now and then move into the property full-time after they retire. If you dream of retiring to the beach or mountains, owning a property already gets you one step closer to achieving that dream.

Finally, you can look at a vacation home as an investment. Over time, the value of the home will likely increase. When your family is no longer interested in vacationing there, you can sell the property or continue to rent it out, generating an ongoing source of income.

Important Questions to Ask Before You Purchase a Vacation Home

Before you start the process of purchasing a vacation home, carefully weigh the pros and cons and ask yourself a few questions to make sure it’s the right option for you.

What’s Your Vacation Style?

Everyone has different vacation styles. Some people prefer to visit the same area yearly, such as the beach, woods or mountains. They like to build up traditions and enjoy the familiarity of staying in the same place.

Others prefer to see the entire world. They might spend a few weeks at the beach one summer, then head off to Europe for a backpacking vacation the next. These people prefer a varied, diverse vacation scene. They choose to visit all the popular vacation spots rather than stay in the same place.

If your vacation style is similar to the first one and you like to go to the same area every year, then buying a second home in that area can make sense. You won’t have to hunt around for a hotel or home rental every time you want to travel. If your style is closer to the second one, purchasing a vacation home might not be the best option for you at the moment.

Buying a vacation home can also make sense if you prefer to take longer vacations or if you want to go away several times during the year. When you own the property, you can easily spend a month or longer there. You can also visit whenever you want, provided you haven’t rented the space out.

Can You Afford a Second Home?

Two residences means two mortgage payments and two sets of property taxes. Buying a second property can stretch your budget depending on your current income and obligations.

Here’s what to look at when deciding whether a second home will work with your budget:

- Your current savings: Ideally, buying a second home won’t keep you from saving for retirement and other goals, such as your kids’ education. If you’re behind on saving for those milestones, waiting to purchase a second home can make sense.

- Your current mortgage: If you’ve nearly already paid off your mortgage, you may have the wiggle room in your budget to buy a second home. Similarly, if you have a lot of equity in your primary residence, you can borrow against it to buy a vacation home.

- Your income: You might have high expenses, such as a big mortgage payment, but at the same time, your income might be high enough to allow you to buy a second home without derailing your other financial goals.

Keep in mind that the cost of a vacation home can vary considerably based on location and size. If you’re comfortable buying a small property in a less popular vacation area, you might get a better price than if you purchased a home in a busier spot or wanted to buy a larger property.

Can You Rent Out the Home?

Unless you decide to make it your primary residence, a vacation home can provide a steady supplemental income stream. You can rent out the property during the weeks you don’t use it or during the low season to bring in some extra cash or help pay down the mortgage.

You’ll want to consider a few factors before you decide to rent out a vacation home, though. While renting the property out can help you pay down the mortgage, you might not want to rely on rental income to cover the second mortgage since you might not rent the property out enough to cover the costs.

Also, consider the effort involved in renting the property. If the vacation home is a considerable distance from your primary home, it can make sense to hire a property management company that’s closer to it. You want someone to be available to respond to the renters’ issues and take care of repairs as needed.

Who Will Take Care of the Home?

Similarly, it’s essential to think about who will care for the vacation home. Houses need regular upkeep. Otherwise, you might spend the first part of your vacation mowing the lawn or fixing leaking pipes.

A property management company can look after the house if you plan on renting it out. The management company charges you for its services and any repairs.

Another option is to hire a housekeeper or groundskeeper to look in on the property and take care of things as needed when you’re not there. The housekeeper can visit weekly during the off-season or when the home is unoccupied to ensure everything’s fine and clean surfaces or the exterior as needed. If you rent the home, the housekeeper can clean it between rentals.

What Are Property Taxes?

Along with paying for the property itself, buying a second home means paying another set of property taxes. Tax rates vary considerably based on location. It’s a good idea to look at taxes before you decide on an area.

The taxes in your dream spot might make owning a home there impractical. However, the taxes in the next town over or in a neighboring vacation locale might be much more reasonable.

How Will You Pay for the Home?

You have a few options for paying for your vacation home. If you have savings, you might pay for it in full, in cash. Another option is to refinance the mortgage on your primary home and use the proceeds from that to pay for a second home.

You can also take out a second mortgage, if you have the credit, a down payment and can afford the additional monthly mortgage payment. You might want to use the rental income from the property to cover the mortgage cost. A more reliable option is to ensure you can afford the mortgage without renting the property out. That way, you’ll always be able to pay the mortgage, even if no one is renting your vacation home.

Does Owning a Second Home Affect Your Taxes?

Buying a second home affects your taxes in a few ways. First, if you rent the property out, you’ll need to declare the rental income when you file your taxes. You might also be able to deduct expenses related to the rental, provided you meet the 14-day rule, meaning you don’t use it as a residence for more than two weeks or 10% of the number of days you rent it out.

Owning a second home can mean you can deduct the interest you pay on the mortgage, provided the total value of both mortgages is less than $750,000. You can deduct property taxes, too.

Benefits of Owning a Vacation Home

If it works for your budget, there are definite benefits to owning a vacation home:

- Better vacations: When you own a vacation property, your holidays can be longer and more affordable. Instead of spending $100 or $200 per night on a hotel or rental home, you’re building equity in your vacation property when you own the house. If you work remotely, you can easily spend the entire summer at your vacation home.

- You can swap: Owning a vacation property doesn’t limit your vacations to one geographic area. You might also sign up for a home exchange program that lets you swap homes with other vacation homeowners, giving you some variety.

- Additional income stream: Your vacation property can create an additional revenue stream for you, helping you build up a solid financial cushion. Just be sure to balance the cost of managing a rental property and the other tax responsibilities with the income it brings in.

- Improved quality of life: Owning your vacation spot can mean you see an improvement in your quality of life. If you’ve had a rough week at work, you can dash off to your cabin in the woods or your home by the shore for some much-needed relaxation.

- Greater financial security: A vacation home can be an investment that leads to greater financial security. You can sell the property later and enjoy a decent return on it. You can also use it as your primary home in retirement or pass it on to your children.